Key Insights

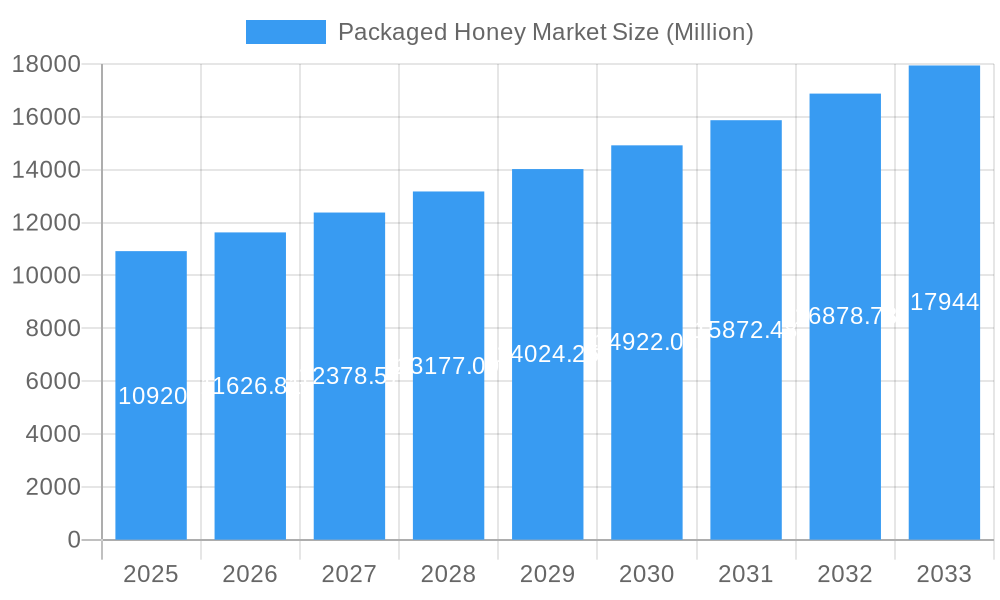

The global Packaged Honey Market is poised for robust growth, projected to reach USD 10.92 billion. This expansion is fueled by an anticipated Compound Annual Growth Rate (CAGR) of 6.43% between 2025 and 2033. A significant driver for this market is the increasing consumer preference for natural and healthy food options, with packaged honey offering a convenient and perceived healthier alternative to refined sugars. The rising awareness of honey's nutritional benefits, coupled with its versatility in culinary applications and its use in traditional medicine and skincare, further bolsters demand. The market's growth is also attributed to improved distribution channels, enhanced packaging technologies that ensure product quality and shelf-life, and the expanding retail landscape, especially in emerging economies. Furthermore, the growing trend of e-commerce has made a diverse range of packaged honey products more accessible to consumers worldwide.

Packaged Honey Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape, with conventional honey holding a dominant share, though organic honey is experiencing faster growth due to heightened consumer focus on sustainability and purity. In terms of packaging, PET bottles are widely adopted for their affordability and convenience, while glass jars cater to premium segments and consumer preference for traditional packaging. The competitive environment is characterized by the presence of both large multinational corporations and smaller regional players, including prominent names like Dabur India Ltd, Sioux Honey Association Co-op, and The J.M. Smucker Company. These companies are actively engaged in product innovation, strategic partnerships, and expanding their geographical reach to capture market share. Emerging trends such as the development of varietal honeys, functional honeys infused with superfoods, and sustainable packaging solutions are expected to shape the future trajectory of the packaged honey market.

Packaged Honey Market Company Market Share

This in-depth report provides a strategic overview and detailed forecast for the global Packaged Honey Market. Analyzing market dynamics, growth trends, regional dominance, product landscape, and key players, this study offers actionable insights for stakeholders aiming to capitalize on the evolving demand for packaged honey. With a focus on both conventional and organic segments, and various packaging types, this report encompasses the intricate parent and child market dynamics influencing this sector.

Packaged Honey Market Dynamics & Structure

The Packaged Honey Market exhibits a moderately concentrated structure, driven by a blend of established multinational corporations and regional players. Technological innovation primarily centers on enhancing shelf-life, developing specialized honey variants (e.g., infused, raw), and improving sustainable packaging solutions. Regulatory frameworks, including food safety standards and labeling requirements, play a crucial role in shaping market entry and product differentiation. Competitive product substitutes, such as artificial sweeteners and other natural sweeteners, pose a constant challenge, necessitating continuous innovation and marketing efforts to emphasize the unique health benefits and natural appeal of honey. End-user demographics reveal a growing preference among health-conscious consumers, millennials, and urban populations seeking convenient and premium food products. Mergers and acquisitions (M&A) trends are moderately active, with larger players seeking to expand their product portfolios, geographical reach, and supply chain control. For instance, acquisitions of smaller, niche honey producers or ingredient suppliers can significantly impact market share. Innovation barriers include the fluctuating availability and quality of raw honey due to climatic factors, as well as the capital investment required for advanced processing and packaging technologies. The market size for packaged honey was approximately USD 8,500 Million units in 2024, with M&A deal volumes averaging 3-5 significant transactions annually over the historical period.

Packaged Honey Market Growth Trends & Insights

The Packaged Honey Market is poised for robust growth, driven by an escalating consumer focus on health and wellness, coupled with an increasing preference for natural and minimally processed food products. The market size for packaged honey has demonstrated a consistent upward trajectory, expanding from an estimated USD 7,200 Million units in 2019 to approximately USD 8,500 Million units in 2024. Projections indicate a Compound Annual Growth Rate (CAGR) of approximately 4.5% to 5.5% during the forecast period of 2025–2033. Adoption rates for premium and organic honey varieties are particularly high, reflecting a willingness among consumers to pay a premium for perceived health benefits and ethical sourcing. Technological disruptions are emerging in areas such as advanced filtration techniques that preserve the natural enzymes and antioxidants in honey, as well as smart packaging solutions that offer enhanced traceability and information to consumers. Consumer behavior shifts are characterized by a growing demand for transparency in sourcing, a desire for honey varieties with distinct flavor profiles, and an increased inclination towards online purchasing channels. The penetration of packaged honey in emerging economies is also on the rise, fueled by rising disposable incomes and greater awareness of honey's health properties. The market is witnessing a surge in demand for honey as a natural sweetener and functional food ingredient, moving beyond its traditional role as a simple condiment. This evolution necessitates continuous product development and strategic market positioning to capture these burgeoning consumer preferences.

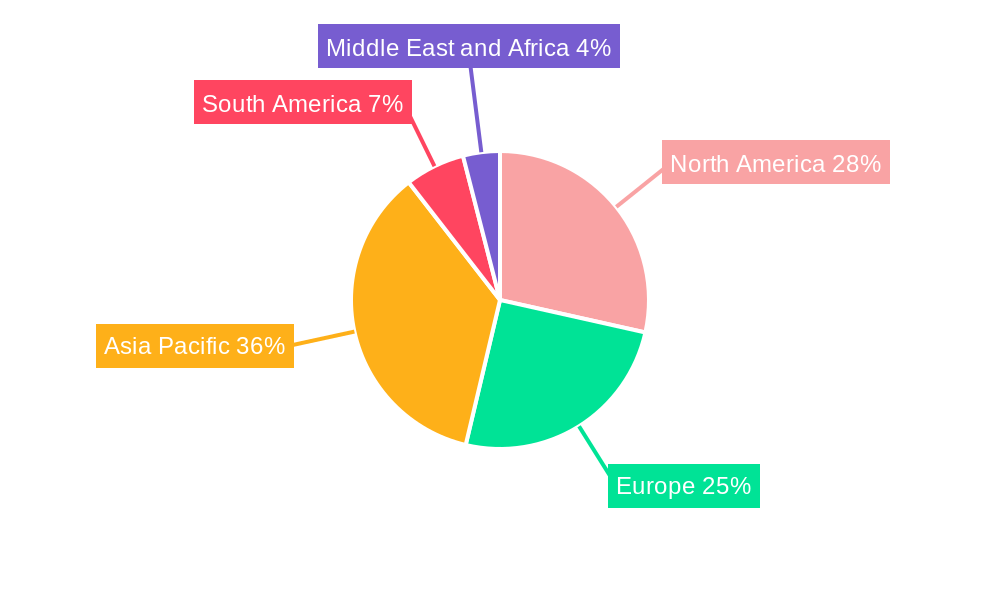

Dominant Regions, Countries, or Segments in Packaged Honey Market

The Conventional Product Category is currently the dominant segment within the Packaged Honey Market, accounting for an estimated 75% of the total market share in 2025. This dominance is underpinned by its widespread availability, broader appeal across diverse consumer demographics, and competitive pricing strategies. The Pet Bottles packaging type also holds a significant lead, representing approximately 45% of the market share, primarily due to its cost-effectiveness, durability, and convenience for on-the-go consumption, particularly in developing regions.

Key Drivers for Conventional Segment and Pet Bottle Dominance:

- Economic Accessibility: Lower production costs and pricing make conventional honey and pet bottle packaging more accessible to a larger consumer base, especially in price-sensitive markets.

- Widespread Distribution Networks: Established distribution channels and retail partnerships favor the broad availability of conventional honey products, ensuring easy access for consumers.

- Consumer Habit and Familiarity: Consumers are accustomed to the taste and packaging of conventional honey, making it a default choice for many households.

- Functional Benefits Awareness: While organic honey emphasizes purity, conventional honey is still widely recognized for its general health benefits, such as aiding digestion and providing energy.

- Logistical Advantages: Pet bottles are lightweight and less prone to breakage compared to glass, offering significant advantages in terms of transportation costs and reduced product damage across vast supply chains.

However, the Organic Product Category is exhibiting a much faster growth rate, with a projected CAGR of over 6.0% for the forecast period, indicating a significant shift in consumer preferences towards healthier and sustainably sourced options. The Glass Jars packaging type, while currently holding a smaller market share (estimated 30%), is experiencing substantial growth due to its premium appeal, perceived preservation of honey quality, and eco-friendly image. Countries in North America and Europe are leading the charge in organic honey consumption and the adoption of premium packaging like glass jars, driven by strong consumer demand for natural and premium food products, stringent regulations supporting organic certification, and higher disposable incomes. Asia-Pacific, particularly China and India, represents a significant growth opportunity for both conventional and organic packaged honey, driven by a burgeoning middle class and increasing health consciousness.

Packaged Honey Market Product Landscape

The Packaged Honey Market is witnessing a dynamic evolution in its product landscape, marked by a surge in product innovations and diverse applications. Manufacturers are focusing on differentiating their offerings through varietal honey, such as Manuka, Acacia, Buckwheat, and Wildflower, each boasting unique flavor profiles and purported health benefits. Raw, unfiltered, and minimally processed honey varieties are gaining traction, appealing to consumers seeking natural goodness. Furthermore, the market is seeing the introduction of honey infused with herbs, spices, and fruits, creating innovative flavor combinations for culinary and wellness applications. Performance metrics are increasingly tied to product purity, natural enzyme content, and specific therapeutic properties, as consumers become more discerning about the quality and origin of their honey. Technological advancements in processing and packaging are enabling manufacturers to maintain the natural integrity of honey while extending its shelf life and enhancing consumer convenience.

Key Drivers, Barriers & Challenges in Packaged Honey Market

Key Drivers:

- Growing Health and Wellness Consciousness: Increasing consumer awareness of honey's natural health benefits, including its antioxidant, antibacterial, and soothing properties, is a primary growth driver.

- Demand for Natural and Unprocessed Foods: A broader trend towards natural, minimally processed, and clean-label food products favors honey over artificial sweeteners.

- Versatile Applications: Honey's use extends beyond a sweetener to include ingredients in food and beverages, cosmetics, and traditional medicine, broadening its market appeal.

- Premiumization and Gifting Trends: High-quality and varietal honeys are increasingly positioned as premium products and popular gifting items, especially during festive seasons.

- Technological Advancements: Innovations in processing, filtration, and packaging enhance product quality, shelf-life, and consumer convenience.

Barriers & Challenges:

- Supply Chain Volatility and Climate Change: Fluctuations in honey production due to adverse weather conditions, disease affecting bee populations, and environmental changes can impact availability and price stability.

- Counterfeiting and Adulteration: The prevalence of fraudulent honey products can erode consumer trust and negatively affect the market for genuine honey.

- Intense Competition: The market faces competition from both established honey brands and a growing number of small-scale producers, as well as from substitute sweeteners.

- Regulatory Scrutiny: Stringent food safety regulations, labeling requirements, and quality standards can pose compliance challenges for manufacturers, particularly for smaller players.

- Price Sensitivity: While there's a premium segment, a significant portion of the market remains price-sensitive, making it challenging to pass on increased production costs. The estimated impact of supply chain disruptions on the global packaged honey market has ranged from 5-10% of annual revenue in recent years.

Emerging Opportunities in Packaged Honey Market

Emerging opportunities within the Packaged Honey Market lie in the burgeoning demand for specialty and functional honey varieties. This includes a growing interest in honey with specific medicinal properties, such as anti-inflammatory or digestive benefits, catering to a health-conscious consumer base. The development of sustainable and innovative packaging solutions, such as biodegradable materials or refillable options, aligns with increasing environmental awareness and presents a significant growth avenue. Furthermore, the direct-to-consumer (DTC) e-commerce channel offers a lucrative opportunity for brands to connect directly with consumers, build loyalty, and offer exclusive product lines. Untapped geographical markets in developing regions with rising disposable incomes also present substantial potential for market expansion. The rise of vegan honey alternatives, such as that from MeliBio, also signals an evolving consumer landscape, pushing for innovation and broader product offerings.

Growth Accelerators in the Packaged Honey Market Industry

The long-term growth of the Packaged Honey Market is being significantly accelerated by several key catalysts. Technological breakthroughs in bee health management and sustainable apiculture practices are crucial for ensuring a stable and high-quality supply of raw honey. Strategic partnerships between honey producers, ingredient manufacturers, and food and beverage companies are fostering innovation in product development and market penetration. For instance, collaborations on developing honey-based functional foods or beverages can unlock new consumer segments. Market expansion strategies, particularly targeting emerging economies with increasing disposable incomes and a growing awareness of natural health products, represent a substantial growth engine. Furthermore, the increasing adoption of traceability technologies, such as blockchain, is enhancing consumer trust and brand loyalty by providing transparent information about product origin and quality.

Key Players Shaping the Packaged Honey Market Market

- Dabur India Ltd

- Sweet Harvest Foods

- Sioux Honey Association Co-op

- Barkman Honey LLC

- Hive & Wellness Australia Pty Ltd

- Patanjali Ayurved Limited

- Bright Food Group co Ltd

- McCormick & Company Inc

- The J M Smucker Company

- Apis Group

Notable Milestones in Packaged Honey Market Sector

- January 2024: Dabur India Ltd. invested approximately INR 135 crore in expanding its manufacturing facility in South India, aiming to boost production capacity for flagship products like Dabur Honey. This expansion is expected to enhance supply chain efficiency and market reach.

- January 2024: APIS Honey launched Apis Organic Honey, sourced from Kashmir, offering products in attractive glass bottles across various retail channels in India. This move signifies a strategic focus on the growing organic segment and premium packaging.

- December 2023: Better Foodie, in collaboration with MeliBio, launched their award-winning 'Vegan H*ney' in approximately 200 UK retailers. This milestone highlights the emergence of innovative plant-based alternatives and caters to evolving dietary preferences.

In-Depth Packaged Honey Market Market Outlook

The future outlook for the Packaged Honey Market is exceptionally promising, driven by an interplay of escalating global health consciousness, a persistent demand for natural food ingredients, and continuous product innovation. Growth accelerators such as the development of specialized honey varietals catering to specific health benefits and the increasing consumer preference for sustainably sourced and ethically produced goods will continue to fuel market expansion. Strategic initiatives focused on enhancing supply chain resilience, combating adulteration through advanced authentication technologies, and tapping into the vast potential of emerging economies are critical for long-term success. The market is poised for significant growth, particularly within the organic and functional honey segments, alongside innovative packaging solutions that address both consumer convenience and environmental concerns. This forward momentum, coupled with strategic investments and evolving consumer preferences, paints a bright picture for the packaged honey industry in the coming years.

Packaged Honey Market Segmentation

-

1. Product Category

- 1.1. Conventional

- 1.2. Organic

-

2. Packaging Type

- 2.1. Pet Bottles

- 2.2. Glass Jars

- 2.3. Other Packaging Types

Packaged Honey Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. Germany

- 2.2. France

- 2.3. Russia

- 2.4. Spain

- 2.5. United Kingdom

- 2.6. Italy

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. Australia

- 3.5. Rest of Asia pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. South Africa

- 5.3. Rest of Middle East

Packaged Honey Market Regional Market Share

Geographic Coverage of Packaged Honey Market

Packaged Honey Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.43% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural Sweeteners; Government Initiatives Boost Honey Production and Beekeeping

- 3.3. Market Restrains

- 3.3.1. Increasing Demand for Natural Sweeteners; Government Initiatives Boost Honey Production and Beekeeping

- 3.4. Market Trends

- 3.4.1. Conventional Honey Is Consumed Globally

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Packaged Honey Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 5.1.1. Conventional

- 5.1.2. Organic

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Pet Bottles

- 5.2.2. Glass Jars

- 5.2.3. Other Packaging Types

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Product Category

- 6. North America Packaged Honey Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Category

- 6.1.1. Conventional

- 6.1.2. Organic

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Pet Bottles

- 6.2.2. Glass Jars

- 6.2.3. Other Packaging Types

- 6.1. Market Analysis, Insights and Forecast - by Product Category

- 7. Europe Packaged Honey Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Category

- 7.1.1. Conventional

- 7.1.2. Organic

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Pet Bottles

- 7.2.2. Glass Jars

- 7.2.3. Other Packaging Types

- 7.1. Market Analysis, Insights and Forecast - by Product Category

- 8. Asia Pacific Packaged Honey Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Category

- 8.1.1. Conventional

- 8.1.2. Organic

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Pet Bottles

- 8.2.2. Glass Jars

- 8.2.3. Other Packaging Types

- 8.1. Market Analysis, Insights and Forecast - by Product Category

- 9. South America Packaged Honey Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Category

- 9.1.1. Conventional

- 9.1.2. Organic

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Pet Bottles

- 9.2.2. Glass Jars

- 9.2.3. Other Packaging Types

- 9.1. Market Analysis, Insights and Forecast - by Product Category

- 10. Middle East and Africa Packaged Honey Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Category

- 10.1.1. Conventional

- 10.1.2. Organic

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Pet Bottles

- 10.2.2. Glass Jars

- 10.2.3. Other Packaging Types

- 10.1. Market Analysis, Insights and Forecast - by Product Category

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Dabur India Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Sweet Harvest Foods

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Sioux Honey Association Co-op

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Barkman Honey LLC

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Hive & Wellness Australia Pty Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Patanjali Ayurved Limited

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Bright Food Group co Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Mccormick & Company Inc

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 The J M Smucker Company

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Apis Group*List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Dabur India Ltd

List of Figures

- Figure 1: Global Packaged Honey Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Packaged Honey Market Volume Breakdown (Billion, %) by Region 2025 & 2033

- Figure 3: North America Packaged Honey Market Revenue (Million), by Product Category 2025 & 2033

- Figure 4: North America Packaged Honey Market Volume (Billion), by Product Category 2025 & 2033

- Figure 5: North America Packaged Honey Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 6: North America Packaged Honey Market Volume Share (%), by Product Category 2025 & 2033

- Figure 7: North America Packaged Honey Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 8: North America Packaged Honey Market Volume (Billion), by Packaging Type 2025 & 2033

- Figure 9: North America Packaged Honey Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 10: North America Packaged Honey Market Volume Share (%), by Packaging Type 2025 & 2033

- Figure 11: North America Packaged Honey Market Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Packaged Honey Market Volume (Billion), by Country 2025 & 2033

- Figure 13: North America Packaged Honey Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Packaged Honey Market Volume Share (%), by Country 2025 & 2033

- Figure 15: Europe Packaged Honey Market Revenue (Million), by Product Category 2025 & 2033

- Figure 16: Europe Packaged Honey Market Volume (Billion), by Product Category 2025 & 2033

- Figure 17: Europe Packaged Honey Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 18: Europe Packaged Honey Market Volume Share (%), by Product Category 2025 & 2033

- Figure 19: Europe Packaged Honey Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 20: Europe Packaged Honey Market Volume (Billion), by Packaging Type 2025 & 2033

- Figure 21: Europe Packaged Honey Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Europe Packaged Honey Market Volume Share (%), by Packaging Type 2025 & 2033

- Figure 23: Europe Packaged Honey Market Revenue (Million), by Country 2025 & 2033

- Figure 24: Europe Packaged Honey Market Volume (Billion), by Country 2025 & 2033

- Figure 25: Europe Packaged Honey Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Packaged Honey Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Asia Pacific Packaged Honey Market Revenue (Million), by Product Category 2025 & 2033

- Figure 28: Asia Pacific Packaged Honey Market Volume (Billion), by Product Category 2025 & 2033

- Figure 29: Asia Pacific Packaged Honey Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 30: Asia Pacific Packaged Honey Market Volume Share (%), by Product Category 2025 & 2033

- Figure 31: Asia Pacific Packaged Honey Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 32: Asia Pacific Packaged Honey Market Volume (Billion), by Packaging Type 2025 & 2033

- Figure 33: Asia Pacific Packaged Honey Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 34: Asia Pacific Packaged Honey Market Volume Share (%), by Packaging Type 2025 & 2033

- Figure 35: Asia Pacific Packaged Honey Market Revenue (Million), by Country 2025 & 2033

- Figure 36: Asia Pacific Packaged Honey Market Volume (Billion), by Country 2025 & 2033

- Figure 37: Asia Pacific Packaged Honey Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Asia Pacific Packaged Honey Market Volume Share (%), by Country 2025 & 2033

- Figure 39: South America Packaged Honey Market Revenue (Million), by Product Category 2025 & 2033

- Figure 40: South America Packaged Honey Market Volume (Billion), by Product Category 2025 & 2033

- Figure 41: South America Packaged Honey Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 42: South America Packaged Honey Market Volume Share (%), by Product Category 2025 & 2033

- Figure 43: South America Packaged Honey Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 44: South America Packaged Honey Market Volume (Billion), by Packaging Type 2025 & 2033

- Figure 45: South America Packaged Honey Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 46: South America Packaged Honey Market Volume Share (%), by Packaging Type 2025 & 2033

- Figure 47: South America Packaged Honey Market Revenue (Million), by Country 2025 & 2033

- Figure 48: South America Packaged Honey Market Volume (Billion), by Country 2025 & 2033

- Figure 49: South America Packaged Honey Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: South America Packaged Honey Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Middle East and Africa Packaged Honey Market Revenue (Million), by Product Category 2025 & 2033

- Figure 52: Middle East and Africa Packaged Honey Market Volume (Billion), by Product Category 2025 & 2033

- Figure 53: Middle East and Africa Packaged Honey Market Revenue Share (%), by Product Category 2025 & 2033

- Figure 54: Middle East and Africa Packaged Honey Market Volume Share (%), by Product Category 2025 & 2033

- Figure 55: Middle East and Africa Packaged Honey Market Revenue (Million), by Packaging Type 2025 & 2033

- Figure 56: Middle East and Africa Packaged Honey Market Volume (Billion), by Packaging Type 2025 & 2033

- Figure 57: Middle East and Africa Packaged Honey Market Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 58: Middle East and Africa Packaged Honey Market Volume Share (%), by Packaging Type 2025 & 2033

- Figure 59: Middle East and Africa Packaged Honey Market Revenue (Million), by Country 2025 & 2033

- Figure 60: Middle East and Africa Packaged Honey Market Volume (Billion), by Country 2025 & 2033

- Figure 61: Middle East and Africa Packaged Honey Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Middle East and Africa Packaged Honey Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Packaged Honey Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 2: Global Packaged Honey Market Volume Billion Forecast, by Product Category 2020 & 2033

- Table 3: Global Packaged Honey Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 4: Global Packaged Honey Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 5: Global Packaged Honey Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Packaged Honey Market Volume Billion Forecast, by Region 2020 & 2033

- Table 7: Global Packaged Honey Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 8: Global Packaged Honey Market Volume Billion Forecast, by Product Category 2020 & 2033

- Table 9: Global Packaged Honey Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 10: Global Packaged Honey Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 11: Global Packaged Honey Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Packaged Honey Market Volume Billion Forecast, by Country 2020 & 2033

- Table 13: United States Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 15: Canada Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 19: Rest of North America Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Rest of North America Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 21: Global Packaged Honey Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 22: Global Packaged Honey Market Volume Billion Forecast, by Product Category 2020 & 2033

- Table 23: Global Packaged Honey Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 24: Global Packaged Honey Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 25: Global Packaged Honey Market Revenue Million Forecast, by Country 2020 & 2033

- Table 26: Global Packaged Honey Market Volume Billion Forecast, by Country 2020 & 2033

- Table 27: Germany Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Germany Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 29: France Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: France Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 31: Russia Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Russia Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 33: Spain Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Spain Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 35: United Kingdom Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: United Kingdom Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 37: Italy Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Italy Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Rest of Europe Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 41: Global Packaged Honey Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 42: Global Packaged Honey Market Volume Billion Forecast, by Product Category 2020 & 2033

- Table 43: Global Packaged Honey Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 44: Global Packaged Honey Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 45: Global Packaged Honey Market Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Global Packaged Honey Market Volume Billion Forecast, by Country 2020 & 2033

- Table 47: India Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: India Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 49: China Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: China Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 51: Japan Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Japan Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 53: Australia Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Australia Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 55: Rest of Asia pacific Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 56: Rest of Asia pacific Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 57: Global Packaged Honey Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 58: Global Packaged Honey Market Volume Billion Forecast, by Product Category 2020 & 2033

- Table 59: Global Packaged Honey Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 60: Global Packaged Honey Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 61: Global Packaged Honey Market Revenue Million Forecast, by Country 2020 & 2033

- Table 62: Global Packaged Honey Market Volume Billion Forecast, by Country 2020 & 2033

- Table 63: Brazil Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Brazil Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 65: Argentina Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: Argentina Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 67: Rest of South America Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: Rest of South America Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 69: Global Packaged Honey Market Revenue Million Forecast, by Product Category 2020 & 2033

- Table 70: Global Packaged Honey Market Volume Billion Forecast, by Product Category 2020 & 2033

- Table 71: Global Packaged Honey Market Revenue Million Forecast, by Packaging Type 2020 & 2033

- Table 72: Global Packaged Honey Market Volume Billion Forecast, by Packaging Type 2020 & 2033

- Table 73: Global Packaged Honey Market Revenue Million Forecast, by Country 2020 & 2033

- Table 74: Global Packaged Honey Market Volume Billion Forecast, by Country 2020 & 2033

- Table 75: United Arab Emirates Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 76: United Arab Emirates Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 77: South Africa Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 78: South Africa Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

- Table 79: Rest of Middle East Packaged Honey Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: Rest of Middle East Packaged Honey Market Volume (Billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Packaged Honey Market?

The projected CAGR is approximately 6.43%.

2. Which companies are prominent players in the Packaged Honey Market?

Key companies in the market include Dabur India Ltd, Sweet Harvest Foods, Sioux Honey Association Co-op, Barkman Honey LLC, Hive & Wellness Australia Pty Ltd, Patanjali Ayurved Limited, Bright Food Group co Ltd, Mccormick & Company Inc, The J M Smucker Company, Apis Group*List Not Exhaustive.

3. What are the main segments of the Packaged Honey Market?

The market segments include Product Category, Packaging Type.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural Sweeteners; Government Initiatives Boost Honey Production and Beekeeping.

6. What are the notable trends driving market growth?

Conventional Honey Is Consumed Globally.

7. Are there any restraints impacting market growth?

Increasing Demand for Natural Sweeteners; Government Initiatives Boost Honey Production and Beekeeping.

8. Can you provide examples of recent developments in the market?

January 2024: Dabur, one of the leading firms in the Ayurvedic and personal care space, recently invested approximately INR 135 crore in expanding its manufacturing facility in South India. This move is geared toward bolstering the production capacity of its flagship products, including Dabur Honey, Dabur Red Paste, and Odonil air fresheners.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Packaged Honey Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Packaged Honey Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Packaged Honey Market?

To stay informed about further developments, trends, and reports in the Packaged Honey Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence