Key Insights

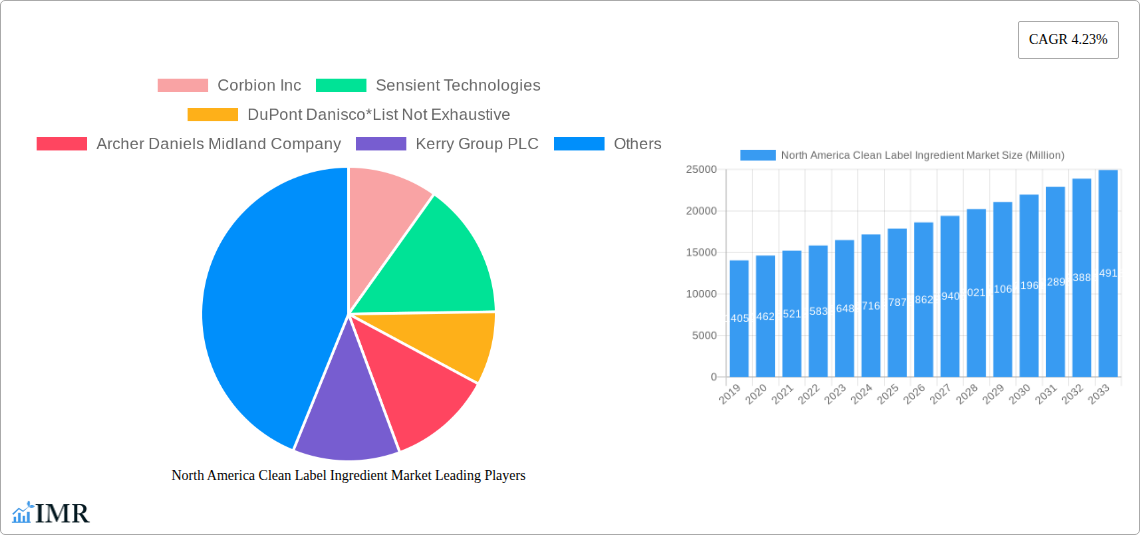

The North American clean label ingredient market is poised for significant expansion, projected to reach approximately $18,000 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.23%. This growth is primarily propelled by a confluence of factors, including escalating consumer demand for natural and minimally processed food products, a heightened awareness of ingredient transparency, and a growing preference for foods free from artificial additives, preservatives, and synthetic colors and flavors. Manufacturers are increasingly prioritizing the reformulation of their products to align with these evolving consumer expectations, driving innovation and investment in clean label solutions. Key segments fueling this surge include colorants, flavors and flavor enhancers, and food sweeteners, reflecting the desire for appealing yet wholesome food and beverage options. The beverage sector, in particular, stands as a major application, followed closely by bakery and confectionery, and dairy and frozen desserts, all seeking to cater to the discerning palates of health-conscious consumers.

North America Clean Label Ingredient Market Market Size (In Billion)

The market's trajectory is further shaped by key trends such as the rise of plant-based ingredients, the adoption of natural preservatives derived from sources like fermentation and plant extracts, and the increasing use of natural sweeteners like stevia and monk fruit. These trends underscore a broader shift towards sustainable and ethically sourced ingredients. However, the market also faces certain restraints, including the higher cost associated with sourcing and processing natural ingredients compared to their synthetic counterparts, potential challenges in achieving desired product stability and shelf-life with natural alternatives, and the complexity of navigating evolving regulatory landscapes across North America. Despite these hurdles, the overwhelming consumer push for healthier, transparently sourced food products ensures a dynamic and growing landscape for clean label ingredients.

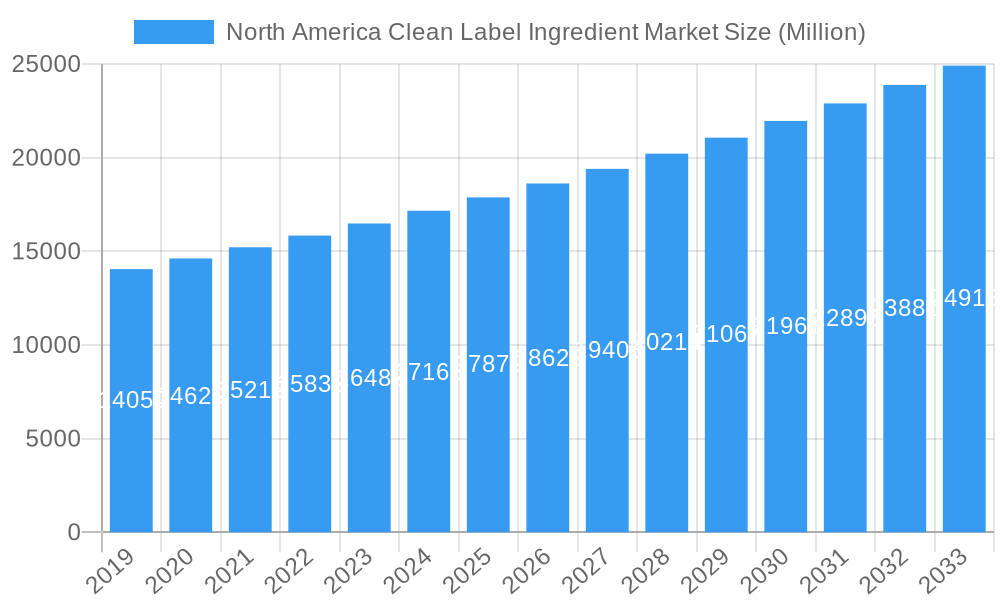

North America Clean Label Ingredient Market Company Market Share

North America Clean Label Ingredient Market: Comprehensive Analysis and Future Outlook

This report offers an in-depth analysis of the North America Clean Label Ingredient Market, covering a study period from 2019 to 2033, with a base and estimated year of 2025 and a forecast period from 2025 to 2033. We delve into market dynamics, growth trends, dominant segments, product landscape, key drivers, barriers, challenges, emerging opportunities, growth accelerators, and the key players shaping this evolving industry. Values are presented in Million Units.

North America Clean Label Ingredient Market Market Dynamics & Structure

The North America Clean Label Ingredient Market exhibits a moderately concentrated structure, with a blend of large multinational corporations and specialized ingredient manufacturers vying for market share. Technological innovation is a primary driver, fueled by ongoing research into natural sourcing, advanced extraction techniques, and the development of bio-based ingredients. Regulatory frameworks, primarily driven by consumer demand for transparency and safety, continue to evolve, influencing ingredient choices and production processes. Competitive product substitutes are abundant, ranging from synthetic alternatives to a growing array of naturally derived options, necessitating continuous innovation and cost-effectiveness from clean label ingredient providers. End-user demographics show a significant shift towards health-conscious consumers, particularly millennials and Gen Z, who prioritize natural, recognizable, and minimally processed ingredients. Mergers and Acquisitions (M&A) trends indicate strategic consolidation and expansion, with companies acquiring smaller players to broaden their clean label portfolios and technological capabilities.

- Market Concentration: Moderately concentrated, with key players holding significant market share.

- Technological Innovation Drivers: Natural sourcing, advanced extraction, bio-based ingredients, improved processing.

- Regulatory Frameworks: Focus on transparency, safety standards, natural claims validation.

- Competitive Product Substitutes: Wide range from synthetic to natural, requiring differentiation.

- End-User Demographics: Health-conscious, prioritizing natural, recognizable ingredients.

- M&A Trends: Strategic acquisitions for portfolio expansion and technology access.

North America Clean Label Ingredient Market Growth Trends & Insights

The North America Clean Label Ingredient Market is poised for robust growth, driven by a confluence of consumer demand, regulatory support, and technological advancements. The market size is projected to expand significantly from an estimated USD XX Million in 2025, reflecting a Compound Annual Growth Rate (CAGR) of XX% during the forecast period of 2025–2033. Adoption rates of clean label ingredients are accelerating across various food and beverage applications as manufacturers respond to escalating consumer preferences for "free-from" claims and shorter ingredient lists. Technological disruptions are playing a pivotal role, with innovations in fermentation, enzyme technology, and plant-based ingredient development enabling the creation of effective and sustainable clean label solutions. Consumer behavior shifts are the cornerstone of this market's expansion; an increasing number of consumers are actively scrutinizing ingredient labels, seeking products perceived as healthier, safer, and more environmentally friendly. This heightened awareness directly translates into a higher demand for ingredients that are perceived as natural, organic, non-GMO, and free from artificial additives. The market penetration of clean label solutions is expanding beyond niche segments into mainstream food and beverage categories, indicating a fundamental shift in product formulation strategies. Market participants are investing heavily in research and development to meet these evolving demands, focusing on taste, texture, shelf-life, and cost-effectiveness while adhering to clean label principles. Furthermore, the growing emphasis on supply chain transparency and traceability is encouraging the adoption of ingredients with verifiable origins.

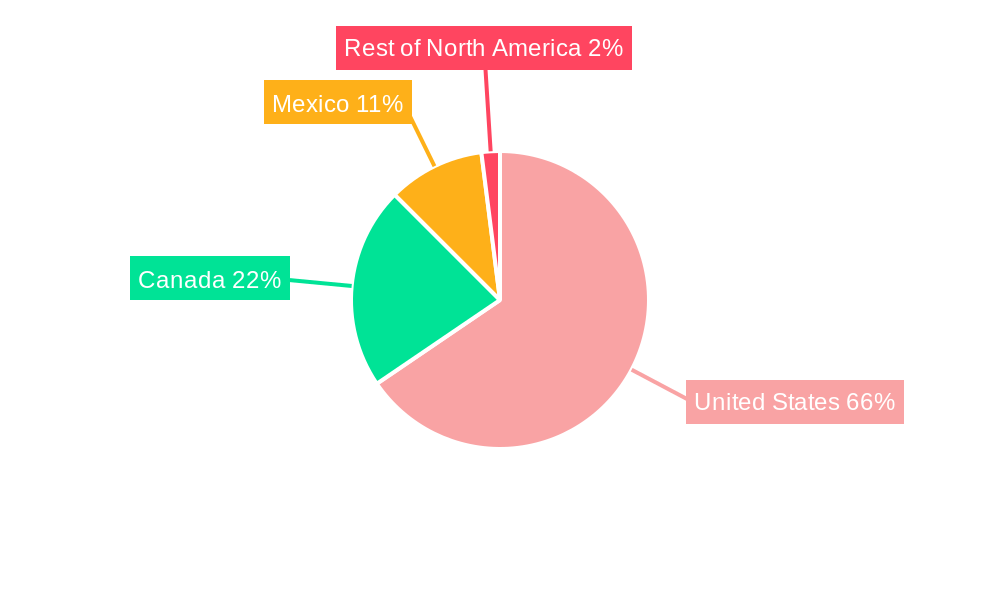

Dominant Regions, Countries, or Segments in North America Clean Label Ingredient Market

The United States stands as the dominant region within the North America Clean Label Ingredient Market, accounting for a substantial XX% of the total market value in 2025. This dominance is attributed to several key factors, including a large and health-conscious consumer base, a highly developed food and beverage industry, and a robust regulatory environment that supports the adoption of clean label practices. The strong presence of major food manufacturers and the presence of leading ingredient suppliers further bolster its leading position.

Key Drivers of Dominance in the United States:

- High Consumer Awareness and Demand: A significant portion of the US population actively seeks out products with clean ingredient labels.

- Well-Established Food and Beverage Industry: The sheer volume of food and beverage production in the US necessitates a strong demand for a wide array of ingredients.

- Supportive Regulatory Landscape: Evolving regulations and consumer protection initiatives encourage greater transparency in ingredient sourcing and labeling.

- Presence of Major Food Corporations: Leading food and beverage companies headquartered in the US are actively reformulating products with clean label ingredients.

- Advanced Research and Development Capabilities: Significant investment in R&D by both ingredient manufacturers and food companies drives innovation in clean label solutions.

Among the ingredient types, Flavors and Flavor Enhancers are projected to exhibit the highest growth and command a significant market share, estimated at USD XX Million in 2025. This is driven by the consumer's desire for natural taste profiles and the challenge of replicating desirable flavors without synthetic additives. In terms of applications, the Beverage segment is expected to remain the largest, valued at USD XX Million in 2025, due to the widespread adoption of clean label principles in juices, functional beverages, and ready-to-drink options. The Bakery and Confectionery segment also presents substantial growth opportunities, as manufacturers strive to offer perceived healthier alternatives. Mexico and Canada, while smaller markets, are experiencing significant growth, driven by increasing consumer awareness and the influence of US market trends.

North America Clean Label Ingredient Market Product Landscape

The product landscape of the North America Clean Label Ingredient Market is characterized by innovation focused on delivering natural alternatives that match or exceed the performance of conventional ingredients. Key product categories include natural colorants derived from fruits, vegetables, and botanicals, offering vibrant hues without synthetic dyes. Natural flavors and flavor enhancers, extracted from sources like herbs, spices, and yeast, are crucial for achieving desired taste profiles. Clean label sweeteners, such as stevia, monk fruit, and sugar alcohols, are gaining traction as sugar reduction trends continue. Preservatives are evolving from synthetic options to natural alternatives like cultured ingredients, rosemary extract, and tocopherols, extending shelf-life while maintaining a clean label. The market also sees a surge in "other" ingredients, including plant-based proteins, fibers, and functional ingredients derived from natural sources. Technological advancements are enabling enhanced functionality, improved stability, and cost-effectiveness for these clean label solutions, making them increasingly viable for widespread adoption across diverse food and beverage applications.

Key Drivers, Barriers & Challenges in North America Clean Label Ingredient Market

The North America Clean Label Ingredient Market is propelled by a powerful surge in consumer demand for healthier, more transparent food options. This trend is amplified by increasing awareness of the potential health risks associated with artificial ingredients and a growing desire for "real food" experiences. Regulatory bodies are increasingly aligning with these consumer preferences, fostering an environment conducive to clean label adoption. Technologically, advancements in sourcing, extraction, and processing of natural ingredients are making them more accessible and cost-effective. Strategic investments by major food corporations in clean label initiatives signal a strong industry commitment.

However, the market faces significant barriers and challenges. The primary challenge is the cost premium often associated with natural ingredients compared to their synthetic counterparts, impacting price-sensitive consumers and manufacturers. Supply chain complexities for certain natural ingredients can lead to variability in quality and availability. Replication of functionality (e.g., texture, shelf-life, intense flavors) using only natural ingredients remains a technical hurdle for some applications. Consumer perception and education also play a role, as some may equate "natural" with inferior performance or shorter shelf life. Navigating diverse and evolving labeling regulations across different jurisdictions can also be complex for manufacturers.

Emerging Opportunities in North America Clean Label Ingredient Market

Emerging opportunities in the North America Clean Label Ingredient Market lie in the development of novel, high-performance natural ingredients that address specific formulation challenges. The growing demand for plant-based and vegan alternatives presents a significant avenue for innovation in clean label proteins, fats, and binders. There's a burgeoning interest in upcycled ingredients, utilizing byproducts from other food processing streams to create sustainable and clean label solutions. Furthermore, opportunities exist in developing fortified clean label ingredients that offer enhanced nutritional benefits, catering to health-conscious consumers seeking both transparency and added value. The expansion of clean label solutions into specialty food categories, such as infant nutrition and medical foods, also represents a significant untapped market.

Growth Accelerators in the North America Clean Label Ingredient Market Industry

Several catalysts are accelerating the growth of the North America Clean Label Ingredient Market. Technological breakthroughs in biotechnology and food science are continuously expanding the palette of available natural ingredients and improving their functional properties. Strategic partnerships and collaborations between ingredient suppliers, food manufacturers, and research institutions are fostering innovation and accelerating product development cycles. Market expansion strategies, including targeting emerging markets and developing customized clean label solutions for specific regional preferences, are further driving growth. The increasing focus on sustainability and ethical sourcing within the food industry also acts as a growth accelerator, as clean label ingredients often align with these values.

Key Players Shaping the North America Clean Label Ingredient Market Market

- Corbion Inc

- Sensient Technologies

- DuPont Danisco

- Archer Daniels Midland Company

- Kerry Group PLC

- Koninklijke DSM NV

- Cargill Inc

- Ingredion Incorporated

- Tate & Lyle

Notable Milestones in North America Clean Label Ingredient Market Sector

- 2020: Increased investment in R&D for natural preservatives and shelf-life extenders.

- 2021: Growing adoption of plant-based protein isolates in the bakery and confectionery sectors.

- 2022: Several major food manufacturers announce commitments to removing artificial colors and flavors.

- 2023: Advancements in fermentation technology lead to new natural flavor enhancers.

- 2024: Increased focus on traceability and transparency in the supply chain for clean label ingredients.

In-Depth North America Clean Label Ingredient Market Market Outlook

The outlook for the North America Clean Label Ingredient Market remains exceptionally bright, driven by a sustained and intensifying consumer demand for transparent, healthier food options. Growth accelerators, including ongoing technological advancements in natural ingredient processing and the strategic expansion of companies into niche applications, are poised to fuel further market penetration. The increasing emphasis on sustainability and the circular economy will also favor clean label ingredients with verifiable eco-friendly sourcing. Strategic partnerships and the continuous innovation pipeline from key players will ensure that the market is well-equipped to meet evolving consumer expectations and regulatory landscapes, promising sustained growth and significant opportunities for market participants in the coming years.

North America Clean Label Ingredient Market Segmentation

-

1. Ingredient Type

- 1.1. Colorants

- 1.2. Flavors and Flavor Enhancers

- 1.3. Food Sweeteners

- 1.4. Preservatives

- 1.5. Others

-

2. Application

- 2.1. Beverage

- 2.2. Bakery and Confectionery

- 2.3. Sauce and Condiment

- 2.4. Dairy and Frozen Dessert

- 2.5. Other Processed Foods

-

3. Geography

- 3.1. United States

- 3.2. Canada

- 3.3. Mexico

- 3.4. Rest of North America

North America Clean Label Ingredient Market Segmentation By Geography

- 1. United States

- 2. Canada

- 3. Mexico

- 4. Rest of North America

North America Clean Label Ingredient Market Regional Market Share

Geographic Coverage of North America Clean Label Ingredient Market

North America Clean Label Ingredient Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Demand for Processed Foods; Strategic Initiatives by Companies Uplifting Market Growth

- 3.3. Market Restrains

- 3.3.1. Availability of Substitute Products

- 3.4. Market Trends

- 3.4.1. Health Issues Associated with the Use of Artificial Food Additives

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Clean Label Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 5.1.1. Colorants

- 5.1.2. Flavors and Flavor Enhancers

- 5.1.3. Food Sweeteners

- 5.1.4. Preservatives

- 5.1.5. Others

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. Beverage

- 5.2.2. Bakery and Confectionery

- 5.2.3. Sauce and Condiment

- 5.2.4. Dairy and Frozen Dessert

- 5.2.5. Other Processed Foods

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. United States

- 5.3.2. Canada

- 5.3.3. Mexico

- 5.3.4. Rest of North America

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. United States

- 5.4.2. Canada

- 5.4.3. Mexico

- 5.4.4. Rest of North America

- 5.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6. United States North America Clean Label Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 6.1.1. Colorants

- 6.1.2. Flavors and Flavor Enhancers

- 6.1.3. Food Sweeteners

- 6.1.4. Preservatives

- 6.1.5. Others

- 6.2. Market Analysis, Insights and Forecast - by Application

- 6.2.1. Beverage

- 6.2.2. Bakery and Confectionery

- 6.2.3. Sauce and Condiment

- 6.2.4. Dairy and Frozen Dessert

- 6.2.5. Other Processed Foods

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. United States

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.4. Rest of North America

- 6.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7. Canada North America Clean Label Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 7.1.1. Colorants

- 7.1.2. Flavors and Flavor Enhancers

- 7.1.3. Food Sweeteners

- 7.1.4. Preservatives

- 7.1.5. Others

- 7.2. Market Analysis, Insights and Forecast - by Application

- 7.2.1. Beverage

- 7.2.2. Bakery and Confectionery

- 7.2.3. Sauce and Condiment

- 7.2.4. Dairy and Frozen Dessert

- 7.2.5. Other Processed Foods

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. United States

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.4. Rest of North America

- 7.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8. Mexico North America Clean Label Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 8.1.1. Colorants

- 8.1.2. Flavors and Flavor Enhancers

- 8.1.3. Food Sweeteners

- 8.1.4. Preservatives

- 8.1.5. Others

- 8.2. Market Analysis, Insights and Forecast - by Application

- 8.2.1. Beverage

- 8.2.2. Bakery and Confectionery

- 8.2.3. Sauce and Condiment

- 8.2.4. Dairy and Frozen Dessert

- 8.2.5. Other Processed Foods

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. United States

- 8.3.2. Canada

- 8.3.3. Mexico

- 8.3.4. Rest of North America

- 8.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9. Rest of North America North America Clean Label Ingredient Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 9.1.1. Colorants

- 9.1.2. Flavors and Flavor Enhancers

- 9.1.3. Food Sweeteners

- 9.1.4. Preservatives

- 9.1.5. Others

- 9.2. Market Analysis, Insights and Forecast - by Application

- 9.2.1. Beverage

- 9.2.2. Bakery and Confectionery

- 9.2.3. Sauce and Condiment

- 9.2.4. Dairy and Frozen Dessert

- 9.2.5. Other Processed Foods

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. United States

- 9.3.2. Canada

- 9.3.3. Mexico

- 9.3.4. Rest of North America

- 9.1. Market Analysis, Insights and Forecast - by Ingredient Type

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 Corbion Inc

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 Sensient Technologies

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 DuPont Danisco*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Archer Daniels Midland Company

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Kerry Group PLC

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Koninklijke DSM NV

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Cargill Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Ingredion Incorporated

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Tate & Lyle

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 Corbion Inc

List of Figures

- Figure 1: North America Clean Label Ingredient Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: North America Clean Label Ingredient Market Share (%) by Company 2025

List of Tables

- Table 1: North America Clean Label Ingredient Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 2: North America Clean Label Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 3: North America Clean Label Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 4: North America Clean Label Ingredient Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: North America Clean Label Ingredient Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 6: North America Clean Label Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 7: North America Clean Label Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: North America Clean Label Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: North America Clean Label Ingredient Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 10: North America Clean Label Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 11: North America Clean Label Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 12: North America Clean Label Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: North America Clean Label Ingredient Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 14: North America Clean Label Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 15: North America Clean Label Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 16: North America Clean Label Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 17: North America Clean Label Ingredient Market Revenue undefined Forecast, by Ingredient Type 2020 & 2033

- Table 18: North America Clean Label Ingredient Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 19: North America Clean Label Ingredient Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 20: North America Clean Label Ingredient Market Revenue undefined Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Clean Label Ingredient Market?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the North America Clean Label Ingredient Market?

Key companies in the market include Corbion Inc, Sensient Technologies, DuPont Danisco*List Not Exhaustive, Archer Daniels Midland Company, Kerry Group PLC, Koninklijke DSM NV, Cargill Inc, Ingredion Incorporated, Tate & Lyle.

3. What are the main segments of the North America Clean Label Ingredient Market?

The market segments include Ingredient Type, Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Rising Demand for Processed Foods; Strategic Initiatives by Companies Uplifting Market Growth.

6. What are the notable trends driving market growth?

Health Issues Associated with the Use of Artificial Food Additives.

7. Are there any restraints impacting market growth?

Availability of Substitute Products.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Clean Label Ingredient Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Clean Label Ingredient Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Clean Label Ingredient Market?

To stay informed about further developments, trends, and reports in the North America Clean Label Ingredient Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence