Key Insights

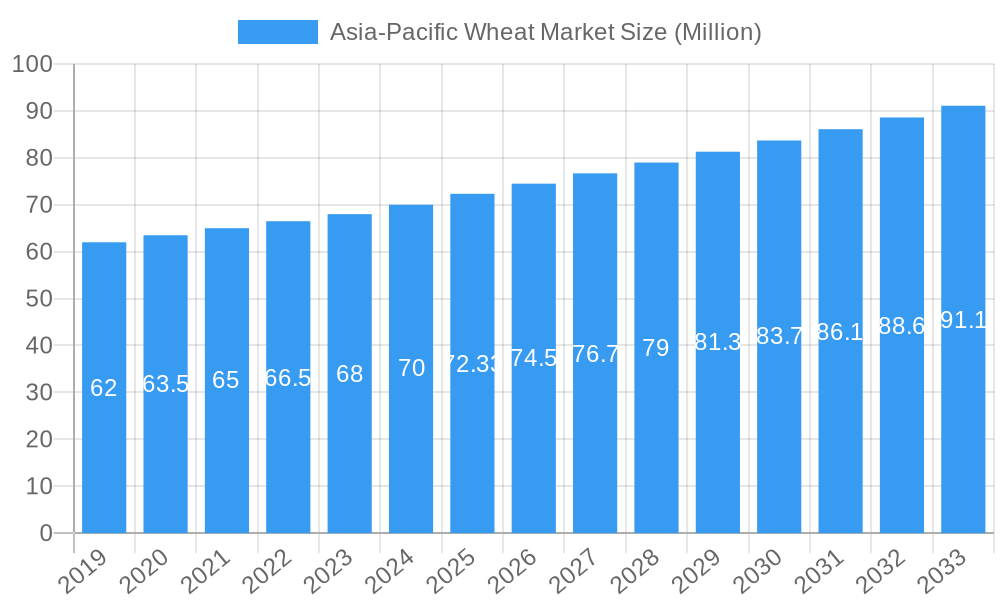

The Asia-Pacific wheat market is poised for steady expansion, projected to reach an estimated USD 72.33 million by 2025, and is expected to grow at a Compound Annual Growth Rate (CAGR) of 3.00% during the forecast period of 2025-2033. This growth is underpinned by several key drivers, including the increasing demand for staple food grains driven by population expansion across the region, particularly in populous nations like India and China. Furthermore, advancements in agricultural technology, including the development of high-yield and disease-resistant wheat varieties by leading companies such as Bayer CropScience, Syngenta, and Limagrain, are contributing to improved production efficiency and output. Government initiatives focused on enhancing food security and promoting modern farming practices are also playing a crucial role in stimulating market growth. The rising adoption of improved farming techniques, coupled with a growing awareness of the nutritional benefits of wheat, further propels the market forward.

Asia-Pacific Wheat Market Market Size (In Million)

The market is witnessing significant trends such as an increasing emphasis on premium and specialty wheat varieties catering to evolving consumer preferences for diverse food products. This includes a growing interest in organic and sustainably produced wheat. The import and export dynamics within the region are also noteworthy, with countries like Australia being major exporters, while others such as China and Pakistan engage in significant import activities to meet domestic demand. Restraints to market growth include fluctuating weather patterns impacting crop yields, the prevalence of certain plant diseases, and the challenge of land fragmentation in some agricultural areas. Despite these challenges, the continuous innovation in seed technology and crop management by companies like BASF and Advanta Seeds, alongside growing investments in agricultural R&D, are expected to mitigate these factors and ensure sustained market development. The focus on optimizing production and consumption analysis will be vital for market players.

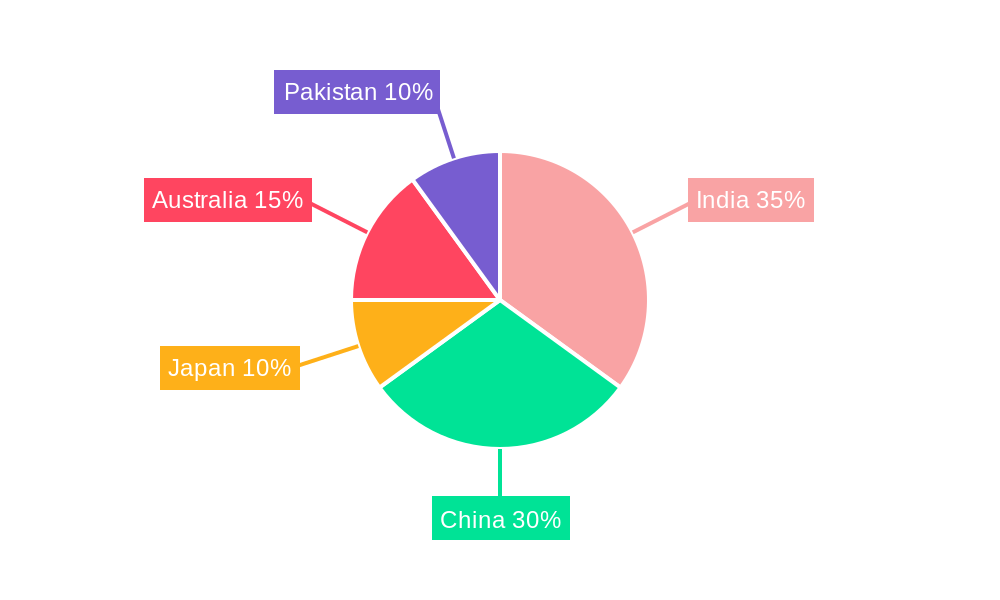

Asia-Pacific Wheat Market Company Market Share

Comprehensive Report: Asia-Pacific Wheat Market Analysis & Forecast (2019-2033)

Unlock critical insights into the dynamic Asia-Pacific wheat market with this in-depth report. Covering production, consumption, trade, pricing, and industry developments, this analysis provides a strategic roadmap for stakeholders navigating this vital agricultural sector. Examine parent and child market trends, understand competitive landscapes, and identify growth opportunities within this crucial global food basket.

Asia-Pacific Wheat Market Market Dynamics & Structure

The Asia-Pacific wheat market is characterized by a moderately concentrated structure, with a few key players dominating specific segments, particularly in seed technology and large-scale agricultural operations. Technological innovation serves as a significant driver, with advancements in genetics, precision agriculture, and disease-resistant varieties continuously reshaping production capabilities. Regulatory frameworks vary significantly across the region, influencing trade policies, import/export tariffs, and the adoption of novel farming techniques. Competitive product substitutes, such as rice and other grains, exert pressure on wheat consumption patterns in certain countries. End-user demographics are diverse, ranging from individual farmers to large food processing conglomerates, with evolving consumer preferences for diverse wheat-based products driving demand. Merger and acquisition (M&A) trends are observable, primarily focused on consolidating seed technology companies and expanding regional distribution networks to enhance market reach and product portfolios. For instance, recent consolidation efforts in the agrochemical and seed sectors have aimed at developing integrated solutions for farmers. The barriers to innovation are often tied to the cost of research and development, stringent regulatory approvals for new crop varieties, and the fragmented nature of agricultural landholdings in many developing economies within the region.

- Market Concentration: Dominated by a few major agrochemical and seed corporations in advanced agricultural economies.

- Technological Drivers: Focus on high-yield varieties, disease resistance (e.g., stripe rust, wheat streak mosaic virus), and climate-resilient crops.

- Regulatory Landscape: Varied national policies on GM crops, import/export quotas, and agricultural subsidies.

- Competitive Landscape: Competition from rice and other staple grains, especially in Southeast Asian countries.

- End-User Segments: Smallholder farmers, large agribusinesses, food manufacturers, and livestock feed producers.

- M&A Activity: Strategic acquisitions aimed at R&D consolidation and market access expansion.

- Innovation Barriers: High R&D investment, lengthy regulatory approval processes, and limited access to capital for smallholder farmers.

Asia-Pacific Wheat Market Growth Trends & Insights

The Asia-Pacific wheat market is poised for robust growth, projected to expand significantly over the forecast period driven by a confluence of escalating population, shifting dietary habits, and a burgeoning food processing industry. The market size evolution reflects increasing demand for wheat-based products, from traditional staples like noodles and bread to processed snacks and animal feed. Adoption rates of advanced agricultural technologies and high-yielding seed varieties are on an upward trajectory, spurred by government initiatives and the inherent economic benefits for farmers seeking to improve productivity and profitability. Technological disruptions, including the development of climate-smart wheat cultivars and improved irrigation techniques, are crucial in mitigating the impact of adverse weather conditions and enhancing yield stability. Consumer behavior shifts towards greater consumption of convenience foods and a growing middle class with higher disposable incomes further fuel the demand for a diverse range of wheat products. These factors collectively contribute to a healthy Compound Annual Growth Rate (CAGR) for the market. Market penetration is expected to deepen, particularly in emerging economies where wheat consumption is traditionally lower but demonstrating significant growth potential. The integration of digital farming solutions and improved supply chain efficiencies are also critical in optimizing resource utilization and reducing post-harvest losses, thereby accelerating market expansion. The increasing focus on food security within many Asia-Pacific nations will continue to underpin steady demand for wheat, positioning it as a strategic agricultural commodity.

Dominant Regions, Countries, or Segments in Asia-Pacific Wheat Market

Within the Asia-Pacific wheat market, Production Analysis is significantly dominated by countries with vast arable land and established agricultural infrastructure. China stands as the largest producer, contributing a substantial volume of wheat annually, driven by government support and extensive cultivation areas. Its dominance is further reinforced by ongoing investments in agricultural research and development, focusing on improving crop yields and resilience.

Consumption Analysis reveals a widespread demand for wheat across the region, with China and India being the largest consumers. This high consumption is attributed to their large populations and the integral role of wheat in their traditional cuisines, such as noodles, bread, and various other baked goods. The growing middle class in these nations also contributes to an increasing demand for diversified wheat-based products.

The Import Market Analysis (Value & Volume) is heavily influenced by countries that face domestic production deficits or seek specific quality grades of wheat. Southeast Asian nations, including the Philippines, Indonesia, and Vietnam, are significant wheat importers, relying on global supplies to meet their escalating consumption demands. Australia and Canada are key suppliers to this sub-region, providing high-quality milling and feed wheat.

For the Export Market Analysis (Value & Volume), Australia emerges as a dominant player, renowned for its consistent quality and large export volumes, primarily to Asian markets. Other notable exporters include Russia and increasingly, China, as its domestic production capacity expands. The growth in exports is driven by competitive pricing and the ability to meet international quality standards.

The Price Trend Analysis in the Asia-Pacific wheat market is a complex interplay of global commodity prices, regional supply-demand dynamics, currency fluctuations, and trade policies. Factors like weather patterns affecting major producing regions, geopolitical events, and the cost of agricultural inputs significantly influence price volatility. Economic policies aimed at enhancing domestic production or managing import costs play a crucial role in shaping regional price trends.

- Production Dominance: China, India, and Australia lead in wheat production volume.

- Key Drivers: Arable land availability, government subsidies, technological adoption, and climate suitability.

- Consumption Dominance: China and India are the largest consumers due to population size and dietary staples.

- Key Drivers: Population growth, urbanization, evolving dietary preferences, and the prevalence of wheat-based food products.

- Import Market Drivers: Southeast Asian nations (Philippines, Indonesia, Vietnam) are major importers.

- Key Drivers: Domestic production deficits, demand for specific wheat grades, and population growth.

- Export Market Drivers: Australia is a leading exporter, supplying high-quality wheat to Asian markets.

- Key Drivers: Competitive pricing, consistent quality, and strong trade relationships.

- Price Trend Influences: Global commodity markets, weather events, currency exchange rates, trade policies, and input costs.

Asia-Pacific Wheat Market Product Landscape

The product landscape in the Asia-Pacific wheat market is increasingly characterized by advanced seed technologies and specialized wheat varieties. Innovations are focused on developing wheat with enhanced yield potential, improved disease and pest resistance, and better nutritional profiles. For instance, the development of hybrid wheat varieties by companies like BASF, branded as Ideltis, aims to deliver higher and more stable performance in yield and quality. Limagrain's introduction of CoAXium Soft White Winter wheat highlights advancements in tolerance to specific viruses and rusts, crucial for maximizing output in challenging growing conditions. These product developments are aimed at meeting the diverse needs of farmers, from those in traditional agricultural settings to those adopting modern farming practices. Applications range from high-quality flour for baking and pasta production to feed for livestock, with increasing interest in specialty wheat for health-conscious consumers.

Key Drivers, Barriers & Challenges in Asia-Pacific Wheat Market

Key Drivers: The Asia-Pacific wheat market is propelled by several critical factors, including a steadily growing population demanding increased food security, leading to higher wheat consumption. Shifting dietary patterns towards more processed foods and baked goods, especially in emerging economies, further boost demand. Government initiatives promoting agricultural productivity, coupled with technological advancements in seed varieties and farming practices, are crucial growth accelerators. Furthermore, the expansion of the food processing industry and the increasing use of wheat for animal feed contribute significantly to market expansion.

Barriers & Challenges: Despite the positive outlook, the market faces significant barriers and challenges. Climate change and extreme weather events pose a substantial threat to crop yields and stability, leading to price volatility. Water scarcity in key growing regions and soil degradation impact productivity. The fragmented landholding structure in many parts of the region can hinder the adoption of advanced technologies and economies of scale. Regulatory hurdles related to genetically modified (GM) crops and international trade policies can also create market access challenges. Supply chain inefficiencies and post-harvest losses further contribute to the overall challenges. The competitive pressure from other staple grains, particularly rice in certain markets, also remains a factor.

Emerging Opportunities in Asia-Pacific Wheat Market

Emerging opportunities in the Asia-Pacific wheat market lie in the development of climate-resilient and drought-tolerant wheat varieties to combat the impact of unpredictable weather patterns. There is a significant untapped market for specialty wheat with enhanced nutritional value, catering to the growing health-conscious consumer segment. The adoption of precision agriculture and digital farming solutions presents a vast opportunity to improve efficiency and yield for farmers, especially smallholders. Furthermore, partnerships and collaborations to strengthen supply chains and reduce post-harvest losses can unlock substantial economic benefits. The increasing demand for value-added wheat products, such as whole grain flours and functional food ingredients, also presents a lucrative avenue for market growth.

Growth Accelerators in the Asia-Pacific Wheat Market Industry

Growth in the Asia-Pacific wheat market is significantly accelerated by ongoing technological breakthroughs in crop genetics and breeding, leading to higher-yielding, disease-resistant, and climate-adaptive wheat varieties. Strategic partnerships between seed companies, agrochemical firms, and local distributors are crucial for expanding market reach and ensuring the availability of advanced agricultural inputs. Furthermore, government-led initiatives focusing on modernizing agricultural infrastructure, providing subsidies for advanced farming techniques, and promoting food security act as significant catalysts. Market expansion strategies, including the development of new wheat-based food products and catering to the growing demand for animal feed, are also driving long-term growth trajectories.

Key Players Shaping the Asia-Pacific Wheat Market Market

- Limagrain

- BASF

- Advanta Seeds

- Syngenta

- Bayer CropScience

- Nuseed

Notable Milestones in Asia-Pacific Wheat Market Sector

- February 2022: Limagrain launched the First CoAXium Soft White Winter wheat variety, offering high yield potential, good straw strength, and excellent tolerance to wheat streak mosaic virus and stripe rust, impacting crop resilience.

- October 2022: BASF and its commercial partner Seednet released two new wheat varieties, Kingston and Reilly, for the Australian market. Kingston wheat boasts high-end yield potential and grain quality with exceptional straw strength and lodging resistance, while Reilly wheat features excellent grain quality and exceptional resistance to stripe rust, enhancing disease management options.

- July 2021: BASF introduced Ideltis as the seed brand name for its future hybrid wheat, signaling a commitment to advanced breeding technologies for higher and more stable performance in yield and quality for farmers.

In-Depth Asia-Pacific Wheat Market Market Outlook

The Asia-Pacific wheat market is projected for sustained and robust growth, driven by increasing food demand and evolving agricultural technologies. Key growth accelerators include innovations in climate-resilient crop varieties, the expanding adoption of digital farming solutions, and strategic collaborations across the value chain. The market's future potential is immense, particularly in developing economies where wheat consumption is rising. Strategic opportunities lie in catering to niche markets for specialty and functional wheat products, alongside strengthening supply chain efficiencies to minimize losses. Continued investment in research and development, coupled with supportive government policies, will be pivotal in realizing this market's full potential and ensuring regional food security.

Asia-Pacific Wheat Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Asia-Pacific Wheat Market Segmentation By Geography

- 1. India

- 2. China

- 3. Japan

- 4. Australia

- 5. Pakistan

Asia-Pacific Wheat Market Regional Market Share

Geographic Coverage of Asia-Pacific Wheat Market

Asia-Pacific Wheat Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle

- 3.3. Market Restrains

- 3.3.1. ; Unfavorable Climatic Conditions; Higher Market Entry Cost

- 3.4. Market Trends

- 3.4.1. The Increasing Demand for Wheat Protein

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. India

- 5.6.2. China

- 5.6.3. Japan

- 5.6.4. Australia

- 5.6.5. Pakistan

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. India Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. China Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Japan Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Australia Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Pakistan Asia-Pacific Wheat Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Limagrain

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BASF

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Advanta Seeds

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Syngenta

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Bayer CropScience

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Nuseed

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.1 Limagrain

List of Figures

- Figure 1: Asia-Pacific Wheat Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Wheat Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Asia-Pacific Wheat Market Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 14: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 15: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 16: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 17: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 18: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 19: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 20: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 21: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 22: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 23: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 24: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 25: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

- Table 31: Asia-Pacific Wheat Market Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 32: Asia-Pacific Wheat Market Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 33: Asia-Pacific Wheat Market Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 34: Asia-Pacific Wheat Market Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 35: Asia-Pacific Wheat Market Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 36: Asia-Pacific Wheat Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Wheat Market?

The projected CAGR is approximately 3.00%.

2. Which companies are prominent players in the Asia-Pacific Wheat Market?

Key companies in the market include Limagrain, BASF , Advanta Seeds , Syngenta , Bayer CropScience , Nuseed.

3. What are the main segments of the Asia-Pacific Wheat Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.33 Million as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Food Security Concerns; Inclination Toward a Healthy Lifestyle.

6. What are the notable trends driving market growth?

The Increasing Demand for Wheat Protein.

7. Are there any restraints impacting market growth?

; Unfavorable Climatic Conditions; Higher Market Entry Cost.

8. Can you provide examples of recent developments in the market?

February 2022: Limagrain launched the First CoAXium Soft White Winter wheat variety with high yield potential, good straw strength, and very good tolerance to wheat streak mosaic virus and stripe rust.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Wheat Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Wheat Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Wheat Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Wheat Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence