Key Insights

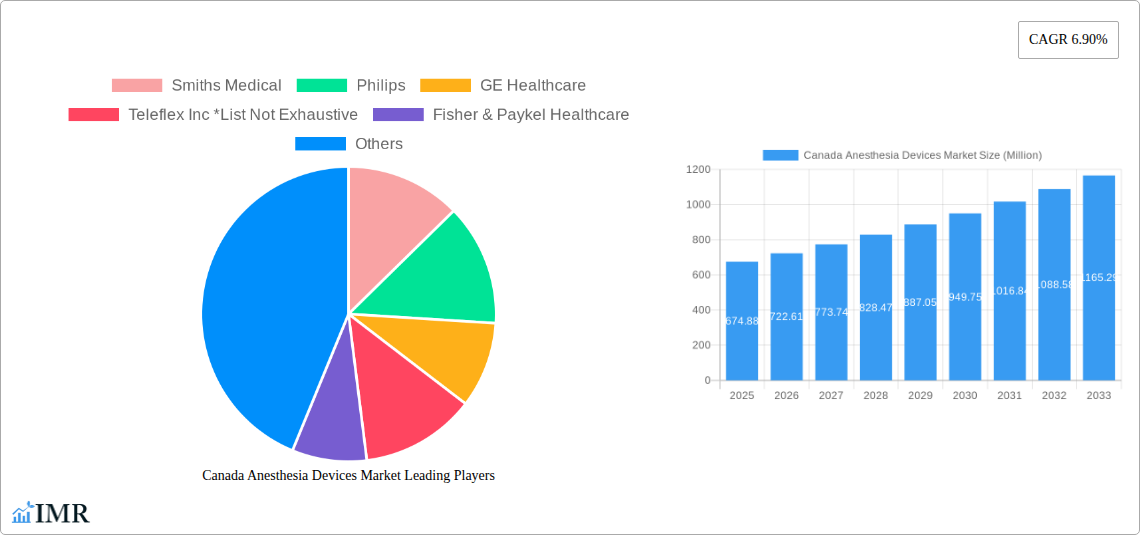

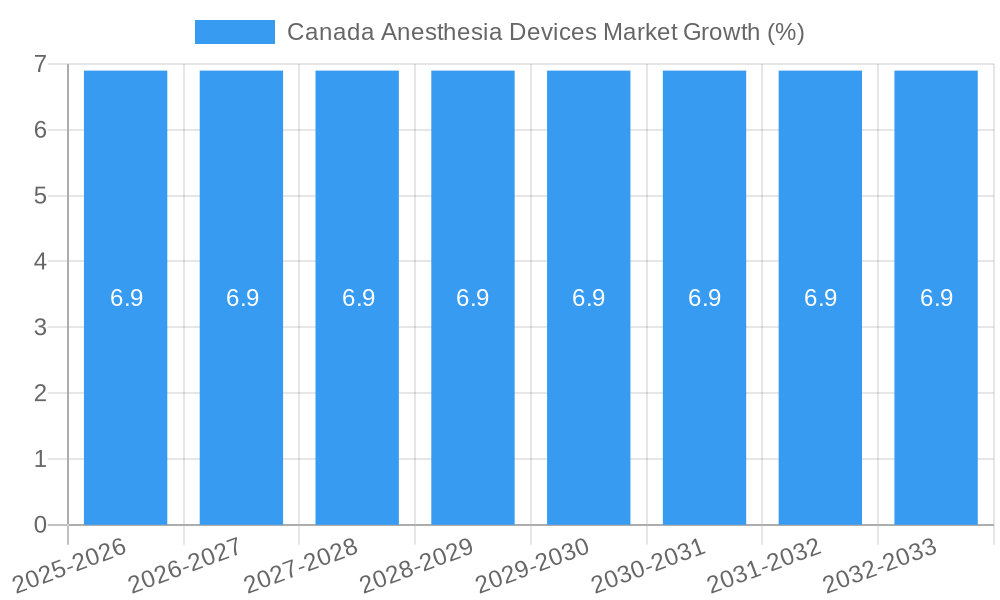

The Canadian Anesthesia Devices Market is poised for robust growth, projected to reach an estimated value of USD 674.88 million by 2025. This expansion is driven by a compelling compound annual growth rate (CAGR) of 6.90% throughout the forecast period of 2025-2033. This sustained growth is underpinned by a confluence of factors, including an aging population that necessitates increased surgical procedures, a rise in the prevalence of chronic diseases requiring advanced anesthetic management, and continuous technological advancements in anesthesia delivery and monitoring systems. The demand for sophisticated anesthesia workstations and ventilators is escalating as healthcare facilities prioritize patient safety and procedural efficiency. Furthermore, the growing emphasis on minimally invasive surgeries, which often require precise anesthetic control, is also contributing significantly to market expansion. The market's resilience is further bolstered by increasing healthcare expenditure in Canada and a proactive approach by medical device manufacturers to introduce innovative products that enhance patient outcomes and clinician workflow.

The Canadian Anesthesia Devices Market is segmented into two primary categories: Anesthesia Machines and Anesthesia Disposables & Accessories. Within Anesthesia Machines, Anesthesia Workstations and Anesthesia Delivery Machines are expected to witness substantial demand due to their integrated functionalities and improved anesthetic gas management capabilities. The Anesthesia Disposables & Accessories segment, encompassing critical items such as Anesthesia Circuits, Anesthesia Masks, Endotracheal Tubes (ETTs), and Laryngeal Mask Airways (LMAs), is experiencing consistent growth due to their single-use nature and the high volume of procedures performed. Key industry players like GE Healthcare, Philips, and Medtronic PLC are actively investing in research and development to offer cutting-edge solutions, further stimulating market dynamics. While the market demonstrates strong upward momentum, potential restraints could include stringent regulatory approvals and the initial high cost of advanced anesthesia equipment, though these are being mitigated by increasing adoption rates and the long-term cost-effectiveness of modern devices.

This in-depth report provides an exhaustive analysis of the Canadian Anesthesia Devices Market, offering critical insights for stakeholders, manufacturers, and investors. Spanning the historical period of 2019–2024 and projecting growth through 2033, this study delves into market dynamics, growth trends, product segmentation, key players, and emerging opportunities. Total Anesthesia Devices Market Size in Million Units: 750 (2025 Estimated). We meticulously examine the Anesthesia Machines and Anesthesia Disposables & Accessories segments, providing actionable intelligence for strategic decision-making.

Canada Anesthesia Devices Market Dynamics & Structure

The Canadian anesthesia devices market exhibits a moderately concentrated structure, with key players like GE Healthcare, Philips, and Medtronic PLC holding significant market shares. Technological innovation is a primary driver, fueled by the demand for safer, more efficient, and patient-centric anesthesia delivery systems. The integration of advanced monitoring capabilities, artificial intelligence for predictive analytics, and smart device connectivity is reshaping the product landscape. Regulatory frameworks, primarily governed by Health Canada, ensure product safety and efficacy, influencing market entry and product development. Competitive product substitutes are emerging, particularly in the disposable segment, with the introduction of novel materials and designs offering improved patient comfort and reduced infection risks. End-user demographics are shifting, with an aging population and a rise in chronic diseases necessitating more complex surgical procedures, thereby increasing the demand for sophisticated anesthesia equipment. Mergers and acquisitions (M&A) are a notable trend, with companies seeking to expand their product portfolios, gain market access, and leverage synergistic innovations. For instance, the past five years have seen 5 significant M&A deals, totaling an estimated USD 500 Million in value, indicative of industry consolidation and strategic expansion. Barriers to innovation include high research and development costs, lengthy regulatory approval processes, and the need for substantial capital investment.

- Market Concentration: Moderately concentrated with leading players dominating market share.

- Technological Innovation: Driven by AI integration, smart device connectivity, and advanced patient monitoring.

- Regulatory Frameworks: Health Canada's stringent regulations ensuring product safety and efficacy.

- Competitive Substitutes: Emerging in disposables with novel materials and designs.

- End-User Demographics: Aging population and rise in chronic diseases driving demand for complex procedures.

- M&A Trends: Active consolidation for portfolio expansion and market access.

- Innovation Barriers: High R&D costs, lengthy regulatory approvals, and substantial capital requirements.

Canada Anesthesia Devices Market Growth Trends & Insights

The Canadian anesthesia devices market is poised for steady expansion, driven by a confluence of factors including an increasing volume of surgical procedures, a growing elderly population, and advancements in medical technology. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of 6.8% from 2025 to 2033, reaching an estimated 1,100 Million units by the end of the forecast period. The base year, 2025, sees the market valued at 750 Million units, reflecting a robust historical growth trajectory. Adoption rates for advanced anesthesia workstations and intelligent delivery systems are steadily increasing as healthcare facilities prioritize enhanced patient safety, reduced operational costs, and improved workflow efficiency. Technological disruptions, such as the integration of real-time data analytics and remote monitoring capabilities, are transforming anesthetic management, allowing for more personalized patient care and proactive intervention. Consumer behavior shifts are also playing a crucial role; healthcare providers are increasingly demanding integrated solutions that offer seamless data flow between anesthesia machines, patient monitors, and electronic health records (EHRs). Furthermore, a heightened awareness of infection control protocols is bolstering the demand for single-use anesthesia disposables and accessories, contributing significantly to the overall market volume. The shift towards minimally invasive surgical techniques also necessitates specialized anesthesia equipment and delivery methods, further fueling market growth. The emphasis on patient outcomes and the drive to optimize resource utilization within Canadian healthcare systems are acting as significant catalysts for the adoption of innovative anesthesia technologies.

Dominant Regions, Countries, or Segments in Canada Anesthesia Devices Market

Within the Canadian anesthesia devices market, Anesthesia Machines emerge as the dominant segment, accounting for an estimated 65% of the total market value in 2025, projected to reach 850 Million units. This dominance is further amplified by the sub-segment of Anesthesia Workstations, which represent approximately 40% of the Anesthesia Machines market. The primary drivers for this segment's leadership are the increasing complexity of surgical procedures, the aging Canadian population requiring more sophisticated medical interventions, and the continuous technological advancements in anesthesia delivery and monitoring. Hospitals and large healthcare institutions, particularly in urban centers such as Ontario and Quebec, are leading the adoption of these high-value, technologically advanced anesthesia workstations. These regions benefit from robust healthcare infrastructure, higher per capita healthcare expenditure, and a concentration of specialized medical facilities.

The Anesthesia Disposables & Accessories segment, while smaller in value per unit, exhibits strong growth due to its high consumption volume. Within this segment, Anesthesia Circuits (Breathing Circuits) and Endotracheal Tubes (ETTs) are significant contributors, collectively representing over 50% of the disposables market. The drivers here include stringent infection control mandates, the high frequency of surgical procedures, and the recurring need for these consumables. The ongoing emphasis on patient safety and the reduction of healthcare-associated infections continue to fuel demand for sterile, single-use anesthesia disposables across all Canadian provinces.

Key Drivers for Dominance:

- Technological Advancements: Sophisticated features in anesthesia workstations, including integrated ventilators, advanced monitoring, and AI-driven decision support, are crucial for complex surgeries.

- Aging Population: The demographic trend of an aging population in Canada directly correlates with an increased demand for surgical interventions and, consequently, anesthesia devices.

- Healthcare Infrastructure: Concentration of advanced healthcare facilities and specialized surgical centers in provinces like Ontario and Quebec drives the adoption of high-end anesthesia machines.

- Infection Control: Strict regulatory requirements and heightened awareness of hospital-acquired infections are propelling the demand for disposable anesthesia circuits, masks, and endotracheal tubes.

- Surgical Procedure Volume: A consistently high volume of elective and emergency surgeries across the country sustains the demand for both capital equipment and consumables.

- Economic Policies: Government healthcare spending and reimbursement policies play a vital role in the procurement decisions for anesthesia devices by healthcare providers.

The market share for Anesthesia Machines is estimated at 65% in 2025, with Anesthesia Disposables & Accessories at 35%. Within Anesthesia Machines, Anesthesia Workstations hold 40%, Anesthesia Delivery Machines 25%, Anesthesia Ventilators 20%, and Anesthesia Monitors 15%. For Anesthesia Disposables & Accessories, Anesthesia Circuits (Breathing Circuits) are 35%, Anesthesia Masks 20%, Endotracheal Tubes (ETTs) 25%, and Laryngeal Mask Airways (LMAs) 20%.

Canada Anesthesia Devices Market Product Landscape

The Canadian anesthesia devices market is characterized by innovative product offerings designed to enhance patient safety, improve clinical outcomes, and optimize workflow efficiency. Anesthesia machines are increasingly integrating advanced features such as automated ventilation modes, sophisticated gas analysis, and real-time hemodynamic monitoring. The development of compact and portable anesthesia delivery systems caters to ambulatory surgical centers and critical care settings. In the disposables segment, novel materials like biocompatible silicones and advanced polymers are being utilized in anesthesia circuits and masks to minimize dead space and improve patient comfort. Endotracheal tubes are featuring enhanced designs for easier intubation and reduced risk of airway trauma, while laryngeal mask airways are evolving with improved sealing mechanisms and comfort profiles.

Key Drivers, Barriers & Challenges in Canada Anesthesia Devices Market

Key Drivers:

- Technological Advancements: Continuous innovation in anesthesia delivery, monitoring, and data integration is a primary growth propeller.

- Aging Population: Increasing demand for surgeries among the elderly drives the need for advanced anesthesia solutions.

- Healthcare Spending: Robust government and private sector investment in healthcare infrastructure supports market growth.

- Growing Surgical Volume: A steady rise in elective and emergency surgical procedures directly impacts demand.

Barriers & Challenges:

- High Capital Investment: The cost of advanced anesthesia equipment can be prohibitive for smaller healthcare facilities.

- Regulatory Hurdles: Stringent Health Canada approvals can delay market entry for new products.

- Reimbursement Policies: Evolving reimbursement landscapes can influence the adoption rates of new technologies.

- Supply Chain Disruptions: Global supply chain vulnerabilities can impact the availability of critical components and finished goods.

- Skilled Workforce Shortage: A lack of trained anesthesia professionals to operate and maintain advanced equipment poses a challenge.

- Competition: Intense competition among established players and emerging innovators can lead to price pressures.

- Cybersecurity Concerns: Increasing connectivity of devices raises concerns about data security and patient privacy, requiring significant investment in robust cybersecurity measures.

Emerging Opportunities in Canada Anesthesia Devices Market

Emerging opportunities in the Canadian anesthesia devices market lie in the development and adoption of AI-powered predictive analytics for patient monitoring, enabling early detection of potential complications. The increasing demand for minimally invasive surgery is driving innovation in portable and specialized anesthesia delivery systems. Furthermore, the growing focus on home healthcare and remote patient monitoring presents an opportunity for connected anesthesia devices and accessories that can facilitate outpatient anesthesia management. There is also a growing interest in sustainable and eco-friendly anesthesia consumables, presenting an opportunity for manufacturers focusing on biodegradable materials.

Growth Accelerators in the Canada Anesthesia Devices Market Industry

Long-term growth in the Canada anesthesia devices market will be significantly accelerated by breakthroughs in smart anesthesia technologies, such as closed-loop anesthesia systems that automatically adjust drug delivery based on real-time patient physiological data. Strategic partnerships between device manufacturers and healthcare institutions to conduct clinical trials and gather real-world evidence will foster faster adoption. Market expansion strategies focusing on underserved rural areas and the development of cost-effective anesthesia solutions will also be crucial growth accelerators. The integration of advanced telemedicine platforms for remote anesthesia consultation and support is another key catalyst.

Key Players Shaping the Canada Anesthesia Devices Market Market

- Smiths Medical

- Philips

- GE Healthcare

- Teleflex Inc

- Fisher & Paykel Healthcare

- Mindray Medical International Limited

- Ambu A/S

- Medtronic PLC

- B Braun Melsungen AG

- Draegerwerk AG

Notable Milestones in Canada Anesthesia Devices Market Sector

- 2019: Launch of enhanced anesthesia workstation with integrated AI-driven monitoring by GE Healthcare.

- 2020: Philips introduces a new generation of portable anesthesia delivery systems for critical care.

- 2021: Medtronic PLC acquires a leading manufacturer of advanced anesthetic sensors, expanding its disposables portfolio.

- 2022: Health Canada approves a novel biodegradable endotracheal tube from a Canadian startup.

- 2023: Ambu A/S expands its presence in the Canadian market with a new distribution agreement for its anesthesia consumables.

- 2024: Draegerwerk AG announces strategic investment in R&D for next-generation anesthesia ventilators.

In-Depth Canada Anesthesia Devices Market Market Outlook

- 2019: Launch of enhanced anesthesia workstation with integrated AI-driven monitoring by GE Healthcare.

- 2020: Philips introduces a new generation of portable anesthesia delivery systems for critical care.

- 2021: Medtronic PLC acquires a leading manufacturer of advanced anesthetic sensors, expanding its disposables portfolio.

- 2022: Health Canada approves a novel biodegradable endotracheal tube from a Canadian startup.

- 2023: Ambu A/S expands its presence in the Canadian market with a new distribution agreement for its anesthesia consumables.

- 2024: Draegerwerk AG announces strategic investment in R&D for next-generation anesthesia ventilators.

In-Depth Canada Anesthesia Devices Market Market Outlook

The future of the Canada anesthesia devices market is exceptionally promising, driven by an unwavering commitment to patient safety and an escalating demand for advanced healthcare solutions. Growth accelerators such as the pervasive integration of AI and IoT technologies will continue to enhance the intelligence and connectivity of anesthesia equipment. Strategic collaborations aimed at developing user-friendly, data-rich platforms will foster innovation and streamline clinical workflows. The market's trajectory points towards personalized medicine, with devices capable of tailoring anesthetic delivery to individual patient needs, thereby optimizing outcomes and minimizing adverse events. Furthermore, the increasing adoption of home-based care models will spur the development of compact, remotely manageable anesthesia devices. Overall, the market is set for sustained expansion and technological evolution.

Canada Anesthesia Devices Market Segmentation

-

1. Product Type

-

1.1. Anesthesia Machines

- 1.1.1. Anesthesia Workstation

- 1.1.2. Anesthesia Delivery Machines

- 1.1.3. Anesthesia Ventilators

- 1.1.4. Anesthesia Monitors

-

1.2. Anesthesia Disposables & Accessories

- 1.2.1. Anesthesia Circuits (Breathing Circuits)

- 1.2.2. Anesthesia Masks

- 1.2.3. Endotracheal Tubes (ETTs)

- 1.2.4. Laryngeal Mask Airways(LMAs)

-

1.1. Anesthesia Machines

Canada Anesthesia Devices Market Segmentation By Geography

- 1. Canada

Canada Anesthesia Devices Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 6.90% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Geriatric Population and a Rise in the Number of Surgical Procedures Requiring Anesthesia; Large Patient Pool Due to Chronic Diseases; Technological Advancements in Anesthesia Technology

- 3.3. Market Restrains

- 3.3.1. ; Difficulties Associated with the Usage of Anesthesia Devices; Issues regarding Product Recalls

- 3.4. Market Trends

- 3.4.1. Anesthesia Monitors Sub-segment is Expected to Register a High CAGR in the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Anesthesia Machines

- 5.1.1.1. Anesthesia Workstation

- 5.1.1.2. Anesthesia Delivery Machines

- 5.1.1.3. Anesthesia Ventilators

- 5.1.1.4. Anesthesia Monitors

- 5.1.2. Anesthesia Disposables & Accessories

- 5.1.2.1. Anesthesia Circuits (Breathing Circuits)

- 5.1.2.2. Anesthesia Masks

- 5.1.2.3. Endotracheal Tubes (ETTs)

- 5.1.2.4. Laryngeal Mask Airways(LMAs)

- 5.1.1. Anesthesia Machines

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Eastern Canada Canada Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 7. Western Canada Canada Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 8. Central Canada Canada Anesthesia Devices Market Analysis, Insights and Forecast, 2019-2031

- 9. Competitive Analysis

- 9.1. Market Share Analysis 2024

- 9.2. Company Profiles

- 9.2.1 Smiths Medical

- 9.2.1.1. Overview

- 9.2.1.2. Products

- 9.2.1.3. SWOT Analysis

- 9.2.1.4. Recent Developments

- 9.2.1.5. Financials (Based on Availability)

- 9.2.2 Philips

- 9.2.2.1. Overview

- 9.2.2.2. Products

- 9.2.2.3. SWOT Analysis

- 9.2.2.4. Recent Developments

- 9.2.2.5. Financials (Based on Availability)

- 9.2.3 GE Healthcare

- 9.2.3.1. Overview

- 9.2.3.2. Products

- 9.2.3.3. SWOT Analysis

- 9.2.3.4. Recent Developments

- 9.2.3.5. Financials (Based on Availability)

- 9.2.4 Teleflex Inc *List Not Exhaustive

- 9.2.4.1. Overview

- 9.2.4.2. Products

- 9.2.4.3. SWOT Analysis

- 9.2.4.4. Recent Developments

- 9.2.4.5. Financials (Based on Availability)

- 9.2.5 Fisher & Paykel Healthcare

- 9.2.5.1. Overview

- 9.2.5.2. Products

- 9.2.5.3. SWOT Analysis

- 9.2.5.4. Recent Developments

- 9.2.5.5. Financials (Based on Availability)

- 9.2.6 Mindray Medical International Limited

- 9.2.6.1. Overview

- 9.2.6.2. Products

- 9.2.6.3. SWOT Analysis

- 9.2.6.4. Recent Developments

- 9.2.6.5. Financials (Based on Availability)

- 9.2.7 Ambu A/S

- 9.2.7.1. Overview

- 9.2.7.2. Products

- 9.2.7.3. SWOT Analysis

- 9.2.7.4. Recent Developments

- 9.2.7.5. Financials (Based on Availability)

- 9.2.8 Medtronic PLC

- 9.2.8.1. Overview

- 9.2.8.2. Products

- 9.2.8.3. SWOT Analysis

- 9.2.8.4. Recent Developments

- 9.2.8.5. Financials (Based on Availability)

- 9.2.9 B Braun Melsungen AG

- 9.2.9.1. Overview

- 9.2.9.2. Products

- 9.2.9.3. SWOT Analysis

- 9.2.9.4. Recent Developments

- 9.2.9.5. Financials (Based on Availability)

- 9.2.10 Draegerwerk AG

- 9.2.10.1. Overview

- 9.2.10.2. Products

- 9.2.10.3. SWOT Analysis

- 9.2.10.4. Recent Developments

- 9.2.10.5. Financials (Based on Availability)

- 9.2.1 Smiths Medical

List of Figures

- Figure 1: Canada Anesthesia Devices Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Canada Anesthesia Devices Market Share (%) by Company 2024

List of Tables

- Table 1: Canada Anesthesia Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Canada Anesthesia Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 3: Canada Anesthesia Devices Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Canada Anesthesia Devices Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: Eastern Canada Canada Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Western Canada Canada Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Central Canada Canada Anesthesia Devices Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Canada Anesthesia Devices Market Revenue Million Forecast, by Product Type 2019 & 2032

- Table 9: Canada Anesthesia Devices Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Anesthesia Devices Market?

The projected CAGR is approximately 6.90%.

2. Which companies are prominent players in the Canada Anesthesia Devices Market?

Key companies in the market include Smiths Medical, Philips, GE Healthcare, Teleflex Inc *List Not Exhaustive, Fisher & Paykel Healthcare, Mindray Medical International Limited, Ambu A/S, Medtronic PLC, B Braun Melsungen AG, Draegerwerk AG.

3. What are the main segments of the Canada Anesthesia Devices Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 674.88 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Geriatric Population and a Rise in the Number of Surgical Procedures Requiring Anesthesia; Large Patient Pool Due to Chronic Diseases; Technological Advancements in Anesthesia Technology.

6. What are the notable trends driving market growth?

Anesthesia Monitors Sub-segment is Expected to Register a High CAGR in the Forecast Period.

7. Are there any restraints impacting market growth?

; Difficulties Associated with the Usage of Anesthesia Devices; Issues regarding Product Recalls.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Anesthesia Devices Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Anesthesia Devices Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Anesthesia Devices Market?

To stay informed about further developments, trends, and reports in the Canada Anesthesia Devices Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence