Key Insights

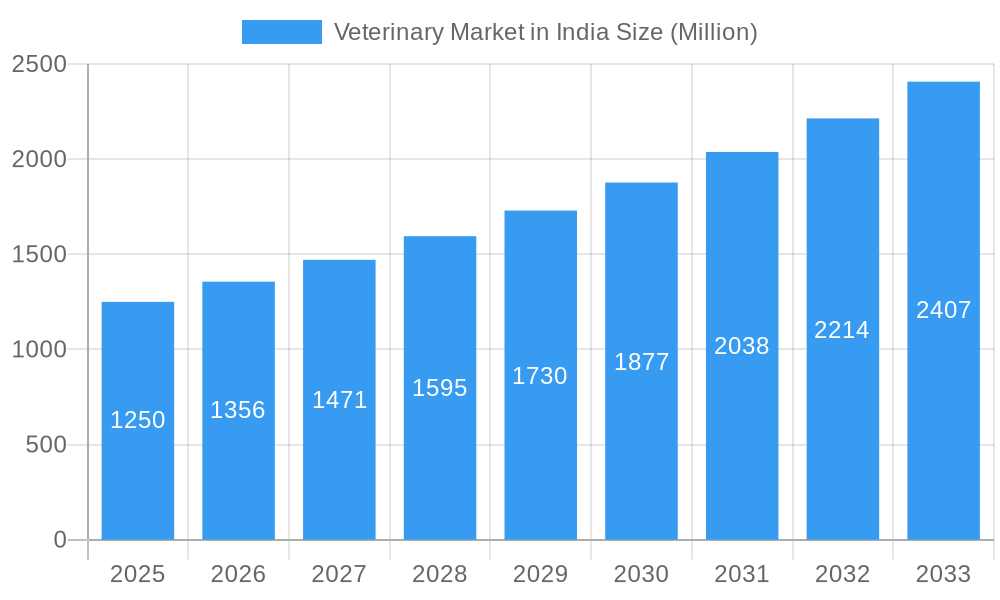

The Indian veterinary market is poised for significant expansion, projected to reach a substantial market size of $1.25 billion by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 8.63%. This robust growth is primarily fueled by increasing pet ownership, rising disposable incomes leading to greater expenditure on animal healthcare, and a growing awareness of zoonotic diseases and their prevention. The demand for advanced veterinary diagnostics, including immunodiagnostic tests and molecular diagnostics, is escalating as owners seek more accurate and timely disease detection. Furthermore, the rising global concerns around food safety and animal welfare are driving the adoption of high-quality veterinary pharmaceuticals, particularly anti-infectives and vaccines, to ensure healthy livestock and poultry. The "Other Therapeutics" segment, likely encompassing a range of specialized treatments and preventative care solutions, is also expected to see considerable uptake.

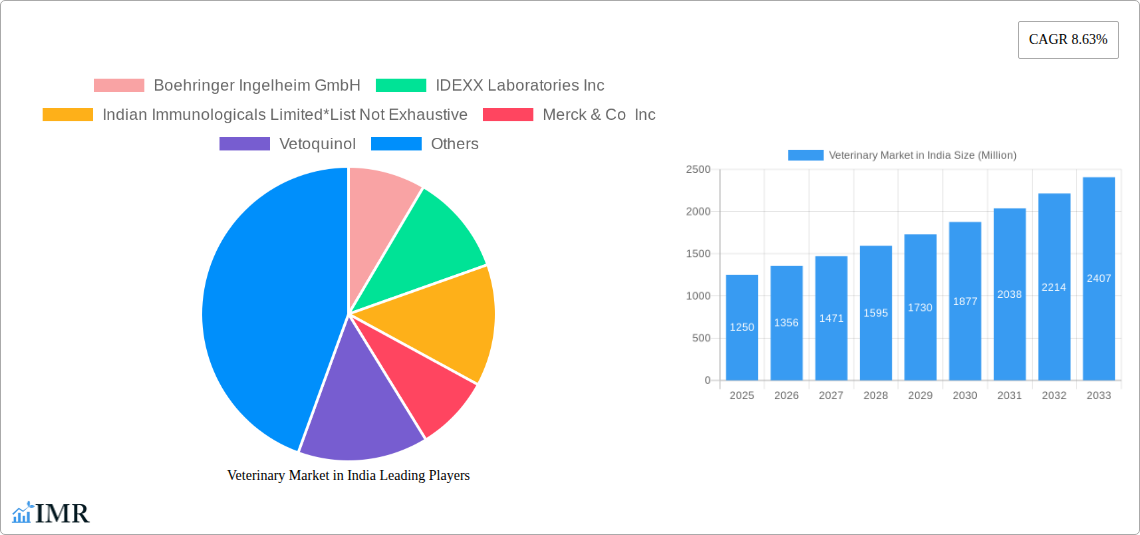

Veterinary Market in India Market Size (In Billion)

The market's trajectory is further supported by continuous innovation from key players like Zoetis Inc., Boehringer Ingelheim GmbH, and Merck & Co. Inc., who are introducing novel products and services. While the market demonstrates strong growth potential, it faces certain restraints. These may include the limited availability of skilled veterinary professionals in remote areas, the cost of advanced veterinary services and products for a segment of the population, and evolving regulatory landscapes. However, the burgeoning demand across diverse animal types, from companion animals like dogs and cats to crucial livestock such as poultry and ruminants, indicates a widespread opportunity. Segments like medical feed additives are also gaining traction as a proactive approach to animal health and productivity in the agricultural sector, underscoring the multifaceted nature of this growing market.

Veterinary Market in India Company Market Share

This in-depth report provides a definitive analysis of the Veterinary Market in India, offering critical insights for industry stakeholders, investors, and decision-makers. Covering the period from 2019 to 2033, with a base year of 2025 and a detailed forecast from 2025 to 2033, this study meticulously examines market dynamics, growth trends, product landscapes, and the competitive environment. We delve into both the parent veterinary market and its crucial child veterinary market segments, providing a holistic view of this rapidly expanding sector. This report is meticulously researched, ensuring no placeholder values and presenting all figures in Million units for clarity and direct applicability.

Veterinary Market in India Market Dynamics & Structure

The Indian veterinary market exhibits a dynamic and evolving structure, characterized by increasing concentration in specific niches driven by technological advancements and a growing pet population. The market is influenced by robust regulatory frameworks aimed at ensuring animal health and food safety, which simultaneously act as both drivers for quality-focused players and potential barriers for new entrants. Technological innovation, particularly in diagnostics and vaccine development, is a key differentiator. Competitive product substitutes are emerging, especially in the generics segment, necessitating continuous innovation from established players. End-user demographics are shifting, with a rising middle class increasingly investing in premium pet care, while the livestock sector continues to be driven by demand for efficient meat and milk production. Mergers and acquisitions (M&A) are becoming more prevalent as companies seek to consolidate market share, expand their product portfolios, and gain access to new technologies and distribution networks. For instance, the past few years have seen several strategic alliances and acquisitions aimed at strengthening presence in specific therapeutic areas or expanding geographical reach within India.

- Market Concentration: Moderate to high in specific segments like vaccines and diagnostics, with key global and domestic players holding significant shares.

- Technological Innovation Drivers: Advancements in molecular diagnostics, biotechnology, and novel drug delivery systems are transforming animal healthcare.

- Regulatory Frameworks: Stringent government regulations for animal drug approval, manufacturing standards, and disease control initiatives are shaping market entry and product development.

- Competitive Product Substitutes: Growing availability of generic veterinary drugs and the emergence of biosecurity solutions for livestock.

- End-User Demographics: Increasing disposable incomes, urbanization, and a growing awareness of zoonotic diseases are fueling demand for advanced animal healthcare.

- M&A Trends: Companies are actively pursuing M&A to enhance R&D capabilities, broaden product offerings, and expand their distribution networks across the vast Indian subcontinent.

Veterinary Market in India Growth Trends & Insights

The Indian veterinary market is poised for remarkable growth, driven by a confluence of factors that are reshaping animal healthcare and consumption patterns. The market size is projected to expand significantly, with a compelling Compound Annual Growth Rate (CAGR) over the forecast period. This expansion is underpinned by escalating adoption rates of advanced veterinary products and services, fueled by increasing pet humanization and a growing emphasis on animal welfare. Technological disruptions, such as the advent of AI-powered diagnostic tools and personalized medicine approaches for animals, are accelerating market evolution. Consumer behavior shifts are equally influential; owners are now more proactive in seeking preventive care, leading to higher demand for vaccines, parasiticides, and regular health check-ups. The livestock sector, crucial for India's economy, is also witnessing a paradigm shift with increased investment in disease prevention and treatment to ensure food security and export potential. This proactive approach, coupled with enhanced veterinary infrastructure and awareness campaigns, is creating a fertile ground for sustained market penetration across both companion and production animals. The digital transformation of veterinary services, including telemedicine and online pharmacies, is further enhancing accessibility and convenience, thereby contributing to the overall market surge.

Dominant Regions, Countries, or Segments in Veterinary Market in India

The Veterinary Market in India is witnessing robust growth, with specific segments and regions taking the lead. Within the Product: By Therapeutics segment, Vaccines are a dominant force, driven by the critical need for disease prevention in both livestock and companion animals. The government's focus on eradicating economically important diseases, coupled with the increasing incidence of emerging infectious diseases, fuels significant demand. This is further propelled by initiatives aimed at ensuring national vaccine security.

- Dominant Therapeutic Segment: Vaccines.

- Key Drivers: Government-led vaccination programs for livestock (e.g., Foot and Mouth Disease), rising incidence of zoonotic diseases, and increasing pet ownership driving demand for pet vaccines.

- Market Share: Estimated to hold a substantial portion of the therapeutics segment due to its essential role in preventive healthcare.

- Growth Potential: High, driven by new product development and expanded vaccination coverage.

Within the Animal Type segment, Poultry and Dogs and Cats are emerging as significant growth drivers. The poultry sector is a cornerstone of India's food supply, necessitating efficient disease management and growth promotion through veterinary interventions. The burgeoning pet care market, fueled by urbanization and increasing disposable incomes, is leading to a surge in demand for high-quality pet health products and services.

- Dominant Animal Type Segments: Poultry and Dogs and Cats.

- Poultry:

- Key Drivers: India's status as a major poultry producer, demand for meat and eggs, and the need for efficient disease control in commercial farming.

- Market Share: Significant contribution to the livestock veterinary market.

- Growth Potential: Steadily growing with industry consolidation and technological adoption.

- Dogs and Cats:

- Key Drivers: Rising pet humanization, increasing disposable incomes, growing awareness of pet health and wellness, and a larger urban pet population.

- Market Share: Rapidly expanding segment with high potential for premium products and services.

- Growth Potential: Exponential growth expected due to changing societal attitudes towards pets.

- Poultry:

Geographically, the Western and Southern regions of India often demonstrate higher market penetration for advanced veterinary products and services due to better infrastructure, higher disposable incomes, and a more developed pet care ecosystem. However, government initiatives and the sheer volume of livestock in other regions ensure consistent demand across the nation.

Veterinary Market in India Product Landscape

The Indian veterinary product landscape is characterized by continuous innovation and diversification. Vaccines remain a cornerstone, with advancements focusing on multi-valent formulations and novel delivery systems to combat prevalent diseases. Parasiticides are seeing innovation in long-acting formulations and targeted treatments for both internal and external parasites. Anti-infectives are witnessing a push towards responsible use and the development of newer classes of antibiotics to combat antimicrobial resistance. Medical feed additives are increasingly being utilized to enhance livestock health and productivity. In diagnostics, immunodiagnostic tests and molecular diagnostics are gaining prominence for rapid and accurate disease detection. Diagnostic imaging and clinical chemistry are becoming more sophisticated, offering deeper insights into animal health.

Key Drivers, Barriers & Challenges in Veterinary Market in India

Key Drivers:

- Rising Pet Humanization: Increased adoption and the perception of pets as family members are driving demand for advanced healthcare.

- Growth in Livestock Sector: India's status as a major producer of milk, meat, and eggs necessitates robust animal health solutions for productivity and food security.

- Government Initiatives: Focus on disease eradication, food safety, and livestock development programs are significant market stimulators.

- Technological Advancements: Innovations in diagnostics, therapeutics, and biosecurity are enhancing treatment efficacy and preventive care.

- Increased Awareness: Growing understanding of zoonotic diseases and the importance of animal welfare.

Barriers & Challenges:

- Supply Chain & Distribution: Reaching remote rural areas with veterinary products and services remains a logistical challenge.

- Regulatory Hurdles: Complex approval processes and varying state-level regulations can impede market entry and product diffusion.

- Affordability & Accessibility: Cost remains a significant factor, particularly for small-holder farmers and pet owners in lower income brackets.

- Counterfeit Products: The prevalence of substandard and counterfeit veterinary medicines poses a threat to market integrity and animal health.

- Skilled Workforce Shortage: A need for more trained veterinarians and veterinary technicians, especially in specialized fields.

Emerging Opportunities in Veterinary Market in India

Emerging opportunities in the Indian veterinary market lie in the expansion of veterinary telemedicine and digital health platforms, offering remote consultations and diagnostics, particularly beneficial for underserved regions. The development of specialized therapeutics for rare animal diseases and age-related conditions in pets presents a niche but growing area. Furthermore, the demand for sustainable and eco-friendly veterinary products, including natural alternatives and biodegradable packaging, is on the rise, driven by conscious consumerism. The integration of wearable technology for animal health monitoring offers proactive disease detection and personalized care solutions. Finally, focusing on preventive healthcare packages for both livestock and companion animals presents a significant opportunity to build long-term customer loyalty and ensure consistent revenue streams.

Growth Accelerators in the Veterinary Market in India Industry

Several catalysts are accelerating the growth of the Veterinary Market in India. Technological breakthroughs in areas like gene editing for disease resistance in livestock and advanced vaccine platforms are pivotal. Strategic partnerships between global innovators and local manufacturers are crucial for technology transfer and market penetration. Market expansion strategies, including the development of more affordable product lines and the enhancement of distribution networks to reach Tier 2 and Tier 3 cities, are vital. Government support through policy reforms and financial incentives for R&D and manufacturing further fuels this expansion. The increasing adoption of integrated animal health management systems that combine diagnostics, therapeutics, and data analytics is also a significant growth accelerator, promising greater efficiency and improved outcomes across the sector.

Key Players Shaping the Veterinary Market in India Market

- Boehringer Ingelheim GmbH

- IDEXX Laboratories Inc

- Indian Immunologicals Limited

- Merck & Co Inc

- Vetoquinol

- Virbac

- Elanco Animal Health

- Zydus Cadila

- Zoetis Inc

- Hester Biosciences Limited

Notable Milestones in Veterinary Market in India Sector

- October 2022: Hyderabad-based Indian Immunologicals Limited (IIL) announced an investment of approximately Rs 700 Crores to establish a new animal vaccine manufacturing facility in Genome Valley, Hyderabad. This initiative aims to bolster the nation's vaccine security against economically significant diseases like Foot and Mouth Disease (FMD) and emerging threats, creating around 750 employment opportunities.

- December 2021: Fujifilm India Pvt. Ltd partnered with A'alda Vet India Pvt. Ltd to enhance healthcare facilities for pets. This collaboration involves Fujifilm India providing innovative medical and screening devices specifically for Dogs, Cats, and Companions (DCC) animals, marking a significant step in advancing pet diagnostics.

In-Depth Veterinary Market in India Market Outlook

The Indian veterinary market outlook is exceptionally promising, characterized by sustained growth driven by a combination of increasing pet ownership, a vital livestock sector, and rapid technological advancements. Future market potential is substantial, with opportunities in preventative healthcare, specialized therapeutics, and diagnostic innovations. Strategic opportunities include leveraging digital platforms for wider reach, developing region-specific solutions for livestock health, and tapping into the premium pet care segment. The continuous evolution of the market, coupled with supportive government policies and increasing investment, positions India as a key player in the global veterinary landscape. This market is set to witness transformative growth, delivering enhanced animal welfare and contributing significantly to India's economy.

Veterinary Market in India Segmentation

-

1. Product

-

1.1. By Therapeutics

- 1.1.1. Vaccines

- 1.1.2. Parasiticides

- 1.1.3. Anti Infectives

- 1.1.4. Medical Feed Additives

- 1.1.5. Other Therapeutics

-

1.2. By Diagnostics

- 1.2.1. Immunodiagnostic Tests

- 1.2.2. Molecular Diagnostics

- 1.2.3. Diagnostic Imaging

- 1.2.4. Clinical Chemistry

- 1.2.5. Other Diagnostics

-

1.1. By Therapeutics

-

2. Animal Type

- 2.1. Dogs and Cats

- 2.2. Horses

- 2.3. Ruminants

- 2.4. Swine

- 2.5. Poultry

- 2.6. Other Animals

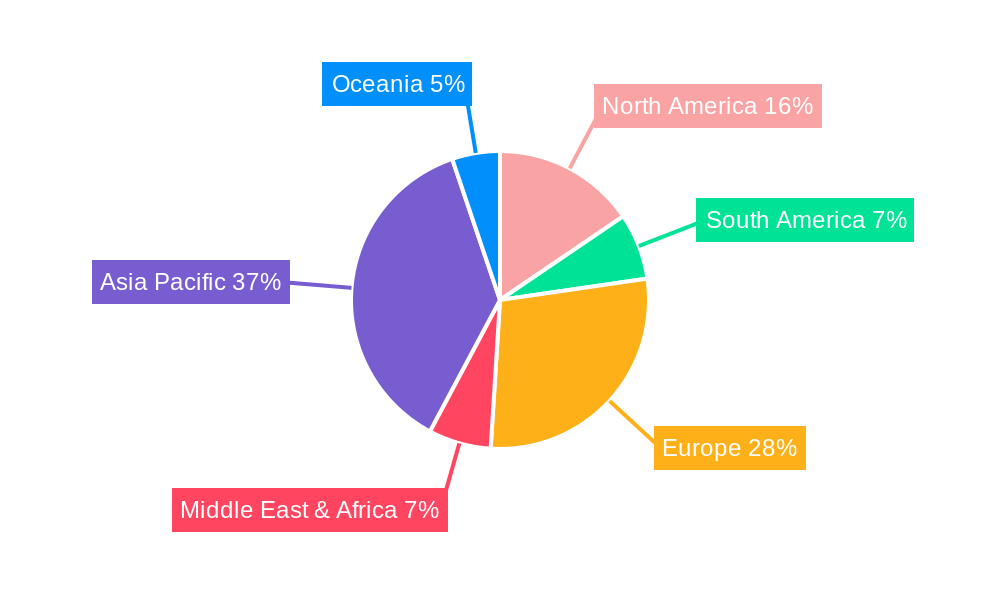

Veterinary Market in India Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Veterinary Market in India Regional Market Share

Geographic Coverage of Veterinary Market in India

Veterinary Market in India REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.63% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Advanced Technology Leading to Innovations in Animal Healthcare; Increasing Adoption of Pet in India

- 3.3. Market Restrains

- 3.3.1. Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Services

- 3.4. Market Trends

- 3.4.1. The Vaccine Segment is Expected to Have the Highest Growth Rate Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. By Therapeutics

- 5.1.1.1. Vaccines

- 5.1.1.2. Parasiticides

- 5.1.1.3. Anti Infectives

- 5.1.1.4. Medical Feed Additives

- 5.1.1.5. Other Therapeutics

- 5.1.2. By Diagnostics

- 5.1.2.1. Immunodiagnostic Tests

- 5.1.2.2. Molecular Diagnostics

- 5.1.2.3. Diagnostic Imaging

- 5.1.2.4. Clinical Chemistry

- 5.1.2.5. Other Diagnostics

- 5.1.1. By Therapeutics

- 5.2. Market Analysis, Insights and Forecast - by Animal Type

- 5.2.1. Dogs and Cats

- 5.2.2. Horses

- 5.2.3. Ruminants

- 5.2.4. Swine

- 5.2.5. Poultry

- 5.2.6. Other Animals

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. By Therapeutics

- 6.1.1.1. Vaccines

- 6.1.1.2. Parasiticides

- 6.1.1.3. Anti Infectives

- 6.1.1.4. Medical Feed Additives

- 6.1.1.5. Other Therapeutics

- 6.1.2. By Diagnostics

- 6.1.2.1. Immunodiagnostic Tests

- 6.1.2.2. Molecular Diagnostics

- 6.1.2.3. Diagnostic Imaging

- 6.1.2.4. Clinical Chemistry

- 6.1.2.5. Other Diagnostics

- 6.1.1. By Therapeutics

- 6.2. Market Analysis, Insights and Forecast - by Animal Type

- 6.2.1. Dogs and Cats

- 6.2.2. Horses

- 6.2.3. Ruminants

- 6.2.4. Swine

- 6.2.5. Poultry

- 6.2.6. Other Animals

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. By Therapeutics

- 7.1.1.1. Vaccines

- 7.1.1.2. Parasiticides

- 7.1.1.3. Anti Infectives

- 7.1.1.4. Medical Feed Additives

- 7.1.1.5. Other Therapeutics

- 7.1.2. By Diagnostics

- 7.1.2.1. Immunodiagnostic Tests

- 7.1.2.2. Molecular Diagnostics

- 7.1.2.3. Diagnostic Imaging

- 7.1.2.4. Clinical Chemistry

- 7.1.2.5. Other Diagnostics

- 7.1.1. By Therapeutics

- 7.2. Market Analysis, Insights and Forecast - by Animal Type

- 7.2.1. Dogs and Cats

- 7.2.2. Horses

- 7.2.3. Ruminants

- 7.2.4. Swine

- 7.2.5. Poultry

- 7.2.6. Other Animals

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. By Therapeutics

- 8.1.1.1. Vaccines

- 8.1.1.2. Parasiticides

- 8.1.1.3. Anti Infectives

- 8.1.1.4. Medical Feed Additives

- 8.1.1.5. Other Therapeutics

- 8.1.2. By Diagnostics

- 8.1.2.1. Immunodiagnostic Tests

- 8.1.2.2. Molecular Diagnostics

- 8.1.2.3. Diagnostic Imaging

- 8.1.2.4. Clinical Chemistry

- 8.1.2.5. Other Diagnostics

- 8.1.1. By Therapeutics

- 8.2. Market Analysis, Insights and Forecast - by Animal Type

- 8.2.1. Dogs and Cats

- 8.2.2. Horses

- 8.2.3. Ruminants

- 8.2.4. Swine

- 8.2.5. Poultry

- 8.2.6. Other Animals

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. By Therapeutics

- 9.1.1.1. Vaccines

- 9.1.1.2. Parasiticides

- 9.1.1.3. Anti Infectives

- 9.1.1.4. Medical Feed Additives

- 9.1.1.5. Other Therapeutics

- 9.1.2. By Diagnostics

- 9.1.2.1. Immunodiagnostic Tests

- 9.1.2.2. Molecular Diagnostics

- 9.1.2.3. Diagnostic Imaging

- 9.1.2.4. Clinical Chemistry

- 9.1.2.5. Other Diagnostics

- 9.1.1. By Therapeutics

- 9.2. Market Analysis, Insights and Forecast - by Animal Type

- 9.2.1. Dogs and Cats

- 9.2.2. Horses

- 9.2.3. Ruminants

- 9.2.4. Swine

- 9.2.5. Poultry

- 9.2.6. Other Animals

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Veterinary Market in India Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. By Therapeutics

- 10.1.1.1. Vaccines

- 10.1.1.2. Parasiticides

- 10.1.1.3. Anti Infectives

- 10.1.1.4. Medical Feed Additives

- 10.1.1.5. Other Therapeutics

- 10.1.2. By Diagnostics

- 10.1.2.1. Immunodiagnostic Tests

- 10.1.2.2. Molecular Diagnostics

- 10.1.2.3. Diagnostic Imaging

- 10.1.2.4. Clinical Chemistry

- 10.1.2.5. Other Diagnostics

- 10.1.1. By Therapeutics

- 10.2. Market Analysis, Insights and Forecast - by Animal Type

- 10.2.1. Dogs and Cats

- 10.2.2. Horses

- 10.2.3. Ruminants

- 10.2.4. Swine

- 10.2.5. Poultry

- 10.2.6. Other Animals

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Boehringer Ingelheim GmbH

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IDEXX Laboratories Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Indian Immunologicals Limited*List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Merck & Co Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Vetoquinol

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Virbac

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Elanco Animal Health

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Zydus Cadila

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Zoetis Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Hester Biosciences Limited

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Boehringer Ingelheim GmbH

List of Figures

- Figure 1: Global Veterinary Market in India Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 3: North America Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 5: North America Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 6: North America Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 7: North America Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 8: South America Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 9: South America Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 10: South America Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 11: South America Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 12: South America Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 13: South America Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 15: Europe Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 16: Europe Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 17: Europe Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 18: Europe Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 19: Europe Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East & Africa Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 21: Middle East & Africa Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 22: Middle East & Africa Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 23: Middle East & Africa Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 24: Middle East & Africa Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 25: Middle East & Africa Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Veterinary Market in India Revenue (Million), by Product 2025 & 2033

- Figure 27: Asia Pacific Veterinary Market in India Revenue Share (%), by Product 2025 & 2033

- Figure 28: Asia Pacific Veterinary Market in India Revenue (Million), by Animal Type 2025 & 2033

- Figure 29: Asia Pacific Veterinary Market in India Revenue Share (%), by Animal Type 2025 & 2033

- Figure 30: Asia Pacific Veterinary Market in India Revenue (Million), by Country 2025 & 2033

- Figure 31: Asia Pacific Veterinary Market in India Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 3: Global Veterinary Market in India Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 6: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 7: United States Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: Canada Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Mexico Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 11: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 12: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Rest of South America Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 17: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 18: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 19: United Kingdom Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Germany Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: France Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Italy Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Spain Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Russia Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Benelux Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Nordics Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Rest of Europe Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 29: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 30: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Turkey Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Israel Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: GCC Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: North Africa Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: South Africa Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Rest of Middle East & Africa Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Global Veterinary Market in India Revenue Million Forecast, by Product 2020 & 2033

- Table 38: Global Veterinary Market in India Revenue Million Forecast, by Animal Type 2020 & 2033

- Table 39: Global Veterinary Market in India Revenue Million Forecast, by Country 2020 & 2033

- Table 40: China Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 41: India Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: Japan Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: South Korea Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: ASEAN Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Oceania Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Rest of Asia Pacific Veterinary Market in India Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Market in India?

The projected CAGR is approximately 8.63%.

2. Which companies are prominent players in the Veterinary Market in India?

Key companies in the market include Boehringer Ingelheim GmbH, IDEXX Laboratories Inc, Indian Immunologicals Limited*List Not Exhaustive, Merck & Co Inc, Vetoquinol, Virbac, Elanco Animal Health, Zydus Cadila, Zoetis Inc, Hester Biosciences Limited.

3. What are the main segments of the Veterinary Market in India?

The market segments include Product, Animal Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.25 Million as of 2022.

5. What are some drivers contributing to market growth?

Advanced Technology Leading to Innovations in Animal Healthcare; Increasing Adoption of Pet in India.

6. What are the notable trends driving market growth?

The Vaccine Segment is Expected to Have the Highest Growth Rate Over the Forecast Period.

7. Are there any restraints impacting market growth?

Use of Counterfeit Medicines; Increasing Costs of Animal Testing and Veterinary Services.

8. Can you provide examples of recent developments in the market?

October 2022 : Hyderabad-based Indian Immunologicals Limited (IIL) announced that the company will invest about Rs 700 Crores to set up a new animal vaccine manufacturing facility in Genome Valley, Hyderabad - the 'Vaccine Hub of the World', to meet the vaccine security of the nation against economically important diseases such as Foot and Mouth disease (FMD) and other emerging diseases. The facility will create total employment for around 750 people.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Market in India," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Market in India report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Market in India?

To stay informed about further developments, trends, and reports in the Veterinary Market in India, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence