Key Insights

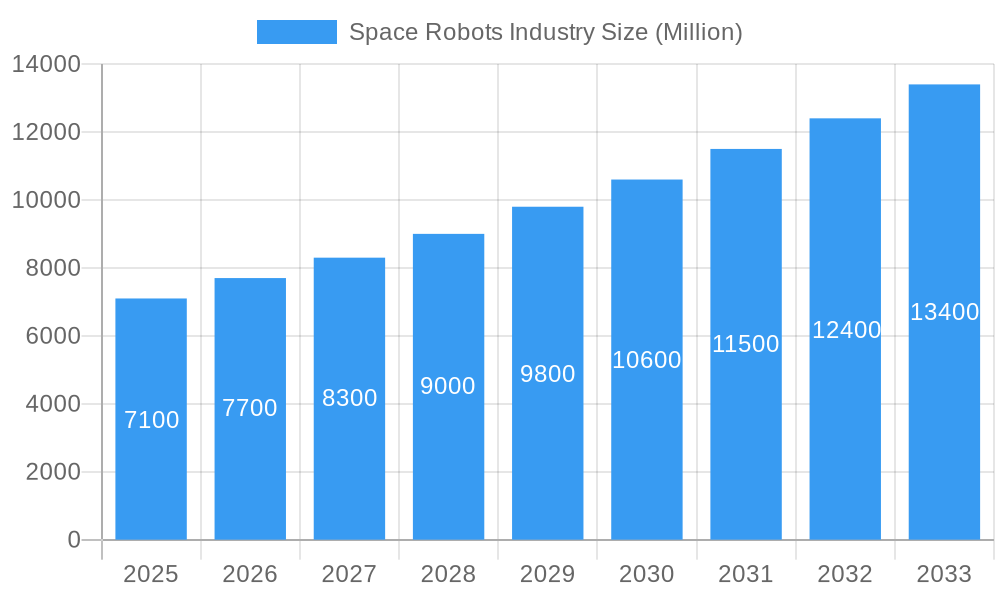

The global Space Robots Industry is poised for substantial growth, projected to reach approximately $7.1 billion in 2025, driven by an impressive Compound Annual Growth Rate (CAGR) of 8.7% through 2033. This robust expansion is fueled by a confluence of factors, including the escalating demand for advanced in-orbit servicing, satellite assembly, and debris removal capabilities. Governments and private entities are increasingly investing in space exploration and commercial ventures, necessitating sophisticated robotic solutions for complex missions. Innovations in artificial intelligence, machine learning, and advanced sensor technologies are further enhancing the capabilities and efficiency of space robots, making them indispensable for future space endeavors. The growing need for automated operations in harsh space environments, coupled with the reduction in launch costs, is creating a fertile ground for the proliferation of space robotics across various applications.

Space Robots Industry Market Size (In Billion)

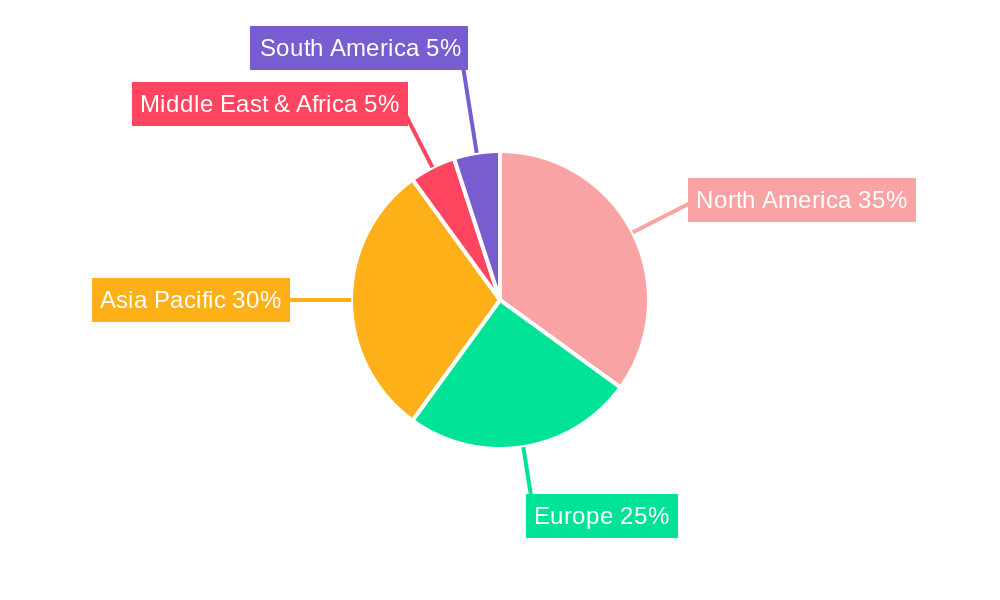

The market is segmented across production, consumption, import/export, and pricing dynamics, each contributing to the overall market trajectory. Key drivers include the burgeoning satellite constellation market, the increasing focus on space resource utilization, and the development of lunar and Martian exploration programs. While the market is experiencing a significant upswing, potential restraints such as high development costs, complex regulatory frameworks, and the need for specialized skilled labor could pose challenges. However, the relentless pace of technological advancements, coupled with strategic collaborations among key industry players like Lockheed Martin Corporation, Northrop Grumman Corporation, and MDA Corporation, are expected to mitigate these challenges. The market's geographical landscape is diverse, with North America and Asia Pacific emerging as major contributors, while Europe and other regions are actively expanding their presence through ongoing research and development initiatives.

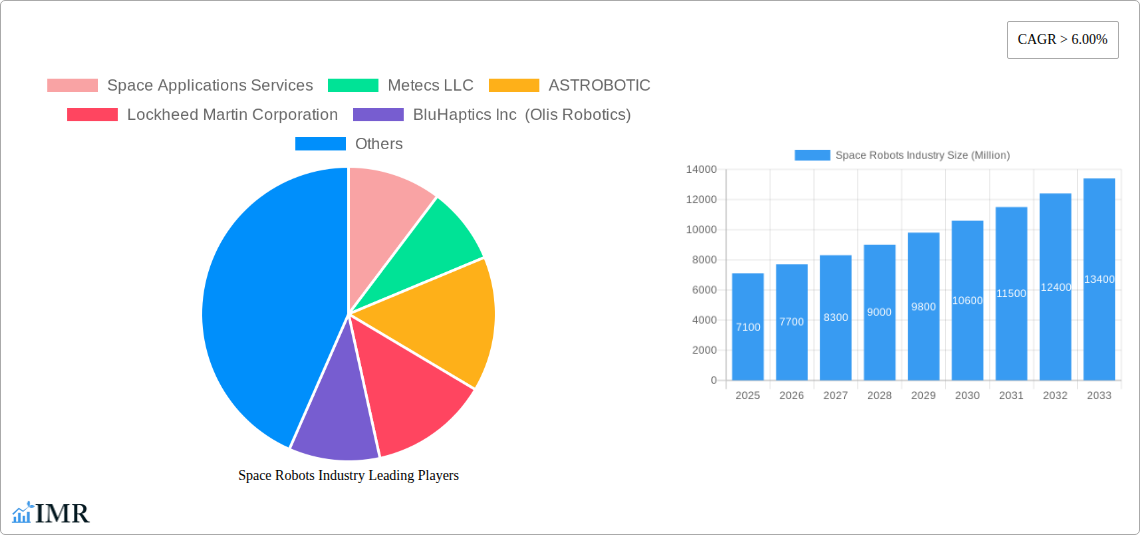

Space Robots Industry Company Market Share

Space Robots Industry: Comprehensive Market Analysis and Future Outlook (2019–2033)

This in-depth report provides a detailed analysis of the global Space Robots Industry, covering market dynamics, growth trends, regional dominance, product landscape, key challenges, emerging opportunities, and the competitive landscape. With a study period from 2019 to 2033, including a base year of 2025 and a forecast period of 2025–2033, this report is an essential resource for understanding the burgeoning space robotics market. We leverage extensive data to provide quantitative insights and qualitative assessments, focusing on parent and child market segments to offer a holistic view. All monetary values are presented in billion units for clarity and impact.

Space Robots Industry Market Dynamics & Structure

The global space robots market is characterized by rapid technological advancement and increasing investment from both government and private entities. Market concentration is moderate, with several key players holding significant shares, but the landscape is dynamic due to ongoing innovation and new entrants.

- Technological Innovation Drivers: Key drivers include advancements in AI, machine learning, advanced robotics, miniaturization, and in-space manufacturing. These innovations are crucial for enabling more complex and autonomous missions, from satellite servicing to lunar exploration.

- Regulatory Frameworks: Evolving international space law and national regulations impact the development and deployment of space robots. These frameworks aim to ensure safety, responsible use of space, and prevent orbital debris.

- Competitive Product Substitutes: While direct substitutes for highly specialized space robots are limited, advancements in ground-based simulations and alternative mission architectures can indirectly influence market demand.

- End-User Demographics: The primary end-users are government space agencies (e.g., NASA, ESA, CNSA) and increasingly, commercial satellite operators, defense contractors, and research institutions. The demand is driven by needs for satellite maintenance, debris removal, in-orbit assembly, and lunar/planetary exploration.

- M&A Trends: Mergers and acquisitions are a significant trend, driven by the desire to acquire specialized technologies, expand market reach, and consolidate expertise. We anticipate continued M&A activity as companies seek to bolster their capabilities in this high-growth sector. For example, recent M&A activities have seen smaller, specialized robotics firms being acquired by larger aerospace conglomerates to integrate cutting-edge robotic solutions into their broader space offerings.

Space Robots Industry Growth Trends & Insights

The Space Robots Industry is experiencing unprecedented growth, fueled by a confluence of technological breakthroughs, expanding government and commercial space initiatives, and a growing recognition of the strategic importance of autonomous systems in orbit and beyond. The market is projected to witness a robust Compound Annual Growth Rate (CAGR) of approximately 15-20% over the forecast period (2025–2033). This surge is underpinned by the increasing complexity and ambition of space missions, ranging from Earth observation and satellite servicing to deep space exploration and the establishment of sustainable lunar outposts.

- Market Size Evolution: The global space robots market, valued at approximately $12.5 billion in 2025, is projected to reach over $45 billion by 2033. This significant expansion is driven by both hardware sales and service-based revenue streams.

- Adoption Rates: Adoption rates are accelerating, particularly within the commercial satellite sector for servicing and debris removal, and for lunar exploration missions. Government agencies are also increasing their reliance on advanced robotics for scientific research and national security applications.

- Technological Disruptions: Key disruptions include the development of highly dexterous robotic arms capable of intricate manipulation, autonomous navigation and docking systems, advanced sensing and perception capabilities, and the integration of AI for on-orbit decision-making. The advent of robotic systems for in-space manufacturing and resource utilization is also a transformative development.

- Consumer Behavior Shifts: While "consumer" in this context refers to end-users, their behavior is shifting towards a demand for more reliable, cost-effective, and versatile robotic solutions. There's a growing preference for robotic systems that can perform multiple tasks, reduce mission risk for human astronauts, and enable longer, more ambitious missions. The increasing participation of private companies in space exploration is also fostering demand for off-the-shelf and customizable robotic solutions.

- Market Penetration: Market penetration is deep within established spacefaring nations and is rapidly expanding into emerging markets as countries invest more heavily in their space programs. The child markets, such as in-orbit servicing and lunar robotics, are seeing particularly high penetration growth.

Dominant Regions, Countries, or Segments in Space Robots Industry

The global Space Robots Industry is experiencing dynamic growth across various regions and segments. The dominance is often dictated by robust government investment, a strong aerospace industrial base, and a thriving private space sector.

Production Analysis:

- North America (primarily the United States) currently dominates production due to the presence of leading aerospace manufacturers and research institutions with decades of experience in space robotics. Significant government funding for space exploration and defense, coupled with a vibrant commercial space ecosystem, fuels this dominance. Companies like Lockheed Martin Corporation and Northrop Grumman Corporation are key contributors.

- Europe is a strong contender, with significant contributions from countries like Germany, France, and the UK. The European Space Agency (ESA) plays a crucial role in funding and directing advanced robotic development.

- Asia-Pacific, particularly China and Japan, is rapidly emerging as a major production hub, driven by ambitious national space programs and increasing private sector involvement.

Consumption Analysis:

- North America also leads in consumption, driven by the extensive operational fleets of satellites requiring servicing, advanced scientific missions, and significant military space applications. The sheer volume of ongoing and planned space missions necessitates substantial investment in robotic systems.

- Europe represents a significant consumption market, with a focus on scientific missions, Earth observation, and a growing interest in in-orbit servicing.

- Asia-Pacific is exhibiting the fastest growth in consumption, as nations aggressively expand their space capabilities and invest in infrastructure that requires robotic support.

Import Market Analysis (Value & Volume):

- North America is a net importer of highly specialized components and advanced robotic technologies that may not be produced domestically. This can include specific sensor technologies, advanced AI algorithms, or specialized actuators.

- Emerging space nations in Asia, Africa, and South America are significant importers as they build their foundational space capabilities and rely on external expertise and technology.

- Europe also imports specialized components and systems to complement its domestic production and R&D efforts.

Export Market Analysis (Value & Volume):

- North America is the leading exporter of finished space robot systems, advanced robotic components, and related services. Companies export their technological prowess and integrated solutions to space agencies and commercial operators worldwide.

- Europe also holds a strong export position, particularly in specialized robotic arms, satellite servicing technologies, and scientific payloads that incorporate robotic elements.

- Japan is emerging as a significant exporter of advanced robotic technologies and components, known for its precision engineering.

Price Trend Analysis:

- High-value, bespoke systems for critical missions command premium prices. These often involve extensive customization and rigorous testing, contributing to higher overall costs.

- Standardized or modular robotic components are experiencing price stabilization or a slight decrease due to increased competition and economies of scale, especially in the child markets like commercial satellite servicing.

- Technological advancements that increase efficiency or reduce the need for human intervention can lead to lower long-term operational costs, influencing the perceived value and price of robotic solutions. The trend is towards a better price-performance ratio for advanced robotic capabilities.

Space Robots Industry Product Landscape

The space robot product landscape is evolving rapidly, driven by the need for greater autonomy, dexterity, and versatility in the harsh environment of space. Key innovations include advanced robotic arms with multiple degrees of freedom, dexterous end-effectors for delicate manipulation, sophisticated navigation and docking systems, and intelligent software for autonomous operation. Applications range from satellite servicing, orbital debris removal, and in-orbit assembly to lunar and planetary surface exploration, resource utilization, and the construction of extraterrestrial infrastructure. Performance metrics are increasingly focused on reliability, power efficiency, radiation tolerance, and the ability to adapt to unpredictable conditions.

Key Drivers, Barriers & Challenges in Space Robots Industry

Key Drivers:

- Growing demand for satellite servicing and maintenance: Extending the lifespan of expensive satellites and de-orbiting defunct ones are critical needs.

- Ambitious governmental space exploration programs: Missions to the Moon, Mars, and beyond require advanced robotic capabilities for exploration, construction, and resource utilization.

- Rise of commercial space ventures: The proliferation of private satellite constellations and the development of space tourism are creating new markets for robotic solutions.

- Technological advancements in AI and robotics: Miniaturization, increased processing power, and improved sensing are enabling more sophisticated and autonomous robots.

- Need for cost reduction in space operations: Robots can perform tasks more efficiently and safely than humans in many scenarios, leading to cost savings.

Key Barriers & Challenges:

- High development and launch costs: Designing, building, and launching space-qualified robots is extremely expensive.

- Harsh space environment: Extreme temperatures, radiation, and vacuum pose significant engineering challenges for robot reliability and longevity.

- Limited communication bandwidth and latency: Real-time control of robots over vast distances is difficult, necessitating a high degree of autonomy.

- Regulatory and legal complexities: International regulations regarding space debris and responsible space operations can slow down development and deployment.

- Supply chain vulnerabilities and geopolitical factors: Reliance on specialized components can lead to delays and disruptions. Supply chain issues for critical electronic components and rare earth materials can have quantifiable impacts, potentially delaying projects by months or even years and increasing costs by 10-20%.

Emerging Opportunities in Space Robots Industry

Emerging opportunities lie in the development of fully autonomous robotic systems capable of self-diagnosis and repair, as well as robots designed for in-situ resource utilization (ISRU) on the Moon and Mars. The burgeoning lunar economy, with plans for lunar bases and resource extraction, presents a massive opportunity for specialized robotic explorers and construction bots. Furthermore, the need for efficient orbital debris removal services is creating a new market segment. The integration of AI with advanced haptics for remote manipulation (e.g., BluHaptics Inc (Olis Robotics)) is opening doors for more intuitive and effective control of robotic assets.

Growth Accelerators in the Space Robots Industry Industry

Long-term growth is being catalyzed by breakthroughs in AI and machine learning that enable robots to perform increasingly complex tasks with minimal human intervention. Strategic partnerships between traditional aerospace giants and agile robotics startups are accelerating the pace of innovation and market penetration. Furthermore, the expansion of space infrastructure, including orbital assembly platforms and lunar bases, will create sustained demand for a wide array of robotic systems. The increasing accessibility of space due to reduced launch costs further amplifies these growth accelerators.

Key Players Shaping the Space Robots Industry Market

- Space Applications Services

- Metecs LLC

- ASTROBOTIC

- Lockheed Martin Corporation

- BluHaptics Inc (Olis Robotics)

- Motiv Space Systems Inc

- Honeybee Robotics

- Oceaneering International

- Effective Space Solutions Limited

- MDA Corporation (Maxar Technologies Ltd)

- GITAI Inc

- Made in Space

- Northrop Grumman Corporation

Notable Milestones in Space Robots Industry Sector

- 2019: Development and testing of advanced AI algorithms for autonomous navigation and hazard avoidance in robotic exploration missions.

- 2020: Successful demonstration of robotic in-orbit assembly techniques, paving the way for larger space structures.

- 2021: Increased investment in robotic solutions for lunar surface exploration and resource prospecting, driven by Artemis program advancements.

- 2022: Significant progress in the development of dexterous robotic manipulators for satellite servicing and debris capture.

- 2023: Enhanced focus on miniaturized robotic systems for swarm operations and detailed inspection tasks.

- 2024: Growing emphasis on AI-driven predictive maintenance for robotic components, improving mission reliability.

In-Depth Space Robots Industry Market Outlook

The future outlook for the Space Robots Industry is exceptionally bright, driven by a confluence of technological advancements, expanding governmental and commercial space ambitions, and the fundamental economic and scientific advantages that robots offer in space exploration and utilization. The increasing demand for satellite servicing, the growing lunar economy, and the imperative to manage orbital debris will continue to fuel robust growth. Innovations in AI, autonomous systems, and in-space manufacturing will further accelerate this trend, creating a sustainable and expanding market for sophisticated robotic solutions. Strategic collaborations and continued investment in R&D will be critical for players to capitalize on these expansive opportunities.

Space Robots Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Space Robots Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

Space Robots Industry Regional Market Share

Geographic Coverage of Space Robots Industry

Space Robots Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 8.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Deep Space Segment is Projected to Register with the Highest CAGR During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Space Robots Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Space Applications Services

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Metecs LLC

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 ASTROBOTIC

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 Lockheed Martin Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 BluHaptics Inc (Olis Robotics)

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Motiv Space Systems Inc

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Honeybee Robotics

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oceaneering International

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Effective Space Solutions Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 MDA Corporation (Maxar Technologies Ltd)

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 GITAI Inc **List Not Exhaustive

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 Made in Space

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.13 Northrop Grumman Corporation

- 11.2.13.1. Overview

- 11.2.13.2. Products

- 11.2.13.3. SWOT Analysis

- 11.2.13.4. Recent Developments

- 11.2.13.5. Financials (Based on Availability)

- 11.2.1 Space Applications Services

List of Figures

- Figure 1: Global Space Robots Industry Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 3: North America Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 5: North America Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 13: North America Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 15: South America Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 17: South America Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 25: South America Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 27: Europe Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 37: Europe Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 49: Middle East & Africa Space Robots Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Space Robots Industry Revenue (undefined), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Space Robots Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Space Robots Industry Revenue (undefined), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Space Robots Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Space Robots Industry Revenue (undefined), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Space Robots Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Space Robots Industry Revenue (undefined), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Space Robots Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Space Robots Industry Revenue (undefined), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Space Robots Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Space Robots Industry Revenue (undefined), by Country 2025 & 2033

- Figure 61: Asia Pacific Space Robots Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Space Robots Industry Revenue undefined Forecast, by Region 2020 & 2033

- Table 7: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 13: United States Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: Canada Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Mexico Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 22: Brazil Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 23: Argentina Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 32: Germany Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 33: France Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Italy Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Spain Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 36: Russia Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 37: Benelux Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 38: Nordics Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 46: Turkey Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 47: Israel Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 48: GCC Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 49: North Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 50: South Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 52: Global Space Robots Industry Revenue undefined Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Space Robots Industry Revenue undefined Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Space Robots Industry Revenue undefined Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Space Robots Industry Revenue undefined Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Space Robots Industry Revenue undefined Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Space Robots Industry Revenue undefined Forecast, by Country 2020 & 2033

- Table 58: China Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 59: India Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 60: Japan Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 61: South Korea Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 63: Oceania Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Space Robots Industry Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Space Robots Industry?

The projected CAGR is approximately 8.7%.

2. Which companies are prominent players in the Space Robots Industry?

Key companies in the market include Space Applications Services, Metecs LLC, ASTROBOTIC, Lockheed Martin Corporation, BluHaptics Inc (Olis Robotics), Motiv Space Systems Inc, Honeybee Robotics, Oceaneering International, Effective Space Solutions Limited, MDA Corporation (Maxar Technologies Ltd), GITAI Inc **List Not Exhaustive, Made in Space, Northrop Grumman Corporation.

3. What are the main segments of the Space Robots Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Deep Space Segment is Projected to Register with the Highest CAGR During the Forecast Period.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Space Robots Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Space Robots Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Space Robots Industry?

To stay informed about further developments, trends, and reports in the Space Robots Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence