Key Insights

Australia's C4ISR (Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance) industry is projected for significant expansion, forecasting a Compound Annual Growth Rate (CAGR) of 5.7%. The market, valued at approximately $126.2 billion in the base year 2024, is propelled by Australia's strategic commitment to modernizing its defense infrastructure and securing a technological advantage in a complex global environment. Key growth drivers include the acquisition of advanced naval platforms, next-generation fighter aircraft, and modernized ground combat systems, all requiring robust C4ISR integration for optimal performance. Escalating cyber warfare threats and the imperative for enhanced border security and disaster response capabilities are also stimulating demand for advanced surveillance and intelligence solutions. Emerging trends such as the integration of artificial intelligence (AI) and machine learning (ML) for data analytics, the increasing deployment of unmanned systems for reconnaissance, and the adoption of cloud-based C4ISR architectures are reshaping the market. These advancements are crucial for improving situational awareness, accelerating decision-making, and ensuring seamless interoperability across the Australian Defence Force.

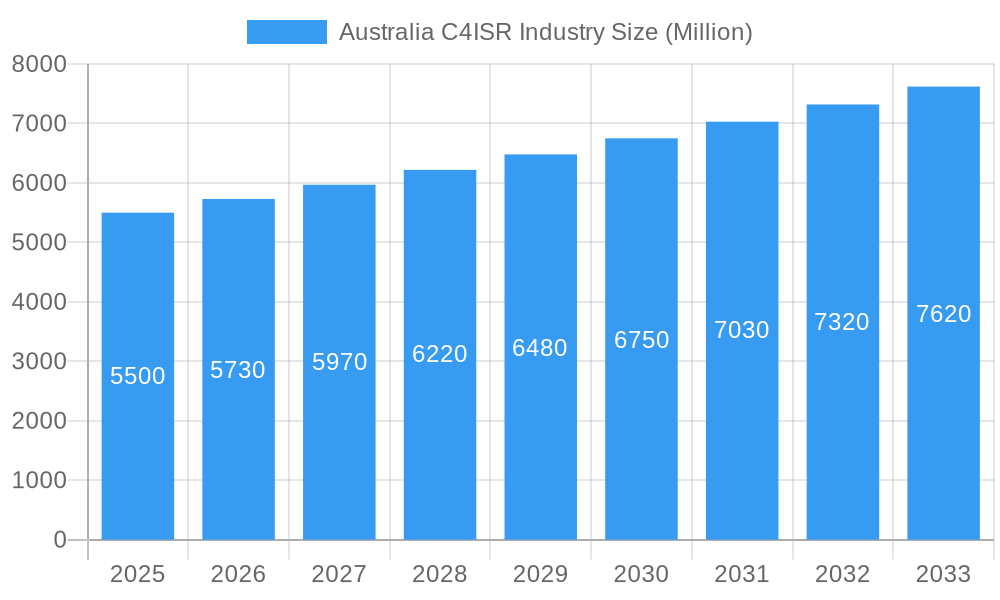

Australia C4ISR Industry Market Size (In Billion)

Despite robust growth, the industry faces challenges. Substantial initial investments for cutting-edge C4ISR technologies and the complexities of integrating new systems with existing legacy infrastructure may pose obstacles for certain defense initiatives. Furthermore, the rigorous regulatory environment governing defense acquisitions, coupled with extensive testing and validation requirements, can extend project timelines. Nevertheless, the unwavering focus on national security and consistent government investment in defense modernization are expected to overcome these constraints. The market encompasses production, consumption, import, export, and price dynamics. Production and consumption analyses highlight strong domestic demand driven by ongoing military modernization. Import market insights indicate reliance on specialized international technologies, while export analyses suggest potential for Australian firms offering specialized C4ISR solutions. Price trends indicate a gradual increase in advanced C4ISR system costs, influenced by technological advancements and evolving component expenses.

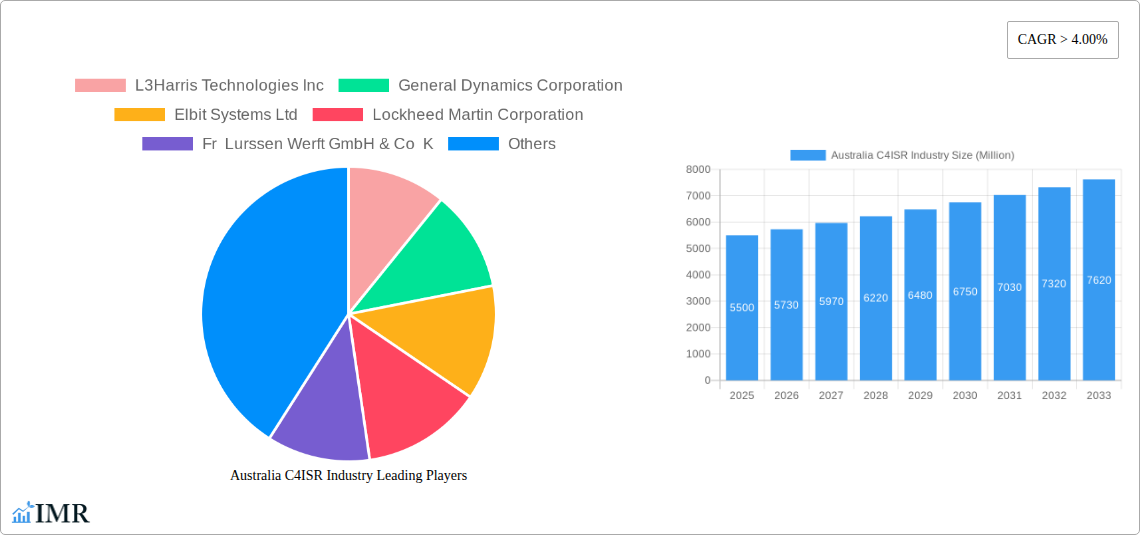

Australia C4ISR Industry Company Market Share

Explore the comprehensive Australia C4ISR industry analysis, covering market size, growth prospects, and future forecasts.

Australia C4ISR Industry Market Dynamics & Structure

The Australian Command, Control, Communications, Computers, Intelligence, Surveillance, and Reconnaissance (C4ISR) industry is characterized by a dynamic and evolving market structure. Driven by significant government investment in defense modernization and national security, the industry exhibits moderate to high market concentration, with a few key global players dominating significant portions of the market. Technological innovation acts as a primary driver, with advancements in artificial intelligence (AI), machine learning (ML), cyber warfare capabilities, and secure cloud infrastructure continually shaping the competitive landscape. Regulatory frameworks, largely influenced by national security directives and procurement policies, play a crucial role in market entry and product development. Competitive product substitutes, while present, often struggle to match the integrated and advanced capabilities offered by established C4ISR systems. End-user demographics are primarily focused on government defense agencies, intelligence services, and critical infrastructure protection sectors. Mergers and Acquisitions (M&A) trends indicate a strategic consolidation aimed at expanding capabilities and market reach, with deal volumes reflecting an active investment environment.

- Market Concentration: Dominated by major defense contractors with specialized C4ISR expertise.

- Technological Innovation Drivers: AI/ML integration, advanced sensor fusion, secure communication networks, cyber resilience.

- Regulatory Frameworks: Stringent national security approvals, export control regulations, interoperability standards.

- Competitive Product Substitutes: Emergence of commercial off-the-shelf (COTS) solutions for specific functions, but limited in integrated defense applications.

- End-User Demographics: Australian Department of Defence, intelligence agencies, border force, emergency services.

- M&A Trends: Strategic acquisitions to bolster cyber capabilities, AI integration, and platform modernization. Expected M&A deal volume of 2-4 significant transactions within the study period.

Australia C4ISR Industry Growth Trends & Insights

The Australian C4ISR industry is poised for substantial growth, projected to expand at a Compound Annual Growth Rate (CAGR) of approximately 7.5% over the study period from 2019 to 2033. This robust expansion is underpinned by a confluence of strategic government initiatives, increasing geopolitical complexities, and the relentless pace of technological advancement. The base year of 2025 is estimated to see a market size of approximately $4,500 million, with significant upward trajectory anticipated through the forecast period. Adoption rates for advanced C4ISR technologies are accelerating, driven by the need for enhanced situational awareness, real-time decision-making, and superior threat detection capabilities. Technological disruptions, particularly in the realms of artificial intelligence, quantum computing applications, and secure, resilient networks, are not only shaping current offerings but also paving the way for entirely new paradigms in defense and security operations. Consumer behavior shifts, within the context of defense procurement, are increasingly prioritizing agility, interoperability, and data-driven insights, compelling defense contractors to innovate beyond traditional hardware-centric solutions. The emphasis is now on integrated systems that can adapt to evolving threat landscapes and provide a decisive operational advantage. The market penetration of advanced C4ISR capabilities within the Australian defense sector is expected to reach over 80% by 2033, reflecting a comprehensive upgrade of national defense infrastructure. This growth is further fueled by substantial long-term defense spending commitments and a proactive approach to cybersecurity.

Dominant Regions, Countries, or Segments in Australia C4ISR Industry

Within the Australian C4ISR industry, the Production Analysis segment is currently showing significant dominance, driven by the nation's commitment to developing sovereign defense capabilities and fostering local industry participation. While Australia is a net importer for many advanced C4ISR components and systems, there's a concerted effort to bolster domestic manufacturing and assembly capabilities. This push is not only for strategic autonomy but also to create high-skilled jobs and reduce reliance on foreign supply chains. Consequently, states with established defense manufacturing hubs, such as South Australia and New South Wales, are at the forefront of production activities.

- Production Analysis: Expected to grow at a CAGR of 8.2% from 2025-2033, reaching an estimated value of $2,200 million by 2033. Key drivers include government incentives for local content, the establishment of advanced manufacturing facilities, and partnerships with international primes to transfer technology. South Australia's Hub for Advanced Manufacturing and New South Wales' defense industry clusters are particularly influential.

- Consumption Analysis: While consumption is broad across all defense branches, the Royal Australian Navy (RAN) and the Royal Australian Air Force (RAAF) represent the largest consumers of integrated C4ISR solutions due to their complex operational environments and ongoing platform modernization programs. Consumption is projected to reach $5,500 million by 2033, with a CAGR of 7.1%.

- Import Market Analysis (Value & Volume): Australia remains a significant importer, particularly for highly specialized electronic warfare systems, advanced radar technologies, and sophisticated communication hardware. Imports are expected to be valued at $2,800 million in 2025, growing to $4,000 million by 2033, with a CAGR of 5.5%. Key importing countries include the United States, the United Kingdom, and Israel.

- Export Market Analysis (Value & Volume): While currently a smaller segment, Australia's export market for C4ISR is anticipated to grow, particularly in niche areas like intelligence analysis software and advanced surveillance drone technology. Exports are estimated at $300 million in 2025, projected to reach $700 million by 2033, exhibiting a CAGR of 9.8%. This growth is fueled by strategic partnerships and the unique operational relevance of Australian-developed systems in the Indo-Pacific region.

- Price Trend Analysis: The price trend for C4ISR systems is generally upward, driven by increasing technological sophistication, complex integration requirements, and R&D investments. However, for mature technologies, economies of scale and competition can lead to price stabilization or marginal decreases. The average price index for C4ISR systems is expected to see a 4% annual increase.

Australia C4ISR Industry Product Landscape

The Australian C4ISR product landscape is characterized by a strong emphasis on integrated, intelligent, and resilient solutions. Innovations focus on enhancing data fusion from diverse sensors, enabling real-time decision-making through AI-powered analytics, and ensuring secure, cyber-hardened communication networks. Key product advancements include multi-domain command and control (MDC2) systems, advanced electronic warfare suites, resilient satellite communication terminals, and sophisticated ISR platforms leveraging unmanned aerial vehicles (UAVs) and cognitive sensing technologies. Performance metrics increasingly prioritize interoperability across different services and allied forces, adaptability to evolving threat environments, and the reduction of the cognitive load on human operators. Unique selling propositions often lie in the tailored integration of cutting-edge commercial technologies with robust defense-grade specifications, providing Australian defense forces with a strategic technological edge.

Key Drivers, Barriers & Challenges in Australia C4ISR Industry

Key Drivers:

- Government Investment in Defense Modernization: Significant budgetary allocations for upgrading existing platforms and acquiring new C4ISR capabilities.

- Geopolitical Tensions: The evolving security landscape in the Indo-Pacific region necessitates enhanced surveillance, intelligence, and rapid response capabilities.

- Technological Advancements: Rapid progress in AI, machine learning, cyber security, and advanced sensor technology offers new opportunities for defense modernization.

- Sovereign Capability Development: Government mandate to foster local industry and reduce reliance on foreign suppliers.

Barriers & Challenges:

- High Cost of R&D and Procurement: Advanced C4ISR systems are inherently expensive, posing significant budgetary challenges.

- Supply Chain Vulnerabilities: Dependence on global supply chains for critical components can create risks and delays.

- Interoperability Standards: Ensuring seamless communication and data exchange between disparate legacy and new systems is complex.

- Cybersecurity Threats: The increasing sophistication of cyberattacks poses a continuous threat to C4ISR networks and data integrity.

- Talent Acquisition and Retention: A shortage of skilled personnel in specialized areas like AI, cybersecurity, and systems engineering.

Emerging Opportunities in Australia C4ISR Industry

Emerging opportunities in the Australian C4ISR industry lie in the burgeoning demand for AI-driven predictive analytics for threat assessment, quantum-resistant cryptography to secure future communications, and the expansion of resilient, distributed C4ISR networks. The growing adoption of commercial off-the-shelf (COTS) components, when integrated with robust defense-grade security, presents a cost-effective avenue for capability enhancement. Furthermore, there's a significant untapped market in providing specialized C4ISR training and simulation solutions, as well as in the development of autonomous and semi-autonomous ISR platforms for diverse operational environments. The focus on enhancing cyber resilience through advanced intrusion detection and response systems also represents a key growth area.

Growth Accelerators in the Australia C4ISR Industry Industry

Growth accelerators for the Australian C4ISR industry include the ongoing digital transformation of the Australian Defence Force, which prioritizes data-centric operations and intelligent decision-making. Strategic partnerships between local defense primes and international technology leaders are facilitating the transfer of cutting-edge C4ISR technologies and fostering domestic innovation. Furthermore, the increasing emphasis on interoperability with allied forces, particularly the United States and the United Kingdom, drives demand for C4ISR systems that meet international standards. Market expansion strategies also involve capitalizing on Australia's unique geographic position and its role in regional security initiatives, creating demand for specialized surveillance and reconnaissance capabilities.

Key Players Shaping the Australia C4ISR Industry Market

- L3Harris Technologies Inc

- General Dynamics Corporation

- Elbit Systems Ltd

- Lockheed Martin Corporation

- Fr Lurssen Werft GmbH & Co K

- Thales Group

- BAE Systems PLC

- Northrop Grumman

- Saab AB

- The Boeing Company

Notable Milestones in Australia C4ISR Industry Sector

- 2019: Launch of the Australian Cyber Security Strategy, increasing focus on cyber resilience within C4ISR.

- 2020: Award of contracts for the enhancement of naval C4ISR systems as part of ongoing fleet modernization.

- 2021: Significant investment in AI and machine learning research for intelligence analysis by defense research organizations.

- 2022: Expansion of sovereign satellite communication capabilities with new ground station development.

- 2023: Introduction of next-generation electronic warfare systems for land-based platforms.

- 2024: Increased collaboration between Australian defense industry and technology startups for innovative C4ISR solutions.

- 2025 (Estimated): Planned procurement of advanced multi-domain command and control (MDC2) systems.

In-Depth Australia C4ISR Industry Market Outlook

The future outlook for the Australian C4ISR industry is exceptionally strong, driven by a sustained commitment to national security and defense modernization. Growth accelerators such as the pervasive integration of AI and machine learning for enhanced threat detection and decision support, coupled with the development of quantum-resistant communication technologies, will redefine operational capabilities. Strategic partnerships and the continued push for sovereign industrial capability will further solidify the market's trajectory. The industry is well-positioned to capitalize on emerging opportunities in advanced cyber warfare, resilient network architectures, and the application of AI in autonomous systems, ensuring Australia maintains a technological edge in a complex global security environment.

Australia C4ISR Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Australia C4ISR Industry Segmentation By Geography

- 1. Australia

Australia C4ISR Industry Regional Market Share

Geographic Coverage of Australia C4ISR Industry

Australia C4ISR Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.7% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. ; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices

- 3.3. Market Restrains

- 3.3.1. ; High Cost Of Connectivity Equipments

- 3.4. Market Trends

- 3.4.1. Growing Military Expenditure is Driving the Market Growth

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Australia C4ISR Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. Australia

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 L3Harris Technologies Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 General Dynamics Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Elbit Systems Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Lockheed Martin Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Fr Lurssen Werft GmbH & Co K

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Thales Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BAE Systems PLC

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Saab AB

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 The Boeing Company

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 L3Harris Technologies Inc

List of Figures

- Figure 1: Australia C4ISR Industry Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Australia C4ISR Industry Share (%) by Company 2025

List of Tables

- Table 1: Australia C4ISR Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 2: Australia C4ISR Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Australia C4ISR Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Australia C4ISR Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Australia C4ISR Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Australia C4ISR Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 7: Australia C4ISR Industry Revenue billion Forecast, by Production Analysis 2020 & 2033

- Table 8: Australia C4ISR Industry Revenue billion Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Australia C4ISR Industry Revenue billion Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Australia C4ISR Industry Revenue billion Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Australia C4ISR Industry Revenue billion Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Australia C4ISR Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Australia C4ISR Industry?

The projected CAGR is approximately 5.7%.

2. Which companies are prominent players in the Australia C4ISR Industry?

Key companies in the market include L3Harris Technologies Inc, General Dynamics Corporation, Elbit Systems Ltd, Lockheed Martin Corporation, Fr Lurssen Werft GmbH & Co K, Thales Group, BAE Systems PLC, Northrop Grumman, Saab AB, The Boeing Company.

3. What are the main segments of the Australia C4ISR Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 126.2 billion as of 2022.

5. What are some drivers contributing to market growth?

; Increasing Number Of Air Passengers; Use Of Portable Electronic Devices.

6. What are the notable trends driving market growth?

Growing Military Expenditure is Driving the Market Growth.

7. Are there any restraints impacting market growth?

; High Cost Of Connectivity Equipments.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Australia C4ISR Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Australia C4ISR Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Australia C4ISR Industry?

To stay informed about further developments, trends, and reports in the Australia C4ISR Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence