Key Insights

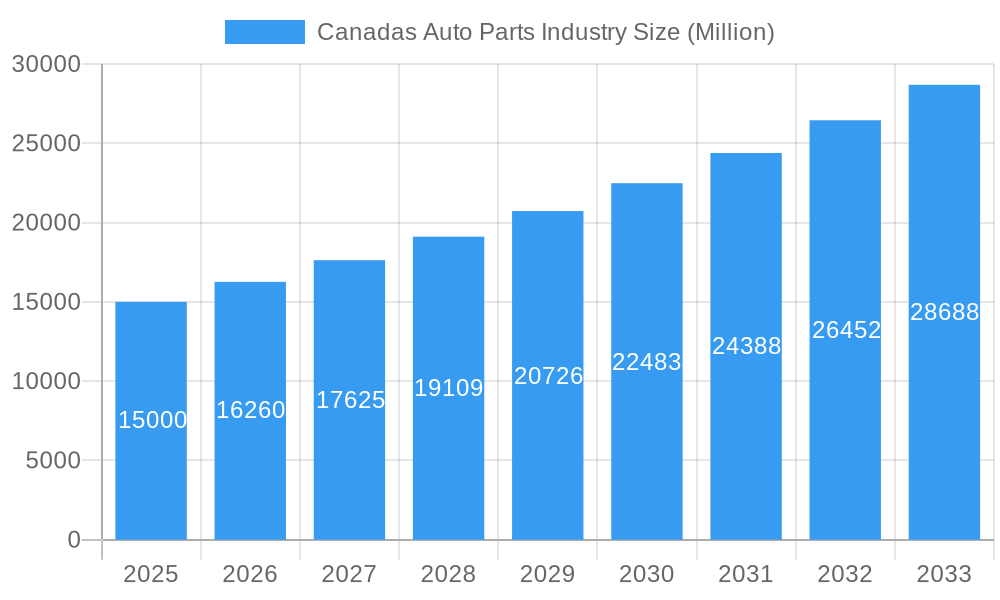

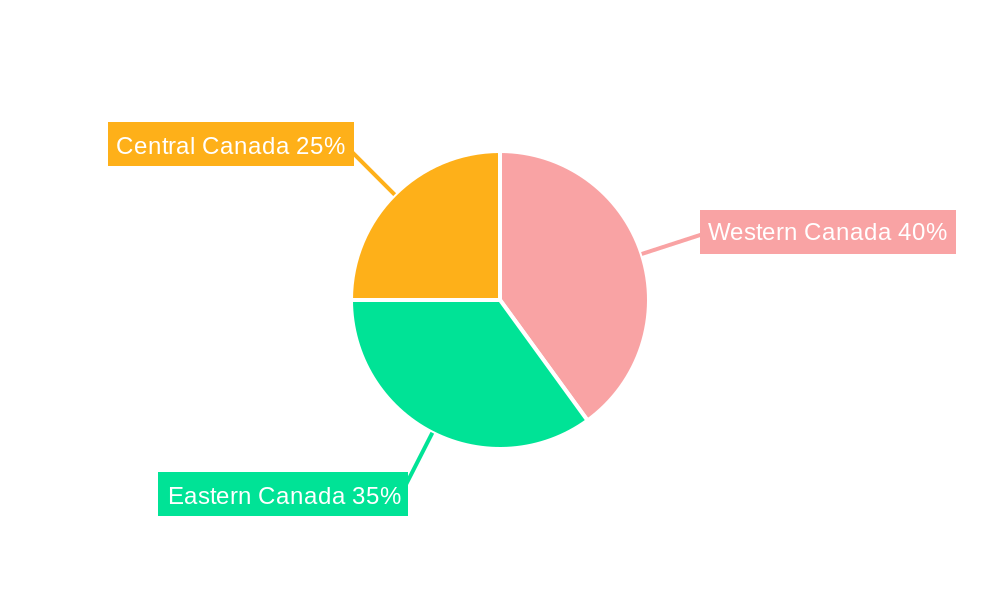

The Canadian automotive parts industry is poised for significant expansion, projected to reach $16152.4 million by 2033, growing at a Compound Annual Growth Rate (CAGR) of 3.2% from the 2025 base year. This growth is underpinned by several key drivers. Increased domestic vehicle production, bolstered by strong demand and exports to the United States, is directly increasing the need for automotive components. Furthermore, the accelerating transition to electric vehicles (EVs) and associated technological advancements are opening new market avenues. While traditional internal combustion engine (ICE) parts remain a significant segment, the demand for EV-specific components, including batteries and electric motors, is rapidly escalating, necessitating industry innovation and adaptation. Government initiatives supporting sustainable transportation and infrastructure investments further contribute to this positive market outlook. Key challenges include ongoing supply chain volatility, fluctuating raw material costs for aluminum, zinc, and magnesium, and intensifying global competition. The industry’s segmentation highlights the dominance of aluminum die casting in raw material consumption, with body assembly and engine parts representing the largest application segments, and pressure die casting leading production methods. Western Canada is anticipated to experience the most substantial growth, benefiting from its proximity to established manufacturing hubs and automotive plants.

Canadas Auto Parts Industry Market Size (In Billion)

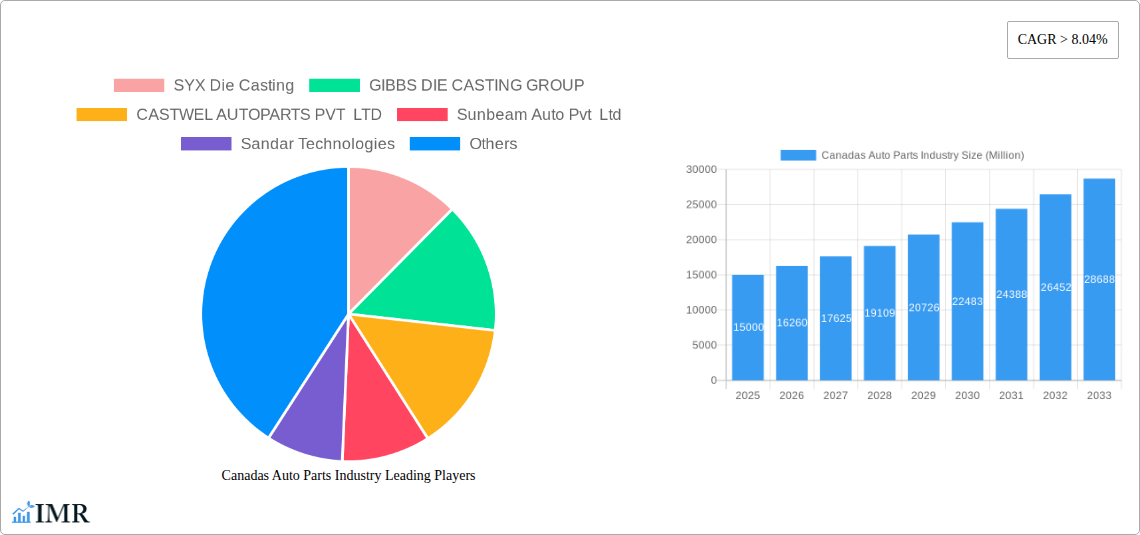

The competitive environment comprises both multinational corporations and domestic enterprises. Leading players such as Dynacast Inc. and GIBBS DIE CASTING GROUP, alongside emerging companies like Castwel Autoparts Pvt Ltd and Sandar Technologies, are actively competing for market share. Future success will depend on companies' adaptability to evolving technologies, effective supply chain risk management, and their capacity to leverage opportunities within the growing EV sector. The forecast period (2025-2033) indicates sustained growth, influenced by global economic trends and the pace of EV adoption. The industry's ability to embrace technological innovation and forge strategic partnerships will be critical for navigating these dynamics and realizing its full growth potential.

Canadas Auto Parts Industry Company Market Share

Canada's Auto Parts Industry Market Report: 2019-2033

This comprehensive report provides an in-depth analysis of Canada's auto parts industry, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. This report is essential for industry professionals, investors, and strategic decision-makers seeking a clear understanding of this dynamic sector.

Canada's Auto Parts Industry Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within Canada's auto parts industry. The analysis incorporates quantitative data, such as market share percentages and M&A deal volumes (xx Million deals in 2024), alongside qualitative factors impacting market growth.

- Market Concentration: The Canadian auto parts market exhibits a moderately concentrated structure, with a few large players dominating specific segments. Smaller, specialized companies focus on niche applications and supply chains. Market share data for top 5 players is detailed in the full report.

- Technological Innovation: Advancements in lightweight materials (e.g., aluminum alloys), additive manufacturing, and sensor integration are driving innovation. However, high R&D costs and integration challenges pose barriers to adoption.

- Regulatory Framework: Stringent emission standards and safety regulations influence product design and manufacturing processes. Compliance costs significantly impact profitability.

- Competitive Product Substitutes: The rise of electric vehicles (EVs) is reshaping the market, necessitating the development of new components and altering the demand for traditional parts.

- End-User Demographics: The increasing demand for SUVs and light trucks in Canada shapes the demand for specific auto parts, influencing production needs.

- M&A Trends: Consolidation is evident through recent M&A activities; however, the report notes a xx% decrease in M&A deal values compared to the previous year, likely due to [mention specific economic factor].

Canada's Auto Parts Industry Growth Trends & Insights

This section details the market size evolution, adoption rates of new technologies, technological disruptions, and consumer behavior shifts within Canada’s auto parts industry from 2019 to 2033. Utilizing robust data analysis, we project a CAGR of xx% from 2025-2033, driven by [mention key factors]. Market penetration of [mention a specific technology or material] is expected to reach xx% by 2033. A detailed breakdown of market segments and their respective growth trajectories is included in the full report. [Insert 600 words of detailed analysis here based on the provided XXX data and market trends.]

Dominant Regions, Countries, or Segments in Canada's Auto Parts Industry

This section identifies the leading regions, countries, and segments within Canada’s auto parts market based on raw material, application type, and production process.

By Raw Material:

- Aluminum: Dominates due to its lightweight properties and suitability for various applications (e.g., body panels, engine components). Market share is estimated at xx Million units in 2025.

- Zinc: Significant market share in die-casting applications, particularly for smaller parts. Market share is projected at xx Million units in 2025.

- Magnesium: Growing but niche segment, used for lightweight components seeking weight reduction. Market share is xx Million units in 2025.

- Other Raw Materials: Includes steel, plastics, and composites; a smaller but diversified market. Market share is at xx Million units in 2025.

By Application Type:

- Engine Parts: A large and crucial segment, driven by technological advancements in engine design and efficiency. Market size is estimated at xx Million units in 2025.

- Body Assembly: Significant market segment, with growth influenced by vehicle production volume and design trends. Market size is at xx Million units in 2025.

- Transmission Parts: Growth is linked to technological advancements in automated transmissions. Market share is estimated at xx Million units in 2025.

- Other Applications: Includes interior components, electrical systems, and safety features. Market share is at xx Million units in 2025.

By Production Process Type:

- Pressure Die Casting: The most prevalent method due to its high productivity and ability to create complex shapes. Market share is projected at xx Million units in 2025.

- Other Production Processes: Vacuum die casting, squeeze die casting, and semi-solid die casting hold smaller market shares but are gaining traction for specific applications. Combined market share is estimated at xx Million units in 2025.

[Insert 600 words of detailed analysis explaining the dominance of specific regions/segments and the key factors driving their growth, including market share data and growth potential forecasts.]

Canada's Auto Parts Industry Product Landscape

The Canadian auto parts industry offers a diverse range of products, from engine components and transmission systems to body panels and safety features. Recent innovations focus on lightweighting, enhanced durability, and integration of advanced sensors and electronics. Key trends include the adoption of advanced materials like high-strength steel and aluminum alloys, the increasing use of additive manufacturing for prototyping and customized parts, and the development of intelligent components incorporating advanced electronics and connectivity. The competitive landscape is driven by factors such as product quality, cost-effectiveness, and ability to meet stringent industry standards.

Key Drivers, Barriers & Challenges in Canada's Auto Parts Industry

Key Drivers: Increased vehicle production, rising consumer demand, technological advancements, and government incentives for fuel-efficient vehicles. The growing adoption of EVs and autonomous driving technologies also creates opportunities for new components and systems.

Key Challenges: Fluctuations in raw material prices, intense competition from international suppliers, stringent environmental regulations, and skilled labor shortages. Supply chain disruptions can significantly impact production timelines and costs.

Emerging Opportunities in Canada's Auto Parts Industry

Emerging opportunities lie in the growing demand for lightweight and fuel-efficient vehicles, increasing adoption of electric vehicles, and the development of autonomous driving technologies. Untapped markets exist in specialized aftermarket parts and the integration of advanced materials and sensors in vehicle components. The industry is also seeing growth in the demand for sustainable and recycled materials.

Growth Accelerators in the Canada's Auto Parts Industry Industry

Long-term growth will be fueled by technological advancements in materials science, automation, and digitalization. Strategic partnerships between automakers and parts suppliers will facilitate innovation and streamline supply chains. Expansion into new markets and diversification of product offerings will play crucial roles.

Key Players Shaping the Canada's Auto Parts Industry Market

- SYX Die Casting

- GIBBS DIE CASTING GROUP

- CASTWEL AUTOPARTS PVT LTD

- Sunbeam Auto Pvt Ltd

- Sandar Technologies

- Amtek Group

- ECO Die Castings

- Endurance Technologies Ltd

- ALUMINIUM DIE CASTING (CHINA) LTD

- Dynacast Inc

Notable Milestones in Canada's Auto Parts Industry Sector

- May 2023: Linamar Corporation announces a new giga casting facility in Welland, Ontario, signifying a significant investment in high-pressure die casting technology and job creation.

- April 2023: Rheinmetall AG and Xiaomi partner to manufacture die-cast components for electric vehicles, showcasing collaboration and investment in the EV sector.

In-Depth Canada's Auto Parts Industry Market Outlook

The Canadian auto parts industry is poised for continued growth, driven by technological innovation, rising vehicle production, and increasing demand for advanced automotive components. Strategic investments in R&D, automation, and sustainable manufacturing processes will further shape market dynamics. The increasing focus on electric vehicles and autonomous driving technologies will create significant opportunities for companies that can adapt and innovate. The market's future success hinges on effectively navigating supply chain challenges, complying with evolving regulations, and maintaining a competitive edge in a globalized market.

Canadas Auto Parts Industry Segmentation

-

1. Production Process Type

- 1.1. Pressure Die Casting

- 1.2. Vacuum Die Casting

- 1.3. Squeeze Die Casting

- 1.4. Semi-Solid Die Casting

-

2. Raw Material

- 2.1. Aluminum

- 2.2. Zinc

- 2.3. Magnesium

- 2.4. Other Raw Materials

-

3. Application Type

- 3.1. Body Assembly

- 3.2. Engine Parts

- 3.3. Transmission Parts

- 3.4. Other Applications

Canadas Auto Parts Industry Segmentation By Geography

- 1. Canada

Canadas Auto Parts Industry Regional Market Share

Geographic Coverage of Canadas Auto Parts Industry

Canadas Auto Parts Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand

- 3.3. Market Restrains

- 3.3.1. High Processing Cost May Hamper Market Expansion

- 3.4. Market Trends

- 3.4.1. Automotive Segment will Drive The Market In Coming Year

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Canadas Auto Parts Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 5.1.1. Pressure Die Casting

- 5.1.2. Vacuum Die Casting

- 5.1.3. Squeeze Die Casting

- 5.1.4. Semi-Solid Die Casting

- 5.2. Market Analysis, Insights and Forecast - by Raw Material

- 5.2.1. Aluminum

- 5.2.2. Zinc

- 5.2.3. Magnesium

- 5.2.4. Other Raw Materials

- 5.3. Market Analysis, Insights and Forecast - by Application Type

- 5.3.1. Body Assembly

- 5.3.2. Engine Parts

- 5.3.3. Transmission Parts

- 5.3.4. Other Applications

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Canada

- 5.1. Market Analysis, Insights and Forecast - by Production Process Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 SYX Die Casting

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 GIBBS DIE CASTING GROUP

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CASTWEL AUTOPARTS PVT LTD

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sunbeam Auto Pvt Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Sandar Technologies

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Amtek Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 ECO Die Castings

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Endurance Technologies Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 ALUMINIUM DIE CASTING (CHINA) LTD

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Dynacast Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 SYX Die Casting

List of Figures

- Figure 1: Canadas Auto Parts Industry Revenue Breakdown (million, %) by Product 2025 & 2033

- Figure 2: Canadas Auto Parts Industry Share (%) by Company 2025

List of Tables

- Table 1: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 2: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 3: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 4: Canadas Auto Parts Industry Revenue million Forecast, by Region 2020 & 2033

- Table 5: Canadas Auto Parts Industry Revenue million Forecast, by Production Process Type 2020 & 2033

- Table 6: Canadas Auto Parts Industry Revenue million Forecast, by Raw Material 2020 & 2033

- Table 7: Canadas Auto Parts Industry Revenue million Forecast, by Application Type 2020 & 2033

- Table 8: Canadas Auto Parts Industry Revenue million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Canadas Auto Parts Industry?

The projected CAGR is approximately 3.2%.

2. Which companies are prominent players in the Canadas Auto Parts Industry?

Key companies in the market include SYX Die Casting, GIBBS DIE CASTING GROUP, CASTWEL AUTOPARTS PVT LTD, Sunbeam Auto Pvt Ltd, Sandar Technologies, Amtek Group, ECO Die Castings, Endurance Technologies Ltd, ALUMINIUM DIE CASTING (CHINA) LTD, Dynacast Inc.

3. What are the main segments of the Canadas Auto Parts Industry?

The market segments include Production Process Type, Raw Material, Application Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 16152.4 million as of 2022.

5. What are some drivers contributing to market growth?

Growth of the Automotive Industry to Drive Demand in the Die Casting Market; Growing Focus Toward Fuel Efficiency of IC Engine Vehicle to Drive Demand.

6. What are the notable trends driving market growth?

Automotive Segment will Drive The Market In Coming Year.

7. Are there any restraints impacting market growth?

High Processing Cost May Hamper Market Expansion.

8. Can you provide examples of recent developments in the market?

May 2023: Linamar Corporation unveiled plans for a cutting-edge giga casting facility in Welland, Ontario. Spanning approximately 300,000 square feet, the plant will create employment for around 200 workers. The facility will house three 6,100-ton high-pressure die-cast machines, with the first installation scheduled for January 2024.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Canadas Auto Parts Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Canadas Auto Parts Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Canadas Auto Parts Industry?

To stay informed about further developments, trends, and reports in the Canadas Auto Parts Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence