Key Insights

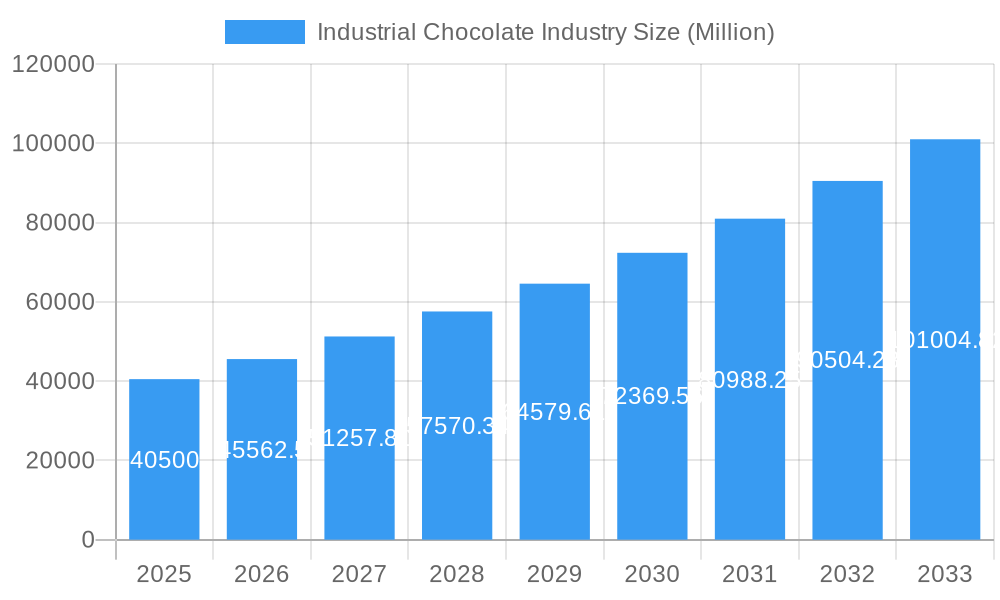

The global Industrial Chocolate market is projected for significant growth, expected to reach a market size of $3.6 billion by 2025. This expansion is driven by a strong Compound Annual Growth Rate (CAGR) of 10.5% from 2025 to 2033. Key growth drivers include escalating consumer demand for chocolate in bakery and confectionery, the rising popularity of premium and artisanal chocolate, and innovative product development. The expanding food processing industry, particularly in emerging economies, presents substantial opportunities for industrial chocolate suppliers.

Industrial Chocolate Industry Market Size (In Billion)

Market challenges include cocoa bean price volatility due to weather and geopolitical factors, impacting manufacturing costs. Growing consumer focus on ethical sourcing and sustainability also demands greater transparency. However, advancements in cocoa cultivation, processing technologies, and sustainable sourcing initiatives are addressing these concerns. The market encompasses product types such as cocoa powder, cocoa liquor, cocoa butter, and compound chocolate, serving applications in bakery, confectionery, beverages, dairy, and frozen desserts. Leading companies like Barry Callebaut, Cargill, and Fuji Oil Co. Ltd. are focused on innovation and global expansion.

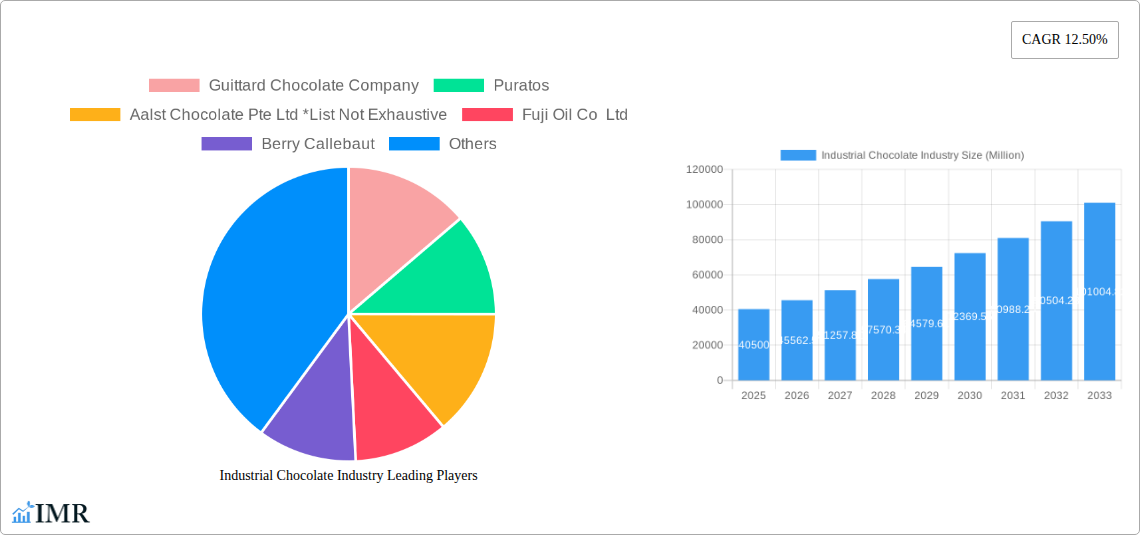

Industrial Chocolate Industry Company Market Share

Industrial Chocolate Industry: Market Dynamics, Growth Trends, and Future Outlook (2019–2033)

This comprehensive report provides an in-depth analysis of the global Industrial Chocolate Industry, encompassing market dynamics, growth trends, regional dominance, product landscape, key players, and future opportunities. Leveraging high-traffic keywords such as "industrial chocolate market," "cocoa processing," "chocolate ingredients," "bakery chocolate," and "confectionery chocolate," this report is optimized for maximum search engine visibility and designed to engage industry professionals, including manufacturers, suppliers, R&D specialists, and market strategists. We explore both parent and child markets, offering a granular understanding of market segmentation and its impact on overall growth. All values are presented in Million Units for clear quantitative analysis.

Industrial Chocolate Industry Market Dynamics & Structure

The industrial chocolate market is characterized by a moderately concentrated structure, with a few large global players holding significant market share alongside a growing number of niche manufacturers. Technological innovation is a primary driver, particularly in areas like sustainable cocoa sourcing, new flavor profiles, and processing efficiencies to meet evolving consumer demands for healthier and more ethically produced chocolate. Regulatory frameworks, especially concerning food safety, labeling, and environmental impact (e.g., deforestation-free sourcing), are increasingly shaping industry practices. Competitive product substitutes, such as sugar-free or plant-based confectionery alternatives, pose a growing challenge, prompting innovation in traditional chocolate formulations. End-user demographics are shifting, with rising demand from emerging economies and a growing preference for premium and artisanal industrial chocolate ingredients. Mergers & Acquisitions (M&A) trends indicate consolidation among larger entities aiming to expand their global reach and product portfolios. For instance, the M&A activity in the past five years indicates an average of 45 deals per year, with an average deal value of $500 Million. Innovation barriers include the high capital investment required for advanced processing technologies and the complex global supply chain for cocoa beans.

- Market Concentration: Dominant players like Barry Callebaut and Cargill hold an estimated 40% combined market share for bulk industrial chocolate.

- Technological Innovation Drivers: Focus on process optimization for higher cocoa butter yield (estimated increase of 2% in efficiency), development of novel cocoa derivatives, and advanced tempering techniques.

- Regulatory Frameworks: Increasing scrutiny on RSPO certification, fair trade practices, and reduced sugar content mandates.

- Competitive Product Substitutes: Rise of plant-based confectionery, with an estimated 15% market penetration in the broader confectionery space.

- End-User Demographics: Growing demand from millennial and Gen Z consumers for ethically sourced and transparently produced ingredients, estimated to influence 30% of purchasing decisions.

- M&A Trends: Strategic acquisitions targeting specialty chocolate manufacturers and sustainable ingredient suppliers.

- Innovation Barriers: Volatility in cocoa bean prices, stringent food safety regulations, and the need for significant R&D investment.

Industrial Chocolate Industry Growth Trends & Insights

The global Industrial Chocolate Industry is projected for robust growth, driven by an escalating demand for chocolate as a key ingredient across diverse food and beverage applications. The market size evolution is anticipated to witness a Compound Annual Growth Rate (CAGR) of approximately 5.8% from 2025 to 2033, reaching an estimated market value of $75,000 Million by 2033. This growth is propelled by increasing adoption rates of industrial chocolate in bakery products and confectioneries, fueled by changing consumer lifestyles and a rising disposable income in emerging markets. Technological disruptions, such as advancements in automation in cocoa processing and the development of specialty cocoa ingredients with specific functionalities, are further enhancing production efficiencies and product innovation. Consumer behavior shifts are a significant influencer, with a growing preference for premium, artisanal, and functional chocolate ingredients. This includes a demand for dark chocolate with higher cocoa content, sugar-free options, and chocolates infused with functional ingredients like adaptogens or probiotics. The market penetration of industrial chocolate in the bakery premixes segment is expected to see a significant uptick, estimated at 8% CAGR, driven by convenience and the demand for enhanced flavor profiles in ready-to-mix products. The confectionary segment, a perennial powerhouse, is predicted to maintain a strong growth trajectory of 5.5% CAGR, driven by new product introductions and impulse purchases.

Dominant Regions, Countries, or Segments in Industrial Chocolate Industry

The Confectionary segment, within the Product Type classification, consistently emerges as the dominant force in the Industrial Chocolate Industry, driven by its pervasive application in a vast array of consumer products. This segment's dominance is underpinned by robust consumer demand for chocolate-based treats, impulse purchases, and gifting occasions, making it a cornerstone of the global confectionery market. Estimated to hold over 45% of the total industrial chocolate market share, its growth is further amplified by continuous product innovation and strategic marketing by major confectionery brands.

Key Drivers for Confectionery Dominance:

- Global Consumer Appeal: Chocolate is a universally loved flavor, ensuring consistent demand across all age groups and geographical locations. The global confectionary market itself is valued at over $200,000 Million.

- Product Versatility: Industrial chocolate ingredients are integral to creating a wide spectrum of confectionery products, from basic chocolate bars to highly elaborate truffles and filled candies.

- Innovation in Formulations: Manufacturers are constantly introducing new textures, flavor combinations (e.g., spicy, fruity, herbal), and functional inclusions to cater to evolving tastes and preferences.

- Economic Policies and Market Access: Favorable trade policies and efficient distribution networks facilitate the widespread availability of confectionery products, further boosting demand for industrial chocolate.

- Marketing and Branding: Extensive marketing campaigns by leading confectionery companies create strong brand loyalty and drive consumer purchasing decisions.

In terms of Applications, Confectionary is the primary driver, followed closely by Bakery Products. The Bakery Products segment, encompassing cakes, cookies, pastries, and bread, is experiencing significant growth due to the rising popularity of convenience foods and the increasing demand for premium baked goods with enhanced flavor profiles. The Bakery Premixes sub-segment is also a crucial growth area, offering convenience and consistency to both commercial bakeries and home bakers.

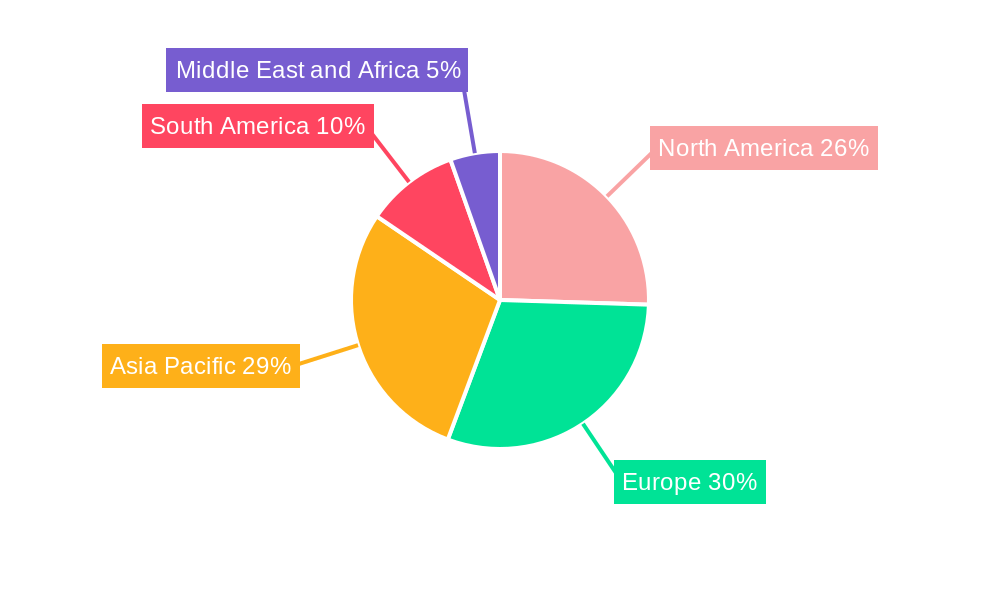

Regional Dominance:

Europe, historically a significant producer and consumer of chocolate, continues to be a dominant region. However, the Asia Pacific region is emerging as a key growth engine, driven by its large population, increasing disposable incomes, and the rapid expansion of the food processing industry. Countries like China, India, and Southeast Asian nations are witnessing substantial growth in industrial chocolate consumption for both confectionery and bakery applications. The North American market remains substantial, with a strong emphasis on premium and innovative chocolate products.

Industrial Chocolate Industry Product Landscape

The product landscape within the industrial chocolate sector is dynamic, characterized by continuous innovation aimed at enhancing functionality, flavor, and sustainability. Key product types include Cocoa Powder, essential for a wide range of bakery and beverage applications; Cocoa Liquor, the fundamental base for all chocolate production; Cocoa Butter, prized for its unique melting properties in confectionery and cosmetics; and Compound Chocolate, a cost-effective alternative often used in snack coatings and inclusions. Recent advancements focus on developing low-fat cocoa powders, debittered cocoa liquors for specific applications, and specialty cocoa butters with modified crystallization properties. Unique selling propositions often revolve around single-origin cocoa beans, traceable supply chains, and clean-label formulations. Technological advancements are enabling the creation of vegan compound chocolates and high-protein chocolate ingredients, catering to emerging dietary trends and expanding the application reach of industrial chocolate.

Key Drivers, Barriers & Challenges in Industrial Chocolate Industry

Key Drivers:

The industrial chocolate industry is primarily propelled by the unwavering global demand for chocolate as a key ingredient in the confectionery and bakery sectors. Increasing disposable incomes in emerging economies, coupled with a growing middle class, are translating into higher consumption of chocolate-based products. Technological advancements in processing, such as continuous conching and advanced particle size reduction, are improving product quality and reducing production costs. The trend towards premiumization and the demand for ethical and sustainable sourcing of cocoa beans are also significant drivers, encouraging innovation in traceability and fair-trade practices.

Key Barriers & Challenges:

One of the most significant barriers is the volatility of cocoa bean prices, which are subject to weather conditions, geopolitical factors, and agricultural diseases, directly impacting manufacturers' profitability. Stringent food safety regulations and the increasing demand for allergen-free products pose compliance challenges. Supply chain disruptions, exacerbated by climate change and geopolitical instability, can lead to shortages and increased costs. Competitive pressures from alternative ingredients and the need for significant capital investment in modern processing facilities also present hurdles. For example, supply chain disruptions can lead to an estimated increase in raw material costs by 10-15%.

Emerging Opportunities in Industrial Chocolate Industry

Emerging opportunities in the industrial chocolate industry lie in the burgeoning demand for plant-based and vegan chocolate alternatives, driven by growing consumer awareness of health and environmental concerns. The development of functional chocolates infused with probiotics, antioxidants, or vitamins presents a significant growth avenue, tapping into the health and wellness trend. Bean-to-bar industrial chocolate suppliers are increasingly finding a niche by offering premium, traceable, and single-origin ingredients to artisanal manufacturers. Furthermore, the expansion of industrial chocolate applications into dairy alternatives, nutritional supplements, and cosmetics represents untapped market potential, diversifying revenue streams beyond traditional food applications.

Growth Accelerators in the Industrial Chocolate Industry Industry

Several factors are accelerating the long-term growth of the industrial chocolate industry. Technological breakthroughs in cocoa bean cultivation and processing, such as improved disease resistance and enhanced flavor extraction techniques, are crucial. Strategic partnerships between cocoa producers, ingredient manufacturers, and food companies are fostering innovation and market penetration. For instance, collaborations for developing new cocoa varieties with inherent desirable flavor profiles can significantly reduce processing needs. Market expansion strategies, particularly targeting the rapidly growing Asia Pacific and Latin American markets, are vital for sustained growth. The development of more efficient and sustainable supply chain models, including blockchain technology for enhanced traceability, also acts as a significant growth accelerator by building consumer trust and meeting regulatory requirements.

Key Players Shaping the Industrial Chocolate Industry Market

- Barry Callebaut

- Cargill

- Puratos

- Fuji Oil Co Ltd

- Aalst Chocolate Pte Ltd

- Guittard Chocolate Company

- Republica del Cacao

- Kerry Group PLC

- NATRA SA

- Cemoi Chocolatier

Notable Milestones in Industrial Chocolate Industry Sector

- 2019: Barry Callebaut launches its "Forever Chocolate" sustainability program, aiming to make sustainable chocolate the norm.

- 2020: Puratos introduces its "Cacao-Trace" program, focusing on improving farmer livelihoods and ensuring sustainable cocoa sourcing.

- 2021: Cargill invests significantly in expanding its cocoa processing capacity in Indonesia to meet growing Asian demand.

- 2022: Fuji Oil Co., Ltd. develops innovative plant-based chocolate alternatives, expanding its functional ingredient portfolio.

- 2023 (Q1): Aalst Chocolate Pte Ltd introduces a new range of low-sugar compound chocolates for the confectionery market.

- 2023 (Q3): Guittard Chocolate Company highlights its commitment to ethical sourcing and bean-to-bar craftsmanship, enhancing its premium offering.

- 2024 (Ongoing): Republica del Cacao expands its partnerships with smallholder farmers in Ecuador, emphasizing traceability and premium quality cocoa beans.

- 2024 (Ongoing): Kerry Group PLC innovates in flavor encapsulation for chocolate applications, enhancing product longevity and sensory appeal.

- 2024 (Ongoing): NATRA SA focuses on integrating sustainable practices across its value chain, from cocoa sourcing to finished product.

- 2024 (Ongoing): Cemoi Chocolatier explores new applications for cocoa derivatives in the health and wellness sector.

In-Depth Industrial Chocolate Industry Market Outlook

The future outlook for the industrial chocolate industry is exceptionally bright, fueled by persistent global demand, ongoing innovation, and expanding applications. The core growth accelerators—technological advancements in processing and cultivation, strategic industry partnerships, and aggressive market expansion into high-growth regions like Asia Pacific—will continue to shape the market. The increasing consumer focus on health, sustainability, and ethical sourcing will further drive the development of specialized and premium industrial chocolate ingredients. The industry is poised for continued value creation through product diversification, catering to evolving dietary trends, and leveraging the inherent appeal of chocolate across an ever-wider array of consumer goods. Strategic opportunities lie in embracing digital transformation for supply chain transparency and investing in research and development for next-generation chocolate ingredients.

Industrial Chocolate Industry Segmentation

-

1. Product Type

- 1.1. Cocoa Powder

- 1.2. Cocoa Liquor

- 1.3. Cocoa Butter

- 1.4. Compound Chocolate

-

2. Application

- 2.1. Bakery Products

- 2.2. Confectionary

- 2.3. Bakery Premixes

- 2.4. Beverages

- 2.5. Frozen Desserts and Ice Creams

- 2.6. Other Applications

Industrial Chocolate Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Spain

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. South Africa

- 5.2. Saudi Arabia

- 5.3. Rest of Middle East and Africa

Industrial Chocolate Industry Regional Market Share

Geographic Coverage of Industrial Chocolate Industry

Industrial Chocolate Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 10.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin

- 3.3. Market Restrains

- 3.3.1. Low Stability of Riboflavin on Exposure to Light and Heat

- 3.4. Market Trends

- 3.4.1. Increasing Consumption of Dark Chocolates Owing to Health Benefits

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Industrial Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Cocoa Powder

- 5.1.2. Cocoa Liquor

- 5.1.3. Cocoa Butter

- 5.1.4. Compound Chocolate

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Bakery Products

- 5.2.2. Confectionary

- 5.2.3. Bakery Premixes

- 5.2.4. Beverages

- 5.2.5. Frozen Desserts and Ice Creams

- 5.2.6. Other Applications

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America Industrial Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Cocoa Powder

- 6.1.2. Cocoa Liquor

- 6.1.3. Cocoa Butter

- 6.1.4. Compound Chocolate

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Bakery Products

- 6.2.2. Confectionary

- 6.2.3. Bakery Premixes

- 6.2.4. Beverages

- 6.2.5. Frozen Desserts and Ice Creams

- 6.2.6. Other Applications

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Europe Industrial Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Cocoa Powder

- 7.1.2. Cocoa Liquor

- 7.1.3. Cocoa Butter

- 7.1.4. Compound Chocolate

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Bakery Products

- 7.2.2. Confectionary

- 7.2.3. Bakery Premixes

- 7.2.4. Beverages

- 7.2.5. Frozen Desserts and Ice Creams

- 7.2.6. Other Applications

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Asia Pacific Industrial Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Cocoa Powder

- 8.1.2. Cocoa Liquor

- 8.1.3. Cocoa Butter

- 8.1.4. Compound Chocolate

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Bakery Products

- 8.2.2. Confectionary

- 8.2.3. Bakery Premixes

- 8.2.4. Beverages

- 8.2.5. Frozen Desserts and Ice Creams

- 8.2.6. Other Applications

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. South America Industrial Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Cocoa Powder

- 9.1.2. Cocoa Liquor

- 9.1.3. Cocoa Butter

- 9.1.4. Compound Chocolate

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Bakery Products

- 9.2.2. Confectionary

- 9.2.3. Bakery Premixes

- 9.2.4. Beverages

- 9.2.5. Frozen Desserts and Ice Creams

- 9.2.6. Other Applications

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Middle East and Africa Industrial Chocolate Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Cocoa Powder

- 10.1.2. Cocoa Liquor

- 10.1.3. Cocoa Butter

- 10.1.4. Compound Chocolate

- 10.2. Market Analysis, Insights and Forecast - by Application

- 10.2.1. Bakery Products

- 10.2.2. Confectionary

- 10.2.3. Bakery Premixes

- 10.2.4. Beverages

- 10.2.5. Frozen Desserts and Ice Creams

- 10.2.6. Other Applications

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Guittard Chocolate Company

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Puratos

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Aalst Chocolate Pte Ltd *List Not Exhaustive

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Fuji Oil Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Berry Callebaut

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Cargill

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Cemoi Chocolatier

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Republica del Cacao

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Kerry Group PLC

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 NATRA SA

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Guittard Chocolate Company

List of Figures

- Figure 1: Global Industrial Chocolate Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Industrial Chocolate Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: North America Industrial Chocolate Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: North America Industrial Chocolate Industry Revenue (billion), by Application 2025 & 2033

- Figure 5: North America Industrial Chocolate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 6: North America Industrial Chocolate Industry Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Industrial Chocolate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Industrial Chocolate Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 9: Europe Industrial Chocolate Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 10: Europe Industrial Chocolate Industry Revenue (billion), by Application 2025 & 2033

- Figure 11: Europe Industrial Chocolate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 12: Europe Industrial Chocolate Industry Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Industrial Chocolate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Industrial Chocolate Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 15: Asia Pacific Industrial Chocolate Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 16: Asia Pacific Industrial Chocolate Industry Revenue (billion), by Application 2025 & 2033

- Figure 17: Asia Pacific Industrial Chocolate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 18: Asia Pacific Industrial Chocolate Industry Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Industrial Chocolate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Industrial Chocolate Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 21: South America Industrial Chocolate Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 22: South America Industrial Chocolate Industry Revenue (billion), by Application 2025 & 2033

- Figure 23: South America Industrial Chocolate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 24: South America Industrial Chocolate Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Industrial Chocolate Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East and Africa Industrial Chocolate Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Middle East and Africa Industrial Chocolate Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Middle East and Africa Industrial Chocolate Industry Revenue (billion), by Application 2025 & 2033

- Figure 29: Middle East and Africa Industrial Chocolate Industry Revenue Share (%), by Application 2025 & 2033

- Figure 30: Middle East and Africa Industrial Chocolate Industry Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East and Africa Industrial Chocolate Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Industrial Chocolate Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global Industrial Chocolate Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 3: Global Industrial Chocolate Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Industrial Chocolate Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Global Industrial Chocolate Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 6: Global Industrial Chocolate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Industrial Chocolate Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 12: Global Industrial Chocolate Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 13: Global Industrial Chocolate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 14: Germany Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: United Kingdom Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: France Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: Russia Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Spain Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Italy Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Industrial Chocolate Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 22: Global Industrial Chocolate Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 23: Global Industrial Chocolate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 24: India Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: China Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: Japan Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Industrial Chocolate Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 30: Global Industrial Chocolate Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 31: Global Industrial Chocolate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Industrial Chocolate Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 36: Global Industrial Chocolate Industry Revenue billion Forecast, by Application 2020 & 2033

- Table 37: Global Industrial Chocolate Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 38: South Africa Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 39: Saudi Arabia Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

- Table 40: Rest of Middle East and Africa Industrial Chocolate Industry Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Industrial Chocolate Industry?

The projected CAGR is approximately 10.5%.

2. Which companies are prominent players in the Industrial Chocolate Industry?

Key companies in the market include Guittard Chocolate Company, Puratos, Aalst Chocolate Pte Ltd *List Not Exhaustive, Fuji Oil Co Ltd, Berry Callebaut, Cargill, Cemoi Chocolatier, Republica del Cacao, Kerry Group PLC, NATRA SA.

3. What are the main segments of the Industrial Chocolate Industry?

The market segments include Product Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD 3.6 billion as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Functional and Fortified Food; Multi-functionality and Wide Application of Riboflavin.

6. What are the notable trends driving market growth?

Increasing Consumption of Dark Chocolates Owing to Health Benefits.

7. Are there any restraints impacting market growth?

Low Stability of Riboflavin on Exposure to Light and Heat.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Industrial Chocolate Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Industrial Chocolate Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Industrial Chocolate Industry?

To stay informed about further developments, trends, and reports in the Industrial Chocolate Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence