Key Insights

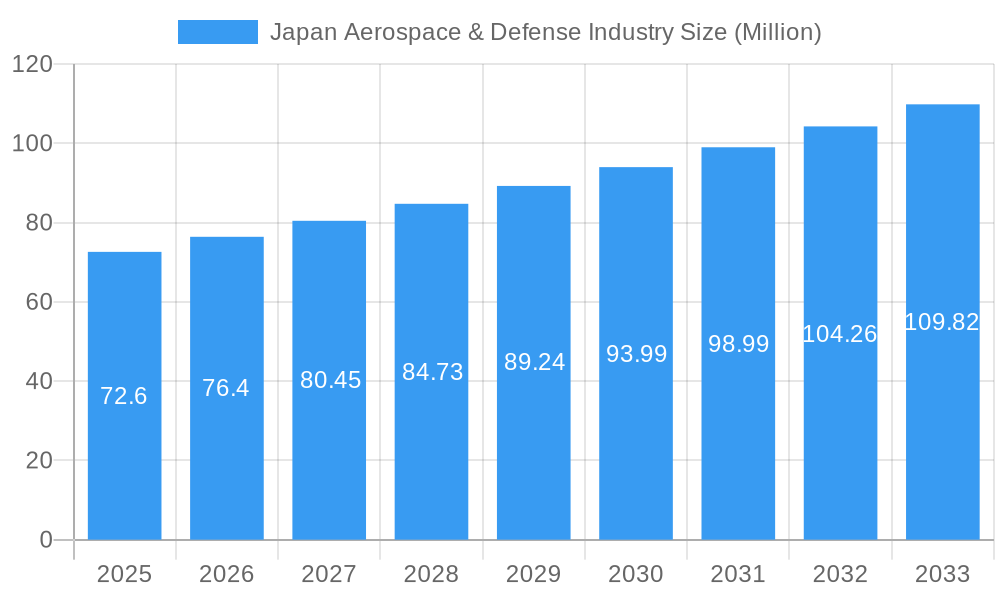

The Japanese Aerospace & Defense (A&D) industry is poised for robust growth, with a current market size of approximately $72.60 million, projected to expand at a Compound Annual Growth Rate (CAGR) of 5.28% through 2033. This sustained expansion is fueled by a confluence of strategic government investments in national security, the increasing demand for advanced defense technologies, and the continuous evolution of the aerospace sector. Key drivers include the modernization of military fleets, the development of next-generation aircraft, and the growing emphasis on unmanned aerial systems (UAS) for both defense and commercial applications. Furthermore, the MRO (Maintenance, Repair, and Overhaul) segment is experiencing significant traction as existing fleets age, requiring specialized services and upgrades. The terrestrial, aerial, and naval platforms are all witnessing advancements, with a particular focus on enhancing capabilities and interoperability across these domains.

Japan Aerospace & Defense Industry Market Size (In Million)

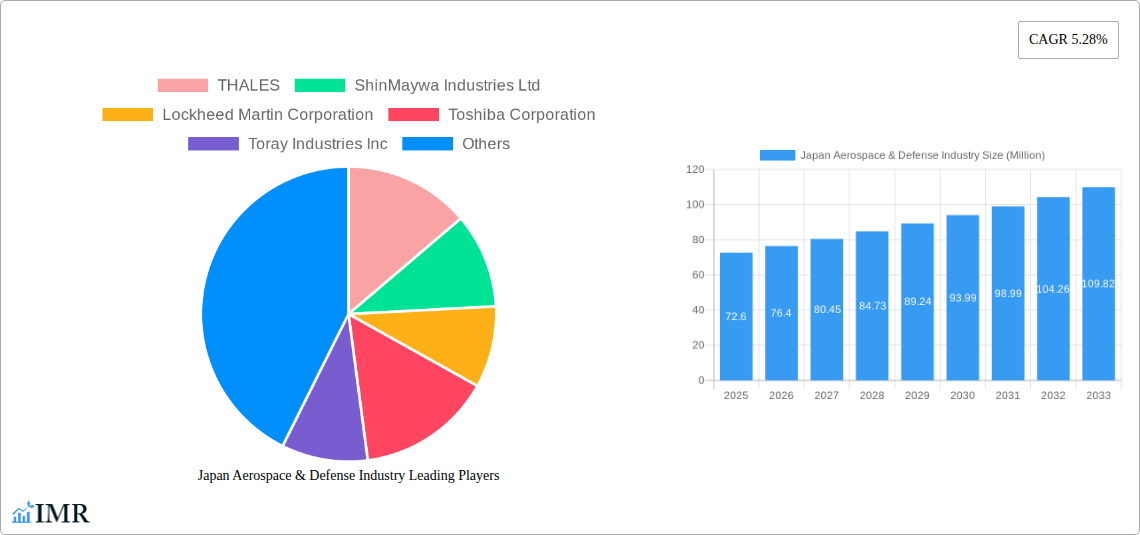

The industry's trajectory is further shaped by evolving trends such as the adoption of digital manufacturing techniques, the integration of artificial intelligence (AI) and machine learning (ML) in defense systems, and a heightened focus on cybersecurity. Companies like THALES, Lockheed Martin Corporation, RTX Corporation, BAE Systems plc, and Northrop Grumman Corporation are actively participating in this dynamic market, alongside key Japanese players such as ShinMaywa Industries Ltd, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, Komatsu Ltd, Kawasaki Heavy Industries Ltd, The Boeing Company, and Mitsubishi Heavy Industries Ltd. While the market benefits from strong governmental support and technological innovation, it faces restraints such as stringent regulatory frameworks, high research and development costs, and global supply chain volatilities. Navigating these challenges will be crucial for sustained success and continued dominance in the global A&D landscape.

Japan Aerospace & Defense Industry Company Market Share

Comprehensive Report: Japan Aerospace & Defense Industry Market Analysis & Forecast (2019–2033)

This in-depth report provides a strategic overview of the Japan Aerospace & Defense Industry, exploring its dynamic market structure, key growth trends, dominant segments, and future outlook. With a focus on Aerospace Manufacturing, Defense Manufacturing, MRO Services, and platforms including Terrestrial, Aerial, and Naval, this analysis offers critical insights for stakeholders navigating this evolving landscape.

Study Period: 2019–2033 | Base Year: 2025 | Estimated Year: 2025 | Forecast Period: 2025–2033 | Historical Period: 2019–2024

Japan Aerospace & Defense Industry Market Dynamics & Structure

The Japan Aerospace & Defense Industry is characterized by a moderate market concentration, with a few major domestic and international players holding significant sway. Technological innovation remains a primary driver, fueled by substantial R&D investments in advanced materials, AI integration, and unmanned systems. The sector operates within a stringent regulatory framework, emphasizing national security and adherence to international export controls. Competitive product substitutes are limited within the high-end defense and aerospace domains, though advancements in commercial off-the-shelf (COTS) technology can influence certain applications. End-user demographics are predominantly governmental defense ministries and major aerospace corporations, with a growing interest in commercial aerospace expansion. Merger and acquisition (M&A) trends are driven by consolidation efforts, technology acquisition, and market access expansion.

- Market Concentration: Dominated by a few key entities, with a gradual increase in strategic partnerships.

- Technological Innovation Drivers: AI, advanced composites, autonomous systems, hypersonics, space technologies.

- Regulatory Frameworks: Strict national security mandates, export control regulations, defense procurement policies.

- Competitive Product Substitutes: Limited in core defense systems, but growing in auxiliary technologies and components.

- End-User Demographics: Primarily government defense agencies and large commercial aerospace firms.

- M&A Trends: Strategic acquisitions for technology, market share consolidation, and joint ventures.

Japan Aerospace & Defense Industry Growth Trends & Insights

The Japan Aerospace & Defense Industry is poised for robust growth, projected to experience a Compound Annual Growth Rate (CAGR) of xx% over the forecast period of 2025–2033. This expansion is underpinned by increasing defense budgets, driven by geopolitical shifts and a heightened emphasis on national security. The adoption rates of advanced technologies such as artificial intelligence, autonomous systems, and cybersecurity solutions are accelerating across both aerospace manufacturing and defense sectors. Technological disruptions are emerging from advancements in drone technology, space exploration, and next-generation aircraft development. Consumer behavior shifts are less pronounced in the defense segment, with procurement driven by strategic needs, but in the commercial aerospace segment, there is a growing demand for fuel-efficient aircraft and enhanced passenger experience. The market penetration of advanced manufacturing techniques, including additive manufacturing (3D printing), is steadily increasing, enhancing production efficiency and enabling complex designs. Insights into the evolving operational requirements for both military and commercial platforms are crucial for anticipating future market demands.

Dominant Regions, Countries, or Segments in Japan Aerospace & Defense Industry

The Aerospace Sector is a dominant force within the Japan Aerospace & Defense Industry, primarily driven by the Manufacturing service type. Within this sector, Aerial platforms command significant attention, reflecting Japan's strategic priorities in air superiority and advanced aviation technology. The country’s commitment to indigenous defense capabilities and its strong position in the global commercial aerospace supply chain contribute to this dominance. Economic policies favoring technological advancement and substantial government investments in R&D further bolster the Aerospace sector. Infrastructure development, including advanced research facilities and manufacturing plants, supports the production and innovation of aerial systems.

- Dominant Segment: Aerospace Sector, with a strong emphasis on Manufacturing.

- Key Platform Focus: Aerial platforms, including fighter jets, transport aircraft, and unmanned aerial vehicles (UAVs).

- Key Drivers:

- Economic Policies: Government initiatives promoting high-tech manufacturing and innovation.

- Infrastructure: World-class research and development centers and advanced manufacturing facilities.

- Geopolitical Landscape: Increased emphasis on national security and regional defense posture.

- Technological Prowess: Japan's leadership in materials science, robotics, and electronics.

- Market Share & Growth Potential: The Aerospace sector, particularly aerial platforms, is expected to maintain a significant market share and exhibit strong growth potential due to ongoing modernization programs and the expansion of Japan's role in global aerospace supply chains.

Japan Aerospace & Defense Industry Product Landscape

The product landscape within the Japan Aerospace & Defense Industry is characterized by a strong emphasis on cutting-edge innovation and high-performance applications. Key product developments include advanced fighter jet components, next-generation transport aircraft, sophisticated unmanned aerial systems (UAS) for surveillance and combat, and specialized naval systems. Innovations in materials science, such as lightweight composites and high-strength alloys, are crucial for enhancing aircraft performance and fuel efficiency. The integration of artificial intelligence and advanced sensor technologies is defining the next generation of defense platforms, enabling enhanced situational awareness and autonomous capabilities. These advancements translate into superior operational effectiveness and a competitive edge for Japanese-made products in both domestic and international markets.

Key Drivers, Barriers & Challenges in Japan Aerospace & Defense Industry

Key Drivers:

- Technological Innovation: Continuous advancements in AI, autonomous systems, advanced materials, and cybersecurity are propelling the industry forward.

- Government Investment: Increased defense budgets and strategic R&D funding from the Japanese government.

- Geopolitical Stability: Evolving regional security concerns driving demand for advanced defense capabilities.

- Commercial Aerospace Demand: Growth in global air travel and the need for modern, efficient aircraft.

Key Barriers & Challenges:

- Supply Chain Complexity: Global supply chain vulnerabilities and reliance on international suppliers can create disruptions.

- Regulatory Hurdles: Stringent export controls and evolving international compliance standards.

- High R&D Costs: The significant capital investment required for developing cutting-edge aerospace and defense technologies.

- Skilled Workforce Shortages: A potential gap in the availability of highly specialized engineers and technicians.

- Intense Competition: Facing formidable competition from established global defense and aerospace giants.

Emerging Opportunities in Japan Aerospace & Defense Industry

Emerging opportunities within the Japan Aerospace & Defense Industry lie in the expanding market for unmanned systems, including drones for both defense and civilian applications. The growing demand for advanced cybersecurity solutions tailored to protect critical aerospace and defense infrastructure presents another significant avenue. Furthermore, the increasing focus on space exploration and satellite technology offers substantial potential for Japanese companies to contribute to and benefit from this burgeoning sector. The development of sustainable aviation technologies and alternative fuel sources also represents a forward-looking opportunity, aligning with global environmental initiatives.

Growth Accelerators in the Japan Aerospace & Defense Industry Industry

Growth in the Japan Aerospace & Defense Industry is significantly accelerated by ongoing technological breakthroughs in areas like quantum computing for advanced simulations and AI-driven predictive maintenance. Strategic partnerships and joint ventures between Japanese firms and leading international aerospace and defense companies are crucial for technology transfer and market access. Furthermore, Japan's increasing role in international defense collaborations and its commitment to developing indigenous advanced defense capabilities are powerful growth catalysts. The continuous drive for modernization across both military and commercial aviation sectors ensures sustained demand for innovative solutions.

Key Players Shaping the Japan Aerospace & Defense Industry Market

- THALES

- ShinMaywa Industries Ltd

- Lockheed Martin Corporation

- Toshiba Corporation

- Toray Industries Inc

- Japan Steel Works Ltd

- RTX Corporation

- Komatsu Ltd

- BAE Systems plc

- Kawasaki Heavy Industries Ltd

- Northrop Grumman Corporation

- The Boeing Company

- Mitsubishi Heavy Industries Ltd

Notable Milestones in Japan Aerospace & Defense Industry Sector

- 2019: Launch of Mitsubishi SpaceJet (formerly MRJ) initial deliveries and further development.

- 2020: ShinMaywa Industries Ltd receives significant orders for its US-2 amphibian aircraft.

- 2021: Toshiba Corporation secures contracts for advanced radar systems and electronic warfare components.

- 2022: Toray Industries Inc announces breakthroughs in advanced composite materials for aerospace applications.

- 2023: Kawasaki Heavy Industries Ltd showcases advancements in next-generation fighter jet technologies.

- 2024: Japan Steel Works Ltd expands its capacity for producing high-strength steel for naval applications.

- 2025 (Estimated): Anticipated major announcements regarding autonomous aerial vehicle programs and space-based defense initiatives.

In-Depth Japan Aerospace & Defense Industry Market Outlook

The future market outlook for the Japan Aerospace & Defense Industry is exceptionally promising, driven by a confluence of technological advancements and strategic geopolitical considerations. The sustained investment in research and development, particularly in AI, advanced materials, and autonomous systems, will continue to fuel innovation and create new product categories. Growth accelerators such as international collaboration, a focus on space technologies, and the development of sustainable aviation solutions will further solidify Japan's position as a global leader. The industry is well-positioned to capitalize on evolving defense requirements and the expansion of the commercial aerospace sector, presenting significant opportunities for stakeholders to invest and grow.

Japan Aerospace & Defense Industry Segmentation

-

1. Sector

- 1.1. Aerospace

- 1.2. Defense

-

2. Service Type

- 2.1. Manufacturing

- 2.2. MRO

-

3. Platform

- 3.1. Terrestrial

- 3.2. Aerial

- 3.3. Naval

Japan Aerospace & Defense Industry Segmentation By Geography

- 1. Japan

Japan Aerospace & Defense Industry Regional Market Share

Geographic Coverage of Japan Aerospace & Defense Industry

Japan Aerospace & Defense Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.28% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Manufacturing Segment Accounted for a Major Share in 2023

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Aerospace & Defense Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 5.1.1. Aerospace

- 5.1.2. Defense

- 5.2. Market Analysis, Insights and Forecast - by Service Type

- 5.2.1. Manufacturing

- 5.2.2. MRO

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Terrestrial

- 5.3.2. Aerial

- 5.3.3. Naval

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Sector

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 THALES

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 ShinMaywa Industries Ltd

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Lockheed Martin Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Toshiba Corporation

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Toray Industries Inc

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Japan Steel Works Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 RTX Corporation

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Komatsu Ltd

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 BAE Systems plc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Kawasaki Heavy Industries Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Northrop Grumman Corporation

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 The Boeing Company

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.13 Mitsubishi Heavy Industries Ltd

- 6.2.13.1. Overview

- 6.2.13.2. Products

- 6.2.13.3. SWOT Analysis

- 6.2.13.4. Recent Developments

- 6.2.13.5. Financials (Based on Availability)

- 6.2.1 THALES

List of Figures

- Figure 1: Japan Aerospace & Defense Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Aerospace & Defense Industry Share (%) by Company 2025

List of Tables

- Table 1: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 2: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 3: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 4: Japan Aerospace & Defense Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 5: Japan Aerospace & Defense Industry Revenue Million Forecast, by Sector 2020 & 2033

- Table 6: Japan Aerospace & Defense Industry Revenue Million Forecast, by Service Type 2020 & 2033

- Table 7: Japan Aerospace & Defense Industry Revenue Million Forecast, by Platform 2020 & 2033

- Table 8: Japan Aerospace & Defense Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Aerospace & Defense Industry?

The projected CAGR is approximately 5.28%.

2. Which companies are prominent players in the Japan Aerospace & Defense Industry?

Key companies in the market include THALES, ShinMaywa Industries Ltd, Lockheed Martin Corporation, Toshiba Corporation, Toray Industries Inc, Japan Steel Works Ltd, RTX Corporation, Komatsu Ltd, BAE Systems plc, Kawasaki Heavy Industries Ltd, Northrop Grumman Corporation, The Boeing Company, Mitsubishi Heavy Industries Ltd.

3. What are the main segments of the Japan Aerospace & Defense Industry?

The market segments include Sector, Service Type, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD 72.60 Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Manufacturing Segment Accounted for a Major Share in 2023.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Aerospace & Defense Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Aerospace & Defense Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Aerospace & Defense Industry?

To stay informed about further developments, trends, and reports in the Japan Aerospace & Defense Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence