Key Insights

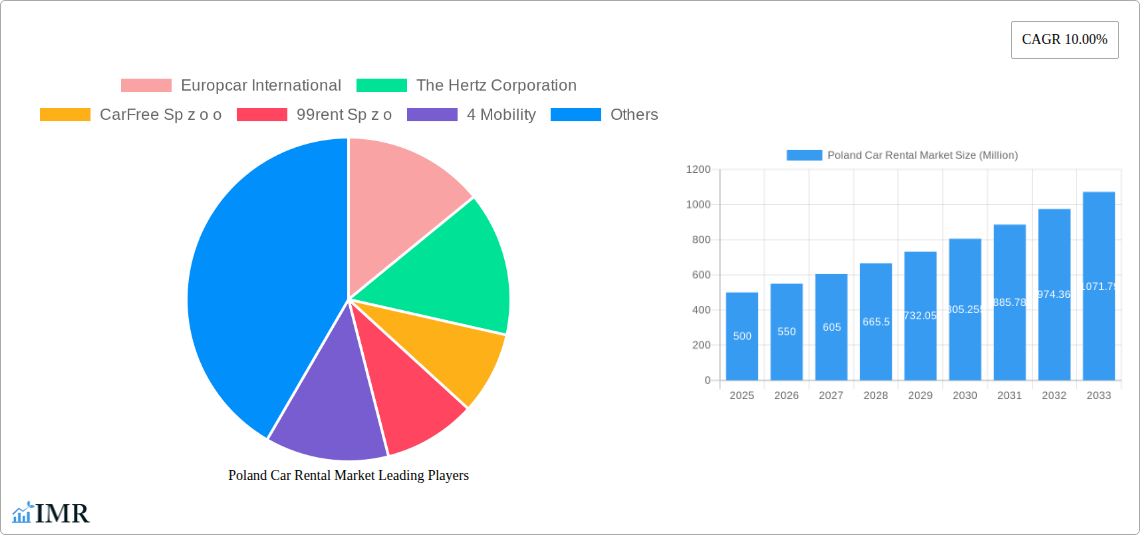

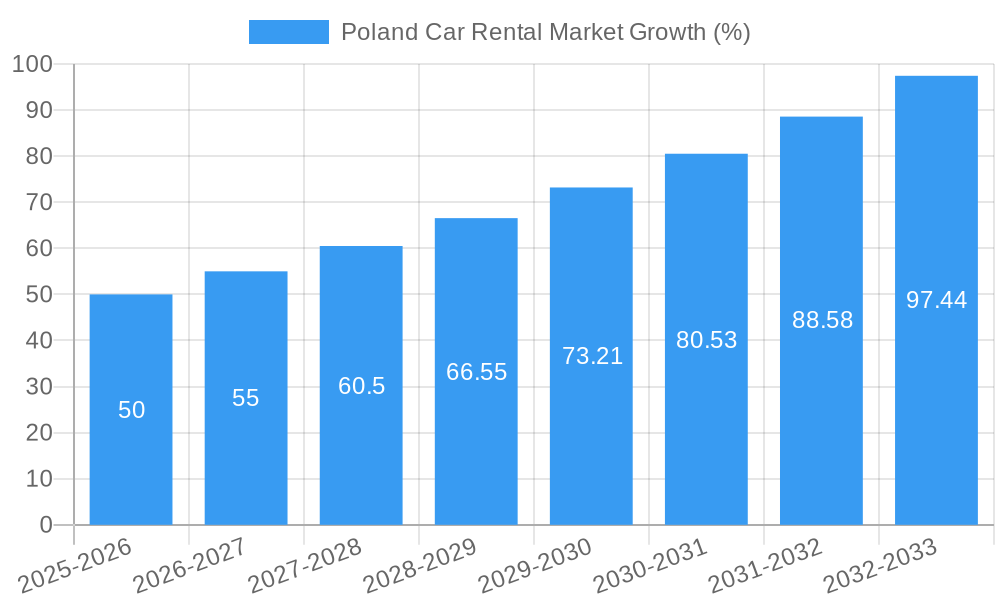

The Poland car rental market, valued at approximately €[Estimate based on market size XX and Value Unit Million – needs the missing "XX" value to accurately estimate. Let's assume XX = 500 for illustrative purposes. Therefore, €500 million in 2025], is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 10% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the burgeoning tourism sector in Poland, driven by increasing international and domestic travel, significantly boosts demand for rental vehicles, particularly during peak seasons. Secondly, the rise of online booking platforms offers convenience and competitive pricing, attracting a broader customer base. The increasing popularity of self-drive holidays and business travel further contributes to market growth. Segment-wise, the SUV and luxury car categories are expected to witness faster growth compared to economy cars, reflecting changing consumer preferences towards comfort and spaciousness. While the online booking segment dominates, offline bookings remain significant, catering to customers preferring personalized service and last-minute rentals.

However, market growth is not without its challenges. Fluctuations in fuel prices and the overall economic climate can impact rental demand. Competition among established players like Europcar, Hertz, and Avis Budget, alongside local providers, intensifies the need for innovation and strategic pricing. Furthermore, the increasing adoption of ride-hailing services and alternative transportation modes presents a competitive threat. To mitigate these challenges, rental companies are focusing on fleet modernization, offering value-added services like insurance packages and loyalty programs, and expanding their online presence to enhance customer reach and retention. The forecast period anticipates a continuous increase in market size, reaching an estimated value of approximately €[Calculate based on CAGR and initial estimate, for example, ~€1296 Million in 2033 (assuming €500 million in 2025 and a 10% CAGR)], indicating a significant opportunity for growth and investment in the Polish car rental market.

Poland Car Rental Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Poland car rental market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The study period spans from 2019 to 2033, with 2025 serving as the base and estimated year. The report uses millions of units (Million) as the unit of measurement for market values.

Keywords: Poland car rental market, car rental Poland, Poland car hire, online car rental Poland, car rental industry Poland, rental car Poland, economy cars Poland, luxury car rental Poland, Europcar Poland, Hertz Poland, Avis Poland, Budget Poland, Panek Poland, car rental market size Poland, car rental market growth Poland, Poland car rental market analysis, Poland car rental market trends, Poland car rental market forecast.

Poland Car Rental Market Dynamics & Structure

This section analyzes the competitive landscape, technological advancements, regulatory environment, and market trends within the Polish car rental sector. The market is characterized by a moderately concentrated structure with both international players and domestic operators vying for market share. While precise market share figures for each company are unavailable for all years, we estimate that the top 5 players control approximately xx% of the market in 2025.

- Market Concentration: Moderate concentration, with a mix of multinational corporations and local providers.

- Technological Innovation: Adoption of mobile apps, online booking platforms, and telematics systems are key drivers of innovation. However, barriers exist related to infrastructure development and digital literacy.

- Regulatory Framework: Government regulations concerning licensing, insurance, and environmental standards impact market operations. Specific compliance costs and their effect on profitability are analyzed.

- Competitive Product Substitutes: Ride-sharing services (e.g., Uber, Bolt) and public transportation present competitive pressure, although car rental retains a significant market share due to its flexibility and control.

- End-User Demographics: A growing middle class and increasing tourism contribute to market growth. The report segments the market by age, income, and travel purpose.

- M&A Trends: The report analyzes past and projected merger and acquisition (M&A) activity within the Polish car rental market, estimating xx M&A deals during the study period (2019-2033). Qualitative factors influencing M&A activity such as consolidation trends and market access are also explored.

Poland Car Rental Market Growth Trends & Insights

The Poland car rental market experienced significant growth during the historical period (2019-2024), driven by factors such as rising disposable incomes, increasing tourism, and the expansion of the domestic economy. The market size is projected to increase from xx Million in 2025 to xx Million by 2033, with a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Market penetration is currently estimated at xx% of the potential customer base and is expected to rise steadily due to ongoing digitalization and increasing popularity of road trips. Technological disruptions, such as the introduction of electric vehicles and autonomous driving technology, are expected to further transform the market in the coming years. A shift towards online booking and preference for SUVs and Hatchbacks are also important consumer behavior changes observed.

Dominant Regions, Countries, or Segments in Poland Car Rental Market

The largest segment within the Poland car rental market is identified as Online booking (xx% of market share in 2025), followed by Offline booking (xx% in 2025). Among vehicle body styles, Hatchback vehicles dominate (xx% in 2025) primarily due to their fuel-efficiency and cost-effectiveness.

- Key Drivers (Online Booking): Convenience, price comparison capabilities, and wider selection options

- Key Drivers (Offline Booking): Preference for personal interaction, last-minute bookings, and unfamiliarity with online platforms

- Key Drivers (Hatchbacks): Affordability, fuel efficiency, and suitability for urban environments

- Key Drivers (SUV): Increasing consumer demand for spaciousness and safety features

- Key Drivers (Economy Cars): Budget-conscious travellers and short-term rentals

- Key Drivers (Luxury Cars): High-end travelers and business clients

- Key Drivers (Leisure/Tourism): Seasonal peaks during holidays and tourist seasons

- Key Drivers (Business): Steady demand throughout the year, linked to corporate travel and business needs.

Major metropolitan areas like Warsaw, Krakow, and Gdansk contribute disproportionately to the overall market volume, owing to high tourist traffic and business activity.

Poland Car Rental Market Product Landscape

The Polish car rental market offers a diverse range of vehicles, from economical hatchbacks and sedans to luxury SUVs and high-performance cars. Recent product innovations focus on incorporating eco-friendly vehicles (hybrids and electric cars) and advanced technology features such as in-car navigation, safety systems, and mobile app integration. Unique selling propositions include specialized rental options for various applications (e.g., business travel, family vacations) and value-added services such as insurance packages, roadside assistance, and airport transfers.

Key Drivers, Barriers & Challenges in Poland Car Rental Market

Key Drivers: Growing tourism, rising disposable incomes, expanding business travel, increased infrastructure development, and government initiatives to boost the tourism sector are driving market growth. The adoption of online booking platforms and smartphone applications also plays a major role.

Key Challenges: Intense competition, especially from ride-sharing services, fluctuating fuel prices, and economic uncertainties, and the need for continual investment in fleet renewal and technology upgrades to remain competitive pose significant challenges. Supply chain disruptions related to vehicle manufacturing can also impact market availability. Regulatory changes and insurance costs also impact profitability.

Emerging Opportunities in Poland Car Rental Market

Untapped potential exists in expanding car rental services to smaller cities and towns, catering to niche markets (e.g., long-term rentals, campervans), and adopting innovative business models such as subscription services. The growing popularity of eco-friendly vehicles presents a significant opportunity for companies to position themselves as environmentally conscious businesses. Also, partnerships with hotels and tour operators can expand market reach.

Growth Accelerators in the Poland Car Rental Market Industry

Technological advancements such as the implementation of AI-powered booking systems and the development of self-driving car rental options will significantly accelerate market growth. Strategic alliances with hotels, airlines, and other travel-related businesses also create additional growth opportunities. The expansion of car-sharing programs will increase market penetration further.

Key Players Shaping the Poland Car Rental Market Market

- Europcar International

- The Hertz Corporation

- CarFree Sp z o o

- 99rent Sp z o

- 4 Mobility

- Budget Rent a Car System Inc

- Panek SA

- Avis Budget Inc

- Enterprise Holding Inc

- TOPCARS

Notable Milestones in Poland Car Rental Market Sector

- March 2022: PANEK SA launched an updated mobile app with online payment integration.

- October 2021: SIXT introduced hybrid and electric vehicle options for its shuttle and limousine services.

- August 2021: Avis Budget Group launched new websites for its Avis and Budget brands, expanding its reach in emerging markets.

In-Depth Poland Car Rental Market Market Outlook

The Poland car rental market is poised for continued growth, driven by sustained economic development, rising tourism numbers, and technological innovations. Strategic initiatives focusing on fleet modernization, enhanced customer service, and the adoption of sustainable practices will be crucial for companies to maintain a competitive edge. The expanding use of technology and the emergence of new mobility solutions provide ample opportunities for growth and market expansion in the coming years.

Poland Car Rental Market Segmentation

-

1. Booking Type

- 1.1. Online Booking

- 1.2. Offline Booking

-

2. Vehicle Body Style

- 2.1. Hatchback

- 2.2. Sedan

- 2.3. SUV

-

3. Vehicle Type

- 3.1. Economy Cars

- 3.2. Luxury Cars

-

4. Application

- 4.1. Leisure/Tourism

- 4.2. Business

Poland Car Rental Market Segmentation By Geography

- 1. Poland

Poland Car Rental Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2019-2033 |

| Base Year | 2024 |

| Estimated Year | 2025 |

| Forecast Period | 2025-2033 |

| Historical Period | 2019-2024 |

| Growth Rate | CAGR of 10.00% from 2019-2033 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Adoption of 2-wheelers across the Globe

- 3.3. Market Restrains

- 3.3.1. Rise in demand of Electric Vehicles

- 3.4. Market Trends

- 3.4.1. Online Booking Segment Likely to Drive Demand in the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Poland Car Rental Market Analysis, Insights and Forecast, 2019-2031

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 5.1.1. Online Booking

- 5.1.2. Offline Booking

- 5.2. Market Analysis, Insights and Forecast - by Vehicle Body Style

- 5.2.1. Hatchback

- 5.2.2. Sedan

- 5.2.3. SUV

- 5.3. Market Analysis, Insights and Forecast - by Vehicle Type

- 5.3.1. Economy Cars

- 5.3.2. Luxury Cars

- 5.4. Market Analysis, Insights and Forecast - by Application

- 5.4.1. Leisure/Tourism

- 5.4.2. Business

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Poland

- 5.1. Market Analysis, Insights and Forecast - by Booking Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2024

- 6.2. Company Profiles

- 6.2.1 Europcar International

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 The Hertz Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 CarFree Sp z o o

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 99rent Sp z o

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 4 Mobility

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Budget Rent a Car System Inc

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Panek SA

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Avis Budget Inc

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Enterprise Holding Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 TOPCARS

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Europcar International

List of Figures

- Figure 1: Poland Car Rental Market Revenue Breakdown (Million, %) by Product 2024 & 2032

- Figure 2: Poland Car Rental Market Share (%) by Company 2024

List of Tables

- Table 1: Poland Car Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 2: Poland Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 3: Poland Car Rental Market Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 4: Poland Car Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 5: Poland Car Rental Market Revenue Million Forecast, by Application 2019 & 2032

- Table 6: Poland Car Rental Market Revenue Million Forecast, by Region 2019 & 2032

- Table 7: Poland Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

- Table 8: Poland Car Rental Market Revenue Million Forecast, by Booking Type 2019 & 2032

- Table 9: Poland Car Rental Market Revenue Million Forecast, by Vehicle Body Style 2019 & 2032

- Table 10: Poland Car Rental Market Revenue Million Forecast, by Vehicle Type 2019 & 2032

- Table 11: Poland Car Rental Market Revenue Million Forecast, by Application 2019 & 2032

- Table 12: Poland Car Rental Market Revenue Million Forecast, by Country 2019 & 2032

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Poland Car Rental Market?

The projected CAGR is approximately 10.00%.

2. Which companies are prominent players in the Poland Car Rental Market?

Key companies in the market include Europcar International, The Hertz Corporation, CarFree Sp z o o, 99rent Sp z o, 4 Mobility, Budget Rent a Car System Inc, Panek SA, Avis Budget Inc, Enterprise Holding Inc, TOPCARS.

3. What are the main segments of the Poland Car Rental Market?

The market segments include Booking Type, Vehicle Body Style, Vehicle Type, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Adoption of 2-wheelers across the Globe.

6. What are the notable trends driving market growth?

Online Booking Segment Likely to Drive Demand in the Market.

7. Are there any restraints impacting market growth?

Rise in demand of Electric Vehicles.

8. Can you provide examples of recent developments in the market?

In March 2022, PANEK SA introduced a major update in its mobile application regarding payments for rental services. The new payment rental service allows users to settle all services and rentals by fast online transfer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Poland Car Rental Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Poland Car Rental Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Poland Car Rental Market?

To stay informed about further developments, trends, and reports in the Poland Car Rental Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence