Key Insights

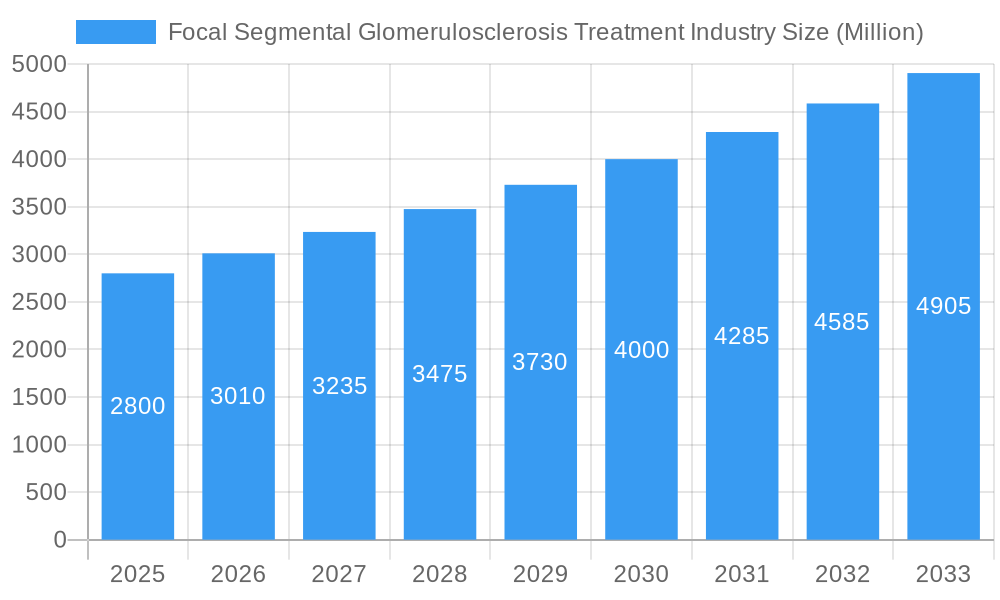

The Focal Segmental Glomerulosclerosis (FSGS) Treatment Market is poised for substantial growth, projected to reach a significant valuation by 2033, driven by an estimated CAGR of 7.50% from its base in 2025. This expansion is fueled by increasing prevalence of both primary and secondary FSGS, coupled with advancements in diagnostic tools and novel therapeutic strategies. The market's evolution is intrinsically linked to a deeper understanding of the disease's complex pathophysiology, leading to the development of targeted therapies beyond traditional immunosuppressants. Early and accurate diagnosis, facilitated by improved kidney biopsy techniques and advanced biomarker detection, plays a crucial role in initiating timely and effective treatment, thereby improving patient outcomes and contributing to market expansion. Furthermore, a growing awareness among healthcare professionals and patients regarding FSGS and its management options is a key enabler of this growth trajectory.

Focal Segmental Glomerulosclerosis Treatment Industry Market Size (In Billion)

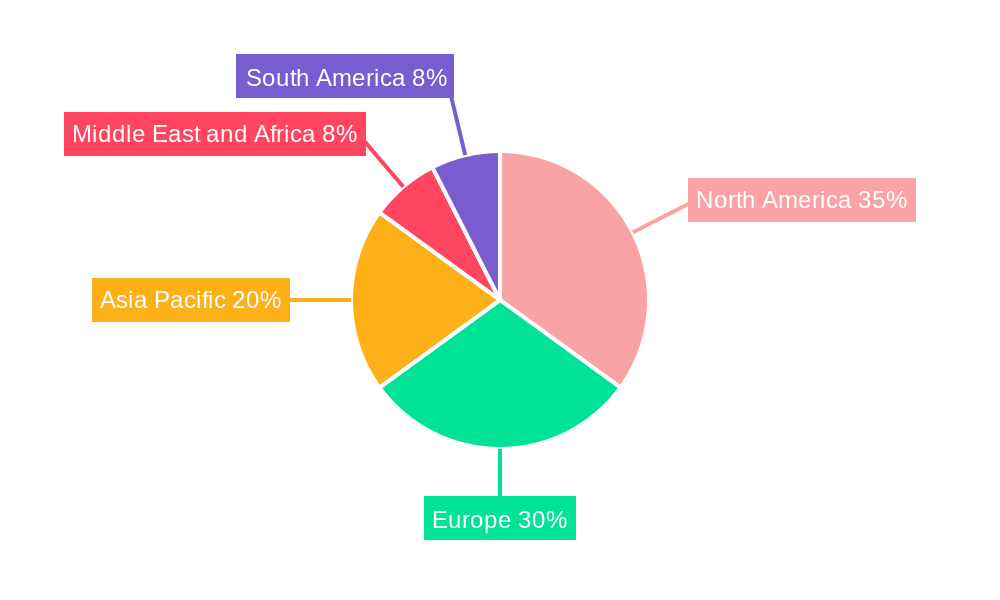

The market is characterized by a robust pipeline of innovative treatments and an increasing focus on personalized medicine approaches to manage FSGS. Drug therapy remains the cornerstone of treatment, with ongoing research into novel immunosuppressants, anti-fibrotic agents, and gene therapies aiming to address the underlying mechanisms of glomerular damage. While dialysis and kidney transplantation represent critical interventions for advanced stages of the disease, the emphasis is shifting towards slowing disease progression and reducing the need for these aggressive measures. Geographically, North America and Europe currently dominate the FSGS treatment landscape due to established healthcare infrastructure, high R&D investments, and strong patient advocacy. However, the Asia Pacific region is emerging as a significant growth avenue, driven by a growing patient pool, increasing healthcare expenditure, and improving access to advanced medical facilities. Key players are actively investing in research and development, strategic collaborations, and market expansion to capture a larger share of this dynamic and evolving market.

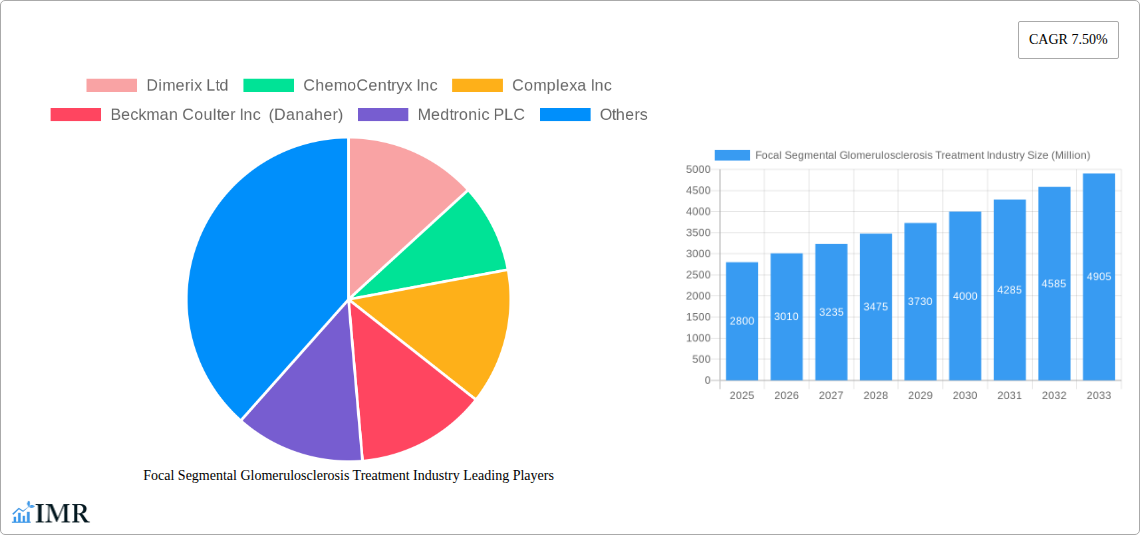

Focal Segmental Glomerulosclerosis Treatment Industry Company Market Share

This comprehensive report delves into the intricate landscape of the Focal Segmental Glomerulosclerosis (FSGS) treatment market, providing in-depth analysis of its dynamics, growth trajectory, and future potential. Covering a study period from 2019 to 2033, with a base year of 2025, this report offers critical insights for industry professionals, investors, and stakeholders navigating this specialized therapeutic area.

Focal Segmental Glomerulosclerosis Treatment Industry Market Dynamics & Structure

The Focal Segmental Glomerulosclerosis (FSGS) treatment market is characterized by a moderate to high degree of market concentration, with a few key pharmaceutical companies holding significant market share. Technological innovation serves as a primary driver, spurred by the unmet need for more effective and targeted therapies for this complex kidney disease. Regulatory frameworks, while evolving, play a crucial role in shaping market access and product development pathways, with stringent approval processes for novel treatments. Competitive product substitutes include advancements in supportive care and alternative therapies, though the focus remains on disease-modifying treatments. End-user demographics are primarily driven by the prevalence of primary FSGS and various forms of secondary FSGS, with patient populations often requiring long-term management and advanced care. Mergers and acquisitions (M&A) trends reflect a strategic push towards consolidating research and development pipelines, acquiring promising assets, and expanding market reach. For instance, recent collaborations highlight a growing trend in M&A and strategic partnerships within the rare disease space.

- Market Concentration: Dominated by a mix of large pharmaceutical players and specialized biotech firms.

- Technological Innovation: Driven by advancements in precision medicine, targeted drug delivery, and novel molecular targets.

- Regulatory Landscape: Influenced by FDA, EMA, and other regional health authorities, with a focus on accelerated pathways for orphan drugs.

- Competitive Substitutes: Include dialysis, kidney transplantation, and lifestyle management protocols.

- End-User Demographics: Encompasses pediatric and adult patients with diverse etiologies of FSGS.

- M&A Trends: Strategic acquisitions and licensing agreements to access innovative FSGS therapies, with approximately 3-5 significant deals anticipated annually within the parent and child market segments.

Focal Segmental Glomerulosclerosis Treatment Industry Growth Trends & Insights

The Focal Segmental Glomerulosclerosis (FSGS) treatment industry is poised for robust growth, projected to witness a compound annual growth rate (CAGR) of xx% during the forecast period of 2025–2033. This expansion is fueled by a growing understanding of FSGS pathogenesis, leading to the development of more targeted and effective therapeutic interventions. The increasing prevalence of FSGS, coupled with a rising diagnosis rate, contributes significantly to market expansion. Technological disruptions, particularly in the realm of precision medicine and gene therapy, are opening new avenues for treatment and are expected to drive adoption rates upward. Consumer behavior shifts are also playing a role, with patients and healthcare providers increasingly seeking personalized treatment plans and innovative therapies that offer improved outcomes and quality of life. The parent market for FSGS treatments is projected to reach a valuation of approximately $4,500 Million by 2025, with the child market, encompassing novel drug therapies, expanding at a faster pace. The market penetration of advanced treatment modalities is expected to rise from xx% in 2019 to an estimated xx% by 2033.

- Market Size Evolution: The global FSGS treatment market, valued at approximately $3,800 Million in 2019, is projected to reach over $5,200 Million by 2033.

- Adoption Rates: Increasing adoption of targeted therapies and biologics, moving away from purely symptomatic management.

- Technological Disruptions: Advancements in genetic sequencing and biomarker identification are enabling precision medicine approaches for FSGS.

- Consumer Behavior Shifts: Growing demand for disease-modifying treatments that can halt or reverse kidney damage, rather than just manage symptoms.

- Market Penetration: Significant growth expected in the penetration of novel drug therapies, moving from xx% in 2024 to an estimated xx% by 2033.

Dominant Regions, Countries, or Segments in Focal Segmental Glomerulosclerosis Treatment Industry

North America currently dominates the Focal Segmental Glomerulosclerosis (FSGS) treatment market, driven by a well-established healthcare infrastructure, high healthcare expenditure, and a proactive approach to rare disease research and development. The United States, in particular, accounts for a substantial share of this dominance due to robust clinical trial activity and a high prevalence of diagnosed FSGS cases. In terms of disease type, Primary FSGS, which accounts for a significant portion of FSGS diagnoses, is the leading segment driving market growth. This is attributed to the inherent complexity of understanding and treating idiopathic forms of the disease, necessitating advanced therapeutic interventions. Within disease management, Drug Therapy is the most dominant segment. The development of novel immunosuppressants, targeted biologics, and potentially gene-modifying therapies is propelling this segment forward. The market size for Drug Therapy in FSGS treatment is estimated to be around $2,500 Million in 2025, with significant contributions from the parent and child market segments.

- Dominant Region: North America, with the United States leading due to advanced research and high healthcare spending.

- Leading Disease Type Segment: Primary FSGS, representing the majority of diagnosed cases requiring specialized treatment.

- Dominant Disease Management Segment: Drug Therapy, driven by ongoing R&D in novel immunosuppressants and targeted biologics.

- Key Drivers in North America:

- Economic Policies: Favorable reimbursement policies for orphan drugs and advanced therapies.

- Infrastructure: Advanced research facilities and a high concentration of specialized nephrology centers.

- Regulatory Support: Expedited review pathways for promising FSGS treatments.

- Market Share in Dominant Segments (Estimated for 2025):

- North America: ~45% of the global market.

- Primary FSGS: ~60% of the total FSGS cases treated.

- Drug Therapy: ~65% of the total FSGS treatment market value.

- Growth Potential: Continued innovation in drug therapy and increased diagnosis rates in emerging economies are expected to drive future growth across all segments.

Focal Segmental Glomerulosclerosis Treatment Industry Product Landscape

The product landscape for Focal Segmental Glomerulosclerosis (FSGS) treatment is characterized by ongoing innovation aimed at addressing the underlying pathology of the disease. Current therapeutic offerings range from broad-spectrum immunosuppressants to more targeted biologics and novel drug candidates in clinical development. Key product innovations include the exploration of small molecule inhibitors targeting specific inflammatory pathways and protein interactions involved in podocyte damage. Performance metrics are increasingly focused on achieving remission, slowing disease progression, and preserving kidney function. Unique selling propositions for emerging treatments often lie in their mechanism of action, offering a more personalized approach to FSGS management compared to traditional broad immunosuppression. Technological advancements are enabling the development of drugs with improved efficacy and reduced side effect profiles, representing significant progress in the parent and child market segments.

Key Drivers, Barriers & Challenges in Focal Segmental Glomerulosclerosis Treatment Industry

Key Drivers: The Focal Segmental Glomerulosclerosis (FSGS) treatment market is propelled by several key drivers. Increased understanding of FSGS pathophysiology is a primary catalyst, enabling the development of more targeted therapies. Advancements in precision medicine and genetic research are unlocking new therapeutic avenues. Furthermore, a growing global prevalence and a higher rate of diagnosis contribute significantly to market expansion. Favorable regulatory pathways for orphan drugs and the increasing unmet medical need for effective treatments also act as significant growth accelerators.

Barriers & Challenges: Despite the promising outlook, the FSGS treatment market faces several barriers and challenges. The complex and heterogeneous nature of FSGS makes drug development challenging, leading to high attrition rates in clinical trials. High treatment costs for novel therapies can limit accessibility for patients. Regulatory hurdles and the need for extensive clinical validation of new drugs also pose significant challenges. Additionally, the limited availability of established biomarkers for treatment response and the reliance on kidney biopsy for definitive diagnosis can complicate patient management and treatment selection. Supply chain issues for specialized raw materials in drug manufacturing can also impact market dynamics, with estimated disruptions affecting production by 5-10% in certain periods.

Emerging Opportunities in Focal Segmental Glomerulosclerosis Treatment Industry

Emerging opportunities within the Focal Segmental Glomerulosclerosis (FSGS) treatment industry are centered on the development of next-generation therapies and innovative diagnostic tools. The growing focus on personalized medicine presents a significant avenue for growth, with opportunities in developing therapies tailored to specific genetic subtypes or molecular profiles of FSGS. Untapped markets in developing economies, where access to advanced FSGS treatments is currently limited, offer substantial growth potential. Furthermore, the exploration of regenerative medicine and cell-based therapies for kidney repair represents a long-term opportunity. Evolving consumer preferences are driving demand for treatments that offer not just remission but also long-term kidney health preservation, opening doors for novel combination therapies and supportive care innovations.

Growth Accelerators in the Focal Segmental Glomerulosclerosis Treatment Industry Industry

Catalysts driving long-term growth in the Focal Segmental Glomerulosclerosis (FSGS) treatment industry include significant technological breakthroughs, strategic partnerships, and expanding market access initiatives. The continuous advancement in understanding the genetic and molecular underpinnings of FSGS is paving the way for highly targeted and effective therapies, including gene therapies and novel small molecule drugs. Strategic collaborations between pharmaceutical companies, academic institutions, and patient advocacy groups are accelerating R&D pipelines and fostering a more collaborative ecosystem for addressing rare kidney diseases. Furthermore, market expansion strategies aimed at improving diagnostic rates and increasing access to advanced treatments in underserved regions are crucial growth accelerators. The continued investment in rare disease research by venture capital and private equity firms further fuels innovation and development within the parent and child market segments.

Key Players Shaping the Focal Segmental Glomerulosclerosis Treatment Industry Market

- Dimerix Ltd

- ChemoCentryx Inc

- Complexa Inc

- Beckman Coulter Inc (Danaher)

- Medtronic PLC

- Variant Pharmaceuticals Inc

- B Braun Melsungen AG

- Retrophin Inc

- Baxter International Inc

- Pfizer Inc

Notable Milestones in Focal Segmental Glomerulosclerosis Treatment Industry Sector

- February 2022: Goldfinch Bio announced positive preliminary data from a phase 2 clinical trial evaluating gfb-887 as a precision medicine for patients with focal segmental glomerulosclerosis (FSGS).

- September 2021: Vifor Pharma and Travere Therapeutics inked a collaboration and licensing partnership to commercialize sparsentan in Europe, Australia, and New Zealand. The drug is being made to treat FSGS and IgAN, which are both rare, progressive kidney diseases that lead to end-stage kidney disease more often than other diseases.

In-Depth Focal Segmental Glomerulosclerosis Treatment Industry Market Outlook

The future outlook for the Focal Segmental Glomerulosclerosis (FSGS) treatment market is exceptionally promising, driven by a convergence of scientific advancements and strategic market initiatives. The sustained growth will be fueled by the successful translation of promising preclinical and clinical-stage assets into approved therapies, particularly within the child market segments targeting specific FSGS subtypes. Strategic partnerships and potential mergers will continue to consolidate expertise and resources, accelerating the development and commercialization of novel treatments. Expansion into emerging markets, coupled with improved diagnostic capabilities and enhanced patient access programs, will further broaden the market's reach. The overarching trend towards personalized medicine and the development of disease-modifying therapies will define the future landscape, offering improved outcomes and a higher quality of life for FSGS patients globally.

Focal Segmental Glomerulosclerosis Treatment Industry Segmentation

-

1. Disease Type

- 1.1. Primary FSGS

- 1.2. Secondary FSGS

-

2. Disease Management

-

2.1. Diagnosis

- 2.1.1. Kidney Biopsy

- 2.1.2. Creatinine Test

- 2.1.3. Other Diagnoses

-

2.2. Treatment

- 2.2.1. Drug Therapy

- 2.2.2. Dialysis

- 2.2.3. Kidney Transplant

-

2.1. Diagnosis

Focal Segmental Glomerulosclerosis Treatment Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Italy

- 2.5. Spain

- 2.6. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. South Korea

- 3.6. Rest of Asia Pacific

-

4. Middle East and Africa

- 4.1. GCC

- 4.2. South Africa

- 4.3. Rest of Middle East and Africa

-

5. South America

- 5.1. Brazil

- 5.2. Argentina

- 5.3. Rest of South America

Focal Segmental Glomerulosclerosis Treatment Industry Regional Market Share

Geographic Coverage of Focal Segmental Glomerulosclerosis Treatment Industry

Focal Segmental Glomerulosclerosis Treatment Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Burden of Focal Segmental Glomerulosclerosis (FSGS); High Focus on Developing New Treatment Options4.2.3

- 3.3. Market Restrains

- 3.3.1. High Cost of Dialysis and Kidney Transplant

- 3.4. Market Trends

- 3.4.1. Primary FSGS Segment is Expected to Witness High Growth Over the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 5.1.1. Primary FSGS

- 5.1.2. Secondary FSGS

- 5.2. Market Analysis, Insights and Forecast - by Disease Management

- 5.2.1. Diagnosis

- 5.2.1.1. Kidney Biopsy

- 5.2.1.2. Creatinine Test

- 5.2.1.3. Other Diagnoses

- 5.2.2. Treatment

- 5.2.2.1. Drug Therapy

- 5.2.2.2. Dialysis

- 5.2.2.3. Kidney Transplant

- 5.2.1. Diagnosis

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. South America

- 5.1. Market Analysis, Insights and Forecast - by Disease Type

- 6. North America Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 6.1.1. Primary FSGS

- 6.1.2. Secondary FSGS

- 6.2. Market Analysis, Insights and Forecast - by Disease Management

- 6.2.1. Diagnosis

- 6.2.1.1. Kidney Biopsy

- 6.2.1.2. Creatinine Test

- 6.2.1.3. Other Diagnoses

- 6.2.2. Treatment

- 6.2.2.1. Drug Therapy

- 6.2.2.2. Dialysis

- 6.2.2.3. Kidney Transplant

- 6.2.1. Diagnosis

- 6.1. Market Analysis, Insights and Forecast - by Disease Type

- 7. Europe Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 7.1.1. Primary FSGS

- 7.1.2. Secondary FSGS

- 7.2. Market Analysis, Insights and Forecast - by Disease Management

- 7.2.1. Diagnosis

- 7.2.1.1. Kidney Biopsy

- 7.2.1.2. Creatinine Test

- 7.2.1.3. Other Diagnoses

- 7.2.2. Treatment

- 7.2.2.1. Drug Therapy

- 7.2.2.2. Dialysis

- 7.2.2.3. Kidney Transplant

- 7.2.1. Diagnosis

- 7.1. Market Analysis, Insights and Forecast - by Disease Type

- 8. Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 8.1.1. Primary FSGS

- 8.1.2. Secondary FSGS

- 8.2. Market Analysis, Insights and Forecast - by Disease Management

- 8.2.1. Diagnosis

- 8.2.1.1. Kidney Biopsy

- 8.2.1.2. Creatinine Test

- 8.2.1.3. Other Diagnoses

- 8.2.2. Treatment

- 8.2.2.1. Drug Therapy

- 8.2.2.2. Dialysis

- 8.2.2.3. Kidney Transplant

- 8.2.1. Diagnosis

- 8.1. Market Analysis, Insights and Forecast - by Disease Type

- 9. Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 9.1.1. Primary FSGS

- 9.1.2. Secondary FSGS

- 9.2. Market Analysis, Insights and Forecast - by Disease Management

- 9.2.1. Diagnosis

- 9.2.1.1. Kidney Biopsy

- 9.2.1.2. Creatinine Test

- 9.2.1.3. Other Diagnoses

- 9.2.2. Treatment

- 9.2.2.1. Drug Therapy

- 9.2.2.2. Dialysis

- 9.2.2.3. Kidney Transplant

- 9.2.1. Diagnosis

- 9.1. Market Analysis, Insights and Forecast - by Disease Type

- 10. South America Focal Segmental Glomerulosclerosis Treatment Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 10.1.1. Primary FSGS

- 10.1.2. Secondary FSGS

- 10.2. Market Analysis, Insights and Forecast - by Disease Management

- 10.2.1. Diagnosis

- 10.2.1.1. Kidney Biopsy

- 10.2.1.2. Creatinine Test

- 10.2.1.3. Other Diagnoses

- 10.2.2. Treatment

- 10.2.2.1. Drug Therapy

- 10.2.2.2. Dialysis

- 10.2.2.3. Kidney Transplant

- 10.2.1. Diagnosis

- 10.1. Market Analysis, Insights and Forecast - by Disease Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dimerix Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 ChemoCentryx Inc

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Complexa Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beckman Coulter Inc (Danaher)

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Medtronic PLC

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Variant Pharmaceuticals Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 B Braun Melsungen AG

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Retrophin Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Baxter International Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Pfizer Inc

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dimerix Ltd

List of Figures

- Figure 1: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume Breakdown (K Unit, %) by Region 2025 & 2033

- Figure 3: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 4: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 5: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 6: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 7: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 8: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 9: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 10: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 11: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 12: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 13: North America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 16: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 17: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 18: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 19: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 20: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 21: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 22: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 23: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 24: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 25: Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 28: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 29: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 30: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 31: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 32: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 33: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 34: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 35: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 36: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 37: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 40: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 41: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 42: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 43: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 44: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 45: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 46: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 47: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 48: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 49: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

- Figure 51: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Type 2025 & 2033

- Figure 52: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Type 2025 & 2033

- Figure 53: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Type 2025 & 2033

- Figure 54: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Type 2025 & 2033

- Figure 55: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Disease Management 2025 & 2033

- Figure 56: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Disease Management 2025 & 2033

- Figure 57: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Disease Management 2025 & 2033

- Figure 58: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Disease Management 2025 & 2033

- Figure 59: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined), by Country 2025 & 2033

- Figure 60: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit), by Country 2025 & 2033

- Figure 61: South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue Share (%), by Country 2025 & 2033

- Figure 62: South America Focal Segmental Glomerulosclerosis Treatment Industry Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 2: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 3: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 4: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 5: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 8: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 9: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 10: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 11: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 12: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 13: United States Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: United States Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 15: Canada Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Canada Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 17: Mexico Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Mexico Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 19: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 20: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 21: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 22: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 23: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 25: Germany Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Germany Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 27: United Kingdom Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: United Kingdom Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 29: France Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 30: France Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 31: Italy Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Italy Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 33: Spain Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Spain Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 35: Rest of Europe Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Rest of Europe Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 37: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 38: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 39: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 40: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 41: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 42: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 43: China Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 44: China Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 45: Japan Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 46: Japan Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 47: India Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: India Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 49: Australia Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: Australia Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 51: South Korea Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: South Korea Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 53: Rest of Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 54: Rest of Asia Pacific Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 55: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 56: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 57: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 58: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 59: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 60: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 61: GCC Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: GCC Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 63: South Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: South Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 65: Rest of Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 66: Rest of Middle East and Africa Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 67: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Type 2020 & 2033

- Table 68: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Type 2020 & 2033

- Table 69: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Disease Management 2020 & 2033

- Table 70: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Disease Management 2020 & 2033

- Table 71: Global Focal Segmental Glomerulosclerosis Treatment Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 72: Global Focal Segmental Glomerulosclerosis Treatment Industry Volume K Unit Forecast, by Country 2020 & 2033

- Table 73: Brazil Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 74: Brazil Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 75: Argentina Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 76: Argentina Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

- Table 77: Rest of South America Focal Segmental Glomerulosclerosis Treatment Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 78: Rest of South America Focal Segmental Glomerulosclerosis Treatment Industry Volume (K Unit) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Focal Segmental Glomerulosclerosis Treatment Industry?

The projected CAGR is approximately 5%.

2. Which companies are prominent players in the Focal Segmental Glomerulosclerosis Treatment Industry?

Key companies in the market include Dimerix Ltd, ChemoCentryx Inc, Complexa Inc, Beckman Coulter Inc (Danaher), Medtronic PLC, Variant Pharmaceuticals Inc , B Braun Melsungen AG, Retrophin Inc, Baxter International Inc, Pfizer Inc.

3. What are the main segments of the Focal Segmental Glomerulosclerosis Treatment Industry?

The market segments include Disease Type, Disease Management.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Burden of Focal Segmental Glomerulosclerosis (FSGS); High Focus on Developing New Treatment Options4.2.3.

6. What are the notable trends driving market growth?

Primary FSGS Segment is Expected to Witness High Growth Over the Forecast Period.

7. Are there any restraints impacting market growth?

High Cost of Dialysis and Kidney Transplant.

8. Can you provide examples of recent developments in the market?

February 2022: Goldfinch Bio announced positive preliminary data from a phase 2 clinical trial evaluating gfb-887 as a precision medicine for patients with focal segmental glomerulosclerosis (FSGS).

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Focal Segmental Glomerulosclerosis Treatment Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Focal Segmental Glomerulosclerosis Treatment Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Focal Segmental Glomerulosclerosis Treatment Industry?

To stay informed about further developments, trends, and reports in the Focal Segmental Glomerulosclerosis Treatment Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence