Key Insights

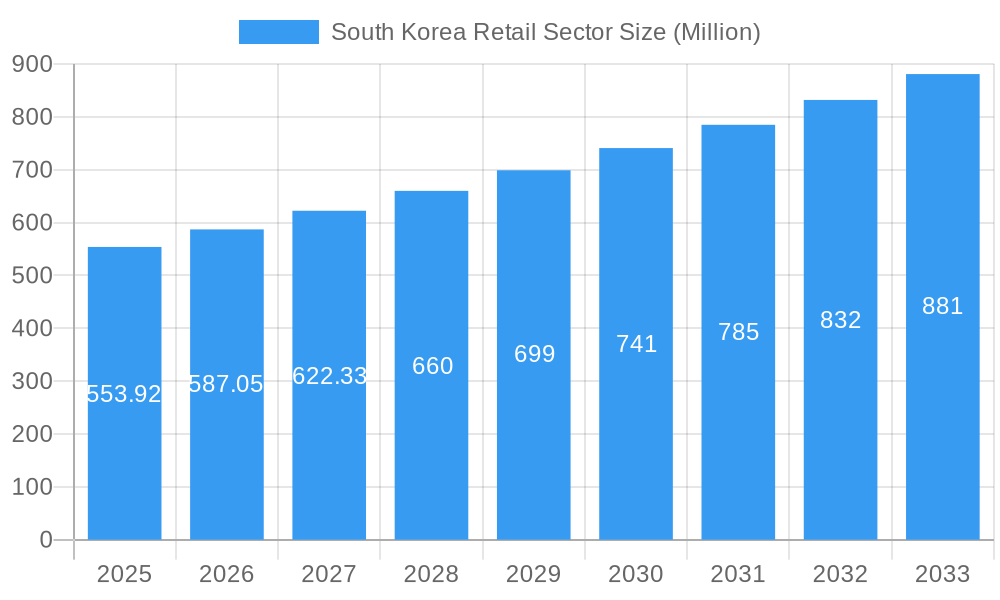

The South Korean retail sector, valued at $553.92 million in 2025, is projected to experience robust growth, driven by a burgeoning e-commerce landscape, rising disposable incomes, and a shift towards convenience-focused shopping experiences. The sector's Compound Annual Growth Rate (CAGR) of 5.68% from 2025 to 2033 indicates a steady expansion, fueled by increasing consumer spending and the adoption of innovative retail technologies. Key drivers include the proliferation of omnichannel strategies by established players like Lotte Mart and E-Mart Inc, the rise of online marketplaces, and the growing popularity of quick-commerce models catering to busy lifestyles. The increasing preference for personalized shopping experiences and loyalty programs further contributes to market growth. While challenges exist, such as intense competition and evolving consumer preferences, the overall outlook remains positive, particularly for retailers that effectively leverage digital platforms and offer value-added services.

South Korea Retail Sector Market Size (In Million)

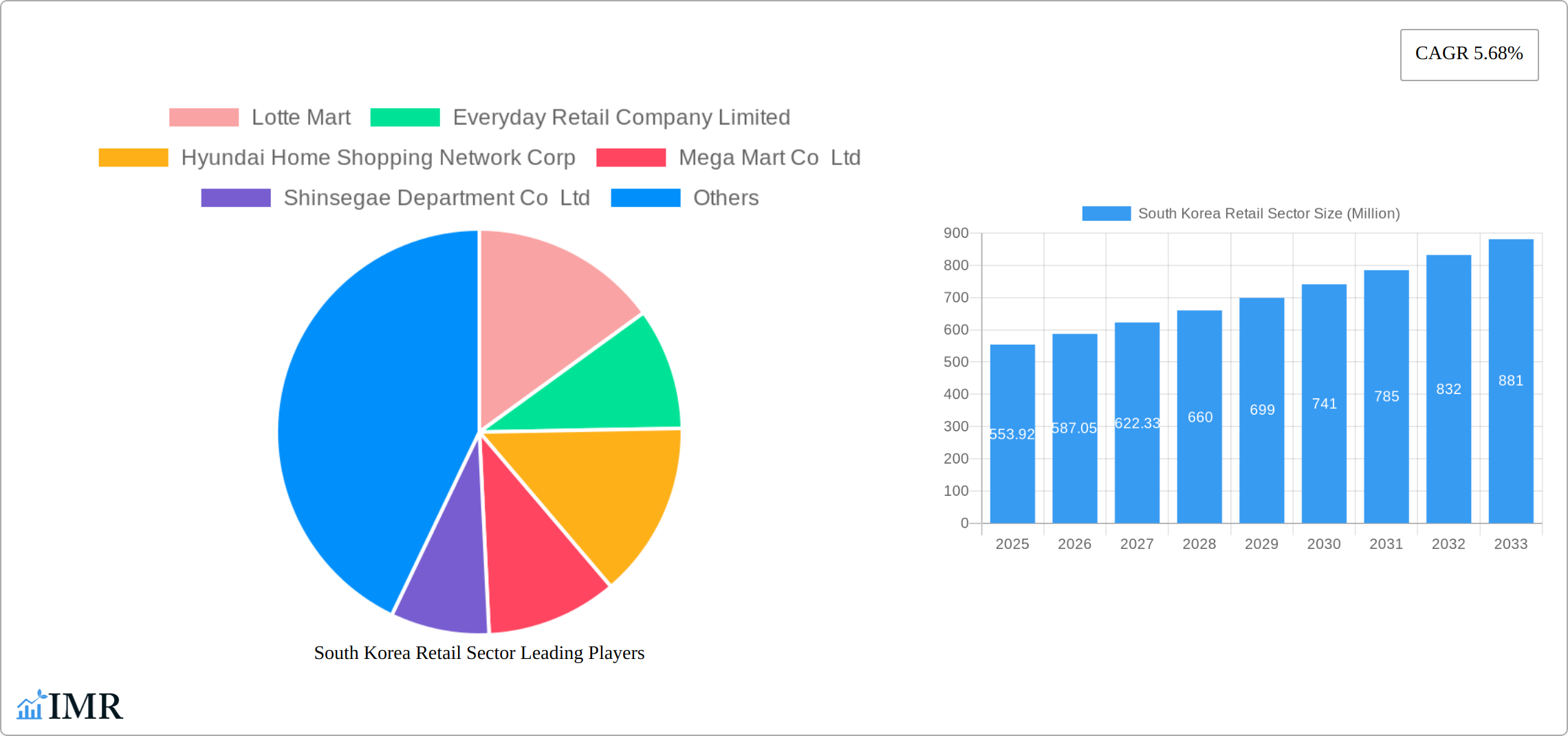

The competitive landscape is characterized by a mix of established domestic players like Shinsegae Department Co Ltd and Homeplus Co Ltd, and international entrants like Costco Wholesale Korea Ltd. These companies are continually innovating to maintain a competitive edge, investing in supply chain optimization, advanced analytics, and personalized marketing strategies. Segments within the market, although not specified, likely include grocery, apparel, electronics, and home goods, each with its own growth trajectory. The continued expansion of convenience stores like 7-Eleven and the growing appeal of specialized retailers like Five Guys reflect the diverse needs of South Korean consumers. Future growth will depend on retailers' ability to adapt to changing consumer behaviors, embrace technological advancements, and provide seamless and engaging shopping experiences across various channels.

South Korea Retail Sector Company Market Share

South Korea Retail Sector: Market Analysis & Forecast (2019-2033)

This comprehensive report provides a detailed analysis of the South Korea retail sector, encompassing market dynamics, growth trends, key players, and future outlook. The study period covers 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. This report is essential for businesses, investors, and analysts seeking to understand and capitalize on opportunities within this dynamic market. Keywords: South Korea Retail Market, South Korea E-commerce, Korean Retail Industry, South Korean Consumer Spending, Lotte Mart, E-Mart, Shinsegae, 7-Eleven, Homeplus, Retail Trends South Korea.

South Korea Retail Sector Market Dynamics & Structure

The South Korean retail sector is characterized by a dynamic interplay of established players and emerging trends. Market concentration is moderate, with a few large players dominating specific segments (e.g., Shinsegae in department stores, Lotte Mart in supermarkets). Technological innovation, particularly in e-commerce and omnichannel strategies, is a key driver. The regulatory framework, while generally supportive of business, includes aspects that impact operations and expansion. Substitute products (e.g., online marketplaces, direct-to-consumer brands) are increasingly challenging traditional retail models. The end-user demographic is diverse, with a growing emphasis on younger consumers' preferences. M&A activity has been relatively consistent, with xx million units in deal volume during the historical period (2019-2024), primarily focused on consolidation and expansion strategies.

- Market Concentration: Moderate, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Strong focus on e-commerce, mobile payments, and data analytics.

- Regulatory Framework: Generally favorable but with specific regulations impacting foreign investment and retail operations.

- Competitive Substitutes: Online marketplaces and direct-to-consumer brands are posing significant challenges.

- End-User Demographics: Diverse, with a growing young adult population driving demand for new experiences and convenience.

- M&A Trends: xx million units in deal volume (2019-2024); Consolidation and expansion are key drivers.

South Korea Retail Sector Growth Trends & Insights

The South Korean retail sector is a dynamic and rapidly evolving landscape. During the historical period (2019-2024), the market demonstrated robust growth, driven by a confluence of factors including a rising middle class with increasing disposable incomes, a highly urbanized population, and rapid advancements in digital technologies. The market size reached an estimated **[Insert Market Size Value] million units** in 2024. Looking ahead, the sector is projected to experience continued expansion, reaching approximately **[Insert Projected Market Size Value] million units** by 2033, with a Compound Annual Growth Rate (CAGR) of **[Insert Projected CAGR Value]%**. A significant trend is the escalating adoption of e-commerce, which reached a penetration rate of **[Insert E-commerce Penetration Rate]%** in 2024. This surge is fueled by technological innovations such as the proliferation of mobile commerce and the increasing demand for hyper-personalized shopping experiences. Consequently, South Korean consumers now prioritize convenience, tailored offerings, and seamless omnichannel integration. Retailers are compelled to respond with agility, making strategic investments in cutting-edge technology and prioritizing the cultivation of strong customer loyalty through innovative programs.

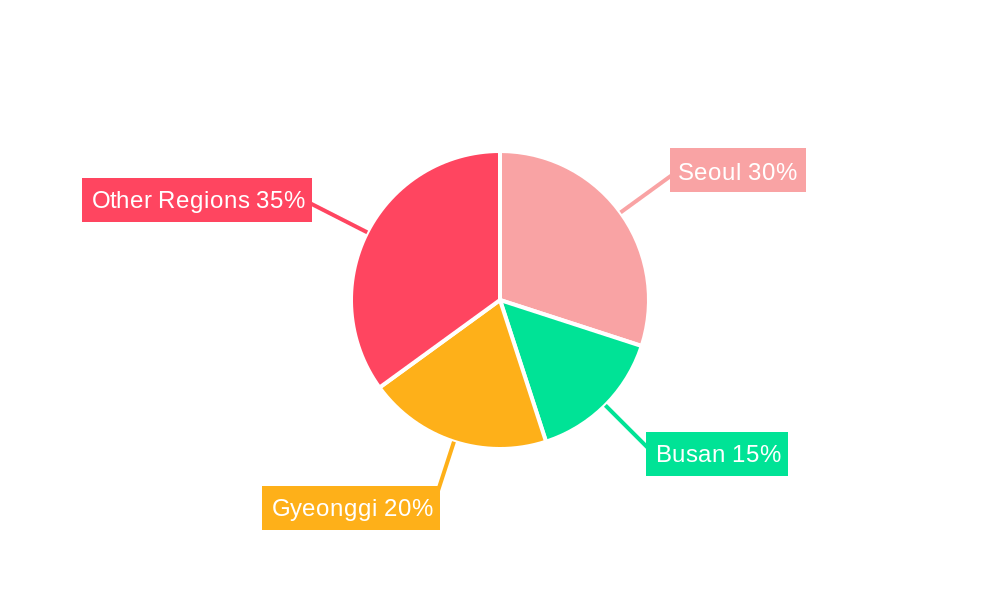

Dominant Regions, Countries, or Segments in South Korea Retail Sector

Seoul and other major metropolitan areas dominate the retail sector, accounting for approximately xx% of total sales in 2024. This is driven by high population density, higher disposable incomes, and robust infrastructure. The grocery segment, including supermarkets and hypermarkets, holds the largest market share, while the e-commerce segment is experiencing the fastest growth.

- Key Drivers: High population density in urban areas, robust infrastructure, rising disposable incomes, and government policies supporting retail growth.

- Dominance Factors: Market size, strong consumer base, advanced infrastructure, and high consumer spending.

- Growth Potential: Continued urbanization, increasing consumer spending, and the expansion of e-commerce.

South Korea Retail Sector Product Landscape

The South Korean retail sector offers a diverse range of products across various segments. Innovation is evident in areas such as personalized shopping experiences (through data analysis and targeted promotions), advanced supply chain management (leveraging technology for efficient inventory control and delivery), and omnichannel integration (seamless transitions between online and offline shopping). This leads to improved customer satisfaction and operational efficiency. Unique selling propositions increasingly focus on convenience, brand loyalty programs, and customized offerings.

Key Drivers, Barriers & Challenges in South Korea Retail Sector

Key Drivers:

- Sustained growth in disposable incomes, bolstering consumer spending power.

- Ongoing urbanization and the resulting evolution of consumer lifestyles and preferences.

- Pervasive technological advancements, particularly in the realms of e-commerce, artificial intelligence for personalization, and the development of sophisticated omnichannel strategies.

- Supportive government policies and initiatives aimed at fostering innovation and growth within the retail ecosystem.

Key Challenges:

- Intensified competition from both established domestic giants and agile international players.

- Escalating operational costs, including rising labor expenses and persistent supply chain vulnerabilities, which can impact profitability and the ability to ensure consistent customer satisfaction.

- Navigating a complex regulatory environment characterized by stringent compliance requirements and evolving consumer protection laws.

Emerging Opportunities in South Korea Retail Sector

- Expansion into niche markets (e.g., sustainable products, imported goods).

- Leveraging data analytics to enhance personalization and customer experience.

- Development of innovative omnichannel strategies integrating online and offline retail experiences.

- Increased focus on convenience and personalized services.

Growth Accelerators in the South Korea Retail Sector Industry

The future trajectory of the South Korean retail sector is poised for accelerated growth, underpinned by ongoing technological innovation, strategic collaborations between traditional brick-and-mortar retailers and burgeoning e-commerce platforms, and successful expansion into new domestic and international markets. Furthermore, government incentives designed to promote technological adoption and the integration of sustainable practices across the industry are expected to be significant catalysts for market expansion.

Key Players Shaping the South Korea Retail Sector Market

- Lotte Mart

- Everyday Retail Company Limited

- Hyundai Home Shopping Network Corp

- Mega Mart Co Ltd

- Shinsegae Department Co Ltd

- 7-Eleven

- E-Mart Inc

- Costco Wholesale Korea Ltd

- Homeplus Co Ltd

- Grand Department Store Co Ltd

- Five Guys

Notable Milestones in South Korea Retail Sector

- September 2023: Lotte Mart launched an innovative dedicated shopping zone tailored to the needs and preferences of non-Korean tourists, enhancing their in-store experience.

- June 2023: The popular international burger chain, Five Guys, made its highly anticipated debut in South Korea with the opening of its first store in Seoul, signaling growing international interest in the market.

In-Depth South Korea Retail Sector Market Outlook

The South Korean retail sector is poised for continued growth, driven by technological innovations and evolving consumer preferences. Opportunities exist in expanding into niche markets, developing omnichannel strategies, and leveraging data analytics. Strategic partnerships and investments in technology will be crucial for success in this dynamic market. The focus on enhancing customer experience and sustainability will be key differentiators for market leaders.

South Korea Retail Sector Segmentation

-

1. Product Type

- 1.1. Food, Beverage, and Tobacco Products

- 1.2. Personal Care and Household

- 1.3. Apparel, Footwear, and Accessories

- 1.4. Furniture, Toys, and Hobby

- 1.5. Industrial and Automotive

- 1.6. Electronic and Household Appliances

- 1.7. Pharmaceuticals and Luxury Goods

-

2. Distribution Channel

- 2.1. Online

- 2.2. Offline

South Korea Retail Sector Segmentation By Geography

- 1. South Korea

South Korea Retail Sector Regional Market Share

Geographic Coverage of South Korea Retail Sector

South Korea Retail Sector REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.68% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.3. Market Restrains

- 3.3.1. Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products

- 3.4. Market Trends

- 3.4.1. Growing E-Commerce is Driving the Retail Market in South Korea

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South Korea Retail Sector Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Food, Beverage, and Tobacco Products

- 5.1.2. Personal Care and Household

- 5.1.3. Apparel, Footwear, and Accessories

- 5.1.4. Furniture, Toys, and Hobby

- 5.1.5. Industrial and Automotive

- 5.1.6. Electronic and Household Appliances

- 5.1.7. Pharmaceuticals and Luxury Goods

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Online

- 5.2.2. Offline

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. South Korea

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Lotte Mart

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Everyday Retail Company Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Hyundai Home Shopping Network Corp

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Mega Mart Co Ltd

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Shinsegae Department Co Ltd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 7-Eleven

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 E-Mart Inc

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Costco Wholesale Korea Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Homeplus Co Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Grand Department Store Co Ltd*

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Five Guys**List Not Exhaustive

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Lotte Mart

List of Figures

- Figure 1: South Korea Retail Sector Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South Korea Retail Sector Share (%) by Company 2025

List of Tables

- Table 1: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 2: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 3: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 5: South Korea Retail Sector Revenue Million Forecast, by Region 2020 & 2033

- Table 6: South Korea Retail Sector Volume Billion Forecast, by Region 2020 & 2033

- Table 7: South Korea Retail Sector Revenue Million Forecast, by Product Type 2020 & 2033

- Table 8: South Korea Retail Sector Volume Billion Forecast, by Product Type 2020 & 2033

- Table 9: South Korea Retail Sector Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 10: South Korea Retail Sector Volume Billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: South Korea Retail Sector Revenue Million Forecast, by Country 2020 & 2033

- Table 12: South Korea Retail Sector Volume Billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South Korea Retail Sector?

The projected CAGR is approximately 5.68%.

2. Which companies are prominent players in the South Korea Retail Sector?

Key companies in the market include Lotte Mart, Everyday Retail Company Limited, Hyundai Home Shopping Network Corp, Mega Mart Co Ltd, Shinsegae Department Co Ltd, 7-Eleven, E-Mart Inc, Costco Wholesale Korea Ltd, Homeplus Co Ltd, Grand Department Store Co Ltd*, Five Guys**List Not Exhaustive.

3. What are the main segments of the South Korea Retail Sector?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 553.92 Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

6. What are the notable trends driving market growth?

Growing E-Commerce is Driving the Retail Market in South Korea.

7. Are there any restraints impacting market growth?

Growing Tourism in South Korea; Growing Awareness About Healthy Lifestyle Products.

8. Can you provide examples of recent developments in the market?

September 2023: Lotte Mart, a South Korean supermarket retail store chain, announced that it will create a unique shopping zone for non-Korean tourists at its stores that travelers and tourists frequently visit.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in Billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South Korea Retail Sector," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South Korea Retail Sector report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South Korea Retail Sector?

To stay informed about further developments, trends, and reports in the South Korea Retail Sector, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence