Key Insights

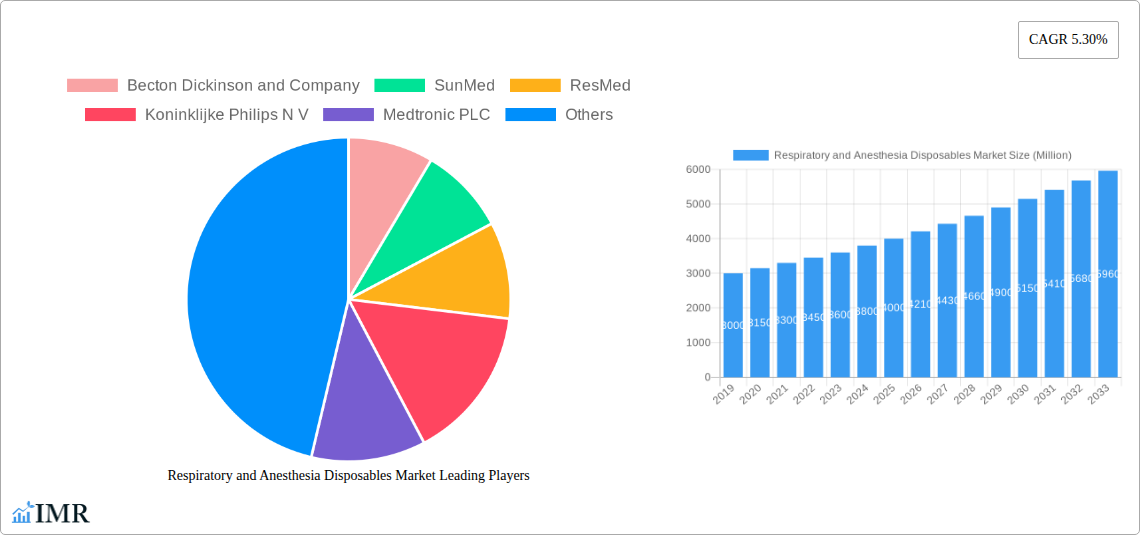

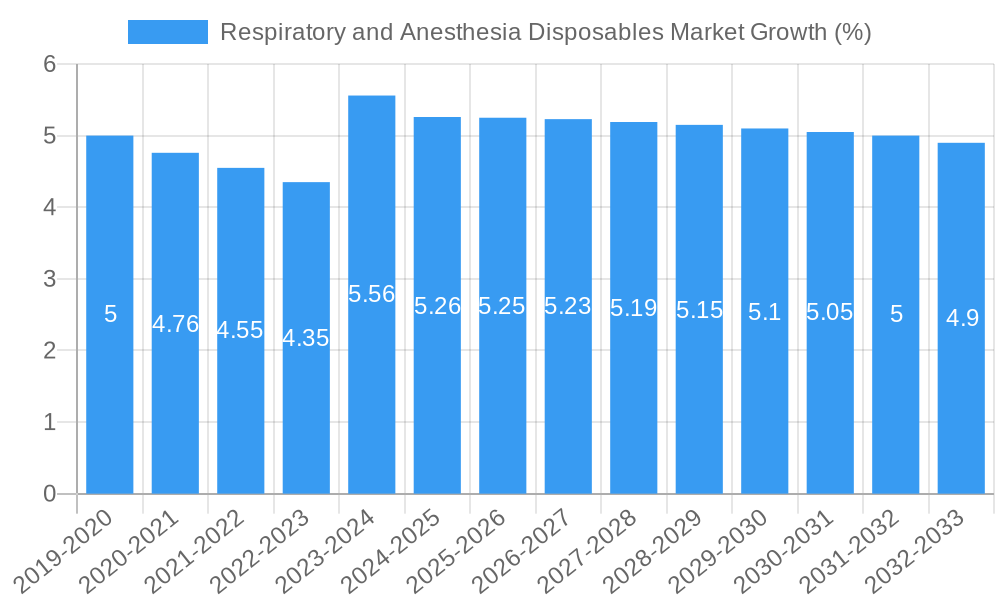

The global Respiratory and Anesthesia Disposables Market is poised for robust growth, projected to reach approximately USD 4,200 million by 2025, driven by an estimated CAGR of 5.30% through 2033. This expansion is underpinned by a confluence of escalating respiratory disease prevalence, increasing surgical procedure volumes, and a growing awareness of advanced respiratory care solutions. The rising incidence of chronic conditions such as COPD and asthma, coupled with the aging global population, creates a sustained demand for essential disposable products like breathing circuits, masks, and ventilators. Furthermore, the surge in elective and emergency surgical interventions, necessitating effective anesthesia management, directly fuels market expansion. Key market players are actively investing in product innovation and strategic collaborations to enhance their market presence and cater to the evolving needs of healthcare providers.

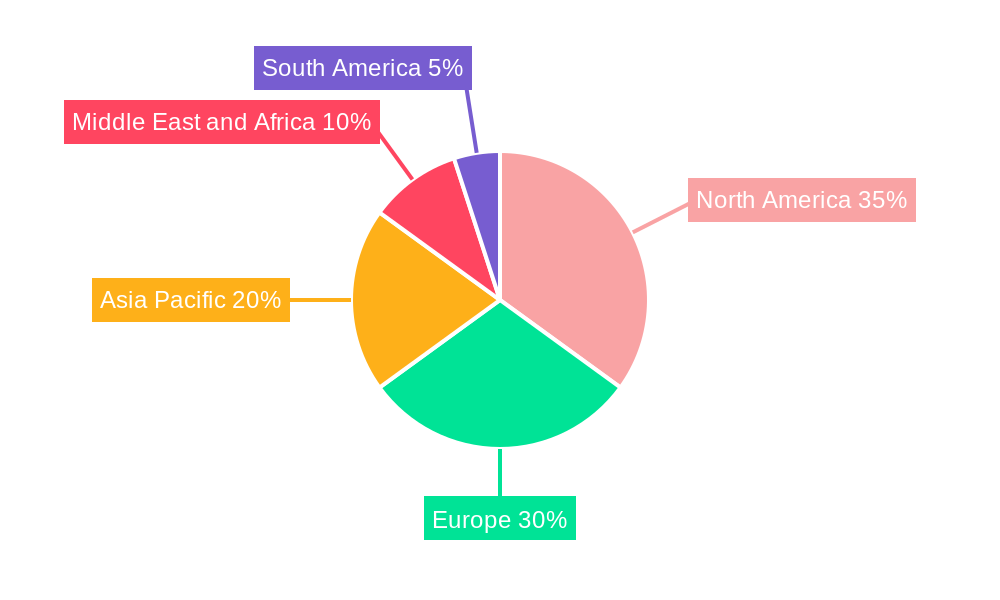

The market is segmented across a diverse range of product types, applications, and end-users, reflecting the broad spectrum of respiratory and anesthesia care. Laryngoscopes, tubes, masks, breathing circuits, resuscitators, breathing bags, and filters constitute the primary product categories, each playing a crucial role in patient management. Applications span critical areas including Chronic Obstructive Pulmonary Disease (COPD), surgical procedures, asthma management, sleep apnea treatment, and emergency response. The demand is predominantly concentrated within hospitals, clinics, and trauma centers, which are the frontline providers of these essential medical supplies. Geographically, North America and Europe currently dominate the market due to well-established healthcare infrastructures and high healthcare spending, while the Asia Pacific region is anticipated to witness the fastest growth, propelled by expanding healthcare access and increasing medical tourism. Challenges such as stringent regulatory approvals and the need for cost-effective solutions are being addressed through technological advancements and streamlined supply chain management.

This in-depth report provides a thorough examination of the global respiratory and anesthesia disposables market, a critical segment within the healthcare industry. Covering the study period of 2019–2033, with a base year of 2025 and a forecast period of 2025–2033, this analysis delves into market dynamics, growth trends, regional dominance, product innovations, key drivers, emerging opportunities, and the competitive landscape. We analyze critical parent market trends and their impact on the child market segments, offering unparalleled insights for stakeholders. This report is optimized with high-traffic keywords such as respiratory disposables, anesthesia disposables, medical devices, COPD treatment, surgical disposables, sleep apnea devices, and emergency medical supplies to maximize search engine visibility. All values are presented in Million units.

Respiratory and Anesthesia Disposables Market Market Dynamics & Structure

The respiratory and anesthesia disposables market is characterized by a moderately fragmented structure, with a mix of large multinational corporations and smaller specialized players. Becton Dickinson and Company, ResMed, and Medtronic PLC hold significant market share due to their extensive product portfolios and established distribution networks. Technological innovation remains a primary driver, with ongoing advancements in material science, miniaturization, and connectivity enhancing product performance and patient comfort. Regulatory frameworks, particularly those set by the FDA in the US and EMA in Europe, play a crucial role in shaping market entry and product approval processes, demanding rigorous safety and efficacy standards. The presence of competitive product substitutes is moderate; however, the disposable nature of these products and the stringent hygiene requirements in healthcare settings limit extensive substitution. End-user demographics are expanding, driven by an aging global population and the rising incidence of chronic respiratory diseases like COPD and asthma. M&A trends are active, with larger companies acquiring innovative startups to expand their product offerings and market reach. For instance, Teleflex Incorporated has been active in strategic acquisitions to bolster its respiratory care portfolio. Innovation barriers include the high cost of R&D, lengthy approval cycles, and the need for substantial clinical validation.

- Market Concentration: Moderately fragmented, with key players holding significant shares.

- Technological Innovation Drivers: Advanced materials, smart devices, improved patient interface designs.

- Regulatory Frameworks: FDA, EMA stringent approval processes ensure quality and safety.

- Competitive Product Substitutes: Limited due to hygiene and single-use requirements, but reusable alternatives are a consideration in some niche applications.

- End-User Demographics: Growing demand from aging populations and patients with chronic respiratory conditions.

- M&A Trends: Active consolidation and strategic partnerships for portfolio expansion.

Respiratory and Anesthesia Disposables Market Growth Trends & Insights

The respiratory and anesthesia disposables market is poised for robust growth, projected to expand at a significant Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is fueled by an increasing global prevalence of respiratory conditions such as Chronic Obstructive Pulmonary Disease (COPD), asthma, and the persistent impact of sleep disorders like sleep apnea. The rising incidence of these conditions directly translates to higher demand for essential medical disposables like masks, breathing circuits, and filters. Furthermore, the burgeoning healthcare infrastructure in emerging economies, coupled with increased healthcare expenditure, is a major growth catalyst. The surgical procedures segment also contributes substantially, as anesthesia is integral to a vast array of medical interventions, driving the need for anesthesia masks, tubes, and breathing bags.

Technological disruptions are continuously reshaping the market. Innovations in areas like video laryngoscopes for improved intubation success rates and advanced, breathable mask materials are enhancing patient outcomes and procedural efficiencies. The COVID-19 pandemic, while presenting unprecedented challenges, also accelerated the adoption of respiratory disposables, particularly high-efficiency filters and advanced respiratory support devices, creating a lasting impact on market awareness and demand for advanced solutions. Consumer behavior shifts are also playing a role; patients are becoming more informed and proactive about their health, leading to increased demand for home-use respiratory devices and related disposables for managing chronic conditions. The penetration of these disposables in both hospital settings and home healthcare environments is expected to rise considerably. Market penetration for advanced anesthesia disposables in developing regions is still in its nascent stages, presenting a substantial opportunity for growth.

Dominant Regions, Countries, or Segments in Respiratory and Anesthesia Disposables Market

North America currently dominates the respiratory and anesthesia disposables market, driven by its advanced healthcare infrastructure, high disposable income, and a significant patient pool suffering from chronic respiratory diseases. The United States, in particular, contributes a substantial share due to the high prevalence of COPD, asthma, and sleep apnea, coupled with widespread adoption of advanced medical technologies. Government initiatives aimed at improving respiratory care access and the continuous influx of technological innovations from leading companies like Becton Dickinson and Company and Medtronic PLC further solidify North America's leading position.

Among the segments, Surgical Procedures represent the largest application, given that anesthesia disposables are indispensable across nearly all types of surgical interventions. The increasing volume of elective and emergency surgeries worldwide directly fuels the demand for anesthesia masks, breathing circuits, and tubes. In terms of product types, Breathing Circuits and Masks are consistently in high demand due to their broad applicability in various respiratory support and anesthesia delivery scenarios. Hospitals remain the primary end-user, accounting for the largest market share due to their role as central hubs for surgical procedures, emergency care, and the management of complex respiratory conditions. However, Clinics and Trauma Centers are also showing significant growth, driven by decentralization of healthcare services and the increasing demand for immediate medical attention.

The Asia Pacific region is emerging as a high-growth market. Rapid economic development, increasing healthcare expenditure, a large and growing population, and a rising incidence of respiratory illnesses are key drivers. Countries like China and India, with their vast patient populations and expanding healthcare access, are expected to witness significant growth in demand for respiratory disposables and anesthesia disposables. Government focus on improving healthcare quality and accessibility further supports this trend. Economic policies encouraging local manufacturing and foreign investment in the medical device sector are also contributing to the region's expansion.

Respiratory and Anesthesia Disposables Market Product Landscape

The product landscape of the respiratory and anesthesia disposables market is marked by continuous innovation aimed at enhancing patient safety, comfort, and procedural efficiency. Key product innovations include the development of ultra-lightweight and ergonomic anesthesia masks, advanced breathing circuits with integrated temperature and humidity monitoring, and laryngoscopes with improved visualization capabilities, such as the Timesco Healthcare Optima View system. Laryngoscopes, including both traditional and video models, are crucial for airway management during anesthesia and in emergency settings. Breathing circuits, essential for delivering anesthetic gases and oxygen, are evolving with designs that minimize dead space and reduce resistance. Masks, ranging from simple oxygen masks to complex CPAP masks for sleep apnea, are being developed with softer materials and more secure fits. Resuscitators are becoming more user-friendly, and breathing bags are being optimized for efficient ventilation. Filters, vital for preventing cross-contamination, are increasingly incorporating advanced filtration media for enhanced protection.

Key Drivers, Barriers & Challenges in Respiratory and Anesthesia Disposables Market

Key Drivers:

- Rising Incidence of Respiratory Diseases: Growing prevalence of COPD, asthma, and sleep apnea necessitates continuous use of respiratory support devices and disposables.

- Technological Advancements: Innovations in product design, materials, and functionality lead to improved patient outcomes and procedural efficiency.

- Increasing Healthcare Expenditure: Global growth in healthcare spending, particularly in emerging economies, expands access to advanced medical devices.

- Aging Global Population: Elderly individuals are more susceptible to respiratory ailments, driving sustained demand.

- Growth in Surgical Procedures: The increasing volume of surgeries necessitates a consistent supply of anesthesia disposables.

Key Barriers & Challenges:

- Stringent Regulatory Approvals: Lengthy and costly regulatory processes can hinder market entry for new products.

- Price Sensitivity in Emerging Markets: While demand is growing, affordability remains a challenge in many developing regions.

- Supply Chain Disruptions: Geopolitical factors, raw material availability, and logistical issues can impact the consistent supply of disposables.

- Competition from Reusable Devices: In certain applications, the higher initial cost of reusable devices can be a deterrent to adopting disposables, though infection control concerns often favor disposables.

- Counterfeit Products: The presence of counterfeit medical devices poses a significant threat to patient safety and market integrity.

Emerging Opportunities in Respiratory and Anesthesia Disposables Market

Emerging opportunities in the respiratory and anesthesia disposables market lie in the expansion of home healthcare solutions. As more patients manage chronic respiratory conditions at home, there's a growing demand for user-friendly and effective disposables like CPAP masks and filters for sleep apnea management. The integration of smart technologies and connectivity in disposable devices presents another significant avenue, enabling remote patient monitoring and personalized treatment. Furthermore, the increasing focus on minimally invasive surgical techniques will drive the demand for specialized anesthesia disposables tailored for these procedures. Untapped markets in developing nations, particularly in Africa and parts of Asia, offer substantial growth potential as healthcare infrastructure improves and awareness of respiratory health increases.

Growth Accelerators in the Respiratory and Anesthesia Disposables Market Industry

Long-term growth in the respiratory and anesthesia disposables market will be significantly accelerated by continuous technological breakthroughs, such as the development of biodegradable and sustainable disposable materials, which address growing environmental concerns. Strategic partnerships between manufacturers of disposables and medical device companies specializing in respiratory therapy equipment will foster synergistic innovation and market penetration. Market expansion strategies focused on addressing unmet needs in underserved populations and regions, coupled with government initiatives promoting universal healthcare access, will also be crucial growth catalysts. The increasing adoption of telemedicine and remote patient monitoring will further drive the demand for connected respiratory disposables, enabling proactive healthcare management.

Key Players Shaping the Respiratory and Anesthesia Disposables Market Market

- Becton Dickinson and Company

- SunMed

- ResMed

- Koninklijke Philips N V

- Medtronic PLC

- Smiths Group plc

- Armstrong Medical Industries Inc

- Teleflex Incorporated

- Boston Scientific Corporation

- Airways Corporation

Notable Milestones in Respiratory and Anesthesia Disposables Market Sector

- January 2023: Timesco Healthcare launched the new video laryngoscope, Optima View system, to support intubation in patients with difficult airways at Arab Health 2023. The system can improve visualization, reduce complications, and improve the success rate of tracheal intubation in pre-hospital settings.

- August 2022: Optrel launched the P Air Clear, the world's first NIOSH-approved N95 respirator with a transparent window that offers the highest quality protection with the added benefit of a transparent window, eliminating the communication barrier posed by traditional masks.

In-Depth Respiratory and Anesthesia Disposables Market Market Outlook

- January 2023: Timesco Healthcare launched the new video laryngoscope, Optima View system, to support intubation in patients with difficult airways at Arab Health 2023. The system can improve visualization, reduce complications, and improve the success rate of tracheal intubation in pre-hospital settings.

- August 2022: Optrel launched the P Air Clear, the world's first NIOSH-approved N95 respirator with a transparent window that offers the highest quality protection with the added benefit of a transparent window, eliminating the communication barrier posed by traditional masks.

In-Depth Respiratory and Anesthesia Disposables Market Market Outlook

The respiratory and anesthesia disposables market is set for a future characterized by innovation, expanding applications, and increasing global reach. Growth accelerators such as advanced material science leading to more sustainable and patient-friendly disposables, coupled with the integration of IoT and AI for enhanced remote monitoring, will redefine the market landscape. Strategic alliances and collaborations among key players will foster an environment of continuous product development and market penetration, especially in emerging economies. The increasing demand for personalized respiratory care solutions and the ongoing need for reliable airway management tools in surgical and emergency settings will ensure a sustained upward trajectory for this vital market segment. Opportunities in expanding home-based care models and addressing the growing burden of respiratory diseases globally present a fertile ground for future growth.

Respiratory and Anesthesia Disposables Market Segmentation

-

1. Type

- 1.1. Laryngoscope

- 1.2. Tubes

- 1.3. Masks

- 1.4. Breathing Circuits

- 1.5. Resuscitators

- 1.6. Breathing Bags

- 1.7. Filters

- 1.8. Other Types

-

2. Application

- 2.1. Chronic Obstructive Pulmonary Disease (COPD)

- 2.2. Surgical Procedures

- 2.3. Asthma

- 2.4. Sleep Apnea

- 2.5. Emergency Use

-

3. End-User

- 3.1. Hospitals

- 3.2. Clinics

- 3.3. Trauma Centers

Respiratory and Anesthesia Disposables Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Respiratory and Anesthesia Disposables Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 5.30% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Prevalence of Respiratory Disorders; Increasing Number of Surgeries; High Prevalence of Tobacco Smoking

- 3.3. Market Restrains

- 3.3.1. Higher Cost of Consumables

- 3.4. Market Trends

- 3.4.1. Chronic Obstructive Pulmonary Disease Segment is Expected to Witness Significant Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Laryngoscope

- 5.1.2. Tubes

- 5.1.3. Masks

- 5.1.4. Breathing Circuits

- 5.1.5. Resuscitators

- 5.1.6. Breathing Bags

- 5.1.7. Filters

- 5.1.8. Other Types

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Chronic Obstructive Pulmonary Disease (COPD)

- 5.2.2. Surgical Procedures

- 5.2.3. Asthma

- 5.2.4. Sleep Apnea

- 5.2.5. Emergency Use

- 5.3. Market Analysis, Insights and Forecast - by End-User

- 5.3.1. Hospitals

- 5.3.2. Clinics

- 5.3.3. Trauma Centers

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Middle East and Africa

- 5.4.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Laryngoscope

- 6.1.2. Tubes

- 6.1.3. Masks

- 6.1.4. Breathing Circuits

- 6.1.5. Resuscitators

- 6.1.6. Breathing Bags

- 6.1.7. Filters

- 6.1.8. Other Types

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Chronic Obstructive Pulmonary Disease (COPD)

- 6.2.2. Surgical Procedures

- 6.2.3. Asthma

- 6.2.4. Sleep Apnea

- 6.2.5. Emergency Use

- 6.3. Market Analysis, Insights and Forecast - by End-User

- 6.3.1. Hospitals

- 6.3.2. Clinics

- 6.3.3. Trauma Centers

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Laryngoscope

- 7.1.2. Tubes

- 7.1.3. Masks

- 7.1.4. Breathing Circuits

- 7.1.5. Resuscitators

- 7.1.6. Breathing Bags

- 7.1.7. Filters

- 7.1.8. Other Types

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Chronic Obstructive Pulmonary Disease (COPD)

- 7.2.2. Surgical Procedures

- 7.2.3. Asthma

- 7.2.4. Sleep Apnea

- 7.2.5. Emergency Use

- 7.3. Market Analysis, Insights and Forecast - by End-User

- 7.3.1. Hospitals

- 7.3.2. Clinics

- 7.3.3. Trauma Centers

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Laryngoscope

- 8.1.2. Tubes

- 8.1.3. Masks

- 8.1.4. Breathing Circuits

- 8.1.5. Resuscitators

- 8.1.6. Breathing Bags

- 8.1.7. Filters

- 8.1.8. Other Types

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Chronic Obstructive Pulmonary Disease (COPD)

- 8.2.2. Surgical Procedures

- 8.2.3. Asthma

- 8.2.4. Sleep Apnea

- 8.2.5. Emergency Use

- 8.3. Market Analysis, Insights and Forecast - by End-User

- 8.3.1. Hospitals

- 8.3.2. Clinics

- 8.3.3. Trauma Centers

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. Middle East and Africa Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Laryngoscope

- 9.1.2. Tubes

- 9.1.3. Masks

- 9.1.4. Breathing Circuits

- 9.1.5. Resuscitators

- 9.1.6. Breathing Bags

- 9.1.7. Filters

- 9.1.8. Other Types

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Chronic Obstructive Pulmonary Disease (COPD)

- 9.2.2. Surgical Procedures

- 9.2.3. Asthma

- 9.2.4. Sleep Apnea

- 9.2.5. Emergency Use

- 9.3. Market Analysis, Insights and Forecast - by End-User

- 9.3.1. Hospitals

- 9.3.2. Clinics

- 9.3.3. Trauma Centers

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. South America Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Laryngoscope

- 10.1.2. Tubes

- 10.1.3. Masks

- 10.1.4. Breathing Circuits

- 10.1.5. Resuscitators

- 10.1.6. Breathing Bags

- 10.1.7. Filters

- 10.1.8. Other Types

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Chronic Obstructive Pulmonary Disease (COPD)

- 10.2.2. Surgical Procedures

- 10.2.3. Asthma

- 10.2.4. Sleep Apnea

- 10.2.5. Emergency Use

- 10.3. Market Analysis, Insights and Forecast - by End-User

- 10.3.1. Hospitals

- 10.3.2. Clinics

- 10.3.3. Trauma Centers

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. North America Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1. undefined

- 12. Europe Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1. undefined

- 13. Asia Pacific Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1. undefined

- 14. Middle East and Africa Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1. undefined

- 15. South America Respiratory and Anesthesia Disposables Market Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1. undefined

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Becton Dickinson and Company

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 SunMed

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 ResMed

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 Koninklijke Philips N V

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 Medtronic PLC

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Smiths Group plc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Armstrong Medical Industries Inc

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Teleflex Incorporated

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Boston Scientific Corporation

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Airways Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.1 Becton Dickinson and Company

List of Figures

- Figure 1: Global Respiratory and Anesthesia Disposables Market Revenue Breakdown (Million, %) by Region 2024 & 2032

- Figure 2: Global Respiratory and Anesthesia Disposables Market Volume Breakdown (K Unit, %) by Region 2024 & 2032

- Figure 3: North America Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 4: North America Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 5: North America Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 6: North America Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 7: Europe Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 8: Europe Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 9: Europe Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 10: Europe Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 11: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 12: Asia Pacific Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 13: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 14: Asia Pacific Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 15: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 16: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 17: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 18: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 19: South America Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 20: South America Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 21: South America Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 22: South America Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 23: North America Respiratory and Anesthesia Disposables Market Revenue (Million), by Type 2024 & 2032

- Figure 24: North America Respiratory and Anesthesia Disposables Market Volume (K Unit), by Type 2024 & 2032

- Figure 25: North America Respiratory and Anesthesia Disposables Market Revenue Share (%), by Type 2024 & 2032

- Figure 26: North America Respiratory and Anesthesia Disposables Market Volume Share (%), by Type 2024 & 2032

- Figure 27: North America Respiratory and Anesthesia Disposables Market Revenue (Million), by Application 2024 & 2032

- Figure 28: North America Respiratory and Anesthesia Disposables Market Volume (K Unit), by Application 2024 & 2032

- Figure 29: North America Respiratory and Anesthesia Disposables Market Revenue Share (%), by Application 2024 & 2032

- Figure 30: North America Respiratory and Anesthesia Disposables Market Volume Share (%), by Application 2024 & 2032

- Figure 31: North America Respiratory and Anesthesia Disposables Market Revenue (Million), by End-User 2024 & 2032

- Figure 32: North America Respiratory and Anesthesia Disposables Market Volume (K Unit), by End-User 2024 & 2032

- Figure 33: North America Respiratory and Anesthesia Disposables Market Revenue Share (%), by End-User 2024 & 2032

- Figure 34: North America Respiratory and Anesthesia Disposables Market Volume Share (%), by End-User 2024 & 2032

- Figure 35: North America Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 36: North America Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 37: North America Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 38: North America Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 39: Europe Respiratory and Anesthesia Disposables Market Revenue (Million), by Type 2024 & 2032

- Figure 40: Europe Respiratory and Anesthesia Disposables Market Volume (K Unit), by Type 2024 & 2032

- Figure 41: Europe Respiratory and Anesthesia Disposables Market Revenue Share (%), by Type 2024 & 2032

- Figure 42: Europe Respiratory and Anesthesia Disposables Market Volume Share (%), by Type 2024 & 2032

- Figure 43: Europe Respiratory and Anesthesia Disposables Market Revenue (Million), by Application 2024 & 2032

- Figure 44: Europe Respiratory and Anesthesia Disposables Market Volume (K Unit), by Application 2024 & 2032

- Figure 45: Europe Respiratory and Anesthesia Disposables Market Revenue Share (%), by Application 2024 & 2032

- Figure 46: Europe Respiratory and Anesthesia Disposables Market Volume Share (%), by Application 2024 & 2032

- Figure 47: Europe Respiratory and Anesthesia Disposables Market Revenue (Million), by End-User 2024 & 2032

- Figure 48: Europe Respiratory and Anesthesia Disposables Market Volume (K Unit), by End-User 2024 & 2032

- Figure 49: Europe Respiratory and Anesthesia Disposables Market Revenue Share (%), by End-User 2024 & 2032

- Figure 50: Europe Respiratory and Anesthesia Disposables Market Volume Share (%), by End-User 2024 & 2032

- Figure 51: Europe Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 52: Europe Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 53: Europe Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 54: Europe Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 55: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue (Million), by Type 2024 & 2032

- Figure 56: Asia Pacific Respiratory and Anesthesia Disposables Market Volume (K Unit), by Type 2024 & 2032

- Figure 57: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue Share (%), by Type 2024 & 2032

- Figure 58: Asia Pacific Respiratory and Anesthesia Disposables Market Volume Share (%), by Type 2024 & 2032

- Figure 59: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue (Million), by Application 2024 & 2032

- Figure 60: Asia Pacific Respiratory and Anesthesia Disposables Market Volume (K Unit), by Application 2024 & 2032

- Figure 61: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue Share (%), by Application 2024 & 2032

- Figure 62: Asia Pacific Respiratory and Anesthesia Disposables Market Volume Share (%), by Application 2024 & 2032

- Figure 63: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue (Million), by End-User 2024 & 2032

- Figure 64: Asia Pacific Respiratory and Anesthesia Disposables Market Volume (K Unit), by End-User 2024 & 2032

- Figure 65: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue Share (%), by End-User 2024 & 2032

- Figure 66: Asia Pacific Respiratory and Anesthesia Disposables Market Volume Share (%), by End-User 2024 & 2032

- Figure 67: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 68: Asia Pacific Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 69: Asia Pacific Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 70: Asia Pacific Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 71: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue (Million), by Type 2024 & 2032

- Figure 72: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume (K Unit), by Type 2024 & 2032

- Figure 73: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue Share (%), by Type 2024 & 2032

- Figure 74: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume Share (%), by Type 2024 & 2032

- Figure 75: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue (Million), by Application 2024 & 2032

- Figure 76: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume (K Unit), by Application 2024 & 2032

- Figure 77: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue Share (%), by Application 2024 & 2032

- Figure 78: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume Share (%), by Application 2024 & 2032

- Figure 79: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue (Million), by End-User 2024 & 2032

- Figure 80: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume (K Unit), by End-User 2024 & 2032

- Figure 81: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue Share (%), by End-User 2024 & 2032

- Figure 82: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume Share (%), by End-User 2024 & 2032

- Figure 83: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 84: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 85: Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 86: Middle East and Africa Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

- Figure 87: South America Respiratory and Anesthesia Disposables Market Revenue (Million), by Type 2024 & 2032

- Figure 88: South America Respiratory and Anesthesia Disposables Market Volume (K Unit), by Type 2024 & 2032

- Figure 89: South America Respiratory and Anesthesia Disposables Market Revenue Share (%), by Type 2024 & 2032

- Figure 90: South America Respiratory and Anesthesia Disposables Market Volume Share (%), by Type 2024 & 2032

- Figure 91: South America Respiratory and Anesthesia Disposables Market Revenue (Million), by Application 2024 & 2032

- Figure 92: South America Respiratory and Anesthesia Disposables Market Volume (K Unit), by Application 2024 & 2032

- Figure 93: South America Respiratory and Anesthesia Disposables Market Revenue Share (%), by Application 2024 & 2032

- Figure 94: South America Respiratory and Anesthesia Disposables Market Volume Share (%), by Application 2024 & 2032

- Figure 95: South America Respiratory and Anesthesia Disposables Market Revenue (Million), by End-User 2024 & 2032

- Figure 96: South America Respiratory and Anesthesia Disposables Market Volume (K Unit), by End-User 2024 & 2032

- Figure 97: South America Respiratory and Anesthesia Disposables Market Revenue Share (%), by End-User 2024 & 2032

- Figure 98: South America Respiratory and Anesthesia Disposables Market Volume Share (%), by End-User 2024 & 2032

- Figure 99: South America Respiratory and Anesthesia Disposables Market Revenue (Million), by Country 2024 & 2032

- Figure 100: South America Respiratory and Anesthesia Disposables Market Volume (K Unit), by Country 2024 & 2032

- Figure 101: South America Respiratory and Anesthesia Disposables Market Revenue Share (%), by Country 2024 & 2032

- Figure 102: South America Respiratory and Anesthesia Disposables Market Volume Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 3: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Type 2019 & 2032

- Table 4: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 5: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 7: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 8: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 9: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Region 2019 & 2032

- Table 10: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Region 2019 & 2032

- Table 11: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 12: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 13: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 14: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 15: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 16: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 17: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 18: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 19: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 20: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 21: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Type 2019 & 2032

- Table 22: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 23: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 24: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 25: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 26: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 27: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 28: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 29: United States Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 30: United States Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 31: Canada Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 32: Canada Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 33: Mexico Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 34: Mexico Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 35: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Type 2019 & 2032

- Table 36: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 37: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 38: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 39: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 40: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 41: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 42: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 43: Germany Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 44: Germany Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 45: United Kingdom Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 46: United Kingdom Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 47: France Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 48: France Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 49: Italy Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 50: Italy Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 51: Spain Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 52: Spain Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 53: Rest of Europe Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 54: Rest of Europe Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 55: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Type 2019 & 2032

- Table 56: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 57: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 58: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 59: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 60: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 61: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 62: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 63: China Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 64: China Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 65: Japan Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 66: Japan Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 67: India Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 68: India Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 69: Australia Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 70: Australia Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 71: South Korea Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 72: South Korea Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 73: Rest of Asia Pacific Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 74: Rest of Asia Pacific Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 75: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Type 2019 & 2032

- Table 76: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 77: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 78: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 79: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 80: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 81: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 82: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 83: GCC Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 84: GCC Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 85: South Africa Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 86: South Africa Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 87: Rest of Middle East and Africa Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 88: Rest of Middle East and Africa Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 89: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Type 2019 & 2032

- Table 90: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Type 2019 & 2032

- Table 91: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Application 2019 & 2032

- Table 92: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Application 2019 & 2032

- Table 93: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by End-User 2019 & 2032

- Table 94: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by End-User 2019 & 2032

- Table 95: Global Respiratory and Anesthesia Disposables Market Revenue Million Forecast, by Country 2019 & 2032

- Table 96: Global Respiratory and Anesthesia Disposables Market Volume K Unit Forecast, by Country 2019 & 2032

- Table 97: Brazil Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 98: Brazil Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 99: Argentina Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 100: Argentina Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

- Table 101: Rest of South America Respiratory and Anesthesia Disposables Market Revenue (Million) Forecast, by Application 2019 & 2032

- Table 102: Rest of South America Respiratory and Anesthesia Disposables Market Volume (K Unit) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Respiratory and Anesthesia Disposables Market?

The projected CAGR is approximately 5.30%.

2. Which companies are prominent players in the Respiratory and Anesthesia Disposables Market?

Key companies in the market include Becton Dickinson and Company, SunMed, ResMed, Koninklijke Philips N V, Medtronic PLC, Smiths Group plc, Armstrong Medical Industries Inc, Teleflex Incorporated, Boston Scientific Corporation, Airways Corporation.

3. What are the main segments of the Respiratory and Anesthesia Disposables Market?

The market segments include Type, Application, End-User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Prevalence of Respiratory Disorders; Increasing Number of Surgeries; High Prevalence of Tobacco Smoking.

6. What are the notable trends driving market growth?

Chronic Obstructive Pulmonary Disease Segment is Expected to Witness Significant Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

Higher Cost of Consumables.

8. Can you provide examples of recent developments in the market?

January 2023: Timesco Healthcare launched the new video laryngoscope, Optima View system, to support intubation in patients with difficult airways at Arab Health 2023. The system can improve visualization, reduce complications, and improve the success rate of tracheal intubation in pre-hospital settings.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Respiratory and Anesthesia Disposables Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Respiratory and Anesthesia Disposables Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Respiratory and Anesthesia Disposables Market?

To stay informed about further developments, trends, and reports in the Respiratory and Anesthesia Disposables Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence