Key Insights

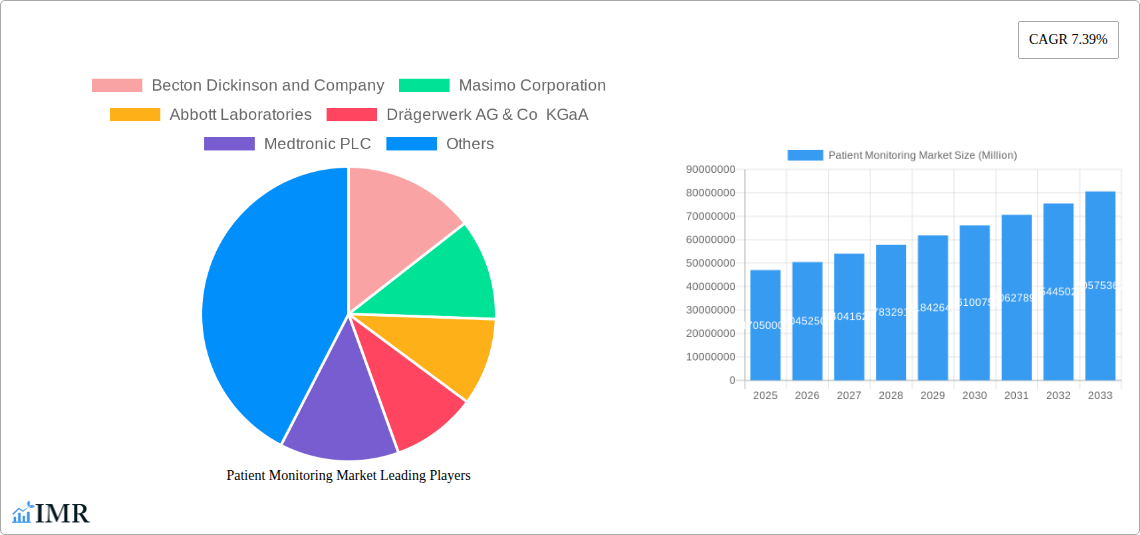

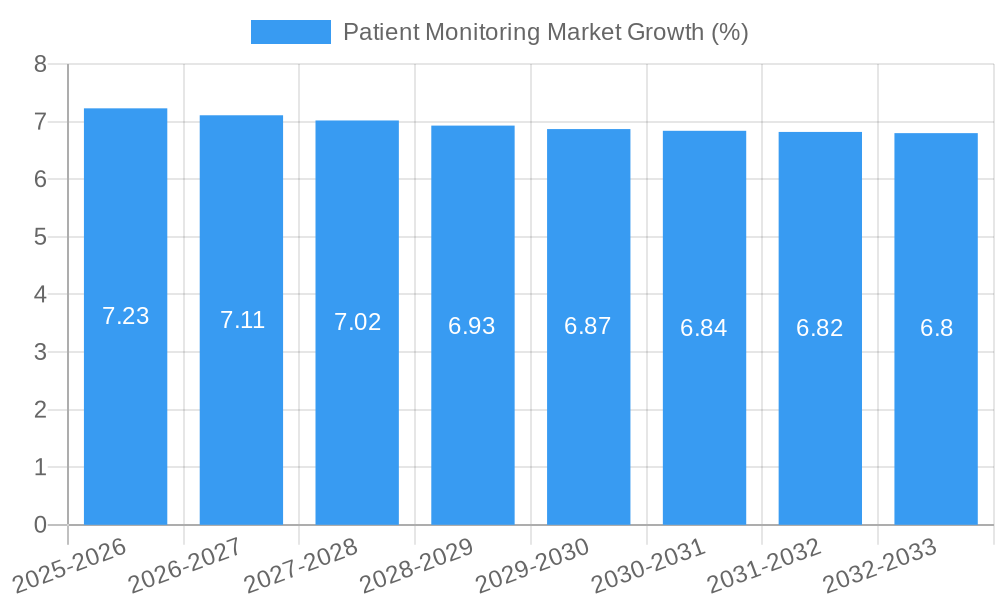

The global Patient Monitoring Market is poised for robust expansion, projected to reach $47.05 million in 2025 and demonstrating a Compound Annual Growth Rate (CAGR) of 7.39% throughout the forecast period of 2025-2033. This significant growth is propelled by a confluence of factors, including an aging global population experiencing an increased prevalence of chronic diseases such as cardiovascular, respiratory, and neurological conditions. The escalating demand for advanced diagnostic and therapeutic tools, coupled with the rising adoption of home healthcare solutions, further fuels market expansion. Technological advancements, particularly in areas like wearable sensors, remote patient monitoring (RPM) systems, and AI-driven analytics, are revolutionizing patient care delivery, enabling continuous and proactive health management. The market's segmentation reveals a strong emphasis on Cardiac Monitoring Devices and Hemodynamic Monitoring Devices, reflecting the persistent burden of cardiovascular diseases worldwide. Similarly, Neuromonitoring Devices are witnessing increased demand due to the growing incidence of neurological disorders. The hospital and clinic segment remains a dominant end-user, but the home healthcare sector is emerging as a significant growth avenue, driven by patient preference for convenience and cost-effectiveness.

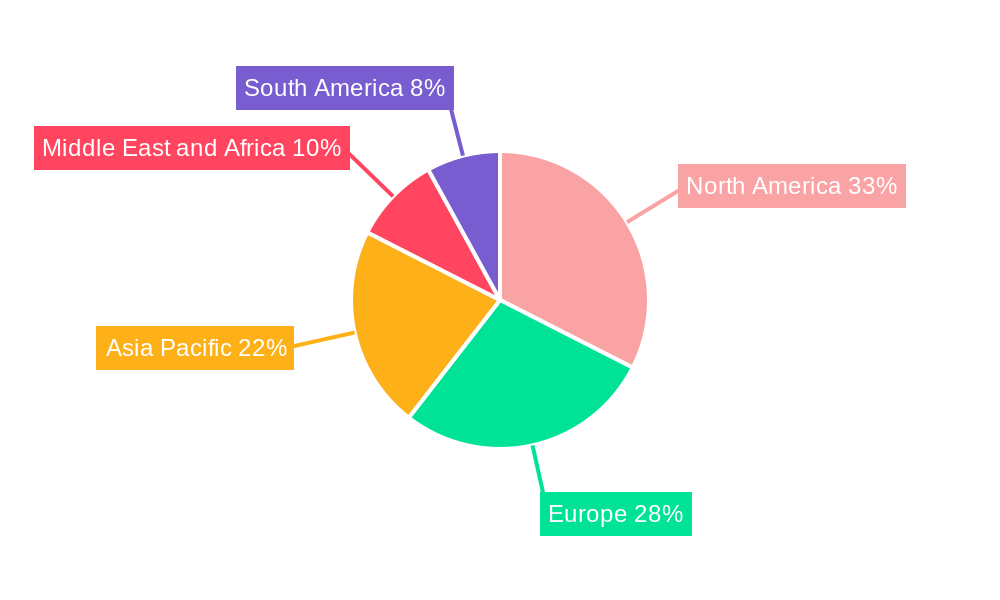

The Patient Monitoring Market is characterized by intense competition among key players such as Becton Dickinson and Company, Masimo Corporation, Abbott Laboratories, Medtronic PLC, and Koninklijke Philips NV. These companies are actively engaged in research and development to introduce innovative products and expand their market reach through strategic collaborations and acquisitions. Emerging trends include the integration of IoT in medical devices for seamless data transfer and analysis, the development of non-invasive monitoring techniques, and a greater focus on personalized medicine. However, challenges such as stringent regulatory frameworks, high initial investment costs for advanced equipment, and concerns regarding data security and privacy need to be addressed to fully unlock the market's potential. Geographically, North America currently leads the market, owing to its advanced healthcare infrastructure and high disposable income, followed closely by Europe. The Asia Pacific region, with its burgeoning economies and increasing healthcare expenditure, presents a substantial growth opportunity, driven by rising awareness and the adoption of advanced medical technologies.

Patient Monitoring Market Report: Navigating the Future of Connected Health (2019-2033)

This comprehensive report provides an in-depth analysis of the global patient monitoring market, a rapidly expanding sector critical for proactive healthcare delivery and improved patient outcomes. Leveraging advanced technologies like AI and IoT, the remote patient monitoring market is transforming how chronic conditions are managed, enabling earlier intervention and reducing hospital readmissions. Our analysis covers the hospital patient monitoring systems market, home healthcare monitoring devices, and the burgeoning wearable patient monitoring devices market. We delve into the intricate dynamics shaping this landscape, from innovative medical device development to evolving healthcare regulations.

The patient monitoring market size is projected to witness significant growth, driven by an aging global population, the increasing prevalence of chronic diseases, and the growing demand for personalized healthcare solutions. This report offers unparalleled insights into the patient monitoring market share, CAGR, and future trajectory, equipping stakeholders with the knowledge to capitalize on emerging opportunities.

Keywords: Patient Monitoring Market, Remote Patient Monitoring, Wearable Patient Monitoring Devices, Hospital Patient Monitoring Systems, Home Healthcare Monitoring Devices, Medical Device Development, Healthcare Regulations, Patient Monitoring Devices, Cardiac Monitoring, Neuromonitoring, Respiratory Monitoring, Hemodynamic Monitoring, Multi-parameter Monitors, Connected Health, IoT in Healthcare, Digital Health, Chronic Disease Management, Telemedicine, Global Health Technology Market.

Patient Monitoring Market Market Dynamics & Structure

The patient monitoring market exhibits a dynamic interplay of technological innovation, stringent regulatory frameworks, and evolving end-user demographics. Market concentration is characterized by the presence of major global players like Becton Dickinson and Company, Masimo Corporation, Abbott Laboratories, Drägerwerk AG & Co KGaA, Medtronic PLC, Omron Corporation, General Electric Company (GE Healthcare), Koninklijke Philips NV, Johnson & Johnson, Boston Scientific Corporation, and Baxter International Inc, who collectively hold a substantial market share. However, the entry of agile startups focusing on specialized niches, particularly in wearable patient monitoring devices, injects competitive pressure and drives continuous innovation.

Technological innovation is a paramount driver, with advancements in miniaturization, wireless connectivity, AI-driven analytics, and non-invasive sensing technologies fueling the development of sophisticated patient monitoring devices. The integration of IoT in healthcare is a significant trend, enabling seamless data transmission and real-time insights.

- Market Concentration: Dominated by established medical device manufacturers with ongoing consolidation through strategic mergers and acquisitions, alongside a growing number of specialized players.

- Technological Innovation Drivers: Miniaturization of sensors, AI/ML for data analytics, IoT integration, cloud-based platforms for data management, and advancements in biosensing technologies.

- Regulatory Frameworks: Stringent approvals from bodies like the FDA and EMA are crucial for market access, influencing product development cycles and market entry strategies. The increasing focus on data privacy and security (e.g., HIPAA, GDPR) also shapes technological implementation.

- Competitive Product Substitutes: While direct substitutes are limited for core monitoring functions, advancements in telehealth platforms and integrated diagnostic tools can offer alternative approaches to patient management.

- End-User Demographics: An aging global population and the rising incidence of chronic diseases like cardiovascular conditions, diabetes, and respiratory illnesses are significant demand drivers. The increasing adoption of home healthcare solutions further expands the market.

- M&A Trends: Several strategic acquisitions and partnerships are observed as larger companies seek to expand their product portfolios, gain access to new technologies, and strengthen their market presence. For instance, key players are investing in companies specializing in remote patient monitoring and AI-driven diagnostic solutions.

Patient Monitoring Market Growth Trends & Insights

The patient monitoring market is experiencing robust growth, fueled by a confluence of technological advancements, shifting healthcare paradigms, and evolving patient expectations. The global patient monitoring market size is projected to reach an estimated \$xx,xxx million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx.x% during the forecast period of 2025–2033. This impressive expansion is underpinned by the increasing adoption of advanced patient monitoring devices across various healthcare settings, from intensive care units in hospitals to individual homes.

A key trend is the significant rise in remote patient monitoring (RPM). This segment, empowered by the integration of IoT in healthcare and advancements in connected health technologies, allows for continuous tracking of patient vital signs outside traditional clinical environments. This not only enhances patient convenience but also enables proactive management of chronic conditions, thereby reducing hospital readmissions and associated healthcare costs. The demand for wearable patient monitoring devices is escalating as consumers become more health-conscious and seek convenient ways to track their well-being. These devices, ranging from smartwatches with ECG capabilities to continuous glucose monitors, are becoming indispensable tools for both preventative care and chronic disease management.

Technological disruptions are continuously reshaping the market. The integration of Artificial Intelligence (AI) and Machine Learning (ML) algorithms into patient monitoring systems is enabling predictive analytics, early detection of deteriorating patient conditions, and personalized treatment recommendations. This analytical capability is transforming raw data into actionable insights, improving clinical decision-making and patient care pathways.

Furthermore, a noticeable shift in consumer behavior is contributing to market growth. Patients are increasingly seeking more personalized and participatory healthcare experiences. The accessibility of advanced patient monitoring devices and the rise of telemedicine have empowered individuals to take a more active role in managing their health. This growing health literacy and demand for continuous health insights are driving the adoption of home healthcare monitoring devices and personal health trackers. The hospital patient monitoring systems market is also evolving, with a focus on integrated, multi-parameter monitoring solutions that provide a holistic view of patient status and facilitate seamless data flow within hospital networks.

Dominant Regions, Countries, or Segments in Patient Monitoring Market

The patient monitoring market exhibits distinct regional dominance and segment leadership, driven by a complex interplay of economic policies, healthcare infrastructure, technological adoption rates, and demographic trends. Among the various device types, Multi-parameter Monitors are consistently emerging as the dominant segment, holding a substantial market share. This dominance is attributed to their versatility and ability to simultaneously track a wide array of vital signs—including heart rate, blood pressure, oxygen saturation, and temperature—making them indispensable in critical care settings such as Intensive Care Units (ICUs), emergency rooms, and operating theaters. The increasing complexity of patient care and the need for comprehensive real-time data to guide clinical decisions directly fuel the demand for these integrated solutions.

- Dominant Segment (Type of Device): Multi-parameter Monitors:

- Market Share: Estimated to hold over 30% of the total patient monitoring device market in 2025.

- Key Drivers:

- Critical Care Needs: Essential for monitoring critically ill patients, providing continuous, integrated data streams for immediate clinical intervention.

- Technological Advancements: Integration of advanced sensors, AI-powered analytics for trend identification, and wireless connectivity enhance their utility and precision.

- Hospital Infrastructure: Wide deployment in hospitals and clinics, supported by robust IT infrastructure for data management and integration with Electronic Health Records (EHRs).

- Versatility: Adaptable for various clinical scenarios, from post-operative recovery to managing multiple comorbidities.

In terms of application, Cardiology remains the leading application area within the patient monitoring market. The escalating global burden of cardiovascular diseases, including heart failure, arrhythmias, and hypertension, necessitates continuous and sophisticated monitoring. This drives the demand for cardiac monitoring devices and multi-parameter monitors with advanced cardiac functionalities.

- Dominant Application: Cardiology:

- Market Growth Driver: High prevalence and incidence of cardiovascular diseases worldwide.

- Key Contributing Devices: ECG monitors, Holter monitors, implantable cardiac monitors, and multi-parameter monitors with comprehensive cardiac monitoring capabilities.

- Technological Influence: Wearable ECG devices and continuous remote cardiac monitoring solutions are expanding patient reach and improving early detection of cardiac anomalies.

Geographically, North America has historically been and is expected to remain a dominant region in the patient monitoring market. This leadership is propelled by a well-established healthcare infrastructure, high per capita healthcare spending, early adoption of advanced medical technologies, and favorable reimbursement policies for remote patient monitoring. The presence of leading medical device manufacturers and robust research and development initiatives further solidify its position.

- Dominant Region: North America:

- Market Drivers: High prevalence of chronic diseases, strong government and private sector investment in healthcare technology, advanced regulatory pathways, and a high degree of technological adoption.

- Country-Specific Dominance: The United States, with its large healthcare expenditure and emphasis on innovation, is the primary contributor within North America.

- Growth Potential: Continued expansion of home healthcare monitoring devices and the integration of AI in diagnostics and treatment pathways will sustain its dominance.

The hospitals and clinics end-user segment accounts for the largest share of the patient monitoring market. This is directly linked to the critical nature of patient monitoring in acute care settings and the established infrastructure for deploying and managing these sophisticated devices.

- Dominant End-User: Hospitals and Clinics:

- Market Share: Constitutes over 60% of the end-user market.

- Factors Driving Dominance: Critical care requirements, availability of trained personnel, integration with existing hospital IT systems, and the necessity for continuous patient surveillance.

- Future Trends: Increasing adoption of networked monitoring systems and the integration of data from various devices into a central command center for enhanced patient management.

Patient Monitoring Market Product Landscape

The patient monitoring market is characterized by a diverse and innovative product landscape, driven by the relentless pursuit of accuracy, portability, and enhanced data analytics. Key product categories include Hemodynamic Monitoring Devices for tracking blood flow and pressure, Neuromonitoring Devices to assess brain activity, Cardiac Monitoring Devices for detecting arrhythmias and other heart conditions, Respiratory Monitoring Devices to measure lung function and oxygen levels, and versatile Multi-parameter Monitors that integrate multiple vital sign measurements. Beyond these established categories, the market is also seeing a surge in novel Other Types of Devices, including continuous glucose monitors, sleep trackers, and wearable sensors for a broad spectrum of physiological data. These products are increasingly incorporating advanced sensing technologies, wireless connectivity, and AI-driven algorithms to provide deeper insights into patient health and facilitate proactive interventions. Unique selling propositions often lie in the non-invasiveness of measurement, the long-term wearability, the real-time data transmission capabilities, and the seamless integration with telehealth platforms, thereby enhancing patient convenience and clinician efficiency.

Key Drivers, Barriers & Challenges in Patient Monitoring Market

Key Drivers:

- Technological Advancements: The integration of AI, IoT, and advanced sensor technology enables more accurate, non-invasive, and continuous patient monitoring, driving innovation in remote patient monitoring and wearable patient monitoring devices.

- Rising Prevalence of Chronic Diseases: The increasing global burden of conditions like cardiovascular diseases, diabetes, and respiratory illnesses necessitates continuous monitoring for effective management and early intervention, boosting the demand for patient monitoring devices.

- Aging Global Population: An expanding elderly demographic often requires ongoing health management and monitoring, accelerating the adoption of home healthcare monitoring devices and connected health solutions.

- Growth of Telemedicine and Home Healthcare: Favorable reimbursement policies and increasing patient preference for convenient care at home are significantly expanding the remote patient monitoring market.

- Increasing Health Awareness: Growing consumer interest in personal health and wellness is driving the adoption of wearable devices for proactive health tracking.

Barriers & Challenges:

- High Cost of Advanced Devices: The initial investment for sophisticated hospital patient monitoring systems and advanced wearable patient monitoring devices can be a deterrent for smaller healthcare facilities and individuals.

- Data Security and Privacy Concerns: The transmission and storage of sensitive patient data in connected health platforms raise significant cybersecurity risks, requiring robust regulatory compliance and advanced security measures.

- Regulatory Hurdles: Obtaining approvals from regulatory bodies like the FDA and EMA for new medical device development can be a time-consuming and expensive process, potentially delaying market entry.

- Interoperability Issues: Ensuring seamless data exchange between different patient monitoring devices, EHR systems, and telehealth platforms remains a significant challenge, hindering the full potential of integrated connected health solutions.

- Technical Expertise and Training: Healthcare professionals require adequate training to effectively operate and interpret data from complex patient monitoring systems, posing a challenge in certain regions or facilities.

Emerging Opportunities in Patient Monitoring Market

The patient monitoring market is ripe with emerging opportunities, particularly in the realm of personalized and preventative healthcare. The burgeoning field of AI-driven diagnostics within connected health promises to unlock predictive capabilities, enabling early identification of health risks and proactive interventions. Furthermore, the expansion of remote patient monitoring into underserved and remote areas, facilitated by low-power wide-area network (LoRaWAN) technologies, presents a significant opportunity to bridge healthcare disparities and improve access to care globally. The development of more sophisticated and user-friendly wearable patient monitoring devices catering to niche applications, such as mental health monitoring and elderly care, also represents a growing market segment. The increasing focus on value-based care models further incentivizes the adoption of technologies that demonstrate improved patient outcomes and reduced healthcare costs, creating a fertile ground for innovative medical device development and service integration.

Growth Accelerators in the Patient Monitoring Market Industry

Several key catalysts are accelerating the growth trajectory of the patient monitoring market. Technological breakthroughs, particularly in miniaturization of sensors, improvements in battery life for wearable patient monitoring devices, and the enhanced analytical capabilities of AI and machine learning algorithms, are creating more sophisticated and accessible patient monitoring devices. Strategic partnerships between technology companies, healthcare providers, and pharmaceutical firms are fostering the development of integrated connected health ecosystems, offering end-to-end patient management solutions. Market expansion strategies, including geographical penetration into emerging economies and the development of cost-effective solutions for diverse patient populations, are further fueling growth. The increasing regulatory support for remote patient monitoring and telehealth services in various countries is also acting as a significant growth accelerator.

Key Players Shaping the Patient Monitoring Market Market

- Becton Dickinson and Company

- Masimo Corporation

- Abbott Laboratories

- Drägerwerk AG & Co KGaA

- Medtronic PLC

- Omron Corporation

- General Electric Company (GE Healthcare)

- Koninklijke Philips NV

- Johnson & Johnson

- Boston Scientific Corporation

- Baxter International Inc

Notable Milestones in Patient Monitoring Market Sector

- April 2023: Honeywell announced the development of a real-time health monitoring system, employing advanced sensing technology via a skin patch for seamless, instant transmission of vital signs to healthcare providers on mobile devices and online dashboards, significantly enhancing both in-hospital and remote patient monitoring capabilities.

- January 2023: Senet and Telli Health launched the first remote patient monitoring (RPM) hardware powered by LoRaWAN, a breakthrough technology designed to extend healthcare reach to remote and underserved populations globally, promoting healthcare equity and laying the groundwork for future smart home health services.

In-Depth Patient Monitoring Market Market Outlook

The patient monitoring market is poised for sustained, accelerated growth, driven by the unwavering commitment to enhancing patient care through technology. The future outlook is characterized by the pervasive integration of AI and IoT, leading to highly predictive and personalized connected health solutions. The continued expansion of remote patient monitoring will not only improve chronic disease management but also democratize healthcare access, particularly in developing regions. Strategic initiatives focusing on interoperability and data analytics will be crucial for unlocking the full potential of these technologies. Investment in user-centric wearable patient monitoring devices and innovative medical device development will cater to evolving consumer preferences for proactive health management, solidifying the patient monitoring market's critical role in the future of global healthcare delivery.

Patient Monitoring Market Segmentation

-

1. Type of Device

- 1.1. Hemodynamic Monitoring Devices

- 1.2. Neuromonitoring Devices

- 1.3. Cardiac Monitoring Devices

- 1.4. Multi-parameter Monitors

- 1.5. Respiratory Monitoring Devices

- 1.6. Other Types of Devices

-

2. Application

- 2.1. Cardiology

- 2.2. Neurology

- 2.3. Respiratory

- 2.4. Fetal and Neonatal

- 2.5. Weight Management and Fitness Monitoring

- 2.6. Other Applications

-

3. End-User

- 3.1. Home Healthcare

- 3.2. Hospitals and Clinics

- 3.3. Other End-Users

Patient Monitoring Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Patient Monitoring Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.39% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring

- 3.3. Market Restrains

- 3.3.1. Resistance from Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems; High Cost of Technology

- 3.4. Market Trends

- 3.4.1. The Cardiology Segment is Expected to Witness Considerable Market Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 5.1.1. Hemodynamic Monitoring Devices

- 5.1.2. Neuromonitoring Devices

- 5.1.3. Cardiac Monitoring Devices

- 5.1.4. Multi-parameter Monitors

- 5.1.5. Respiratory Monitoring Devices

- 5.1.6. Other Types of Devices

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Cardiology

- 5.2.2. Neurology

- 5.2.3. Respiratory

- 5.2.4. Fetal and Neonatal

- 5.2.5. Weight Management and Fitness Monitoring

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Home Healthcare

- 5.3.2. Hospitals and Clinics

- 5.3.3. Other End-Users

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type of Device

- 6. North America Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 6.1.1. Hemodynamic Monitoring Devices

- 6.1.2. Neuromonitoring Devices

- 6.1.3. Cardiac Monitoring Devices

- 6.1.4. Multi-parameter Monitors

- 6.1.5. Respiratory Monitoring Devices

- 6.1.6. Other Types of Devices

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Cardiology

- 6.2.2. Neurology

- 6.2.3. Respiratory

- 6.2.4. Fetal and Neonatal

- 6.2.5. Weight Management and Fitness Monitoring

- 6.2.6. Other Applications

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Home Healthcare

- 6.3.2. Hospitals and Clinics

- 6.3.3. Other End-Users

- 6.1. Market Analysis, Insights and Forecast - by Type of Device

- 7. Europe Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 7.1.1. Hemodynamic Monitoring Devices

- 7.1.2. Neuromonitoring Devices

- 7.1.3. Cardiac Monitoring Devices

- 7.1.4. Multi-parameter Monitors

- 7.1.5. Respiratory Monitoring Devices

- 7.1.6. Other Types of Devices

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Cardiology

- 7.2.2. Neurology

- 7.2.3. Respiratory

- 7.2.4. Fetal and Neonatal

- 7.2.5. Weight Management and Fitness Monitoring

- 7.2.6. Other Applications

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Home Healthcare

- 7.3.2. Hospitals and Clinics

- 7.3.3. Other End-Users

- 7.1. Market Analysis, Insights and Forecast - by Type of Device

- 8. Asia Pacific Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 8.1.1. Hemodynamic Monitoring Devices

- 8.1.2. Neuromonitoring Devices

- 8.1.3. Cardiac Monitoring Devices

- 8.1.4. Multi-parameter Monitors

- 8.1.5. Respiratory Monitoring Devices

- 8.1.6. Other Types of Devices

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Cardiology

- 8.2.2. Neurology

- 8.2.3. Respiratory

- 8.2.4. Fetal and Neonatal

- 8.2.5. Weight Management and Fitness Monitoring

- 8.2.6. Other Applications

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Home Healthcare

- 8.3.2. Hospitals and Clinics

- 8.3.3. Other End-Users

- 8.1. Market Analysis, Insights and Forecast - by Type of Device

- 9. Middle East and Africa Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 9.1.1. Hemodynamic Monitoring Devices

- 9.1.2. Neuromonitoring Devices

- 9.1.3. Cardiac Monitoring Devices

- 9.1.4. Multi-parameter Monitors

- 9.1.5. Respiratory Monitoring Devices

- 9.1.6. Other Types of Devices

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Cardiology

- 9.2.2. Neurology

- 9.2.3. Respiratory

- 9.2.4. Fetal and Neonatal

- 9.2.5. Weight Management and Fitness Monitoring

- 9.2.6. Other Applications

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Home Healthcare

- 9.3.2. Hospitals and Clinics

- 9.3.3. Other End-Users

- 9.1. Market Analysis, Insights and Forecast - by Type of Device

- 10. South America Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 10.1.1. Hemodynamic Monitoring Devices

- 10.1.2. Neuromonitoring Devices

- 10.1.3. Cardiac Monitoring Devices

- 10.1.4. Multi-parameter Monitors

- 10.1.5. Respiratory Monitoring Devices

- 10.1.6. Other Types of Devices

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Cardiology

- 10.2.2. Neurology

- 10.2.3. Respiratory

- 10.2.4. Fetal and Neonatal

- 10.2.5. Weight Management and Fitness Monitoring

- 10.2.6. Other Applications

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Home Healthcare

- 10.3.2. Hospitals and Clinics

- 10.3.3. Other End-Users

- 10.1. Market Analysis, Insights and Forecast - by Type of Device

- 11. North America Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. South America Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Brazil

- 12.1.2 Mexico

- 12.1.3 Rest of South America

- 13. Europe Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 United Kingdom

- 13.1.2 Germany

- 13.1.3 France

- 13.1.4 Italy

- 13.1.5 Spain

- 13.1.6 Russia

- 13.1.7 Rest of Europe

- 14. Asia Pacific Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 China

- 14.1.2 Japan

- 14.1.3 India

- 14.1.4 South Korea

- 14.1.5 Taiwan

- 14.1.6 Australia

- 14.1.7 Rest of Asia-Pacific

- 15. MEA Patient Monitoring Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Middle East

- 15.1.2 Africa

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Masimo Corporation

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 Abbott Laboratories

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Drägerwerk AG & Co KGaA

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Medtronic PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Omron Corporation

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 General Electric Company (GE Healthcare)

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Koninklijke Philips NV

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Johnson & Johnson

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Boston Scientific Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Baxter International Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Patient Monitoring Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Patient Monitoring Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 7: South America Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 8: South America Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 9: South America Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Europe Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Europe Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 13: Europe Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Asia Pacific Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Asia Pacific Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 17: Asia Pacific Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Asia Pacific Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 19: MEA Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 20: MEA Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 21: MEA Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: MEA Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Patient Monitoring Market Revenue (Million), by Type of Device 2024 & 2032

- Figure 24: North America Patient Monitoring Market Volume (K Unit), by Type of Device 2024 & 2032

- Figure 25: North America Patient Monitoring Market Revenue Share (%), by Type of Device 2024 & 2032

- Figure 26: North America Patient Monitoring Market Volume Share (%), by Type of Device 2024 & 2032

- Figure 27: North America Patient Monitoring Market Revenue (Million), by Application 2024 & 2032

- Figure 28: North America Patient Monitoring Market Volume (K Unit), by Application 2024 & 2032

- Figure 29: North America Patient Monitoring Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: North America Patient Monitoring Market Volume Share (%), by Application 2024 & 2032

- Figure 31: North America Patient Monitoring Market Revenue (Million), by End-User 2024 & 2032

- Figure 32: North America Patient Monitoring Market Volume (K Unit), by End-User 2024 & 2032

- Figure 33: North America Patient Monitoring Market Revenue Share (%), by End-User 2024 & 2032

- Figure 34: North America Patient Monitoring Market Volume Share (%), by End-User 2024 & 2032

- Figure 35: North America Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 37: North America Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Patient Monitoring Market Revenue (Million), by Type of Device 2024 & 2032

- Figure 40: Europe Patient Monitoring Market Volume (K Unit), by Type of Device 2024 & 2032

- Figure 41: Europe Patient Monitoring Market Revenue Share (%), by Type of Device 2024 & 2032

- Figure 42: Europe Patient Monitoring Market Volume Share (%), by Type of Device 2024 & 2032

- Figure 43: Europe Patient Monitoring Market Revenue (Million), by Application 2024 & 2032

- Figure 44: Europe Patient Monitoring Market Volume (K Unit), by Application 2024 & 2032

- Figure 45: Europe Patient Monitoring Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Europe Patient Monitoring Market Volume Share (%), by Application 2024 & 2032

- Figure 47: Europe Patient Monitoring Market Revenue (Million), by End-User 2024 & 2032

- Figure 48: Europe Patient Monitoring Market Volume (K Unit), by End-User 2024 & 2032

- Figure 49: Europe Patient Monitoring Market Revenue Share (%), by End-User 2024 & 2032

- Figure 50: Europe Patient Monitoring Market Volume Share (%), by End-User 2024 & 2032

- Figure 51: Europe Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 52: Europe Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 53: Europe Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Europe Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Patient Monitoring Market Revenue (Million), by Type of Device 2024 & 2032

- Figure 56: Asia Pacific Patient Monitoring Market Volume (K Unit), by Type of Device 2024 & 2032

- Figure 57: Asia Pacific Patient Monitoring Market Revenue Share (%), by Type of Device 2024 & 2032

- Figure 58: Asia Pacific Patient Monitoring Market Volume Share (%), by Type of Device 2024 & 2032

- Figure 59: Asia Pacific Patient Monitoring Market Revenue (Million), by Application 2024 & 2032

- Figure 60: Asia Pacific Patient Monitoring Market Volume (K Unit), by Application 2024 & 2032

- Figure 61: Asia Pacific Patient Monitoring Market Revenue Share (%), by Application 2024 & 2032

- Figure 62: Asia Pacific Patient Monitoring Market Volume Share (%), by Application 2024 & 2032

- Figure 63: Asia Pacific Patient Monitoring Market Revenue (Million), by End-User 2024 & 2032

- Figure 64: Asia Pacific Patient Monitoring Market Volume (K Unit), by End-User 2024 & 2032

- Figure 65: Asia Pacific Patient Monitoring Market Revenue Share (%), by End-User 2024 & 2032

- Figure 66: Asia Pacific Patient Monitoring Market Volume Share (%), by End-User 2024 & 2032

- Figure 67: Asia Pacific Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 68: Asia Pacific Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 69: Asia Pacific Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 70: Asia Pacific Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East and Africa Patient Monitoring Market Revenue (Million), by Type of Device 2024 & 2032

- Figure 72: Middle East and Africa Patient Monitoring Market Volume (K Unit), by Type of Device 2024 & 2032

- Figure 73: Middle East and Africa Patient Monitoring Market Revenue Share (%), by Type of Device 2024 & 2032

- Figure 74: Middle East and Africa Patient Monitoring Market Volume Share (%), by Type of Device 2024 & 2032

- Figure 75: Middle East and Africa Patient Monitoring Market Revenue (Million), by Application 2024 & 2032

- Figure 76: Middle East and Africa Patient Monitoring Market Volume (K Unit), by Application 2024 & 2032

- Figure 77: Middle East and Africa Patient Monitoring Market Revenue Share (%), by Application 2024 & 2032

- Figure 78: Middle East and Africa Patient Monitoring Market Volume Share (%), by Application 2024 & 2032

- Figure 79: Middle East and Africa Patient Monitoring Market Revenue (Million), by End-User 2024 & 2032

- Figure 80: Middle East and Africa Patient Monitoring Market Volume (K Unit), by End-User 2024 & 2032

- Figure 81: Middle East and Africa Patient Monitoring Market Revenue Share (%), by End-User 2024 & 2032

- Figure 82: Middle East and Africa Patient Monitoring Market Volume Share (%), by End-User 2024 & 2032

- Figure 83: Middle East and Africa Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East and Africa Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 85: Middle East and Africa Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East and Africa Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

- Figure 87: South America Patient Monitoring Market Revenue (Million), by Type of Device 2024 & 2032

- Figure 88: South America Patient Monitoring Market Volume (K Unit), by Type of Device 2024 & 2032

- Figure 89: South America Patient Monitoring Market Revenue Share (%), by Type of Device 2024 & 2032

- Figure 90: South America Patient Monitoring Market Volume Share (%), by Type of Device 2024 & 2032

- Figure 91: South America Patient Monitoring Market Revenue (Million), by Application 2024 & 2032

- Figure 92: South America Patient Monitoring Market Volume (K Unit), by Application 2024 & 2032

- Figure 93: South America Patient Monitoring Market Revenue Share (%), by Application 2024 & 2032

- Figure 94: South America Patient Monitoring Market Volume Share (%), by Application 2024 & 2032

- Figure 95: South America Patient Monitoring Market Revenue (Million), by End-User 2024 & 2032

- Figure 96: South America Patient Monitoring Market Volume (K Unit), by End-User 2024 & 2032

- Figure 97: South America Patient Monitoring Market Revenue Share (%), by End-User 2024 & 2032

- Figure 98: South America Patient Monitoring Market Volume Share (%), by End-User 2024 & 2032

- Figure 99: South America Patient Monitoring Market Revenue (Million), by Country 2024 & 2032

- Figure 100: South America Patient Monitoring Market Volume (K Unit), by Country 2024 & 2032

- Figure 101: South America Patient Monitoring Market Revenue Share (%), by Country 2024 & 2032

- Figure 102: South America Patient Monitoring Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Patient Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Patient Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Patient Monitoring Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 4: Global Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 5: Global Patient Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Patient Monitoring Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Global Patient Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Global Patient Monitoring Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 9: Global Patient Monitoring Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Patient Monitoring Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: United States Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 14: United States Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 15: Canada Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 16: Canada Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 17: Mexico Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 18: Mexico Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 19: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Brazil Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 22: Brazil Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 23: Mexico Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 24: Mexico Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 25: Rest of South America Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 26: Rest of South America Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 27: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United Kingdom Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United Kingdom Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Germany Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Germany Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: France Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: France Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Italy Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 36: Italy Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 37: Spain Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 38: Spain Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 39: Russia Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 40: Russia Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 41: Rest of Europe Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 42: Rest of Europe Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 43: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 44: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 45: China Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: China Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: Japan Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: Japan Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: India Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: India Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: South Korea Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: South Korea Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Taiwan Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Taiwan Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Australia Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 56: Australia Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 57: Rest of Asia-Pacific Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 58: Rest of Asia-Pacific Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 59: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 60: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 61: Middle East Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 62: Middle East Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 63: Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Global Patient Monitoring Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 66: Global Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 67: Global Patient Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 68: Global Patient Monitoring Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 69: Global Patient Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 70: Global Patient Monitoring Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 71: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 72: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 73: United States Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: United States Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Canada Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 76: Canada Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 77: Mexico Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 78: Mexico Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 79: Global Patient Monitoring Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 80: Global Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 81: Global Patient Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 82: Global Patient Monitoring Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 83: Global Patient Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 84: Global Patient Monitoring Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 85: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 86: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 87: Germany Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Germany Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: United Kingdom Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 90: United Kingdom Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 91: France Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 92: France Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 93: Italy Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 94: Italy Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 95: Spain Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 96: Spain Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 97: Rest of Europe Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Rest of Europe Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Global Patient Monitoring Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 100: Global Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 101: Global Patient Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 102: Global Patient Monitoring Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 103: Global Patient Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 104: Global Patient Monitoring Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 105: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 106: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 107: China Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 108: China Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 109: Japan Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 110: Japan Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 111: India Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 112: India Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 113: Australia Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 114: Australia Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 115: South Korea Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 116: South Korea Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 117: Rest of Asia Pacific Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 118: Rest of Asia Pacific Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 119: Global Patient Monitoring Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 120: Global Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 121: Global Patient Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 122: Global Patient Monitoring Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 123: Global Patient Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 124: Global Patient Monitoring Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 125: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 126: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 127: GCC Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 128: GCC Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 129: South Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 130: South Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 131: Rest of Middle East and Africa Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 132: Rest of Middle East and Africa Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 133: Global Patient Monitoring Market Revenue Million Forecast, by Type of Device 2019 & 2032

- Table 134: Global Patient Monitoring Market Volume K Unit Forecast, by Type of Device 2019 & 2032

- Table 135: Global Patient Monitoring Market Revenue Million Forecast, by Application 2019 & 2032

- Table 136: Global Patient Monitoring Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 137: Global Patient Monitoring Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 138: Global Patient Monitoring Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 139: Global Patient Monitoring Market Revenue Million Forecast, by Country 2019 & 2032

- Table 140: Global Patient Monitoring Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 141: Brazil Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 142: Brazil Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 143: Argentina Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 144: Argentina Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 145: Rest of South America Patient Monitoring Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 146: Rest of South America Patient Monitoring Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Patient Monitoring Market?

The projected CAGR is approximately 7.39%.

2. Which companies are prominent players in the Patient Monitoring Market?

Key companies in the market include Becton Dickinson and Company, Masimo Corporation, Abbott Laboratories, Drägerwerk AG & Co KGaA, Medtronic PLC, Omron Corporation, General Electric Company (GE Healthcare), Koninklijke Philips NV, Johnson & Johnson, Boston Scientific Corporation, Baxter International Inc.

3. What are the main segments of the Patient Monitoring Market?

The market segments include Type of Device, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD 47.05 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising Burden of Chronic Diseases due to Lifestyle Changes; Growing Preference for Home and Remote Monitoring.

6. What are the notable trends driving market growth?

The Cardiology Segment is Expected to Witness Considerable Market Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Resistance from Healthcare Industry Professionals Toward the Adoption of Patient Monitoring Systems; High Cost of Technology.

8. Can you provide examples of recent developments in the market?

April 2023: Honeywell announced that it has developed a real-time health monitoring system, which captures and records patients' vital signs both within the hospital setting and remotely. Honeywell's solution uses advanced sensing technology to monitor vital signs via a skin patch, which connects the data instantaneously to healthcare providers on mobile devices and an online dashboard.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Patient Monitoring Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Patient Monitoring Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Patient Monitoring Market?

To stay informed about further developments, trends, and reports in the Patient Monitoring Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence