Key Insights

The China coffee market is projected to expand significantly, reaching an estimated 11.68 billion USD by 2025. This growth is driven by a 10.93% CAGR through 2033, fueled by evolving consumer preferences, a growing middle class, and the rise of a sophisticated coffee culture influenced by global trends. Consumers are increasingly seeking premium, specialty, and convenient coffee options, including whole beans, ground coffee, and pods. Awareness of coffee origins, roasting, and brewing methods is fostering demand for higher quality and diverse experiences. The market benefits from a robust distribution network, combining traditional retail with the rapid growth of online sales and the educational role of specialty stores.

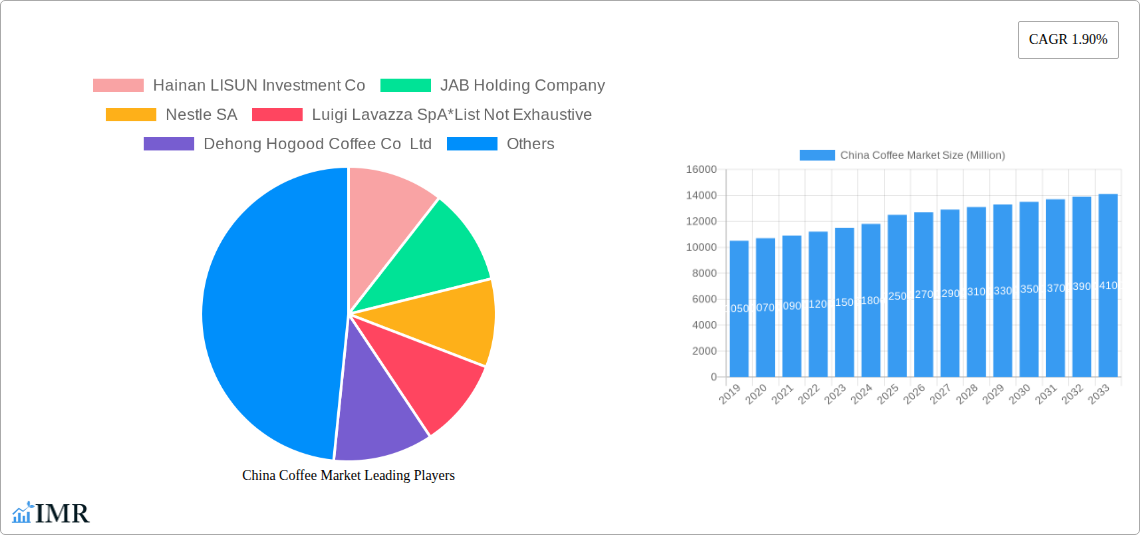

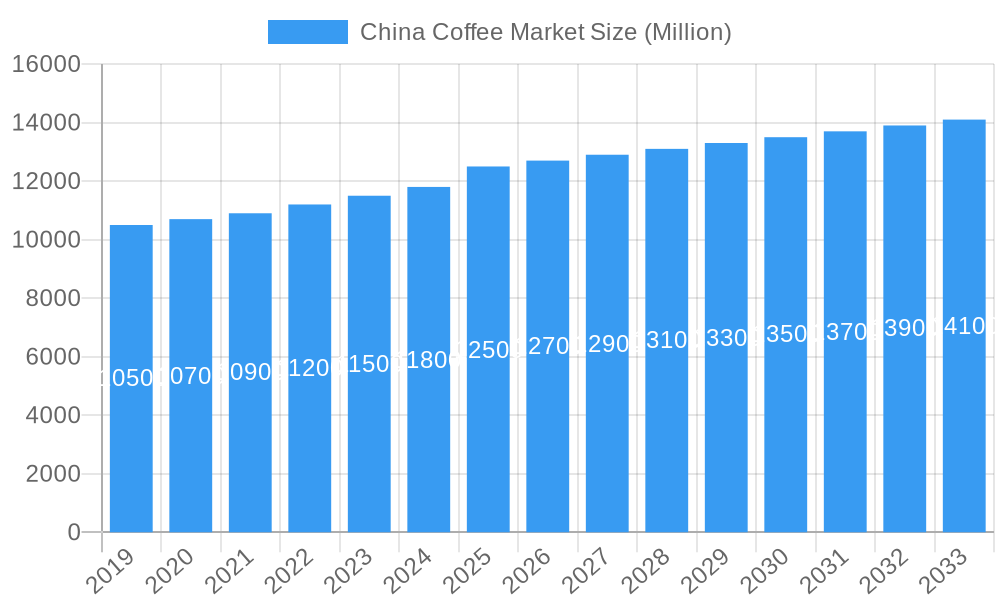

China Coffee Market Market Size (In Billion)

Despite a positive outlook, the market faces restraints, including intense competition from global and local players such as Nestle, Starbucks, and Luckin Coffee, leading to price pressures. While instant coffee remains accessible, premium segments are expected to grow faster. Companies must differentiate through innovative products and effective marketing, adapting to regional preferences and navigating regulatory landscapes. The long-term prospects remain strong, supported by urbanization, increased spending power, and coffee's adoption as a lifestyle beverage. The market is set for sustained growth, offering opportunities for players who can meet the evolving demands of Chinese coffee consumers.

China Coffee Market Company Market Share

China Coffee Market Report: Comprehensive Analysis & Forecast (2019–2033)

This in-depth report provides an exhaustive analysis of the burgeoning China coffee market, offering critical insights for stakeholders navigating this dynamic landscape. Covering the historical period (2019–2024), base year (2025), and an extensive forecast period (2025–2033), this research delves into market size evolution, growth trends, key drivers, emerging opportunities, and the competitive strategies of major players. Explore parent and child market dynamics, detailed segmentation by product type and distribution channel, and crucial industry developments to inform your strategic decisions. All values are presented in millions of units.

China Coffee Market Market Dynamics & Structure

The China coffee market is characterized by a dynamic interplay of factors shaping its competitive and structural landscape. Market concentration is evolving, with established global giants and rapidly growing domestic players vying for market share. Technological innovation is a significant driver, with advancements in brewing technologies, sustainable sourcing, and digital integration enhancing consumer experience and operational efficiency. Regulatory frameworks, while becoming more refined, continue to influence market access and product standards. Competitive product substitutes, including traditional tea and other beverages, pose a constant challenge, necessitating continuous product differentiation and marketing efforts. End-user demographics are shifting, with a growing middle class, increasing urbanization, and a younger demographic driving demand for premium and convenient coffee options. Mergers and acquisitions (M&A) trends are indicative of strategic consolidation and expansion, with companies seeking to enhance their portfolios and market reach.

- Market Concentration: Increasing competition between multinational corporations and burgeoning domestic brands, alongside a growing number of independent specialty coffee shops.

- Technological Innovation Drivers: Focus on advanced brewing equipment, contactless ordering, personalized beverage options, and sustainable packaging solutions.

- Regulatory Frameworks: Evolving food safety regulations, import/export policies for coffee beans, and labeling requirements impacting market entry and product development.

- Competitive Product Substitutes: Dominance of the traditional tea market, alongside the rise of other ready-to-drink (RTD) beverages.

- End-User Demographics: Rapidly expanding middle-class, tech-savvy millennials and Gen Z consumers with disposable income and a preference for Western lifestyle trends.

- M&A Trends: Strategic acquisitions by larger players to gain market share, expand product lines, and integrate supply chains. Deal volumes are projected to increase as consolidation continues.

China Coffee Market Growth Trends & Insights

The China coffee market is poised for substantial growth, driven by a confluence of economic, social, and cultural factors. The market size evolution reflects a dramatic increase in coffee consumption, transitioning from a niche beverage to a mainstream option. Adoption rates are accelerating, particularly in urban centers, as consumers embrace coffee as part of their daily routine and social lifestyle. Technological disruptions are playing a pivotal role, with e-commerce platforms and mobile ordering apps revolutionizing accessibility and convenience. Consumer behavior shifts are evident, with a growing appreciation for quality, variety, and the experiential aspect of coffee consumption. The market is witnessing a rise in demand for specialty coffee, ready-to-drink (RTD) options, and convenient at-home brewing solutions.

The market is projected to experience a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Market penetration is expected to deepen significantly, moving beyond Tier 1 cities to encompass Tier 2 and Tier 3 cities as disposable incomes rise and coffee culture permeates further. Digital transformation in the coffee sector is transforming how consumers discover, purchase, and consume coffee. This includes the proliferation of online coffee subscription services, virtual cafes, and augmented reality (AR) experiences enhancing brand engagement. The influence of social media and online influencers is also a significant factor in shaping consumer preferences and driving trial of new products and brands. Sustainability and ethical sourcing are emerging as key considerations for a growing segment of Chinese consumers, influencing purchasing decisions and brand loyalty. This trend presents an opportunity for brands that can effectively communicate their commitment to responsible practices. The overall trajectory indicates a robust and expanding market, with significant opportunities for both domestic and international players.

Dominant Regions, Countries, or Segments in China Coffee Market

The China coffee market's dominance is a multifaceted phenomenon, influenced by geographical economic disparities, evolving distribution channels, and specific product preferences. Among the Product Types, Instant Coffee has historically held a significant share due to its convenience and affordability, making it accessible to a broader consumer base. However, the demand for Whole-bean and Ground Coffee is rapidly ascending, driven by a growing appreciation for artisanal coffee and at-home brewing. Coffee Pods and Capsules are also gaining traction, appealing to consumers seeking convenience without compromising on quality.

In terms of Distribution Channels, the Off-trade segment is witnessing explosive growth, particularly Online Retail Stores. E-commerce platforms like Tmall, JD.com, and Pinduoduo have become indispensable channels for coffee sales, offering a vast selection and competitive pricing. Supermarkets/Hypermarkets remain crucial for mass-market penetration, while Specialty Stores cater to a growing segment of coffee enthusiasts seeking premium experiences and unique beans. Convenience Stores are also emerging as key touchpoints for RTD coffee and quick impulse purchases. The On-trade segment, encompassing cafes and restaurants, continues to be vital for building brand awareness and providing an experiential dimension to coffee consumption, with Starbucks Corporation and Luckin Coffee leading this segment.

The dominance of specific regions is often tied to economic development and urbanization. Eastern China, particularly cities like Shanghai and Beijing, are leading the charge in coffee consumption due to higher disposable incomes and a more developed coffee culture. This region demonstrates a higher propensity for adopting premium coffee products and experiencing branded coffee shops. The rapid expansion into Tier 2 and Tier 3 cities is a key growth driver, with Online Retail Stores serving as a crucial bridge to reach these burgeoning markets. Government initiatives promoting domestic consumption and e-commerce infrastructure further bolster the growth in these areas. The increasing availability of imported specialty beans and the rise of local roasters are also contributing to the diversification and premiumization of the coffee landscape across these dominant regions.

China Coffee Market Product Landscape

The product landscape within the China coffee market is marked by rapid innovation and diversification. From classic Instant Coffee formats that cater to convenience-seeking consumers to the burgeoning demand for premium Whole-bean and Ground Coffee, driven by the rise of specialty coffee culture, the market offers a wide spectrum. Coffee Pods and Capsules are increasingly popular, providing a convenient yet quality-conscious option for at-home brewing, mirroring global trends. Key innovations include the introduction of flavored coffees, plant-based milk options, and cold brew concentrates designed for the Chinese palate. Companies are focusing on unique selling propositions such as single-origin beans, sustainable sourcing certifications, and innovative packaging that extends shelf life and enhances consumer appeal. Technological advancements in roasting and processing are also contributing to improved flavor profiles and product consistency.

Key Drivers, Barriers & Challenges in China Coffee Market

Key Drivers: The China coffee market is propelled by several key drivers. The rapidly growing middle class with increasing disposable income is a primary force, fueling demand for premium and convenience-oriented coffee products. Urbanization and the adoption of Western lifestyles, particularly among younger generations, are fostering a coffee-drinking culture. Technological advancements in brewing and distribution, coupled with the widespread adoption of e-commerce platforms, enhance accessibility and convenience. The increasing presence of both global and domestic coffee chains is also expanding market reach and consumer awareness.

Barriers & Challenges: Despite robust growth, the market faces significant barriers and challenges. The entrenched dominance of the traditional tea market presents a formidable competitive substitute. Fluctuations in global coffee bean prices can impact raw material costs and profitability. Evolving regulatory landscapes and stringent food safety standards require continuous adaptation. Intense competition from a multitude of domestic and international players necessitates significant marketing investment and product differentiation. Supply chain complexities, particularly for specialty and imported beans, can pose logistical hurdles.

Emerging Opportunities in China Coffee Market

Emerging opportunities in the China coffee market are abundant and diverse. The burgeoning demand for plant-based and functional coffees, catering to health-conscious consumers, represents a significant untapped market. Further expansion into Tier 2 and Tier 3 cities, leveraging e-commerce and innovative distribution models, offers vast growth potential. The increasing interest in sustainable and ethically sourced coffee presents an opportunity for brands to build strong consumer loyalty based on shared values. Furthermore, the development of unique, localized flavor profiles and the experiential aspect of coffee consumption, including artisanal brewing workshops and themed cafes, can attract a new wave of consumers.

Growth Accelerators in the China Coffee Market Industry

Several catalysts are accelerating the growth of the China coffee market. Technological breakthroughs in areas such as advanced roasting techniques and smart brewing appliances are enhancing product quality and consumer experience. Strategic partnerships between coffee companies and food delivery platforms are expanding reach and convenience. The increasing focus on direct-to-consumer (DTC) models and subscription services is fostering brand loyalty and recurring revenue. Furthermore, the growing influence of social media marketing and influencer collaborations is effectively driving consumer awareness and trial of new coffee products and brands, solidifying coffee's position in the Chinese consumer's lifestyle.

Key Players Shaping the China Coffee Market Market

- Hainan LISUN Investment Co

- JAB Holding Company

- Nestle SA

- Luigi Lavazza SpA

- Dehong Hogood Coffee Co Ltd

- Gloria Jean's

- The Kraft Heinz Company

- The Coca-Cola Company

- Luckin Coffee

- Starbucks Corporation

Notable Milestones in China Coffee Market Sector

- April 2023: Nestle, the Swiss food and beverage industry leader, unveiled Nescafe Ice Roast instant coffee in China, catering to the growing demand for "cafe-style cold coffee experiences" in the comfort of one's home. This product launch directly addresses evolving consumer preferences for convenient and refreshing beverage options.

- September 2022: Luckin Coffee, a prominent Chinese beverage chain, initiated an entrepreneurial endeavor by introducing a new coffee brand called "Cotti Coffee." This strategic move signals an expansion of its brand portfolio and an attempt to capture a broader segment of the coffee market.

- January 2022: Ethiopian Coffee Brands made their debut on China's largest e-commerce Platform. This strategic move aims to harness the infrastructure offered by the electronic World Trade Platform (e-WTP) to create a conducive environment for promoting e-commerce and tourism among African entrepreneurs, all while bringing high-quality African products into the Chinese market. This milestone highlights the increasing importance of international trade and e-commerce for coffee bean sourcing.

In-Depth China Coffee Market Market Outlook

The in-depth market outlook for China's coffee sector is overwhelmingly positive, with several growth accelerators set to shape its future. The continued expansion of disposable incomes and a deepening coffee culture, especially in emerging urban centers, will fuel sustained demand for both premium and convenient coffee products. Technological integration, from AI-powered personalized recommendations to advanced brewing technologies, will further enhance the consumer experience. Strategic expansion into underserved markets and the development of localized product offerings will be crucial for capturing market share. Furthermore, the growing emphasis on sustainability and ethical sourcing will drive brand differentiation and consumer loyalty, presenting significant strategic opportunities for forward-thinking companies in this dynamic and rapidly evolving market.

China Coffee Market Segmentation

-

1. Product Type

- 1.1. Whole-bean

- 1.2. Ground Coffee

- 1.3. Instant Coffee

- 1.4. Coffee Pods and Capsules

-

2. Distribution Channel

- 2.1. On-trade

-

2.2. Off-trade

- 2.2.1. Supermarkets/Hypermarkets

- 2.2.2. Specialty Stores

- 2.2.3. Convenience Stores

- 2.2.4. Online Retail Stores

- 2.2.5. Other Distribution Channels

China Coffee Market Segmentation By Geography

- 1. China

China Coffee Market Regional Market Share

Geographic Coverage of China Coffee Market

China Coffee Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.93% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Government Initiatives and E-commerce Penetration

- 3.3. Market Restrains

- 3.3.1. Detrimental Health Impact of Caffeine Intake

- 3.4. Market Trends

- 3.4.1. Government Initiatives and E-commerce Penetration Drive the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. China Coffee Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Whole-bean

- 5.1.2. Ground Coffee

- 5.1.3. Instant Coffee

- 5.1.4. Coffee Pods and Capsules

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. On-trade

- 5.2.2. Off-trade

- 5.2.2.1. Supermarkets/Hypermarkets

- 5.2.2.2. Specialty Stores

- 5.2.2.3. Convenience Stores

- 5.2.2.4. Online Retail Stores

- 5.2.2.5. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. China

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Hainan LISUN Investment Co

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 JAB Holding Company

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nestle SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Luigi Lavazza SpA*List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Dehong Hogood Coffee Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gloria Jean's

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 The Kraft Heinz Company

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 The Coca-Cola Company

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Luckin Coffee

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Starbucks Corporation

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Hainan LISUN Investment Co

List of Figures

- Figure 1: China Coffee Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: China Coffee Market Share (%) by Company 2025

List of Tables

- Table 1: China Coffee Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: China Coffee Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: China Coffee Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: China Coffee Market Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: China Coffee Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: China Coffee Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the China Coffee Market?

The projected CAGR is approximately 10.93%.

2. Which companies are prominent players in the China Coffee Market?

Key companies in the market include Hainan LISUN Investment Co, JAB Holding Company, Nestle SA, Luigi Lavazza SpA*List Not Exhaustive, Dehong Hogood Coffee Co Ltd, Gloria Jean's, The Kraft Heinz Company, The Coca-Cola Company, Luckin Coffee, Starbucks Corporation.

3. What are the main segments of the China Coffee Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 11.68 billion as of 2022.

5. What are some drivers contributing to market growth?

Government Initiatives and E-commerce Penetration.

6. What are the notable trends driving market growth?

Government Initiatives and E-commerce Penetration Drive the Market.

7. Are there any restraints impacting market growth?

Detrimental Health Impact of Caffeine Intake.

8. Can you provide examples of recent developments in the market?

April 2023: Nestle, the Swiss food and beverage industry leader, unveiled Nescafe Ice Roast instant coffee in China, catering to the growing demand for "cafe-style cold coffee experiences" in the comfort of one's home.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "China Coffee Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the China Coffee Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the China Coffee Market?

To stay informed about further developments, trends, and reports in the China Coffee Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence