Key Insights

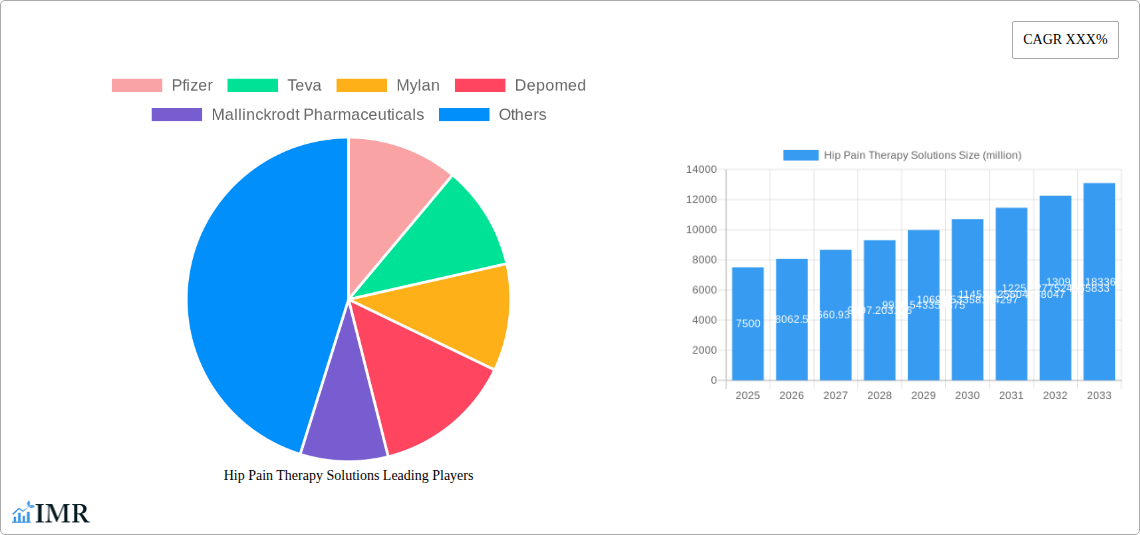

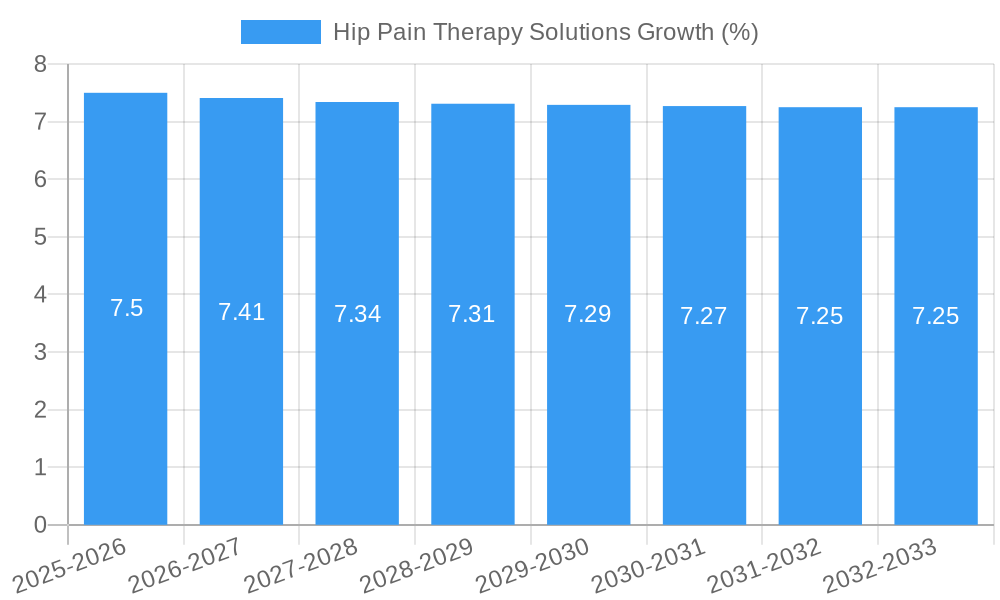

The Hip Pain Therapy Solutions market is poised for significant expansion, projected to reach an estimated $7,500 million by 2025, exhibiting a robust Compound Annual Growth Rate (CAGR) of approximately 7.5% through 2033. This growth is primarily propelled by the escalating prevalence of hip-related conditions, including osteoarthritis, fractures, and inflammatory disorders, often exacerbated by an aging global population and increasingly sedentary lifestyles. The rising demand for effective pain management and mobility restoration is a critical driver, pushing innovation in both physical and pharmacological therapeutic approaches. Hospitals and physiotherapy institutions represent the dominant application segments, reflecting the critical role of these settings in diagnosis, treatment, and rehabilitation. The increasing awareness of non-surgical treatment options and the continuous development of advanced therapeutic modalities are further fueling market traction.

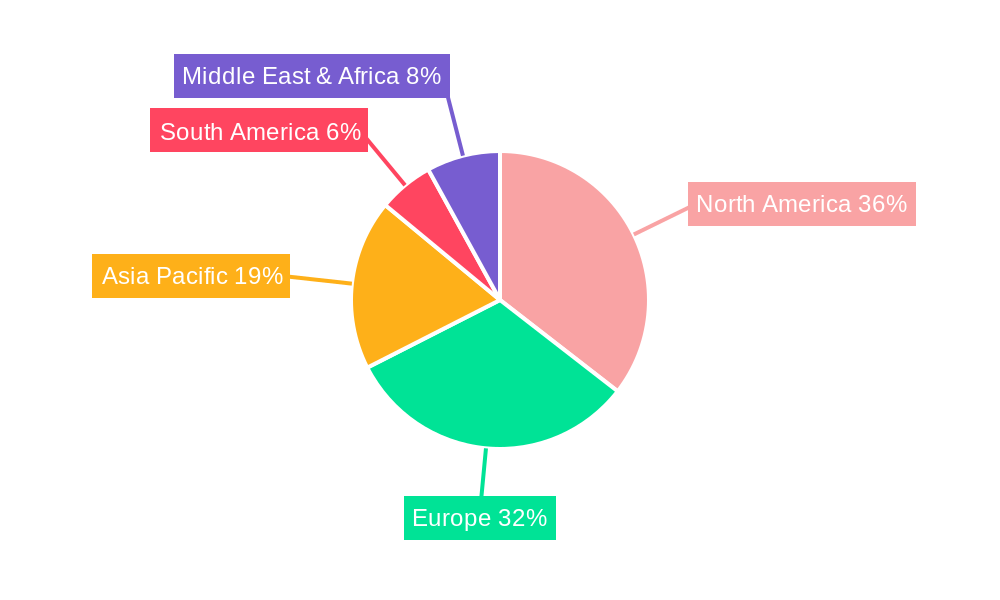

The market dynamics are characterized by a blend of innovation and strategic collaborations among key players such as Pfizer, Bayer, and Novartis. While medication therapy remains a cornerstone, the growing emphasis on holistic patient care and the long-term benefits of physical rehabilitation are driving the adoption of physical therapy solutions. Emerging trends include the integration of digital health technologies, such as remote patient monitoring and AI-driven personalized treatment plans, aiming to enhance patient outcomes and accessibility. However, challenges such as high treatment costs, reimbursement complexities, and the need for widespread patient education on available therapies can temper the market's full potential. Geographically, North America and Europe are anticipated to lead the market due to advanced healthcare infrastructure and a high incidence of hip disorders. Asia Pacific is expected to witness the fastest growth, driven by a burgeoning middle class, improving healthcare access, and increasing health consciousness.

This comprehensive report provides an in-depth analysis of the global Hip Pain Therapy Solutions market, covering historical trends, current dynamics, and future projections. It delves into market segmentation, regional dominance, key players, and emerging opportunities, offering valuable insights for industry professionals, investors, and stakeholders. The report spans the Study Period of 2019–2033, with a Base Year of 2025, and an Estimated Year also of 2025, followed by a Forecast Period from 2025–2033, encompassing the Historical Period of 2019–2024.

Hip Pain Therapy Solutions Market Dynamics & Structure

The global Hip Pain Therapy Solutions market exhibits a moderately concentrated structure, characterized by a blend of large, established pharmaceutical giants and agile, specialized medical device companies. Technological innovation is a primary driver, with advancements in minimally invasive surgical techniques, regenerative medicine, and targeted drug delivery systems constantly reshaping treatment paradigms. Regulatory frameworks, primarily governed by health authorities like the FDA and EMA, play a crucial role in product approval, safety standards, and market access, influencing the pace of innovation and market penetration. Competitive product substitutes are diverse, ranging from over-the-counter pain relievers and physical therapy modalities to surgical interventions, creating a complex competitive landscape. End-user demographics are shifting, with an aging global population experiencing a higher prevalence of hip conditions like osteoarthritis and fractures, driving sustained demand. Mergers and acquisitions (M&A) trends, though not at an extremely high volume, are observed as key players seek to expand their product portfolios and geographical reach. For instance, the past few years have seen a few strategic acquisitions focused on innovative biomaterials and digital health solutions for rehabilitation.

- Market Concentration: Moderately concentrated, with key players holding significant market shares.

- Technological Innovation Drivers: Minimally invasive surgery, regenerative medicine, drug delivery, digital health platforms.

- Regulatory Frameworks: FDA, EMA, and other national health agencies influence product approvals and market entry.

- Competitive Product Substitutes: Pharmaceuticals, physical therapy, surgical procedures, assistive devices.

- End-User Demographics: Aging population, individuals with chronic hip conditions, athletes.

- M&A Trends: Strategic acquisitions of innovative technologies and companies to expand portfolios and market presence.

Hip Pain Therapy Solutions Growth Trends & Insights

The global Hip Pain Therapy Solutions market is projected to experience robust growth, driven by a confluence of demographic shifts, technological advancements, and increasing healthcare expenditure. The market size is anticipated to evolve from an estimated USD 28,500 million in 2025 to over USD 45,000 million by 2033, demonstrating a Compound Annual Growth Rate (CAGR) of approximately 5.8% during the forecast period. Adoption rates for advanced therapies, particularly regenerative medicine and personalized treatment approaches, are on an upward trajectory. Technological disruptions, such as the integration of artificial intelligence in diagnostic tools and robotic-assisted surgery, are poised to revolutionize hip pain management by offering enhanced precision and improved patient outcomes. Consumer behavior is shifting towards less invasive and more holistic treatment options, with a growing preference for therapies that reduce recovery time and minimize side effects. This trend is fueling the demand for physical therapy solutions and innovative pharmacological interventions. Market penetration is expected to deepen as awareness of advanced treatment options increases and healthcare accessibility improves in emerging economies. The rising prevalence of age-related musculoskeletal disorders and sports-related injuries continues to be a foundational driver for market expansion. Furthermore, the increasing focus on quality of life and pain management among individuals is a significant catalyst for the adoption of advanced hip pain therapy solutions. The market's expansion is also supported by advancements in diagnostic imaging technologies that enable earlier and more accurate detection of hip conditions, leading to prompt intervention.

Dominant Regions, Countries, or Segments in Hip Pain Therapy Solutions

North America is identified as the dominant region in the Hip Pain Therapy Solutions market, driven by a combination of high healthcare spending, advanced technological infrastructure, and a large aging population experiencing a high incidence of hip-related ailments. The United States, in particular, stands out due to its well-established healthcare system, significant research and development investments, and a robust presence of leading pharmaceutical and medical device companies. The application segment of Hospitals is a primary driver of growth within North America, accounting for an estimated 45% of the market share in 2025, owing to the prevalence of complex surgical procedures and access to advanced treatment technologies. Physical Therapy Institutions also represent a substantial segment, contributing approximately 35% of the market value, reflecting the growing emphasis on non-pharmacological and rehabilitative approaches. Key economic policies, such as reimbursement structures that favor innovative treatments and government initiatives promoting geriatric care, further bolster the market's dominance.

- Dominant Region: North America, with the United States as a leading country.

- Leading Application Segment: Hospitals, driven by surgical interventions and advanced care.

- Key Application Segment: Physiotherapy Institutions, emphasizing rehabilitation and non-invasive methods.

- Growth Drivers: High healthcare expenditure, aging population, advanced technological adoption, robust R&D investment, favorable reimbursement policies.

- Market Share (2025 - Estimated): Hospitals (45%), Physiotherapy Institutions (35%), Other (20%).

- Growth Potential: Continued expansion driven by demographic trends and ongoing technological innovation in healthcare.

Hip Pain Therapy Solutions Product Landscape

The product landscape for Hip Pain Therapy Solutions is marked by continuous innovation aimed at improving efficacy, reducing invasiveness, and enhancing patient recovery. Key product categories include advanced analgesics with targeted delivery mechanisms, regenerative therapies like stem cell injections and platelet-rich plasma (PRP) treatments, and sophisticated orthopedic implants designed for enhanced durability and functionality. Furthermore, the market is seeing a rise in innovative physical therapy equipment and digital rehabilitation platforms that offer personalized exercise programs and real-time progress monitoring. These advancements are driven by a focus on addressing the root causes of hip pain, such as osteoarthritis, avascular necrosis, and fractures, with unique selling propositions emphasizing faster healing times, reduced side effects, and improved long-term joint health.

Key Drivers, Barriers & Challenges in Hip Pain Therapy Solutions

Key Drivers: The Hip Pain Therapy Solutions market is propelled by several key drivers. The escalating prevalence of age-related degenerative conditions like osteoarthritis and an increasing number of sports-related injuries are major contributors. Advancements in medical technology, including minimally invasive surgical techniques, regenerative medicine, and innovative pharmaceutical formulations, offer more effective and less burdensome treatment options. Growing healthcare expenditure globally, coupled with a rising awareness among patients about available treatment modalities and the importance of pain management for quality of life, further fuels market expansion.

Barriers & Challenges: Despite robust growth prospects, the market faces several challenges. High treatment costs, particularly for advanced therapies and novel implants, can limit accessibility for a significant portion of the population, especially in developing economies. Stringent regulatory approval processes for new drugs and medical devices can delay market entry and increase development costs. The availability of effective generic alternatives for some pain medications and the preference for conservative treatments among some patient groups can also pose a restraint. Furthermore, potential supply chain disruptions and the need for specialized training for healthcare professionals to administer complex therapies present operational hurdles.

Emerging Opportunities in Hip Pain Therapy Solutions

Emerging opportunities in the Hip Pain Therapy Solutions sector are centered on untapped markets and innovative applications. The growing demand for personalized medicine, leveraging genetic insights and patient-specific data to tailor treatment plans, presents a significant avenue for growth. The development and adoption of telemedicine and digital health solutions for remote patient monitoring and rehabilitation offer enhanced convenience and accessibility, particularly for individuals in remote areas or with mobility limitations. Furthermore, the exploration of novel drug targets and biologics for chronic hip pain management, beyond traditional pain relievers and anti-inflammatories, holds considerable potential. The increasing focus on preventive strategies and early intervention for hip conditions also opens up new markets for diagnostic tools and prophylactic therapies.

Growth Accelerators in the Hip Pain Therapy Solutions Industry

Long-term growth in the Hip Pain Therapy Solutions industry will be significantly accelerated by breakthroughs in regenerative medicine, such as advancements in stem cell therapy and tissue engineering for cartilage repair. Strategic partnerships between pharmaceutical companies, medical device manufacturers, and research institutions are crucial for fostering innovation and bringing novel treatments to market faster. Market expansion into emerging economies, driven by improving healthcare infrastructure and increasing disposable incomes, will unlock new patient populations. The integration of artificial intelligence and machine learning in diagnostics, treatment planning, and surgical robotics will lead to more precise and effective interventions, thereby accelerating adoption and improving patient outcomes.

Key Players Shaping the Hip Pain Therapy Solutions Market

- Pfizer

- Teva

- Mylan

- Depomed

- Mallinckrodt Pharmaceuticals

- Eli Lilly

- Bayer

- Novartis

- Sun Pharmaceutical

- Astrazeneca

- Lundbeck

- Arbor Pharma

Notable Milestones in Hip Pain Therapy Solutions Sector

- 2019: Launch of a new generation of bio-resorbable implants designed for faster patient recovery.

- 2020: FDA approval for a novel injectable biologic for the management of osteoarthritis pain.

- 2021: Major pharmaceutical company acquires a leading regenerative medicine startup focused on hip joint repair.

- 2022: Introduction of AI-powered diagnostic tools for early detection of hip pathologies.

- 2023: Significant investment in clinical trials for gene therapy targeting chronic hip pain.

- 2024: Expansion of robotic-assisted surgery programs for hip replacements in key global markets.

In-Depth Hip Pain Therapy Solutions Market Outlook

- 2019: Launch of a new generation of bio-resorbable implants designed for faster patient recovery.

- 2020: FDA approval for a novel injectable biologic for the management of osteoarthritis pain.

- 2021: Major pharmaceutical company acquires a leading regenerative medicine startup focused on hip joint repair.

- 2022: Introduction of AI-powered diagnostic tools for early detection of hip pathologies.

- 2023: Significant investment in clinical trials for gene therapy targeting chronic hip pain.

- 2024: Expansion of robotic-assisted surgery programs for hip replacements in key global markets.

In-Depth Hip Pain Therapy Solutions Market Outlook

The future outlook for the Hip Pain Therapy Solutions market is exceptionally promising, driven by a confluence of accelerating factors. Continued advancements in regenerative medicine and personalized treatment approaches are set to redefine the standard of care, moving beyond symptomatic relief to restorative therapies. The increasing integration of digital health technologies, including AI-powered diagnostics and telehealth rehabilitation platforms, will enhance accessibility and improve patient engagement. Strategic collaborations and a sustained focus on research and development will fuel the pipeline of innovative products and therapies. As global healthcare systems increasingly prioritize quality of life and proactive pain management, the demand for comprehensive hip pain solutions is expected to surge, creating substantial growth opportunities for market participants.

Hip Pain Therapy Solutions Segmentation

-

1. Application

- 1.1. Hospital

- 1.2. Physiotherapy Institution

- 1.3. Other

-

2. Type

- 2.1. Physical Therapy

- 2.2. Medication Therapy

Hip Pain Therapy Solutions Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Hip Pain Therapy Solutions REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of XXX% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Hip Pain Therapy Solutions Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Hospital

- 5.1.2. Physiotherapy Institution

- 5.1.3. Other

- 5.2. Market Analysis, Insights and Forecast - by Type

- 5.2.1. Physical Therapy

- 5.2.2. Medication Therapy

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. North America Hip Pain Therapy Solutions Analysis, Insights and Forecast, 2019-2031

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Hospital

- 6.1.2. Physiotherapy Institution

- 6.1.3. Other

- 6.2. Market Analysis, Insights and Forecast - by Type

- 6.2.1. Physical Therapy

- 6.2.2. Medication Therapy

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. South America Hip Pain Therapy Solutions Analysis, Insights and Forecast, 2019-2031

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Hospital

- 7.1.2. Physiotherapy Institution

- 7.1.3. Other

- 7.2. Market Analysis, Insights and Forecast - by Type

- 7.2.1. Physical Therapy

- 7.2.2. Medication Therapy

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Europe Hip Pain Therapy Solutions Analysis, Insights and Forecast, 2019-2031

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Hospital

- 8.1.2. Physiotherapy Institution

- 8.1.3. Other

- 8.2. Market Analysis, Insights and Forecast - by Type

- 8.2.1. Physical Therapy

- 8.2.2. Medication Therapy

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Middle East & Africa Hip Pain Therapy Solutions Analysis, Insights and Forecast, 2019-2031

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Hospital

- 9.1.2. Physiotherapy Institution

- 9.1.3. Other

- 9.2. Market Analysis, Insights and Forecast - by Type

- 9.2.1. Physical Therapy

- 9.2.2. Medication Therapy

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Asia Pacific Hip Pain Therapy Solutions Analysis, Insights and Forecast, 2019-2031

- 10.1. Market Analysis, Insights and Forecast - by Application

- 10.1.1. Hospital

- 10.1.2. Physiotherapy Institution

- 10.1.3. Other

- 10.2. Market Analysis, Insights and Forecast - by Type

- 10.2.1. Physical Therapy

- 10.2.2. Medication Therapy

- 10.1. Market Analysis, Insights and Forecast - by Application

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2024

- 11.2. Company Profiles

- 11.2.1 Pfizer

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Teva

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Mylan

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Depomed

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Mallinckrodt Pharmaceuticals

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Eli Lilly

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bayer

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Novartis

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Sun Pharmaceutical

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Astrazeneca

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Lundbeck

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Arbor Pharma

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Pfizer

List of Figures

- Figure 1: Global Hip Pain Therapy Solutions Revenue Breakdown (million, %) by Region 2024 & 2032

- Figure 2: North America Hip Pain Therapy Solutions Revenue (million), by Application 2024 & 2032

- Figure 3: North America Hip Pain Therapy Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 4: North America Hip Pain Therapy Solutions Revenue (million), by Type 2024 & 2032

- Figure 5: North America Hip Pain Therapy Solutions Revenue Share (%), by Type 2024 & 2032

- Figure 6: North America Hip Pain Therapy Solutions Revenue (million), by Country 2024 & 2032

- Figure 7: North America Hip Pain Therapy Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 8: South America Hip Pain Therapy Solutions Revenue (million), by Application 2024 & 2032

- Figure 9: South America Hip Pain Therapy Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 10: South America Hip Pain Therapy Solutions Revenue (million), by Type 2024 & 2032

- Figure 11: South America Hip Pain Therapy Solutions Revenue Share (%), by Type 2024 & 2032

- Figure 12: South America Hip Pain Therapy Solutions Revenue (million), by Country 2024 & 2032

- Figure 13: South America Hip Pain Therapy Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 14: Europe Hip Pain Therapy Solutions Revenue (million), by Application 2024 & 2032

- Figure 15: Europe Hip Pain Therapy Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 16: Europe Hip Pain Therapy Solutions Revenue (million), by Type 2024 & 2032

- Figure 17: Europe Hip Pain Therapy Solutions Revenue Share (%), by Type 2024 & 2032

- Figure 18: Europe Hip Pain Therapy Solutions Revenue (million), by Country 2024 & 2032

- Figure 19: Europe Hip Pain Therapy Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 20: Middle East & Africa Hip Pain Therapy Solutions Revenue (million), by Application 2024 & 2032

- Figure 21: Middle East & Africa Hip Pain Therapy Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 22: Middle East & Africa Hip Pain Therapy Solutions Revenue (million), by Type 2024 & 2032

- Figure 23: Middle East & Africa Hip Pain Therapy Solutions Revenue Share (%), by Type 2024 & 2032

- Figure 24: Middle East & Africa Hip Pain Therapy Solutions Revenue (million), by Country 2024 & 2032

- Figure 25: Middle East & Africa Hip Pain Therapy Solutions Revenue Share (%), by Country 2024 & 2032

- Figure 26: Asia Pacific Hip Pain Therapy Solutions Revenue (million), by Application 2024 & 2032

- Figure 27: Asia Pacific Hip Pain Therapy Solutions Revenue Share (%), by Application 2024 & 2032

- Figure 28: Asia Pacific Hip Pain Therapy Solutions Revenue (million), by Type 2024 & 2032

- Figure 29: Asia Pacific Hip Pain Therapy Solutions Revenue Share (%), by Type 2024 & 2032

- Figure 30: Asia Pacific Hip Pain Therapy Solutions Revenue (million), by Country 2024 & 2032

- Figure 31: Asia Pacific Hip Pain Therapy Solutions Revenue Share (%), by Country 2024 & 2032

List of Tables

- Table 1: Global Hip Pain Therapy Solutions Revenue million Forecast, by Region 2019 & 2032

- Table 2: Global Hip Pain Therapy Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 3: Global Hip Pain Therapy Solutions Revenue million Forecast, by Type 2019 & 2032

- Table 4: Global Hip Pain Therapy Solutions Revenue million Forecast, by Region 2019 & 2032

- Table 5: Global Hip Pain Therapy Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 6: Global Hip Pain Therapy Solutions Revenue million Forecast, by Type 2019 & 2032

- Table 7: Global Hip Pain Therapy Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 8: United States Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 9: Canada Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 10: Mexico Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 11: Global Hip Pain Therapy Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 12: Global Hip Pain Therapy Solutions Revenue million Forecast, by Type 2019 & 2032

- Table 13: Global Hip Pain Therapy Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 14: Brazil Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 15: Argentina Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 16: Rest of South America Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 17: Global Hip Pain Therapy Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 18: Global Hip Pain Therapy Solutions Revenue million Forecast, by Type 2019 & 2032

- Table 19: Global Hip Pain Therapy Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 20: United Kingdom Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 21: Germany Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 22: France Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 23: Italy Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 24: Spain Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 25: Russia Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 26: Benelux Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 27: Nordics Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 28: Rest of Europe Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 29: Global Hip Pain Therapy Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 30: Global Hip Pain Therapy Solutions Revenue million Forecast, by Type 2019 & 2032

- Table 31: Global Hip Pain Therapy Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 32: Turkey Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 33: Israel Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 34: GCC Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 35: North Africa Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 36: South Africa Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 37: Rest of Middle East & Africa Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 38: Global Hip Pain Therapy Solutions Revenue million Forecast, by Application 2019 & 2032

- Table 39: Global Hip Pain Therapy Solutions Revenue million Forecast, by Type 2019 & 2032

- Table 40: Global Hip Pain Therapy Solutions Revenue million Forecast, by Country 2019 & 2032

- Table 41: China Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 42: India Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 43: Japan Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 44: South Korea Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 45: ASEAN Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 46: Oceania Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

- Table 47: Rest of Asia Pacific Hip Pain Therapy Solutions Revenue (million) Forecast, by Application 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Hip Pain Therapy Solutions?

The projected CAGR is approximately XXX%.

2. Which companies are prominent players in the Hip Pain Therapy Solutions?

Key companies in the market include Pfizer, Teva, Mylan, Depomed, Mallinckrodt Pharmaceuticals, Eli Lilly, Bayer, Novartis, Sun Pharmaceutical, Astrazeneca, Lundbeck, Arbor Pharma.

3. What are the main segments of the Hip Pain Therapy Solutions?

The market segments include Application, Type.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

N/A

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 2900.00, USD 4350.00, and USD 5800.00 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Hip Pain Therapy Solutions," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Hip Pain Therapy Solutions report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Hip Pain Therapy Solutions?

To stay informed about further developments, trends, and reports in the Hip Pain Therapy Solutions, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence