Key Insights

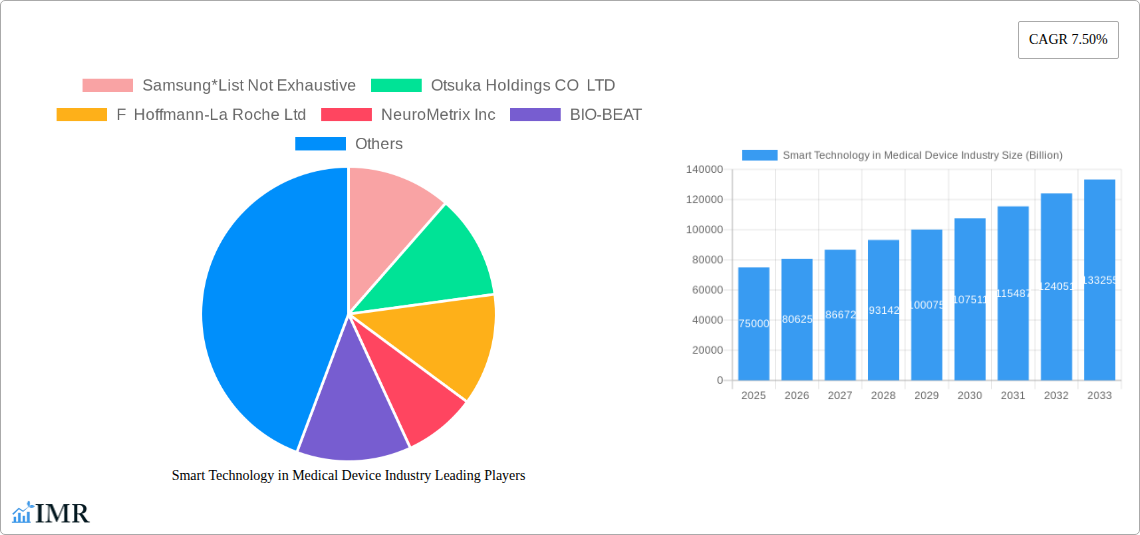

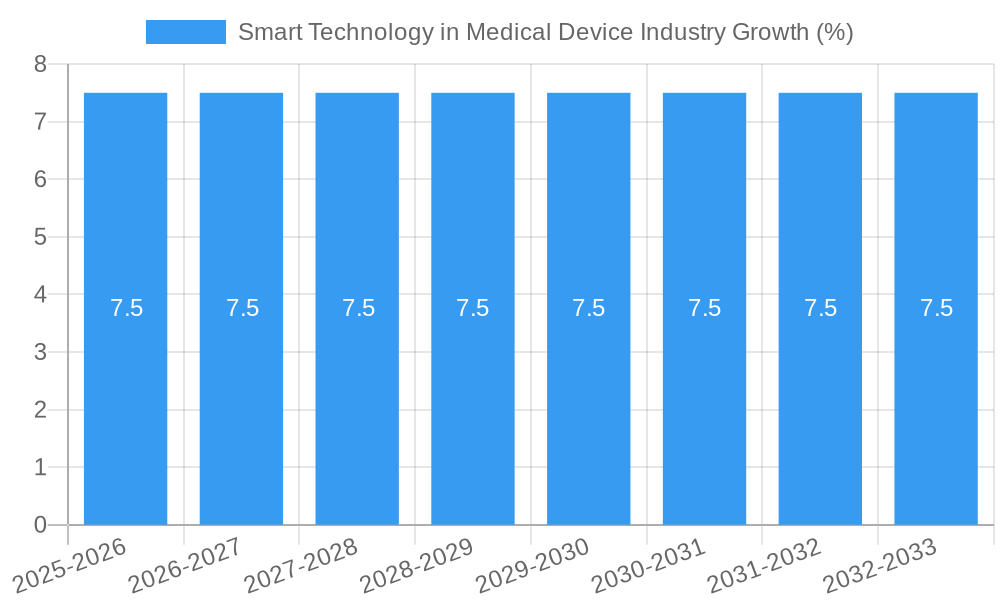

The global market for Smart Technology in Medical Devices is poised for significant expansion, projected to reach a substantial market size in 2025 and exhibiting a robust Compound Annual Growth Rate (CAGR) of 7.50% through 2033. This dynamic growth is propelled by a confluence of factors, including the increasing prevalence of chronic diseases worldwide, the escalating demand for remote patient monitoring and home-care solutions, and rapid advancements in IoT, AI, and wearable technology integration within healthcare. The diagnostic and monitoring segment, encompassing devices such as blood glucose monitors, heart rate monitors, and blood pressure monitors, is a primary driver, reflecting a growing emphasis on proactive health management and early disease detection. Simultaneously, therapeutic devices, including portable oxygen concentrators and insulin pumps, are witnessing increased adoption due to their ability to enhance patient quality of life and enable greater independence.

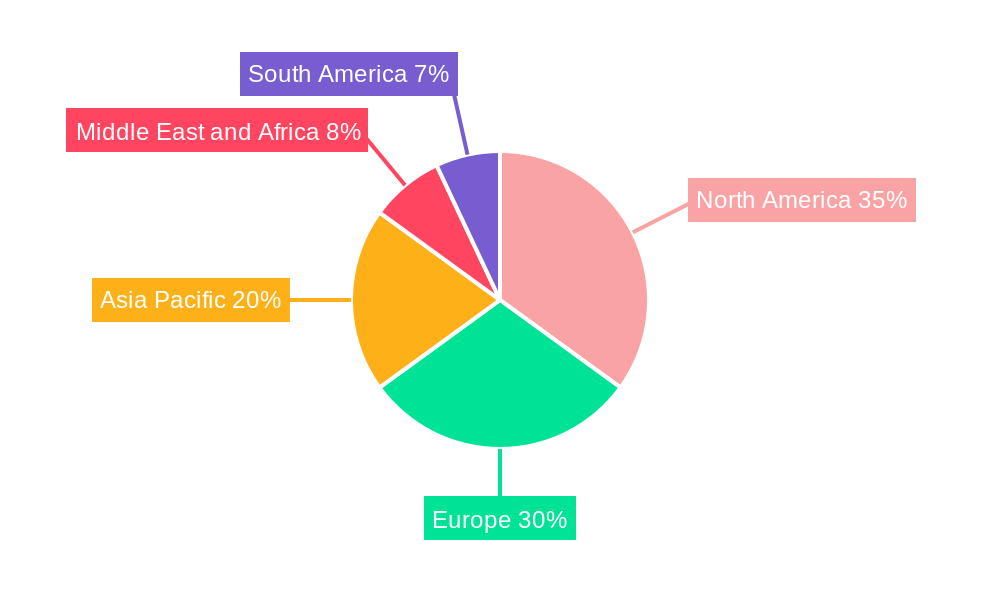

The market's trajectory is further shaped by evolving consumer preferences towards personalized healthcare and the growing acceptance of connected devices. Leading companies like Abbott Laboratories, Medtronic PLC, and Koninklijke Philips N.V. are at the forefront of innovation, investing heavily in R&D to develop sophisticated smart medical devices. While the market presents immense opportunities, certain restraints, such as stringent regulatory approvals, data security and privacy concerns, and the initial cost of advanced technology, need careful navigation. North America and Europe currently dominate the market due to established healthcare infrastructures and high adoption rates of advanced technologies. However, the Asia Pacific region, driven by a burgeoning population, increasing healthcare expenditure, and a growing awareness of smart health solutions, is expected to emerge as a key growth market in the coming years.

This in-depth report provides a meticulous analysis of the Smart Technology in Medical Device Industry, a rapidly evolving sector transforming healthcare delivery. With a study period spanning from 2019 to 2033, this report offers critical insights into market dynamics, growth trends, regional dominance, product landscape, and key players. The base year is 2025, with forecast projections for 2025-2033, built upon historical data from 2019-2024. We explore the intricate interplay between parent and child markets, offering a holistic view of market expansion and opportunities.

Smart Technology in Medical Device Industry Market Dynamics & Structure

The Smart Technology in Medical Device Industry is characterized by a dynamic and evolving structure, driven by relentless technological innovation and increasing demand for personalized, remote patient monitoring. Market concentration varies across segments, with larger, established players like Medtronic PLC and Abbott Laboratories holding significant shares in core device categories, while emerging companies are carving niches in specialized applications. The primary drivers of technological innovation include advancements in AI and machine learning for predictive analytics, miniaturization of sensors, and the proliferation of wearable technology. Regulatory frameworks, such as FDA guidelines for medical devices and data privacy laws (e.g., HIPAA), play a crucial role in shaping product development and market entry, acting as both enablers and potential barriers. Competitive product substitutes are rapidly emerging, ranging from traditional medical devices to sophisticated consumer-grade health trackers that are increasingly being integrated into healthcare ecosystems. End-user demographics are shifting, with a growing aging population and an increasing preference for home-care settings amplifying the demand for smart medical devices. Mergers and acquisitions (M&A) are a significant trend, with companies strategically acquiring innovative technologies and expanding their product portfolios to capture market share. For instance, the acquisition of Fitbit Inc. by Google (Alphabet Inc.) signifies the growing interest in integrating consumer wearables into broader health ecosystems.

- Market Concentration: Moderate to high in established segments, with increasing fragmentation in newer, specialized areas.

- Technological Innovation Drivers: AI/ML, IoT, miniaturization, Big Data analytics, wearable technology.

- Regulatory Frameworks: FDA, CE Marking, HIPAA, GDPR, posing compliance challenges and ensuring product safety.

- Competitive Product Substitutes: Advanced diagnostics, consumer wearables with health tracking features, telehealth platforms.

- End-User Demographics: Aging population, increasing prevalence of chronic diseases, growing demand for remote patient monitoring.

- M&A Trends: Strategic acquisitions to gain technology, market access, and expand product offerings. For example, the integration of smart functionalities into existing diagnostic tools is a key M&A driver.

Smart Technology in Medical Device Industry Growth Trends & Insights

The Smart Technology in Medical Device Industry is poised for substantial growth, driven by an increasing adoption rate of connected health solutions and technological disruptions that are redefining patient care. The global market size is projected to reach $XXX Billion by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of approximately XX% during the forecast period (2025-2033). This expansion is underpinned by a significant shift in consumer behavior towards proactive health management and a growing reliance on wearable and implantable devices for continuous health monitoring. The integration of artificial intelligence and machine learning algorithms into these devices is enabling predictive diagnostics and personalized treatment plans, thereby reducing hospital readmissions and improving patient outcomes. For instance, the advancements in continuous glucose monitoring (CGM) systems, such as those offered by Dexcom Inc., have revolutionized diabetes management, allowing patients greater autonomy and physicians better insights. The COVID-19 pandemic further accelerated the adoption of remote patient monitoring (RPM) technologies, highlighting their efficacy in managing chronic conditions and providing healthcare access to remote populations. This trend is expected to continue, with a significant portion of the market growth attributed to home-care settings.

Technological disruptions, including the development of more sophisticated biosensors and the increasing connectivity through 5G networks, are further fueling market expansion. These advancements allow for real-time data transmission and analysis, facilitating timely interventions and more effective chronic disease management. The parent market, encompassing all medical devices, provides a broad foundation for the growth of smart technologies, which are increasingly becoming integral components of both diagnostic and therapeutic devices. The child markets, such as wearable health trackers and implantable sensors, are experiencing exponential growth as they democratize access to health data. Consumer preferences are increasingly leaning towards devices that offer convenience, accuracy, and actionable insights, pushing manufacturers to innovate rapidly. The penetration of smart medical devices in both developed and emerging economies is expected to increase significantly as healthcare systems strive for greater efficiency and improved patient engagement. The transition from reactive to proactive healthcare is a dominant theme, with smart devices playing a pivotal role in this paradigm shift.

Dominant Regions, Countries, or Segments in Smart Technology in Medical Device Industry

North America, particularly the United States, stands as the dominant region in the Smart Technology in Medical Device Industry, driven by robust healthcare infrastructure, high disposable income, a proactive approach to technological adoption, and significant investments in research and development. The US healthcare system's emphasis on value-based care and preventative medicine strongly aligns with the capabilities offered by smart medical devices. The presence of leading medical device manufacturers and innovative tech companies, such as Abbott Laboratories, Medtronic PLC, and Apple Inc., further solidifies North America's leadership. Economic policies supporting healthcare innovation and a well-established regulatory framework that balances patient safety with technological advancement contribute to this dominance.

Within the product type segment, Diagnostic and Monitoring devices are currently leading the market.

- Blood Glucose Monitors: The increasing prevalence of diabetes globally, coupled with the demand for continuous monitoring solutions, makes this sub-segment a major growth driver.

- Heart Rate Monitors: The rising awareness of cardiovascular health and the integration of advanced heart rate monitoring into wearables are fueling demand.

- Pulse Oximeters: Essential for respiratory health monitoring, their demand surged during the pandemic and remains high for chronic lung disease management.

- Blood Pressure Monitors: Home-use blood pressure monitors with smart connectivity are gaining traction for remote patient management.

In terms of End User, Hospitals/Clinics represent a significant market share due to their adoption of integrated smart device systems for patient care and remote monitoring protocols. However, the Home-care Setting is exhibiting the fastest growth rate. This surge is attributed to the aging global population, the increasing preference for personalized and convenient healthcare, and the development of user-friendly smart medical devices. Government initiatives and private sector investments in telehealth and remote patient management platforms are further accelerating this trend. Countries like Germany, the UK, and France in Europe also contribute significantly to market growth due to advanced healthcare systems and early adoption of digital health technologies. Asia-Pacific is emerging as a high-growth region, propelled by expanding healthcare access, increasing chronic disease burden, and government support for digital health initiatives in countries like China and India.

Smart Technology in Medical Device Industry Product Landscape

The product landscape of the Smart Technology in Medical Device Industry is characterized by continuous innovation, focusing on enhanced accuracy, connectivity, and user-friendliness. Smart devices now encompass a wide array of applications, from sophisticated implantable sensors for continuous monitoring of vital signs and disease biomarkers to advanced diagnostic tools that provide real-time data for clinicians. For example, Otsuka Holdings CO LTD is investing in smart solutions for mental health monitoring, while NeuroMetrix Inc. is developing advanced diagnostic tools for neurological conditions. The unique selling propositions of these products lie in their ability to deliver actionable insights, facilitate early disease detection, and enable personalized treatment plans, thereby improving patient outcomes and reducing healthcare costs. Technological advancements such as the integration of AI for predictive analytics, the use of novel biosensors, and the development of low-power, long-lasting implantable devices are key differentiators.

Key Drivers, Barriers & Challenges in Smart Technology in Medical Device Industry

The Smart Technology in Medical Device Industry is propelled by several key drivers.

- Technological Advancements: The rapid evolution of AI, IoT, and miniaturized sensors enables the development of more sophisticated and effective smart devices.

- Increasing Chronic Disease Prevalence: A growing global burden of chronic diseases necessitates continuous monitoring and proactive management, for which smart devices are ideal.

- Demand for Remote Patient Monitoring: Aging populations and the desire for convenient healthcare are driving the adoption of home-based monitoring solutions.

- Government Initiatives and Investments: Supportive policies and funding for digital health accelerate innovation and market penetration.

However, significant barriers and challenges exist.

- Regulatory Hurdles: Navigating complex and evolving regulatory pathways for medical devices can be time-consuming and expensive.

- Data Security and Privacy Concerns: Protecting sensitive patient data from cyber threats is paramount and requires robust security measures.

- High Development and Manufacturing Costs: The complexity of smart medical devices leads to substantial upfront investment.

- Interoperability Issues: Ensuring seamless data integration between different devices and healthcare systems remains a challenge.

- Digital Divide and Accessibility: Ensuring equitable access to these technologies across different socioeconomic groups and geographical regions.

Emerging Opportunities in Smart Technology in Medical Device Industry

Emerging opportunities in the Smart Technology in Medical Device Industry are vast and promising. The development of AI-powered personalized health coaching platforms integrated with wearable devices presents a significant untapped market. Furthermore, the increasing demand for remote diagnostics in underserved regions and for post-operative care offers substantial growth potential. The intersection of smart medical devices with genomics and precision medicine is opening avenues for highly targeted therapeutic interventions. Innovations in non-invasive biosensing technologies for a wider range of biomarkers are also creating new application areas. The integration of smart devices into existing healthcare workflows, improving efficiency and reducing clinician burnout, is another key opportunity.

Growth Accelerators in the Smart Technology in Medical Device Industry Industry

Several factors are acting as crucial growth accelerators for the Smart Technology in Medical Device Industry. The continuous advancements in Artificial Intelligence and Machine Learning are enabling more sophisticated data analysis and predictive capabilities, making devices more intelligent and valuable. Strategic partnerships between technology giants, like Apple Inc. and Samsung, and traditional medical device companies are accelerating product development and market penetration. The growing investment from venture capitalists and private equity firms in digital health startups is fueling innovation and expansion. Furthermore, the increasing acceptance and demand for telehealth and remote patient monitoring by both consumers and healthcare providers are creating a fertile ground for the widespread adoption of smart medical devices.

Key Players Shaping the Smart Technology in Medical Device Industry Market

- Samsung

- Otsuka Holdings CO LTD

- F Hoffmann-La Roche Ltd

- NeuroMetrix Inc

- BIO-BEAT

- Dexcom Inc

- Abbott Laboratories

- Koninklijke Philips N V

- Medtronic PLC

- Omron Corporation

- Fitbit Inc

- Apple Inc

- Vital Connect

Notable Milestones in Smart Technology in Medical Device Industry Sector

- 2019: FDA clearance for continuous glucose monitoring (CGM) systems with enhanced connectivity and data sharing capabilities.

- 2020: Surge in demand and regulatory approvals for remote patient monitoring (RPM) devices driven by the COVID-19 pandemic.

- 2021: Introduction of advanced AI-powered diagnostic algorithms for wearable ECG monitors, enabling early detection of cardiac arrhythmias.

- 2022: Major tech companies like Apple and Samsung significantly enhance health tracking features in their smartwatches, blurring the lines between consumer and medical devices.

- 2023: Significant investment and development in smart inhalers for chronic respiratory conditions, providing real-time adherence data.

- 2024: Expansion of smart implantable devices for long-term monitoring of chronic diseases, with improved battery life and data transmission capabilities.

In-Depth Smart Technology in Medical Device Industry Market Outlook

- 2019: FDA clearance for continuous glucose monitoring (CGM) systems with enhanced connectivity and data sharing capabilities.

- 2020: Surge in demand and regulatory approvals for remote patient monitoring (RPM) devices driven by the COVID-19 pandemic.

- 2021: Introduction of advanced AI-powered diagnostic algorithms for wearable ECG monitors, enabling early detection of cardiac arrhythmias.

- 2022: Major tech companies like Apple and Samsung significantly enhance health tracking features in their smartwatches, blurring the lines between consumer and medical devices.

- 2023: Significant investment and development in smart inhalers for chronic respiratory conditions, providing real-time adherence data.

- 2024: Expansion of smart implantable devices for long-term monitoring of chronic diseases, with improved battery life and data transmission capabilities.

In-Depth Smart Technology in Medical Device Industry Market Outlook

The future market outlook for the Smart Technology in Medical Device Industry is exceptionally robust, driven by a confluence of technological breakthroughs and evolving healthcare demands. Growth accelerators such as the integration of AI for predictive diagnostics, the expansion of the Internet of Medical Things (IoMT), and the increasing consumer demand for personalized health management will continue to shape the market. Strategic partnerships between established healthcare players and innovative tech companies are expected to drive further integration and market penetration. The increasing focus on preventative care and home-based healthcare solutions will create sustained demand for smart devices. The market is poised for significant expansion as it moves towards more connected, data-driven, and patient-centric healthcare models.

Smart Technology in Medical Device Industry Segmentation

-

1. Product Type

-

1.1. By Diagnostic and Monitoring

- 1.1.1. Blood Glucose Monitors

- 1.1.2. Heart Rate Monitors

- 1.1.3. Pulse Oximeters

- 1.1.4. Blood Pressure Monitors

- 1.1.5. Breath Analyzer

- 1.1.6. Other Diagnostic Monitoring Products

-

1.2. By Therapeutic Devices

- 1.2.1. Portable Oxygen Concentrators and Ventilators

- 1.2.2. Insulin Pumps

- 1.2.3. Hearing Aid

- 1.2.4. Other Therapeutic Devices

-

1.1. By Diagnostic and Monitoring

-

2. End User

- 2.1. Hospitals/Clinics

- 2.2. Home-care Setting

- 2.3. Others

Smart Technology in Medical Device Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Smart Technology in Medical Device Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 7.50% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rise in Demand for Smartphone-compatible and Wireless Medical Devices; Technological Advancement in Devices; Rising Awareness and Focus on Fitness

- 3.3. Market Restrains

- 3.3.1. High Cost of Devices; Patients Privacy Concerns

- 3.4. Market Trends

- 3.4.1. Insulin Pumps are Expected to Witness Good Growth in the Market Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. By Diagnostic and Monitoring

- 5.1.1.1. Blood Glucose Monitors

- 5.1.1.2. Heart Rate Monitors

- 5.1.1.3. Pulse Oximeters

- 5.1.1.4. Blood Pressure Monitors

- 5.1.1.5. Breath Analyzer

- 5.1.1.6. Other Diagnostic Monitoring Products

- 5.1.2. By Therapeutic Devices

- 5.1.2.1. Portable Oxygen Concentrators and Ventilators

- 5.1.2.2. Insulin Pumps

- 5.1.2.3. Hearing Aid

- 5.1.2.4. Other Therapeutic Devices

- 5.1.1. By Diagnostic and Monitoring

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Hospitals/Clinics

- 5.2.2. Home-care Setting

- 5.2.3. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. By Diagnostic and Monitoring

- 6.1.1.1. Blood Glucose Monitors

- 6.1.1.2. Heart Rate Monitors

- 6.1.1.3. Pulse Oximeters

- 6.1.1.4. Blood Pressure Monitors

- 6.1.1.5. Breath Analyzer

- 6.1.1.6. Other Diagnostic Monitoring Products

- 6.1.2. By Therapeutic Devices

- 6.1.2.1. Portable Oxygen Concentrators and Ventilators

- 6.1.2.2. Insulin Pumps

- 6.1.2.3. Hearing Aid

- 6.1.2.4. Other Therapeutic Devices

- 6.1.1. By Diagnostic and Monitoring

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Hospitals/Clinics

- 6.2.2. Home-care Setting

- 6.2.3. Others

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. By Diagnostic and Monitoring

- 7.1.1.1. Blood Glucose Monitors

- 7.1.1.2. Heart Rate Monitors

- 7.1.1.3. Pulse Oximeters

- 7.1.1.4. Blood Pressure Monitors

- 7.1.1.5. Breath Analyzer

- 7.1.1.6. Other Diagnostic Monitoring Products

- 7.1.2. By Therapeutic Devices

- 7.1.2.1. Portable Oxygen Concentrators and Ventilators

- 7.1.2.2. Insulin Pumps

- 7.1.2.3. Hearing Aid

- 7.1.2.4. Other Therapeutic Devices

- 7.1.1. By Diagnostic and Monitoring

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Hospitals/Clinics

- 7.2.2. Home-care Setting

- 7.2.3. Others

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. By Diagnostic and Monitoring

- 8.1.1.1. Blood Glucose Monitors

- 8.1.1.2. Heart Rate Monitors

- 8.1.1.3. Pulse Oximeters

- 8.1.1.4. Blood Pressure Monitors

- 8.1.1.5. Breath Analyzer

- 8.1.1.6. Other Diagnostic Monitoring Products

- 8.1.2. By Therapeutic Devices

- 8.1.2.1. Portable Oxygen Concentrators and Ventilators

- 8.1.2.2. Insulin Pumps

- 8.1.2.3. Hearing Aid

- 8.1.2.4. Other Therapeutic Devices

- 8.1.1. By Diagnostic and Monitoring

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Hospitals/Clinics

- 8.2.2. Home-care Setting

- 8.2.3. Others

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East and Africa Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. By Diagnostic and Monitoring

- 9.1.1.1. Blood Glucose Monitors

- 9.1.1.2. Heart Rate Monitors

- 9.1.1.3. Pulse Oximeters

- 9.1.1.4. Blood Pressure Monitors

- 9.1.1.5. Breath Analyzer

- 9.1.1.6. Other Diagnostic Monitoring Products

- 9.1.2. By Therapeutic Devices

- 9.1.2.1. Portable Oxygen Concentrators and Ventilators

- 9.1.2.2. Insulin Pumps

- 9.1.2.3. Hearing Aid

- 9.1.2.4. Other Therapeutic Devices

- 9.1.1. By Diagnostic and Monitoring

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Hospitals/Clinics

- 9.2.2. Home-care Setting

- 9.2.3. Others

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. South America Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. By Diagnostic and Monitoring

- 10.1.1.1. Blood Glucose Monitors

- 10.1.1.2. Heart Rate Monitors

- 10.1.1.3. Pulse Oximeters

- 10.1.1.4. Blood Pressure Monitors

- 10.1.1.5. Breath Analyzer

- 10.1.1.6. Other Diagnostic Monitoring Products

- 10.1.2. By Therapeutic Devices

- 10.1.2.1. Portable Oxygen Concentrators and Ventilators

- 10.1.2.2. Insulin Pumps

- 10.1.2.3. Hearing Aid

- 10.1.2.4. Other Therapeutic Devices

- 10.1.1. By Diagnostic and Monitoring

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Hospitals/Clinics

- 10.2.2. Home-care Setting

- 10.2.3. Others

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. North America Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 11.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 11.1.1 United States

- 11.1.2 Canada

- 11.1.3 Mexico

- 12. Europe Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 12.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 12.1.1 Germany

- 12.1.2 United Kingdom

- 12.1.3 France

- 12.1.4 Italy

- 12.1.5 Spain

- 12.1.6 Rest of Europe

- 13. Asia Pacific Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 13.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 13.1.1 China

- 13.1.2 Japan

- 13.1.3 India

- 13.1.4 Australia

- 13.1.5 South Korea

- 13.1.6 Rest of Asia Pacific

- 14. Middle East and Africa Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 14.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 14.1.1 GCC

- 14.1.2 South Africa

- 14.1.3 Rest of Middle East and Africa

- 15. South America Smart Technology in Medical Device Industry Analysis, Insights and Forecast, 2019-2031

- 15.1. Market Analysis, Insights and Forecast - By Country/Sub-region

- 15.1.1 Brazil

- 15.1.2 Argentina

- 15.1.3 Rest of South America

- 16. Competitive Analysis

- 16.1. Global Market Share Analysis 2024

- 16.2. Company Profiles

- 16.2.1 Samsung*List Not Exhaustive

- 16.2.1.1. Overview

- 16.2.1.2. Products

- 16.2.1.3. SWOT Analysis

- 16.2.1.4. Recent Developments

- 16.2.1.5. Financials (Based on Availability)

- 16.2.2 Otsuka Holdings CO LTD

- 16.2.2.1. Overview

- 16.2.2.2. Products

- 16.2.2.3. SWOT Analysis

- 16.2.2.4. Recent Developments

- 16.2.2.5. Financials (Based on Availability)

- 16.2.3 F Hoffmann-La Roche Ltd

- 16.2.3.1. Overview

- 16.2.3.2. Products

- 16.2.3.3. SWOT Analysis

- 16.2.3.4. Recent Developments

- 16.2.3.5. Financials (Based on Availability)

- 16.2.4 NeuroMetrix Inc

- 16.2.4.1. Overview

- 16.2.4.2. Products

- 16.2.4.3. SWOT Analysis

- 16.2.4.4. Recent Developments

- 16.2.4.5. Financials (Based on Availability)

- 16.2.5 BIO-BEAT

- 16.2.5.1. Overview

- 16.2.5.2. Products

- 16.2.5.3. SWOT Analysis

- 16.2.5.4. Recent Developments

- 16.2.5.5. Financials (Based on Availability)

- 16.2.6 Dexcom Inc

- 16.2.6.1. Overview

- 16.2.6.2. Products

- 16.2.6.3. SWOT Analysis

- 16.2.6.4. Recent Developments

- 16.2.6.5. Financials (Based on Availability)

- 16.2.7 Abbott Laboratories

- 16.2.7.1. Overview

- 16.2.7.2. Products

- 16.2.7.3. SWOT Analysis

- 16.2.7.4. Recent Developments

- 16.2.7.5. Financials (Based on Availability)

- 16.2.8 Koninklijke Philips N V

- 16.2.8.1. Overview

- 16.2.8.2. Products

- 16.2.8.3. SWOT Analysis

- 16.2.8.4. Recent Developments

- 16.2.8.5. Financials (Based on Availability)

- 16.2.9 Medtronic PLC

- 16.2.9.1. Overview

- 16.2.9.2. Products

- 16.2.9.3. SWOT Analysis

- 16.2.9.4. Recent Developments

- 16.2.9.5. Financials (Based on Availability)

- 16.2.10 Omron Corporation

- 16.2.10.1. Overview

- 16.2.10.2. Products

- 16.2.10.3. SWOT Analysis

- 16.2.10.4. Recent Developments

- 16.2.10.5. Financials (Based on Availability)

- 16.2.11 Fitbit Inc

- 16.2.11.1. Overview

- 16.2.11.2. Products

- 16.2.11.3. SWOT Analysis

- 16.2.11.4. Recent Developments

- 16.2.11.5. Financials (Based on Availability)

- 16.2.12 Apple Inc

- 16.2.12.1. Overview

- 16.2.12.2. Products

- 16.2.12.3. SWOT Analysis

- 16.2.12.4. Recent Developments

- 16.2.12.5. Financials (Based on Availability)

- 16.2.13 Vital Connect

- 16.2.13.1. Overview

- 16.2.13.2. Products

- 16.2.13.3. SWOT Analysis

- 16.2.13.4. Recent Developments

- 16.2.13.5. Financials (Based on Availability)

- 16.2.1 Samsung*List Not Exhaustive

List of Figures

- Figure 1: Global Smart Technology in Medical Device Industry Revenue Breakdown (Billion, %) by Region 2024 & 2032

- Figure 2: North America Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 3: North America Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 4: Europe Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 5: Europe Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 6: Asia Pacific Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 7: Asia Pacific Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 8: Middle East and Africa Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 9: Middle East and Africa Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 10: South America Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 11: South America Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 12: North America Smart Technology in Medical Device Industry Revenue (Billion), by Product Type 2024 & 2032

- Figure 13: North America Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 14: North America Smart Technology in Medical Device Industry Revenue (Billion), by End User 2024 & 2032

- Figure 15: North America Smart Technology in Medical Device Industry Revenue Share (%), by End User 2024 & 2032

- Figure 16: North America Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 17: North America Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 18: Europe Smart Technology in Medical Device Industry Revenue (Billion), by Product Type 2024 & 2032

- Figure 19: Europe Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 20: Europe Smart Technology in Medical Device Industry Revenue (Billion), by End User 2024 & 2032

- Figure 21: Europe Smart Technology in Medical Device Industry Revenue Share (%), by End User 2024 & 2032

- Figure 22: Europe Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 23: Europe Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 24: Asia Pacific Smart Technology in Medical Device Industry Revenue (Billion), by Product Type 2024 & 2032

- Figure 25: Asia Pacific Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 26: Asia Pacific Smart Technology in Medical Device Industry Revenue (Billion), by End User 2024 & 2032

- Figure 27: Asia Pacific Smart Technology in Medical Device Industry Revenue Share (%), by End User 2024 & 2032

- Figure 28: Asia Pacific Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 29: Asia Pacific Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 30: Middle East and Africa Smart Technology in Medical Device Industry Revenue (Billion), by Product Type 2024 & 2032

- Figure 31: Middle East and Africa Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 32: Middle East and Africa Smart Technology in Medical Device Industry Revenue (Billion), by End User 2024 & 2032

- Figure 33: Middle East and Africa Smart Technology in Medical Device Industry Revenue Share (%), by End User 2024 & 2032

- Figure 34: Middle East and Africa Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 35: Middle East and Africa Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

- Figure 36: South America Smart Technology in Medical Device Industry Revenue (Billion), by Product Type 2024 & 2032

- Figure 37: South America Smart Technology in Medical Device Industry Revenue Share (%), by Product Type 2024 & 2032

- Figure 38: South America Smart Technology in Medical Device Industry Revenue (Billion), by End User 2024 & 2032

- Figure 39: South America Smart Technology in Medical Device Industry Revenue Share (%), by End User 2024 & 2032

- Figure 40: South America Smart Technology in Medical Device Industry Revenue (Billion), by Country 2024 & 2032

- Figure 41: South America Smart Technology in Medical Device Industry Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 2: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 3: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 4: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Region 2019 & 2032

- Table 5: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 6: United States Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 7: Canada Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 8: Mexico Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 9: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 10: Germany Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 11: United Kingdom Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 12: France Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 13: Italy Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 14: Spain Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 15: Rest of Europe Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 16: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 17: China Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 18: Japan Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 19: India Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 20: Australia Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 21: South Korea Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 22: Rest of Asia Pacific Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 23: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 24: GCC Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 25: South Africa Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 26: Rest of Middle East and Africa Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 27: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 28: Brazil Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 29: Argentina Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 30: Rest of South America Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 31: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 32: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 33: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 34: United States Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 35: Canada Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 36: Mexico Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 37: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 38: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 39: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 40: Germany Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 41: United Kingdom Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 42: France Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 43: Italy Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 44: Spain Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 45: Rest of Europe Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 46: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 47: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 48: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 49: China Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 50: Japan Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 51: India Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 52: Australia Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 53: South Korea Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 54: Rest of Asia Pacific Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 55: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 56: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 57: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 58: GCC Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 59: South Africa Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 60: Rest of Middle East and Africa Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 61: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Product Type 2019 & 2032

- Table 62: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by End User 2019 & 2032

- Table 63: Global Smart Technology in Medical Device Industry Revenue Billion Forecast, by Country 2019 & 2032

- Table 64: Brazil Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 65: Argentina Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

- Table 66: Rest of South America Smart Technology in Medical Device Industry Revenue (Billion) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Smart Technology in Medical Device Industry?

The projected CAGR is approximately 7.50%.

2. Which companies are prominent players in the Smart Technology in Medical Device Industry?

Key companies in the market include Samsung*List Not Exhaustive, Otsuka Holdings CO LTD, F Hoffmann-La Roche Ltd, NeuroMetrix Inc, BIO-BEAT, Dexcom Inc, Abbott Laboratories, Koninklijke Philips N V, Medtronic PLC, Omron Corporation, Fitbit Inc, Apple Inc, Vital Connect.

3. What are the main segments of the Smart Technology in Medical Device Industry?

The market segments include Product Type, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Billion as of 2022.

5. What are some drivers contributing to market growth?

Rise in Demand for Smartphone-compatible and Wireless Medical Devices; Technological Advancement in Devices; Rising Awareness and Focus on Fitness.

6. What are the notable trends driving market growth?

Insulin Pumps are Expected to Witness Good Growth in the Market Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Devices; Patients Privacy Concerns.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Smart Technology in Medical Device Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Smart Technology in Medical Device Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Smart Technology in Medical Device Industry?

To stay informed about further developments, trends, and reports in the Smart Technology in Medical Device Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence