Key Insights

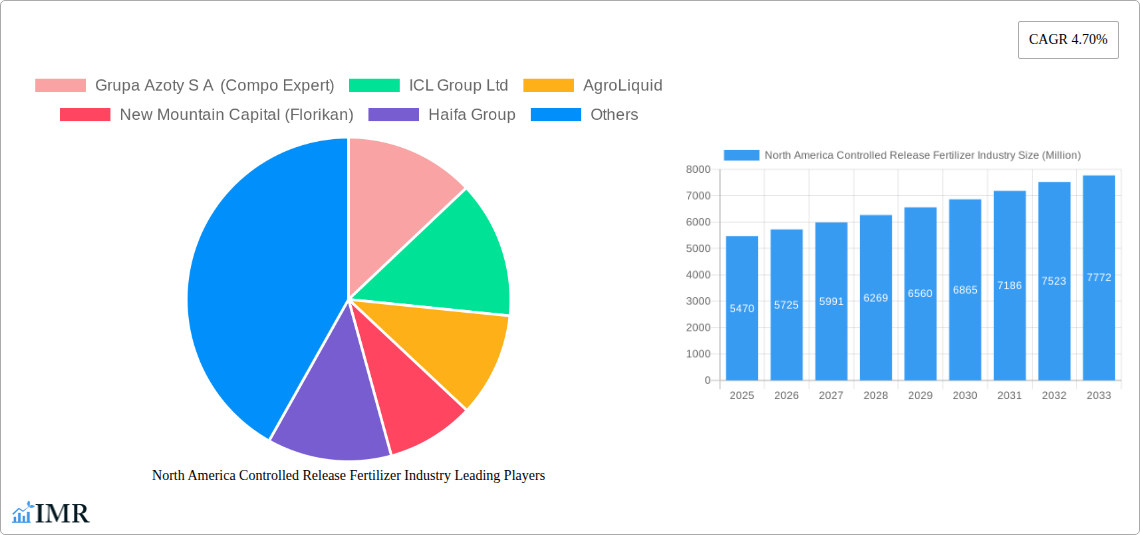

The North America Controlled Release Fertilizer (CRF) market is poised for significant expansion, driven by increasing agricultural productivity demands and a growing emphasis on sustainable farming practices. With a current market size estimated at USD 5,470 million, the industry is projected to grow at a Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033, reaching an estimated USD 7,772 million by the end of the forecast period. Key growth drivers include the adoption of advanced fertilizer technologies that enhance nutrient use efficiency, reduce environmental impact through minimized leaching, and offer labor savings for farmers. The demand for CRF is particularly robust in regions with intensive agricultural operations and stringent environmental regulations, such as the United States and Canada, where precision agriculture is gaining traction.

North America Controlled Release Fertilizer Industry Market Size (In Billion)

The market's upward trajectory is further supported by ongoing innovation in CRF formulations and coating technologies, leading to improved product performance and tailored nutrient delivery for specific crops and soil conditions. Emerging trends like the integration of smart technologies for real-time nutrient monitoring and application, alongside a surge in organic and bio-based fertilizer alternatives that can be combined with CRF, are shaping market dynamics. However, the market faces certain restraints, including the higher initial cost of CRF compared to conventional fertilizers, which can be a barrier for some farmers, and the need for greater farmer education and awareness regarding the long-term economic and environmental benefits. Nevertheless, the growing awareness of climate change mitigation and the imperative for efficient resource management are expected to outweigh these challenges, ensuring sustained market growth and innovation in the North American CRF landscape.

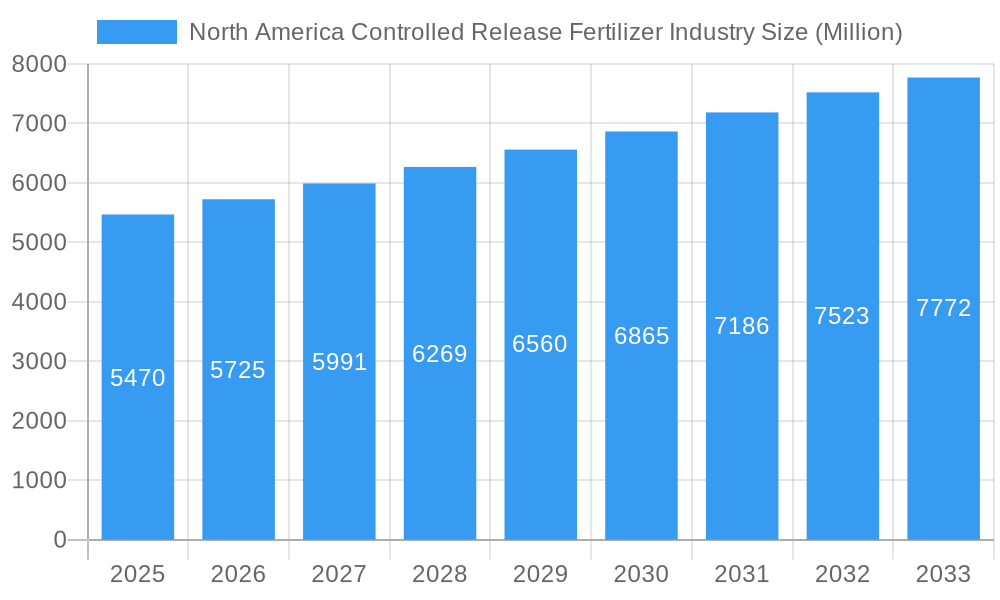

North America Controlled Release Fertilizer Industry Company Market Share

North America Controlled Release Fertilizer Industry: Market Dynamics, Trends, and Outlook (2019-2033)

This comprehensive report provides an in-depth analysis of the North America Controlled Release Fertilizer (CRF) industry, a critical sector for sustainable agriculture and enhanced crop yields. Covering a detailed study period from 2019 to 2033, with a base year of 2025 and a forecast period extending to 2033, this report offers invaluable insights for stakeholders seeking to understand market evolution, growth drivers, competitive landscape, and future opportunities. We meticulously analyze production, consumption, import/export markets, price trends, and technological advancements, segmenting the market by parent and child applications for granular understanding. All quantitative data is presented in million units for ease of comparison and integration.

North America Controlled Release Fertilizer Industry Market Dynamics & Structure

The North America controlled release fertilizer industry is characterized by a moderately concentrated market, driven by technological innovation in nutrient management and increasing adoption of precision agriculture. Key drivers include the imperative for enhanced crop yields, reduced environmental impact through minimized nutrient leaching, and evolving regulatory frameworks promoting sustainable farming practices. End-user demographics are shifting towards larger-scale commercial farms and specialty crop growers seeking optimized fertilization strategies.

- Market Concentration: Dominated by a few key players with significant R&D capabilities and established distribution networks.

- Technological Innovation Drivers: Advancements in polymer coatings, biodegradable matrices, and microencapsulation technologies are crucial for developing efficient and environmentally friendly CRF products.

- Regulatory Frameworks: Government initiatives promoting soil health, water quality, and greenhouse gas reduction indirectly support the demand for CRFs.

- Competitive Product Substitutes: While conventional fertilizers remain a substitute, the growing emphasis on efficiency and sustainability is favoring CRFs.

- End-User Demographics: Increasing adoption by large-scale agricultural enterprises, horticultural operations, and turf management companies.

- M&A Trends: Strategic acquisitions and partnerships are observed as companies aim to expand product portfolios, geographical reach, and technological expertise. For example, the acquisition of Horticoop Andina by Haifa Group signifies a strategic move to bolster market presence.

North America Controlled Release Fertilizer Industry Growth Trends & Insights

The North America controlled release fertilizer market is poised for robust expansion, driven by a confluence of economic, environmental, and technological factors. The market size has witnessed a steady evolution, fueled by increasing awareness of the benefits associated with CRFs, such as enhanced nutrient use efficiency, reduced application frequency, and improved crop quality. Adoption rates are progressively rising as growers recognize the long-term economic advantages and environmental stewardship offered by these advanced fertilizer formulations. Technological disruptions, including advancements in slow-release and controlled-release mechanisms, are continuously enhancing product performance and opening new application avenues.

Consumer behavior shifts are also playing a pivotal role, with a growing demand for sustainably produced food and a greater emphasis on environmentally responsible agricultural practices. Farmers are actively seeking solutions that not only optimize yields but also minimize their ecological footprint. This paradigm shift is directly translating into higher demand for CRFs, which are instrumental in achieving these objectives. The market penetration of CRFs is expected to deepen as their cost-effectiveness becomes more apparent over the long term, outweighing the initial investment through reduced labor, material, and environmental compliance costs. For instance, the projected CAGR for the CRF market is estimated to be between 6% and 8% during the forecast period, reflecting a strong growth trajectory. The market's value is projected to reach approximately $6,500 million by 2033, up from an estimated $3,800 million in 2025. This growth is underpinned by continuous innovation in product efficacy and the increasing focus on precision farming techniques that leverage the inherent advantages of CRFs.

Dominant Regions, Countries, or Segments in North America Controlled Release Fertilizer Industry

The North America controlled release fertilizer industry's dominance is multifaceted, with distinct regions and segments showcasing exceptional growth. From a Production Analysis perspective, the United States, particularly its agricultural heartlands in the Midwest, leads due to established chemical manufacturing infrastructure and a strong agricultural base. Canada, with its vast agricultural expanse and increasing adoption of advanced farming techniques, also plays a significant role in production.

In terms of Consumption Analysis, the United States remains the dominant market, driven by its large agricultural sector, including extensive row crop cultivation (corn, soybeans, wheat) and significant horticultural production. Specialty crops and the golf and turf management sectors also contribute substantially to consumption. Mexico, while smaller, is a rapidly growing market, influenced by increasing foreign investment in agriculture and a rising demand for higher yields.

The Import Market Analysis (Value & Volume) is largely led by the United States, which imports specialized CRF products and raw materials not produced domestically. Canada also contributes to import volumes, particularly for niche fertilizer types. The Export Market Analysis (Value & Volume) sees the United States as a significant exporter, particularly of high-value, technologically advanced CRFs, to various global markets, including Latin America and parts of Europe.

The Price Trend Analysis indicates a general upward trend, influenced by raw material costs (e.g., nitrogen, phosphate, potash), energy prices, and the premium associated with advanced release technologies. However, competitive pressures and economies of scale can moderate price increases.

- Production Dominance: United States (Midwest), Canada.

- Consumption Dominance: United States (row crops, horticulture, turf), Mexico (growing).

- Import Drivers: Specialized products, raw materials, technological gap fulfillment.

- Export Strengths: High-value, innovative CRF formulations.

- Price Influences: Raw material volatility, energy costs, technological sophistication.

The agricultural sector's focus on yield optimization and sustainable practices, coupled with supportive government policies promoting efficient nutrient management, solidifies the dominance of key regions and segments within the North American CRF market.

North America Controlled Release Fertilizer Industry Product Landscape

The North America Controlled Release Fertilizer (CRF) industry is characterized by continuous product innovation, focusing on enhancing nutrient delivery and environmental sustainability. Key advancements include polymer-coated urea and NPK fertilizers, offering precise nutrient release patterns aligned with crop growth stages. Biodegradable matrix technologies and microencapsulation are also gaining traction, providing extended nutrient availability and reduced environmental impact. Applications span broadacre agriculture, specialty crops, horticulture, and turf & ornamental sectors, each benefiting from tailored release profiles. Performance metrics are increasingly focused on nitrogen use efficiency, reduced leaching, and improved crop quality, differentiating products by their environmental benefits and yield enhancement capabilities.

Key Drivers, Barriers & Challenges in North America Controlled Release Fertilizer Industry

The North America Controlled Release Fertilizer industry is propelled by several key drivers, primarily centered around the increasing demand for sustainable agriculture and enhanced crop yields.

- Technological Advancement: Continuous innovation in coating technologies and fertilizer formulations leads to more efficient and environmentally friendly products.

- Environmental Concerns: Growing awareness of nutrient runoff and its impact on water quality is pushing farmers towards solutions that minimize losses, like CRFs.

- Economic Benefits: Although initial costs can be higher, CRFs offer long-term savings through reduced application frequency, labor, and increased yields.

- Regulatory Support: Government policies promoting precision agriculture and sustainable land management favor the adoption of CRFs.

However, the industry faces significant barriers and challenges:

- High Initial Cost: The upfront investment for CRF products can be a deterrent for some farmers, especially in price-sensitive markets.

- Lack of Awareness & Education: Limited understanding of CRF benefits and application techniques can hinder widespread adoption.

- Supply Chain Volatility: Fluctuations in raw material prices and availability can impact production costs and product pricing.

- Regulatory Hurdles: Complex and evolving regulations related to fertilizer production and application can pose compliance challenges.

- Competitive Pressures: Competition from conventional fertilizers and emerging alternative nutrient management strategies. The market is projected to face a supply chain bottleneck with an estimated 5% to 7% disruption risk in the coming years due to geopolitical factors.

Emerging Opportunities in North America Controlled Release Fertilizer Industry

Emerging opportunities in the North America Controlled Release Fertilizer industry lie in the untapped potential of specialty crop markets and urban agriculture. The increasing demand for high-value produce with specific nutritional profiles presents a significant avenue for customized CRF solutions. Furthermore, the growth of vertical farming and controlled environment agriculture offers unique opportunities for precisely engineered CRFs that optimize nutrient delivery in soilless systems. Innovations in biodegradable and bio-based CRF formulations are also gaining traction, aligning with the growing consumer preference for eco-friendly products and sustainable farming practices. There's also a substantial opportunity in leveraging data analytics and IoT to provide farmers with more precise application recommendations, further enhancing the value proposition of CRFs.

Growth Accelerators in the North America Controlled Release Fertilizer Industry Industry

Several catalysts are accelerating the growth of the North America Controlled Release Fertilizer industry. Technological breakthroughs in slow-release coatings and nutrient delivery mechanisms are continuously enhancing product efficacy and expanding their application range. Strategic partnerships between fertilizer manufacturers and agricultural technology providers are fostering the development of integrated nutrient management solutions. Market expansion strategies, including the penetration into emerging agricultural regions and the development of crop-specific formulations, are also significant growth accelerators. For example, Nutrien Ltd.'s focus on digital agriculture platforms aims to provide farmers with data-driven insights that will promote the efficient use of CRFs. The projected market growth rate is further boosted by increased R&D investments, expected to be in the range of 4% to 6% annually.

Key Players Shaping the North America Controlled Release Fertilizer Industry Market

- Grupa Azoty S A (Compo Expert)

- ICL Group Ltd

- AgroLiquid

- New Mountain Capital (Florikan)

- Haifa Group

- Nutrien Ltd

Notable Milestones in North America Controlled Release Fertilizer Industry Sector

- May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.

- May 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric ton of potash, respectively in 2022 at 590 USD per ton.

- March 2022: The Haifa Group entered into a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the latin market and strengthen its position as a global superbrand in advanced plant nutrition.

In-Depth North America Controlled Release Fertilizer Industry Market Outlook

The North America Controlled Release Fertilizer industry is set for continued expansion, driven by an unwavering commitment to sustainable agricultural practices and the pursuit of optimized crop yields. Future market potential is significantly bolstered by ongoing research and development in smart fertilizer technologies, which promise even greater precision in nutrient delivery. Strategic opportunities abound in the development of tailored CRF solutions for niche markets and the integration of CRFs into comprehensive digital farming ecosystems that provide real-time feedback and adjustments. The industry's ability to adapt to evolving environmental regulations and to demonstrate tangible economic benefits to growers will be paramount in capitalizing on this promising future.

North America Controlled Release Fertilizer Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

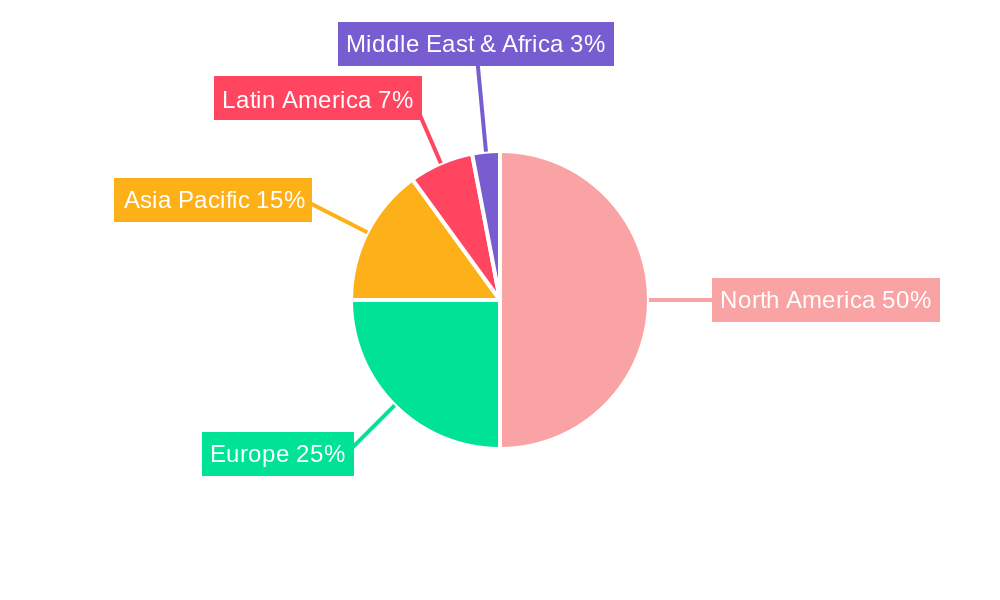

North America Controlled Release Fertilizer Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

North America Controlled Release Fertilizer Industry Regional Market Share

Geographic Coverage of North America Controlled Release Fertilizer Industry

North America Controlled Release Fertilizer Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.70% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. North America Controlled Release Fertilizer Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grupa Azoty S A (Compo Expert)

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ICL Group Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 AgroLiquid

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 New Mountain Capital (Florikan)

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Haifa Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Nutrien Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.1 Grupa Azoty S A (Compo Expert)

List of Figures

- Figure 1: North America Controlled Release Fertilizer Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: North America Controlled Release Fertilizer Industry Share (%) by Company 2025

List of Tables

- Table 1: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: North America Controlled Release Fertilizer Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States North America Controlled Release Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada North America Controlled Release Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico North America Controlled Release Fertilizer Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the North America Controlled Release Fertilizer Industry?

The projected CAGR is approximately 4.70%.

2. Which companies are prominent players in the North America Controlled Release Fertilizer Industry?

Key companies in the market include Grupa Azoty S A (Compo Expert), ICL Group Ltd, AgroLiquid, New Mountain Capital (Florikan), Haifa Group, Nutrien Ltd.

3. What are the main segments of the North America Controlled Release Fertilizer Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

May 2022: ICL launched three new NPK formulations of Solinure, a product with increased trace elements to optimize yields.May 2022: ICL signed an agreement with customers in India and China to supply 600,000 and 700,000 metric ton of potash, respectively in 2022 at 590 USD per ton.March 2022: The Haifa Group entered into a purchase agreement with HORTICOOP BV to acquire Horticoop Andina, the distributor of nutritional products for agriculture. Through this acquisition of the brand, Haifa intends to expand its market presence in the latin market and strengthen its position as a global superbrand in advanced plant nutrition.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "North America Controlled Release Fertilizer Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the North America Controlled Release Fertilizer Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the North America Controlled Release Fertilizer Industry?

To stay informed about further developments, trends, and reports in the North America Controlled Release Fertilizer Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence