Key Insights

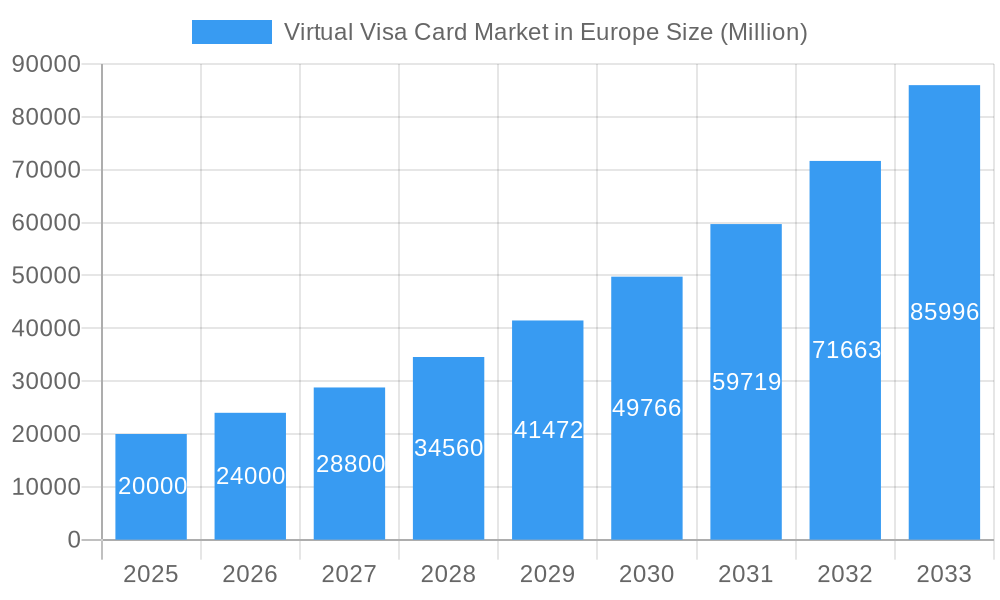

The European Virtual Visa Card Market is poised for remarkable expansion, projected to reach a substantial size of approximately USD 20,000 million by 2025, with an impressive Compound Annual Growth Rate (CAGR) of 20.00% through 2033. This robust growth is propelled by several key drivers. The increasing adoption of digital payment solutions across both businesses and consumers is a primary catalyst. Businesses are leveraging virtual cards for enhanced control, security, and efficiency in managing expenses, procurement, and employee reimbursements, particularly in the B2B virtual cards segment. Concurrently, the surge in e-commerce and online transactions fuels the demand for convenient and secure remote payment solutions for consumers, driving the B2C Remote Payments Virtual Cards segment. Emerging trends such as the integration of virtual cards with mobile wallets, the rise of account-to-account payments, and the increasing demand for personalized payment experiences further contribute to the market's upward trajectory.

Virtual Visa Card Market in Europe Market Size (In Billion)

The market’s dynamism is further shaped by evolving consumer and business behaviors, with a notable trend towards faster, more seamless payment experiences. Virtual Visa cards offer an inherent advantage in this regard, providing instant issuance and greater flexibility compared to traditional physical cards. While the market exhibits strong growth, certain restraints may influence its pace. These include evolving regulatory landscapes, the need for robust cybersecurity measures to combat fraud, and the potential for consumer and business inertia in adopting new financial technologies. However, the inherent benefits of enhanced security, cost-effectiveness, and improved transaction management offered by virtual cards are expected to outweigh these challenges, solidifying their position as a critical component of the European digital payment ecosystem. The market is segmented into B2B Virtual Cards and B2C Virtual Cards (including Remote Payments and POC Virtual Cards), catering to both consumer and business use cases, indicating a broad spectrum of applications.

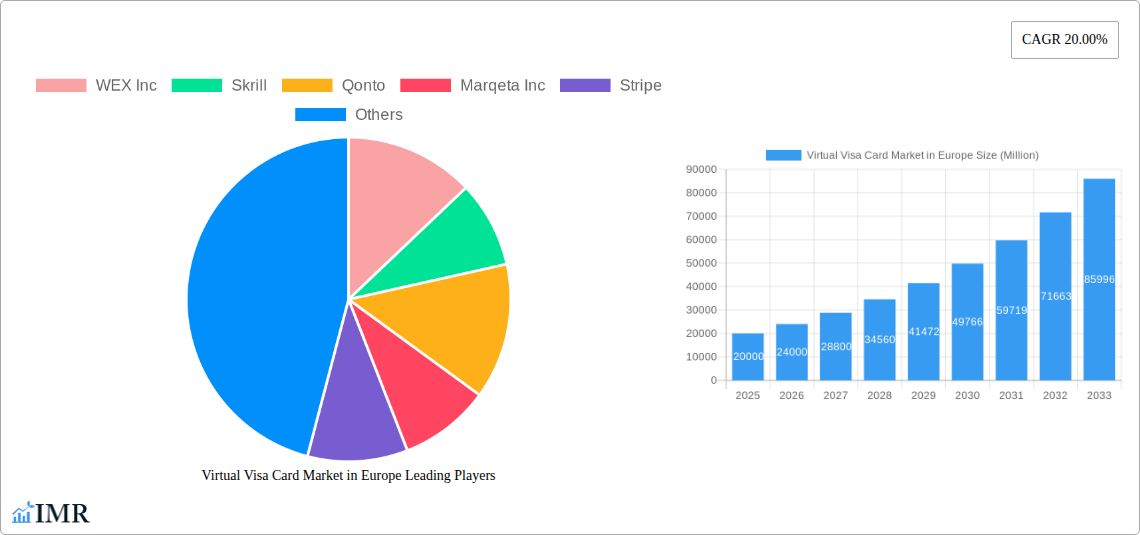

Virtual Visa Card Market in Europe Company Market Share

This in-depth report provides an exhaustive analysis of the Europe Virtual Visa Card Market, meticulously examining its dynamics, growth trajectories, and future outlook. With a focus on virtual card payments, digital payment solutions, and fintech innovation, this report is an essential resource for industry stakeholders seeking to capitalize on the burgeoning European digital payments landscape. We delve into parent and child markets, offering a nuanced understanding of market segmentation and key growth drivers. All values are presented in Million units to ensure consistent and comparable data.

Virtual Visa Card Market in Europe Market Dynamics & Structure

The Europe Virtual Visa Card Market is characterized by a moderate to high market concentration, with key players like Mastercard Inc., WEX Inc., and Stripe holding significant market shares. Technological innovation, driven by the demand for secure online payments and frictionless transactions, is a primary catalyst. Regulatory frameworks, including PSD2 and evolving data privacy laws, are shaping market entry and operational strategies. Competitive product substitutes, such as traditional credit/debit cards and alternative payment methods, are present but are increasingly being challenged by the convenience and security of virtual cards. End-user demographics are diverse, with both consumer spending and business expense management fueling adoption. Mergers and Acquisitions (M&A) are a notable trend, with companies consolidating to expand their reach and enhance their service offerings in the digital card solutions space.

- Market Concentration: Moderate to High, driven by established financial institutions and agile fintech players.

- Technological Innovation: Driven by demand for enhanced security, real-time transaction monitoring, and integration with existing financial platforms.

- Regulatory Frameworks: PSD2 compliance and evolving data protection laws are crucial for market participants.

- Competitive Landscape: Traditional payment methods, while prevalent, face increasing competition from specialized virtual card solutions.

- End-User Adoption: Strong growth in both consumer-centric and B2B applications for virtual payment cards.

- M&A Activity: Strategic acquisitions are aimed at expanding geographical presence and technological capabilities.

Virtual Visa Card Market in Europe Growth Trends & Insights

The Europe Virtual Visa Card Market is poised for substantial growth, driven by the accelerating shift towards digital transformation and the increasing preference for contactless payments. The market size is expected to witness a robust CAGR of XX% during the forecast period (2025–2033), reflecting a significant rise in adoption rates across various sectors. Technological disruptions, such as advancements in tokenization and AI-powered fraud detection, are enhancing the security and efficiency of virtual card transactions, making them an attractive alternative to physical cards. Consumer behavior is increasingly favoring online shopping and subscription services, where virtual cards offer enhanced control over spending and greater security against online fraud. The convenience of instant issuance and the ability to create single-use virtual cards for specific transactions are further propelling market penetration. The proliferation of e-commerce platforms and the growing adoption of cloud-based financial management tools by businesses are creating fertile ground for virtual card solutions. The market's evolution is a testament to its adaptability and its integral role in the modern financial ecosystem.

Dominant Regions, Countries, or Segments in Virtual Visa Card Market in Europe

The B2B Virtual Cards segment is emerging as a dominant force within the Europe Virtual Visa Card Market, driven by the increasing need for enhanced corporate expense management and procurement solutions. This segment benefits from strong economic policies that encourage digitalization of business processes and robust financial infrastructure across key European countries.

- B2B Virtual Cards:

- Key Drivers: Simplified expense tracking, improved budget control, fraud prevention for business transactions, efficient vendor payments, and integration with accounting software.

- Dominance Factors: Businesses are actively seeking ways to streamline payment processes and gain greater visibility into spending. The ability to issue multiple virtual cards with customizable spending limits and permissions for employees makes B2B virtual cards a highly attractive solution for companies of all sizes.

- Market Share: Projected to hold approximately XX% of the total market revenue by 2025.

- Growth Potential: Significant untapped potential in SMEs and across cross-border business transactions.

Consumer Use is also a significant growth driver, particularly within the B2C Remote Payments Virtual Cards sub-segment. This is fueled by the exponential growth of e-commerce and the increasing consumer demand for secure and convenient online purchasing options. Countries with high internet penetration and strong digital payment adoption rates, such as the UK, Germany, France, and the Nordic countries, are leading this charge.

- Consumer Use (B2C Remote Payments Virtual Cards):

- Key Drivers: Enhanced online security, protection against card skimming, ability to set spending limits for specific purchases or subscriptions, ease of use for online gambling and other age-restricted services.

- Dominance Factors: Growing consumer awareness of online security threats and a desire for greater control over personal finances. The ease of obtaining and using these cards for everyday online transactions is a major contributor to their popularity.

- Market Share: Expected to account for around XX% of the consumer segment by 2025.

- Growth Potential: Continued expansion with emerging online services and evolving consumer preferences.

Virtual Visa Card Market in Europe Product Landscape

The Europe Virtual Visa Card Market's product landscape is characterized by continuous innovation focused on enhancing security, user experience, and integration capabilities. Key product types include B2B Virtual Cards designed for corporate expense management, offering features like automated reconciliation and spending controls. B2C Remote Payments Virtual Cards cater to online purchases and subscription services, providing a secure alternative to sharing physical card details. B2C POC (Point of Contact) Virtual Cards, while less prevalent, offer specialized use cases. Leading companies are differentiating through features such as instant card issuance, customizable spending limits, real-time transaction alerts, and seamless integration with popular e-wallets and business management software. Performance metrics are evaluated based on transaction speed, security protocols, fraud rates, and customer satisfaction.

Key Drivers, Barriers & Challenges in Virtual Visa Card Market in Europe

Key Drivers:

- Increasing E-commerce Penetration: The surge in online shopping and digital transactions globally is a primary growth catalyst.

- Demand for Enhanced Security: Growing consumer and business concerns about online fraud and data breaches drive the adoption of secure virtual card solutions.

- Technological Advancements: Innovations in tokenization, AI-powered fraud detection, and API integrations simplify and secure virtual card usage.

- Convenience and Control: Instant issuance, customizable spending limits, and easy transaction management offer superior user experience.

- Regulatory Support for Digital Payments: Initiatives like PSD2 encourage the adoption of digital payment methods.

Key Barriers & Challenges:

- Customer Education and Awareness: A segment of the population still needs to be educated on the benefits and usage of virtual cards.

- Legacy System Integration: Integrating new virtual card solutions with existing, often outdated, financial systems can be complex and costly.

- Fraud and Security Risks: While inherently secure, virtual card platforms remain targets for sophisticated cyberattacks, requiring continuous vigilance.

- Interoperability Issues: Ensuring seamless functionality across different platforms and payment gateways can be a challenge.

- Merchant Acceptance: While growing, universal merchant acceptance for all types of virtual card transactions is still evolving.

- Regulatory Compliance Costs: Adhering to evolving financial regulations can incur significant compliance costs for providers.

Emerging Opportunities in Virtual Visa Card Market in Europe

Emerging opportunities in the Europe Virtual Visa Card Market lie in the expansion of virtual card solutions for the gig economy, enabling freelancers and contract workers to manage their income and expenses more efficiently. The integration of virtual cards with Buy Now, Pay Later (BNPL) services presents another promising avenue, offering consumers flexible payment options. Furthermore, the increasing adoption of IoT devices opens up possibilities for automated payments through virtual cards embedded in smart appliances and vehicles. Untapped markets in Eastern Europe also represent significant growth potential as digital payment infrastructure continues to develop. The development of specialized virtual cards for specific industries, such as travel or healthcare, will also cater to niche demands.

Growth Accelerators in the Virtual Visa Card Market in Europe Industry

Several catalysts are accelerating the growth of the Virtual Visa Card Market in Europe. Technological breakthroughs in areas like biometric authentication and decentralized finance (DeFi) integration will further enhance security and unlock new use cases. Strategic partnerships between fintech companies, established financial institutions, and e-commerce platforms are crucial for expanding market reach and customer acquisition. Initiatives by governments to promote digital financial inclusion and reduce reliance on cash are also significant growth accelerators. The continuous innovation in product features, such as enhanced loyalty programs and personalized offers, will drive increased adoption and usage.

Key Players Shaping the Virtual Visa Card Market in Europe Market

- WEX Inc.

- Skrill

- Qonto

- Marqeta Inc.

- Stripe

- Mastercard Inc.

- MineralTree

- Klarna

- Bunq

- Aion bank

- Monese Mastercard

- Revolut

- Wirecard

Notable Milestones in Virtual Visa Card Market in Europe Sector

- September 2023: Lloyds Bank launched a new virtual card for its businesses in partnership with Visa. This service offers enhanced control and tracking of spending, simplifying payment processes for Lloyds customers. Visa Commercial Pay, a virtual payment solution, aids businesses in streamlining secure and controlled payments.

- September 2023: Wallester, a virtual card solutions provider, partnered with Transferra, a European fintech provider. This collaboration aims to expand Wallester's virtual card business in Europe and bolster transaction security.

In-Depth Virtual Visa Card Market in Europe Market Outlook

The future outlook for the Europe Virtual Visa Card Market is exceptionally positive, fueled by the ongoing digital revolution and evolving consumer expectations. Growth accelerators will continue to be driven by innovations in secure digital payment infrastructure, the increasing demand for personalized financial solutions, and strategic collaborations between key industry players. The market is expected to witness significant expansion as more businesses and consumers embrace the convenience, security, and efficiency offered by virtual card technology. Strategic opportunities lie in leveraging emerging technologies to create more intelligent and integrated payment experiences, catering to diverse user needs and solidifying the position of virtual cards as a cornerstone of modern financial transactions.

Virtual Visa Card Market in Europe Segmentation

-

1. Product type

- 1.1. B2B Virtual cards

- 1.2. B2C Remote Payments Virtual Cards

- 1.3. B2C POC Virtual Cards

-

2. End-user

- 2.1. Consumer use

- 2.2. Business use

Virtual Visa Card Market in Europe Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

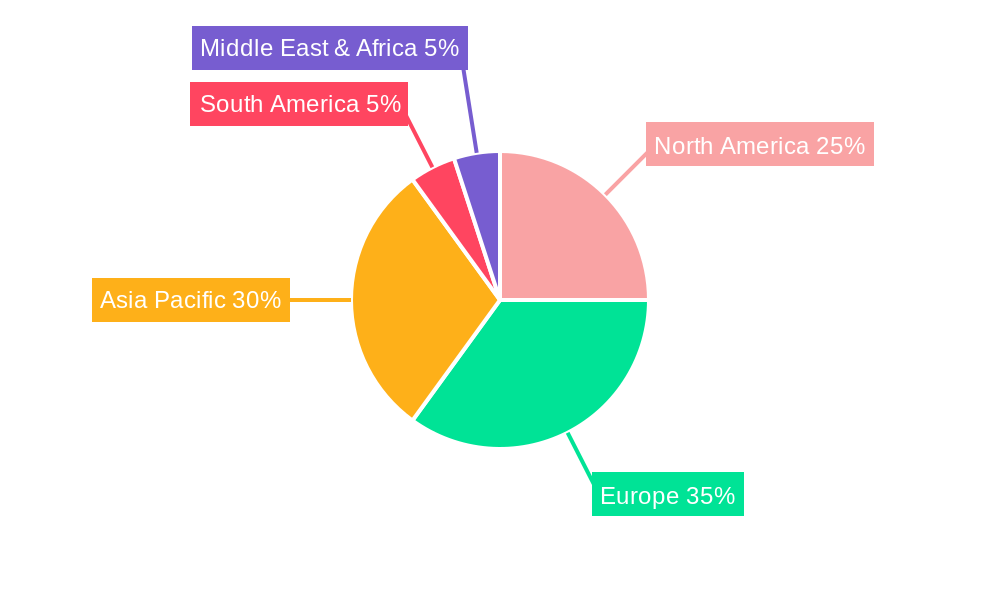

Virtual Visa Card Market in Europe Regional Market Share

Geographic Coverage of Virtual Visa Card Market in Europe

Virtual Visa Card Market in Europe REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 20.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising in Adoption of Digital Payment Method; Increase in Adoption of Virtual Card Payments by E-Commerce Business

- 3.3. Market Restrains

- 3.3.1. Rising in Adoption of Digital Payment Method; Increase in Adoption of Virtual Card Payments by E-Commerce Business

- 3.4. Market Trends

- 3.4.1. Rising Digital Payment

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Virtual Visa Card Market in Europe Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 5.1.1. B2B Virtual cards

- 5.1.2. B2C Remote Payments Virtual Cards

- 5.1.3. B2C POC Virtual Cards

- 5.2. Market Analysis, Insights and Forecast - by End-user

- 5.2.1. Consumer use

- 5.2.2. Business use

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product type

- 6. North America Virtual Visa Card Market in Europe Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 6.1.1. B2B Virtual cards

- 6.1.2. B2C Remote Payments Virtual Cards

- 6.1.3. B2C POC Virtual Cards

- 6.2. Market Analysis, Insights and Forecast - by End-user

- 6.2.1. Consumer use

- 6.2.2. Business use

- 6.1. Market Analysis, Insights and Forecast - by Product type

- 7. South America Virtual Visa Card Market in Europe Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 7.1.1. B2B Virtual cards

- 7.1.2. B2C Remote Payments Virtual Cards

- 7.1.3. B2C POC Virtual Cards

- 7.2. Market Analysis, Insights and Forecast - by End-user

- 7.2.1. Consumer use

- 7.2.2. Business use

- 7.1. Market Analysis, Insights and Forecast - by Product type

- 8. Europe Virtual Visa Card Market in Europe Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 8.1.1. B2B Virtual cards

- 8.1.2. B2C Remote Payments Virtual Cards

- 8.1.3. B2C POC Virtual Cards

- 8.2. Market Analysis, Insights and Forecast - by End-user

- 8.2.1. Consumer use

- 8.2.2. Business use

- 8.1. Market Analysis, Insights and Forecast - by Product type

- 9. Middle East & Africa Virtual Visa Card Market in Europe Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 9.1.1. B2B Virtual cards

- 9.1.2. B2C Remote Payments Virtual Cards

- 9.1.3. B2C POC Virtual Cards

- 9.2. Market Analysis, Insights and Forecast - by End-user

- 9.2.1. Consumer use

- 9.2.2. Business use

- 9.1. Market Analysis, Insights and Forecast - by Product type

- 10. Asia Pacific Virtual Visa Card Market in Europe Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 10.1.1. B2B Virtual cards

- 10.1.2. B2C Remote Payments Virtual Cards

- 10.1.3. B2C POC Virtual Cards

- 10.2. Market Analysis, Insights and Forecast - by End-user

- 10.2.1. Consumer use

- 10.2.2. Business use

- 10.1. Market Analysis, Insights and Forecast - by Product type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 WEX Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Skrill

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Qonto

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Marqeta Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Stripe

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Master card Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 MineralTree

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Klarna

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Bunq

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Aion bank

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Monese Mastercard

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Revolut

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Wirecard**List Not Exhaustive

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 WEX Inc

List of Figures

- Figure 1: Global Virtual Visa Card Market in Europe Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Virtual Visa Card Market in Europe Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Virtual Visa Card Market in Europe Revenue (Million), by Product type 2025 & 2033

- Figure 4: North America Virtual Visa Card Market in Europe Volume (Billion), by Product type 2025 & 2033

- Figure 5: North America Virtual Visa Card Market in Europe Revenue Share (%), by Product type 2025 & 2033

- Figure 6: North America Virtual Visa Card Market in Europe Volume Share (%), by Product type 2025 & 2033

- Figure 7: North America Virtual Visa Card Market in Europe Revenue (Million), by End-user 2025 & 2033

- Figure 8: North America Virtual Visa Card Market in Europe Volume (Billion), by End-user 2025 & 2033

- Figure 9: North America Virtual Visa Card Market in Europe Revenue Share (%), by End-user 2025 & 2033

- Figure 10: North America Virtual Visa Card Market in Europe Volume Share (%), by End-user 2025 & 2033

- Figure 11: North America Virtual Visa Card Market in Europe Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Virtual Visa Card Market in Europe Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Virtual Visa Card Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Virtual Visa Card Market in Europe Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Virtual Visa Card Market in Europe Revenue (Million), by Product type 2025 & 2033

- Figure 16: South America Virtual Visa Card Market in Europe Volume (Billion), by Product type 2025 & 2033

- Figure 17: South America Virtual Visa Card Market in Europe Revenue Share (%), by Product type 2025 & 2033

- Figure 18: South America Virtual Visa Card Market in Europe Volume Share (%), by Product type 2025 & 2033

- Figure 19: South America Virtual Visa Card Market in Europe Revenue (Million), by End-user 2025 & 2033

- Figure 20: South America Virtual Visa Card Market in Europe Volume (Billion), by End-user 2025 & 2033

- Figure 21: South America Virtual Visa Card Market in Europe Revenue Share (%), by End-user 2025 & 2033

- Figure 22: South America Virtual Visa Card Market in Europe Volume Share (%), by End-user 2025 & 2033

- Figure 23: South America Virtual Visa Card Market in Europe Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Virtual Visa Card Market in Europe Volume (Billion), by Country 2025 & 2033

- Figure 25: South America Virtual Visa Card Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Virtual Visa Card Market in Europe Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Virtual Visa Card Market in Europe Revenue (Million), by Product type 2025 & 2033

- Figure 28: Europe Virtual Visa Card Market in Europe Volume (Billion), by Product type 2025 & 2033

- Figure 29: Europe Virtual Visa Card Market in Europe Revenue Share (%), by Product type 2025 & 2033

- Figure 30: Europe Virtual Visa Card Market in Europe Volume Share (%), by Product type 2025 & 2033

- Figure 31: Europe Virtual Visa Card Market in Europe Revenue (Million), by End-user 2025 & 2033

- Figure 32: Europe Virtual Visa Card Market in Europe Volume (Billion), by End-user 2025 & 2033

- Figure 33: Europe Virtual Visa Card Market in Europe Revenue Share (%), by End-user 2025 & 2033

- Figure 34: Europe Virtual Visa Card Market in Europe Volume Share (%), by End-user 2025 & 2033

- Figure 35: Europe Virtual Visa Card Market in Europe Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Virtual Visa Card Market in Europe Volume (Billion), by Country 2025 & 2033

- Figure 37: Europe Virtual Visa Card Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Virtual Visa Card Market in Europe Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Virtual Visa Card Market in Europe Revenue (Million), by Product type 2025 & 2033

- Figure 40: Middle East & Africa Virtual Visa Card Market in Europe Volume (Billion), by Product type 2025 & 2033

- Figure 41: Middle East & Africa Virtual Visa Card Market in Europe Revenue Share (%), by Product type 2025 & 2033

- Figure 42: Middle East & Africa Virtual Visa Card Market in Europe Volume Share (%), by Product type 2025 & 2033

- Figure 43: Middle East & Africa Virtual Visa Card Market in Europe Revenue (Million), by End-user 2025 & 2033

- Figure 44: Middle East & Africa Virtual Visa Card Market in Europe Volume (Billion), by End-user 2025 & 2033

- Figure 45: Middle East & Africa Virtual Visa Card Market in Europe Revenue Share (%), by End-user 2025 & 2033

- Figure 46: Middle East & Africa Virtual Visa Card Market in Europe Volume Share (%), by End-user 2025 & 2033

- Figure 47: Middle East & Africa Virtual Visa Card Market in Europe Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Virtual Visa Card Market in Europe Volume (Billion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Virtual Visa Card Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Virtual Visa Card Market in Europe Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Virtual Visa Card Market in Europe Revenue (Million), by Product type 2025 & 2033

- Figure 52: Asia Pacific Virtual Visa Card Market in Europe Volume (Billion), by Product type 2025 & 2033

- Figure 53: Asia Pacific Virtual Visa Card Market in Europe Revenue Share (%), by Product type 2025 & 2033

- Figure 54: Asia Pacific Virtual Visa Card Market in Europe Volume Share (%), by Product type 2025 & 2033

- Figure 55: Asia Pacific Virtual Visa Card Market in Europe Revenue (Million), by End-user 2025 & 2033

- Figure 56: Asia Pacific Virtual Visa Card Market in Europe Volume (Billion), by End-user 2025 & 2033

- Figure 57: Asia Pacific Virtual Visa Card Market in Europe Revenue Share (%), by End-user 2025 & 2033

- Figure 58: Asia Pacific Virtual Visa Card Market in Europe Volume Share (%), by End-user 2025 & 2033

- Figure 59: Asia Pacific Virtual Visa Card Market in Europe Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Virtual Visa Card Market in Europe Volume (Billion), by Country 2025 & 2033

- Figure 61: Asia Pacific Virtual Visa Card Market in Europe Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Virtual Visa Card Market in Europe Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Product type 2020 & 2033

- Table 2: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Product type 2020 & 2033

- Table 3: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by End-user 2020 & 2033

- Table 4: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by End-user 2020 & 2033

- Table 5: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Product type 2020 & 2033

- Table 8: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Product type 2020 & 2033

- Table 9: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by End-user 2020 & 2033

- Table 10: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by End-user 2020 & 2033

- Table 11: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Product type 2020 & 2033

- Table 20: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Product type 2020 & 2033

- Table 21: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by End-user 2020 & 2033

- Table 22: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by End-user 2020 & 2033

- Table 23: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Country 2020 & 2033

- Table 25: Brazil Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Product type 2020 & 2033

- Table 32: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Product type 2020 & 2033

- Table 33: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by End-user 2020 & 2033

- Table 34: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by End-user 2020 & 2033

- Table 35: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Germany Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: France Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 43: Italy Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 45: Spain Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 47: Russia Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Product type 2020 & 2033

- Table 56: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Product type 2020 & 2033

- Table 57: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by End-user 2020 & 2033

- Table 58: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by End-user 2020 & 2033

- Table 59: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Country 2020 & 2033

- Table 61: Turkey Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 63: Israel Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: GCC Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 73: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Product type 2020 & 2033

- Table 74: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Product type 2020 & 2033

- Table 75: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by End-user 2020 & 2033

- Table 76: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by End-user 2020 & 2033

- Table 77: Global Virtual Visa Card Market in Europe Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Virtual Visa Card Market in Europe Volume Billion Forecast, by Country 2020 & 2033

- Table 79: China Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 81: India Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 83: Japan Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Virtual Visa Card Market in Europe Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Virtual Visa Card Market in Europe Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Virtual Visa Card Market in Europe?

The projected CAGR is approximately 20.00%.

2. Which companies are prominent players in the Virtual Visa Card Market in Europe?

Key companies in the market include WEX Inc, Skrill, Qonto, Marqeta Inc, Stripe, Master card Inc, MineralTree, Klarna, Bunq, Aion bank, Monese Mastercard, Revolut, Wirecard**List Not Exhaustive.

3. What are the main segments of the Virtual Visa Card Market in Europe?

The market segments include Product type, End-user.

4. Can you provide details about the market size?

The market size is estimated to be USD 51.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Rising in Adoption of Digital Payment Method; Increase in Adoption of Virtual Card Payments by E-Commerce Business.

6. What are the notable trends driving market growth?

Rising Digital Payment.

7. Are there any restraints impacting market growth?

Rising in Adoption of Digital Payment Method; Increase in Adoption of Virtual Card Payments by E-Commerce Business.

8. Can you provide examples of recent developments in the market?

In September 2023, Lloyds Bank launched a new virtual card for its businesses in partnership with Visa. The virtual card payment service will be available to Lloyds customers and is designed for users to control and track spending with the simplification of the payment process. Visa Commercial Pay exists as a virtual payment solution providing the technology to help businesses simplify and streamline their payments in a secure and controlled way.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Virtual Visa Card Market in Europe," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Virtual Visa Card Market in Europe report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Virtual Visa Card Market in Europe?

To stay informed about further developments, trends, and reports in the Virtual Visa Card Market in Europe, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence