Key Insights

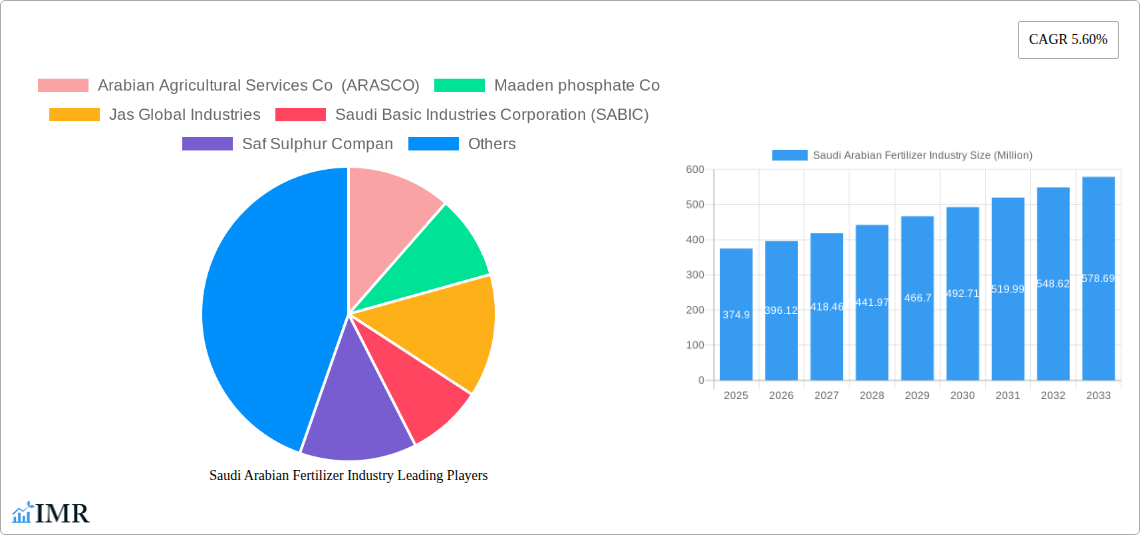

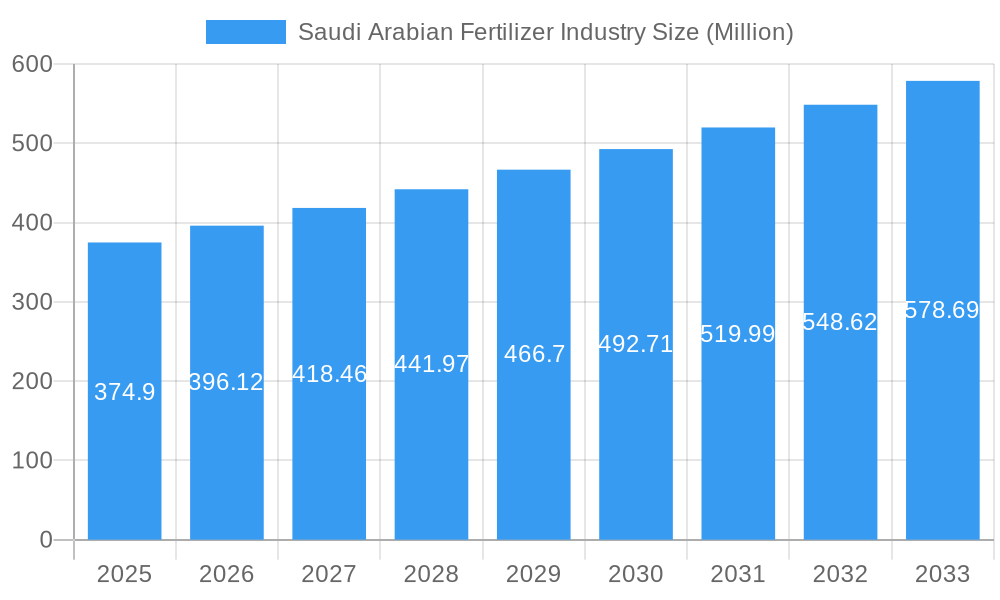

The Saudi Arabian fertilizer industry is poised for significant expansion, with a current market size of approximately USD 374.90 million. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 5.60% between 2025 and 2033. The sector's expansion is primarily driven by Saudi Arabia's strategic focus on agricultural development and food security initiatives, aiming to bolster domestic production and reduce reliance on imports. Government support through subsidies, investment in advanced farming techniques, and the development of state-of-the-art production facilities further fuels this upward trajectory. The increasing demand for high-quality fertilizers to enhance crop yields and quality, coupled with the nation's abundant natural resources, particularly phosphate and sulfur, provide a strong foundation for sustained growth. Furthermore, the country's ambition to diversify its economy beyond oil and gas, as outlined in Vision 2030, actively promotes and supports the growth of its industrial and manufacturing sectors, including fertilizers.

Saudi Arabian Fertilizer Industry Market Size (In Million)

The fertilizer market in Saudi Arabia is characterized by several key trends. Advanced production technologies are being adopted to improve efficiency and reduce environmental impact. There's a growing emphasis on specialty fertilizers and customized nutrient solutions to meet the specific needs of various crops and soil types. The industry is also witnessing increased export activity, leveraging Saudi Arabia's strategic location and competitive production costs to serve regional and international markets. Major players like Arabian Agricultural Services Co (ARASCO), Maaden Phosphate Co., and Saudi Basic Industries Corporation (SABIC) are instrumental in shaping the market through their significant production capacities and strategic investments. While the market enjoys strong growth drivers, potential restraints include fluctuating global commodity prices, which can impact production costs and export competitiveness, as well as evolving environmental regulations that may necessitate further investment in sustainable practices. Nevertheless, the overall outlook for the Saudi Arabian fertilizer industry remains highly positive, reflecting its critical role in supporting the nation's agricultural ambitions and economic diversification.

Saudi Arabian Fertilizer Industry Company Market Share

Here is a compelling, SEO-optimized report description for the Saudi Arabian Fertilizer Industry, designed to maximize visibility and engage industry professionals.

Saudi Arabian Fertilizer Industry Market Dynamics & Structure

The Saudi Arabian fertilizer industry is characterized by a highly concentrated market structure, dominated by a few major players who leverage economies of scale and integrated operations. Technological innovation is a key driver, with significant investments in advanced production processes, enhanced nutrient efficiency, and the development of specialty fertilizers to meet diverse agricultural needs. Robust regulatory frameworks, primarily driven by government initiatives to boost agricultural output and diversify the economy, provide a supportive environment for growth. While direct competitive product substitutes are limited in the core fertilizer market, the increasing adoption of precision agriculture and biostimulants represents an emerging area of indirect competition. End-user demographics are primarily agricultural sectors, both large-scale commercial farms and smaller holdings, with a growing emphasis on sustainable farming practices influencing demand. Mergers and acquisitions (M&A) trends are notably active, as larger entities consolidate their market positions and expand their product portfolios.

- Market Concentration: Dominated by SABIC and Maaden Phosphate Co., holding significant market share.

- Technological Innovation: Focus on energy-efficient production, slow-release fertilizers, and digital agriculture solutions.

- Regulatory Frameworks: Government incentives for fertilizer production and domestic consumption, environmental compliance standards.

- Competitive Substitutes: Rise of biostimulants, organic fertilizers, and precision farming technologies.

- End-User Demographics: Primarily commercial agriculture, with increasing demand from the horticulture and greenhouse sectors.

- M&A Trends: Consolidation opportunities and strategic partnerships for vertical integration and market expansion.

Saudi Arabian Fertilizer Industry Growth Trends & Insights

The Saudi Arabian fertilizer industry is poised for substantial growth, projected to witness a Compound Annual Growth Rate (CAGR) of approximately 4.8% from 2019 to 2033. This robust expansion is fueled by increasing domestic demand driven by Saudi Vision 2030's focus on food security and agricultural self-sufficiency. The market size is expected to evolve from an estimated $3,500 million in the historical period to surpass $5,000 million by the end of the forecast period. Adoption rates for advanced fertilizer technologies, such as controlled-release and slow-release formulations, are steadily increasing as farmers seek to optimize nutrient use efficiency and minimize environmental impact. Technological disruptions, including the integration of AI and IoT in precision agriculture, are further influencing fertilizer application and demand patterns, leading to a more targeted and efficient approach to crop nutrition.

Consumer behavior shifts are playing a crucial role, with a growing awareness of sustainable farming practices and the demand for high-quality, locally sourced produce. This translates into a preference for fertilizers that contribute to soil health and reduce environmental footprints. The development of specialized fertilizers catering to specific crop requirements and soil conditions is also gaining traction. Government initiatives, such as subsidies and research and development support, are further accelerating the adoption of these innovative solutions. The country's strategic location and abundant natural resources, particularly for the production of nitrogenous and phosphate fertilizers, provide a strong foundation for sustained growth.

Dominant Regions, Countries, or Segments in Saudi Arabian Fertilizer Industry

The Export Market Analysis (Value & Volume) segment is a dominant force driving growth within the Saudi Arabian fertilizer industry. Saudi Arabia's strategic position as a major global producer of key fertilizer components, coupled with significant investments in large-scale production facilities, has enabled it to capture a substantial share of international markets. The economic policies aimed at diversifying revenue streams beyond oil have further amplified the focus on petrochemical and related industries, including fertilizers.

- Export Market Dominance Drivers:

- Abundant Natural Resources: Access to natural gas for ammonia production and phosphate rock reserves.

- Strategic Location: Proximity to key agricultural markets in Asia, Africa, and Europe.

- World-Scale Production Facilities: Economies of scale achieved through massive production capacities, leading to cost competitiveness.

- Government Support & Incentives: Vision 2030 initiatives encouraging export-oriented industries and foreign investment.

- High Demand for Nitrogenous and Phosphate Fertilizers: Global agricultural needs for urea, DAP, and MAP contribute significantly to export volumes and value.

The Production Analysis: segment is intrinsically linked to export dominance. Companies like SABIC and Maaden Phosphate Co. operate state-of-the-art production complexes in industrial cities like Jubail, significantly contributing to the overall output. These facilities benefit from access to low-cost feedstock and advanced technologies, enabling them to produce fertilizers competitively on a global scale. The Consumption Analysis: segment, while growing, remains secondary to export volumes, indicating the industry's strong outward-looking strategy. The Import Market Analysis (Value & Volume): is relatively smaller, primarily for specialized fertilizers not produced domestically or for specific niche applications. The Price Trend Analysis: is heavily influenced by global commodity prices and supply-demand dynamics in international markets.

Saudi Arabian Fertilizer Industry Product Landscape

The Saudi Arabian fertilizer industry showcases a robust product landscape, with a strong focus on bulk nitrogenous fertilizers like Urea, Ammonia, and Ammonium Nitrate, alongside a growing presence of phosphate-based products such as Diammonium Phosphate (DAP) and Monoammonium Phosphate (MAP). Innovations are geared towards enhancing nutrient use efficiency and reducing environmental impact, leading to the development of slow-release and controlled-release formulations. Applications span across a wide range of agricultural crops, with increasing specialization for high-value horticulture and greenhouse farming. Unique selling propositions revolve around high purity, consistent quality, and competitive pricing stemming from access to abundant feedstock. Technological advancements are continuously improving production processes for greater energy efficiency and reduced emissions.

Key Drivers, Barriers & Challenges in Saudi Arabian Fertilizer Industry

Key Drivers:

- Growing Global Food Demand: Increasing population worldwide necessitates higher agricultural output, driving fertilizer consumption.

- Government Support & Vision 2030: Saudi Arabia's strategic focus on food security and economic diversification through industrial development.

- Abundant Feedstock Availability: Access to natural gas and phosphate rock provides a significant competitive advantage in production costs.

- Technological Advancements: Development of efficient production methods and specialized, high-performance fertilizers.

- Export Market Opportunities: Strategic location and competitive pricing open doors to international markets.

Key Barriers & Challenges:

- Global Price Volatility: Fluctuations in global fertilizer prices can impact profitability and investment decisions.

- Environmental Regulations: Increasingly stringent environmental standards require continuous investment in sustainable practices and emission control technologies.

- Water Scarcity: Water-intensive production processes pose a challenge in an arid region, necessitating efficient water management.

- Supply Chain Disruptions: Global logistics issues and geopolitical events can impact the availability of raw materials and the timely delivery of finished products.

- Competition from Other Producing Nations: Intense competition from established and emerging fertilizer-producing countries.

Emerging Opportunities in Saudi Arabian Fertilizer Industry

Emerging opportunities lie in the development and promotion of specialty fertilizers, including micronutrient-enhanced products and bio-fertilizers, catering to the growing demand for sustainable and precision agriculture. The expansion into downstream fertilizer derivatives and value-added products presents another significant avenue for growth. Furthermore, leveraging Saudi Arabia's strategic location to become a hub for fertilizer distribution and logistics within the Middle East and Africa holds substantial untapped potential. The increasing focus on industrial diversification also opens doors for the development of fertilizer-grade industrial chemicals.

Growth Accelerators in the Saudi Arabian Fertilizer Industry Industry

Long-term growth in the Saudi Arabian fertilizer industry will be accelerated by significant investments in research and development to create next-generation fertilizers with enhanced efficacy and reduced environmental impact. Strategic partnerships with international agricultural technology firms can foster innovation and market penetration. The ongoing expansion of domestic agricultural projects, driven by Vision 2030, will create sustained demand. Furthermore, the exploration of new export markets and the optimization of logistical networks to ensure competitive delivery times will be crucial growth catalysts.

Key Players Shaping the Saudi Arabian Fertilizer Industry Market

- Saudi Basic Industries Corporation (SABIC)

- Arabian Agricultural Services Co (ARASCO)

- Maaden Phosphate Co.

- Al-Jubail Fertilizer Company (AlBayroni)

- Saudi United Fertilizer Company (AlAsmida)

- Jas Global Industries

- Takamul National Agriculture

- Al-Tayseer Chemical Industry

- Saf Sulphur Company

Notable Milestones in Saudi Arabian Fertilizer Industry Sector

- 2019: SABIC announces significant expansion plans for its fertilizer production capacity to meet growing domestic and international demand.

- 2020: Maaden Phosphate Co. commences operations at its new integrated phosphate complex, boosting the nation's phosphate fertilizer output.

- 2021: The Saudi government reiterates its commitment to agricultural self-sufficiency, providing further impetus for the fertilizer sector's growth.

- 2022: ARASCO invests in advanced fertilizer blending technologies to offer customized nutrient solutions to farmers.

- 2023: AlBayroni explores partnerships for the development of slow-release fertilizer technologies to improve nutrient efficiency.

- 2024: Saudi companies begin to explore increased adoption of digital farming solutions, influencing fertilizer application strategies.

In-Depth Saudi Arabian Fertilizer Industry Market Outlook

The outlook for the Saudi Arabian fertilizer industry remains exceptionally bright, propelled by a confluence of strategic government initiatives, abundant natural resources, and expanding global demand. Growth accelerators such as ongoing technological innovation in specialty fertilizers and enhanced production efficiencies will solidify its competitive edge. Strategic alliances and a continued focus on export market diversification will further unlock significant potential, positioning Saudi Arabia as a pivotal player in global fertilizer supply chains. The industry is well-positioned for sustained, robust growth in the coming years.

Saudi Arabian Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Saudi Arabian Fertilizer Industry Segmentation By Geography

- 1. Saudi Arabia

Saudi Arabian Fertilizer Industry Regional Market Share

Geographic Coverage of Saudi Arabian Fertilizer Industry

Saudi Arabian Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.60% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Skilled Labor Shortage; Favorable Government Policies

- 3.3. Market Restrains

- 3.3.1. Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center

- 3.4. Market Trends

- 3.4.1. Increasing Export Potential for Fertilizers

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Saudi Arabian Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Saudi Arabia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Arabian Agricultural Services Co (ARASCO)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Maaden phosphate Co

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Jas Global Industries

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Saudi Basic Industries Corporation (SABIC)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Saf Sulphur Compan

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Al-Jubail Fertilizer Company (AlBayroni)

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Al-Tayseer Chemical Industry

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Takamul National Agriculture

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saudi United Fertilizer Company (AlAsmida)

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Arabian Agricultural Services Co (ARASCO)

List of Figures

- Figure 1: Saudi Arabian Fertilizer Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Saudi Arabian Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Saudi Arabian Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Saudi Arabian Fertilizer Industry?

The projected CAGR is approximately 5.60%.

2. Which companies are prominent players in the Saudi Arabian Fertilizer Industry?

Key companies in the market include Arabian Agricultural Services Co (ARASCO), Maaden phosphate Co, Jas Global Industries, Saudi Basic Industries Corporation (SABIC), Saf Sulphur Compan, Al-Jubail Fertilizer Company (AlBayroni), Al-Tayseer Chemical Industry, Takamul National Agriculture, Saudi United Fertilizer Company (AlAsmida).

3. What are the main segments of the Saudi Arabian Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 374.90 Million as of 2022.

5. What are some drivers contributing to market growth?

Skilled Labor Shortage; Favorable Government Policies.

6. What are the notable trends driving market growth?

Increasing Export Potential for Fertilizers.

7. Are there any restraints impacting market growth?

Fragmentation of Land Holdings; Increasing Interest of Farmers Toward Custom Hiring Center.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Saudi Arabian Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Saudi Arabian Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Saudi Arabian Fertilizer Industry?

To stay informed about further developments, trends, and reports in the Saudi Arabian Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence