Key Insights

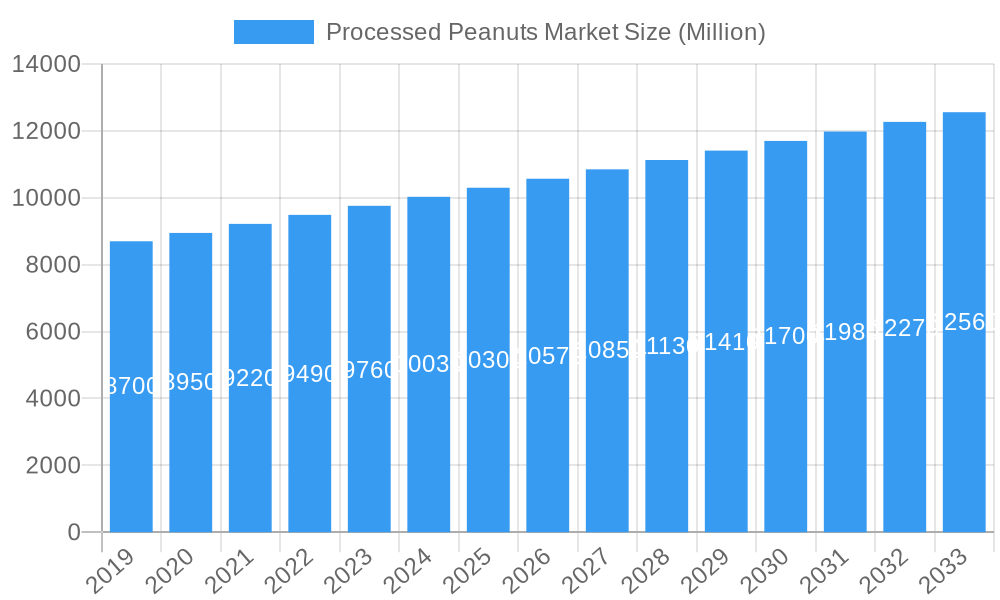

The global processed peanuts market is projected to reach $115.47 billion by 2025, driven by a CAGR of 5.8% through 2033. This expansion is fueled by escalating consumer preference for convenient, flavorful snack options, particularly flavored variants like salted, sweet, and spicy. Evolving taste profiles and a growing appetite for diverse culinary experiences are key contributors. Online retail channels enhance market penetration alongside traditional channels such as supermarkets and hypermarkets. Increasing health consciousness also supports market growth, as processed peanuts are recognized for their nutritional benefits, including protein and healthy fats.

Processed Peanuts Market Market Size (In Billion)

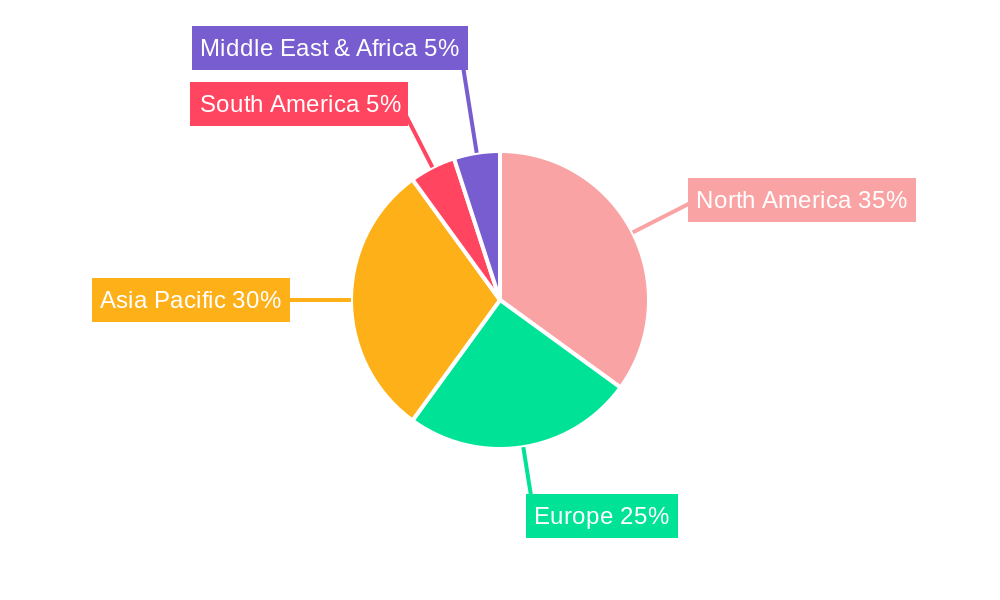

Changing lifestyle patterns and rising disposable incomes are significant market drivers. The convenience of ready-to-eat processed peanut products aligns with fast-paced modern lives. Key players are prioritizing product innovation, introducing new flavor combinations and healthier processing methods to cater to niche segments and expand their consumer base. While growth is robust, stakeholders must strategically manage restraints like fluctuating raw material prices and potential health concerns associated with processed food overconsumption. North America and Asia Pacific are expected to maintain dominance due to established consumer bases and emerging market opportunities, respectively. Product diversification and efficient distribution networks are critical for sustained market leadership.

Processed Peanuts Market Company Market Share

This comprehensive report provides a definitive outlook on the global processed peanuts market, offering critical insights for industry stakeholders. Analyzing trends from 2019 to 2033, with a base year of 2025, this study explores market dynamics, growth trajectories, regional influence, product innovation, and key player strategies. We examine the market landscape of plain and flavored peanuts (including salted, sweet, spicy, and other variants), and their distribution across supermarkets/hypermarkets, convenience stores, online channels, and other segments.

Processed Peanuts Market Market Dynamics & Structure

The global processed peanuts market exhibits a moderately concentrated structure, with key players like Hampton Farms, Haldiram's India Pvt Ltd, Frito-Lay North America Inc (PepsiCo), Snak Club, Hormel Foods LLC, John B Sanfilippo & Son Inc, The Peanut Shop of Williamsburg, Jabsons Foods, Whitley's Peanut Factory, and Margaret Holmes holding significant sway. Technological innovation is a primary driver, with continuous advancements in roasting techniques, flavor infusion, and packaging solutions enhancing product appeal and shelf life. Regulatory frameworks, particularly concerning food safety and labeling standards, play a crucial role in shaping market entry and product development. The competitive landscape is characterized by the presence of various substitutes, including other nuts and snack products, necessitating continuous product differentiation. End-user demographics are diverse, with a growing segment of health-conscious consumers seeking premium and innovative peanut-based snacks. Mergers and acquisitions (M&A) trends are moderate, primarily focusing on expanding market reach and product portfolios. For instance, the acquisition of Planters by Hormel Foods signifies consolidation efforts within the industry.

- Market Concentration: Moderately concentrated, with a few dominant players.

- Technological Drivers: Advanced roasting, flavor encapsulation, and sustainable packaging.

- Regulatory Impact: Food safety certifications, ingredient transparency, and labeling compliance.

- Competitive Substitutes: Almonds, cashews, walnuts, and other savory snacks.

- End-User Trends: Growing demand for healthy, gourmet, and internationally inspired flavors.

- M&A Activity: Strategic acquisitions to enhance market share and diversify product offerings.

Processed Peanuts Market Growth Trends & Insights

The processed peanuts market is poised for robust expansion, driven by escalating consumer demand for convenient, flavorful, and versatile snack options. The market size is projected to witness significant evolution, propelled by increasing disposable incomes and changing lifestyle patterns globally. Adoption rates for premium and specialty processed peanuts, particularly those catering to specific dietary preferences (e.g., low-sodium, plant-based), are on an upward trajectory. Technological disruptions, including advancements in processing technologies that preserve nutritional value and enhance sensory appeal, are further fueling growth. Consumer behavior shifts are evident, with a growing preference for convenient single-serving packs, on-the-go options, and a willingness to explore novel flavor profiles. The market is expected to grow at a Compound Annual Growth Rate (CAGR) of approximately xx% during the forecast period. Market penetration is deepening across emerging economies, mirroring the established growth patterns in developed regions.

- Market Size Evolution: Projected to reach over $xx billion by 2033.

- Adoption Rates: Increasing for healthy and innovative processed peanut products.

- Technological Disruptions: Innovations in processing and flavor development driving adoption.

- Consumer Behavior Shifts: Preference for convenience, health consciousness, and diverse flavors.

- CAGR (Forecast Period): Approximately xx%

- Market Penetration: Expanding across both developed and developing markets.

Dominant Regions, Countries, or Segments in Processed Peanuts Market

North America currently dominates the processed peanuts market, driven by established consumption patterns and a strong presence of major snack manufacturers. The United States, in particular, represents a significant market share, fueled by a mature snack culture and high consumer spending power. Within this region, flavored peanuts, especially sweet flavored peanuts and spicy flavored peanuts, are experiencing exceptional growth. The distribution channel of supermarkets/hypermarkets remains the most dominant, accounting for a substantial portion of sales due to their wide reach and product variety. However, the rapid expansion of online stores is a notable trend, offering convenience and access to niche brands.

- Dominant Region: North America, with the United States as a key market.

- Leading Segment (Type): Flavored Peanuts, with Sweet and Spicy varieties showing high demand.

- Leading Distribution Channel: Supermarkets/Hypermarkets, followed by the rapidly growing Online Stores.

- Key Drivers in North America:

- High disposable income and consumer spending on snacks.

- Well-established snack culture and brand loyalty.

- Proactive new product development and marketing by key players.

- Growing demand for convenience and ready-to-eat food products.

- Advancements in processing and packaging technologies.

- Growth Potential in Online Stores: Significant, driven by e-commerce penetration and consumer preference for digital purchasing.

- Emerging Markets: Asia Pacific shows substantial growth potential due to a burgeoning middle class and increasing urbanization.

Processed Peanuts Market Product Landscape

The processed peanuts market is characterized by a dynamic product landscape driven by relentless innovation. Manufacturers are focusing on developing novel flavor profiles, catering to diverse palates and dietary trends. Innovations include gourmet seasonings, fusion flavors, and healthier formulations such as roasted and air-fried varieties. Applications range from standalone snacks to ingredients in confectionery, baked goods, and savory dishes. Performance metrics are being redefined by enhanced shelf-life, improved texture, and superior taste profiles. Unique selling propositions often lie in the premium sourcing of peanuts, unique seasoning blends, and sustainable production practices. Technological advancements in flavor encapsulation and drying techniques are enabling the creation of more intense and long-lasting flavors.

Key Drivers, Barriers & Challenges in Processed Peanuts Market

Key Drivers:

- Growing Snack Culture: Increased consumption of convenient and on-the-go snack options.

- Versatile Applications: Peanuts used in diverse food products, from snacks to meal components.

- Health and Nutrition Trends: Demand for protein-rich and plant-based snack alternatives.

- Product Innovation: Continuous introduction of new flavors, textures, and product formats.

- Economic Growth: Rising disposable incomes in emerging economies boosting consumer spending.

Barriers & Challenges:

- Supply Chain Volatility: Fluctuations in peanut crop yields and pricing due to weather and agricultural factors.

- Allergen Concerns: Strict regulations and consumer awareness surrounding peanut allergies.

- Intense Competition: Presence of numerous established and emerging players.

- Raw Material Price Volatility: Dependence on agricultural commodities can lead to unpredictable cost fluctuations.

- Health Scrutiny: Concerns over high fat and sodium content in certain processed peanut products.

Emerging Opportunities in Processed Peanuts Market

Emerging opportunities in the processed peanuts market lie in tapping into the growing demand for plant-based protein snacks and functional food products. The development of peanut butter alternatives with enhanced nutritional profiles and unique flavor infusions presents a significant avenue. Untapped markets in developing regions, with increasing urbanization and disposable incomes, offer substantial growth potential. Innovative applications in the ready-to-eat meal sector and the development of premium, artisanal peanut snacks for niche consumer segments are also promising. The increasing consumer interest in sustainable sourcing and ethical production practices provides an opportunity for brands to differentiate themselves through transparent supply chains.

Growth Accelerators in the Processed Peanuts Market Industry

Growth in the processed peanuts industry is being significantly accelerated by strategic partnerships between snack manufacturers and beverage companies, such as the Humdinger and Budweiser collaboration, which opens new avenues for flavored peanut pairings. Technological breakthroughs in roasting and coating techniques are enabling the creation of novel textures and flavors, broadening consumer appeal. Market expansion strategies by key players, focusing on emerging economies and e-commerce platforms, are further driving sales. The increasing availability of single-serve and value-added packaging formats catering to on-the-go consumption also acts as a catalyst for sustained growth.

Key Players Shaping the Processed Peanuts Market Market

- Hampton Farms

- Haldiram's India Pvt Ltd

- Frito-Lay North America Inc (PepsiCo)

- Snak Club

- Hormel Foods LLC

- John B Sanfilippo & Son Inc

- The Peanut Shop of Williamsburg

- Jabsons Foods

- Whitley's Peanut Factory

- Margaret Holmes

Notable Milestones in Processed Peanuts Market Sector

- June 2022: Planters (Hormel Foods) launched sweet & spicy dry roasted peanuts, available in convenience and grocery stores, catering to on-the-go snacking and larger format consumption.

- June 2022: Humdinger partnered with Budweiser to launch three new American-based flavored peanuts (Smokey Texan BBQ, Buffalo Chicken Wings, and Flame Grilled Ribs) in the UK, aimed at beverage pairing.

- October 2020: SkinnyDipped announced the launch of thinly-dipped peanuts in milk chocolate and PB & J flavors, targeting nostalgic and convenient snacking preferences.

In-Depth Processed Peanuts Market Market Outlook

The processed peanuts market is on a robust growth trajectory, characterized by evolving consumer preferences and innovative product development. Future market potential is immense, driven by the increasing global demand for convenient, nutritious, and flavorful snacks. Strategic opportunities lie in expanding into untapped geographical markets, particularly in Asia Pacific and Latin America, and in developing value-added products that cater to specific dietary needs, such as gluten-free and vegan options. The continued integration of online sales channels and the adoption of sustainable packaging solutions will be crucial for capitalizing on emerging trends and securing long-term market leadership.

Processed Peanuts Market Segmentation

-

1. Type

- 1.1. Plain

-

1.2. Flavored

- 1.2.1. Salted

- 1.2.2. Sweet Flavored

- 1.2.3. Spicy Flavored

- 1.2.4. Others

-

2. Distibution Channel

- 2.1. Supermarkets/Hypermarkets

- 2.2. Convenience Stores

- 2.3. Online Stores

- 2.4. Other Distribution Channels

Processed Peanuts Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

- 1.4. Rest of North America

-

2. Europe

- 2.1. United Kingdom

- 2.2. Germany

- 2.3. Spain

- 2.4. France

- 2.5. Italy

- 2.6. Russia

- 2.7. Rest of Europe

-

3. Asia Pacific

- 3.1. China

- 3.2. Japan

- 3.3. India

- 3.4. Australia

- 3.5. Rest of Asia Pacific

-

4. South America

- 4.1. Brazil

- 4.2. Argentina

- 4.3. Rest of South America

- 5. Middle East

-

6. Saudi Arabia

- 6.1. South Africa

- 6.2. Rest of Middle East

Processed Peanuts Market Regional Market Share

Geographic Coverage of Processed Peanuts Market

Processed Peanuts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular

- 3.3. Market Restrains

- 3.3.1. Rising Demand for Other Vinegar Types

- 3.4. Market Trends

- 3.4.1. Rising Demand For Convenient And Healthy Snacking

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Plain

- 5.1.2. Flavored

- 5.1.2.1. Salted

- 5.1.2.2. Sweet Flavored

- 5.1.2.3. Spicy Flavored

- 5.1.2.4. Others

- 5.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 5.2.1. Supermarkets/Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Online Stores

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. South America

- 5.3.5. Middle East

- 5.3.6. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. North America Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Type

- 6.1.1. Plain

- 6.1.2. Flavored

- 6.1.2.1. Salted

- 6.1.2.2. Sweet Flavored

- 6.1.2.3. Spicy Flavored

- 6.1.2.4. Others

- 6.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 6.2.1. Supermarkets/Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Online Stores

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Type

- 7. Europe Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Type

- 7.1.1. Plain

- 7.1.2. Flavored

- 7.1.2.1. Salted

- 7.1.2.2. Sweet Flavored

- 7.1.2.3. Spicy Flavored

- 7.1.2.4. Others

- 7.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 7.2.1. Supermarkets/Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Online Stores

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Type

- 8. Asia Pacific Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Type

- 8.1.1. Plain

- 8.1.2. Flavored

- 8.1.2.1. Salted

- 8.1.2.2. Sweet Flavored

- 8.1.2.3. Spicy Flavored

- 8.1.2.4. Others

- 8.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 8.2.1. Supermarkets/Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Online Stores

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Type

- 9. South America Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Type

- 9.1.1. Plain

- 9.1.2. Flavored

- 9.1.2.1. Salted

- 9.1.2.2. Sweet Flavored

- 9.1.2.3. Spicy Flavored

- 9.1.2.4. Others

- 9.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 9.2.1. Supermarkets/Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Online Stores

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Type

- 10. Middle East Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Type

- 10.1.1. Plain

- 10.1.2. Flavored

- 10.1.2.1. Salted

- 10.1.2.2. Sweet Flavored

- 10.1.2.3. Spicy Flavored

- 10.1.2.4. Others

- 10.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 10.2.1. Supermarkets/Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Online Stores

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Type

- 11. Saudi Arabia Processed Peanuts Market Analysis, Insights and Forecast, 2020-2032

- 11.1. Market Analysis, Insights and Forecast - by Type

- 11.1.1. Plain

- 11.1.2. Flavored

- 11.1.2.1. Salted

- 11.1.2.2. Sweet Flavored

- 11.1.2.3. Spicy Flavored

- 11.1.2.4. Others

- 11.2. Market Analysis, Insights and Forecast - by Distibution Channel

- 11.2.1. Supermarkets/Hypermarkets

- 11.2.2. Convenience Stores

- 11.2.3. Online Stores

- 11.2.4. Other Distribution Channels

- 11.1. Market Analysis, Insights and Forecast - by Type

- 12. Competitive Analysis

- 12.1. Global Market Share Analysis 2025

- 12.2. Company Profiles

- 12.2.1 Hampton Farms

- 12.2.1.1. Overview

- 12.2.1.2. Products

- 12.2.1.3. SWOT Analysis

- 12.2.1.4. Recent Developments

- 12.2.1.5. Financials (Based on Availability)

- 12.2.2 Haldiram's India Pvt Ltd

- 12.2.2.1. Overview

- 12.2.2.2. Products

- 12.2.2.3. SWOT Analysis

- 12.2.2.4. Recent Developments

- 12.2.2.5. Financials (Based on Availability)

- 12.2.3 Frito-Lay North America Inc (PepsiCo)

- 12.2.3.1. Overview

- 12.2.3.2. Products

- 12.2.3.3. SWOT Analysis

- 12.2.3.4. Recent Developments

- 12.2.3.5. Financials (Based on Availability)

- 12.2.4 Snak Club

- 12.2.4.1. Overview

- 12.2.4.2. Products

- 12.2.4.3. SWOT Analysis

- 12.2.4.4. Recent Developments

- 12.2.4.5. Financials (Based on Availability)

- 12.2.5 Hormel Foods LLC

- 12.2.5.1. Overview

- 12.2.5.2. Products

- 12.2.5.3. SWOT Analysis

- 12.2.5.4. Recent Developments

- 12.2.5.5. Financials (Based on Availability)

- 12.2.6 John B Sanfilippo & Son Inc

- 12.2.6.1. Overview

- 12.2.6.2. Products

- 12.2.6.3. SWOT Analysis

- 12.2.6.4. Recent Developments

- 12.2.6.5. Financials (Based on Availability)

- 12.2.7 The Peanut Shop of Williamsburg

- 12.2.7.1. Overview

- 12.2.7.2. Products

- 12.2.7.3. SWOT Analysis

- 12.2.7.4. Recent Developments

- 12.2.7.5. Financials (Based on Availability)

- 12.2.8 Jabsons Foods*List Not Exhaustive

- 12.2.8.1. Overview

- 12.2.8.2. Products

- 12.2.8.3. SWOT Analysis

- 12.2.8.4. Recent Developments

- 12.2.8.5. Financials (Based on Availability)

- 12.2.9 Whitley's Peanut Factory

- 12.2.9.1. Overview

- 12.2.9.2. Products

- 12.2.9.3. SWOT Analysis

- 12.2.9.4. Recent Developments

- 12.2.9.5. Financials (Based on Availability)

- 12.2.10 Margaret Holmes

- 12.2.10.1. Overview

- 12.2.10.2. Products

- 12.2.10.3. SWOT Analysis

- 12.2.10.4. Recent Developments

- 12.2.10.5. Financials (Based on Availability)

- 12.2.1 Hampton Farms

List of Figures

- Figure 1: Global Processed Peanuts Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 3: North America Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 4: North America Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 5: North America Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 6: North America Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 9: Europe Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 10: Europe Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 11: Europe Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 12: Europe Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 15: Asia Pacific Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 16: Asia Pacific Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 17: Asia Pacific Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 18: Asia Pacific Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: South America Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 21: South America Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 22: South America Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 23: South America Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 24: South America Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 25: South America Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 27: Middle East Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 28: Middle East Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 29: Middle East Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 30: Middle East Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Middle East Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

- Figure 32: Saudi Arabia Processed Peanuts Market Revenue (billion), by Type 2025 & 2033

- Figure 33: Saudi Arabia Processed Peanuts Market Revenue Share (%), by Type 2025 & 2033

- Figure 34: Saudi Arabia Processed Peanuts Market Revenue (billion), by Distibution Channel 2025 & 2033

- Figure 35: Saudi Arabia Processed Peanuts Market Revenue Share (%), by Distibution Channel 2025 & 2033

- Figure 36: Saudi Arabia Processed Peanuts Market Revenue (billion), by Country 2025 & 2033

- Figure 37: Saudi Arabia Processed Peanuts Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 2: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 3: Global Processed Peanuts Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 5: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 6: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: United States Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 8: Canada Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 9: Mexico Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 10: Rest of North America Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 11: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 12: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 13: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 14: United Kingdom Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 15: Germany Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 16: Spain Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 17: France Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 18: Italy Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 19: Russia Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 20: Rest of Europe Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 21: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 22: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 23: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 24: China Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 25: Japan Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 26: India Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 27: Australia Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 29: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 30: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 31: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 32: Brazil Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 33: Argentina Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 34: Rest of South America Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 35: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 36: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 37: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 38: Global Processed Peanuts Market Revenue billion Forecast, by Type 2020 & 2033

- Table 39: Global Processed Peanuts Market Revenue billion Forecast, by Distibution Channel 2020 & 2033

- Table 40: Global Processed Peanuts Market Revenue billion Forecast, by Country 2020 & 2033

- Table 41: South Africa Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East Processed Peanuts Market Revenue (billion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Processed Peanuts Market?

The projected CAGR is approximately 5.8%.

2. Which companies are prominent players in the Processed Peanuts Market?

Key companies in the market include Hampton Farms, Haldiram's India Pvt Ltd, Frito-Lay North America Inc (PepsiCo), Snak Club, Hormel Foods LLC, John B Sanfilippo & Son Inc, The Peanut Shop of Williamsburg, Jabsons Foods*List Not Exhaustive, Whitley's Peanut Factory, Margaret Holmes.

3. What are the main segments of the Processed Peanuts Market?

The market segments include Type, Distibution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 115.47 billion as of 2022.

5. What are some drivers contributing to market growth?

Health Benefits Promoting Apple Cider Vinegar Demand; Unfiltered Apple Cider Vinegar Being Popular.

6. What are the notable trends driving market growth?

Rising Demand For Convenient And Healthy Snacking.

7. Are there any restraints impacting market growth?

Rising Demand for Other Vinegar Types.

8. Can you provide examples of recent developments in the market?

In June 2022, Planters, a Hormel Foods Corp. brand, launched sweet & spicy dry roasted peanuts that are now available at convenience stores. The company claims that this snack is dry roasted with honey and dried red chili peppers, then seasoned with salt. They are currently available in a 1.75-ounce on-the-go package in convenience stores and 16-ounce bottles at grocery stores

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Processed Peanuts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Processed Peanuts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Processed Peanuts Market?

To stay informed about further developments, trends, and reports in the Processed Peanuts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence