Key Insights

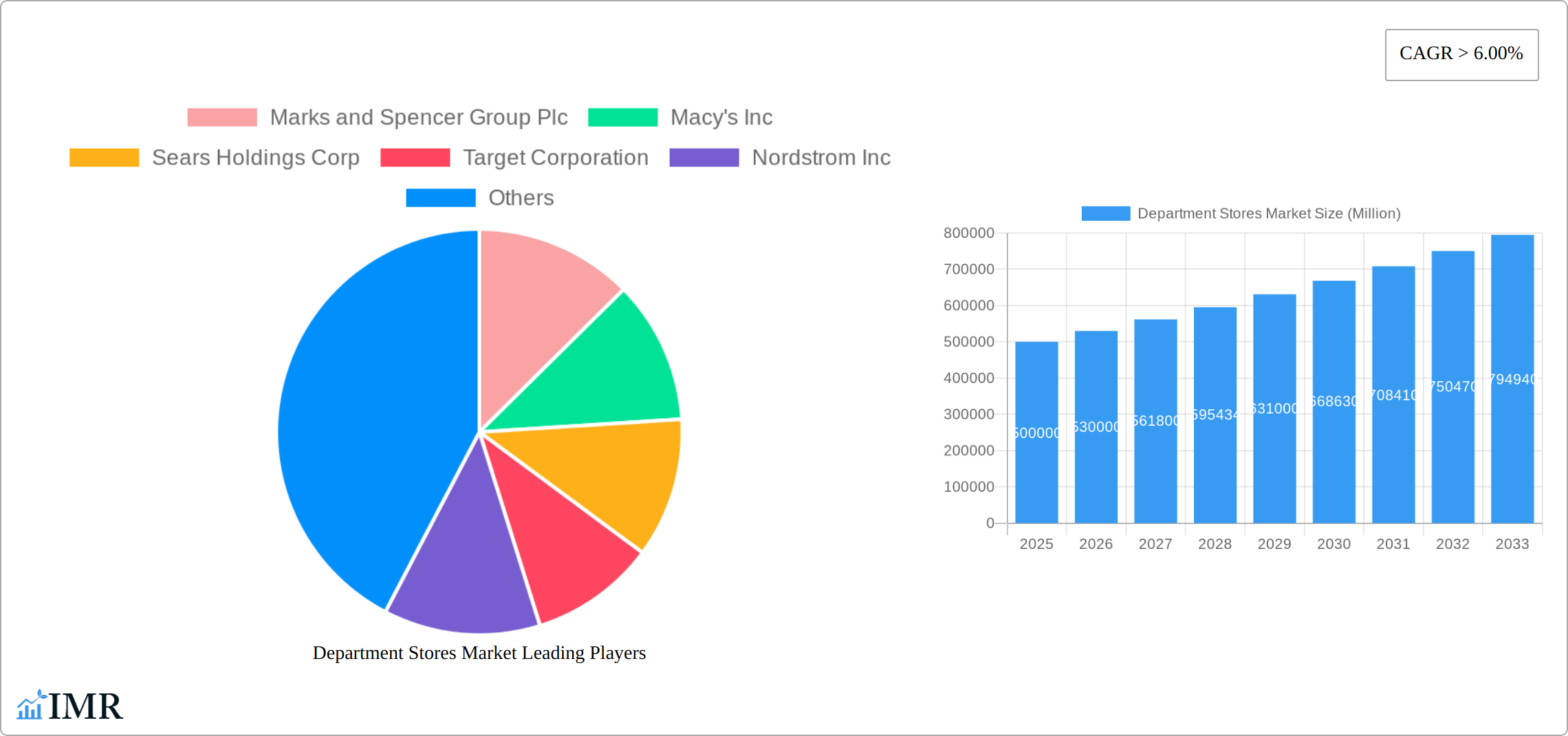

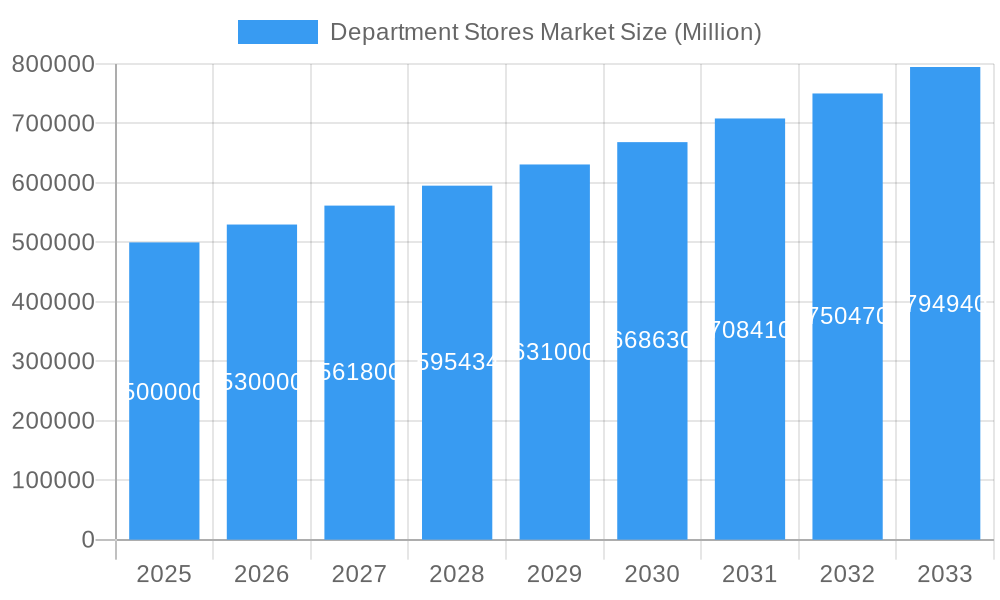

The department store market, while facing significant disruption from e-commerce, remains a substantial sector with a projected Compound Annual Growth Rate (CAGR) exceeding 6% from 2025 to 2033. This growth, despite challenges, is driven by several key factors. Firstly, a resurgence of interest in in-person shopping experiences, particularly among younger demographics seeking social interaction and immediate gratification, is proving beneficial. Secondly, the strategic implementation of omnichannel strategies by major players like Macy's, Nordstrom, and Target is bridging the gap between online and offline retail, enhancing customer convenience and loyalty. Furthermore, the focus on experiential retail – incorporating restaurants, entertainment, and personalized services within department stores – is attracting new customers and creating a unique value proposition. However, the market also faces considerable restraints. The persistent rise of e-commerce giants like Amazon continues to exert pressure on market share, while rising operational costs and the need for significant investments in digital infrastructure present ongoing challenges for traditional department stores. Successful players will need to adapt nimbly to shifting consumer preferences, invest strategically in technology, and cultivate a strong brand identity to thrive in this competitive landscape.

Department Stores Market Market Size (In Billion)

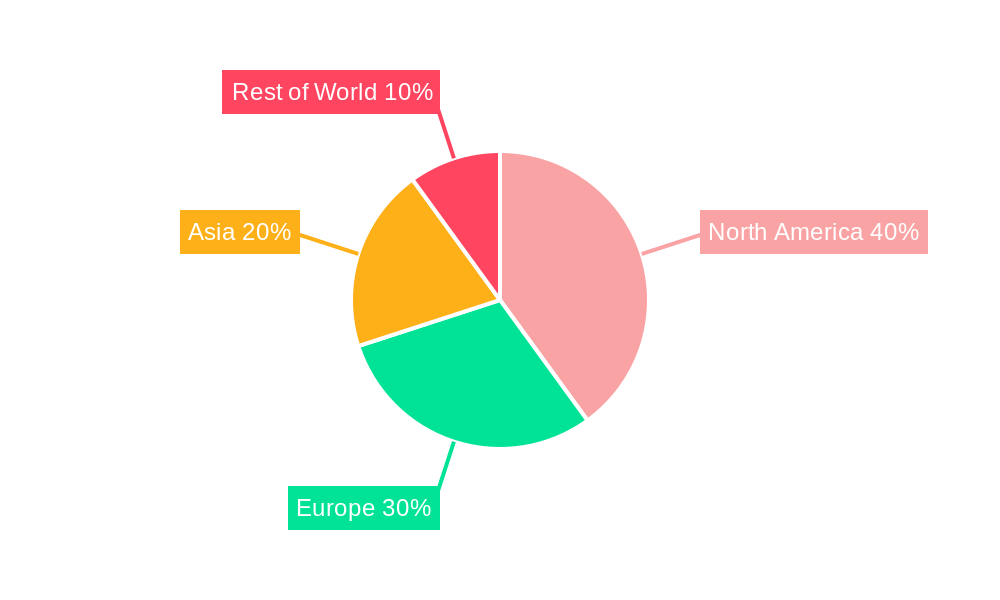

The competitive landscape is dominated by a mix of established global players and regional chains. Major players like Marks & Spencer, Macy's, and Walmart are leveraging their established brand recognition and extensive store networks to maintain market share. However, smaller, more agile regional chains are also gaining traction by focusing on niche markets and personalized service. The geographical distribution of market share is likely skewed towards North America and Europe, which historically have the largest concentration of established department stores. However, growth in emerging markets in Asia and other regions is anticipated, albeit at a slower pace, due to factors such as developing infrastructure and changing consumer spending patterns. The market segmentation will likely continue to be defined by product categories (apparel, home goods, cosmetics, etc.), price points, and target customer demographics. A thorough understanding of these segments and consumer trends is critical for success in this evolving market.

Department Stores Market Company Market Share

Department Stores Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Department Stores Market, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future outlook. The study period covers 2019-2033, with 2025 as the base and estimated year. The report leverages extensive data and expert analysis to offer actionable insights for industry professionals, investors, and strategic decision-makers. This report covers the parent market of Retail and the child market of Department Stores.

Department Stores Market Dynamics & Structure

This section analyzes the Department Stores market's competitive landscape, technological advancements, regulatory environment, and market trends. We delve into market concentration, examining the market share held by key players like Marks and Spencer Group Plc, Macy's Inc, Sears Holdings Corp, Target Corporation, Nordstrom Inc, Walmart Inc, Isetan Mitsukoshi Holdings Ltd, Kohl's Corporation, Chongqing Department Store Co Ltd, and Lotte Department Store (list not exhaustive). The report quantifies market share percentages and analyzes M&A activity within the sector, providing insights into deal volumes over the historical period. Qualitative factors influencing market dynamics, such as innovation barriers and regulatory hurdles, are also discussed. The analysis includes:

- Market Concentration: Analysis of market share distribution among top players and assessment of market concentration levels (e.g., Herfindahl-Hirschman Index). xx% market share is held by the top 5 players in 2024.

- Technological Innovation: Examination of the impact of e-commerce, omnichannel strategies, and personalized shopping experiences on market growth. xx% of sales are expected to be online by 2033.

- Regulatory Frameworks: Assessment of relevant regulations and their impact on market operations. Potential changes in regulations could influence market growth by xx%.

- Competitive Product Substitutes: Analysis of alternative retail channels and their influence on department store sales. Discount retailers are gaining market share at an estimated xx% annually.

- End-User Demographics: Segmentation of the customer base based on age, income, and purchasing behavior. Millennials and Gen Z contribute xx% of total sales.

- M&A Trends: Analysis of mergers and acquisitions activity in the department store sector, including deal volume and value. xx M&A deals occurred between 2019 and 2024.

Department Stores Market Growth Trends & Insights

This section provides a comprehensive analysis of the Department Stores market's evolution, leveraging a robust blend of primary and secondary data. We meticulously examine market size, compound annual growth rate (CAGR), and penetration rates across the historical period (2019-2024) and the projected forecast period (2025-2033). Our granular breakdown by region and segment offers deep insights into the dynamic forces shaping the market and its future potential. The estimated market size for 2025 is xx Million units, with a projected CAGR of xx% for the forecast period. We delve into critical factors such as evolving consumer preferences, the pervasive influence of e-commerce, and the impact of economic volatility to deliver a well-rounded understanding of the market's trajectory.

Dominant Regions, Countries, or Segments in Department Stores Market

This section identifies the vanguard regions, countries, and segments propelling the growth of the Department Stores market. Our analysis encompasses a detailed evaluation of market share and growth potential by geography, meticulously considering economic policies, consumer spending habits, and the state of infrastructure development. The preeminence of specific areas or categories is assessed through a multidimensional lens, offering a refined perspective on the market's current and future landscape. North America is forecasted to command the largest market share in 2025, estimated at xx%, largely propelled by a robust ecosystem of established retailers and high levels of consumer expenditure. We further dissect the principal growth drivers for each distinct region, supported by empirical data and insightful commentary.

- North America: Continues its leadership due to robust consumer spending power and a mature, well-established retail infrastructure that supports innovation and customer engagement.

- Europe: Navigates a dynamic market influenced by economic uncertainties and the continuous adaptation to evolving consumer tastes and digital shopping trends.

- Asia-Pacific: Exhibits significant growth potential, fueled by accelerating economic development, a burgeoning middle class, and a notable increase in disposable incomes, driving demand for diverse retail offerings.

Department Stores Market Product Landscape

This section offers a focused overview of the product spectrum within the Department Stores market, highlighting innovations, their diverse applications, and key performance indicators. We detail the distinct value propositions of various product categories and underscore recent technological advancements that have redefined the market's contours. This includes an in-depth exploration of how department stores are proactively responding to the ever-shifting demands of consumers and integrating cutting-edge technologies to elevate the overall shopping experience, fostering greater customer loyalty and satisfaction.

Key Drivers, Barriers & Challenges in Department Stores Market

This section meticulously identifies the core catalysts accelerating market expansion and the significant hurdles impeding its progress.

Key Drivers:

- Sustained growth in consumer spending, indicating a healthy demand for retail goods and services.

- Strategic integration of technological advancements in e-commerce platforms and the development of seamless omnichannel retailing strategies.

- The ongoing expansion of modern retail infrastructure, particularly in emerging economies, opening new avenues for market penetration.

Challenges & Restraints:

- Intensified competition from online retailers, which is estimated to impact sales by an average of xx% annually, necessitating a strategic response.

- Escalating operating costs, including labor and real estate, coupled with persistent supply chain disruptions that affect product availability and pricing.

- The imperative to adapt to rapidly changing consumer preferences and the evolving landscape of shopping behaviors, demanding agility and innovation.

Emerging Opportunities in Department Stores Market

This section spotlights emerging trends and opportunities in the Department Stores market, focusing on untapped markets, innovative applications, and evolving consumer preferences. The potential for growth in niche segments, personalized shopping experiences, and the integration of sustainable practices within department store operations are considered. Opportunities in emerging markets represent a growth potential of xx% by 2033.

Growth Accelerators in the Department Stores Market Industry

This section critically examines the pivotal factors that are poised to propel long-term growth within the Department Stores market. Our analysis centers on disruptive technological breakthroughs, the formation of strategic alliances and partnerships, and the execution of forward-thinking market expansion strategies. The successful implementation of integrated omnichannel approaches and substantial investments aimed at enhancing the customer experience are identified as paramount growth drivers, setting the stage for sustained success and market leadership.

Key Players Shaping the Department Stores Market Market

- Marks and Spencer Group Plc

- Macy's Inc

- Sears Holdings Corp

- Target Corporation

- Nordstrom Inc

- Walmart Inc

- Isetan Mitsukoshi Holdings Ltd

- Kohl's Corporation

- Chongqing Department Store Co Ltd

- Lotte Department Store (List Not Exhaustive)

Notable Milestones in Department Stores Market Sector

- February 2023: Macy's launches PATTERN Beauty, expanding its hair care portfolio and strengthening its brand image.

- January 2023: Marks and Spencer announces a significant investment in upgrading its stores, creating jobs and improving customer experience.

In-Depth Department Stores Market Market Outlook

The Department Stores market is poised for continued growth, driven by technological advancements, strategic partnerships, and expanding consumer bases in emerging markets. Opportunities exist for companies to innovate their offerings and enhance the customer experience. The market is projected to reach xx Million units by 2033, representing substantial growth potential for key players and new entrants alike.

Department Stores Market Segmentation

-

1. Product Type

- 1.1. Apparel and Accessories

- 1.2. FMCG

- 1.3. Hardline and Softline

Department Stores Market Segmentation By Geography

-

1. North America

- 1.1. U

-

2. Canada

- 2.1. Rest of North America

-

3. Europe

- 3.1. Germany

- 3.2. France

- 3.3. Italy

- 3.4. U

-

4. Spain

- 4.1. Rest of Europe

-

5. Asia Pacific

- 5.1. China

- 5.2. Japan

- 5.3. South Korea

- 5.4. India

- 5.5. Australia

- 5.6. Rest of Asia Pacific

-

6. Middle East and Africa

- 6.1. Saudi Arab

- 6.2. South Africa

- 6.3. UAE

- 6.4. Rest of Middle East and Africa

-

7. South America

- 7.1. Brazil

- 7.2. Mexico

- 7.3. Rest of South America

Department Stores Market Regional Market Share

Geographic Coverage of Department Stores Market

Department Stores Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.1% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increase in Retail E-Commerce Sales have the Negative Impact on Department Stores Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Apparel and Accessories

- 5.1.2. FMCG

- 5.1.3. Hardline and Softline

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. North America

- 5.2.2. Canada

- 5.2.3. Europe

- 5.2.4. Spain

- 5.2.5. Asia Pacific

- 5.2.6. Middle East and Africa

- 5.2.7. South America

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Apparel and Accessories

- 6.1.2. FMCG

- 6.1.3. Hardline and Softline

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Canada Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Apparel and Accessories

- 7.1.2. FMCG

- 7.1.3. Hardline and Softline

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Apparel and Accessories

- 8.1.2. FMCG

- 8.1.3. Hardline and Softline

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Spain Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Apparel and Accessories

- 9.1.2. FMCG

- 9.1.3. Hardline and Softline

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Apparel and Accessories

- 10.1.2. FMCG

- 10.1.3. Hardline and Softline

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Middle East and Africa Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 11.1.1. Apparel and Accessories

- 11.1.2. FMCG

- 11.1.3. Hardline and Softline

- 11.1. Market Analysis, Insights and Forecast - by Product Type

- 12. South America Department Stores Market Analysis, Insights and Forecast, 2020-2032

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 12.1.1. Apparel and Accessories

- 12.1.2. FMCG

- 12.1.3. Hardline and Softline

- 12.1. Market Analysis, Insights and Forecast - by Product Type

- 13. Competitive Analysis

- 13.1. Global Market Share Analysis 2025

- 13.2. Company Profiles

- 13.2.1 Marks and Spencer Group Plc

- 13.2.1.1. Overview

- 13.2.1.2. Products

- 13.2.1.3. SWOT Analysis

- 13.2.1.4. Recent Developments

- 13.2.1.5. Financials (Based on Availability)

- 13.2.2 Macy's Inc

- 13.2.2.1. Overview

- 13.2.2.2. Products

- 13.2.2.3. SWOT Analysis

- 13.2.2.4. Recent Developments

- 13.2.2.5. Financials (Based on Availability)

- 13.2.3 Sears Holdings Corp

- 13.2.3.1. Overview

- 13.2.3.2. Products

- 13.2.3.3. SWOT Analysis

- 13.2.3.4. Recent Developments

- 13.2.3.5. Financials (Based on Availability)

- 13.2.4 Target Corporation

- 13.2.4.1. Overview

- 13.2.4.2. Products

- 13.2.4.3. SWOT Analysis

- 13.2.4.4. Recent Developments

- 13.2.4.5. Financials (Based on Availability)

- 13.2.5 Nordstrom Inc

- 13.2.5.1. Overview

- 13.2.5.2. Products

- 13.2.5.3. SWOT Analysis

- 13.2.5.4. Recent Developments

- 13.2.5.5. Financials (Based on Availability)

- 13.2.6 Walmart Inc

- 13.2.6.1. Overview

- 13.2.6.2. Products

- 13.2.6.3. SWOT Analysis

- 13.2.6.4. Recent Developments

- 13.2.6.5. Financials (Based on Availability)

- 13.2.7 Isetan Mitsukoshi Holdings Ltd

- 13.2.7.1. Overview

- 13.2.7.2. Products

- 13.2.7.3. SWOT Analysis

- 13.2.7.4. Recent Developments

- 13.2.7.5. Financials (Based on Availability)

- 13.2.8 Kohl's Corporation

- 13.2.8.1. Overview

- 13.2.8.2. Products

- 13.2.8.3. SWOT Analysis

- 13.2.8.4. Recent Developments

- 13.2.8.5. Financials (Based on Availability)

- 13.2.9 Chongqing Department Store Co Ltd

- 13.2.9.1. Overview

- 13.2.9.2. Products

- 13.2.9.3. SWOT Analysis

- 13.2.9.4. Recent Developments

- 13.2.9.5. Financials (Based on Availability)

- 13.2.10 Lotte Department Store**List Not Exhaustive

- 13.2.10.1. Overview

- 13.2.10.2. Products

- 13.2.10.3. SWOT Analysis

- 13.2.10.4. Recent Developments

- 13.2.10.5. Financials (Based on Availability)

- 13.2.1 Marks and Spencer Group Plc

List of Figures

- Figure 1: Global Department Stores Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 3: North America Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 5: North America Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 6: Canada Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 7: Canada Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 8: Canada Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: Canada Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 11: Europe Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Europe Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 13: Europe Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Spain Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 15: Spain Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Spain Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Spain Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 19: Asia Pacific Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Asia Pacific Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 21: Asia Pacific Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 22: Middle East and Africa Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 23: Middle East and Africa Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 24: Middle East and Africa Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Middle East and Africa Department Stores Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Department Stores Market Revenue (undefined), by Product Type 2025 & 2033

- Figure 27: South America Department Stores Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: South America Department Stores Market Revenue (undefined), by Country 2025 & 2033

- Figure 29: South America Department Stores Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 2: Global Department Stores Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 3: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 4: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 5: U Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 6: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 7: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 8: Rest of North America Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 9: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 10: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: Germany Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: France Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: Italy Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: U Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: Rest of Europe Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 19: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: China Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Japan Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: South Korea Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: India Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Australia Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Rest of Asia Pacific Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 27: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 28: Saudi Arab Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: South Africa Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: UAE Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 31: Rest of Middle East and Africa Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Global Department Stores Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 33: Global Department Stores Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 34: Brazil Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Mexico Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of South America Department Stores Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Department Stores Market?

The projected CAGR is approximately 5.1%.

2. Which companies are prominent players in the Department Stores Market?

Key companies in the market include Marks and Spencer Group Plc, Macy's Inc, Sears Holdings Corp, Target Corporation, Nordstrom Inc, Walmart Inc, Isetan Mitsukoshi Holdings Ltd, Kohl's Corporation, Chongqing Department Store Co Ltd, Lotte Department Store**List Not Exhaustive.

3. What are the main segments of the Department Stores Market?

The market segments include Product Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increase in Retail E-Commerce Sales have the Negative Impact on Department Stores Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Macy's launches PATTERN Beauty with the brand's extensive assortment of washes, treatments, styling tools, and more. As the brand's first-ever department store partner, PATTERN expands Macy's portfolio of hair care products, specifically in the curl category.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Department Stores Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Department Stores Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Department Stores Market?

To stay informed about further developments, trends, and reports in the Department Stores Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence