Key Insights

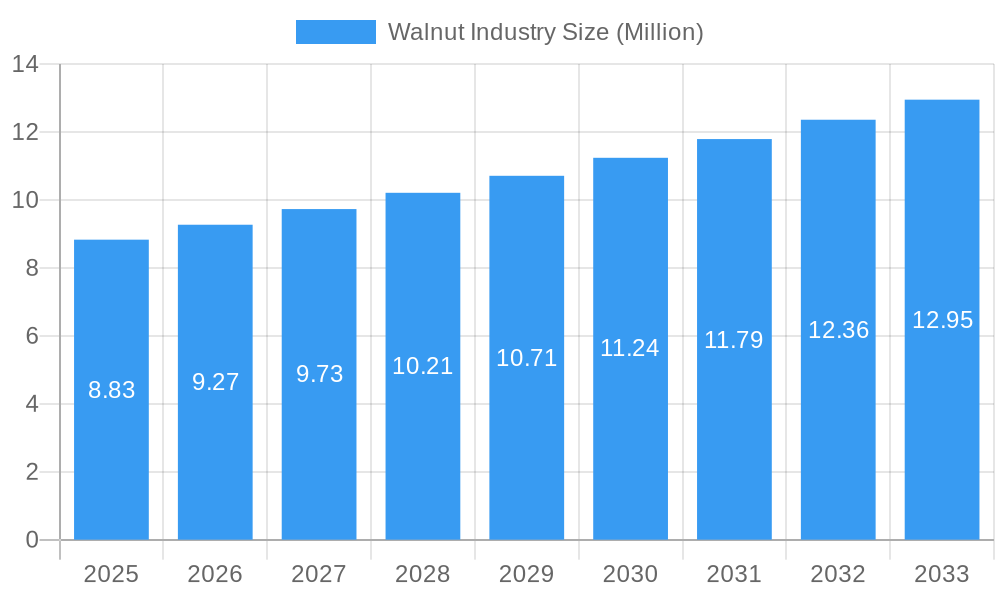

The global Walnut Industry is poised for robust expansion, with the market size projected to reach $8.83 million by 2025. This growth is underpinned by a compelling Compound Annual Growth Rate (CAGR) of 4.90%, indicating sustained upward momentum through the forecast period of 2025-2033. A significant driver for this expansion is the increasing consumer awareness regarding the health benefits associated with walnut consumption, including their rich omega-3 fatty acid content, antioxidants, and vitamins, which are vital for cognitive function and cardiovascular health. This heightened health consciousness is particularly prevalent in developed economies and is steadily gaining traction in emerging markets. Furthermore, the versatility of walnuts in culinary applications, from savory dishes and salads to baked goods and snacks, continues to fuel demand across diverse food sectors. The industry is also benefiting from advancements in cultivation and processing technologies, leading to improved yield and quality.

Walnut Industry Market Size (In Million)

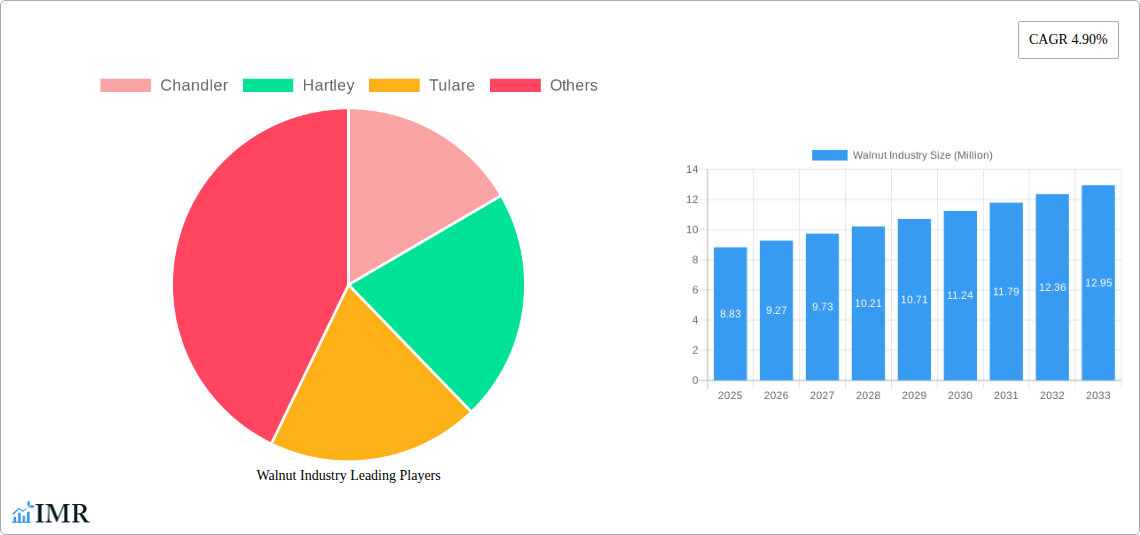

Key trends shaping the Walnut Industry include the growing demand for organic and sustainably sourced walnuts, appealing to environmentally conscious consumers. Innovations in packaging and product development, such as ready-to-eat walnut snacks and walnut-based dairy alternatives, are also expanding market reach and catering to evolving consumer lifestyles. However, the industry faces certain restraints, including the susceptibility of walnut crops to adverse weather conditions and pest outbreaks, which can impact supply and price stability. Fluctuations in global commodity prices and trade policies can also present challenges. Despite these hurdles, the proactive adoption of modern agricultural practices and the establishment of robust supply chains are expected to mitigate these risks, ensuring continued market growth. The market is segmented across production, consumption, import/export analysis, and price trends, with key players like Chandler, Hartley, and Tulare actively contributing to market dynamics. Geographically, North America, Europe, and Asia Pacific are significant regions, with specific countries like the United States, China, and Turkey playing pivotal roles in production and consumption.

Walnut Industry Company Market Share

Comprehensive Report: Global Walnut Industry Market Analysis & Forecast (2019-2033)

This in-depth report provides a detailed analysis of the global walnut industry, encompassing production, consumption, import/export markets, pricing trends, and significant industry developments. Leveraging high-traffic keywords such as "walnut market," "nut industry," "food processing," "agricultural commodities," and "healthy foods," this report is meticulously crafted for industry professionals, investors, and stakeholders seeking actionable insights into market dynamics, growth trajectories, and competitive landscapes. We delve into the intricate parent and child market structures, offering a holistic view of the value chain. All quantitative data is presented in millions of units for clear comprehension.

Walnut Industry Market Dynamics & Structure

The global walnut industry exhibits a moderately concentrated market structure, with a few key players holding significant market shares in both shelled and in-shell segments. Technological innovation is a primary driver, focusing on improved cultivation techniques, efficient harvesting, advanced processing technologies like automated shelling and sorting, and value-added product development. Regulatory frameworks, particularly those related to food safety standards, organic certifications, and international trade agreements, play a crucial role in shaping market access and compliance. Competitive substitutes, such as almonds, pistachios, and other tree nuts, present a continuous challenge, necessitating differentiation through quality, branding, and unique product offerings. End-user demographics are increasingly shifting towards health-conscious consumers seeking nutritious snacks and ingredients. Mergers and acquisitions (M&A) trends are observed as companies aim to consolidate market presence, secure supply chains, and expand product portfolios. For instance, the acquisition of smaller processing units by larger entities aims to leverage economies of scale and enhance market reach.

- Market Concentration: Dominated by a few large-scale producers and processors, with regional variations.

- Technological Drivers: Focus on precision agriculture, automation in processing, and development of shelf-stable walnut products.

- Regulatory Impact: Food safety certifications (e.g., HACCP, ISO) and import/export regulations are critical for market entry.

- Competitive Landscape: High competition from other edible nuts requiring product diversification and quality assurance.

- End-User Focus: Growing demand from health-conscious consumers, the food service industry, and the confectionery sector.

- M&A Activity: Consolidation efforts aimed at expanding production capacity and market penetration.

Walnut Industry Growth Trends & Insights

The global walnut market is poised for robust growth, projected to expand significantly throughout the forecast period. This expansion is fueled by escalating consumer demand for healthy and nutrient-dense food options, driven by increasing awareness of the health benefits associated with regular walnut consumption, including improved cardiovascular health and cognitive function. The adoption rate of walnuts across various food applications, from snacks and baked goods to savory dishes and dairy alternatives, is steadily rising. Technological disruptions are playing a pivotal role, with innovations in cultivation practices leading to higher yields and improved nut quality, alongside advancements in processing technologies that enhance efficiency and reduce post-harvest losses. For instance, the development of sophisticated sorting and grading machinery ensures consistent quality, meeting the stringent requirements of global markets. Consumer behavior shifts are evident in the growing preference for convenience foods and ready-to-eat snack options, where walnuts are increasingly incorporated. The surge in plant-based diets further bolsters the demand for walnuts as a versatile ingredient in vegan and vegetarian culinary creations.

The market size evolution showcases a consistent upward trajectory, with the compound annual growth rate (CAGR) anticipated to remain strong. Market penetration is expanding beyond traditional markets into emerging economies, driven by improving disposable incomes and a growing middle class that can afford premium food products. The health and wellness trend is a paramount influencer, with consumers actively seeking natural, unprocessed foods. This trend is well-aligned with the inherent nutritional profile of walnuts, rich in omega-3 fatty acids, antioxidants, and proteins. Furthermore, the versatility of walnuts as an ingredient allows for their inclusion in a wide array of food products, ranging from breakfast cereals and granola bars to confectionery items and culinary oils. The food processing industry, a significant end-user, is increasingly leveraging walnuts to enhance the nutritional value and appeal of its products. Emerging applications in the pharmaceutical and nutraceutical sectors, capitalizing on the antioxidant and anti-inflammatory properties of walnuts, also contribute to market expansion. The study period from 2019 to 2033, with the base and estimated year at 2025 and a forecast period from 2025 to 2033, provides a comprehensive outlook on this dynamic market.

Dominant Regions, Countries, or Segments in Walnut Industry

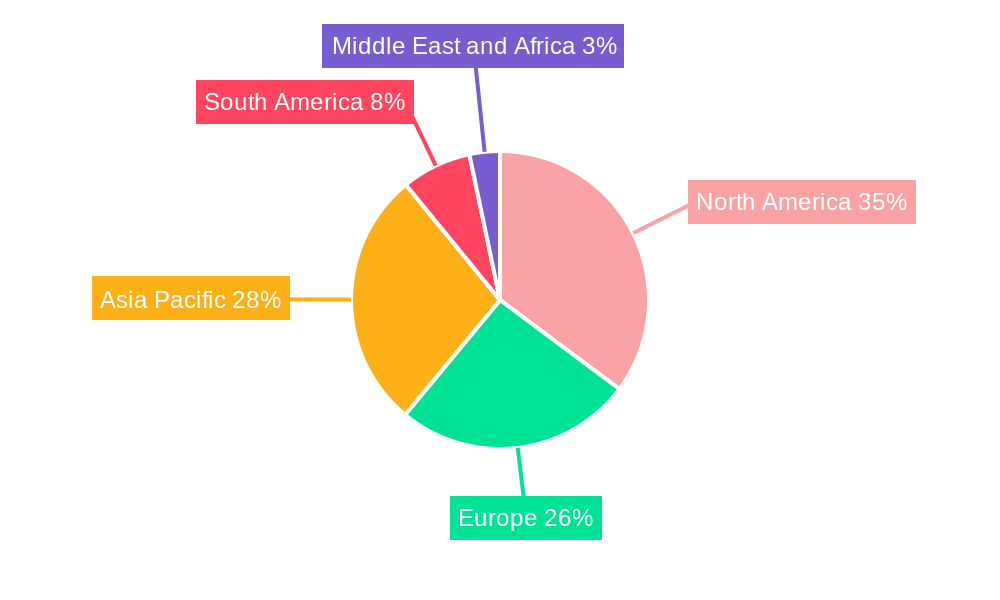

The global walnut industry is characterized by distinct regional leadership across various market facets. In terms of Production Analysis, North America, particularly the United States (primarily California), and China stand as dominant forces, accounting for a substantial portion of global output due to favorable climatic conditions and established agricultural infrastructure. Their production is driven by advanced farming techniques and a strong focus on both conventional and organic cultivation methods.

For Consumption Analysis, the United States, European nations (especially Germany, France, and the UK), and Asian markets (including India and Japan) are key consumption hubs. This demand is propelled by a growing health-conscious consumer base, the widespread use of walnuts in culinary applications, and the expansion of the snack food industry. The increasing popularity of plant-based diets also contributes significantly to consumption patterns.

The Import Market Analysis (Value & Volume) sees significant activity from countries with high consumer demand but limited domestic production. The European Union, as a collective bloc, is a major importer, along with nations like Japan and South Korea. Import volumes are substantially influenced by seasonal availability from major producing regions and trade agreements. The value of imports is often driven by demand for premium-quality walnuts and processed products.

Conversely, the Export Market Analysis (Value & Volume) is dominated by major producing nations. The United States is consistently the largest exporter globally, followed by countries like Chile and emerging players in Eastern Europe. Export value is often higher for processed and shelled walnuts, catering to specific industry requirements in importing countries. Robust logistics and quality control measures are crucial for maintaining export competitiveness.

Regarding Price Trend Analysis, prices are influenced by global supply and demand dynamics, crop yields, the cost of production (including labor and inputs), and currency fluctuations. The market for walnuts is typically characterized by seasonal price variations, with prices often peaking before the harvest season and stabilizing post-harvest. The premium segment, comprising organic and specialty varieties, commands higher prices. The historical period (2019-2024) has shown fluctuating prices influenced by weather patterns and geopolitical events impacting supply chains.

- Production Dominance: United States (California) and China lead global walnut production.

- Key Drivers: Favorable climate, advanced agricultural technology, government support for agriculture.

- Market Share: Consistently accounts for over 70% of global output.

- Consumption Hubs: North America, Europe, and key Asian markets.

- Key Drivers: Health awareness, culinary trends, growth in snack and convenience food sectors.

- Growth Potential: Emerging economies with rising disposable incomes.

- Import Market Dynamics: Driven by demand from regions with production deficits.

- Key Drivers: Consumer demand, trade policies, price competitiveness.

- Volume Impact: Significant volumes imported to meet widespread demand for culinary and snack applications.

- Export Powerhouses: United States, Chile, and Eastern European nations.

- Key Drivers: High production capacity, quality standards, established export infrastructure.

- Value Proposition: Shelled and processed walnuts fetch higher export values.

- Price Determinants: Supply and demand, crop yield variability, production costs, and currency exchange rates.

- Trend Analysis: Seasonal fluctuations and premium pricing for specialized varieties are evident.

Walnut Industry Product Landscape

The walnut industry's product landscape is evolving rapidly, driven by consumer demand for both raw and processed forms, alongside innovative applications. Primary products include in-shell walnuts and shelled walnuts, available in various grades and sizes catering to different end-use requirements. Value-added products are gaining significant traction, encompassing walnut oils, walnut flours, walnut pastes, and pre-packaged walnut snacks. Emerging applications leverage the unique nutritional profile of walnuts, finding their way into plant-based milk alternatives, vegan cheese formulations, and functional food products aimed at cognitive enhancement and heart health. Technological advancements in processing are crucial, enabling efficient shelling, sorting, and packaging, thereby extending shelf life and maintaining product quality. Unique selling propositions often lie in sourcing from specific regions known for superior quality, organic certifications, or innovative processing techniques that preserve the nut's natural flavor and nutritional integrity.

Key Drivers, Barriers & Challenges in Walnut Industry

Key Drivers: The global walnut market is propelled by several significant factors. Growing consumer awareness regarding the health benefits of walnuts, particularly their rich omega-3 fatty acid content and antioxidant properties, is a primary driver. The increasing global demand for plant-based and healthy food alternatives, coupled with the versatility of walnuts as an ingredient in diverse culinary applications – from snacks and baked goods to savory dishes – further fuels market growth. Advancements in agricultural technology, leading to improved yields and nut quality, alongside innovations in processing that enhance efficiency and product shelf-life, also act as crucial growth catalysts. Government initiatives promoting agriculture and food processing also contribute to a favorable market environment.

Barriers & Challenges: Despite the positive growth trajectory, the walnut industry faces several challenges. Fluctuations in crop yields due to adverse weather conditions, pest infestations, and diseases can lead to supply chain disruptions and price volatility. High production costs, including land, labor, and water resources, can impact profitability, especially for smaller growers. Stringent quality control standards and evolving food safety regulations in international markets can pose compliance hurdles for exporters. Furthermore, the presence of competitive substitutes like almonds and pistachios, which are often more readily available or competitively priced, presents a constant challenge. The long gestation period for walnut tree cultivation also limits rapid expansion of production capacity.

Emerging Opportunities in Walnut Industry

The walnut industry is ripe with emerging opportunities for growth and innovation. The expanding market for organic and sustainably sourced walnuts presents a significant avenue, catering to a growing segment of environmentally conscious consumers. Development of novel value-added products, such as walnut-based protein powders, nutrient-fortified snacks, and specialized culinary ingredients for the food service industry, offers avenues for market differentiation and premium pricing. Untapped markets in developing economies, with rising disposable incomes and increasing health consciousness, represent substantial growth potential. Furthermore, exploring new applications in the nutraceutical and pharmaceutical sectors, leveraging the scientifically proven health benefits of walnuts, could unlock significant future revenue streams. The increasing consumer interest in plant-based diets continues to drive demand for walnuts as a key ingredient in vegan and vegetarian product development.

Growth Accelerators in the Walnut Industry Industry

Several catalysts are accelerating the long-term growth of the walnut industry. Technological breakthroughs in precision agriculture, including drip irrigation and advanced soil management, are enhancing yield and quality while optimizing resource utilization. Strategic partnerships between growers, processors, and retailers are streamlining the supply chain, ensuring consistent supply and better market access. The development of drought-resistant and disease-resistant walnut varieties through advanced breeding programs will bolster resilience against climate change and pest outbreaks. Furthermore, aggressive marketing campaigns highlighting the health benefits and culinary versatility of walnuts are expanding consumer awareness and demand across global markets. Investment in research and development for innovative processing techniques, such as cold-pressing for high-quality oils and improved methods for shelling and packaging, will further enhance product appeal and market competitiveness.

Key Players Shaping the Walnut Industry Market

- Chandler

- Hartley

- Tulare

- Wonderful Pistachios & Almonds

- Diamond of California

- Northern California Walnut Growers

- The Kraft Heinz Company

- Mars Inc.

- Olam International

- California Walnut Board

Notable Milestones in Walnut Industry Sector

- April 2022: Ministry of Food Processing Industries (MoFPI), under the Pradhan Mantri Formalisation of Micro food processing Enterprises (PMFME) Scheme, organized a One District One Product (ODOP) initiative in the Kishtwar district. This aimed to foster innovation and introduce stakeholders to emerging trends and technological advancements in walnut processing, boosting the local economy and industry practices.

- January 2022: The Indian Ministry of Science and Technology announced significant innovations in walnut processing, including the development of a walnut cracking machine and a walnut peeler, washer, and sorter. These innovations are crucial for streamlining production and reducing the drudgery associated with walnut processing, particularly in the Union Territories of Jammu and Kashmir and Ladakh, as well as in parts of Himachal Pradesh, Uttarakhand, Sikkim, and Arunachal Pradesh.

In-Depth Walnut Industry Market Outlook

The global walnut market is projected for substantial and sustained growth, driven by an expanding health-conscious consumer base and the increasing incorporation of walnuts into a wide array of food products. Future market potential is significantly bolstered by ongoing technological advancements in cultivation and processing, leading to improved efficiencies and higher quality yields. Strategic opportunities lie in tapping into emerging economies with growing disposable incomes and increasing demand for nutritious food options. Furthermore, the continued trend towards plant-based diets and the growing awareness of walnuts' health benefits present avenues for innovation in product development and market penetration within the nutraceutical and functional food sectors. The industry is well-positioned to capitalize on these trends, ensuring a robust outlook for the foreseeable future.

Walnut Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Walnut Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Mexico

-

2. Europe

- 2.1. Ukraine

- 2.2. Chile

- 2.3. Italy

- 2.4. Spain

- 2.5. Netherlands

- 2.6. Moldova

-

3. Asia Pacific

- 3.1. China

- 3.2. Australia

- 3.3. Turkey

-

4. South America

- 4.1. Chile

- 4.2. Brazil

- 4.3. Peru

-

5. Middle East and Africa

- 5.1. Turkey

- 5.2. Egypt

Walnut Industry Regional Market Share

Geographic Coverage of Walnut Industry

Walnut Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.90% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries

- 3.3. Market Restrains

- 3.3.1. High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations

- 3.4. Market Trends

- 3.4.1. Increasing Demand in the Food Processing Industry

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Walnut Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. Europe

- 5.6.3. Asia Pacific

- 5.6.4. South America

- 5.6.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Walnut Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. Europe Walnut Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Asia Pacific Walnut Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. South America Walnut Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Middle East and Africa Walnut Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Chandler

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Hartley

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Tulare

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.1 Chandler

List of Figures

- Figure 1: Global Walnut Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Walnut Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Walnut Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Walnut Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Walnut Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Walnut Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Walnut Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Walnut Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Walnut Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Walnut Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Walnut Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Walnut Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Walnut Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: Europe Walnut Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: Europe Walnut Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: Europe Walnut Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: Europe Walnut Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: Europe Walnut Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: Europe Walnut Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: Europe Walnut Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: Europe Walnut Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: Europe Walnut Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: Europe Walnut Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: Europe Walnut Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: Europe Walnut Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Asia Pacific Walnut Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Asia Pacific Walnut Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Asia Pacific Walnut Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Asia Pacific Walnut Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Asia Pacific Walnut Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Asia Pacific Walnut Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Asia Pacific Walnut Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Asia Pacific Walnut Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Asia Pacific Walnut Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Asia Pacific Walnut Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Asia Pacific Walnut Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Asia Pacific Walnut Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: South America Walnut Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: South America Walnut Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: South America Walnut Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: South America Walnut Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: South America Walnut Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: South America Walnut Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: South America Walnut Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: South America Walnut Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: South America Walnut Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: South America Walnut Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: South America Walnut Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: South America Walnut Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East and Africa Walnut Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Middle East and Africa Walnut Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Middle East and Africa Walnut Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Middle East and Africa Walnut Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Middle East and Africa Walnut Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Middle East and Africa Walnut Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Middle East and Africa Walnut Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Middle East and Africa Walnut Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Middle East and Africa Walnut Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Middle East and Africa Walnut Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Middle East and Africa Walnut Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Middle East and Africa Walnut Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Walnut Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Walnut Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Walnut Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Walnut Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Walnut Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Walnut Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Walnut Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Walnut Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Walnut Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Walnut Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Walnut Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Walnut Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Mexico Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Global Walnut Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 16: Global Walnut Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 17: Global Walnut Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 18: Global Walnut Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Walnut Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 20: Global Walnut Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 21: Ukraine Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 22: Chile Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Italy Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Spain Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Netherlands Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 26: Moldova Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 27: Global Walnut Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 28: Global Walnut Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 29: Global Walnut Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 30: Global Walnut Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 31: Global Walnut Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 32: Global Walnut Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 33: China Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Australia Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Turkey Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Global Walnut Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 37: Global Walnut Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 38: Global Walnut Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 39: Global Walnut Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 40: Global Walnut Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 41: Global Walnut Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 42: Chile Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 43: Brazil Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 44: Peru Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 45: Global Walnut Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 46: Global Walnut Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 47: Global Walnut Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 48: Global Walnut Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 49: Global Walnut Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 50: Global Walnut Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 51: Turkey Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Egypt Walnut Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Walnut Industry?

The projected CAGR is approximately 4.90%.

2. Which companies are prominent players in the Walnut Industry?

Key companies in the market include Chandler, Hartley, Tulare.

3. What are the main segments of the Walnut Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 8.83 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Berry Consumption for Health Benefits; Increasing Adoption of High-Technology Farm Practices; Growing Usage of Berries in the Food and Beverage Industries.

6. What are the notable trends driving market growth?

Increasing Demand in the Food Processing Industry.

7. Are there any restraints impacting market growth?

High Production Cost Involved in Berry Production; Increasing Disease and Pest Infestations.

8. Can you provide examples of recent developments in the market?

April 2022: Ministry of Food Processing Industries (MoFPI), under the Pradhan Mantri Formalisation of Micro food processing Enterprises (PMFME) Scheme, recently organized a One District One Product (ODOP). The ODOP Scheme aimed to set the stage for all food-tech stakeholders to impart and acquaint the stakeholders with the new emerging trends in food processing and technological innovation in walnut processing in the Kishtwar district.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Walnut Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Walnut Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Walnut Industry?

To stay informed about further developments, trends, and reports in the Walnut Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence