Key Insights

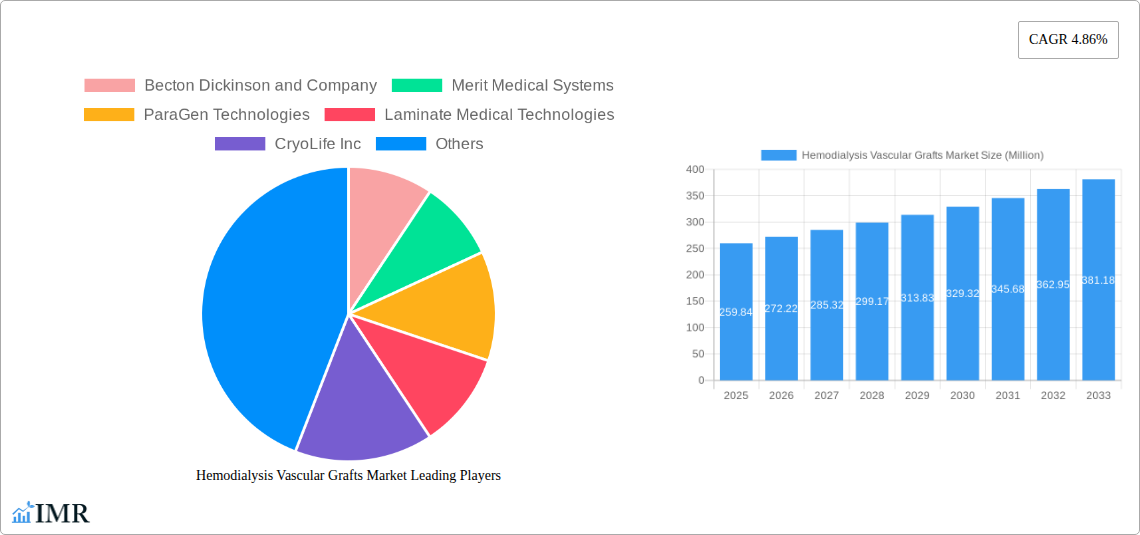

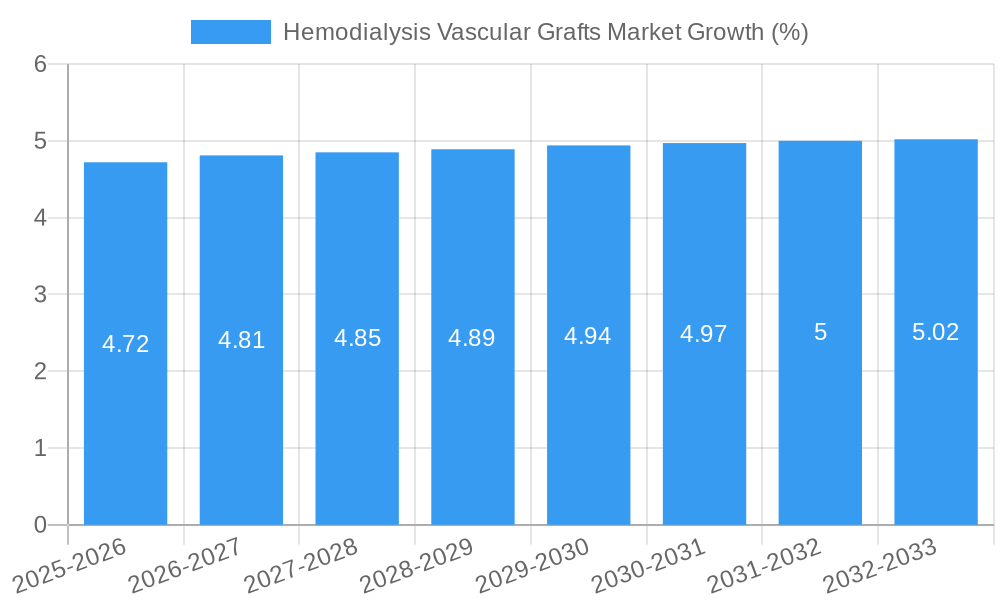

The global Hemodialysis Vascular Grafts Market is poised for significant expansion, currently valued at an estimated \$259.84 million. This growth is propelled by a projected Compound Annual Growth Rate (CAGR) of 4.86% over the forecast period of 2025-2033. The increasing prevalence of chronic kidney disease (CKD) worldwide, coupled with an aging global population, serves as a primary driver for this market. As CKD progresses to end-stage renal disease (ESRD), hemodialysis becomes a crucial life-sustaining treatment, directly escalating the demand for reliable vascular access solutions like hemodialysis grafts. Technological advancements in graft materials, aiming to improve biocompatibility, reduce infection rates, and enhance long-term patency, are also significant contributors to market growth. Companies are investing in research and development to create innovative grafts that offer superior performance and patient outcomes.

The market segmentation reveals a diverse landscape of materials, with Polyester and Polytetrafluoroethylene (PTFE) currently dominating due to their established efficacy and widespread use. However, the rising interest and advancements in Biological Materials, including human saphenous veins and tissue-engineered alternatives, signal a promising future trend. These biological options offer potential advantages in terms of reduced rejection and improved integration. Key market restraints include the high cost associated with advanced graft technologies and the availability of alternative vascular access methods like fistulas and catheters, which can sometimes present perceived lower-risk options. Despite these challenges, the continuous innovation and the growing need for effective hemodialysis access solutions will likely sustain robust market growth. Major players like Becton Dickinson and Company, Merit Medical Systems, and W L Gore & Associates Inc. are actively shaping this market through product development and strategic collaborations.

Hemodialysis Vascular Grafts Market: Comprehensive Analysis and Future Outlook (2019-2033)

Unlock critical insights into the global Hemodialysis Vascular Grafts Market. This in-depth report provides a data-driven forecast, analyzing market dynamics, growth trends, regional dominance, product innovation, and key players. Essential for understanding the evolving landscape of vascular access solutions in hemodialysis.

Hemodialysis Vascular Grafts Market Dynamics & Structure

The Hemodialysis Vascular Grafts Market is characterized by a moderately concentrated landscape, with leading players like W.L. Gore & Associates Inc., Becton Dickinson and Company, and Getinge AB holding significant market share. Technological innovation remains a paramount driver, with ongoing research and development focused on enhancing graft patency rates, reducing infection risks, and improving biocompatibility. Advancements in biomaterials, such as improved PTFE formulations and the exploration of tissue-engineered grafts, are key areas of focus. Regulatory frameworks, including FDA approvals and CE marking, play a crucial role in market entry and product lifecycle management, ensuring patient safety and efficacy. Competitive product substitutes, primarily autogenous fistulas and synthetic grafts, present an ongoing challenge, with the choice often dictated by patient anatomy and surgeon preference. End-user demographics are increasingly influenced by the aging global population and the rising prevalence of chronic kidney disease (CKD), leading to a consistent demand for reliable vascular access solutions. Mergers and acquisitions (M&A) activity, while not at an extreme level, has been observed as companies seek to expand their product portfolios and geographic reach. For instance, strategic acquisitions of smaller innovative firms can accelerate the integration of novel technologies.

- Market Concentration: Moderately concentrated, with 3-5 major players holding a substantial portion of the market share.

- Technological Innovation Drivers: Enhanced patency, reduced infection rates, improved biocompatibility, novel biomaterials, and minimally invasive implantation techniques.

- Regulatory Frameworks: Stringent FDA and CE marking requirements, impacting product development timelines and market access.

- Competitive Product Substitutes: Autogenous arteriovenous fistulas, synthetic grafts, and other less common vascular access methods.

- End-User Demographics: Growing aging population, increasing incidence of Chronic Kidney Disease (CKD), and a rising demand for long-term dialysis solutions.

- M&A Trends: Strategic acquisitions for portfolio expansion and technological integration.

Hemodialysis Vascular Grafts Market Growth Trends & Insights

The Hemodialysis Vascular Grafts Market is poised for robust growth over the forecast period, driven by a confluence of escalating incidences of kidney failure globally and continuous advancements in vascular access technology. The market size, estimated at approximately USD 500 million in 2025, is projected to expand at a Compound Annual Growth Rate (CAGR) of XX% through 2033, reaching an estimated USD 950 million by the end of the period. This upward trajectory is primarily fueled by the increasing prevalence of conditions such as diabetes and hypertension, which are leading causes of end-stage renal disease (ESRD). The adoption rates of advanced hemodialysis vascular grafts are also seeing a significant uplift as healthcare providers and patients recognize their advantages over less durable or more invasive access methods. Technological disruptions are central to this market's evolution. Innovations such as antimicrobial-impregnated grafts, grafts with enhanced thrombotic resistance, and grafts designed for easier cannulation are gaining traction. These advancements are directly addressing some of the key limitations of traditional grafts, such as infection and occlusion, thereby improving patient outcomes and reducing healthcare costs. Consumer behavior shifts are also playing a role; patients are becoming more informed about their treatment options and are actively seeking the most effective and long-lasting vascular access solutions. This, coupled with increased healthcare expenditure in emerging economies and a growing emphasis on preventative healthcare, is creating a fertile ground for market expansion. The development of bio-engineered grafts that mimic natural vascular tissue is a particularly exciting frontier, promising even greater biocompatibility and reduced complications. The push towards value-based healthcare is also incentivizing the adoption of durable and reliable grafts that minimize re-interventions and hospitalizations. The parent market, which encompasses all vascular access devices for dialysis, is a critical benchmark, and within it, hemodialysis vascular grafts represent a significant and growing segment. The child market for specifically biomaterial-based vascular grafts is experiencing even faster growth due to their perceived advantages in biocompatibility and reduced rejection rates.

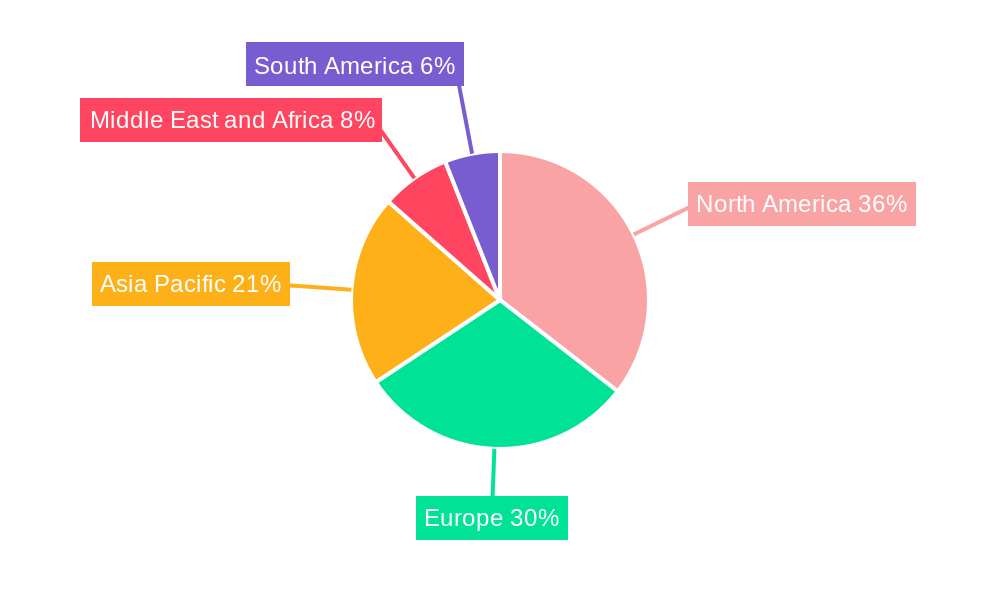

Dominant Regions, Countries, or Segments in Hemodialysis Vascular Grafts Market

North America currently dominates the Hemodialysis Vascular Grafts Market, propelled by a high prevalence of chronic kidney disease, advanced healthcare infrastructure, and a strong emphasis on technological innovation and adoption. The United States, in particular, accounts for a substantial share of this regional dominance, driven by robust reimbursement policies and a large patient pool requiring long-term dialysis. The availability of sophisticated medical facilities and a high concentration of key market players contribute to its leading position. The adoption of Polytetrafluoroethylene (PTFE) grafts has historically been very strong in this region due to their established track record, durability, and biocompatibility. However, there's a growing interest and investment in advanced materials and tissue-engineered solutions.

North America (Dominant Region):

- Key Drivers: High CKD prevalence, well-established healthcare infrastructure, strong R&D investment, favorable reimbursement policies.

- Market Share: Estimated to hold over XX% of the global market.

- Growth Potential: Steady growth expected, with increasing adoption of next-generation grafts.

- Country Focus: United States leads regional growth.

Europe (Significant Market):

- Key Drivers: Aging population, rising ESRD rates, supportive regulatory environment for medical devices, increasing awareness of dialysis access importance.

- Market Share: Holds the second-largest market share.

- Growth Potential: Moderate to strong growth, with Germany and the UK being key contributors.

- Segment Focus: Significant use of both PTFE and polyester grafts, with increasing exploration of biological materials.

Asia Pacific (Fastest Growing Region):

- Key Drivers: Rapidly growing population, increasing incidence of diabetes and hypertension, expanding healthcare access, government initiatives for improving dialysis services, cost-effectiveness driving adoption of synthetic grafts.

- Market Share: Fastest growth rate globally.

- Growth Potential: High growth potential driven by unmet demand and increasing disposable incomes.

- Country Focus: China and India are emerging as major markets.

- Raw Material Trend: Growing preference for cost-effective Polyester and Polyurethane grafts, with increasing research into biological materials.

Raw Material Segment: Polytetrafluoroethylene (PTFE):

- Dominance: Historically the most dominant raw material due to its established efficacy, biocompatibility, and resistance to infection and thrombosis.

- Market Share: Holds a significant portion of the market, estimated at XX%.

- Key Advantages: Smooth inner surface, good patency rates, and ease of implantation.

- Challenges: Potential for stricture formation and challenges in revision compared to biological options.

Raw Material Segment: Polyester:

- Growth: Experiencing steady growth, particularly in cost-sensitive markets.

- Market Share: Estimated at XX%.

- Key Advantages: Cost-effectiveness and widespread availability.

- Challenges: Can have higher rates of infection and thrombosis compared to PTFE in some applications.

Raw Material Segment: Biological Materials:

- Emerging Trend: Significant growth potential driven by the pursuit of superior biocompatibility and reduced immunogenic responses.

- Market Share: Currently smaller but rapidly expanding, estimated at XX%.

- Key Advantages: Mimics natural vessels, potentially lower infection and thrombosis rates.

- Challenges: Availability, cost, and long-term data are still being established.

Hemodialysis Vascular Grafts Market Product Landscape

The product landscape of the Hemodialysis Vascular Grafts Market is defined by continuous innovation aimed at enhancing graft performance and patient outcomes. Key advancements include the development of antimicrobial-coated grafts that significantly reduce the risk of infection, a major complication in hemodialysis. Furthermore, research is focused on creating grafts with superior thrombotic resistance and extended patency rates, minimizing the need for frequent interventions. Innovations in graft materials, including improved polytetrafluoroethylene (PTFE) formulations and the growing exploration of bio-engineered tissues derived from human saphenous veins or tissue-engineered materials, are pushing the boundaries of biocompatibility and patient tolerance. These novel products offer unique selling propositions such as reduced inflammatory responses and improved integration with host tissues, ultimately leading to more durable and reliable vascular access for patients requiring lifelong hemodialysis.

Key Drivers, Barriers & Challenges in Hemodialysis Vascular Grafts Market

Key Drivers: The Hemodialysis Vascular Grafts Market is propelled by a growing global incidence of End-Stage Renal Disease (ESRD), largely driven by increasing rates of diabetes and hypertension. Technological advancements in biomaterials and graft design are leading to improved patency rates and reduced complication risks, making grafts a more attractive option. Furthermore, favorable reimbursement policies in developed nations and expanding healthcare access in emerging economies are boosting market penetration. The demand for durable and reliable vascular access solutions that improve patient quality of life is a significant underlying driver.

Barriers & Challenges: Despite its growth potential, the market faces several challenges. The established effectiveness and lower upfront cost of autogenous arteriovenous fistulas continue to pose a competitive barrier. High costs associated with novel, advanced graft technologies can limit their adoption, especially in resource-constrained settings. Stringent regulatory approval processes can lead to extended product development timelines and increased market entry costs. Supply chain disruptions, particularly for specialized biomaterials, and the inherent risk of infection and thrombosis associated with any foreign body implant remain persistent challenges that manufacturers and clinicians must actively manage. The need for skilled surgical implantation also presents a barrier in certain regions.

Emerging Opportunities in Hemodialysis Vascular Grafts Market

Emerging opportunities within the Hemodialysis Vascular Grafts Market lie in the development and widespread adoption of next-generation biomaterial grafts, including tissue-engineered vascular constructs. These offer the potential for superior biocompatibility and reduced immunogenicity, addressing key limitations of current synthetic grafts. Untapped markets in developing economies, where the prevalence of kidney disease is rising but access to advanced dialysis solutions is limited, present significant growth potential. Furthermore, innovations in minimally invasive implantation techniques for vascular grafts could broaden their applicability and reduce procedural risks. The increasing focus on personalized medicine also opens avenues for customized graft solutions tailored to individual patient needs and anatomies.

Growth Accelerators in the Hemodialysis Vascular Grafts Market Industry

Several catalysts are accelerating the growth of the Hemodialysis Vascular Grafts Market. Technological breakthroughs in biomaterial science are leading to the creation of grafts with enhanced biocompatibility, increased resistance to infection, and prolonged patency rates. Strategic partnerships between graft manufacturers and research institutions are fostering rapid innovation and the translation of novel technologies into clinical practice. Market expansion strategies, particularly targeting underserved regions in Asia Pacific and Latin America, are opening up new revenue streams. Furthermore, increasing global healthcare expenditure and a growing emphasis on improving the quality of life for dialysis patients are creating a supportive environment for market growth. The continuous improvement in graft designs, aimed at simplifying implantation procedures and reducing post-operative complications, also acts as a significant growth accelerator.

Key Players Shaping the Hemodialysis Vascular Grafts Market Market

- Becton Dickinson and Company

- Merit Medical Systems

- ParaGen Technologies

- Laminate Medical Technologies

- CryoLife Inc

- LeMaitre

- Vascudyne Inc

- W L Gore & Associates Inc

- InnAVasc Medical Inc

- Getinge AB

- BIOVIC Sdn Bhd

Notable Milestones in Hemodialysis Vascular Grafts Market Sector

- May 2024: Healionics Corporation, a company focused on developing biomaterial-based medical devices, was awarded a USD 1.25 million Small Business Innovation Research grant by the National Heart, Lung, and Blood Institute to commercialize its STARgraft vascular graft.

- September 2023: South Africa observed National Kidney Awareness Week under the global theme "Kidney Health for All." The awareness emphasized the life-saving role of vascular access in hemodialysis.

In-Depth Hemodialysis Vascular Grafts Market Market Outlook

The future outlook for the Hemodialysis Vascular Grafts Market is exceptionally promising, driven by sustained growth accelerators and a clear path for innovation. The increasing global burden of kidney disease will continue to fuel demand for effective vascular access solutions. Strategic investments in research and development for advanced biomaterials and bio-engineered grafts are expected to yield groundbreaking products with improved patient outcomes. Expansion into emerging markets, coupled with an evolving regulatory landscape that increasingly supports innovative medical devices, will create significant growth opportunities. The market is set to witness a gradual shift towards more biocompatible and infection-resistant graft options, potentially transforming the standard of care in hemodialysis vascular access.

Hemodialysis Vascular Grafts Market Segmentation

-

1. Raw Material

- 1.1. Polyester

- 1.2. Polytetrafluoroethylene

- 1.3. Polyurethane

-

1.4. Biological Materials

- 1.4.1. Human Saphenous & Umbilical Veins

- 1.4.2. Tissue Engineered Materials

Hemodialysis Vascular Grafts Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Hemodialysis Vascular Grafts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 4.86% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of End-Stage Renal Disease (ESRD); Rising Geriatric Population

- 3.3. Market Restrains

- 3.3.1. High Cost and Alternative Treatment Options

- 3.4. Market Trends

- 3.4.1. The Polytetrafluoroethylene Segment is Expected to Witness Significant Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 5.1.1. Polyester

- 5.1.2. Polytetrafluoroethylene

- 5.1.3. Polyurethane

- 5.1.4. Biological Materials

- 5.1.4.1. Human Saphenous & Umbilical Veins

- 5.1.4.2. Tissue Engineered Materials

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Europe

- 5.2.3. Asia Pacific

- 5.2.4. Middle East and Africa

- 5.2.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Raw Material

- 6. North America Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 6.1.1. Polyester

- 6.1.2. Polytetrafluoroethylene

- 6.1.3. Polyurethane

- 6.1.4. Biological Materials

- 6.1.4.1. Human Saphenous & Umbilical Veins

- 6.1.4.2. Tissue Engineered Materials

- 6.1. Market Analysis, Insights and Forecast - by Raw Material

- 7. Europe Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 7.1.1. Polyester

- 7.1.2. Polytetrafluoroethylene

- 7.1.3. Polyurethane

- 7.1.4. Biological Materials

- 7.1.4.1. Human Saphenous & Umbilical Veins

- 7.1.4.2. Tissue Engineered Materials

- 7.1. Market Analysis, Insights and Forecast - by Raw Material

- 8. Asia Pacific Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 8.1.1. Polyester

- 8.1.2. Polytetrafluoroethylene

- 8.1.3. Polyurethane

- 8.1.4. Biological Materials

- 8.1.4.1. Human Saphenous & Umbilical Veins

- 8.1.4.2. Tissue Engineered Materials

- 8.1. Market Analysis, Insights and Forecast - by Raw Material

- 9. Middle East and Africa Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 9.1.1. Polyester

- 9.1.2. Polytetrafluoroethylene

- 9.1.3. Polyurethane

- 9.1.4. Biological Materials

- 9.1.4.1. Human Saphenous & Umbilical Veins

- 9.1.4.2. Tissue Engineered Materials

- 9.1. Market Analysis, Insights and Forecast - by Raw Material

- 10. South America Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 10.1.1. Polyester

- 10.1.2. Polytetrafluoroethylene

- 10.1.3. Polyurethane

- 10.1.4. Biological Materials

- 10.1.4.1. Human Saphenous & Umbilical Veins

- 10.1.4.2. Tissue Engineered Materials

- 10.1. Market Analysis, Insights and Forecast - by Raw Material

- 11. North America Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Hemodialysis Vascular Grafts Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Merit Medical Systems

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 ParaGen Technologies

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Laminate Medical Technologies

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 CryoLife Inc

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 LeMaitre

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Vascudyne Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 W L Gore & Associates Inc

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 InnAVasc Medical Inc

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Getinge AB

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 BIOVIC Sdn Bhd

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Hemodialysis Vascular Grafts Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: North America Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 3: North America Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 5: Europe Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 7: Asia Pacific Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 9: Middle East and Africa Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 11: South America Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Hemodialysis Vascular Grafts Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 13: North America Hemodialysis Vascular Grafts Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 14: North America Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 15: North America Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 16: Europe Hemodialysis Vascular Grafts Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 17: Europe Hemodialysis Vascular Grafts Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 18: Europe Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 19: Europe Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 20: Asia Pacific Hemodialysis Vascular Grafts Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 21: Asia Pacific Hemodialysis Vascular Grafts Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 22: Asia Pacific Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 23: Asia Pacific Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 24: Middle East and Africa Hemodialysis Vascular Grafts Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 25: Middle East and Africa Hemodialysis Vascular Grafts Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 26: Middle East and Africa Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 27: Middle East and Africa Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

- Figure 28: South America Hemodialysis Vascular Grafts Market Revenue (Million), by Raw Material 2024 & 2032

- Figure 29: South America Hemodialysis Vascular Grafts Market Revenue Share (%), by Raw Material 2024 & 2032

- Figure 30: South America Hemodialysis Vascular Grafts Market Revenue (Million), by Country 2024 & 2032

- Figure 31: South America Hemodialysis Vascular Grafts Market Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 3: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Region 2019 & 2032

- Table 4: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 5: United States Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 6: Canada Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 7: Mexico Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 8: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 9: Germany Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 10: United Kingdom Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 11: France Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 12: Italy Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 13: Spain Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: Rest of Europe Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 15: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: China Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 17: Japan Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: India Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 19: Australia Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 20: South Korea Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 21: Rest of Asia Pacific Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 23: GCC Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: South Africa Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 25: Rest of Middle East and Africa Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 27: Brazil Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 28: Argentina Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 29: Rest of South America Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 31: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 32: United States Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 33: Canada Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 35: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 36: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 37: Germany Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: United Kingdom Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 39: France Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Italy Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 41: Spain Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 43: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 44: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 45: China Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: Japan Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 47: India Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Australia Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 49: South Korea Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Rest of Asia Pacific Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 51: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 52: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 53: GCC Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: South Africa Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 55: Rest of Middle East and Africa Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Raw Material 2019 & 2032

- Table 57: Global Hemodialysis Vascular Grafts Market Revenue Million Forecast, by Country 2019 & 2032

- Table 58: Brazil Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 59: Argentina Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 60: Rest of South America Hemodialysis Vascular Grafts Market Revenue (Million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hemodialysis Vascular Grafts Market?

The projected CAGR is approximately 4.86%.

2. Which companies are prominent players in the Hemodialysis Vascular Grafts Market?

Key companies in the market include Becton Dickinson and Company, Merit Medical Systems, ParaGen Technologies, Laminate Medical Technologies, CryoLife Inc, LeMaitre, Vascudyne Inc, W L Gore & Associates Inc, InnAVasc Medical Inc, Getinge AB, BIOVIC Sdn Bhd.

3. What are the main segments of the Hemodialysis Vascular Grafts Market?

The market segments include Raw Material.

4. Can you provide details about the market size?

The market size is estimated to be USD 259.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of End-Stage Renal Disease (ESRD); Rising Geriatric Population.

6. What are the notable trends driving market growth?

The Polytetrafluoroethylene Segment is Expected to Witness Significant Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost and Alternative Treatment Options.

8. Can you provide examples of recent developments in the market?

May 2024: Healionics Corporation, a company focused on developing biomaterial-based medical devices, was awarded a USD 1.25 million Small Business Innovation Research grant by the National Heart, Lung, and Blood Institute to commercialize its STARgraft vascular graft.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hemodialysis Vascular Grafts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hemodialysis Vascular Grafts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hemodialysis Vascular Grafts Market?

To stay informed about further developments, trends, and reports in the Hemodialysis Vascular Grafts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence