Key Insights

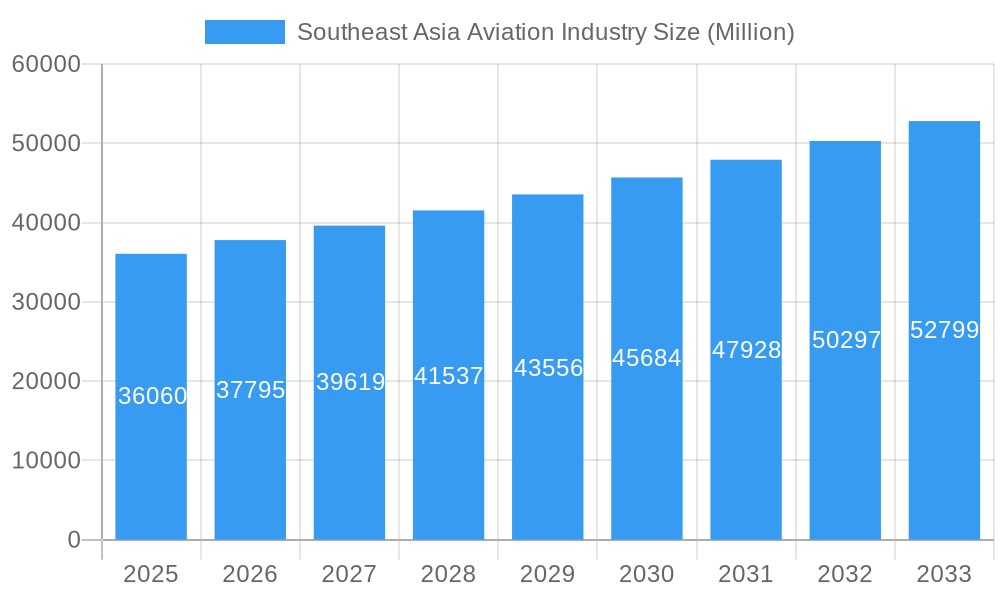

The Southeast Asia Aviation Industry is poised for significant expansion, with an estimated market size of USD 36.06 billion in 2025. This robust growth is underpinned by a projected Compound Annual Growth Rate (CAGR) of 4.84% from 2019 to 2033. This upward trajectory is primarily driven by a burgeoning middle class, increasing disposable incomes, and a growing demand for air travel for both leisure and business purposes across nations like Indonesia, Vietnam, and the Philippines. Furthermore, ongoing investments in aviation infrastructure, including airport upgrades and the expansion of airline fleets, are crucial enablers for this market's ascent. The region's strategic location as a transit hub for global air traffic also contributes to sustained demand.

Southeast Asia Aviation Industry Market Size (In Billion)

Key trends shaping the Southeast Asia Aviation Industry include the rapid adoption of digital technologies for enhanced passenger experiences, such as mobile check-ins and personalized services. The industry is also witnessing a greater focus on sustainability, with airlines exploring fuel-efficient aircraft and eco-friendly operational practices in response to environmental concerns and evolving passenger preferences. However, the market faces certain restraints. These include intense price competition among low-cost carriers, which can impact profitability, and the need for continuous investment in pilot training and skilled labor to meet the expanding operational demands. Geopolitical uncertainties and fluctuating fuel prices also present challenges that require strategic navigation by industry players.

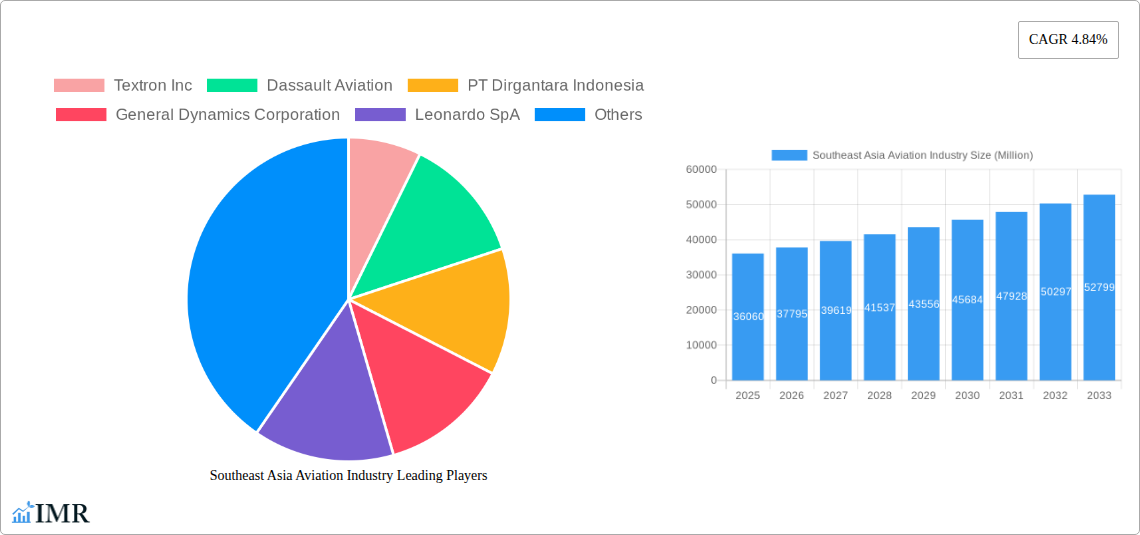

Southeast Asia Aviation Industry Company Market Share

Here is a compelling, SEO-optimized report description for the Southeast Asia Aviation Industry, designed for maximum visibility and engagement:

Southeast Asia Aviation Industry Market Dynamics & Structure

The Southeast Asia aviation industry is a dynamic sector characterized by robust growth potential and evolving market structures. Driven by a burgeoning middle class, increasing tourism, and a growing demand for efficient cargo transport, the region presents a significant opportunity for aviation stakeholders. Market concentration varies across segments, with established global players like Airbus SE and The Boeing Company holding substantial shares in commercial aircraft manufacturing, while specialized companies such as Textron Inc. and Honda Aircraft Company LL cater to the growing business and general aviation markets. PT Dirgantara Indonesia plays a crucial role in the regional manufacturing landscape, particularly in the defense and regional transport aircraft segments.

Key Market Dynamics:

- Technological Innovation: Advancements in fuel efficiency, sustainable aviation fuels (SAFs), and digital cockpit technologies are key drivers of innovation, influencing aircraft design and operational efficiency.

- Regulatory Frameworks: Evolving air traffic management systems, safety regulations, and environmental compliance standards are shaping industry practices and investment decisions.

- Competitive Product Substitutes: While traditional aircraft remain dominant, the rise of urban air mobility (UAM) solutions and advancements in high-speed rail present potential long-term substitutes in certain transport niches.

- End-User Demographics: A youthful and increasingly affluent population in Southeast Asia is fueling demand for air travel, both for leisure and business purposes, impacting airline fleet planning and route development.

- M&A Trends: Consolidation and strategic partnerships are observed as companies seek to expand their market reach, acquire new technologies, and leverage economies of scale. For instance, the consolidation within the defense sector, involving companies like Lockheed Martin Corporation and General Dynamics Corporation, impacts the supply chain for advanced aerospace components. The study forecasts a significant volume of M&A activity within the forecast period of 2025–2033.

Southeast Asia Aviation Industry Growth Trends & Insights

The Southeast Asia aviation industry is poised for substantial expansion, driven by a confluence of economic prosperity, expanding travel corridors, and ongoing technological advancements. The market size evolution is projected to witness a compound annual growth rate (CAGR) of approximately 7.5% from 2025 to 2033, reaching an estimated value of $150,000 million by the end of the forecast period. This growth trajectory is underpinned by a significant increase in air passenger traffic and a corresponding surge in demand for new aircraft, components, and maintenance services. The adoption rates of next-generation aircraft, characterized by enhanced fuel efficiency and reduced environmental impact, are steadily climbing, reflecting a growing industry commitment to sustainability.

Technological disruptions are profoundly reshaping the sector. The integration of advanced materials, lightweight composites, and sophisticated avionics systems are enhancing aircraft performance and reducing operational costs for airlines. Furthermore, the proliferation of digital technologies, including AI-powered predictive maintenance and optimized flight planning, is driving efficiency across the aviation value chain. Consumer behavior shifts are also playing a pivotal role. Travelers are increasingly seeking more convenient and personalized travel experiences, which is prompting airlines to invest in fleet modernization and route network expansion. The burgeoning middle class across countries like Indonesia, Vietnam, and the Philippines represents a vast untapped market for air travel. This demographic trend directly influences demand for both short-haul and long-haul routes, thereby impacting the types of aircraft being procured.

The import market analysis indicates a significant reliance on foreign manufacturers for large commercial aircraft and advanced aerospace technologies. Companies like Airbus SE, The Boeing Company, and Leonardo SpA are key beneficiaries of this demand. Conversely, the export market, though smaller in comparison, is showing promising growth, particularly for regional aircraft and specialized components manufactured by entities such as ATR and PT Dirgantara Indonesia. The price trend analysis reveals a steady increase in aircraft acquisition costs, driven by inflation, raw material prices, and the inherent complexity of aerospace manufacturing. However, advancements in production processes and the increasing competition among suppliers are helping to moderate these increases to some extent. The consumption analysis highlights a sustained demand for aviation services, including passenger transport, air cargo, and business aviation, fueled by robust economic activity and growing intra-regional connectivity. Industry developments are continuously shaped by government initiatives aimed at boosting aviation infrastructure, promoting domestic manufacturing capabilities, and liberalizing air travel policies across ASEAN nations.

Dominant Regions, Countries, or Segments in Southeast Asia Aviation Industry

The Southeast Asia aviation industry is characterized by a multifaceted dominance across its key segments, driven by distinct economic and strategic factors within the region.

Production Analysis:

The production landscape is dominated by a few key players with significant manufacturing capabilities. Airbus SE, a global giant, holds a substantial share in the production of commercial passenger aircraft, with its assembly lines and supply chain networks extending into the region. The Boeing Company also maintains a strong presence, particularly in the defense and commercial aircraft sectors. Within the region, PT Dirgantara Indonesia is a notable contributor, focusing on the production of regional aircraft, helicopters, and defense-related aerospace components. The market share for regional aircraft production is significantly influenced by the demand for shorter routes connecting numerous islands and cities. Production of business jets is spearheaded by companies like Honda Aircraft Company LL and Textron Inc., catering to a growing segment of high-net-worth individuals and corporate clients.

Consumption Analysis:

Consumption Analysis is overwhelmingly dominated by the Commercial Passenger Aircraft segment. The burgeoning middle class across countries like Indonesia, the Philippines, Vietnam, and Thailand is driving unprecedented demand for air travel. This translates into airlines constantly seeking to expand their fleets to cater to both domestic and international routes. The Air Cargo segment is also experiencing robust growth, fueled by the rapid expansion of e-commerce and manufacturing industries within Southeast Asia. This increased demand for air cargo necessitates a growing fleet of freighter aircraft and dedicated cargo handling infrastructure. The Business and General Aviation segment, while smaller in volume, represents a high-value market, driven by corporate travel and specialized services.

Import Market Analysis (Value & Volume):

The Import Market Analysis for Southeast Asia is heavily skewed towards the Commercial Passenger Aircraft segment, particularly large wide-body and narrow-body jets. This is driven by the significant fleet expansion plans of major regional carriers such as Singapore Airlines, Garuda Indonesia, and Thai Airways. The volume of imported aircraft is substantial, reflecting the region's insatiable appetite for modern, fuel-efficient passenger planes. The Import Market Value is also significantly driven by the import of advanced aerospace components, engines, and sophisticated avionics systems from global manufacturers like Rolls-Royce plc and GE Aviation, which are integral to aircraft production and maintenance. The import of specialized military aircraft and defense systems by countries like Singapore, Vietnam, and Thailand also contributes significantly to the import market value.

Export Market Analysis (Value & Volume):

The Export Market Analysis for Southeast Asia, while smaller in overall volume compared to imports, shows promising growth, particularly in the Regional Aircraft and Aerospace Components segments. ATR, a joint venture involving Airbus, and PT Dirgantara Indonesia are key players in exporting regional turboprop aircraft tailored for short-haul routes connecting secondary cities and islands. The export of specialized aerospace components and sub-assemblies, manufactured by a growing number of regional suppliers, is also on the rise. This is driven by the globalized nature of the aerospace supply chain, where Southeast Asian manufacturers are increasingly integrated. The export of maintenance, repair, and overhaul (MRO) services also represents a significant, albeit often unquantified, export value.

Price Trend Analysis:

The Price Trend Analysis in Southeast Asia mirrors global trends, with a general upward trajectory for new aircraft. The increasing cost of raw materials, complex manufacturing processes, and inflationary pressures contribute to higher acquisition costs for both commercial and business aircraft. However, the Regional Aircraft segment often presents more competitive pricing due to specialized designs catering to specific market needs. The aftermarket for spare parts and maintenance services also exhibits price fluctuations influenced by supply chain dynamics and demand from a rapidly growing fleet. The value of aircraft is also influenced by factors such as age, flight hours, and technological upgrades.

Southeast Asia Aviation Industry Product Landscape

The Southeast Asia aviation industry product landscape is defined by a diverse range of aircraft, from wide-body jets designed for intercontinental travel to agile regional aircraft connecting smaller communities. Innovations focus on enhancing fuel efficiency, reducing emissions, and improving passenger comfort. Advanced materials like carbon fiber composites are increasingly utilized to reduce aircraft weight, leading to better performance and lower operational costs. The integration of smart avionics and connectivity solutions, such as advanced navigation systems and in-flight entertainment, is a key selling proposition for new aircraft. For instance, the latest generation of narrow-body aircraft from Airbus SE and The Boeing Company offer significant improvements in fuel burn and passenger experience. The business aviation segment, led by manufacturers like Textron Inc. and Honda Aircraft Company LL, emphasizes speed, range, and cabin customization.

Key Drivers, Barriers & Challenges in Southeast Asia Aviation Industry

The Southeast Asia aviation industry is propelled by several key drivers. Economic growth and a rising middle class fuel an insatiable demand for air travel, both for leisure and business. Government initiatives promoting tourism and trade, coupled with infrastructure development, further accelerate growth. The increasing focus on regional connectivity and the expansion of low-cost carriers are making air travel more accessible.

However, significant barriers and challenges exist. High capital investment for aircraft acquisition and infrastructure development is a major hurdle. Stringent regulatory requirements and safety standards, while crucial, can increase operational complexities and costs. Intense competition among airlines, particularly in the low-cost carrier segment, puts pressure on profitability. Supply chain disruptions, geopolitical instability, and fluctuating fuel prices also pose significant challenges to sustained growth.

Emerging Opportunities in Southeast Asia Aviation Industry

Emerging opportunities in the Southeast Asia aviation industry lie in the rapidly growing demand for air cargo services, driven by e-commerce expansion. The development of sustainable aviation fuels (SAFs) and green aviation technologies presents a significant avenue for innovation and market differentiation. Furthermore, the increasing interest in urban air mobility (UAM) solutions for intra-city transportation offers a nascent but promising market. The region's vast archipelagic nature also creates continuous demand for efficient regional air connectivity, favoring the growth of turboprop and smaller jet aircraft.

Growth Accelerators in the Southeast Asia Aviation Industry Industry

Several catalysts are accelerating growth in the Southeast Asia aviation industry. Technological breakthroughs in engine efficiency and aircraft design, pioneered by companies like Rolls-Royce plc and GE Aviation, are reducing operational costs for airlines. Strategic partnerships between global manufacturers such as Lockheed Martin Corporation and Rostec with regional players are fostering local expertise and production capabilities. Market expansion strategies, including the introduction of new routes and the development of secondary airports, are broadening access and stimulating demand. The growing commitment to sustainability and the adoption of environmentally friendly practices are also positioning the industry for long-term, responsible growth.

Key Players Shaping the Southeast Asia Aviation Industry Market

- Airbus SE

- The Boeing Company

- Textron Inc.

- Dassault Aviation

- PT Dirgantara Indonesia

- General Dynamics Corporation

- Leonardo SpA

- Lockheed Martin Corporation

- Rostec

- Honda Aircraft Company LL

- United Aircraft Corporation

- ATR

Notable Milestones in Southeast Asia Aviation Industry Sector

- 2019: Launch of new generation aircraft with enhanced fuel efficiency by major manufacturers.

- 2020: Increased focus on cargo operations due to global supply chain shifts.

- 2021: Growing investment in MRO (Maintenance, Repair, and Overhaul) facilities across the region.

- 2022: Emergence of new airline entrants in emerging markets like Vietnam and the Philippines.

- 2023: Significant advancements in sustainable aviation fuel research and pilot programs.

- 2024: Expansion of airport infrastructure to accommodate growing passenger and cargo volumes.

In-Depth Southeast Asia Aviation Industry Market Outlook

The outlook for the Southeast Asia aviation industry remains exceptionally bright, with sustained growth projected over the next decade. Accelerated by technological advancements in fuel efficiency and digital integration, the market is set to capitalize on robust passenger and cargo demand. Strategic partnerships and market expansion initiatives by key players will further solidify this growth trajectory. Emerging opportunities in sustainable aviation and urban air mobility promise to diversify the industry landscape. The region’s inherent connectivity needs and expanding economies position it as a critical hub for global aviation.

Southeast Asia Aviation Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

Southeast Asia Aviation Industry Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

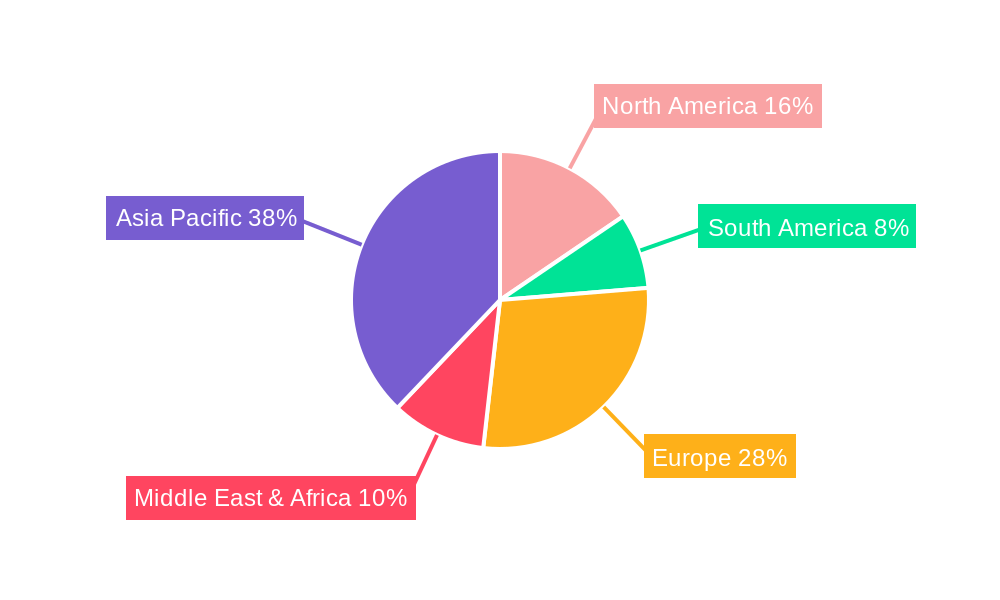

Southeast Asia Aviation Industry Regional Market Share

Geographic Coverage of Southeast Asia Aviation Industry

Southeast Asia Aviation Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.84% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions

- 3.3. Market Restrains

- 3.3.1. Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data

- 3.4. Market Trends

- 3.4.1. The Commercial Aircraft Segment is Expected to Dominate the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. North America

- 5.6.2. South America

- 5.6.3. Europe

- 5.6.4. Middle East & Africa

- 5.6.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. North America Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 6.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 6.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 6.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 6.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7. South America Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 7.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 7.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 7.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 7.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 7.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8. Europe Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 8.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 8.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 8.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 8.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 8.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9. Middle East & Africa Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 9.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 9.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 9.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 9.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 9.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10. Asia Pacific Southeast Asia Aviation Industry Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 10.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 10.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 10.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 10.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 10.1. Market Analysis, Insights and Forecast - by Production Analysis

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Textron Inc

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Dassault Aviation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 PT Dirgantara Indonesia

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 General Dynamics Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Leonardo SpA

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Lockheed Martin Corporation

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Rostec

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Airbus SE

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Honda Aircraft Company LL

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 United Aircraft Corporation

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 ATR

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 The Boeing Company

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 Textron Inc

List of Figures

- Figure 1: Global Southeast Asia Aviation Industry Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: North America Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 3: North America Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 4: North America Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 5: North America Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 6: North America Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 7: North America Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 8: North America Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 9: North America Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 10: North America Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 11: North America Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 12: North America Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 13: North America Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 14: South America Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 15: South America Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 16: South America Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 17: South America Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 18: South America Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 19: South America Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 20: South America Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 21: South America Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 22: South America Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 23: South America Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 24: South America Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 25: South America Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Europe Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 27: Europe Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 28: Europe Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 29: Europe Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 30: Europe Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 31: Europe Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 32: Europe Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 33: Europe Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 34: Europe Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 35: Europe Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 36: Europe Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 37: Europe Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 38: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 39: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 40: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 41: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 42: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 43: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 44: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 45: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 46: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 47: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 48: Middle East & Africa Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 49: Middle East & Africa Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

- Figure 50: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Production Analysis 2025 & 2033

- Figure 51: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Production Analysis 2025 & 2033

- Figure 52: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Consumption Analysis 2025 & 2033

- Figure 53: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Consumption Analysis 2025 & 2033

- Figure 54: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 55: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Import Market Analysis (Value & Volume) 2025 & 2033

- Figure 56: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 57: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Export Market Analysis (Value & Volume) 2025 & 2033

- Figure 58: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Price Trend Analysis 2025 & 2033

- Figure 59: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Price Trend Analysis 2025 & 2033

- Figure 60: Asia Pacific Southeast Asia Aviation Industry Revenue (Million), by Country 2025 & 2033

- Figure 61: Asia Pacific Southeast Asia Aviation Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 13: United States Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Canada Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Mexico Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 17: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 18: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 19: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 20: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 21: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 22: Brazil Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 23: Argentina Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 24: Rest of South America Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 25: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 26: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 27: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 28: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 29: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 30: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 31: United Kingdom Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 32: Germany Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 33: France Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 34: Italy Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 35: Spain Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 36: Russia Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 37: Benelux Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 38: Nordics Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 39: Rest of Europe Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 40: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 41: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 42: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 43: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 44: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 45: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 46: Turkey Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 47: Israel Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 48: GCC Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 49: North Africa Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 50: South Africa Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 51: Rest of Middle East & Africa Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 52: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 53: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 54: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 55: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 56: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 57: Global Southeast Asia Aviation Industry Revenue Million Forecast, by Country 2020 & 2033

- Table 58: China Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 59: India Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 60: Japan Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 61: South Korea Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 62: ASEAN Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 63: Oceania Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

- Table 64: Rest of Asia Pacific Southeast Asia Aviation Industry Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Southeast Asia Aviation Industry?

The projected CAGR is approximately 4.84%.

2. Which companies are prominent players in the Southeast Asia Aviation Industry?

Key companies in the market include Textron Inc, Dassault Aviation, PT Dirgantara Indonesia, General Dynamics Corporation, Leonardo SpA, Lockheed Martin Corporation, Rostec, Airbus SE, Honda Aircraft Company LL, United Aircraft Corporation, ATR, The Boeing Company.

3. What are the main segments of the Southeast Asia Aviation Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 36.06 Million as of 2022.

5. What are some drivers contributing to market growth?

Increase in Internet of Things (IoT) and Autonomous Systems; Rise in Demand for Military and Defense Satellite Communication Solutions.

6. What are the notable trends driving market growth?

The Commercial Aircraft Segment is Expected to Dominate the Market.

7. Are there any restraints impacting market growth?

Cybersecurity Threats to Satellite Communication; Interference in Transmission of Data.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Southeast Asia Aviation Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Southeast Asia Aviation Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Southeast Asia Aviation Industry?

To stay informed about further developments, trends, and reports in the Southeast Asia Aviation Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence