Key Insights

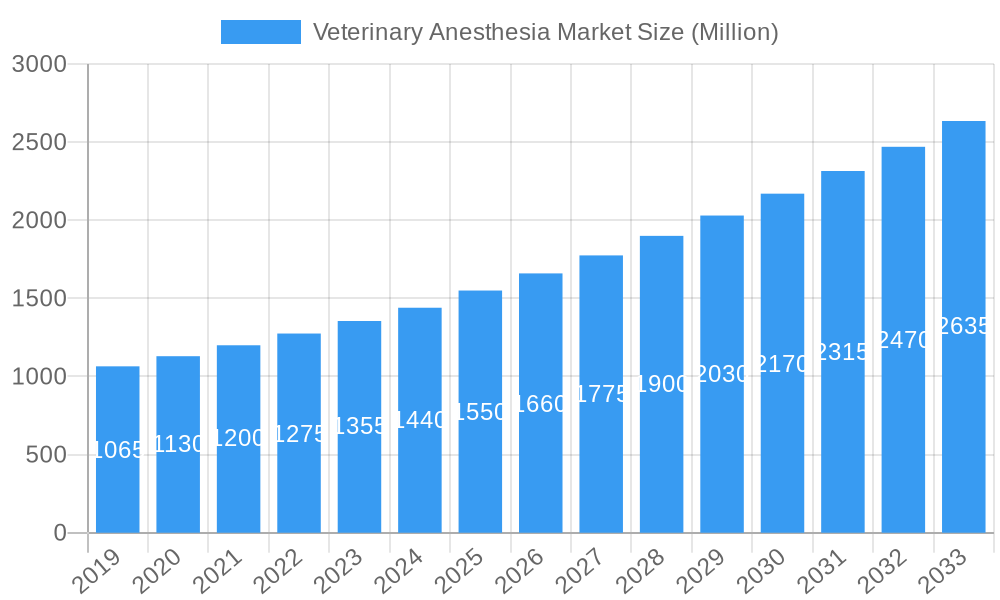

The global Veterinary Anesthesia Market is poised for significant expansion, projected to reach an estimated market size of approximately $1,550 million by 2025, driven by a robust Compound Annual Growth Rate (CAGR) of 6.50%. This growth is sustained throughout the forecast period from 2025 to 2033, indicating a steady and healthy increase in market value. A key driver for this market's ascent is the escalating global pet ownership, coupled with an increasing willingness among pet owners to invest in advanced veterinary care, including complex surgical procedures that necessitate sophisticated anesthesia solutions. The trend towards personalized and advanced veterinary medicine further fuels demand for specialized anesthetic equipment and drugs. Furthermore, the growing prevalence of chronic diseases and the aging pet population necessitate more frequent and intricate medical interventions, thereby boosting the need for reliable and effective veterinary anesthesia systems. The market segments are broadly categorized by product type, including On Trolley, Wall Mounted, and Table top anesthesia machines, and by animal type, encompassing Companion animals and Livestock. The rising number of veterinary clinics and hospitals, alongside advancements in anesthesia technology that enhance patient safety and efficacy, are critical contributing factors to the market's positive trajectory.

Veterinary Anesthesia Market Market Size (In Billion)

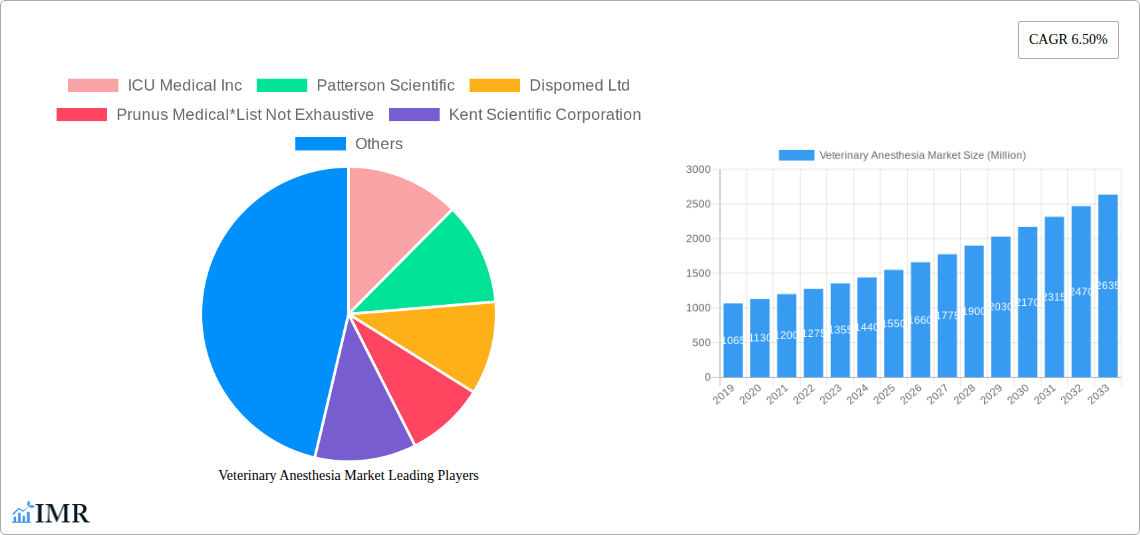

Despite the promising outlook, certain restraints could potentially temper the market's full potential. High initial investment costs for advanced anesthesia equipment may pose a challenge, particularly for smaller veterinary practices or those in emerging economies. Moreover, stringent regulatory frameworks governing the approval and use of veterinary medical devices and pharmaceuticals can lead to extended product development cycles and increased compliance costs. However, ongoing research and development focused on more cost-effective and user-friendly anesthesia solutions, along with increasing government initiatives to promote animal health and welfare, are expected to mitigate these challenges. Emerging markets in Asia Pacific and Latin America represent significant untapped potential, with growing veterinary infrastructure and increasing disposable incomes driving demand. The competitive landscape features prominent players such as ICU Medical Inc., Patterson Scientific, and Mindray Medical International Limited, all actively engaged in innovation and strategic collaborations to capture market share.

Veterinary Anesthesia Market Company Market Share

This in-depth report provides an exhaustive analysis of the global veterinary anesthesia market, offering critical insights for stakeholders seeking to navigate this dynamic industry. Covering the period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period extending to 2033, this report delves into market dynamics, growth trends, regional dominance, product landscapes, key challenges, emerging opportunities, and pivotal industry players. Optimize your strategy with data-driven intelligence on veterinary anesthesia machines, veterinary inhalant anesthetics, veterinary injectable anesthetics, and advanced anesthesia monitoring systems.

Veterinary Anesthesia Market Market Dynamics & Structure

The veterinary anesthesia market is characterized by a moderately consolidated structure, with leading companies holding significant market share, estimated to be around 45% by the end of the forecast period. Technological innovation is a primary driver, fueled by advancements in patient monitoring, drug delivery systems, and anesthetic agents, pushing the boundaries of safe and effective pain management for animals. Regulatory frameworks, particularly those governing drug approvals and equipment safety standards, play a crucial role in market entry and product development. While highly effective, competitive product substitutes like advanced pain management protocols and non-anesthetic sedatives exist, they often supplement rather than fully replace traditional anesthetic methods. End-user demographics are shifting, with an increasing emphasis on specialized veterinary care for companion animals and a growing demand for efficient anesthetic solutions in livestock production to improve animal welfare and productivity. Mergers and acquisitions (M&A) are a significant trend, with an estimated 8-10 major M&A deals anticipated during the forecast period, aimed at expanding product portfolios and geographic reach.

- Market Concentration: Moderate, with key players like ICU Medical Inc. and Patterson Scientific holding substantial shares.

- Technological Innovation: Driven by advancements in anesthesia delivery systems (e.g., precise vaporizers, automated ventilation) and real-time patient monitoring technologies.

- Regulatory Landscape: Stringent but evolving, requiring robust compliance for product efficacy and safety.

- Competitive Substitutes: Focus on advanced analgesia, local anesthesia, and minimally invasive surgical techniques.

- End-User Demographics: Growing demand for advanced care in companion animal veterinary practices and efficiency improvements in large animal husbandry.

- M&A Trends: Strategic acquisitions to consolidate market presence and diversify product offerings.

Veterinary Anesthesia Market Growth Trends & Insights

The global veterinary anesthesia market is poised for robust expansion, driven by escalating pet ownership, increased expenditure on animal healthcare, and the growing recognition of animal welfare. The market size is projected to grow from approximately $1,200 Million in 2023 to an estimated $2,500 Million by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of around 7.5% during the forecast period. Adoption rates for advanced anesthesia monitoring systems and low-flow anesthesia techniques are steadily increasing, reflecting a greater emphasis on patient safety and cost-effectiveness in veterinary practices. Technological disruptions are predominantly seen in the development of new anesthetic agents with improved safety profiles and faster recovery times, alongside the integration of artificial intelligence for predictive diagnostics and personalized anesthesia protocols. Consumer behavior shifts are evident in the rising demand for specialized veterinary procedures requiring sophisticated anesthesia, as well as a growing preference for minimally invasive techniques that minimize patient stress and recovery duration. The increasing prevalence of chronic diseases in aging pet populations further contributes to the demand for advanced anesthetic management.

- Market Size Evolution: Expected to more than double between 2023 and 2033, reaching an estimated $2,500 Million.

- Adoption Rates: Significant increase in adoption of advanced anesthesia monitoring and low-flow anesthesia systems.

- Technological Disruptions: Focus on novel anesthetic compounds, improved delivery systems, and integrated monitoring solutions.

- Consumer Behavior Shifts: Growing demand for specialized procedures, minimally invasive techniques, and enhanced animal welfare.

- Market Penetration: Deepening penetration in developed economies with a growing focus on advanced care for companion animals.

Dominant Regions, Countries, or Segments in Veterinary Anesthesia Market

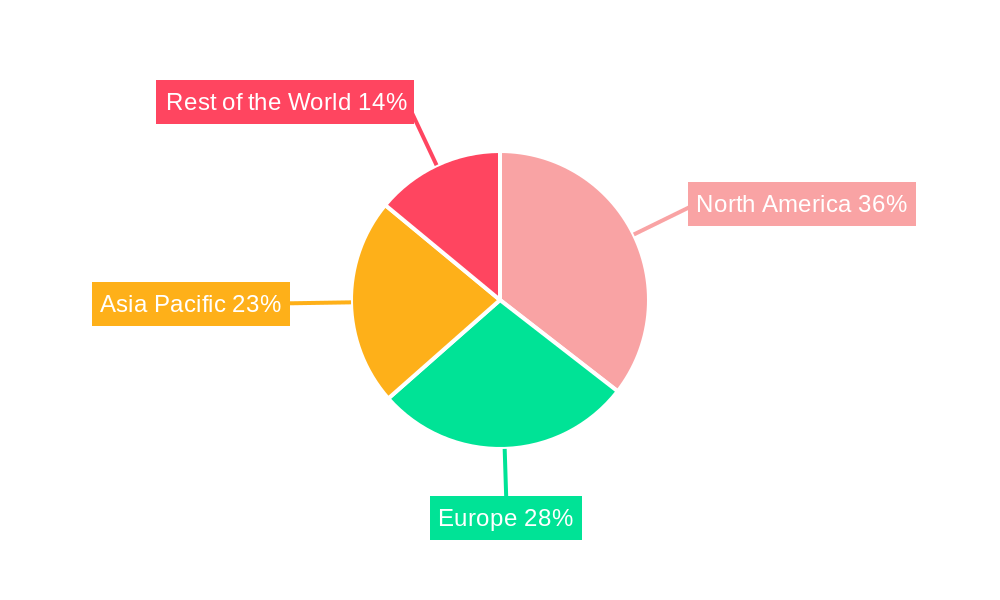

North America currently holds a dominant position in the veterinary anesthesia market, driven by its well-established veterinary infrastructure, high pet ownership rates, and significant investments in animal healthcare research and development. The region is estimated to account for approximately 35% of the global market share in 2025. Within North America, the United States leads due to its advanced veterinary education systems and a strong economic environment that supports higher spending on pet care.

The Companion animal segment is the primary growth driver, representing over 70% of the market revenue in 2025. This dominance is attributed to the increasing humanization of pets, where owners view their animals as integral family members and are willing to invest in comprehensive veterinary care, including advanced anesthesia for complex surgeries and routine procedures. The demand for innovative anesthetic solutions that ensure rapid recovery and minimize patient discomfort is particularly high in this segment.

Among the product segments, On Trolley anesthesia machines are the most widely adopted, accounting for an estimated 55% of the market in 2025. Their mobility and integrated functionality make them highly versatile for various veterinary settings, from general practices to specialized surgical suites. The development of more compact and feature-rich trolley-based systems continues to fuel their market leadership.

- Dominant Region: North America, driven by high pet ownership and healthcare expenditure.

- Leading Country: United States, with advanced veterinary infrastructure and R&D investment.

- Dominant Animal Segment: Companion animals, fueled by pet humanization and demand for advanced care.

- Dominant Product Segment: On Trolley anesthesia machines, due to their versatility and mobility.

- Key Drivers: Economic policies supporting animal health, advanced veterinary education, and increased consumer spending on pet well-being.

- Growth Potential: Significant growth potential in emerging economies as veterinary infrastructure develops and awareness of animal welfare increases.

Veterinary Anesthesia Market Product Landscape

The veterinary anesthesia market is characterized by a diverse and evolving product landscape. Innovations in On Trolley anesthesia machines focus on enhanced precision in gas delivery, integrated patient monitoring capabilities, and user-friendly interfaces, offering unparalleled versatility for various clinical settings. Wall Mounted systems provide space-saving solutions and robust integration with hospital infrastructure, ideal for specialized surgical centers and high-volume clinics. Table Top anesthesia devices cater to smaller practices and mobile veterinary units, prioritizing portability and ease of use without compromising essential anesthetic functions. Advancements in anesthetic agents are emphasizing improved safety profiles, faster induction and recovery times, and reduced physiological impact on animals. The integration of digital technologies for data logging, remote monitoring, and AI-driven diagnostic support is a growing trend across all product types.

Key Drivers, Barriers & Challenges in Veterinary Anesthesia Market

Key Drivers:

- Rising Pet Ownership and Humanization: Increased emotional and financial investment in pet health.

- Technological Advancements: Development of safer, more effective anesthetic agents and sophisticated monitoring equipment.

- Growing Demand for Specialized Veterinary Care: Increased complexity of procedures requiring precise anesthetic management.

- Emphasis on Animal Welfare: Greater awareness and regulatory push for humane animal care, including pain management.

- Expanding Veterinary Infrastructure: Investment in veterinary clinics and hospitals globally.

Barriers & Challenges:

- High Cost of Advanced Equipment: Significant capital investment required for state-of-the-art anesthesia systems.

- Stringent Regulatory Approvals: Lengthy and complex processes for new drug and device approvals.

- Limited Availability of Skilled Veterinary Anesthetists: Shortage of trained professionals to operate complex equipment and administer specialized anesthesia.

- Reimbursement Policies and Cost-Consciousness: Pressure on veterinary practices to manage costs, impacting adoption of premium solutions.

- Supply Chain Disruptions: Potential for delays in manufacturing and distribution of critical anesthetic agents and equipment.

Emerging Opportunities in Veterinary Anesthesia Market

Emerging opportunities lie in the development of AI-powered predictive anesthesia analytics, offering personalized anesthetic protocols based on individual patient data. The growing demand for remote patient monitoring solutions allows for continuous observation of animals post-anesthesia, enhancing safety and reducing the need for constant in-person supervision. Untapped markets in developing economies, where veterinary care is rapidly advancing, present significant growth potential for cost-effective yet advanced anesthesia solutions. Furthermore, the expansion of telehealth services in veterinary medicine could integrate anesthesia management, enabling remote consultation and support for complex cases. Innovative training programs and virtual reality simulators for veterinary anesthetists also represent a burgeoning opportunity.

Growth Accelerators in the Veterinary Anesthesia Market Industry

The veterinary anesthesia market's long-term growth will be significantly accelerated by ongoing research into novel anesthetic compounds with reduced side effects and faster recovery. Strategic partnerships between equipment manufacturers and veterinary pharmaceutical companies are fostering integrated solutions that enhance efficacy and convenience. The increasing prevalence of advanced surgical techniques, such as minimally invasive procedures and complex orthopedic surgeries, directly fuels the demand for highly sophisticated and reliable anesthesia systems. Furthermore, the growing global focus on One Health initiatives, recognizing the interconnectedness of human, animal, and environmental health, is likely to drive increased investment and innovation in animal healthcare, including anesthesia.

Key Players Shaping the Veterinary Anesthesia Market Market

- ICU Medical Inc.

- Patterson Scientific

- Dispomed Ltd

- Prunus Medical

- Kent Scientific Corporation

- Vetland Medical Sales & Services LLC

- Mindray Medical International Limited

- JD Medical Dist Co Inc

- Avante Health Solutions

- Midmark Corporation

- Supera Anesthesia Innovations

- Tecnologia Veterinaria y Medica S L

Notable Milestones in Veterinary Anesthesia Market Sector

- April 2022: Dispomed acquired ARVS, aiming to expand its medical equipment offerings, including veterinary anesthesia and technical services, in western Canada.

- January 2022: ICU Medical Inc. acquired Smiths Medical (US), enhancing its veterinary product portfolio with syringe and ambulatory infusion devices, vascular access, and vital care products, particularly strengthening its position in anesthetics.

In-Depth Veterinary Anesthesia Market Market Outlook

The veterinary anesthesia market is projected for sustained and significant growth, driven by an unwavering commitment to improving animal health and welfare. Key growth accelerators include the continuous pipeline of novel anesthetic agents and advanced monitoring technologies, alongside the increasing adoption of integrated, digital solutions. Strategic collaborations and market expansion into underserved regions will be crucial for capitalizing on this potential. The increasing demand for specialized veterinary procedures and a deeper understanding of pain management in animals will further solidify the market's upward trajectory. The outlook is exceptionally positive, with substantial opportunities for innovation and market leadership for companies that can effectively address the evolving needs of veterinary professionals and pet owners.

Veterinary Anesthesia Market Segmentation

-

1. Product

- 1.1. On Trolley

- 1.2. Wall Mounted

- 1.3. Table top

-

2. Animals

- 2.1. Companion

- 2.2. Livestock

Veterinary Anesthesia Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

- 4. Rest of the World

Veterinary Anesthesia Market Regional Market Share

Geographic Coverage of Veterinary Anesthesia Market

Veterinary Anesthesia Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.04% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Chronic Diseases And Associated Surgical Procedures; Technological Advancements in Veterinary Anesthesia

- 3.3. Market Restrains

- 3.3.1. High Cost of Anesthesia Machines

- 3.4. Market Trends

- 3.4.1. Companion Segment is Expected to Hold a Significant Market Share Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Veterinary Anesthesia Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. On Trolley

- 5.1.2. Wall Mounted

- 5.1.3. Table top

- 5.2. Market Analysis, Insights and Forecast - by Animals

- 5.2.1. Companion

- 5.2.2. Livestock

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Rest of the World

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Veterinary Anesthesia Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. On Trolley

- 6.1.2. Wall Mounted

- 6.1.3. Table top

- 6.2. Market Analysis, Insights and Forecast - by Animals

- 6.2.1. Companion

- 6.2.2. Livestock

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. Europe Veterinary Anesthesia Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. On Trolley

- 7.1.2. Wall Mounted

- 7.1.3. Table top

- 7.2. Market Analysis, Insights and Forecast - by Animals

- 7.2.1. Companion

- 7.2.2. Livestock

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Asia Pacific Veterinary Anesthesia Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. On Trolley

- 8.1.2. Wall Mounted

- 8.1.3. Table top

- 8.2. Market Analysis, Insights and Forecast - by Animals

- 8.2.1. Companion

- 8.2.2. Livestock

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Rest of the World Veterinary Anesthesia Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. On Trolley

- 9.1.2. Wall Mounted

- 9.1.3. Table top

- 9.2. Market Analysis, Insights and Forecast - by Animals

- 9.2.1. Companion

- 9.2.2. Livestock

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 ICU Medical Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Patterson Scientific

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Dispomed Ltd

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Prunus Medical*List Not Exhaustive

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kent Scientific Corporation

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Vetland Medical Sales & Services LLC

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Mindray Medical International Limited

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 JD Medical Dist Co Inc

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Avante Health Solutions

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Midmark Corporation

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.11 Supera Anesthesia Innovations

- 10.2.11.1. Overview

- 10.2.11.2. Products

- 10.2.11.3. SWOT Analysis

- 10.2.11.4. Recent Developments

- 10.2.11.5. Financials (Based on Availability)

- 10.2.12 Tecnologia Veterinaria y Medica S L

- 10.2.12.1. Overview

- 10.2.12.2. Products

- 10.2.12.3. SWOT Analysis

- 10.2.12.4. Recent Developments

- 10.2.12.5. Financials (Based on Availability)

- 10.2.1 ICU Medical Inc

List of Figures

- Figure 1: Global Veterinary Anesthesia Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Veterinary Anesthesia Market Revenue (undefined), by Product 2025 & 2033

- Figure 3: North America Veterinary Anesthesia Market Revenue Share (%), by Product 2025 & 2033

- Figure 4: North America Veterinary Anesthesia Market Revenue (undefined), by Animals 2025 & 2033

- Figure 5: North America Veterinary Anesthesia Market Revenue Share (%), by Animals 2025 & 2033

- Figure 6: North America Veterinary Anesthesia Market Revenue (undefined), by Country 2025 & 2033

- Figure 7: North America Veterinary Anesthesia Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Veterinary Anesthesia Market Revenue (undefined), by Product 2025 & 2033

- Figure 9: Europe Veterinary Anesthesia Market Revenue Share (%), by Product 2025 & 2033

- Figure 10: Europe Veterinary Anesthesia Market Revenue (undefined), by Animals 2025 & 2033

- Figure 11: Europe Veterinary Anesthesia Market Revenue Share (%), by Animals 2025 & 2033

- Figure 12: Europe Veterinary Anesthesia Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Veterinary Anesthesia Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Veterinary Anesthesia Market Revenue (undefined), by Product 2025 & 2033

- Figure 15: Asia Pacific Veterinary Anesthesia Market Revenue Share (%), by Product 2025 & 2033

- Figure 16: Asia Pacific Veterinary Anesthesia Market Revenue (undefined), by Animals 2025 & 2033

- Figure 17: Asia Pacific Veterinary Anesthesia Market Revenue Share (%), by Animals 2025 & 2033

- Figure 18: Asia Pacific Veterinary Anesthesia Market Revenue (undefined), by Country 2025 & 2033

- Figure 19: Asia Pacific Veterinary Anesthesia Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Rest of the World Veterinary Anesthesia Market Revenue (undefined), by Product 2025 & 2033

- Figure 21: Rest of the World Veterinary Anesthesia Market Revenue Share (%), by Product 2025 & 2033

- Figure 22: Rest of the World Veterinary Anesthesia Market Revenue (undefined), by Animals 2025 & 2033

- Figure 23: Rest of the World Veterinary Anesthesia Market Revenue Share (%), by Animals 2025 & 2033

- Figure 24: Rest of the World Veterinary Anesthesia Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Rest of the World Veterinary Anesthesia Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 2: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Animals 2020 & 2033

- Table 3: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 5: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Animals 2020 & 2033

- Table 6: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 7: United States Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 8: Canada Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Mexico Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 11: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Animals 2020 & 2033

- Table 12: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Germany Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United Kingdom Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: France Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Italy Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Spain Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Rest of Europe Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 20: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Animals 2020 & 2033

- Table 21: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: China Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Japan Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: India Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Australia Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: South Korea Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: Rest of Asia Pacific Veterinary Anesthesia Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Product 2020 & 2033

- Table 29: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Animals 2020 & 2033

- Table 30: Global Veterinary Anesthesia Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Veterinary Anesthesia Market?

The projected CAGR is approximately 7.04%.

2. Which companies are prominent players in the Veterinary Anesthesia Market?

Key companies in the market include ICU Medical Inc, Patterson Scientific, Dispomed Ltd, Prunus Medical*List Not Exhaustive, Kent Scientific Corporation, Vetland Medical Sales & Services LLC, Mindray Medical International Limited, JD Medical Dist Co Inc, Avante Health Solutions, Midmark Corporation, Supera Anesthesia Innovations, Tecnologia Veterinaria y Medica S L.

3. What are the main segments of the Veterinary Anesthesia Market?

The market segments include Product, Animals.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Chronic Diseases And Associated Surgical Procedures; Technological Advancements in Veterinary Anesthesia.

6. What are the notable trends driving market growth?

Companion Segment is Expected to Hold a Significant Market Share Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Anesthesia Machines.

8. Can you provide examples of recent developments in the market?

April 2022: Dispomed acquired ARVS. The acquisition aims to provide veterinary clinics with medical equipment, including veterinary anesthesia and adapted technical services in western Canada.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Veterinary Anesthesia Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Veterinary Anesthesia Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Veterinary Anesthesia Market?

To stay informed about further developments, trends, and reports in the Veterinary Anesthesia Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence