Key Insights

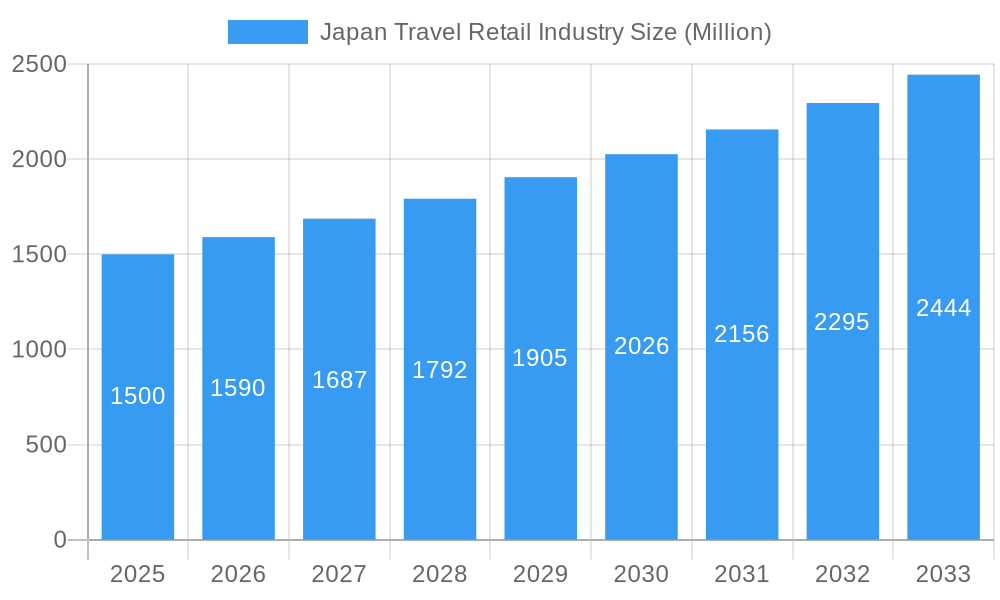

The Japan travel retail market is poised for significant expansion, projected to reach $19.9 billion by 2025. From 2025 to 2033, the market is expected to grow at a compound annual growth rate (CAGR) of 5.7%. This robust growth is driven by the strong recovery of inbound tourism, a rising Japanese consumer affluence, and enhanced airport and airline retail experiences. Key product categories, including cosmetics, perfumes, and luxury goods, are leading this expansion. Leading companies are focusing on innovation and strategic partnerships to capitalize on evolving consumer preferences and a dynamic retail landscape.

Japan Travel Retail Industry Market Size (In Billion)

Despite positive market trajectories, potential challenges such as global economic volatility and increasing competition from e-commerce necessitate strategic adaptation. Market segmentation indicates a concentration of sales in major urban centers and key international airports. Industry players are increasingly leveraging personalized customer experiences and data analytics to optimize offerings and drive satisfaction. The forecast anticipates continued growth, fueled by evolving travel patterns and innovative retail strategies within the travel retail sector.

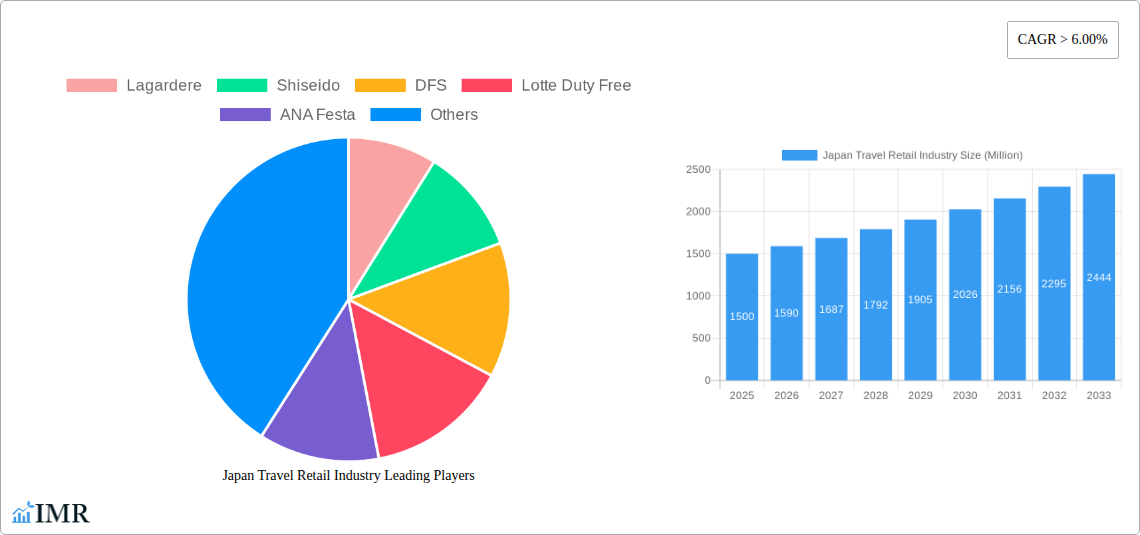

Japan Travel Retail Industry Company Market Share

Japan Travel Retail Industry: Market Report 2019-2033

This comprehensive report provides an in-depth analysis of the Japan Travel Retail industry, covering market dynamics, growth trends, key players, and future outlook from 2019 to 2033. With a focus on key segments and parent/child markets, this report is essential for industry professionals, investors, and strategic decision-makers. The study period encompasses 2019-2024 (Historical Period), with 2025 serving as the Base and Estimated Year. The forecast period extends to 2033. Market values are presented in Million units.

Japan Travel Retail Industry Market Dynamics & Structure

This section analyzes the competitive landscape of Japan's travel retail market, exploring market concentration, technological advancements, regulatory influence, substitute products, consumer demographics, and mergers & acquisitions (M&A) activity. The market is characterized by a mix of large international players and established domestic businesses.

Market Concentration: The Japanese travel retail market exhibits moderate concentration, with a few dominant players such as DFS, Lotte Duty Free, and Lagardère holding significant market share (estimated at xx% combined in 2025). However, a large number of smaller players, particularly in specific product categories, contribute to the overall market dynamics.

Technological Innovation: E-commerce integration and omnichannel strategies are key innovation drivers. However, the integration of technology faces barriers such as legacy systems and data privacy concerns. The adoption of AI-powered personalized recommendations and mobile payment solutions is growing.

Regulatory Framework: Japan's regulatory environment for travel retail is relatively stable, but evolving tax policies and import regulations can impact market players. Stringent regulations around cosmetics and pharmaceuticals require constant compliance monitoring.

Competitive Product Substitutes: Online retail and domestic retail present significant competition, particularly for less price-sensitive products. The rise of cross-border e-commerce also impacts sales.

End-User Demographics: The market is driven by a mix of domestic and international tourists, with a growing emphasis on catering to the preferences of high-spending Chinese and other Asian tourists. This influences product offerings and marketing strategies.

M&A Trends: The historical period (2019-2024) saw a moderate level of M&A activity, with strategic acquisitions focused on expanding product portfolios and geographic reach. The forecast period is expected to see continued consolidation, with larger players looking to acquire smaller, specialized businesses. The volume of M&A deals is predicted to reach xx in 2025.

Japan Travel Retail Industry Growth Trends & Insights

The Japan travel retail market witnessed significant fluctuations between 2019 and 2024, largely influenced by the COVID-19 pandemic and subsequent travel restrictions. The market experienced a sharp decline in 2020 and 2021, followed by a gradual recovery in 2022. The easing of travel restrictions and the resumption of international tourism in 2023 significantly boosted market growth.

The market is expected to show a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). This growth will be driven by increased inbound tourism, expanding product categories, and the adoption of innovative retail technologies. Market penetration of premium brands and experiences is expected to increase substantially. Technological disruptions, such as the growing popularity of online pre-ordering and personalized shopping experiences, will further shape the market's evolution. Shifts in consumer behavior, including a heightened demand for luxury goods and personalized services, will also significantly influence the market’s growth trajectory.

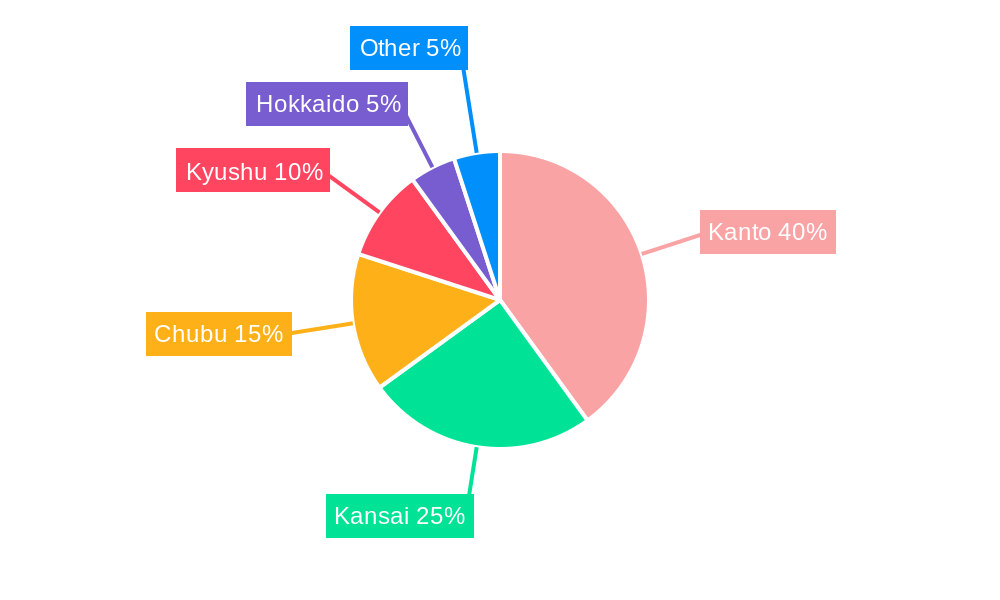

Dominant Regions, Countries, or Segments in Japan Travel Retail Industry

The major airports in major metropolitan areas like Tokyo (Narita and Haneda) and Kansai International Airport are the key growth drivers, accounting for a significant share of the overall market revenue. These airports benefit from high passenger traffic and a concentration of duty-free shops and retail outlets.

Key Drivers:

- High passenger traffic at major airports

- Strong focus on luxury goods and premium experiences

- Government initiatives promoting tourism

- Development of advanced retail infrastructure

Dominance Factors:

- Strategic location of retail spaces within airports and transit hubs.

- High concentration of luxury brands and exclusive product offerings.

- Effective marketing and promotional campaigns targeting international tourists.

- Strong partnerships between retailers and airlines or airport authorities.

The market share of major airports is expected to remain significant throughout the forecast period, driven by continued investments in airport infrastructure and growing international passenger numbers. Other regions might show moderate growth, particularly those with increasing tourism.

Japan Travel Retail Industry Product Landscape

The product landscape is diverse, encompassing cosmetics and fragrances, spirits and wines, confectionery, luxury goods, and electronics. Innovation focuses on premiumization, personalization, and unique experiences. Brands leverage technology to enhance customer engagement through interactive displays, mobile apps, and personalized recommendations. The focus is on creating exclusive travel retail products, packaging, and limited edition items to enhance the shopping experience and increase perceived value.

Key Drivers, Barriers & Challenges in Japan Travel Retail Industry

Key Drivers:

- Increased Inbound Tourism: The resurgence of international travel following the pandemic is a major driver.

- Rising Disposable Incomes: Higher purchasing power among both domestic and international travelers fuels spending.

- Technological Advancements: Omnichannel strategies and personalized shopping enhance customer experience and sales.

Key Challenges & Restraints:

- Global Economic Uncertainty: Recessions and currency fluctuations can dampen consumer spending.

- Supply Chain Disruptions: Global logistics challenges and potential shortages impact product availability.

- Intense Competition: Both established players and new entrants compete fiercely for market share. This pressure reduces margins.

Emerging Opportunities in Japan Travel Retail Industry

Emerging opportunities include:

- Leveraging Technology: Implementing augmented reality (AR) experiences, personalized recommendations, and mobile payment systems.

- Targeting Niche Markets: Focusing on specific demographics or product categories (e.g., sustainable products, Japanese craft goods).

- Expanding into Regional Airports: Capitalizing on growth in smaller, less-saturated airports.

Growth Accelerators in the Japan Travel Retail Industry Industry

Several factors will drive long-term growth. These include sustained investments in airport infrastructure, expansion of luxury and premium brands, the increasing adoption of omnichannel strategies, and a focus on enhancing customer experiences through innovative technologies and personalized services. Strategic partnerships between retailers, airlines, and airport authorities will also play a critical role in driving future market growth.

Key Players Shaping the Japan Travel Retail Industry Market

- Lagardere

- Shiseido

- DFS

- Lotte Duty Free

- ANA Festa

- LOFT

- HIS Group

- Daiso

- Jalux

- Fa-So-La

- TIAT Duty Free

- Donki

Notable Milestones in Japan Travel Retail Industry Sector

- October 2022: Lotte Duty-Free Retail expanded its South Korean operations due to Japan's visa-free travel policy opening, boosting sales in both markets.

- February 2023: Shiseido Travel Retail launched its Baum brand in travel retail at Japan Duty-Free Ginza, expanding its presence in the premium skincare segment.

In-Depth Japan Travel Retail Industry Market Outlook

The future of the Japan travel retail market is promising, with significant growth potential driven by continued increases in inbound tourism, expansion of product offerings, and adoption of innovative technologies. Strategic partnerships and investments in omnichannel retail strategies will be crucial for success. The market's long-term prospects remain positive, anticipating a sustained period of growth and expansion, particularly in the premium and luxury segments.

Japan Travel Retail Industry Segmentation

-

1. Product Type

- 1.1. Fashion and Accessories

- 1.2. Wine and Spirits

- 1.3. Tobacco

- 1.4. Food and Confectionary

- 1.5. Fragrances and Cosmetics

- 1.6. Other Pr

-

2. Distribution Channel

- 2.1. Airports

- 2.2. Airlines

- 2.3. Ferries

- 2.4. Other Distribution Channels

Japan Travel Retail Industry Segmentation By Geography

- 1. Japan

Japan Travel Retail Industry Regional Market Share

Geographic Coverage of Japan Travel Retail Industry

Japan Travel Retail Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Tourism Growth is Driving the Market; Airport Expansions is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Tourism Growth is Driving the Market; Airport Expansions is Driving the Market

- 3.4. Market Trends

- 3.4.1. Rising International Tourist Arrivals to Japan is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Travel Retail Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Fashion and Accessories

- 5.1.2. Wine and Spirits

- 5.1.3. Tobacco

- 5.1.4. Food and Confectionary

- 5.1.5. Fragrances and Cosmetics

- 5.1.6. Other Pr

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Airports

- 5.2.2. Airlines

- 5.2.3. Ferries

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lagardere

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Shiseido

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 DFS

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lotte Duty Free

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 ANA Festa

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 LOFT

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 HIS Group

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daiso

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Jalux

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Fa-So-La

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 TIAT Duty Free

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Donki**List Not Exhaustive

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 Lagardere

List of Figures

- Figure 1: Japan Travel Retail Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Japan Travel Retail Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Japan Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Japan Travel Retail Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Japan Travel Retail Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 5: Japan Travel Retail Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 6: Japan Travel Retail Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Travel Retail Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Japan Travel Retail Industry?

Key companies in the market include Lagardere, Shiseido, DFS, Lotte Duty Free, ANA Festa, LOFT, HIS Group, Daiso, Jalux, Fa-So-La, TIAT Duty Free, Donki**List Not Exhaustive.

3. What are the main segments of the Japan Travel Retail Industry?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 19.9 billion as of 2022.

5. What are some drivers contributing to market growth?

Tourism Growth is Driving the Market; Airport Expansions is Driving the Market.

6. What are the notable trends driving market growth?

Rising International Tourist Arrivals to Japan is Driving the Market.

7. Are there any restraints impacting market growth?

Tourism Growth is Driving the Market; Airport Expansions is Driving the Market.

8. Can you provide examples of recent developments in the market?

February 2023: Shiseido Travel Retail has launched the Japanese skin and mind brand, Baum, in travel retail with the opening of its first counter with Japan Duty-Free Ginza at Mitsukoshi Ginza Department Store in downtown Tokyo.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Travel Retail Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Travel Retail Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Travel Retail Industry?

To stay informed about further developments, trends, and reports in the Japan Travel Retail Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence