Key Insights

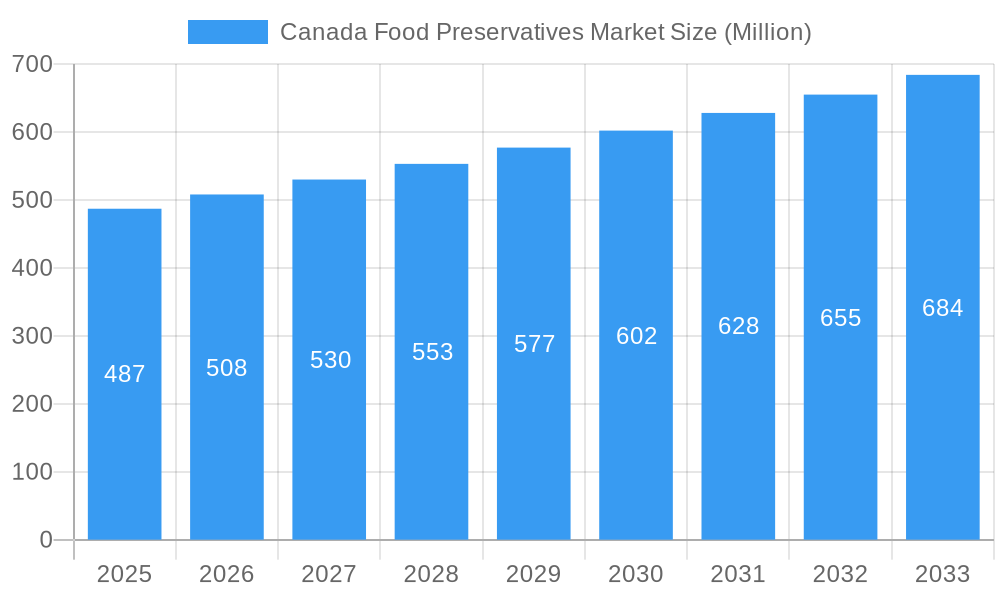

The Canadian food preservatives market is poised for robust growth, projected to reach an estimated USD 487 million by 2025, expanding at a Compound Annual Growth Rate (CAGR) of 4.32% during the forecast period of 2025-2033. This expansion is primarily fueled by a growing consumer demand for longer shelf-life food products, driven by busy lifestyles and an increasing preference for convenience. Furthermore, stringent food safety regulations and an escalating focus on reducing food waste are compelling food manufacturers to adopt advanced preservation technologies. The natural segment is expected to witness significant traction, aligning with the rising consumer consciousness towards clean labels and healthier ingredients, thereby driving demand for natural preservatives derived from sources like fruits, vegetables, and herbs.

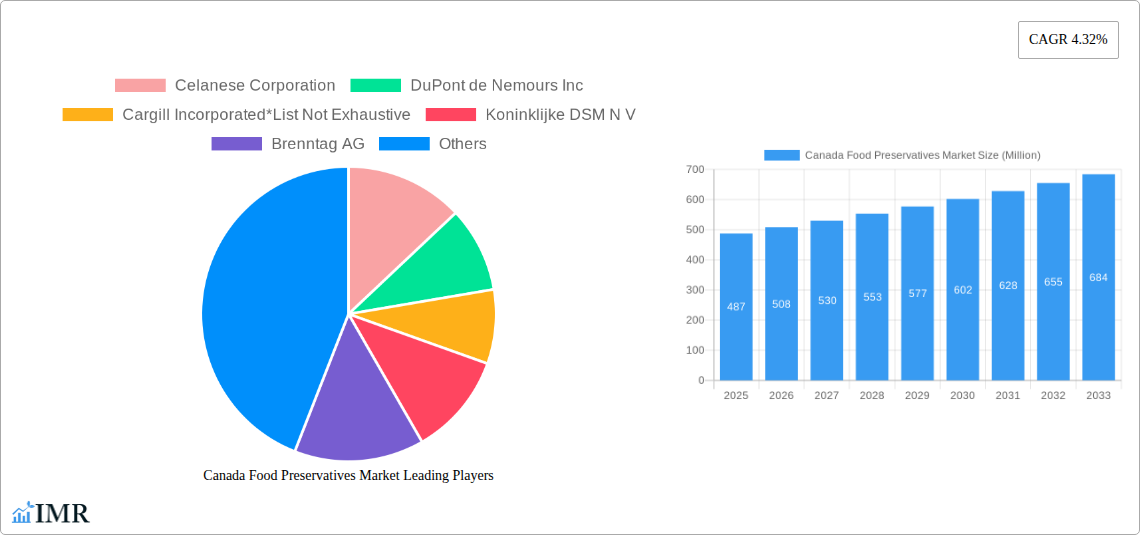

Canada Food Preservatives Market Market Size (In Million)

The market segmentation by application highlights key growth areas, with the Beverages, Dairy & Frozen Products, and Bakery sectors leading the adoption of food preservatives. These sectors, characterized by their susceptibility to spoilage and a strong emphasis on product quality and safety, are continuously seeking effective solutions to extend shelf life and maintain product integrity. Key players such as DuPont de Nemours Inc., Cargill Incorporated, and Kerry Group plc are actively investing in research and development to innovate and offer a diverse portfolio of preservative solutions, catering to evolving consumer preferences and regulatory landscapes. Emerging trends like the development of novel antimicrobial compounds and the integration of preservation technologies with packaging solutions are expected to further shape the market dynamics in Canada.

Canada Food Preservatives Market Company Market Share

Canada Food Preservatives Market Report: Comprehensive Analysis & Future Outlook (2019-2033)

This report offers an in-depth analysis of the Canada Food Preservatives Market, providing critical insights into its current dynamics, historical performance, and future trajectory. Covering a comprehensive study period from 2019 to 2033, with a base year of 2025, this research is vital for stakeholders seeking to understand market evolution, identify growth opportunities, and navigate challenges within this dynamic sector. We examine parent and child market segments, leveraging high-traffic keywords to ensure maximum visibility and engagement with industry professionals. All quantitative values are presented in Million units.

Canada Food Preservatives Market Market Dynamics & Structure

The Canada Food Preservatives Market is characterized by a moderate level of concentration, with key players actively engaging in strategic initiatives to expand their market share and product portfolios. Technological innovation is a significant driver, fueled by the continuous demand for improved shelf-life, food safety, and the growing preference for natural alternatives. Regulatory frameworks, overseen by Health Canada, play a crucial role in shaping product development and market access, emphasizing stringent safety standards. Competitive product substitutes, particularly in the realm of natural preservatives, are gaining traction, prompting established synthetic preservative manufacturers to innovate. End-user demographics are shifting, with an increasing consumer awareness regarding ingredients and health implications, influencing purchasing decisions. Mergers and acquisitions (M&A) trends are also prevalent, as companies seek to consolidate their market position and acquire specialized technologies. For instance, the acquisition of Danisco by DuPont in 2011 significantly bolstered DuPont's offerings in this sector. Innovation barriers include the high cost of research and development for novel preservative solutions and the need for extensive efficacy and safety testing to meet regulatory approval.

- Market Concentration: Moderate, with a few dominant players and a growing number of niche providers.

- Technological Innovation Drivers: Demand for extended shelf-life, enhanced food safety, and the rise of clean-label trends.

- Regulatory Frameworks: Health Canada's stringent approval processes for food additives and preservatives.

- Competitive Product Substitutes: Increasing adoption of natural preservatives like essential oils, plant extracts, and fermentation-derived antimicrobials.

- End-User Demographics: Growing consumer demand for processed foods with a focus on health and natural ingredients.

- M&A Trends: Strategic acquisitions to gain access to new technologies and expand product lines.

Canada Food Preservatives Market Growth Trends & Insights

The Canada Food Preservatives Market is poised for steady growth, driven by evolving consumer preferences, increasing demand for processed and convenience foods, and advancements in preservation technologies. The market size is projected to expand significantly over the forecast period (2025–2033), reflecting a healthy Compound Annual Growth Rate (CAGR). Adoption rates of both synthetic and natural preservatives are influenced by factors such as cost-effectiveness, regulatory acceptance, and perceived consumer safety. Technological disruptions, including the development of active packaging and intelligent labeling systems, are also playing a role in influencing the demand for traditional preservatives.

Consumer behavior shifts are a pivotal element in this market's evolution. There's a discernible move towards "clean label" products, where consumers seek transparency in ingredients and a preference for natural, minimally processed food items. This trend is directly impacting the demand for natural food preservatives, which are perceived as healthier and safer alternatives to their synthetic counterparts. However, synthetic preservatives continue to hold a significant market share due to their cost-effectiveness and established efficacy in a wide range of applications, particularly in extending the shelf-life of staple food products like bakery items and processed meats.

The market penetration of advanced preservation techniques is also on the rise. While traditional methods like refrigeration and canning remain prevalent, innovative approaches are gaining traction. This includes the utilization of antimicrobial agents derived from natural sources, such as essential oils, plant extracts, and bacteriocins. Furthermore, advancements in processing technologies like high-pressure processing (HPP) and pulsed electric fields (PEF) are contributing to a reduced reliance on chemical preservatives in certain food categories. The overall market outlook is positive, with a balanced interplay between the established dominance of synthetic preservatives and the burgeoning demand for natural alternatives, creating a dynamic and evolving landscape.

Dominant Regions, Countries, or Segments in Canada Food Preservatives Market

Within the Canada Food Preservatives Market, the Natural segment of the Type category is a significant driver of growth. This dominance is underpinned by a confluence of economic policies, robust consumer awareness campaigns, and evolving demographic trends across Canada. The increasing emphasis on health and wellness by Canadian consumers has directly translated into a higher demand for products perceived as "cleaner" and free from artificial additives. This preference is further amplified by media coverage and educational initiatives highlighting the potential health impacts of synthetic preservatives.

The Application segment contributing to this growth is broadly Beverages, Dairy & Frozen Products, and Bakery. In the beverage industry, the demand for extended shelf-life and a natural ingredient profile has spurred the adoption of natural preservatives. Similarly, the dairy and frozen products sector, including yogurts, cheeses, and ready-to-eat meals, benefits from natural preservatives that maintain product integrity and appeal to health-conscious consumers. The bakery sector, with its wide array of products susceptible to spoilage, is also witnessing a growing interest in natural solutions that extend shelf life without compromising taste or texture.

The market share within the natural preservatives segment is gradually increasing, reflecting a long-term shift in consumer preference and industry innovation. Key drivers include:

- Economic Policies: Government initiatives promoting sustainable agriculture and natural product development indirectly benefit the natural preservatives market.

- Consumer Awareness: Widespread public discourse on healthy eating and ingredient transparency significantly influences purchasing decisions.

- Technological Advancements: Ongoing research and development in extracting and stabilizing natural compounds are enhancing their efficacy and applicability.

- Regulatory Support: While stringent, regulatory bodies are increasingly recognizing the safety and efficacy of approved natural preservatives.

- Retailer Influence: Major Canadian retailers are responding to consumer demand by prioritizing products with natural ingredients and clear labeling.

The growth potential within these dominant segments is substantial. The increasing market penetration of natural preservatives across various food applications, coupled with continuous product innovation, indicates a sustained upward trend. For instance, the demand for natural antioxidants, such as tocopherols and vitamin C, and antimicrobial agents like cultured dextrose and vinegar derivatives, is expected to surge.

Canada Food Preservatives Market Product Landscape

The Canada Food Preservatives Market is characterized by a diverse product landscape, encompassing both synthetic and natural solutions designed to enhance food safety, extend shelf life, and maintain product quality. Innovations are focused on developing highly effective, cost-efficient, and consumer-accepted preservatives. Key product developments include advanced antimicrobial agents for meat, poultry, and seafood, as well as natural antioxidants and antifungal agents for bakery and dairy products. Performance metrics are increasingly evaluated based on efficacy at low concentrations, minimal impact on sensory attributes, and compliance with stringent regulatory standards. Unique selling propositions often revolve around the "clean label" appeal of natural preservatives and the superior performance of enhanced synthetic options in specific applications, such as acidulants and emulsifiers.

Key Drivers, Barriers & Challenges in Canada Food Preservatives Market

Key Drivers:

- Growing Demand for Processed & Convenience Foods: An increasing urban population and busy lifestyles drive the consumption of processed foods, necessitating effective preservation.

- Health & Wellness Trends: Consumer preference for natural ingredients and perceived "healthier" options fuels the demand for natural preservatives.

- Stringent Food Safety Regulations: Adherence to strict food safety standards mandates the use of effective preservatives to prevent spoilage and microbial contamination.

- Technological Advancements: Innovations in extraction and formulation of both natural and synthetic preservatives enhance their efficacy and application range.

Barriers & Challenges:

- High Cost of Natural Preservatives: Production and sourcing of natural ingredients can be more expensive than synthetic alternatives, impacting affordability.

- Regulatory Hurdles for Novel Ingredients: Gaining approval for new or less common preservatives can be a time-consuming and costly process.

- Consumer Perception of Synthetic Preservatives: Negative consumer perception and demand for "chemical-free" products pose a challenge for synthetic preservative manufacturers.

- Supply Chain Volatility for Natural Ingredients: The availability and price of natural raw materials can be subject to seasonal variations and agricultural factors.

Emerging Opportunities in Canada Food Preservatives Market

Emerging opportunities in the Canada Food Preservatives Market are primarily centered around the expanding demand for plant-based and clean-label ingredients. The growth of the plant-based food sector presents a significant opportunity for preservatives that are compatible with these formulations and appeal to the target consumer. Furthermore, the development of novel antimicrobial peptides and fermentation-derived preservatives offers promising alternatives to traditional synthetic options. Untapped markets within niche food categories, such as ready-to-drink functional beverages and specialized baked goods, also represent areas for growth. Evolving consumer preferences for personalized nutrition and functional foods will also create demand for preservatives that can maintain the integrity of these complex formulations.

Growth Accelerators in the Canada Food Preservatives Market Industry

The Canada Food Preservatives Market is propelled by several growth accelerators. Technological breakthroughs in identifying and synthesizing novel preservative compounds, particularly from natural sources, are key. For instance, advancements in understanding the antimicrobial properties of specific plant extracts and microbial metabolites are leading to the development of more potent and versatile solutions. Strategic partnerships and collaborations between ingredient manufacturers, food producers, and research institutions are fostering innovation and accelerating the commercialization of new preservation technologies. Furthermore, market expansion strategies targeting emerging food categories, such as plant-based alternatives and allergen-free products, are creating new avenues for growth and increasing the overall demand for effective preservation solutions.

Key Players Shaping the Canada Food Preservatives Market Market

Celanese Corporation DuPont de Nemours Inc Cargill Incorporated Koninklijke DSM N V Brenntag AG Corbion NV Kerry Group plc

Notable Milestones in Canada Food Preservatives Market Sector

- 2011: Acquisition of Danisco by DuPont, significantly expanding its portfolio of food preservatives and ingredient solutions.

- Ongoing: Launch of innovative natural preservatives by Cargill, such as rosemary extract and vinegar-based solutions, catering to the growing clean-label trend.

- Ongoing: Collaboration between Brenntag and Corbion to develop sustainable and effective food preservatives, focusing on innovative solutions for the food industry.

In-Depth Canada Food Preservatives Market Market Outlook

The outlook for the Canada Food Preservatives Market remains robust, driven by sustained consumer demand for safe, high-quality, and convenient food products. The ongoing shift towards natural and clean-label ingredients will continue to be a significant growth accelerator, encouraging further investment in research and development of plant-derived and fermentation-based preservatives. Strategic alliances and acquisitions will likely shape the competitive landscape, with companies aiming to broaden their product portfolios and geographical reach. Opportunities lie in developing preservation solutions tailored for emerging food categories, such as plant-based alternatives and ready-to-eat meals, while simultaneously addressing the cost-effectiveness and broad applicability required by the mainstream food industry. The market is well-positioned for continued expansion, balancing innovation with established preservation needs.

Canada Food Preservatives Market Segmentation

-

1. Type

- 1.1. Natural

- 1.2. Synthetic

-

2. Application

- 2.1. Beverages

- 2.2. Dairy & Frozen Products

- 2.3. Bakery

- 2.4. Meat, Poultry & Seafood

- 2.5. Confectionery

- 2.6. Sauces and Salad Mixes

- 2.7. Others

Canada Food Preservatives Market Segmentation By Geography

- 1. Canada

Canada Food Preservatives Market Regional Market Share

Geographic Coverage of Canada Food Preservatives Market

Canada Food Preservatives Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework

- 3.3. Market Restrains

- 3.3.1. High Processing Cost and Low Yield of Flavonoids

- 3.4. Market Trends

- 3.4.1. Strategic Investment Towards Specility Ingredients

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canada Food Preservatives Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Natural

- 5.1.2. Synthetic

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverages

- 5.2.2. Dairy & Frozen Products

- 5.2.3. Bakery

- 5.2.4. Meat, Poultry & Seafood

- 5.2.5. Confectionery

- 5.2.6. Sauces and Salad Mixes

- 5.2.7. Others

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Celanese Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 DuPont de Nemours Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Cargill Incorporated*List Not Exhaustive

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Koninklijke DSM N V

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Brenntag AG

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Corbion NV

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Kerry Group plc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.1 Celanese Corporation

List of Figures

- Figure 1: Canada Food Preservatives Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Canada Food Preservatives Market Share (%) by Company 2025

List of Tables

- Table 1: Canada Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 2: Canada Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: Canada Food Preservatives Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 4: Canada Food Preservatives Market Revenue undefined Forecast, by Type 2020 & 2033

- Table 5: Canada Food Preservatives Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 6: Canada Food Preservatives Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canada Food Preservatives Market?

The projected CAGR is approximately 4.7%.

2. Which companies are prominent players in the Canada Food Preservatives Market?

Key companies in the market include Celanese Corporation, DuPont de Nemours Inc, Cargill Incorporated*List Not Exhaustive, Koninklijke DSM N V, Brenntag AG, Corbion NV, Kerry Group plc.

3. What are the main segments of the Canada Food Preservatives Market?

The market segments include Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Awareness and Extensive Promotions for Differentiated Food Ingredients; Favorable Regulatory Framework.

6. What are the notable trends driving market growth?

Strategic Investment Towards Specility Ingredients.

7. Are there any restraints impacting market growth?

High Processing Cost and Low Yield of Flavonoids.

8. Can you provide examples of recent developments in the market?

1. Acquisition of Danisco by DuPont in 2011, expanding its portfolio of food preservatives 2.Launch of innovative natural preservatives by Cargill, such as rosemary extract and vinegar-based solutions 3. Collaboration between Brenntag and Corbion to develop sustainable and effective food preservatives

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canada Food Preservatives Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canada Food Preservatives Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canada Food Preservatives Market?

To stay informed about further developments, trends, and reports in the Canada Food Preservatives Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence