Key Insights

The Asia Pacific (APAC) sports drink market is projected for substantial growth, anticipated to reach 15845.9 million by 2029, driven by a compound annual growth rate (CAGR) of 9.9%. This expansion is fueled by heightened health awareness and the increasing adoption of active lifestyles across the region. Growing disposable incomes in emerging economies, such as China and India, are empowering consumers to invest more in health and wellness products that support physical performance and recovery. The rising popularity of fitness trends and a greater understanding of hydration and electrolyte replenishment, particularly among younger demographics and athletes, are key growth drivers.

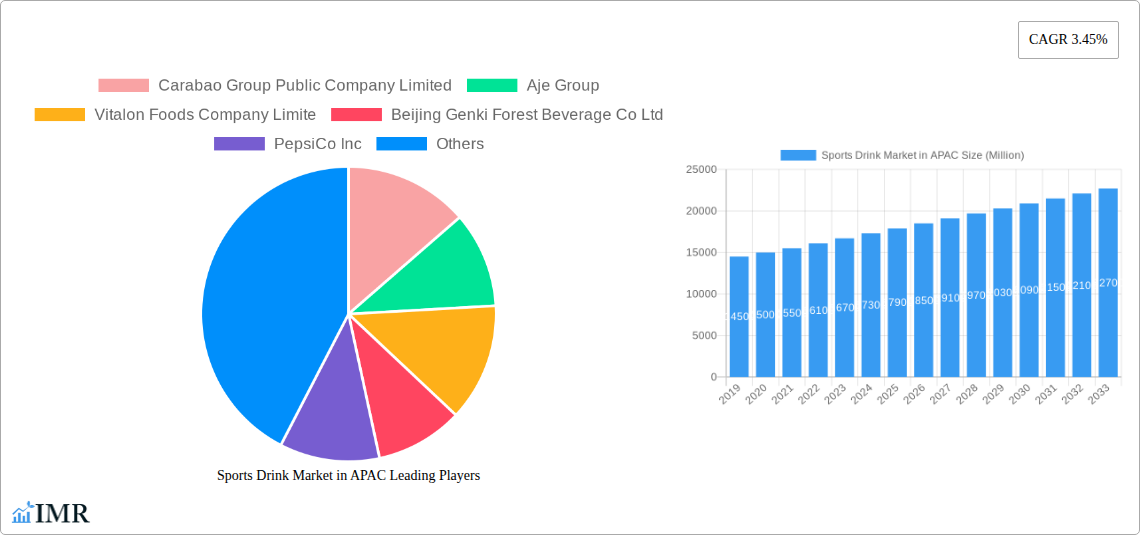

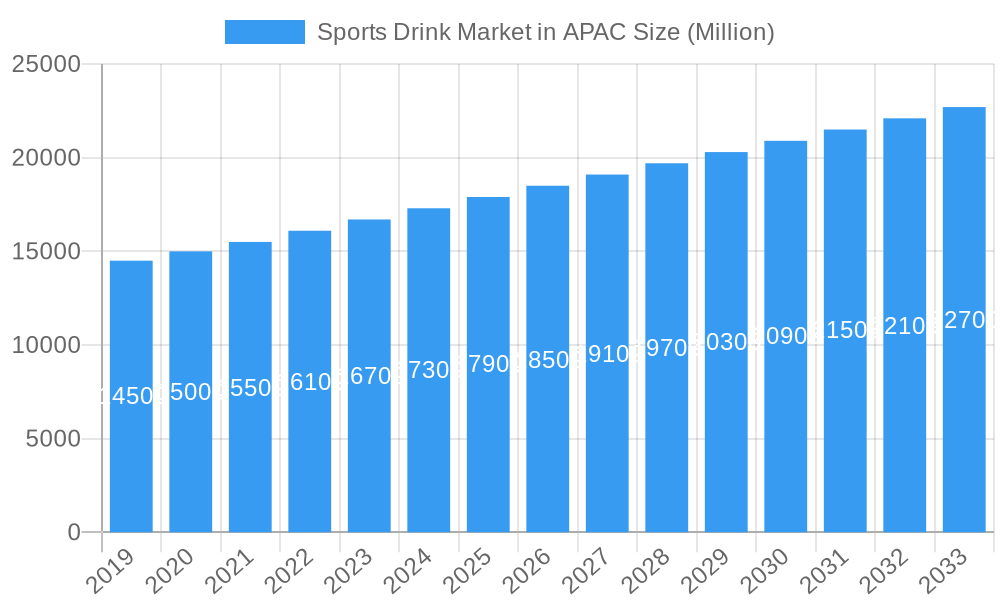

Sports Drink Market in APAC Market Size (In Billion)

The APAC sports drink market is segmented by product type and distribution channel. Electrolyte-enhanced waters and protein-based sports drinks are in high demand for their targeted hydration and muscle recovery benefits. Innovations in sustainable packaging, including aseptic containers and metal cans, cater to eco-conscious consumers and enhance convenience. Online retail is rapidly growing alongside traditional channels like supermarkets and convenience stores, reflecting evolving consumer purchasing habits. Leading companies are focusing on product innovation and strategic expansions within key markets such as China, India, and ASEAN nations. The market also faces challenges from counterfeit products and price competition, which are being mitigated through robust brand building and quality assurance initiatives.

Sports Drink Market in APAC Company Market Share

This report offers a comprehensive analysis of the APAC Sports Drink Market. It examines market dynamics, growth trends, regional performance, and key player strategies, providing crucial insights for stakeholders. The report details parent and child market segments, with granular data on product types, packaging, and distribution channels, all presented in million units for the base year 2024.

Sports Drink Market in APAC Market Dynamics & Structure

The APAC Sports Drink Market is characterized by a moderate to high concentration, with major multinational corporations and strong regional players vying for market share. Technological innovation is a key driver, with companies investing in R&D to develop advanced formulations offering superior hydration, electrolyte replenishment, and targeted nutritional benefits. Regulatory frameworks, while varied across countries, are generally supportive of health and wellness products, though labeling and ingredient regulations require careful navigation. Competitive product substitutes include traditional beverages and functional waters, but dedicated sports drinks offer specialized benefits that resonate with active consumers. End-user demographics are diverse, encompassing professional athletes, amateur sports enthusiasts, fitness-conscious individuals, and increasingly, everyday consumers seeking post-exercise recovery. Mergers and acquisitions (M&A) trends are present, with larger companies acquiring smaller, innovative brands to expand their product portfolios and market reach.

- Market Concentration: Dominated by key global and regional players, with increasing fragmentation in niche segments.

- Technological Innovation: Focus on enhanced electrolyte formulations, natural ingredients, and functional benefits (e.g., protein, vitamins).

- Regulatory Landscape: Evolving regulations concerning health claims, ingredients, and labeling across different APAC nations.

- Competitive Landscape: Competition from functional beverages, enhanced waters, and traditional soft drinks.

- End-User Segmentation: Professional athletes, fitness enthusiasts, and the growing "weekend warrior" segment.

- M&A Activity: Strategic acquisitions to gain market share and access new product technologies.

Sports Drink Market in APAC Growth Trends & Insights

The APAC Sports Drink Market is projected to experience robust growth throughout the forecast period, fueled by a confluence of evolving consumer behaviors and favorable market conditions. The market size is estimated to have reached approximately 8,500 Million units in the base year 2025, with a projected Compound Annual Growth Rate (CAGR) of XX% from 2025 to 2033. This expansion is driven by a significant increase in adoption rates, particularly in emerging economies within Southeast Asia and the Indian subcontinent, where rising disposable incomes and a greater emphasis on health and fitness are translating into higher per capita consumption. Technological disruptions are playing a crucial role, with advancements in ingredient science leading to the development of more effective and targeted sports nutrition products. For instance, the integration of probiotics and adaptogens into sports drinks is gaining traction, appealing to a segment of consumers seeking holistic wellness benefits beyond basic hydration.

Consumer behavior shifts are a cornerstone of this market's evolution. There's a discernible move away from purely sugar-laden beverages towards healthier alternatives, with a growing preference for drinks that offer tangible functional benefits, such as improved endurance, faster recovery, and enhanced cognitive function during physical activity. The "gamification" of fitness, coupled with the proliferation of fitness apps and wearable technology, has also encouraged more individuals to engage in regular exercise, thereby amplifying the demand for sports drinks. Furthermore, a greater awareness of the importance of electrolyte balance and hydration, especially in the hot and humid climates prevalent across much of APAC, is driving the uptake of specialized sports beverages. The influence of social media and fitness influencers is also significant, shaping consumer perceptions and popularizing specific brands and product types. The market penetration of sports drinks, while already substantial in developed markets like Australia and Japan, is still in its nascent stages in many developing APAC nations, presenting a substantial opportunity for future growth. The demand for 'clean label' products, with fewer artificial ingredients and a focus on natural sweeteners and flavors, is also on the rise, prompting manufacturers to reformulate their offerings and introduce new, health-conscious options. This shift in consumer preference is a key indicator of the market's maturation and its potential for sustained, high-value growth.

Dominant Regions, Countries, or Segments in Sports Drink Market in APAC

The APAC Sports Drink Market exhibits distinct regional and segment-level dominance, with Electrolyte-Enhanced Water emerging as the most significant segment within the Soft Drink Type category, driven by its broad appeal and fundamental role in hydration for a wide range of physical activities. This segment's dominance is underpinned by its perceived health benefits and versatility, catering to both elite athletes and casual exercisers. In terms of packaging, PET Bottles represent the leading format, accounting for a substantial market share due to their convenience, durability, and cost-effectiveness in mass production and distribution. The widespread availability and consumer familiarity with PET bottles make them the preferred choice for many brands.

Geographically, China stands out as the dominant country, propelled by its massive population, burgeoning middle class, and a rapidly expanding sports and fitness culture. Government initiatives promoting public health and sports participation, coupled with significant investments in sports infrastructure, have created a fertile ground for sports drink consumption. The sheer volume of consumers actively seeking performance-enhancing and recovery products in China significantly influences the overall market trajectory. This dominance is further amplified by the presence of major domestic players like Nongfu Spring and Beijing Genki Forest, alongside global giants, all vying for a substantial slice of the pie.

The Supermarket/Hypermarket sub-distribution channel commands the largest share, reflecting the traditional purchasing habits of a majority of consumers in the region. These large retail formats offer a wide selection of brands and product types, making them a one-stop shop for household needs, including beverages. However, the Online Retail channel is experiencing exponential growth, driven by the increasing adoption of e-commerce platforms, the convenience of home delivery, and targeted marketing efforts by brands. This channel is particularly effective in reaching consumers in Tier 2 and Tier 3 cities and for niche or specialized products.

- Dominant Soft Drink Type: Electrolyte-Enhanced Water, driven by fundamental hydration needs and broad consumer appeal.

- Dominant Packaging Type: PET Bottles, favored for their convenience, affordability, and widespread availability.

- Dominant Country: China, due to its large population, growing disposable income, and strong government support for sports.

- Dominant Sub Distribution Channel: Supermarket/Hypermarket, reflecting traditional consumer purchasing behavior, with Online Retail showing rapid growth.

- Key Drivers of Dominance in China:

- Massive consumer base and increasing health awareness.

- Government promotion of sports and healthy lifestyles.

- Robust domestic and international brand presence.

- Rapid urbanization and adoption of Western fitness trends.

- Key Drivers of Dominance for PET Bottles:

- Cost-effectiveness and ease of manufacturing.

- Consumer preference for single-serving, portable formats.

- Recyclability and evolving sustainable packaging initiatives.

- Growth Potential of Online Retail:

- Increasing internet penetration and smartphone usage.

- Convenience and accessibility for consumers in remote areas.

- Personalized marketing and direct-to-consumer sales models.

Sports Drink Market in APAC Product Landscape

The APAC Sports Drink Market is characterized by a vibrant product landscape focused on innovation and meeting diverse consumer needs. Key product developments include advanced electrolyte blends for optimal hydration and mineral replenishment, such as those incorporating sodium, potassium, magnesium, and calcium. Protein-based sport drinks are gaining traction for muscle recovery and growth, catering to the fitness segment. Companies are also exploring natural sweeteners, fruit-derived flavors, and functional ingredients like BCAAs (branched-chain amino acids) and adaptogens to enhance product appeal and perceived benefits. Innovations in packaging, such as lighter-weight PET bottles and resealable options, contribute to product convenience and sustainability. Performance metrics are often highlighted through claims related to hydration efficiency, electrolyte balance, and rapid energy restoration.

Key Drivers, Barriers & Challenges in Sports Drink Market in APAC

Key Drivers:

- Growing Health and Wellness Consciousness: Increasing awareness of the link between hydration, nutrition, and physical performance.

- Rising Disposable Incomes: Greater purchasing power among consumers across the APAC region, enabling them to spend on premium beverages.

- Expansion of Sports and Fitness Culture: Proliferation of gyms, sports clubs, and organized sporting events, boosting demand among participants.

- Product Innovation and Diversification: Development of specialized drinks catering to specific needs (e.g., endurance, recovery, immunity).

- Influence of Social Media and Fitness Trends: Growing popularity of fitness influencers and active lifestyles promoted online.

Barriers & Challenges:

- Price Sensitivity: High cost of premium sports drinks can be a deterrent in price-sensitive markets.

- Regulatory Hurdles: Navigating diverse and sometimes complex food and beverage regulations across different countries.

- Competition from Traditional Beverages: Established market presence of juices, carbonated soft drinks, and functional waters.

- Supply Chain Complexities: Ensuring consistent availability and quality of raw materials and finished products across a vast geographical area.

- Consumer Education: The need to educate consumers on the specific benefits and usage occasions of sports drinks beyond basic hydration.

- Counterfeit Products: Risk of counterfeit or substandard products entering the market, impacting brand reputation and consumer trust.

Emerging Opportunities in Sports Drink Market in APAC

Emerging opportunities in the APAC Sports Drink Market are abundant, driven by evolving consumer preferences and untapped market potential. The growing demand for plant-based and natural ingredient sports drinks presents a significant avenue for product development, catering to health-conscious and environmentally aware consumers. The expansion of online retail and direct-to-consumer (D2C) models offers direct access to a wider customer base and allows for personalized marketing strategies. Furthermore, the increasing participation in niche sports and outdoor activities (e.g., trail running, cycling, yoga) creates opportunities for specialized sports drinks formulated for specific endurance and recovery needs. The development of innovative functional ingredients, such as prebiotics, probiotics, and nootropics, within sports drinks can attract consumers seeking holistic wellness benefits. Finally, targeting emerging markets within Southeast Asia and the Indian subcontinent with tailored product offerings and distribution strategies promises substantial long-term growth.

Growth Accelerators in the Sports Drink Market in APAC Industry

Several growth accelerators are poised to propel the APAC Sports Drink Market forward. The relentless pursuit of product innovation, particularly in areas like low-sugar formulations, natural ingredients, and enhanced functional benefits, will continue to drive consumer adoption. Strategic partnerships and collaborations between sports brands, fitness influencers, and beverage companies can amplify market reach and consumer engagement. The expansion of distribution networks, especially into rural and semi-urban areas, coupled with the robust growth of e-commerce platforms, will ensure greater accessibility. Moreover, government initiatives promoting sports and healthy lifestyles, such as increased funding for sports infrastructure and public health campaigns, will create a more conducive environment for market expansion. The growing trend of personalization, allowing consumers to tailor their hydration and nutrition based on individual needs and activity levels, will also be a significant growth catalyst.

Key Players Shaping the Sports Drink Market in APAC Market

- Carabao Group Public Company Limited

- Aje Group

- Vitalon Foods Company Limite

- Beijing Genki Forest Beverage Co Ltd

- PepsiCo Inc

- Nongfu Spring Co Ltd

- Suntory Holdings Limited

- Steric Pty Ltd

- Danone S A

- The Coca-Cola Company

- Guangdong Jianlibao Group

- Thai Beverages PCL

- Otsuka Holdings Co Ltd

- Sapporo Holdings Limited

Notable Milestones in Sports Drink Market in APAC Sector

- September 2023: Limca Sportz, the sports drink from Coca-Cola India's home-grown brand Limca, announced the launch of its new variant Limca Sportz ION4 in India.

- June 2023: Danone China launched a grapefruit-flavored electrolyte drink in the Chinese market, containing 455g of five essential electrolytes (potassium, calcium, magnesium, sodium, and chloride).

- August 2022: Coca‑Cola India announced the first-ever brand extension for its homegrown brand Limca into the hydrating sports drinks category with ‘Limca Sportz’. The brand’s new offering ‘Limca Sportz’ is a Glucose + Electrolyte-based beverage containing essential minerals for rapid fluid intake.

In-Depth Sports Drink Market in APAC Market Outlook

The APAC Sports Drink Market is set for sustained and significant growth, driven by a potent combination of macro-economic factors and evolving consumer demands. The increasing emphasis on preventative healthcare and the desire for enhanced athletic performance will continue to fuel demand for specialized beverages. Market players are strategically focusing on expanding their product portfolios to include healthier, more functional options, such as those with reduced sugar content and natural ingredients, appealing to a broader demographic. The rapid digitalization of retail channels and targeted marketing campaigns will further penetrate nascent markets, driving accessibility and brand visibility. Anticipated advancements in beverage technology, coupled with strategic M&A activities to consolidate market presence and acquire innovative capabilities, will shape the competitive landscape. The long-term outlook remains exceptionally bright, with the APAC region poised to become a dominant force in the global sports drink industry.

Sports Drink Market in APAC Segmentation

-

1. Soft Drink Type

- 1.1. Electrolyte-Enhanced Water

- 1.2. Hypertonic

- 1.3. Hypotonic

- 1.4. Isotonic

- 1.5. Protein-based Sport Drinks

-

2. Packaging Type

- 2.1. Aseptic packages

- 2.2. Metal Can

- 2.3. PET Bottles

-

3. Sub Distribution Channel

- 3.1. Convenience Stores

- 3.2. Online Retail

- 3.3. Specialty Stores

- 3.4. Supermarket/Hypermarket

- 3.5. Others

Sports Drink Market in APAC Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

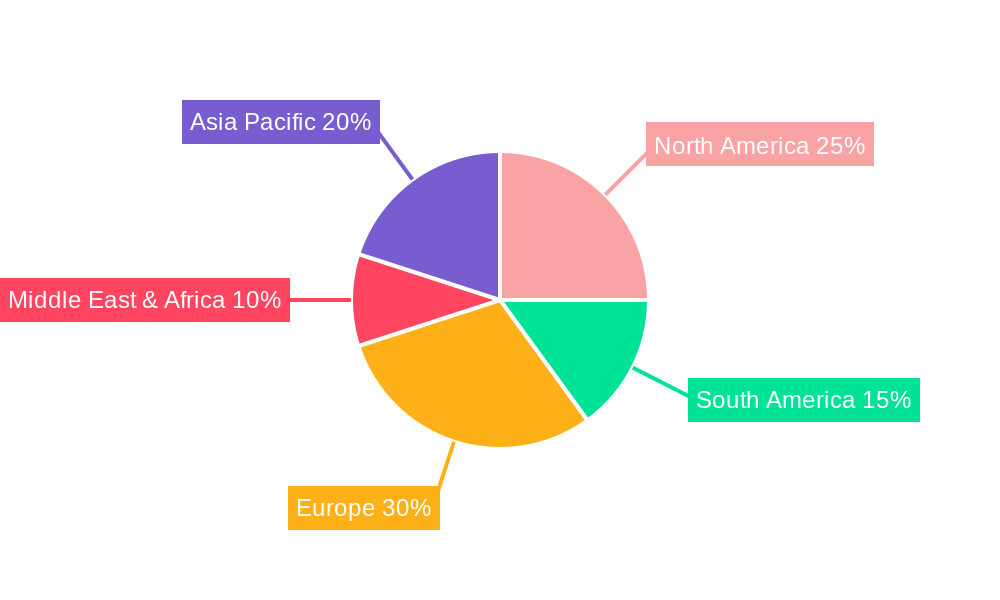

Sports Drink Market in APAC Regional Market Share

Geographic Coverage of Sports Drink Market in APAC

Sports Drink Market in APAC REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 9.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products

- 3.3. Market Restrains

- 3.3.1. Availability of Counterfeit Beauty Supplements Products

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Sports Drink Market in APAC Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 5.1.1. Electrolyte-Enhanced Water

- 5.1.2. Hypertonic

- 5.1.3. Hypotonic

- 5.1.4. Isotonic

- 5.1.5. Protein-based Sport Drinks

- 5.2. Market Analysis, Insights and Forecast - by Packaging Type

- 5.2.1. Aseptic packages

- 5.2.2. Metal Can

- 5.2.3. PET Bottles

- 5.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 5.3.1. Convenience Stores

- 5.3.2. Online Retail

- 5.3.3. Specialty Stores

- 5.3.4. Supermarket/Hypermarket

- 5.3.5. Others

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. South America

- 5.4.3. Europe

- 5.4.4. Middle East & Africa

- 5.4.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6. North America Sports Drink Market in APAC Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 6.1.1. Electrolyte-Enhanced Water

- 6.1.2. Hypertonic

- 6.1.3. Hypotonic

- 6.1.4. Isotonic

- 6.1.5. Protein-based Sport Drinks

- 6.2. Market Analysis, Insights and Forecast - by Packaging Type

- 6.2.1. Aseptic packages

- 6.2.2. Metal Can

- 6.2.3. PET Bottles

- 6.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 6.3.1. Convenience Stores

- 6.3.2. Online Retail

- 6.3.3. Specialty Stores

- 6.3.4. Supermarket/Hypermarket

- 6.3.5. Others

- 6.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7. South America Sports Drink Market in APAC Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 7.1.1. Electrolyte-Enhanced Water

- 7.1.2. Hypertonic

- 7.1.3. Hypotonic

- 7.1.4. Isotonic

- 7.1.5. Protein-based Sport Drinks

- 7.2. Market Analysis, Insights and Forecast - by Packaging Type

- 7.2.1. Aseptic packages

- 7.2.2. Metal Can

- 7.2.3. PET Bottles

- 7.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 7.3.1. Convenience Stores

- 7.3.2. Online Retail

- 7.3.3. Specialty Stores

- 7.3.4. Supermarket/Hypermarket

- 7.3.5. Others

- 7.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8. Europe Sports Drink Market in APAC Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 8.1.1. Electrolyte-Enhanced Water

- 8.1.2. Hypertonic

- 8.1.3. Hypotonic

- 8.1.4. Isotonic

- 8.1.5. Protein-based Sport Drinks

- 8.2. Market Analysis, Insights and Forecast - by Packaging Type

- 8.2.1. Aseptic packages

- 8.2.2. Metal Can

- 8.2.3. PET Bottles

- 8.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 8.3.1. Convenience Stores

- 8.3.2. Online Retail

- 8.3.3. Specialty Stores

- 8.3.4. Supermarket/Hypermarket

- 8.3.5. Others

- 8.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9. Middle East & Africa Sports Drink Market in APAC Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 9.1.1. Electrolyte-Enhanced Water

- 9.1.2. Hypertonic

- 9.1.3. Hypotonic

- 9.1.4. Isotonic

- 9.1.5. Protein-based Sport Drinks

- 9.2. Market Analysis, Insights and Forecast - by Packaging Type

- 9.2.1. Aseptic packages

- 9.2.2. Metal Can

- 9.2.3. PET Bottles

- 9.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 9.3.1. Convenience Stores

- 9.3.2. Online Retail

- 9.3.3. Specialty Stores

- 9.3.4. Supermarket/Hypermarket

- 9.3.5. Others

- 9.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10. Asia Pacific Sports Drink Market in APAC Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 10.1.1. Electrolyte-Enhanced Water

- 10.1.2. Hypertonic

- 10.1.3. Hypotonic

- 10.1.4. Isotonic

- 10.1.5. Protein-based Sport Drinks

- 10.2. Market Analysis, Insights and Forecast - by Packaging Type

- 10.2.1. Aseptic packages

- 10.2.2. Metal Can

- 10.2.3. PET Bottles

- 10.3. Market Analysis, Insights and Forecast - by Sub Distribution Channel

- 10.3.1. Convenience Stores

- 10.3.2. Online Retail

- 10.3.3. Specialty Stores

- 10.3.4. Supermarket/Hypermarket

- 10.3.5. Others

- 10.1. Market Analysis, Insights and Forecast - by Soft Drink Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Carabao Group Public Company Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Aje Group

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Vitalon Foods Company Limite

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Beijing Genki Forest Beverage Co Ltd

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 PepsiCo Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nongfu Spring Co Ltd

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Suntory Holdings Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Steric Pty Ltd

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Danone S A

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 The Coca-Cola Company

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Guangdong Jianlibao Group

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Thai Beverages PCL

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Otsuka Holdings Co Ltd

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.14 Sapporo Holdings Limited

- 11.2.14.1. Overview

- 11.2.14.2. Products

- 11.2.14.3. SWOT Analysis

- 11.2.14.4. Recent Developments

- 11.2.14.5. Financials (Based on Availability)

- 11.2.1 Carabao Group Public Company Limited

List of Figures

- Figure 1: Global Sports Drink Market in APAC Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: North America Sports Drink Market in APAC Revenue (million), by Soft Drink Type 2025 & 2033

- Figure 3: North America Sports Drink Market in APAC Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 4: North America Sports Drink Market in APAC Revenue (million), by Packaging Type 2025 & 2033

- Figure 5: North America Sports Drink Market in APAC Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 6: North America Sports Drink Market in APAC Revenue (million), by Sub Distribution Channel 2025 & 2033

- Figure 7: North America Sports Drink Market in APAC Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 8: North America Sports Drink Market in APAC Revenue (million), by Country 2025 & 2033

- Figure 9: North America Sports Drink Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 10: South America Sports Drink Market in APAC Revenue (million), by Soft Drink Type 2025 & 2033

- Figure 11: South America Sports Drink Market in APAC Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 12: South America Sports Drink Market in APAC Revenue (million), by Packaging Type 2025 & 2033

- Figure 13: South America Sports Drink Market in APAC Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 14: South America Sports Drink Market in APAC Revenue (million), by Sub Distribution Channel 2025 & 2033

- Figure 15: South America Sports Drink Market in APAC Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 16: South America Sports Drink Market in APAC Revenue (million), by Country 2025 & 2033

- Figure 17: South America Sports Drink Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 18: Europe Sports Drink Market in APAC Revenue (million), by Soft Drink Type 2025 & 2033

- Figure 19: Europe Sports Drink Market in APAC Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 20: Europe Sports Drink Market in APAC Revenue (million), by Packaging Type 2025 & 2033

- Figure 21: Europe Sports Drink Market in APAC Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 22: Europe Sports Drink Market in APAC Revenue (million), by Sub Distribution Channel 2025 & 2033

- Figure 23: Europe Sports Drink Market in APAC Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 24: Europe Sports Drink Market in APAC Revenue (million), by Country 2025 & 2033

- Figure 25: Europe Sports Drink Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 26: Middle East & Africa Sports Drink Market in APAC Revenue (million), by Soft Drink Type 2025 & 2033

- Figure 27: Middle East & Africa Sports Drink Market in APAC Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 28: Middle East & Africa Sports Drink Market in APAC Revenue (million), by Packaging Type 2025 & 2033

- Figure 29: Middle East & Africa Sports Drink Market in APAC Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 30: Middle East & Africa Sports Drink Market in APAC Revenue (million), by Sub Distribution Channel 2025 & 2033

- Figure 31: Middle East & Africa Sports Drink Market in APAC Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 32: Middle East & Africa Sports Drink Market in APAC Revenue (million), by Country 2025 & 2033

- Figure 33: Middle East & Africa Sports Drink Market in APAC Revenue Share (%), by Country 2025 & 2033

- Figure 34: Asia Pacific Sports Drink Market in APAC Revenue (million), by Soft Drink Type 2025 & 2033

- Figure 35: Asia Pacific Sports Drink Market in APAC Revenue Share (%), by Soft Drink Type 2025 & 2033

- Figure 36: Asia Pacific Sports Drink Market in APAC Revenue (million), by Packaging Type 2025 & 2033

- Figure 37: Asia Pacific Sports Drink Market in APAC Revenue Share (%), by Packaging Type 2025 & 2033

- Figure 38: Asia Pacific Sports Drink Market in APAC Revenue (million), by Sub Distribution Channel 2025 & 2033

- Figure 39: Asia Pacific Sports Drink Market in APAC Revenue Share (%), by Sub Distribution Channel 2025 & 2033

- Figure 40: Asia Pacific Sports Drink Market in APAC Revenue (million), by Country 2025 & 2033

- Figure 41: Asia Pacific Sports Drink Market in APAC Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Sports Drink Market in APAC Revenue million Forecast, by Soft Drink Type 2020 & 2033

- Table 2: Global Sports Drink Market in APAC Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 3: Global Sports Drink Market in APAC Revenue million Forecast, by Sub Distribution Channel 2020 & 2033

- Table 4: Global Sports Drink Market in APAC Revenue million Forecast, by Region 2020 & 2033

- Table 5: Global Sports Drink Market in APAC Revenue million Forecast, by Soft Drink Type 2020 & 2033

- Table 6: Global Sports Drink Market in APAC Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 7: Global Sports Drink Market in APAC Revenue million Forecast, by Sub Distribution Channel 2020 & 2033

- Table 8: Global Sports Drink Market in APAC Revenue million Forecast, by Country 2020 & 2033

- Table 9: United States Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 10: Canada Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 11: Mexico Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 12: Global Sports Drink Market in APAC Revenue million Forecast, by Soft Drink Type 2020 & 2033

- Table 13: Global Sports Drink Market in APAC Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 14: Global Sports Drink Market in APAC Revenue million Forecast, by Sub Distribution Channel 2020 & 2033

- Table 15: Global Sports Drink Market in APAC Revenue million Forecast, by Country 2020 & 2033

- Table 16: Brazil Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 17: Argentina Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Rest of South America Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 19: Global Sports Drink Market in APAC Revenue million Forecast, by Soft Drink Type 2020 & 2033

- Table 20: Global Sports Drink Market in APAC Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 21: Global Sports Drink Market in APAC Revenue million Forecast, by Sub Distribution Channel 2020 & 2033

- Table 22: Global Sports Drink Market in APAC Revenue million Forecast, by Country 2020 & 2033

- Table 23: United Kingdom Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 24: Germany Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 25: France Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Italy Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 27: Spain Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Russia Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 29: Benelux Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Nordics Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 31: Rest of Europe Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 32: Global Sports Drink Market in APAC Revenue million Forecast, by Soft Drink Type 2020 & 2033

- Table 33: Global Sports Drink Market in APAC Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 34: Global Sports Drink Market in APAC Revenue million Forecast, by Sub Distribution Channel 2020 & 2033

- Table 35: Global Sports Drink Market in APAC Revenue million Forecast, by Country 2020 & 2033

- Table 36: Turkey Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 37: Israel Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: GCC Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 39: North Africa Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: South Africa Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 41: Rest of Middle East & Africa Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: Global Sports Drink Market in APAC Revenue million Forecast, by Soft Drink Type 2020 & 2033

- Table 43: Global Sports Drink Market in APAC Revenue million Forecast, by Packaging Type 2020 & 2033

- Table 44: Global Sports Drink Market in APAC Revenue million Forecast, by Sub Distribution Channel 2020 & 2033

- Table 45: Global Sports Drink Market in APAC Revenue million Forecast, by Country 2020 & 2033

- Table 46: China Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 47: India Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Japan Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 49: South Korea Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: ASEAN Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 51: Oceania Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Rest of Asia Pacific Sports Drink Market in APAC Revenue (million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Sports Drink Market in APAC?

The projected CAGR is approximately 9.9%.

2. Which companies are prominent players in the Sports Drink Market in APAC?

Key companies in the market include Carabao Group Public Company Limited, Aje Group, Vitalon Foods Company Limite, Beijing Genki Forest Beverage Co Ltd, PepsiCo Inc, Nongfu Spring Co Ltd, Suntory Holdings Limited, Steric Pty Ltd, Danone S A, The Coca-Cola Company, Guangdong Jianlibao Group, Thai Beverages PCL, Otsuka Holdings Co Ltd, Sapporo Holdings Limited.

3. What are the main segments of the Sports Drink Market in APAC?

The market segments include Soft Drink Type, Packaging Type, Sub Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 15845.9 million as of 2022.

5. What are some drivers contributing to market growth?

Rising Trend of Ingestible Beauty Products; Growing demand for Nutrient-Enriched Cosmetic Products.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Availability of Counterfeit Beauty Supplements Products.

8. Can you provide examples of recent developments in the market?

September 2023: Limca Sportz, the sports drink from Coca-Cola India's home-grown brand Limca, is thrilled to announce the launch of its new variant Limca Sportz ION4 in India.June 2023: Danone China has launched a grapefruit-flavored electrolyte drink in the Chinese market. Each bottle contains 455g of five essential electrolytes (potassium, calcium, magnesium, sodium, and chloride.August 2022: Coca‑Cola India has announced the first-ever brand extension for its homegrown brand Limca into the hydrating sports drinks category with ‘Limca Sportz’. The brand’s new offering ‘Limca Sportz’ is a Glucose + Electrolyte-based beverage containing essential minerals for rapid fluid intake.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Sports Drink Market in APAC," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Sports Drink Market in APAC report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Sports Drink Market in APAC?

To stay informed about further developments, trends, and reports in the Sports Drink Market in APAC, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence