Key Insights

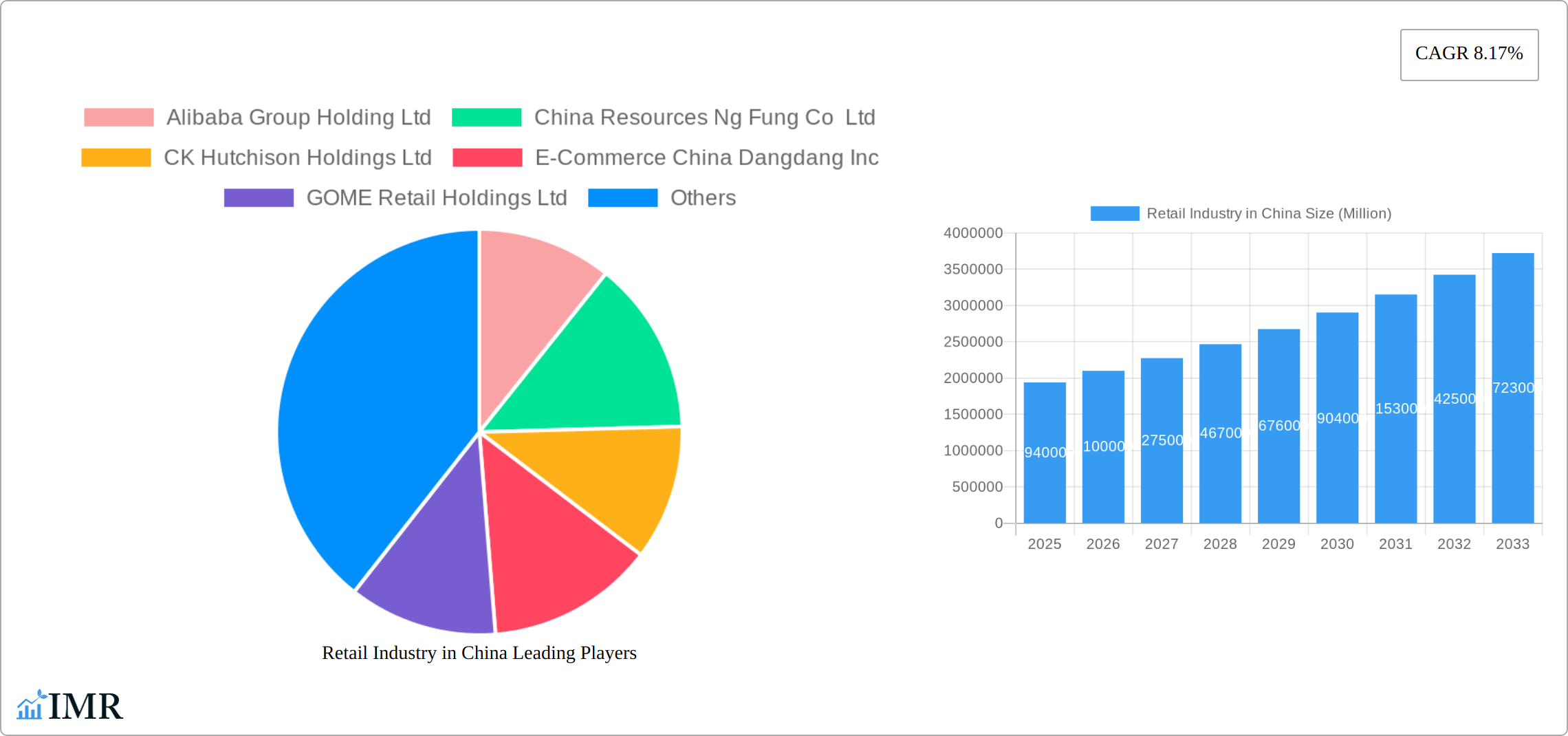

The Chinese retail industry, a $1.94 trillion market in 2025, is experiencing robust growth, projected to expand at a compound annual growth rate (CAGR) of 8.17% from 2025 to 2033. This expansion is fueled by several key factors. The rise of e-commerce giants like Alibaba and JD.com continues to drive online retail sales, penetrating even smaller cities and rural areas with improved logistics and digital literacy. Furthermore, the increasing disposable income of China's burgeoning middle class fuels demand for a wider variety of goods and services, boosting both online and offline retail. Changing consumer preferences towards premium products and personalized experiences also present opportunities for retailers to innovate and cater to evolving demands. However, challenges remain. Intense competition among established players and new entrants necessitates constant innovation and efficiency improvements. Supply chain disruptions and economic fluctuations also pose risks to sustained growth. Government regulations aimed at fostering fair competition and protecting consumer rights also influence market dynamics. The industry is segmented by various retail formats, including supermarkets, hypermarkets, department stores, convenience stores, and online marketplaces, each with its own growth trajectory and competitive landscape. Key players like Alibaba, JD.com, Walmart, and Sun Art Retail Group are vying for market share through strategic investments, technological advancements, and omnichannel strategies.

Retail Industry in China Market Size (In Million)

The forecast for the Chinese retail market through 2033 points to continued expansion, albeit with a potential moderation of the CAGR in later years as the market matures. The continued integration of technology, particularly artificial intelligence (AI) and big data analytics, will be crucial for retailers to optimize operations, personalize customer experiences, and enhance supply chain management. The focus on sustainable and ethical practices is also gaining traction, prompting retailers to adopt environmentally friendly and socially responsible business models. Regional variations in consumer behavior and economic development will also impact the growth trajectory, with more developed regions potentially showing slower growth rates compared to less developed areas. Navigating these complex dynamics will be key to success for companies operating in this dynamic and competitive market.

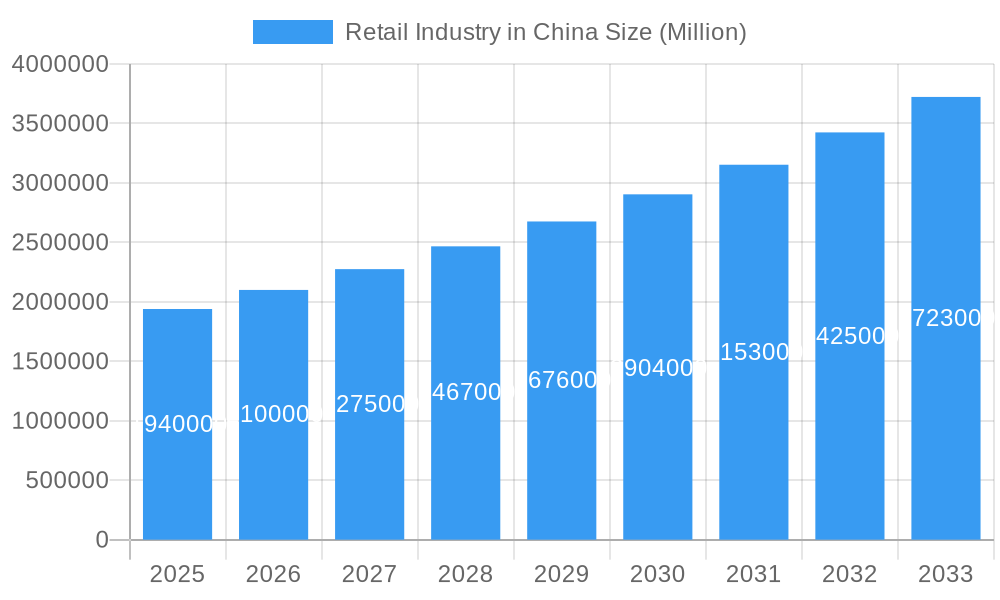

Retail Industry in China Company Market Share

Retail Industry in China: A Comprehensive Market Report (2019-2033)

This in-depth report provides a comprehensive analysis of the dynamic Chinese retail market, encompassing its evolution from 2019 to 2033. The study leverages robust data analysis and expert insights to offer actionable intelligence for businesses seeking to thrive in this lucrative yet complex landscape. We explore key segments, dominant players like Alibaba Group Holding Ltd and JD.com Inc, and emerging trends shaping the future of retail in China. This report is essential for investors, industry professionals, and strategists seeking to understand and capitalize on the opportunities within the Chinese retail sector.

Retail Industry in China Market Dynamics & Structure

This section provides an in-depth analysis of the structural components that define China's dynamic retail market. We explore the interplay of market concentration, the transformative impact of technological advancements, the evolving regulatory landscape, the intricacies of competitive dynamics, the characteristics of consumer demographics, and the strategic significance of merger & acquisition (M&A) activities.

China's retail market is characterized by a significant degree of concentration, with a handful of major players commanding a substantial portion of market share. E-commerce behemoths such as Alibaba and JD.com wield considerable influence, while established traditional retailers like Sun Art Retail Group Ltd and Yonghui Supermarket Co Ltd are actively embracing digital transformation to remain competitive. Technological innovation, particularly in mobile payments and AI-driven personalization, stands as a primary catalyst for market growth. However, the market's evolution is also shaped by dynamic regulatory changes and the ever-shifting preferences of Chinese consumers, which introduce inherent complexities.

- Market Concentration: As of 2024, Alibaba and JD.com collectively dominate the online retail space, holding an estimated [Insert specific percentage]% of the market share. Traditional brick-and-mortar retail accounts for [Insert specific percentage]%, with the remaining [Insert specific percentage]% distributed among a multitude of smaller, fragmented players.

- Technological Innovation: The sector is being fundamentally reshaped by the rapid adoption of mobile commerce, sophisticated big data analytics, and AI-powered recommendation engines, which are enhancing customer engagement and operational efficiency.

- Regulatory Framework: Government policies and regulations pertaining to e-commerce operations, data privacy, and antitrust measures play a crucial role in shaping market dynamics and influencing business strategies.

- Competitive Substitutes: The rise of new retail formats, including social commerce platforms and live-streaming e-commerce, presents evolving competitive pressures and opportunities for established market participants.

- End-User Demographics: A burgeoning middle class and ongoing urbanization trends are significant drivers of demand across a diverse spectrum of retail segments, indicating sustained consumer spending power.

- M&A Trends: The last five years have seen a notable trend of consolidation within the retail sector, with approximately [Insert number] M&A deals recorded. These transactions have primarily focused on the grocery and e-commerce segments, with an aggregate deal value reaching approximately [Insert currency and amount].

Retail Industry in China Growth Trends & Insights

The Chinese retail market has experienced substantial growth over the past few years, driven by the burgeoning middle class, rapid urbanization, and the proliferation of e-commerce. This analysis delves into the market size evolution, adoption rates of new technologies, disruptive innovations, and evolving consumer behaviors.

From 2019 to 2024, the market exhibited a compound annual growth rate (CAGR) of xx%. The market size expanded from xx million units in 2019 to xx million units in 2024. E-commerce penetration increased significantly, reaching xx% in 2024, compared to xx% in 2019. Shifts in consumer behavior towards online shopping, mobile payments, and personalized experiences are reshaping the retail landscape. Technology adoption, including mobile apps, omnichannel strategies, and AI-powered customer service, are impacting growth.

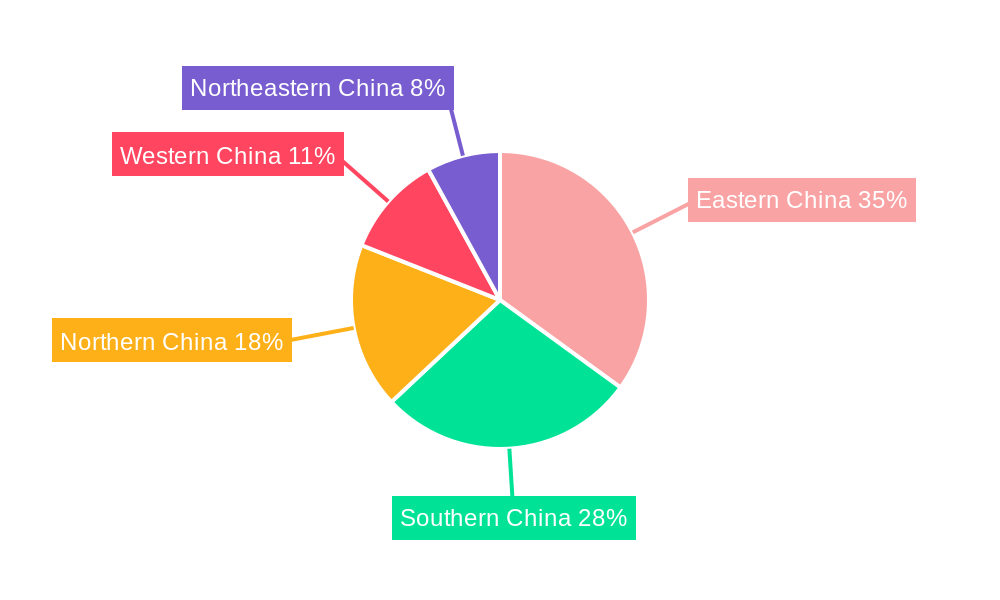

Dominant Regions, Countries, or Segments in Retail Industry in China

While the entire nation is experiencing robust retail expansion, certain geographical regions and specific market segments are exhibiting particularly strong performance and leading the growth trajectory. This section identifies the foremost regions and segments propelling market expansion, examining critical factors such as targeted economic policies, the development of advanced infrastructure, and prevailing consumer preferences.

Tier 1 cities, including the metropolises of Beijing, Shanghai, Guangzhou, and Shenzhen, continue to assert their dominance as prime retail markets owing to their higher levels of disposable income and highly developed infrastructure. The e-commerce segment consistently outpaces traditional retail in growth, driven by extensive internet penetration and the inherent convenience offered by online shopping experiences.

- Key Drivers: Government-led initiatives promoting digitalization, substantial investments in logistics and infrastructure networks, and supportive policies designed to foster e-commerce growth are key contributors to the dominance observed in specific regions and segments.

- Dominance Factors: High disposable incomes, sophisticated technological infrastructure, and the early and widespread adoption of e-commerce are instrumental in solidifying the market dominance of these specific regions and segments. Consequently, market share within these areas significantly surpasses the national average.

Retail Industry in China Product Landscape

The Chinese retail market is distinguished by an exceptionally diverse product landscape, encompassing an extensive array of goods and services. Continuous innovation is fueling the development of novel products and services, while advancements in technology are enhancing the overall consumer experience. Successful market players are increasingly differentiating themselves through unique selling propositions and the strategic integration of cutting-edge technology.

Product innovation is strategically oriented towards delivering personalized offerings, high-quality premium products, and convenient consumption experiences. Enhancements in supply chain management, sophisticated delivery systems, and superior customer service are critical elements that distinguish leading products in the market. The growing popularity of omnichannel retail strategies allows businesses to create a seamless and integrated experience for consumers across both their online and offline touchpoints.

Key Drivers, Barriers & Challenges in Retail Industry in China

This section examines the major forces propelling market growth and the obstacles hindering expansion.

Key Drivers:

- Rising Disposable Incomes: Growth of the middle class fuels increased consumer spending.

- E-commerce Boom: Rapid adoption of online shopping platforms and mobile payments is transforming retail.

- Government Support: Policies favoring digitalization and infrastructure development create favorable conditions for growth.

Challenges:

- Intense Competition: The market is fiercely competitive, with numerous domestic and international players vying for market share.

- Supply Chain Disruptions: Global events and logistical complexities can impact product availability and pricing.

- Regulatory Uncertainty: Changes in government regulations can impact business operations and investment decisions. The impact on market growth has been estimated at xx million units.

Emerging Opportunities in Retail Industry in China

The Chinese retail landscape presents a fertile ground for lucrative opportunities, driven by the exploration of untapped markets, the continuous evolution of consumer preferences, and the pervasive influence of technological advancements.

- Rural Market Penetration: Significant untapped potential exists in reaching underserved rural areas through the implementation of effective logistics solutions and the development of precisely tailored product offerings designed to meet local needs.

- Experiential Retail: A strategic focus on creating immersive and engaging shopping experiences, by integrating technology and entertainment elements, is proving highly effective in attracting and retaining a younger, more digitally native demographic.

- Sustainability and Ethical Consumption: A rising tide of consumer awareness regarding environmental and social issues is driving increased demand for sustainably sourced products and ethically conducted retail practices, presenting a growing market segment.

Growth Accelerators in the Retail Industry in China Industry

Long-term growth will be driven by technological breakthroughs, strategic collaborations, and market expansion.

Technological advancements, particularly in AI-powered personalization, supply chain optimization, and innovative payment systems, will fuel market growth. Strategic partnerships among retailers, technology companies, and logistics providers facilitate efficiency improvements and expanded market reach. Expansion into new market segments and geographic areas creates significant long-term opportunities.

Key Players Shaping the Retail Industry in China Market

The Chinese retail sector is significantly influenced by a constellation of key players, each contributing to the market's ongoing evolution and competitive landscape. These companies are at the forefront of innovation, market expansion, and strategic partnerships.

- Alibaba Group Holding Ltd: A dominant force in e-commerce, cloud computing, and digital media.

- China Resources Ng Fung Co Ltd: A major player in the food and retail sectors.

- CK Hutchison Holdings Ltd: A diversified conglomerate with significant retail interests.

- E-Commerce China Dangdang Inc: A prominent online retailer, particularly known for books and general merchandise.

- GOME Retail Holdings Ltd: A leading consumer electronics and home appliance retailer.

- JD.com Inc: A major e-commerce platform known for its strong logistics network and product authenticity.

- Sun Art Retail Group Ltd: A leading hypermarket operator in China.

- Suning Holdings Group: A major retailer of consumer electronics and home appliances, with a growing presence in e-commerce.

- Walmart Inc: A global retail giant with a significant and growing presence in the Chinese market.

- Yonghui Supermarket Co Ltd: A prominent supermarket chain focusing on fresh produce and groceries.

Notable Milestones in Retail Industry in China Sector

- January 2023: Alibaba Group Holding Ltd. signed a cooperation agreement with the Hangzhou government, fostering tech sector growth and regulatory alignment.

- January 2023: JD.com retreated from Southeast Asia, closing shops in Indonesia and Thailand, reflecting the challenging market conditions for Chinese retail and technology companies.

In-Depth Retail Industry in China Market Outlook

The future of the Chinese retail market appears bright, with continuous growth projected throughout the forecast period (2025-2033). Technological advancements, strategic partnerships, and continued market expansion will drive this growth, offering substantial opportunities for both established and emerging players. Focus on adapting to evolving consumer preferences, leveraging data analytics, and optimizing supply chains will be critical for success in this dynamic and competitive market. This report provides a solid foundation for businesses to formulate effective strategies to capitalize on the tremendous potential of the Chinese retail market.

Retail Industry in China Segmentation

-

1. Product

- 1.1. Food and Beverages

- 1.2. Personal and Household Care

- 1.3. Apparel, Footware, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Electronic and Household Appliances

- 1.6. Other Products

-

2. Distribution Channel

- 2.1. Supermar

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Retail Industry in China Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Retail Industry in China Regional Market Share

Geographic Coverage of Retail Industry in China

Retail Industry in China REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. E-commerce is Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Retail Industry in China Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Food and Beverages

- 5.1.2. Personal and Household Care

- 5.1.3. Apparel, Footware, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Electronic and Household Appliances

- 5.1.6. Other Products

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermar

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. North America Retail Industry in China Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product

- 6.1.1. Food and Beverages

- 6.1.2. Personal and Household Care

- 6.1.3. Apparel, Footware, and Accessories

- 6.1.4. Furniture, Toys, and Hobby

- 6.1.5. Electronic and Household Appliances

- 6.1.6. Other Products

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermar

- 6.2.2. Specialty Stores

- 6.2.3. Online

- 6.2.4. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product

- 7. South America Retail Industry in China Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product

- 7.1.1. Food and Beverages

- 7.1.2. Personal and Household Care

- 7.1.3. Apparel, Footware, and Accessories

- 7.1.4. Furniture, Toys, and Hobby

- 7.1.5. Electronic and Household Appliances

- 7.1.6. Other Products

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermar

- 7.2.2. Specialty Stores

- 7.2.3. Online

- 7.2.4. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product

- 8. Europe Retail Industry in China Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product

- 8.1.1. Food and Beverages

- 8.1.2. Personal and Household Care

- 8.1.3. Apparel, Footware, and Accessories

- 8.1.4. Furniture, Toys, and Hobby

- 8.1.5. Electronic and Household Appliances

- 8.1.6. Other Products

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermar

- 8.2.2. Specialty Stores

- 8.2.3. Online

- 8.2.4. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product

- 9. Middle East & Africa Retail Industry in China Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product

- 9.1.1. Food and Beverages

- 9.1.2. Personal and Household Care

- 9.1.3. Apparel, Footware, and Accessories

- 9.1.4. Furniture, Toys, and Hobby

- 9.1.5. Electronic and Household Appliances

- 9.1.6. Other Products

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermar

- 9.2.2. Specialty Stores

- 9.2.3. Online

- 9.2.4. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product

- 10. Asia Pacific Retail Industry in China Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product

- 10.1.1. Food and Beverages

- 10.1.2. Personal and Household Care

- 10.1.3. Apparel, Footware, and Accessories

- 10.1.4. Furniture, Toys, and Hobby

- 10.1.5. Electronic and Household Appliances

- 10.1.6. Other Products

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermar

- 10.2.2. Specialty Stores

- 10.2.3. Online

- 10.2.4. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Alibaba Group Holding Ltd

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 China Resources Ng Fung Co Ltd

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 CK Hutchison Holdings Ltd

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 E-Commerce China Dangdang Inc

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 GOME Retail Holdings Ltd

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 JD com Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Sun Art Retail Group Ltd

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Suning Holdings Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Walmart Inc

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Yonghui Supermarket Co Ltd **List Not Exhaustive

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Alibaba Group Holding Ltd

List of Figures

- Figure 1: Global Retail Industry in China Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Global Retail Industry in China Volume Breakdown (Trillion, %) by Region 2025 & 2033

- Figure 3: North America Retail Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 4: North America Retail Industry in China Volume (Trillion), by Product 2025 & 2033

- Figure 5: North America Retail Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 6: North America Retail Industry in China Volume Share (%), by Product 2025 & 2033

- Figure 7: North America Retail Industry in China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 8: North America Retail Industry in China Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 9: North America Retail Industry in China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America Retail Industry in China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America Retail Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 12: North America Retail Industry in China Volume (Trillion), by Country 2025 & 2033

- Figure 13: North America Retail Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America Retail Industry in China Volume Share (%), by Country 2025 & 2033

- Figure 15: South America Retail Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 16: South America Retail Industry in China Volume (Trillion), by Product 2025 & 2033

- Figure 17: South America Retail Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 18: South America Retail Industry in China Volume Share (%), by Product 2025 & 2033

- Figure 19: South America Retail Industry in China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 20: South America Retail Industry in China Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 21: South America Retail Industry in China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America Retail Industry in China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America Retail Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 24: South America Retail Industry in China Volume (Trillion), by Country 2025 & 2033

- Figure 25: South America Retail Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America Retail Industry in China Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe Retail Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 28: Europe Retail Industry in China Volume (Trillion), by Product 2025 & 2033

- Figure 29: Europe Retail Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 30: Europe Retail Industry in China Volume Share (%), by Product 2025 & 2033

- Figure 31: Europe Retail Industry in China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 32: Europe Retail Industry in China Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 33: Europe Retail Industry in China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe Retail Industry in China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe Retail Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 36: Europe Retail Industry in China Volume (Trillion), by Country 2025 & 2033

- Figure 37: Europe Retail Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe Retail Industry in China Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa Retail Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 40: Middle East & Africa Retail Industry in China Volume (Trillion), by Product 2025 & 2033

- Figure 41: Middle East & Africa Retail Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 42: Middle East & Africa Retail Industry in China Volume Share (%), by Product 2025 & 2033

- Figure 43: Middle East & Africa Retail Industry in China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa Retail Industry in China Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa Retail Industry in China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa Retail Industry in China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa Retail Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 48: Middle East & Africa Retail Industry in China Volume (Trillion), by Country 2025 & 2033

- Figure 49: Middle East & Africa Retail Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa Retail Industry in China Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific Retail Industry in China Revenue (Million), by Product 2025 & 2033

- Figure 52: Asia Pacific Retail Industry in China Volume (Trillion), by Product 2025 & 2033

- Figure 53: Asia Pacific Retail Industry in China Revenue Share (%), by Product 2025 & 2033

- Figure 54: Asia Pacific Retail Industry in China Volume Share (%), by Product 2025 & 2033

- Figure 55: Asia Pacific Retail Industry in China Revenue (Million), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific Retail Industry in China Volume (Trillion), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific Retail Industry in China Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific Retail Industry in China Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific Retail Industry in China Revenue (Million), by Country 2025 & 2033

- Figure 60: Asia Pacific Retail Industry in China Volume (Trillion), by Country 2025 & 2033

- Figure 61: Asia Pacific Retail Industry in China Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific Retail Industry in China Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Retail Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Global Retail Industry in China Volume Trillion Forecast, by Product 2020 & 2033

- Table 3: Global Retail Industry in China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global Retail Industry in China Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global Retail Industry in China Revenue Million Forecast, by Region 2020 & 2033

- Table 6: Global Retail Industry in China Volume Trillion Forecast, by Region 2020 & 2033

- Table 7: Global Retail Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 8: Global Retail Industry in China Volume Trillion Forecast, by Product 2020 & 2033

- Table 9: Global Retail Industry in China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global Retail Industry in China Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global Retail Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 12: Global Retail Industry in China Volume Trillion Forecast, by Country 2020 & 2033

- Table 13: United States Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: United States Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 15: Canada Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Canada Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 17: Mexico Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Mexico Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 19: Global Retail Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 20: Global Retail Industry in China Volume Trillion Forecast, by Product 2020 & 2033

- Table 21: Global Retail Industry in China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global Retail Industry in China Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global Retail Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 24: Global Retail Industry in China Volume Trillion Forecast, by Country 2020 & 2033

- Table 25: Brazil Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Brazil Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 27: Argentina Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 28: Argentina Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 31: Global Retail Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 32: Global Retail Industry in China Volume Trillion Forecast, by Product 2020 & 2033

- Table 33: Global Retail Industry in China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global Retail Industry in China Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global Retail Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 36: Global Retail Industry in China Volume Trillion Forecast, by Country 2020 & 2033

- Table 37: United Kingdom Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 39: Germany Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Germany Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 41: France Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 42: France Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 43: Italy Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Italy Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 45: Spain Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 46: Spain Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 47: Russia Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: Russia Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 49: Benelux Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: Benelux Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 51: Nordics Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Nordics Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 55: Global Retail Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 56: Global Retail Industry in China Volume Trillion Forecast, by Product 2020 & 2033

- Table 57: Global Retail Industry in China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global Retail Industry in China Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global Retail Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 60: Global Retail Industry in China Volume Trillion Forecast, by Country 2020 & 2033

- Table 61: Turkey Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: Turkey Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 63: Israel Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Israel Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 65: GCC Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 66: GCC Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 67: North Africa Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 68: North Africa Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 69: South Africa Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 70: South Africa Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 73: Global Retail Industry in China Revenue Million Forecast, by Product 2020 & 2033

- Table 74: Global Retail Industry in China Volume Trillion Forecast, by Product 2020 & 2033

- Table 75: Global Retail Industry in China Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global Retail Industry in China Volume Trillion Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global Retail Industry in China Revenue Million Forecast, by Country 2020 & 2033

- Table 78: Global Retail Industry in China Volume Trillion Forecast, by Country 2020 & 2033

- Table 79: China Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 80: China Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 81: India Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 82: India Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 83: Japan Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 84: Japan Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 85: South Korea Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 86: South Korea Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 87: ASEAN Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 89: Oceania Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 90: Oceania Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific Retail Industry in China Revenue (Million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific Retail Industry in China Volume (Trillion) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Retail Industry in China?

The projected CAGR is approximately 8.17%.

2. Which companies are prominent players in the Retail Industry in China?

Key companies in the market include Alibaba Group Holding Ltd, China Resources Ng Fung Co Ltd, CK Hutchison Holdings Ltd, E-Commerce China Dangdang Inc, GOME Retail Holdings Ltd, JD com Inc, Sun Art Retail Group Ltd, Suning Holdings Group, Walmart Inc, Yonghui Supermarket Co Ltd **List Not Exhaustive.

3. What are the main segments of the Retail Industry in China?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 1.94 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

E-commerce is Driving the Market.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

January 2023: Chinese e-commerce giant Alibaba Group Holding Ltd. signed a cooperation agreement with the government of Hangzhou, where the company is headquartered. It will help the tech sector to grow and include a good regulatory relationship with the government.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Trillion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Retail Industry in China," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Retail Industry in China report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Retail Industry in China?

To stay informed about further developments, trends, and reports in the Retail Industry in China, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence