Key Insights

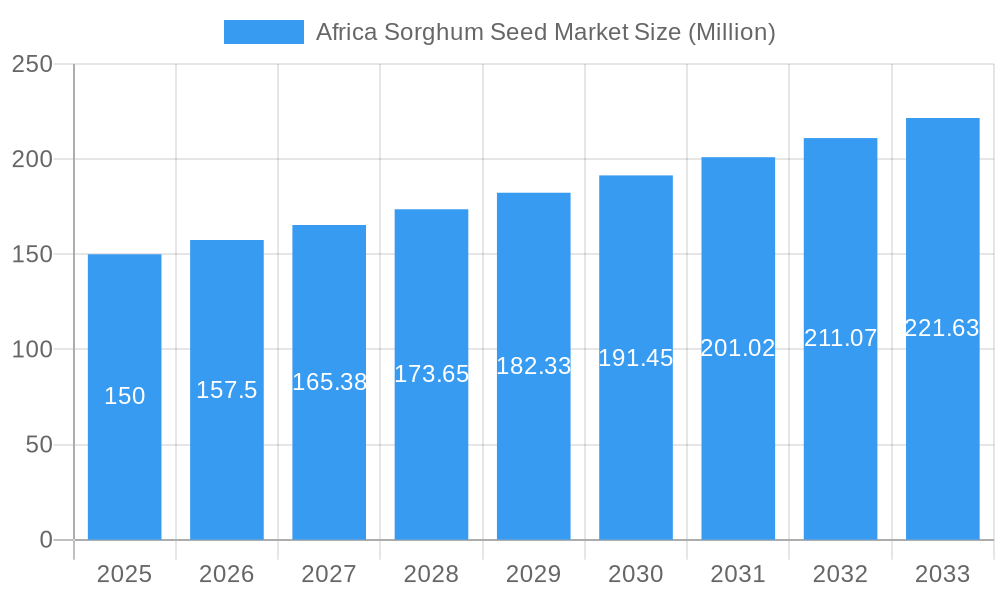

The African sorghum seed market, valued at approximately $XX million in 2025, is projected to experience robust growth, exhibiting a compound annual growth rate (CAGR) of 5% from 2025 to 2033. This expansion is driven by several key factors. Rising demand for sorghum as a staple food crop across sub-Saharan Africa fuels the need for improved, high-yielding seed varieties. Increased awareness of sorghum's drought resistance and adaptability to diverse climates further enhances its appeal to farmers, particularly in regions facing water scarcity. Government initiatives promoting agricultural diversification and improved farming practices, along with investments in agricultural research and development, are also contributing to market growth. The market is segmented by breeding technology (hybrids and non-transgenic hybrids like open-pollinated varieties and hybrid derivatives) and geography, with South Africa, Nigeria, and Ethiopia emerging as major markets due to their significant sorghum production and consumption. While the market faces challenges such as inconsistent rainfall patterns, limited access to quality inputs like fertilizers and pesticides in some regions, and competition from other cereal crops, the overall growth trajectory remains positive, driven by increasing farmer adoption of improved seed technologies. The presence of established players like Zamseed, Seed Co Limited, and Corteva Agriscience, alongside smaller regional companies, indicates a competitive but growing market landscape.

Africa Sorghum Seed Market Market Size (In Million)

The significant potential of the African sorghum seed market is further underscored by the ongoing efforts to improve seed quality and distribution networks. The introduction of new, disease-resistant and high-yielding hybrid varieties promises to significantly boost sorghum yields and contribute to food security in the region. Furthermore, the growing adoption of improved agricultural practices, supported by training and extension services, is expected to enhance the overall productivity and profitability of sorghum farming. The market's future prospects are strongly linked to continued investment in agricultural research, infrastructure development, and supportive government policies aimed at promoting sustainable agricultural practices and enhancing the livelihoods of smallholder farmers. Considering these factors, the market is poised for sustained growth over the forecast period, with significant opportunities for seed companies to capitalize on the expanding demand.

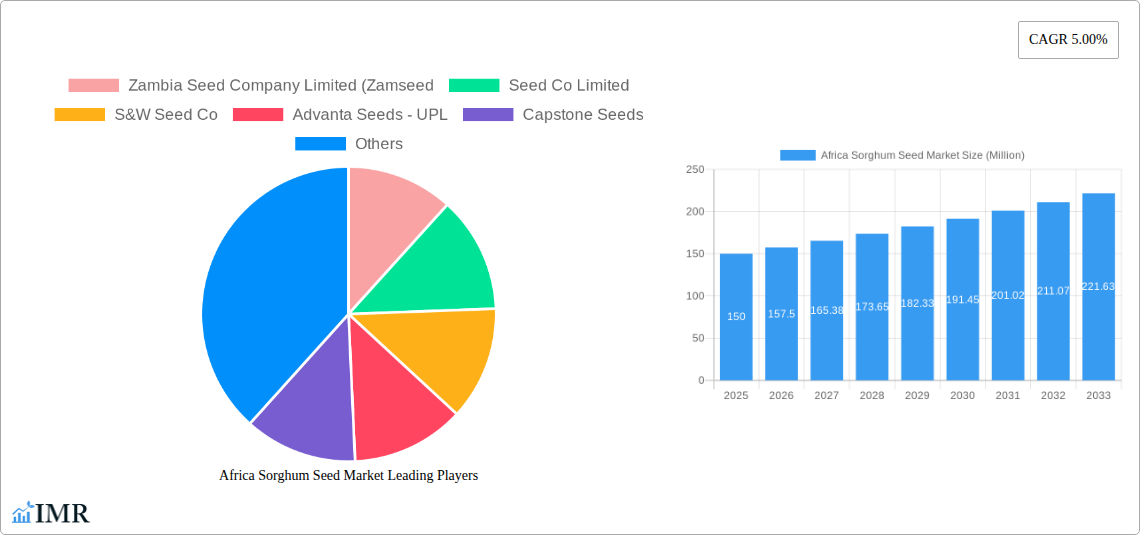

Africa Sorghum Seed Market Company Market Share

Africa Sorghum Seed Market: A Comprehensive Market Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Africa sorghum seed market, encompassing market dynamics, growth trends, regional performance, product landscape, and future outlook. The study period covers 2019-2033, with 2025 serving as the base and estimated year. The forecast period extends from 2025 to 2033, while the historical period spans 2019-2024. This report is crucial for industry professionals, investors, and stakeholders seeking to understand this dynamic market and capitalize on emerging opportunities. The report analyzes the parent market of agricultural seeds in Africa and the child market specifically focusing on Sorghum seeds.

Africa Sorghum Seed Market Dynamics & Structure

This section delves into the competitive landscape of the African sorghum seed market, analyzing market concentration, technological advancements, regulatory frameworks, and market dynamics. We examine the impact of mergers and acquisitions (M&A) activities and the influence of substitute products. The analysis incorporates both quantitative data (market share, M&A deal volumes - estimated at xx million deals in the historical period) and qualitative factors (innovation barriers, regulatory hurdles).

- Market Concentration: The market is characterized by a mix of multinational corporations and local players, with a moderate level of concentration (estimated xx% market share held by the top 5 players in 2024).

- Technological Innovation: The adoption of hybrid sorghum varieties and improved breeding technologies are key drivers of market growth. However, access to advanced technologies and high initial investment costs pose significant challenges for smaller players.

- Regulatory Frameworks: Varying regulations across African countries influence seed production, distribution, and sales, creating complexities for market participants.

- Competitive Substitutes: Other cereals and grains compete with sorghum, impacting market demand. The report assesses the competitive intensity and potential market substitution effects.

- End-User Demographics: The report analyzes the distribution of sorghum seed consumption across different farming types (e.g., smallholder farmers, large-scale commercial farms).

- M&A Trends: The analysis covers M&A activities within the sector, providing insights into consolidation trends and their impact on market structure.

Africa Sorghum Seed Market Growth Trends & Insights

This section provides a detailed analysis of the Africa sorghum seed market's growth trajectory, incorporating key metrics such as Compound Annual Growth Rate (CAGR), market penetration rates, and adoption patterns of new technologies. The analysis covers market size evolution, technology disruptions, and shifts in consumer behavior, leveraging proprietary data and market intelligence. The market is projected to experience significant growth, driven by factors such as increasing demand for sorghum, government initiatives promoting agricultural development, and technological improvements in seed production. The CAGR for the forecast period (2025-2033) is estimated at xx%. Market penetration of improved sorghum seed varieties is expected to reach xx% by 2033.

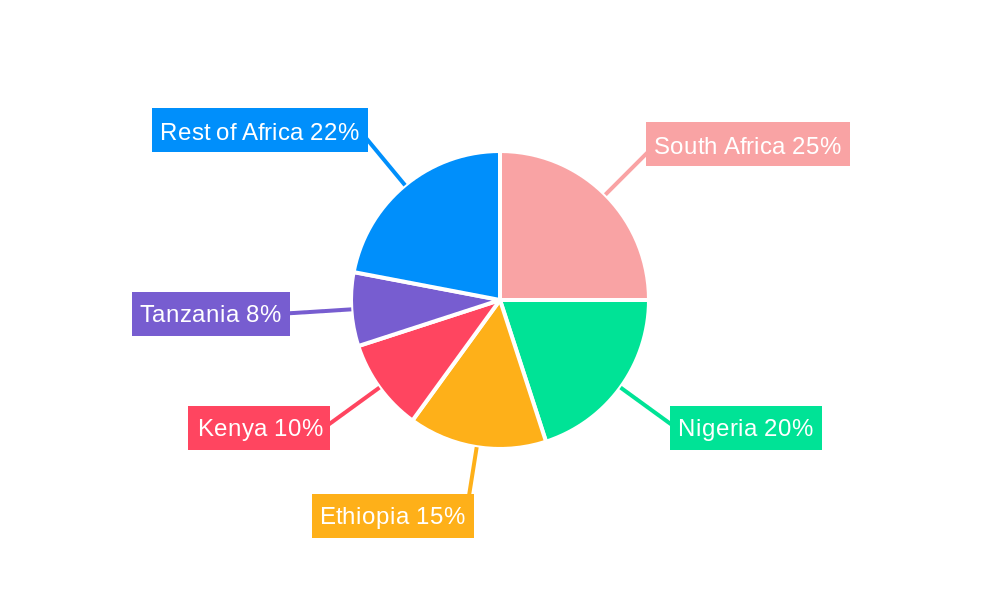

Dominant Regions, Countries, or Segments in Africa Sorghum Seed Market

This section identifies the leading regions, countries, and segments within the African sorghum seed market, analyzing factors contributing to their dominance. The analysis considers market share, growth potential, and key drivers such as economic policies, infrastructure, and agricultural practices.

- Leading Regions: South Africa, Nigeria, and Ethiopia are projected to be the dominant regions, driven by large-scale production, favorable climatic conditions, and government support for agricultural development.

- Country-Specific Analysis: The report provides detailed analyses for Egypt, Ethiopia, Ghana, Kenya, Nigeria, South Africa, Tanzania, and the Rest of Africa, highlighting unique market dynamics and growth drivers in each country.

- Segment Analysis: The report analyzes market performance by segment: Hybrids, Non-Transgenic Hybrids, and Open Pollinated Varieties & Hybrid Derivatives. The Hybrid segment is expected to be the fastest-growing, fueled by technological advances and increasing adoption among farmers seeking higher yields. However, open-pollinated varieties remain prevalent among smallholder farmers due to lower costs.

Africa Sorghum Seed Market Product Landscape

This section examines the sorghum seed product landscape, describing product innovations, applications, and key performance indicators. It highlights the unique selling propositions of different sorghum varieties and technological advancements driving product differentiation. The market offers a range of sorghum seed varieties, including hybrids and open-pollinated varieties, each tailored to specific agro-ecological conditions and farming practices. Key characteristics such as drought tolerance, disease resistance, and yield potential are critical factors influencing product selection. Recent innovations include the introduction of insect-resistant and herbicide-tolerant varieties, increasing productivity and reducing input costs.

Key Drivers, Barriers & Challenges in Africa Sorghum Seed Market

This section identifies the key drivers and challenges affecting the African sorghum seed market. The analysis includes both opportunities and impediments to market growth.

Key Drivers:

- Increasing demand for sorghum due to its nutritional value and drought tolerance.

- Government initiatives promoting agricultural development and investment in the seed sector.

- Technological advancements in breeding and seed production leading to higher yields and improved quality.

Key Challenges:

- Climate change and unpredictable weather patterns affecting sorghum production.

- Limited access to finance and credit for smallholder farmers hindering seed adoption.

- Inadequate infrastructure and logistics impacting seed distribution and market access.

- Counterfeit seed proliferation impacting product quality and farmer trust (estimated xx% of the market in 2024).

Emerging Opportunities in Africa Sorghum Seed Market

This section highlights emerging trends and untapped opportunities within the African sorghum seed market. These include the growing demand for organic and biofortified sorghum, the potential for increased value addition through processing, and the expansion of markets for sorghum-based products.

Growth Accelerators in the Africa Sorghum Seed Market Industry

Long-term growth is expected to be driven by advancements in biotechnology, strategic collaborations between seed companies and research institutions, and market expansion into new regions and segments. The development of climate-resilient varieties and the promotion of integrated pest management practices are also key growth catalysts.

Key Players Shaping the Africa Sorghum Seed Market Market

- Zambia Seed Company Limited (Zamseed)

- Seed Co Limited

- S&W Seed Co

- Advanta Seeds - UPL

- Capstone Seeds

- Victoria Seeds Limited

- Corteva Agriscience

- FICA SEEDS

Notable Milestones in Africa Sorghum Seed Market Sector

- March 2022: Corteva introduced the Inzent trait sorghum variety under the Pioneer brand, enhancing pest control and yield.

- January 2019: FICA Seeds, in collaboration with Equator Seeds and USAID's Feed the Future program, focused on youth leadership in agriculture, potentially boosting future market adoption.

In-Depth Africa Sorghum Seed Market Market Outlook

The Africa sorghum seed market shows significant potential for growth driven by increasing demand, technological innovations, and supportive government policies. Strategic partnerships, investment in research and development, and the expansion of distribution networks will be crucial for realizing this potential. The focus on developing climate-resilient varieties and improving access to quality seed for smallholder farmers will be essential for long-term market sustainability and growth.

Africa Sorghum Seed Market Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Africa Sorghum Seed Market Segmentation By Geography

-

1. Africa

- 1.1. Nigeria

- 1.2. South Africa

- 1.3. Egypt

- 1.4. Kenya

- 1.5. Ethiopia

- 1.6. Morocco

- 1.7. Ghana

- 1.8. Algeria

- 1.9. Tanzania

- 1.10. Ivory Coast

Africa Sorghum Seed Market Regional Market Share

Geographic Coverage of Africa Sorghum Seed Market

Africa Sorghum Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.17% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support

- 3.3. Market Restrains

- 3.3.1 Increasing Loses due to Physiological Disorder

- 3.3.2 Pest and Disease; Unfavourable Climatic Condition

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Africa Sorghum Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Africa

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Zambia Seed Company Limited (Zamseed

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Seed Co Limited

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 S&W Seed Co

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Advanta Seeds - UPL

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Capstone Seeds

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Victoria Seeds Limited

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Corteva Agriscience

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 FICA SEEDS

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Zambia Seed Company Limited (Zamseed

List of Figures

- Figure 1: Africa Sorghum Seed Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Africa Sorghum Seed Market Share (%) by Company 2025

List of Tables

- Table 1: Africa Sorghum Seed Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Africa Sorghum Seed Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Africa Sorghum Seed Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Africa Sorghum Seed Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Africa Sorghum Seed Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Africa Sorghum Seed Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Africa Sorghum Seed Market Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Africa Sorghum Seed Market Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Africa Sorghum Seed Market Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Africa Sorghum Seed Market Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Africa Sorghum Seed Market Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Africa Sorghum Seed Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: Nigeria Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: South Africa Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Egypt Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Kenya Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Ethiopia Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Morocco Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Ghana Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Algeria Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Tanzania Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Ivory Coast Africa Sorghum Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Africa Sorghum Seed Market?

The projected CAGR is approximately 6.17%.

2. Which companies are prominent players in the Africa Sorghum Seed Market?

Key companies in the market include Zambia Seed Company Limited (Zamseed, Seed Co Limited, S&W Seed Co, Advanta Seeds - UPL, Capstone Seeds, Victoria Seeds Limited, Corteva Agriscience, FICA SEEDS.

3. What are the main segments of the Africa Sorghum Seed Market?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Tomato; Adoption of Greenhouse Technology in Tomato Cultivation; Government support.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Increasing Loses due to Physiological Disorder. Pest and Disease; Unfavourable Climatic Condition.

8. Can you provide examples of recent developments in the market?

March 2022: Corteva introduced the Inzent trait sorghum variety under the Pioneer brand. The variety controls yield-depleting annual grasses such as foxtail, barnyard grass, and panicum.January 2019: With its regional peer Equator Seeds, FICA Seeds collaborated with USAID on the Feed the Future Youth Leadership for Agriculture program.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Africa Sorghum Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Africa Sorghum Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Africa Sorghum Seed Market?

To stay informed about further developments, trends, and reports in the Africa Sorghum Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence