Key Insights

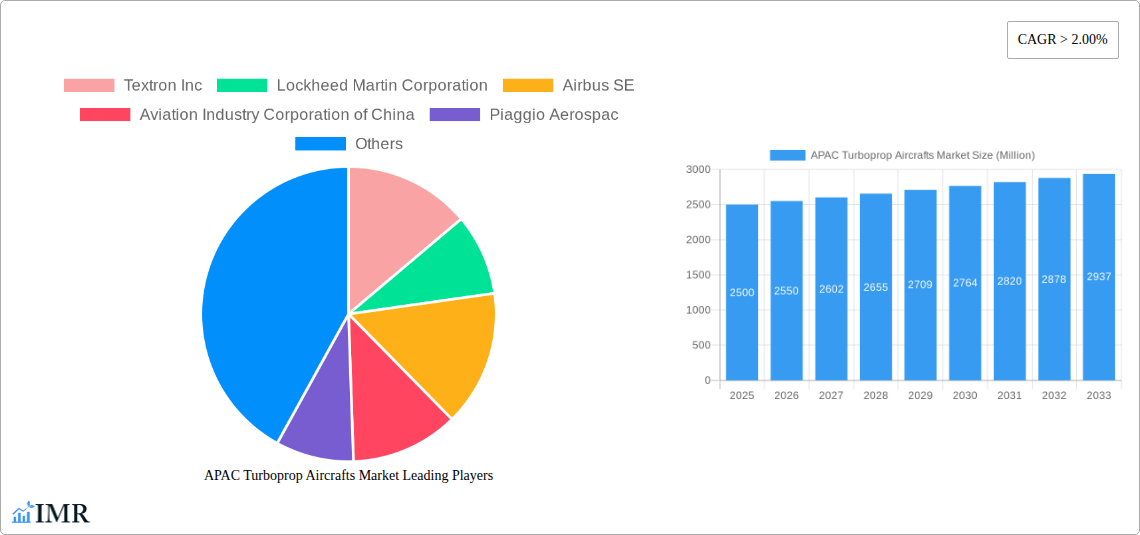

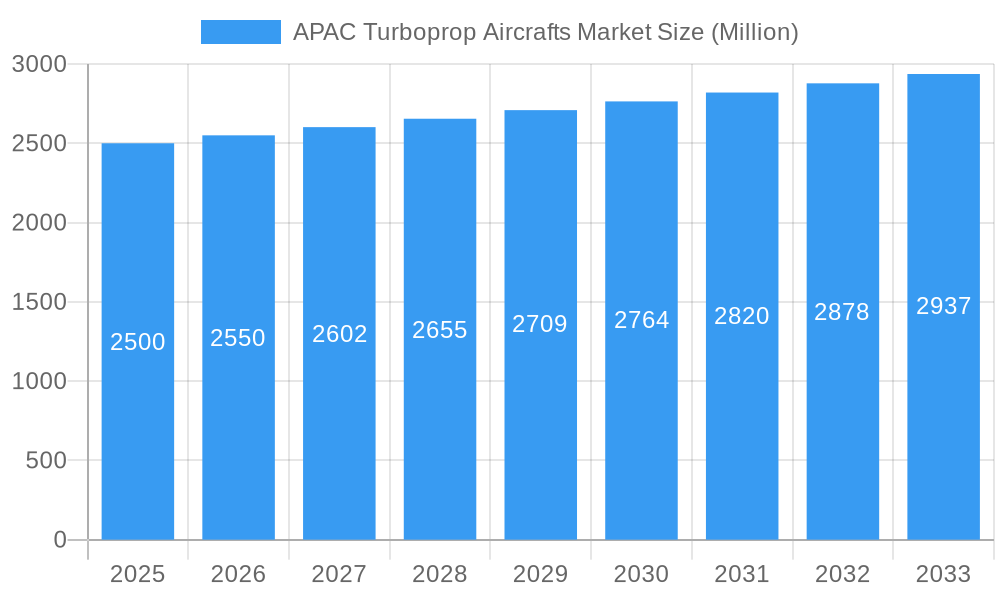

The Asia-Pacific (APAC) turboprop aircraft market is experiencing robust growth, driven by increasing demand for regional connectivity, particularly in the burgeoning economies of China and India. The market's Compound Annual Growth Rate (CAGR) exceeding 2.00% indicates a steady expansion, projected to continue through 2033. Key drivers include the development of regional air transportation networks, government initiatives promoting air travel accessibility in underserved areas, and the rising popularity of tourism and business travel within the region. Furthermore, the replacement of aging fleets with modern, fuel-efficient turboprop aircraft contributes significantly to market expansion. Segments within the APAC turboprop market show variations in growth trajectory. While Commercial Aviation holds the largest share, General Aviation is exhibiting impressive growth, fuelled by the increasing popularity of private and recreational flying. The presence of significant aircraft manufacturers, including Textron, Lockheed Martin, and Airbus, amongst others within the region, further boosts the market's prospects. However, factors like fluctuating fuel prices, economic downturns, and potential regulatory hurdles present challenges to sustained growth.

APAC Turboprop Aircrafts Market Market Size (In Billion)

Despite these potential restraints, the long-term outlook for the APAC turboprop aircraft market remains positive. The continued investment in infrastructure development and the expanding middle class within the region are strong indicators of sustained demand. The market's segmentation offers opportunities for tailored product offerings and strategic partnerships. Manufacturers are focusing on technological advancements such as improved fuel efficiency, enhanced safety features, and advanced avionics to meet the evolving needs of airlines and operators. This continuous innovation, along with the region’s promising economic growth, promises to propel the APAC turboprop aircraft market to new heights in the coming years. A strategic focus on meeting the specific needs of the APAC market, addressing potential regulatory complexities, and adapting to economic fluctuations will be crucial for stakeholders seeking success in this dynamic sector.

APAC Turboprop Aircrafts Market Company Market Share

This in-depth report provides a comprehensive analysis of the Asia-Pacific (APAC) turboprop aircraft market, covering market dynamics, growth trends, key players, and future outlook. The report utilizes data from 2019-2024 (historical period), with a base year of 2025 and a forecast period spanning 2025-2033. The market is segmented by application (Commercial Aviation, Military Aviation, General Aviation) and examines key players including Textron Inc, Lockheed Martin Corporation, Airbus SE, Aviation Industry Corporation of China, Piaggio Aero, Pilatus Aircraft Ltd, DAHER, ATR, and Piper Aircraft Inc. The total market value in 2025 is estimated at XX Million units.

APAC Turboprop Aircrafts Market Market Dynamics & Structure

The APAC turboprop aircraft market is characterized by a moderately consolidated structure, with key players holding significant market share. Technological innovation, particularly in fuel efficiency and emission reduction, is a crucial driver. Stringent regulatory frameworks concerning safety and environmental standards significantly impact market dynamics. The market also faces competition from alternative technologies, such as helicopters for certain applications. The end-user demographics are diverse, ranging from regional airlines and military forces to private operators. M&A activity has been moderate, with a few notable deals in recent years aiming to enhance technological capabilities and expand geographical reach. The total number of M&A deals between 2019 and 2024 was approximately xx.

- Market Concentration: Moderately consolidated, with top 5 players holding approximately xx% market share in 2025.

- Technological Innovation: Focus on fuel efficiency, reduced emissions, and advanced avionics.

- Regulatory Framework: Stringent safety and environmental regulations driving technological advancements.

- Competitive Substitutes: Helicopters and other short-haul aircraft pose competitive pressure.

- End-User Demographics: Regional airlines, military, and private operators.

- M&A Trends: Moderate activity, focused on technology enhancement and geographic expansion.

APAC Turboprop Aircrafts Market Growth Trends & Insights

The APAC turboprop aircraft market experienced significant growth between 2019 and 2024, driven by factors such as increasing air travel demand, expanding regional connectivity, and modernization of existing fleets. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching an estimated value of XX Million units by 2033. This growth is fueled by rising disposable incomes, infrastructure development, and government initiatives supporting regional air connectivity. Technological disruptions, such as the development of more fuel-efficient engines and advanced avionics, are further accelerating market growth. Consumer behavior shifts towards preferring convenient and faster regional air travel contribute significantly. Market penetration is expected to increase from xx% in 2025 to xx% in 2033.

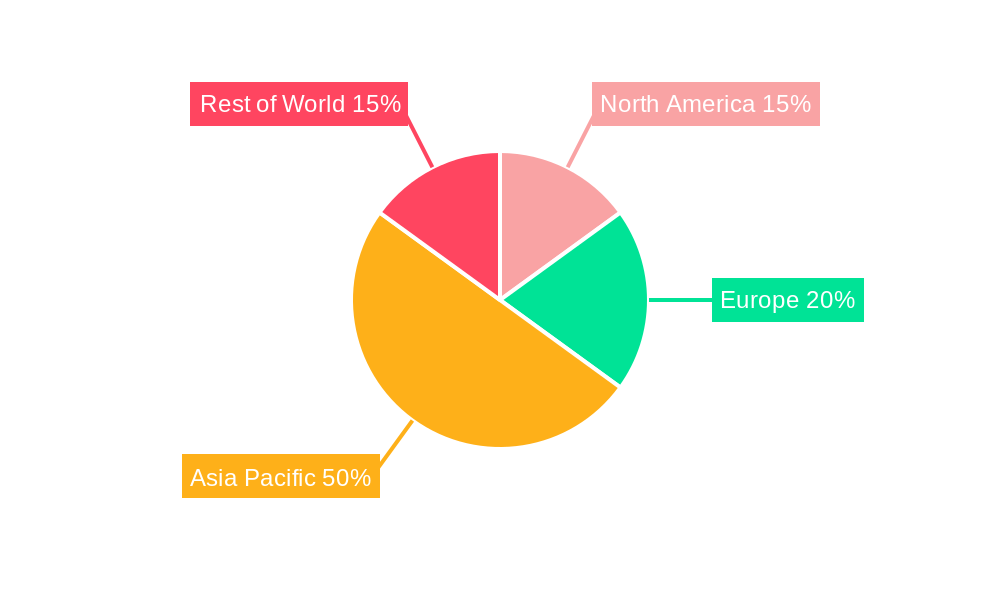

Dominant Regions, Countries, or Segments in APAC Turboprop Aircrafts Market

Within the APAC region, [Country X] and [Country Y] are currently the dominant markets for turboprop aircraft. The Commercial Aviation segment leads market growth, driven by increasing passenger traffic and the expansion of regional airlines.

Key Drivers for Commercial Aviation:

- Rapid expansion of low-cost carriers.

- Growing air passenger traffic.

- Government investments in airport infrastructure.

- Focus on regional connectivity.

Dominance Factors:

- Large and growing air travel market.

- Favorable government policies.

- Significant investments in infrastructure development.

- High demand from regional airlines.

APAP Turboprop Aircrafts Market Product Landscape

Turboprop aircraft in the APAP market showcase ongoing innovations in engine technology, enhancing fuel efficiency and reducing noise pollution. The integration of advanced avionics and improved cabin comfort further enhances the appeal of these aircraft. Unique selling propositions often focus on operational costs, reliability, and maintenance simplicity, making them attractive to operators in various segments, including commercial, military, and general aviation. Recent technological advancements include the incorporation of fly-by-wire systems and advanced materials to improve safety and performance.

Key Drivers, Barriers & Challenges in APAC Turboprop Aircrafts Market

Key Drivers: Rising air travel demand, expanding regional connectivity, government initiatives promoting regional air travel, and technological advancements in fuel efficiency and avionics. Specific examples include government subsidies for regional airlines and the development of new, more fuel-efficient turboprop engines.

Key Challenges: Supply chain disruptions impacting component availability, stringent regulatory hurdles related to safety and emissions, and intense competition among manufacturers. These factors could lead to cost increases and potential delays in production and delivery. The impact is estimated to result in a xx% reduction in market growth by 2030 if not effectively addressed.

Emerging Opportunities in APAP Turboprop Aircrafts Market

Untapped markets in Southeast Asia present significant growth opportunities. The increasing demand for cargo transport and specialized operations, such as medical evacuations, creates niche opportunities. Furthermore, evolving consumer preferences towards environmentally friendly travel drive interest in aircraft with reduced emissions.

Growth Accelerators in the APAC Turboprop Aircrafts Market Industry

Technological breakthroughs in engine technology and avionics, coupled with strategic partnerships between manufacturers and airlines, are poised to accelerate market growth. Expansion strategies focusing on untapped markets and catering to specific operational needs will play a crucial role in shaping market dynamics in the coming years.

Key Players Shaping the APAC Turboprop Aircrafts Market Market

- Textron Inc

- Lockheed Martin Corporation

- Airbus SE

- Aviation Industry Corporation of China

- Piaggio Aero

- Pilatus Aircraft Ltd

- DAHER

- ATR

- Piper Aircraft Inc

Notable Milestones in APAC Turboprop Aircrafts Market Sector

- 2021-Q4: Launch of the new [Turboprop Model Name] by [Manufacturer Name], featuring enhanced fuel efficiency.

- 2022-Q2: [Airline Name] placed a large order for [Turboprop Model Name] aircraft, signifying growing market demand.

- 2023-Q1: Merger between [Manufacturer A] and [Manufacturer B], creating a larger entity with expanded market reach.

In-Depth APAC Turboprop Aircrafts Market Market Outlook

The APAC turboprop aircraft market is expected to witness sustained growth driven by technological innovations, strategic partnerships, and the expansion of regional connectivity. Significant opportunities exist for manufacturers focusing on fuel efficiency, advanced avionics, and catering to specific niche markets. The continued growth of regional airlines and the increasing demand for air travel within the APAC region strongly support a positive long-term market outlook.

APAC Turboprop Aircrafts Market Segmentation

-

1. Application

- 1.1. Commercial Aviation

- 1.2. Military Aviation

- 1.3. General Aviation

-

2. Geography

-

2.1. Asia-Pacific

- 2.1.1. China

- 2.1.2. India

- 2.1.3. Japan

- 2.1.4. South Korea

- 2.1.5. Australia

- 2.1.6. Rest of Asia-Pacific

-

2.1. Asia-Pacific

APAC Turboprop Aircrafts Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. India

- 1.3. Japan

- 1.4. South Korea

- 1.5. Australia

- 1.6. Rest of Asia Pacific

APAC Turboprop Aircrafts Market Regional Market Share

Geographic Coverage of APAC Turboprop Aircrafts Market

APAC Turboprop Aircrafts Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 2.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The Commercial Aviation Segment Expected to Exhibit the Highest Growth Rate

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Turboprop Aircrafts Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial Aviation

- 5.1.2. Military Aviation

- 5.1.3. General Aviation

- 5.2. Market Analysis, Insights and Forecast - by Geography

- 5.2.1. Asia-Pacific

- 5.2.1.1. China

- 5.2.1.2. India

- 5.2.1.3. Japan

- 5.2.1.4. South Korea

- 5.2.1.5. Australia

- 5.2.1.6. Rest of Asia-Pacific

- 5.2.1. Asia-Pacific

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. Competitive Analysis

- 6.1. Global Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Textron Inc

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Lockheed Martin Corporation

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Airbus SE

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Aviation Industry Corporation of China

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Piaggio Aerospac

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Pilatus Aircraft Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 DAHER

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 ATR

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Piper Aircraft Inc

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.1 Textron Inc

List of Figures

- Figure 1: Global APAC Turboprop Aircrafts Market Revenue Breakdown (Million, %) by Region 2025 & 2033

- Figure 2: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Application 2025 & 2033

- Figure 3: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Application 2025 & 2033

- Figure 4: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Geography 2025 & 2033

- Figure 5: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Geography 2025 & 2033

- Figure 6: Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million), by Country 2025 & 2033

- Figure 7: Asia Pacific APAC Turboprop Aircrafts Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 2: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 3: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Application 2020 & 2033

- Table 5: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Geography 2020 & 2033

- Table 6: Global APAC Turboprop Aircrafts Market Revenue Million Forecast, by Country 2020 & 2033

- Table 7: China APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Japan APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: South Korea APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Australia APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Rest of Asia Pacific APAC Turboprop Aircrafts Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Turboprop Aircrafts Market?

The projected CAGR is approximately > 2.00%.

2. Which companies are prominent players in the APAC Turboprop Aircrafts Market?

Key companies in the market include Textron Inc, Lockheed Martin Corporation, Airbus SE, Aviation Industry Corporation of China, Piaggio Aerospac, Pilatus Aircraft Ltd, DAHER, ATR, Piper Aircraft Inc.

3. What are the main segments of the APAC Turboprop Aircrafts Market?

The market segments include Application, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The Commercial Aviation Segment Expected to Exhibit the Highest Growth Rate.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Turboprop Aircrafts Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Turboprop Aircrafts Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Turboprop Aircrafts Market?

To stay informed about further developments, trends, and reports in the APAC Turboprop Aircrafts Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence