Key Insights

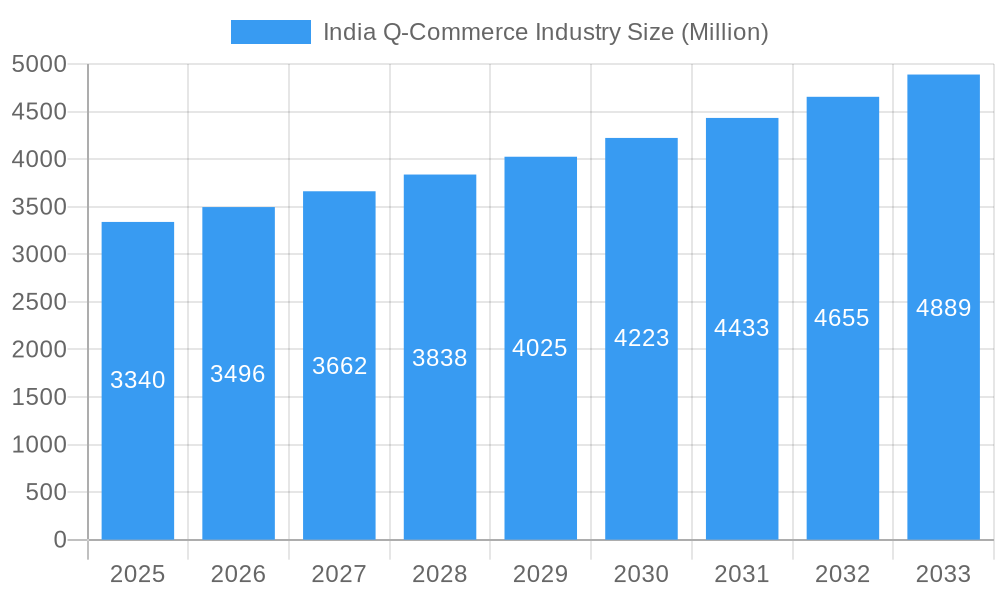

The Indian quick-commerce (Q-commerce) industry, valued at $3.34 billion in 2025, is experiencing robust growth, projected to expand at a CAGR exceeding 4.5% from 2025 to 2033. This explosive growth is fueled by several key factors. Increasing smartphone penetration and internet access across India, particularly in urban areas, are creating a massive consumer base readily adopting online grocery delivery services. The convenience offered by Q-commerce platforms, enabling rapid delivery of essential goods and groceries within minutes, strongly appeals to time-constrained urban professionals and households. Furthermore, aggressive marketing campaigns and competitive pricing strategies employed by major players like Swiggy Instamart, Blinkit, and Zepto have effectively driven adoption. The industry's expansion is also benefiting from evolving consumer preferences towards cashless transactions and the increasing popularity of online shopping for everyday necessities. However, challenges remain, including infrastructure limitations in some regions, high operational costs related to maintaining fast delivery networks, and the need for consistent quality control across diverse product ranges.

India Q-Commerce Industry Market Size (In Billion)

The competitive landscape is highly dynamic, with established players like BigBasket and new entrants vying for market share. Strategic partnerships, technological innovations focusing on efficient delivery logistics and inventory management, and expansion into new geographic regions will be crucial for success. The industry is expected to see further consolidation in the coming years, with stronger players likely acquiring smaller competitors. While maintaining profitability will be a key focus area for companies, the long-term potential of the Q-commerce sector in India remains considerable, driven by continued urbanization, rising disposable incomes, and the increasing demand for convenience in daily life. The evolution of innovative delivery models and expanding service offerings, including personalized recommendations and loyalty programs, will further shape the industry's future growth trajectory.

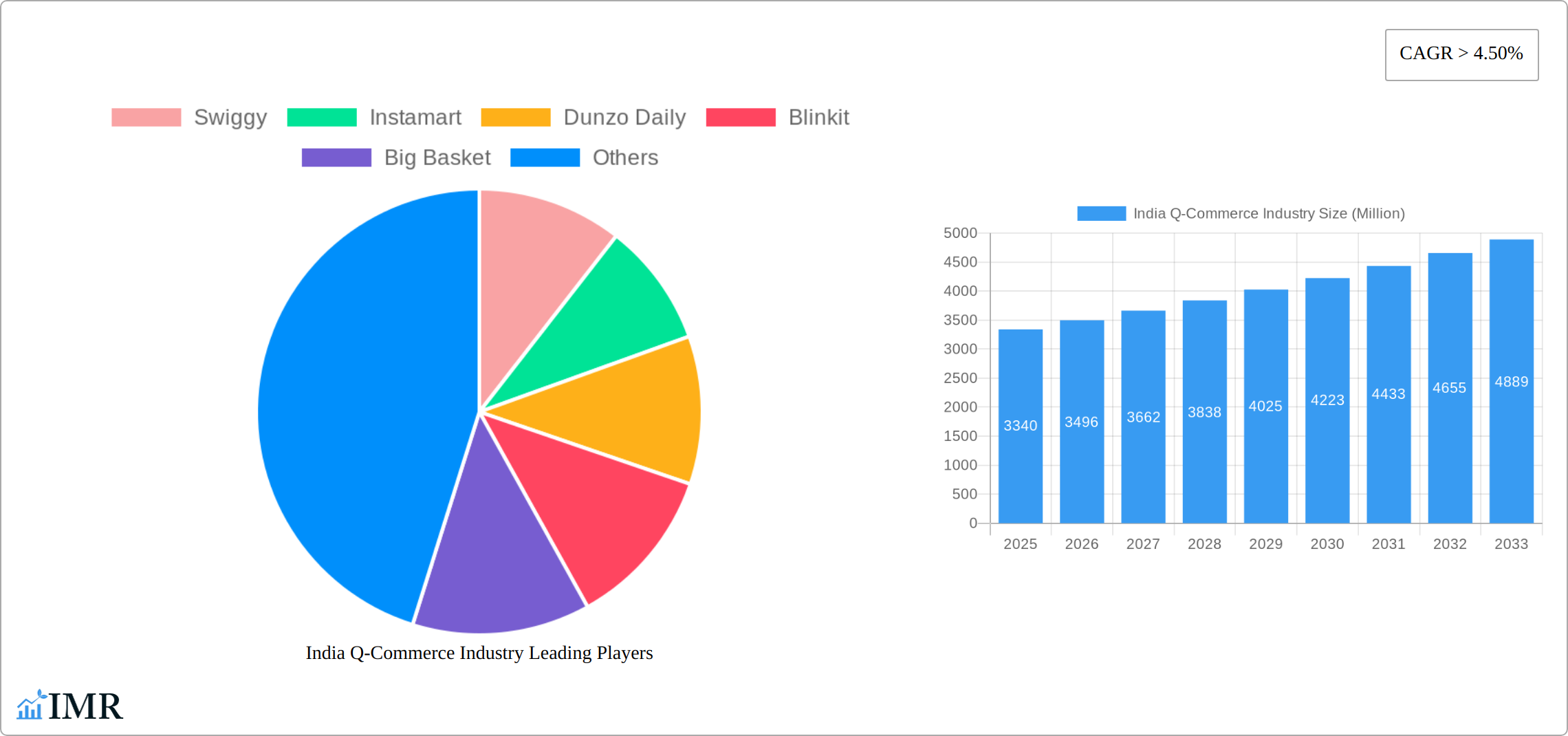

India Q-Commerce Industry Company Market Share

India Q-Commerce Industry Report: 2019-2033

This comprehensive report provides an in-depth analysis of the burgeoning India Q-commerce industry, encompassing market dynamics, growth trends, competitive landscape, and future outlook. With a focus on the period 2019-2033 (Base Year: 2025, Forecast Period: 2025-2033), this report is an essential resource for industry professionals, investors, and strategists seeking to navigate this rapidly evolving sector. The report covers key players such as Swiggy, Instamart, Dunzo Daily, Blinkit, Big Basket, Zepto, Grofers, Flipkart Quick, Supr Daily, and Zomato (list not exhaustive).

India Q-Commerce Industry Market Dynamics & Structure

The Indian Quick Commerce (Q-Commerce) market, a dynamic and rapidly evolving segment within the broader e-commerce landscape, is characterized by fierce competition and a relentless pursuit of innovation. The sector is currently experiencing a significant wave of consolidation, propelled by strategic mergers and acquisitions (M&A). Market observers estimate deals worth approximately INR 500-700 crore in 2024 alone. Key enablers of this growth include substantial advancements in logistics technology, particularly in route optimization and last-mile delivery efficiency. However, navigating the complexities of evolving regulatory frameworks and addressing existing infrastructure limitations present considerable hurdles that players must overcome.

- Market Concentration: The market, while appearing fragmented on the surface, is increasingly dominated by a few major players. In 2024, Swiggy and Blinkit collectively held an estimated 60-70% of the market share, highlighting a trend towards duopolistic tendencies.

- Technological Innovation: Significant investment is being channeled into AI-powered delivery optimization algorithms, pilot programs for drone delivery, and the strategic expansion of dark store networks to ensure faster fulfillment. However, the high initial capital outlay required for these technologies and the scarcity of a skilled workforce capable of managing them represent substantial barriers to entry and scaling.

- Regulatory Framework: The absence of a fully established and harmonized regulatory framework presents a degree of uncertainty. Evolving guidelines concerning food safety standards, the rights and welfare of delivery personnel, and stringent data privacy laws necessitate constant adaptation and compliance from Q-commerce operators.

- Competitive Product Substitutes: Traditional brick-and-mortar grocery stores, neighborhood kiranas, and smaller local businesses continue to be formidable competitors. Their established customer loyalty and localized presence, particularly in semi-urban and rural areas, pose an ongoing challenge to digital-first Q-commerce models.

- End-User Demographics: The primary consumer base for Q-commerce currently comprises young, urban, and tech-savvy individuals with a disposable income and a strong preference for convenience. Significant untapped growth potential lies in strategically expanding services and adapting offerings to cater to the needs of consumers in tier 2 and tier 3 cities.

- M&A Trends: Mergers and acquisitions are not merely a response to market saturation but a proactive strategy for market consolidation, geographical expansion, and diversification into new product categories. Projections for 2025 indicate continued M&A activity, potentially involving deals worth upwards of INR 800-1000 crore as companies seek to gain market share and operational synergies.

India Q-Commerce Industry Growth Trends & Insights

The Indian Q-commerce market experienced explosive growth during the historical period (2019-2024), fueled by increased smartphone penetration, rising internet usage, and changing consumer preferences. The market size is projected to reach xx million units in 2025, exhibiting a CAGR of xx% during the forecast period (2025-2033). This growth is driven by technological disruptions, such as improved delivery infrastructure and advanced apps, coupled with a shift towards convenience-driven consumption patterns. Market penetration is expected to increase from xx% in 2024 to xx% in 2033, driven largely by expansion into less-penetrated regions.

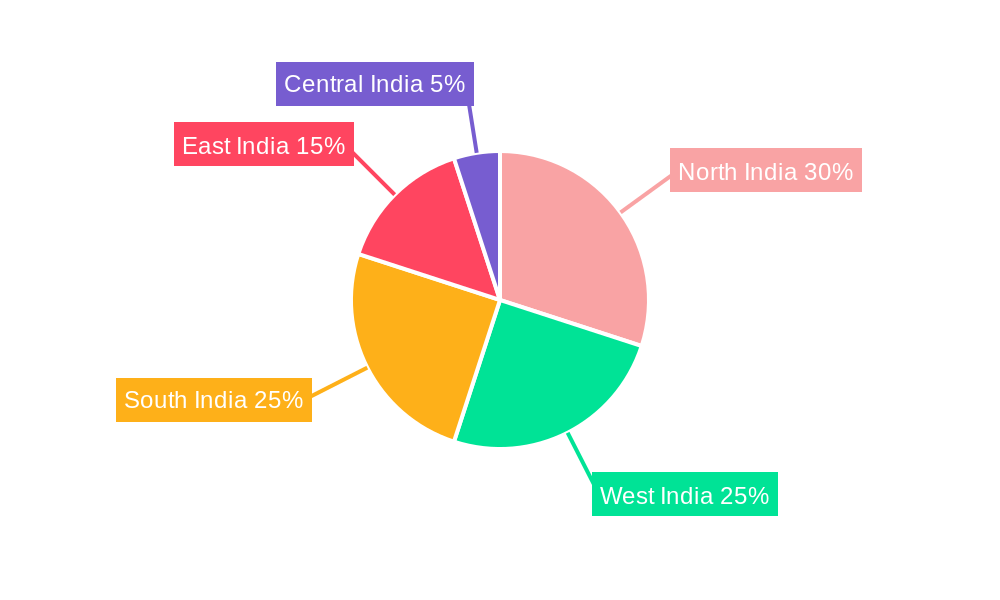

Dominant Regions, Countries, or Segments in India Q-Commerce Industry

Major metropolitan areas like Mumbai, Delhi, Bangalore, and Hyderabad are currently dominating the Q-commerce landscape, benefiting from higher internet penetration, dense populations, and established delivery networks. However, significant growth opportunities exist in expanding to Tier 2 and 3 cities.

- Key Drivers:

- Rapid urbanization and rising disposable incomes in Tier 2 and 3 cities.

- Government initiatives promoting digital infrastructure development.

- Improved logistics networks and last-mile delivery solutions.

- Dominance Factors: Existing infrastructure, consumer awareness, and the presence of established players. Growth potential lies in leveraging technological advancements to overcome logistical challenges in less developed areas.

India Q-Commerce Industry Product Landscape

The product assortment within the Indian Q-commerce sector is rapidly expanding beyond its initial focus on groceries and ready-to-eat meals. It now prominently includes essential pharmaceuticals, personal care items, and a growing array of other daily necessities. Innovation is a cornerstone of this landscape, with companies prioritizing not only the swift delivery of these products but also the enhancement of the overall customer experience. This includes the development of personalized recommendation engines, the introduction of flexible subscription models, and the meticulous curation of product offerings based on real-time demand. Technological advancements are playing a pivotal role in achieving these goals, with AI-powered inventory management systems optimizing stock levels and automated fulfillment centers streamlining the picking, packing, and dispatch processes to improve efficiency and curtail operational costs.

Key Drivers, Barriers & Challenges in India Q-Commerce Industry

Key Drivers: The exponential growth in smartphone penetration and widespread internet access in India are foundational. This is coupled with a significant shift in consumer behavior towards valuing convenience and instant gratification. Furthermore, continuous advancements in logistics and delivery technology are enabling faster and more efficient service delivery, directly fueling market expansion.

Key Challenges: The operational landscape is fraught with significant challenges, including high fixed and variable operating costs, leading to intense price wars and pressure on margins. The regulatory environment, encompassing obtaining licenses and permits, can be complex and time-consuming. Last-mile delivery in densely populated urban areas presents logistical nightmares due to traffic congestion and infrastructure constraints. Maintaining consistent product quality and freshness, especially for perishable items, is a constant battle. The heavy reliance on a gig workforce introduces complexities related to worker retention, training, and compliance with labor laws. These interconnected factors contribute to a substantial burn rate for many Q-commerce players, with an estimated 20-25% of annual revenue lost due to factors such as failed deliveries, returns, and operational inefficiencies in 2024.

Emerging Opportunities in India Q-Commerce Industry

Untapped markets in Tier 2 and 3 cities, expanding product categories beyond groceries and daily essentials (e.g., electronics, fashion), leveraging hyperlocal delivery networks, and personalized offerings tailored to customer preferences.

Growth Accelerators in the India Q-Commerce Industry

Technological advancements (AI, automation), strategic partnerships with local businesses, expansion into new geographic markets, and development of innovative business models (subscription services, loyalty programs).

Key Players Shaping the India Q-Commerce Industry Market

- Swiggy (Instamart)

- Blinkit (formerly Grofers)

- Zepto

- Dunzo Daily

- BigBasket (Quick-Commerce segment)

- Flipkart Quick

- Zomato (Quick-Commerce segment)

- Supr Daily (owned by BigBasket)

Notable Milestones in India Q-Commerce Industry Sector

- February 2023: Zomato launched Zomato Instant, a quick commerce delivery service focusing on affordable home-style cooked food.

- December 2023: Walmart's acquisition of Flipkart led to the launch of Flipkart Quick, expanding quick commerce services to 20 Indian cities.

In-Depth India Q-Commerce Industry Market Outlook

The Indian Q-commerce market is positioned for robust and sustained growth over the next decade. This optimistic outlook is underpinned by a favorable demographic dividend characterized by a young and increasingly urbanized population, coupled with escalating digital adoption across all strata of society. Continuous technological innovation, particularly in areas like AI, automation, and sustainable delivery solutions, will remain a critical catalyst. Strategic collaborations, ambitious expansion into underserved tier 2 and tier 3 cities, and the development of adaptive, customer-centric business models will be paramount for companies aiming to capture the significant opportunities presented by this dynamic sector. The market is projected to achieve a valuation of USD 25-35 billion by 2033, offering substantial and lucrative prospects for both established industry giants and agile new entrants.

India Q-Commerce Industry Segmentation

-

1. Product Type

- 1.1. Groceries

- 1.2. Personal Care

- 1.3. Fresh Food

- 1.4. Other Product Types

-

2. Company Type

- 2.1. Pureplay

- 2.2. Non-pureplay

India Q-Commerce Industry Segmentation By Geography

- 1. India

India Q-Commerce Industry Regional Market Share

Geographic Coverage of India Q-Commerce Industry

India Q-Commerce Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 4.50% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market

- 3.3. Market Restrains

- 3.3.1. Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market

- 3.4. Market Trends

- 3.4.1. Rising Entry of Startups into the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Q-Commerce Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Groceries

- 5.1.2. Personal Care

- 5.1.3. Fresh Food

- 5.1.4. Other Product Types

- 5.2. Market Analysis, Insights and Forecast - by Company Type

- 5.2.1. Pureplay

- 5.2.2. Non-pureplay

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Swiggy

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Instamart

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Dunzo Daily

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Blinkit

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Big Basket

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Zepto

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Grofers

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Flipkart Quick

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Supr Daily

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Zomato**List Not Exhaustive

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Swiggy

List of Figures

- Figure 1: India Q-Commerce Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Q-Commerce Industry Share (%) by Company 2025

List of Tables

- Table 1: India Q-Commerce Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: India Q-Commerce Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: India Q-Commerce Industry Revenue Million Forecast, by Company Type 2020 & 2033

- Table 4: India Q-Commerce Industry Volume Billion Forecast, by Company Type 2020 & 2033

- Table 5: India Q-Commerce Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Q-Commerce Industry Volume Billion Forecast, by Region 2020 & 2033

- Table 7: India Q-Commerce Industry Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: India Q-Commerce Industry Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: India Q-Commerce Industry Revenue Million Forecast, by Company Type 2020 & 2033

- Table 10: India Q-Commerce Industry Volume Billion Forecast, by Company Type 2020 & 2033

- Table 11: India Q-Commerce Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Q-Commerce Industry Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Q-Commerce Industry?

The projected CAGR is approximately > 4.50%.

2. Which companies are prominent players in the India Q-Commerce Industry?

Key companies in the market include Swiggy, Instamart, Dunzo Daily, Blinkit, Big Basket, Zepto, Grofers, Flipkart Quick, Supr Daily, Zomato**List Not Exhaustive.

3. What are the main segments of the India Q-Commerce Industry?

The market segments include Product Type, Company Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.34 Million as of 2022.

5. What are some drivers contributing to market growth?

Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market.

6. What are the notable trends driving market growth?

Rising Entry of Startups into the Market.

7. Are there any restraints impacting market growth?

Faster Buying Process Drives the Market; Faster Response to Buyer/Market Demands Drives the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Zomato launched a quick commerce delivery service known as Zomato Instant. The aim is to provide customers with home-style cooked food at affordable prices.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Q-Commerce Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Q-Commerce Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Q-Commerce Industry?

To stay informed about further developments, trends, and reports in the India Q-Commerce Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence