Key Insights

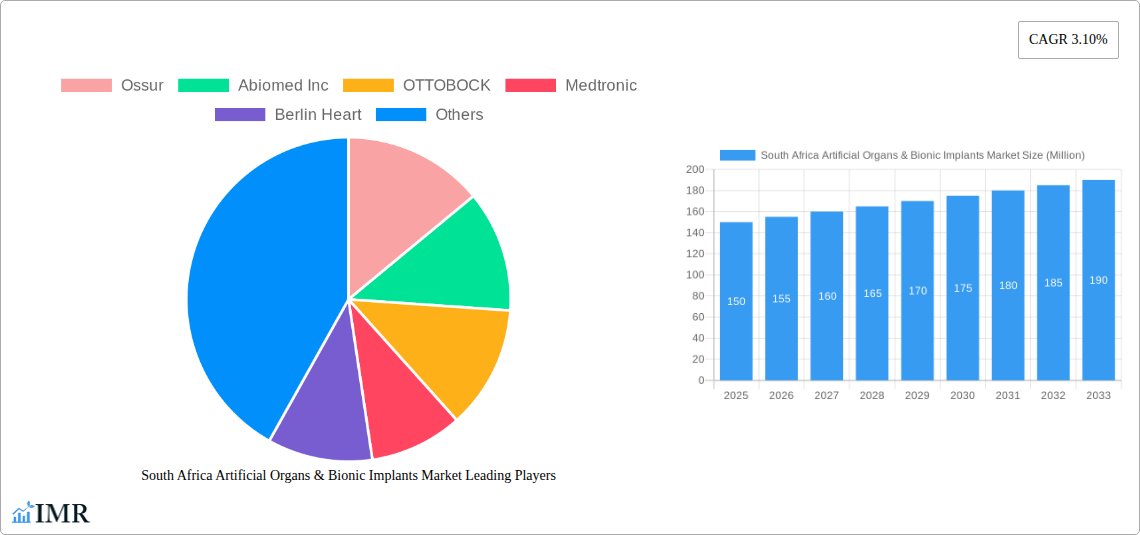

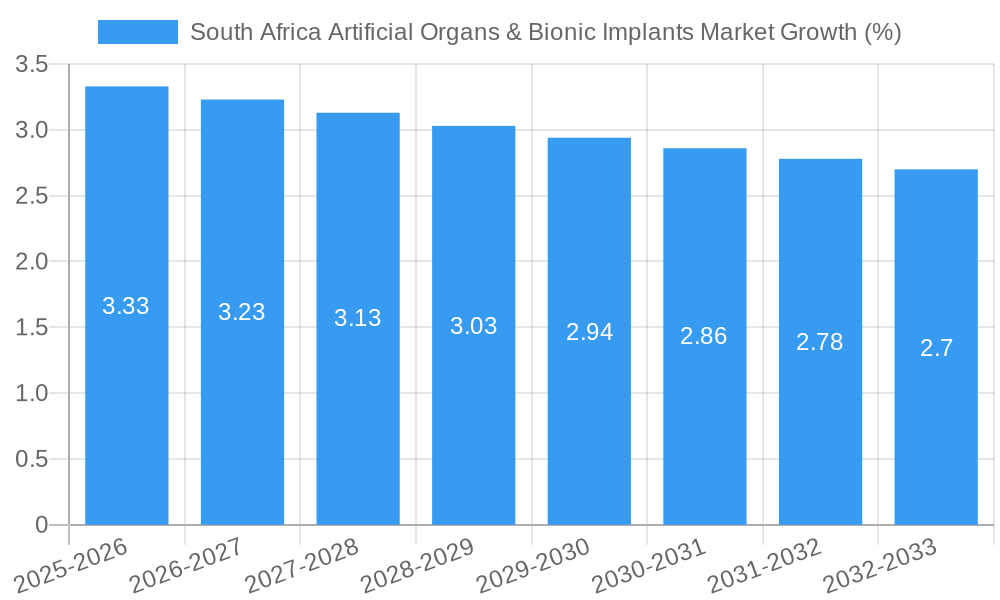

The South African market for Artificial Organs and Bionic Implants is poised for robust growth, projected to reach a substantial market size by the end of the forecast period. Fueled by an estimated Compound Annual Growth Rate (CAGR) of 3.10%, this sector is experiencing significant expansion driven by a confluence of critical factors. An increasing prevalence of chronic diseases, coupled with a rising aging population, necessitates advanced medical interventions, thereby boosting the demand for artificial organs and bionic solutions. Furthermore, technological advancements in areas like 3D printing for custom implants and sophisticated prosthetics are enhancing the efficacy and accessibility of these devices. Government initiatives aimed at improving healthcare infrastructure and increasing access to advanced medical treatments also play a pivotal role in market expansion. The growing awareness among the populace regarding the benefits of bionic prosthetics and artificial organs, supported by a greater capacity to afford these life-changing technologies, further propels market adoption.

The market is broadly segmented into Artificial Organs and Bionics. Within Artificial Organs, segments like artificial hearts, artificial kidneys, and cochlear implants are witnessing steady demand due to advancements in implantable technologies and increasing rates of organ failure and hearing impairment. The Bionics segment, encompassing orthopedic, ear, and cardiac bionics, is experiencing even more dynamic growth. This is largely attributed to the development of more intuitive and responsive prosthetics and implants that significantly improve the quality of life for individuals with disabilities. Key players such as Ossur, Abiomed Inc., OTTOBOCK, Medtronic, and Cochlear Ltd. are at the forefront of innovation, investing heavily in research and development to introduce next-generation products. While the market benefits from technological innovation and rising healthcare expenditure, potential restraints include the high cost of these advanced medical devices and the need for specialized surgical expertise and rehabilitation, which can limit widespread adoption in certain demographics and regions within South Africa.

South Africa Artificial Organs & Bionic Implants Market: Comprehensive Analysis and Future Outlook (2019-2033)

This report offers an in-depth analysis of the South African Artificial Organs & Bionic Implants Market, providing critical insights into market dynamics, growth trends, and future opportunities. Spanning from 2019 to 2033, with a base year of 2025, this comprehensive study equips industry professionals with the data and foresight needed to navigate this rapidly evolving sector. We delve into the intricate parent and child market structures, exploring segments such as Artificial Organs (Artificial Heart, Artificial Kidney, Cochlear Implants, Other Organ Types) and Bionics (Ear Bionics, Orthopedic Bionic, Cardiac Bionics, Other Bionics), with all values presented in Million units.

South Africa Artificial Organs & Bionic Implants Market Market Dynamics & Structure

The South African Artificial Organs & Bionic Implants Market is characterized by a moderately concentrated landscape, driven by significant technological advancements and an increasing prevalence of chronic diseases and age-related conditions. Key drivers include the rising demand for enhanced quality of life among patients and the growing sophistication of medical technology, fostering innovation in both artificial organs and bionic solutions. Regulatory frameworks, while evolving, aim to balance patient safety with market accessibility, influencing product approvals and adoption rates. Competitive product substitutes, such as advanced prosthetics and regenerative medicine, present an ongoing challenge and spur further innovation. End-user demographics are shifting, with an aging population and a growing middle class increasingly able to afford advanced medical treatments. Mergers and acquisitions (M&A) are pivotal in shaping market concentration, enabling key players to expand their portfolios and geographical reach.

- Market Concentration: Dominated by a few key global and local players, but with increasing opportunities for specialized niche providers.

- Technological Innovation Drivers: Miniaturization, AI integration in bionics, advanced materials for artificial organs, and improved biocompatibility are crucial.

- Regulatory Frameworks: The South African Health Products Regulatory Authority (SAHPRA) plays a vital role in ensuring product safety and efficacy.

- Competitive Product Substitutes: Advancements in pharmaceuticals and non-invasive treatments offer alternative solutions.

- End-User Demographics: Growing elderly population, increasing incidence of diabetes and cardiovascular diseases, and rising disposable incomes.

- M&A Trends: Strategic acquisitions to gain market share, acquire novel technologies, and expand product offerings.

- Innovation Barriers: High R&D costs, lengthy regulatory approval processes, and the need for specialized surgical expertise.

South Africa Artificial Organs & Bionic Implants Market Growth Trends & Insights

The South African Artificial Organs & Bionic Implants Market is poised for significant expansion, driven by a confluence of factors including an increasing burden of chronic diseases, a growing awareness of advanced medical solutions, and supportive government initiatives aimed at improving healthcare infrastructure. The market size is expected to witness a robust Compound Annual Growth Rate (CAGR) from 2025 to 2033, fueled by rising disposable incomes and a proactive approach to healthcare expenditure among the South African populace. Technological disruptions, such as the development of more sophisticated and personalized bionic limbs and advanced artificial organ replacements, are significantly enhancing adoption rates. Consumer behavior is shifting towards proactive health management and a preference for long-term, effective treatment solutions, including implants and prosthetics. The penetration of these advanced medical devices is steadily increasing, driven by both public and private healthcare investments.

The market is witnessing a surge in demand for cardiac bionics due to the high prevalence of cardiovascular diseases in South Africa. Similarly, orthopedic bionic solutions are gaining traction as the aging population experiences a rise in degenerative joint conditions. In the artificial organs segment, cochlear implants are experiencing sustained growth, addressing the needs of individuals with hearing impairments. The development of more advanced artificial kidneys and research into artificial hearts, while still in nascent stages for widespread adoption, represent significant future growth avenues. The integration of smart technologies, such as AI-powered prosthetics and sensor-equipped artificial organs, is revolutionizing patient care and driving market demand for cutting-edge solutions. The focus on improving patient outcomes and reducing long-term healthcare costs further bolsters the adoption of these life-enhancing technologies. Investment in research and development by both domestic and international players is crucial for sustaining this growth trajectory, introducing next-generation products that cater to specific patient needs and improve quality of life. The growing availability of financing options and insurance coverage for these procedures is also a critical factor in expanding market accessibility.

Dominant Regions, Countries, or Segments in South Africa Artificial Organs & Bionic Implants Market

The South African Artificial Organs & Bionic Implants Market is experiencing significant growth, with the Bionics segment demonstrating a particularly dominant position, especially within Orthopedic Bionic solutions. This dominance is propelled by a high incidence of orthopedic conditions, including osteoarthritis, trauma-related injuries, and age-related wear and tear, which are prevalent across the nation. The increasing aging population in South Africa directly correlates with a higher demand for joint replacements and advanced prosthetics, making orthopedic bionics a cornerstone of the market.

Within the broader Bionics category, Orthopedic Bionic devices, such as advanced prosthetic limbs, bionic knees, and hips, are experiencing substantial market share. This is further supported by advancements in materials science and robotics that enhance functionality, comfort, and user mobility, making these devices increasingly attractive to patients seeking to regain independence and an active lifestyle. The economic policies in South Africa, which encourage investment in healthcare infrastructure and technological adoption, also contribute to the growth of this segment.

In the Artificial Organs segment, Cochlear Implants stand out as a key driver of growth. South Africa has a significant population suffering from hearing loss, and cochlear implants offer a viable solution for profound deafness, restoring a crucial sense and significantly improving quality of life. The increasing awareness about the benefits of cochlear implantation, coupled with improving healthcare accessibility and specialized audiology services, are contributing to its market penetration.

The Cardiac Bionics segment, encompassing devices like ventricular assist devices (VADs) and artificial hearts, while still a more niche area, holds immense growth potential due to the high burden of cardiovascular diseases in South Africa. As these technologies become more advanced and less invasive, their adoption is expected to rise.

The dominance of these segments is underpinned by:

- High Disease Prevalence: A substantial patient pool suffering from orthopedic ailments and hearing loss.

- Technological Advancements: Continuous innovation in bionic limb functionality and cochlear implant technology.

- Government Health Initiatives: Policies aimed at improving access to advanced medical devices.

- Growing Disposable Income: An expanding middle class with greater capacity to afford specialized treatments.

- Infrastructure Development: Investment in specialized surgical centers and rehabilitation facilities.

The market share within these dominant segments is expected to see consistent growth, with orthopedic bionics and cochlear implants leading the charge due to their established demand and ongoing technological refinements.

South Africa Artificial Organs & Bionic Implants Market Product Landscape

The South African Artificial Organs & Bionic Implants Market is characterized by a dynamic product landscape driven by continuous innovation aimed at enhancing patient outcomes and quality of life. Key product advancements include the development of lightweight, durable, and highly functional prosthetic limbs that mimic natural movement with greater precision. In artificial organs, breakthroughs in biocompatible materials are leading to longer-lasting and more reliable implants, reducing rejection rates and improving patient comfort. The integration of sophisticated sensor technology and artificial intelligence in bionic devices allows for personalized adjustments and real-time feedback, optimizing performance. For artificial organs, advancements are focused on improving efficiency, minimizing invasiveness, and exploring more integrated solutions within the body. These innovations are not only addressing unmet medical needs but also expanding the applicability of artificial organs and bionic implants across a wider range of conditions and patient demographics.

Key Drivers, Barriers & Challenges in South Africa Artificial Organs & Bionic Implants Market

Key Drivers:

The South African Artificial Organs & Bionic Implants Market is propelled by several key drivers, including a rising prevalence of chronic diseases such as cardiovascular ailments and diabetes, which often necessitate advanced medical interventions. The growing aging population in South Africa is also a significant factor, increasing the demand for orthopedic implants and bionic prosthetics. Furthermore, continuous technological innovation, leading to more sophisticated, efficient, and patient-friendly devices, is a major growth accelerator. Increased disposable income and greater access to private healthcare are also contributing to market expansion, as more individuals can afford these life-enhancing technologies.

Barriers & Challenges:

Despite the promising growth, the market faces several barriers and challenges. High manufacturing and research & development costs associated with these advanced medical devices translate into significant price points, limiting accessibility for a large segment of the population. Stringent regulatory approval processes, while essential for patient safety, can lead to extended product launch timelines. Moreover, a shortage of highly skilled surgeons and specialized medical professionals trained in implanting and managing these complex devices poses a significant challenge. Supply chain disruptions and the reliance on imported components can also impact availability and cost. The competitive landscape, though expanding, remains dominated by a few key players, creating barriers for new entrants.

Emerging Opportunities in South Africa Artificial Organs & Bionic Implants Market

Emerging opportunities in the South African Artificial Organs & Bionic Implants Market lie in the development of more affordable and accessible solutions, particularly for the large segment of the population with limited financial resources. The untapped potential in pediatric bionics and artificial organs, catering to the specific needs of children, presents a significant avenue for growth. Furthermore, the integration of remote monitoring and telemedicine capabilities with bionic implants and artificial organs can enhance patient care, improve adherence, and reduce the burden on healthcare facilities. There is also a growing consumer preference for personalized and aesthetically superior bionic prosthetics, opening doors for customized solutions. Expansion into rural and underserved areas through mobile clinics and partnerships with local healthcare providers represents another significant growth frontier.

Growth Accelerators in the South Africa Artificial Organs & Bionic Implants Market Industry

Several catalysts are accelerating the growth within the South African Artificial Organs & Bionic Implants Market. Technological breakthroughs in biomaterials and miniaturization are leading to safer, more durable, and functional implants. Strategic partnerships between global manufacturers and local distributors are crucial for expanding market reach and ensuring product availability. Government initiatives aimed at enhancing healthcare infrastructure and promoting medical device innovation further fuel this growth. The increasing awareness campaigns highlighting the benefits of artificial organs and bionic implants, coupled with successful patient testimonials, are positively influencing market demand and adoption rates. Investment in research and development focused on next-generation technologies, such as neural interfaces for bionics and more sophisticated artificial organ systems, will continue to be a significant growth driver.

Key Players Shaping the South Africa Artificial Organs & Bionic Implants Market Market

- Ossur

- Abiomed Inc

- OTTOBOCK

- Medtronic

- Berlin Heart

- Ekso Bionics

- Abbott

- Sonova (Advanced Bionics AG)

- Cochlear Ltd

- Zimmer Biomet

Notable Milestones in South Africa Artificial Organs & Bionic Implants Market Sector

- May 2022: Medtronic PLC acquired Intersect ENT, enhancing its ENT portfolio with advanced technologies for sinus surgeries, aiming to improve post-operative results and treat nasal polyps.

- April 2022: Cochlear Limited agreed to acquire Oticon Medical, following Demant's exit from hearing implant activities. Cochlear committed to supporting over 75,000 Oticon Medical hearing implant recipients, including those with cochlear and acoustic implants.

In-Depth South Africa Artificial Organs & Bionic Implants Market Market Outlook

The future outlook for the South African Artificial Organs & Bionic Implants Market is exceptionally promising, with growth being significantly propelled by ongoing technological advancements and an increasing demand for improved patient outcomes. Strategic collaborations and market expansion initiatives will continue to broaden accessibility to these life-altering devices. The focus on developing more personalized and user-friendly bionic solutions, alongside more integrated and efficient artificial organ technologies, represents a key strategic opportunity. As healthcare policies evolve to support the adoption of advanced medical technologies and as disposable incomes rise, the market is poised for sustained and robust expansion, offering substantial potential for innovation and improved public health.

South Africa Artificial Organs & Bionic Implants Market Segmentation

-

1. Type

-

1.1. Artificial Organ

- 1.1.1. Artificial Heart

- 1.1.2. Artificial Kidney

- 1.1.3. Cochlear Implants

- 1.1.4. Other Organ Types

-

1.2. Bionics

- 1.2.1. Ear Bionics

- 1.2.2. Orthopedic Bionic

- 1.2.3. Cardiac Bionics

- 1.2.4. Other Bionics

-

1.1. Artificial Organ

South Africa Artificial Organs & Bionic Implants Market Segmentation By Geography

- 1. South Africa

South Africa Artificial Organs & Bionic Implants Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 3.10% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 Increased Incidence of Disabilities

- 3.2.2 Organ Failures

- 3.2.3 and Scarcity of Donor Organs; Technological Advancements in Artificial Organs and Bionics

- 3.3. Market Restrains

- 3.3.1. Expensive Procedures; Risk of Compatibility Issues and Malfunctions

- 3.4. Market Trends

- 3.4.1. Artificial Kidney Segment Expected to Garner a Large Share of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Africa Artificial Organs & Bionic Implants Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Artificial Organ

- 5.1.1.1. Artificial Heart

- 5.1.1.2. Artificial Kidney

- 5.1.1.3. Cochlear Implants

- 5.1.1.4. Other Organ Types

- 5.1.2. Bionics

- 5.1.2.1. Ear Bionics

- 5.1.2.2. Orthopedic Bionic

- 5.1.2.3. Cardiac Bionics

- 5.1.2.4. Other Bionics

- 5.1.1. Artificial Organ

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. South Africa

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Ossur

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Abiomed Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 OTTOBOCK

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Medtronic

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Berlin Heart

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Ekso Bionics

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Abbott

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Sonova (Advanced Bionics AG)

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Cochlear Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zimmer Biomet

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Ossur

List of Figures

- Figure 1: South Africa Artificial Organs & Bionic Implants Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: South Africa Artificial Organs & Bionic Implants Market Share (%) by Company 2024

List of Tables

- Table 1: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Region 2019 & 2032

- Table 6: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 7: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 9: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Type 2019 & 2032

- Table 10: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 11: South Africa Artificial Organs & Bionic Implants Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: South Africa Artificial Organs & Bionic Implants Market Volume K Unit Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Africa Artificial Organs & Bionic Implants Market?

The projected CAGR is approximately 3.10%.

2. Which companies are prominent players in the South Africa Artificial Organs & Bionic Implants Market?

Key companies in the market include Ossur, Abiomed Inc, OTTOBOCK, Medtronic, Berlin Heart, Ekso Bionics, Abbott, Sonova (Advanced Bionics AG), Cochlear Ltd, Zimmer Biomet.

3. What are the main segments of the South Africa Artificial Organs & Bionic Implants Market?

The market segments include Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increased Incidence of Disabilities. Organ Failures. and Scarcity of Donor Organs; Technological Advancements in Artificial Organs and Bionics.

6. What are the notable trends driving market growth?

Artificial Kidney Segment Expected to Garner a Large Share of the Market.

7. Are there any restraints impacting market growth?

Expensive Procedures; Risk of Compatibility Issues and Malfunctions.

8. Can you provide examples of recent developments in the market?

May 2022: Medtronic PLC acquired Intersect ENT, increasing the company's comprehensive ENT portfolio with cutting-edge technologies used in sinus surgeries to enhance post-operative results and cure nasal polyps.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Africa Artificial Organs & Bionic Implants Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Africa Artificial Organs & Bionic Implants Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Africa Artificial Organs & Bionic Implants Market?

To stay informed about further developments, trends, and reports in the South Africa Artificial Organs & Bionic Implants Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence