Key Insights

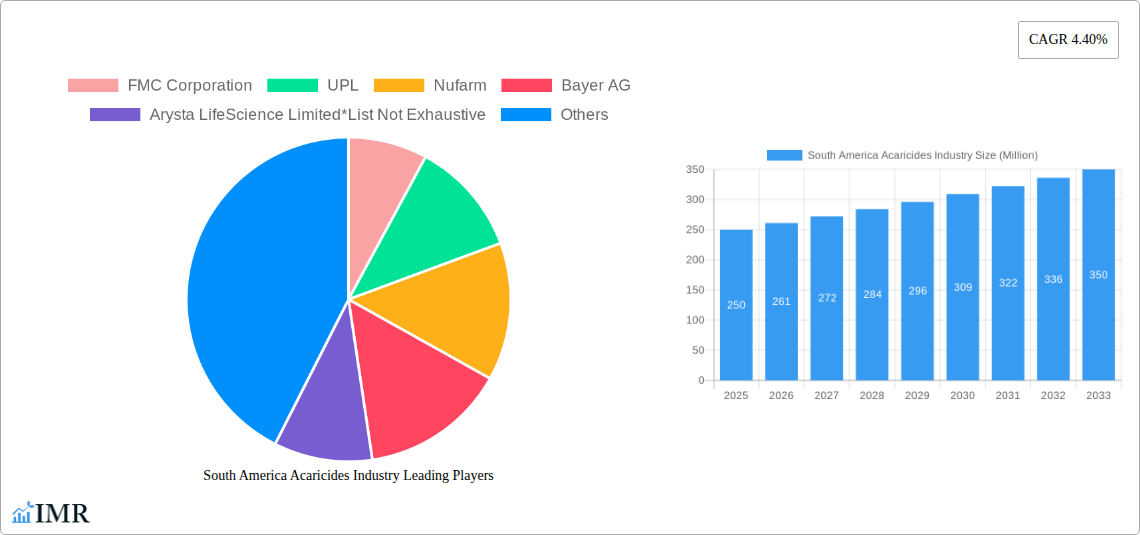

The South America Acaricides Market is poised for robust expansion, driven by a confluence of factors crucial for agricultural productivity and food security across the region. With an estimated market size of approximately $250 million in 2025, the industry is projected to witness a Compound Annual Growth Rate (CAGR) of 4.40% through 2033. This growth is primarily fueled by the escalating need for effective pest management solutions to protect high-value crops from destructive mite infestations, which are exacerbated by changing climatic patterns and the intensification of agricultural practices. Key drivers include the increasing adoption of integrated pest management (IPM) strategies, the demand for higher crop yields to meet growing domestic and international food requirements, and the continuous innovation in acaricide formulations offering enhanced efficacy and reduced environmental impact. Furthermore, the expanding agricultural sector in countries like Brazil and Argentina, characterized by their significant output of soybeans, corn, and fruits, creates a substantial and sustained demand for acaricide products.

South America Acaricides Industry Market Size (In Million)

Despite the promising growth trajectory, the South America Acaricides Market faces certain restraints. The rising cost of raw materials and the complex regulatory landscape surrounding pesticide registration and usage in various South American nations can pose challenges for market expansion. Moreover, the increasing consumer preference for organic produce and a growing awareness regarding the potential health and environmental risks associated with chemical pesticides are leading to a gradual shift towards bio-based acaricides and alternative pest control methods. However, the sheer volume of conventional agriculture in South America and the immediate need for effective and cost-efficient mite control solutions ensure a continued strong demand for synthetic acaricides in the medium term. The market is segmented across various product types and applications, with a particular focus on crop protection for key agricultural commodities. Leading global players like Bayer AG, Syngenta, and BASF SE are actively engaged in research and development to introduce novel and sustainable acaricide solutions tailored to the specific needs of the South American agricultural ecosystem.

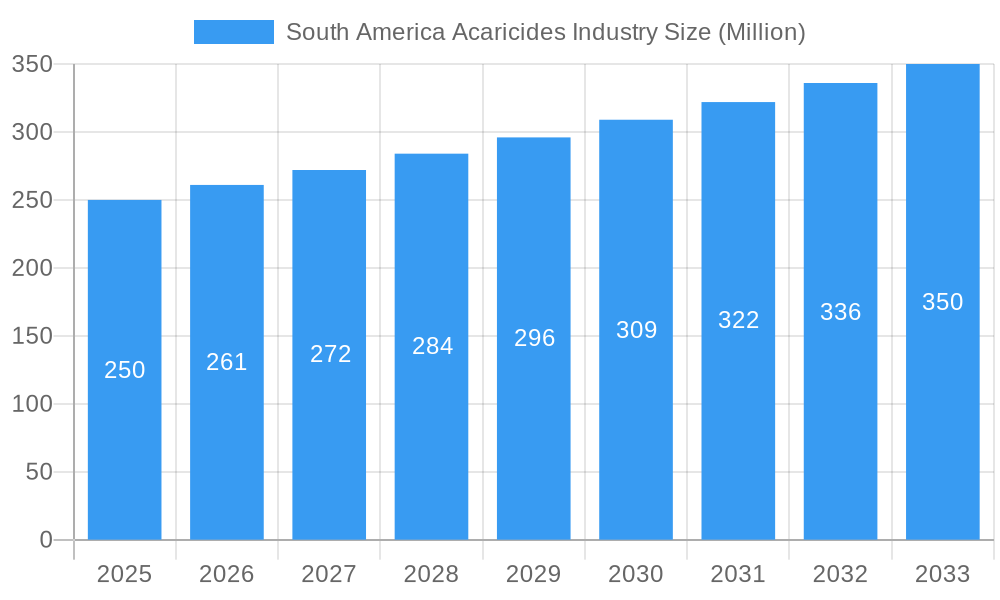

South America Acaricides Industry Company Market Share

South America Acaricides Industry Market Dynamics & Structure

The South American acaricides market is characterized by a moderately concentrated competitive landscape, with major global players like FMC Corporation, UPL, Nufarm, Bayer AG, Arysta LifeScience Limited, Syngenta, Corteva Agriscience, and BASF SE holding significant market shares. Technological innovation is a primary driver, with continuous development of more potent, targeted, and environmentally friendly acaricide formulations. Regulatory frameworks, varying across South American nations, significantly influence market entry and product approval processes, impacting the adoption of new chemistries.

- Market Concentration: A few leading agrochemical giants dominate market share, with smaller regional players often focusing on niche markets or specific crop types.

- Technological Innovation: Investment in R&D is focused on creating acaricides with novel modes of action, reducing resistance development, and enhancing efficacy against a broader spectrum of mite species.

- Regulatory Frameworks: Stringent registration requirements and evolving environmental guidelines necessitate significant investment in product testing and compliance for market access.

- Competitive Product Substitutes: While chemical acaricides remain dominant, there is growing interest in biological control agents and integrated pest management (IPM) strategies as alternatives, particularly for organic farming.

- End-User Demographics: The market is largely driven by commercial agriculture, with key end-users including soybean growers, fruit orchards, coffee plantations, and vegetable farmers. Smallholder farmers also represent a significant, albeit fragmented, consumer base.

- M&A Trends: Mergers and acquisitions are a strategic tool for companies to expand their product portfolios, gain market access, and consolidate their presence in key South American countries. For instance, the acquisition of certain assets by UPL has strengthened its regional footprint.

South America Acaricides Industry Growth Trends & Insights

The South American acaricides market is poised for robust expansion, driven by the persistent threat of mite infestations across the continent's vital agricultural sectors. The estimated market size for acaricides in South America reached USD 1,850.5 million in 2025, with projections indicating a compound annual growth rate (CAGR) of 5.2% from 2025 to 2033. This sustained growth trajectory is underpinned by several critical factors: increasing awareness among farmers regarding the economic impact of mite damage, the continuous need to protect high-value crops such as soybeans, corn, fruits, and coffee, and the ongoing efforts by agricultural research institutions to develop more effective pest management solutions.

The adoption rates of advanced acaricide formulations are steadily increasing, fueled by the demand for higher yields and improved crop quality. Farmers are increasingly transitioning from older, less effective chemistries to newer-generation products that offer better efficacy, longer residual activity, and improved safety profiles for both users and the environment. Technological disruptions, including the development of novel active ingredients with different modes of action, are crucial in combating mite resistance, a growing concern that threatens the long-term effectiveness of existing acaricides. This is particularly evident in major agricultural hubs like Brazil and Argentina, where extensive cultivation of susceptible crops creates a fertile ground for mite populations to evolve resistance.

Consumer behavior shifts are also playing a subtle yet significant role. While the primary focus remains on economic viability, there is a growing, albeit nascent, demand for acaricide solutions that align with sustainable agricultural practices and meet evolving international food safety standards. This includes a greater emphasis on products with lower environmental impact and those suitable for integration into broader pest management programs. The expanding agricultural land under cultivation across South America, coupled with intensifying cropping systems, directly correlates with an increased reliance on effective pest control, making acaricides indispensable tools for ensuring food security and supporting the region's agricultural export economy. The continued investment by major agrochemical companies in product development and market penetration strategies will further accelerate the adoption of advanced acaricide technologies, solidifying their indispensable role in safeguarding South American agriculture.

Dominant Regions, Countries, or Segments in South America Acaricides Industry

Brazil unequivocally emerges as the dominant region within the South American acaricides market, driven by its colossal agricultural output and the inherent susceptibility of its staple crops to mite infestations. The country's extensive soybean cultivation, a primary global supplier, consistently faces significant pressure from mites, necessitating substantial acaricide applications to maintain yield and quality. This demand is further amplified by the large-scale production of corn, coffee, sugarcane, and various fruits and vegetables, all of which are prone to mite damage.

- Production Analysis: While actual production figures in million units are proprietary, Brazil's significant manufacturing base for agrochemicals and its role as a hub for research and development contribute to its leadership in the production segment. Companies like BASF SE and Syngenta have substantial production facilities and R&D centers in Brazil, catering to both domestic and export markets.

- Consumption Analysis: Brazil's consumption of acaricides, estimated to be over 800 million units in 2025, far surpasses that of other South American nations. This high consumption is directly linked to its vast cultivated land area and the economic value of its agricultural exports. The adoption of sophisticated farming practices and the availability of a wide range of acaricide products contribute to this dominance.

- Import Market Analysis (Value & Volume): Brazil also represents a significant import market for specialized acaricide active ingredients and formulations, with import volumes estimated to be in the range of 150-200 million units in 2025. The country imports advanced chemistries and patented formulations to complement its domestic production and address specific pest challenges.

- Export Market Analysis (Value & Volume): While primarily a consumer, Brazil also exports agrochemical products, including acaricides, to neighboring South American countries. Export volumes are estimated to be around 50-70 million units in 2025, facilitating regional pest management strategies.

- Price Trend Analysis: Prices in Brazil are influenced by global commodity prices, currency exchange rates, and the competitive intensity of the domestic market. Premium, patented products command higher prices, while generic formulations offer more affordable alternatives.

- Industry Developments: Brazil is a hotbed for new product introductions and field trials for acaricides. Regulatory bodies in Brazil are often among the first in the region to approve novel chemistries, further solidifying its leadership.

Beyond Brazil, Argentina stands as another crucial market, particularly for its significant grain production (soybeans and corn) and livestock farming, both of which are susceptible to mite infestations. The country's favorable regulatory environment and substantial agricultural investments contribute to its strong performance in the acaricides sector. Other nations like Colombia (coffee and horticulture), Chile (fruits), and Peru (horticulture and fruits) represent important, albeit smaller, markets with specific crop-focused demands for acaricides.

South America Acaricides Industry Product Landscape

The South American acaricides product landscape is characterized by a diverse array of chemical classes designed to combat various mite species impacting key crops. Innovations are focused on developing acaricides with novel modes of action to manage resistance, enhanced residual efficacy for prolonged protection, and improved environmental and toxicological profiles. Organophosphates, pyrethroids, and abamectin remain prevalent, but there's a growing adoption of newer chemistries like diamides and spirotetramat for their targeted action and reduced impact on beneficial insects.

Key Drivers, Barriers & Challenges in South America Acaricides Industry

Key Drivers:

- Increasing Mite Resistance: The evolution of mite resistance to existing acaricides necessitates the continuous development and adoption of new, more effective products.

- Growing Demand for High-Value Crops: Expansion in soybean, corn, fruit, and coffee cultivation across South America directly correlates with increased demand for acaricide protection.

- Technological Advancements: Ongoing R&D by leading agrochemical companies yields novel acaricide formulations with improved efficacy and safety.

- Favorable Regulatory Environments (in key markets): Countries like Brazil and Argentina have established processes for new product registrations, facilitating market entry.

Key Barriers & Challenges:

- High Cost of R&D and Registration: Developing and registering new acaricide active ingredients is an expensive and time-consuming process, posing a significant barrier for smaller companies.

- Regulatory Hurdles and Stricter Environmental Standards: Evolving environmental regulations and the need for extensive safety data can delay product launches and increase compliance costs.

- Supply Chain Disruptions: Global supply chain volatility can impact the availability and cost of raw materials and finished acaricide products.

- Counterfeit Products and Grey Market: The presence of counterfeit acaricides undermines legitimate market players and poses risks to crop health and farmer investment.

Emerging Opportunities in South America Acaricides Industry

Emerging opportunities lie in the development and promotion of acaricides with integrated pest management (IPM) compatibility, offering reduced reliance on broad-spectrum chemicals. The growing demand for organic produce presents a niche but expanding market for biological acaricides and naturally derived pest control solutions. Furthermore, advancements in precision agriculture technologies, such as drone application and sensor-based pest monitoring, can drive demand for targeted and efficient acaricide application, optimizing usage and reducing environmental impact. Untapped regions with expanding agricultural frontiers also represent significant growth potential.

Growth Accelerators in the South America Acaricides Industry Industry

Growth accelerators for the South American acaricides industry are primarily fueled by sustained investment in research and development by multinational agrochemical corporations, leading to the introduction of innovative active ingredients and sophisticated formulations. Strategic partnerships between chemical manufacturers and local distributors or agricultural cooperatives facilitate broader market reach and farmer education. Furthermore, government initiatives promoting agricultural modernization and productivity, coupled with favorable trade policies for agricultural inputs, act as significant catalysts for market expansion. The increasing adoption of climate-smart agriculture practices, which often involve proactive pest management, also contributes to sustained demand.

Key Players Shaping the South America Acaricides Industry Market

- FMC Corporation

- UPL

- Nufarm

- Bayer AG

- Arysta LifeScience Limited

- Syngenta

- Corteva Agriscience

- BASF SE

Notable Milestones in South America Acaricides Industry Sector

- 2023/March: UPL announces acquisition of Arysta LifeScience, significantly expanding its global agrochemical portfolio, including acaricides, and strengthening its presence in South America.

- 2024/Q2: Bayer AG receives registration for a new acaricide active ingredient in Brazil, offering novel mode of action for key mite pests in soybean.

- 2024/Q4: Syngenta launches an enhanced formulation of a popular acaricide in Argentina, improving efficacy and application flexibility for wheat and barley growers.

- 2025/Q1: Corteva Agriscience expands its acaricide offerings in Colombia to address increased pest pressure on coffee plantations.

- 2025/Q3: FMC Corporation introduces a new acaricide product targeting resistance management in Brazilian citrus orchards.

In-Depth South America Acaricides Industry Market Outlook

The South American acaricides industry is projected for sustained and dynamic growth, with a strong emphasis on innovation and strategic market penetration. Future market potential is significant, driven by the ongoing need to protect diverse agricultural crops from the pervasive threat of mite infestations and the increasing demand for higher agricultural yields. Strategic opportunities lie in the development of acaricides that not only offer superior efficacy but also align with evolving sustainability mandates and integrated pest management strategies. Companies that can effectively navigate complex regulatory landscapes, invest in localized product development, and foster strong distribution networks will be best positioned to capitalize on this expanding market.

South America Acaricides Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

South America Acaricides Industry Segmentation By Geography

-

1. South America

- 1.1. Brazil

- 1.2. Argentina

- 1.3. Chile

- 1.4. Colombia

- 1.5. Peru

- 1.6. Venezuela

- 1.7. Ecuador

- 1.8. Bolivia

- 1.9. Paraguay

- 1.10. Uruguay

South America Acaricides Industry Regional Market Share

Geographic Coverage of South America Acaricides Industry

South America Acaricides Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.40% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns

- 3.3. Market Restrains

- 3.3.1. High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants

- 3.4. Market Trends

- 3.4.1. Need for Increasing the Productivity

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. South America Acaricides Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. South America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 FMC Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 UPL

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Nufarm

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Bayer AG

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Arysta LifeScience Limited*List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Syngenta

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corteva Agriscience

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 BASF SE

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 FMC Corporation

List of Figures

- Figure 1: South America Acaricides Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: South America Acaricides Industry Share (%) by Company 2025

List of Tables

- Table 1: South America Acaricides Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: South America Acaricides Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: South America Acaricides Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: South America Acaricides Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: South America Acaricides Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: South America Acaricides Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: South America Acaricides Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: South America Acaricides Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: South America Acaricides Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: South America Acaricides Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: South America Acaricides Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: South America Acaricides Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: Brazil South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Argentina South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Chile South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Colombia South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 17: Peru South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 18: Venezuela South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 19: Ecuador South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 20: Bolivia South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 21: Paraguay South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Uruguay South America Acaricides Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the South America Acaricides Industry?

The projected CAGR is approximately 4.40%.

2. Which companies are prominent players in the South America Acaricides Industry?

Key companies in the market include FMC Corporation, UPL, Nufarm, Bayer AG, Arysta LifeScience Limited*List Not Exhaustive, Syngenta, Corteva Agriscience, BASF SE.

3. What are the main segments of the South America Acaricides Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Adoption of Organic and Eco-friendly Farming Practices; Declining Area of Arable Land and Rising Food Security Concerns.

6. What are the notable trends driving market growth?

Need for Increasing the Productivity.

7. Are there any restraints impacting market growth?

High Demand for Conventional and Synthetic Products; Lack of Awareness and Other Factors Limiting the Adoption of Agricultural Inoculants.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "South America Acaricides Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the South America Acaricides Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the South America Acaricides Industry?

To stay informed about further developments, trends, and reports in the South America Acaricides Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence