Key Insights

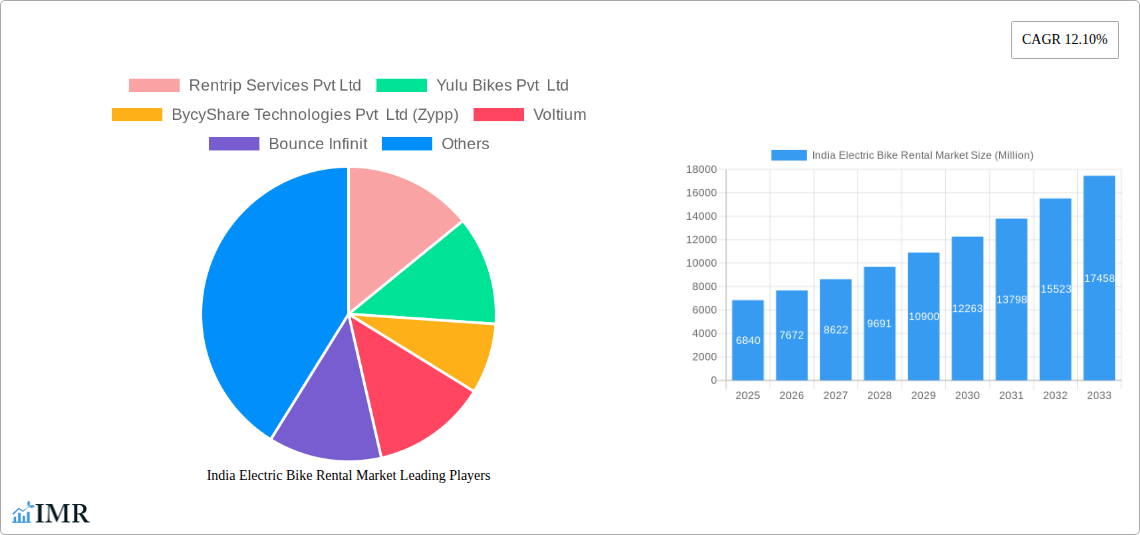

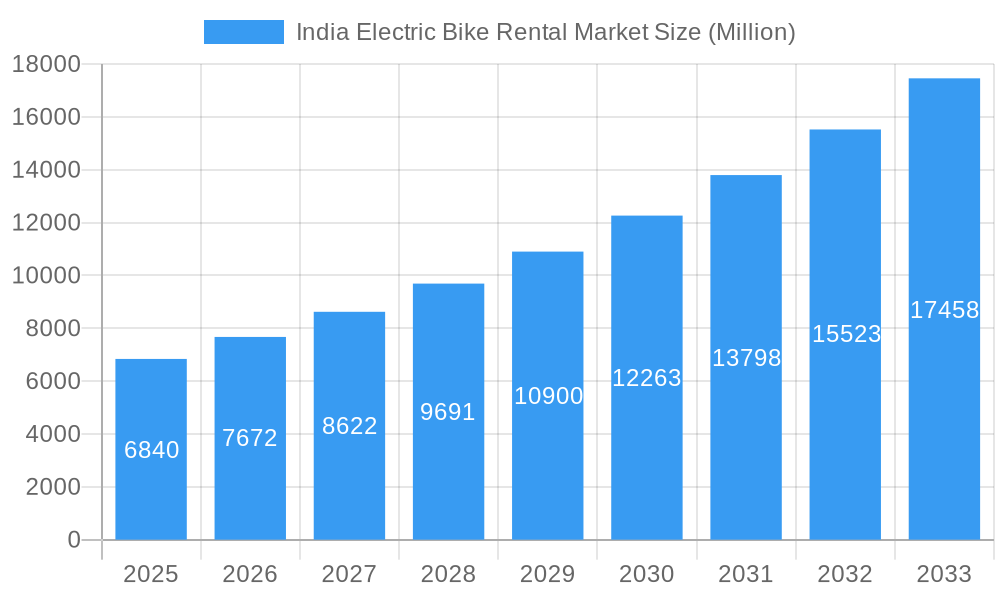

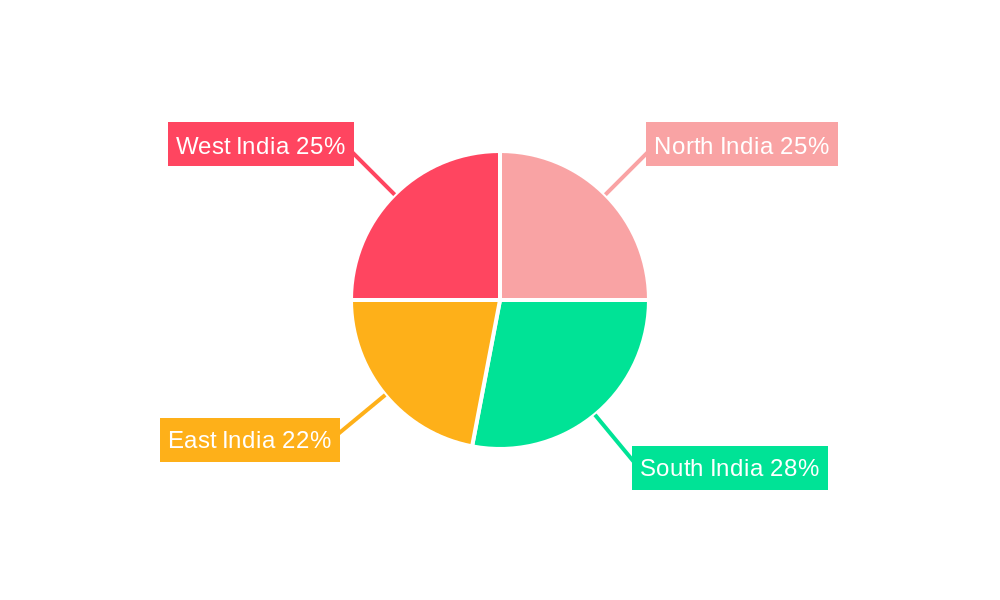

The India electric bike rental market is experiencing robust growth, projected to reach a market size of $6.84 billion in 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 12.10% from 2019 to 2033. This surge is driven by several key factors. Increasing environmental concerns and government initiatives promoting sustainable transportation are significantly boosting demand. Furthermore, the convenience and affordability of electric bike rentals compared to traditional vehicles, coupled with the rising urban population and traffic congestion in major Indian cities, are creating a fertile ground for market expansion. The market is segmented by application type (urban/city, cargo) and vehicle type (pedal-assisted, throttle-assisted), with urban applications and throttle-assisted bikes currently dominating the market share. Companies like Rentrip Services, Yulu Bikes, Zypp, and Bounce Infinit are key players, actively shaping the market landscape through strategic expansion and technological advancements in battery technology and rental platforms. The regional distribution shows significant potential across all regions of India – North, South, East, and West – with variations in market penetration possibly influenced by factors such as infrastructure development, consumer preferences, and government policies. The historical period (2019-2024) likely reflects a period of initial market establishment and technological refinement, paving the way for the substantial growth predicted in the forecast period (2025-2033).

India Electric Bike Rental Market Market Size (In Billion)

The competitive landscape is dynamic, with established players alongside emerging startups. The market's future growth hinges on sustained technological innovation, expansion of charging infrastructure, favorable regulatory policies, and increased consumer awareness of the environmental and economic benefits of electric bike rentals. Addressing challenges such as range anxiety, battery life, and the need for widespread and reliable charging networks will be crucial for ensuring the market’s continued trajectory. The diverse range of rental options catering to various needs, from short commutes to last-mile delivery services, positions the market for sustained expansion and further diversification in the coming years. Growth will likely be seen in the development of more specialized applications and vehicle types, further catering to individual and business needs within the Indian market.

India Electric Bike Rental Market Company Market Share

India Electric Bike Rental Market: A Comprehensive Report (2019-2033)

This comprehensive report provides a detailed analysis of the burgeoning India Electric Bike Rental Market, offering invaluable insights for industry professionals, investors, and stakeholders. The study covers the period 2019-2033, with a focus on the 2025-2033 forecast period. The base year for this report is 2025. We delve into market dynamics, growth trends, key players, and future opportunities within the parent market of Electric Two-Wheeler Rental and its child market segment of Electric Bike Rentals. The market size is presented in million units.

India Electric Bike Rental Market Dynamics & Structure

The Indian electric bike rental market is experiencing rapid expansion, driven by factors such as increasing environmental awareness, government initiatives promoting electric mobility, and the affordability of electric bikes compared to gasoline-powered counterparts. Market concentration is currently moderate, with several key players vying for dominance. Technological innovation, particularly in battery technology and smart features, is a crucial driver. Regulatory frameworks, including licensing and safety standards, play a significant role in shaping market growth. The rise of shared mobility services and the increasing prevalence of e-commerce are fueling demand for cargo e-bikes. Competition from traditional bicycle rentals and ride-hailing services remains a key consideration. M&A activity is expected to increase as larger players consolidate their market share.

- Market Concentration: Moderate, with a few major players holding significant market share (xx%).

- Technological Innovation: Key drivers include advancements in battery technology, improved charging infrastructure, and smart features such as GPS tracking and integrated payment systems. Barriers include high initial investment costs for technology development and integration.

- Regulatory Framework: Government policies promoting electric vehicles and initiatives to improve charging infrastructure significantly impact market growth. Challenges include the need for standardized regulations across different states.

- Competitive Substitutes: Traditional bicycle rentals, ride-hailing services, and personal vehicle ownership represent competitive substitutes.

- End-User Demographics: Primarily young urban professionals and students, with increasing adoption among delivery services and businesses.

- M&A Trends: Consolidation is expected to increase, with larger players acquiring smaller companies to expand their reach and service offerings. Estimated M&A deal volume in 2024: xx deals.

India Electric Bike Rental Market Growth Trends & Insights

The Indian electric bike rental market has witnessed significant growth in recent years, driven by urbanization, rising disposable incomes, and environmental concerns. The market size in 2024 was estimated at xx million units, and is projected to reach xx million units by 2033, exhibiting a CAGR of xx% during the forecast period (2025-2033). The increasing adoption of electric bikes as a last-mile transportation solution in urban areas is a major growth driver. Technological disruptions, such as the introduction of improved battery technologies and smart connectivity features, are accelerating market expansion. Shifting consumer preferences toward sustainable and convenient transportation options further fuels this growth. Market penetration is currently at xx% and is projected to increase to xx% by 2033.

Dominant Regions, Countries, or Segments in India Electric Bike Rental Market

Metropolitan cities like Bengaluru, Mumbai, Delhi, and Chennai are currently driving the market due to high population density, favorable government policies, and increased awareness of sustainable transportation. The Urban/City application type dominates the market, representing approximately xx% of the total units rented. Within vehicle types, Pedal-Assisted e-bikes have higher adoption due to lower maintenance costs and increased affordability. Key growth drivers include:

- Economic Policies: Government subsidies and tax incentives for electric vehicles are boosting market growth.

- Infrastructure Development: Investments in charging infrastructure are crucial for increasing adoption.

- Urbanization: Rapid urbanization is leading to increased demand for efficient and affordable transportation solutions.

The Cargo segment is expected to see significant growth driven by the rise of e-commerce and last-mile delivery services. The projected market share for Urban/City will remain dominant at xx% in 2033, while the Cargo segment is expected to grow to xx%.

India Electric Bike Rental Market Product Landscape

The electric bike rental market offers a diverse range of products, including pedal-assisted and throttle-assisted e-bikes, catering to various user needs and preferences. Innovations focus on improved battery life, enhanced safety features, and user-friendly interfaces. The key differentiators are battery range, speed, and smart features such as GPS tracking and mobile app integration. Technological advancements are continuously improving battery technology, leading to longer range and faster charging times.

Key Drivers, Barriers & Challenges in India Electric Bike Rental Market

Key Drivers:

- Increasing environmental awareness and concerns about air pollution.

- Government initiatives promoting electric vehicles through subsidies and tax benefits.

- Rising fuel prices and the increasing affordability of electric bikes.

- Growing popularity of shared mobility services.

Key Challenges:

- High initial investment costs for electric bike fleets and charging infrastructure.

- Range anxiety and limited charging infrastructure in certain areas.

- Safety concerns and the need for robust safety regulations.

- Competition from traditional transportation modes and other shared mobility services. Market share loss to competitors is estimated at xx% annually.

Emerging Opportunities in India Electric Bike Rental Market

- Expansion into smaller cities and towns with increasing internet and smartphone penetration.

- Development of specialized e-bike rental services for specific applications, such as tourism or delivery services.

- Integration with other mobility services, such as public transportation or ride-hailing apps.

- Customization of e-bikes to meet specific user needs and preferences.

Growth Accelerators in the India Electric Bike Rental Market Industry

Technological advancements in battery technology, particularly solid-state batteries, will significantly extend range and reduce charging times, driving market growth. Strategic partnerships between rental companies and electric vehicle manufacturers can enhance the availability of high-quality e-bikes at competitive prices. Government initiatives to expand charging infrastructure and streamline licensing processes will further accelerate market expansion.

Key Players Shaping the India Electric Bike Rental Market Market

- Rentrip Services Pvt Ltd

- Yulu Bikes Pvt Ltd

- BycyShare Technologies Pvt Ltd (Zypp)

- Voltium

- Bounce Infinit

- EXA MOBILITY EXA RIDE

- Giant Bikes

- Zypp Electric

- Motoride Scooter Rentals

- Wheelbros

- Vogo Rental

- eBikeGo Pvt Ltd

Notable Milestones in India Electric Bike Rental Market Sector

- June 2023: Yulu launches Yulu Wynn, a new low-speed e-bike model, expanding its market reach in Bengaluru, Delhi, and Mumbai.

- February 2023: Yulu Bikes Pvt Ltd partners with Bajaj Auto Ltd to launch two new e2Ws, Miracle GR and DeX GR, enhancing its product portfolio.

- December 2022: Bounce secures a license to operate electric bike taxi services in Karnataka, signifying regulatory approval and market expansion.

In-Depth India Electric Bike Rental Market Market Outlook

The future of the India electric bike rental market is exceptionally promising. Continued technological advancements, supportive government policies, and increasing consumer preference for sustainable and convenient transportation options will propel significant growth. Strategic partnerships, innovative business models, and expansion into untapped markets will further contribute to market expansion. The market is poised for substantial growth, driven by strong underlying trends and a supportive regulatory environment.

India Electric Bike Rental Market Segmentation

-

1. Application Type

- 1.1. Urban/City

- 1.2. Cargo

-

2. Vehicle Type

- 2.1. Pedal-Assisted

- 2.2. Throttle-Assisted

India Electric Bike Rental Market Segmentation By Geography

- 1. India

India Electric Bike Rental Market Regional Market Share

Geographic Coverage of India Electric Bike Rental Market

India Electric Bike Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 12.10% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Adoption of Electric Vehicles is Anticipated to Boost the Market

- 3.3. Market Restrains

- 3.3.1. Limited EV Charging Infrastructure May Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. The Pedal-assisted Segment Holds the Highest Share by Vehicle Type

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Electric Bike Rental Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 5.1.1. Urban/City

- 5.1.2. Cargo

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.2.1. Pedal-Assisted

- 5.2.2. Throttle-Assisted

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Application Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Rentrip Services Pvt Ltd

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Yulu Bikes Pvt Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 BycyShare Technologies Pvt Ltd (Zypp)

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Voltium

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Bounce Infinit

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 EXA MOBILITY EXA RIDE

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Giant Bikes

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Zypp Electric

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Motoride Scooter Rentals

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Wheelbros

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Vogo Rental

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 eBikeGo Pvt Ltd

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Rentrip Services Pvt Ltd

List of Figures

- Figure 1: India Electric Bike Rental Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Electric Bike Rental Market Share (%) by Company 2025

List of Tables

- Table 1: India Electric Bike Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 2: India Electric Bike Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 3: India Electric Bike Rental Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: India Electric Bike Rental Market Revenue Million Forecast, by Application Type 2020 & 2033

- Table 5: India Electric Bike Rental Market Revenue Million Forecast, by Vehicle Type 2020 & 2033

- Table 6: India Electric Bike Rental Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Electric Bike Rental Market?

The projected CAGR is approximately 12.10%.

2. Which companies are prominent players in the India Electric Bike Rental Market?

Key companies in the market include Rentrip Services Pvt Ltd, Yulu Bikes Pvt Ltd, BycyShare Technologies Pvt Ltd (Zypp), Voltium, Bounce Infinit, EXA MOBILITY EXA RIDE, Giant Bikes, Zypp Electric, Motoride Scooter Rentals, Wheelbros, Vogo Rental, eBikeGo Pvt Ltd.

3. What are the main segments of the India Electric Bike Rental Market?

The market segments include Application Type, Vehicle Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.84 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Adoption of Electric Vehicles is Anticipated to Boost the Market.

6. What are the notable trends driving market growth?

The Pedal-assisted Segment Holds the Highest Share by Vehicle Type.

7. Are there any restraints impacting market growth?

Limited EV Charging Infrastructure May Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

February 2023: Joining the burgeoning electric two-wheeler space, Bengaluru-headquartered electric mobility platform Yulu Bikes Pvt Ltd, in partnership with Bajaj Auto Ltd, launched two new electric 2-wheelers (e2Ws), namely Miracle GR and DeX GR.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Electric Bike Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Electric Bike Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Electric Bike Rental Market?

To stay informed about further developments, trends, and reports in the India Electric Bike Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence