Key Insights

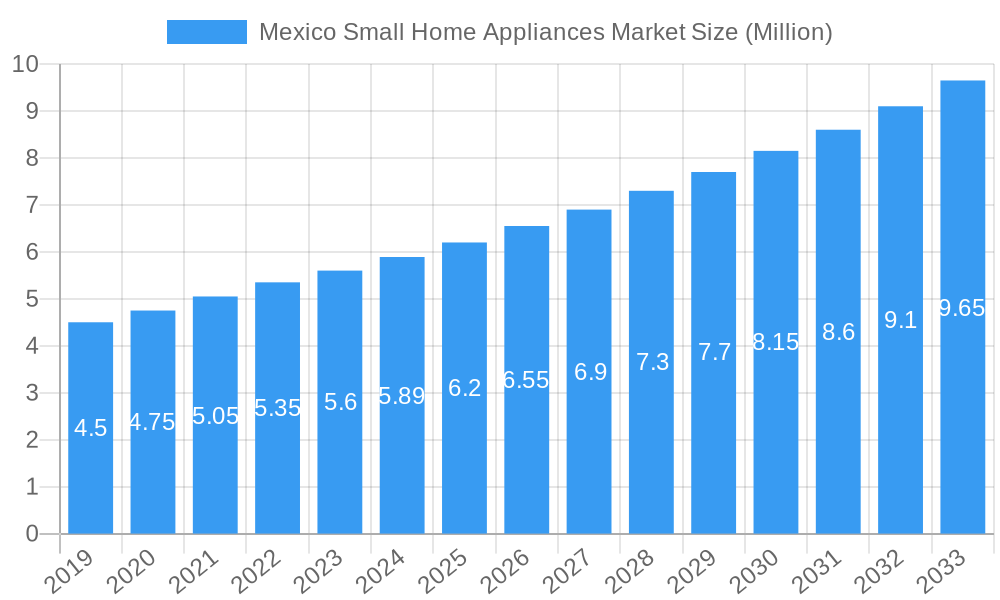

The Mexico Small Home Appliances Market is poised for significant expansion, with a current market size of approximately USD 5.89 billion. This robust growth is fueled by several key factors, including increasing disposable incomes, a growing middle class with a penchant for modern living, and a rising awareness of energy-efficient and technologically advanced appliances. The market is projected to experience a Compound Annual Growth Rate (CAGR) of over 6.5% during the forecast period of 2025-2033. This upward trajectory is supported by a strong historical performance from 2019-2024, indicating sustained consumer demand and industry resilience. Key segments within the market, such as kitchen appliances (blenders, toasters, coffee makers), personal care appliances (hair dryers, shavers), and cleaning appliances (vacuum cleaners), are all anticipated to contribute to this expansion. The evolving consumer preferences towards convenience, space-saving designs, and smart home integration further bolster the market's outlook, presenting ample opportunities for both domestic and international players to innovate and capture market share.

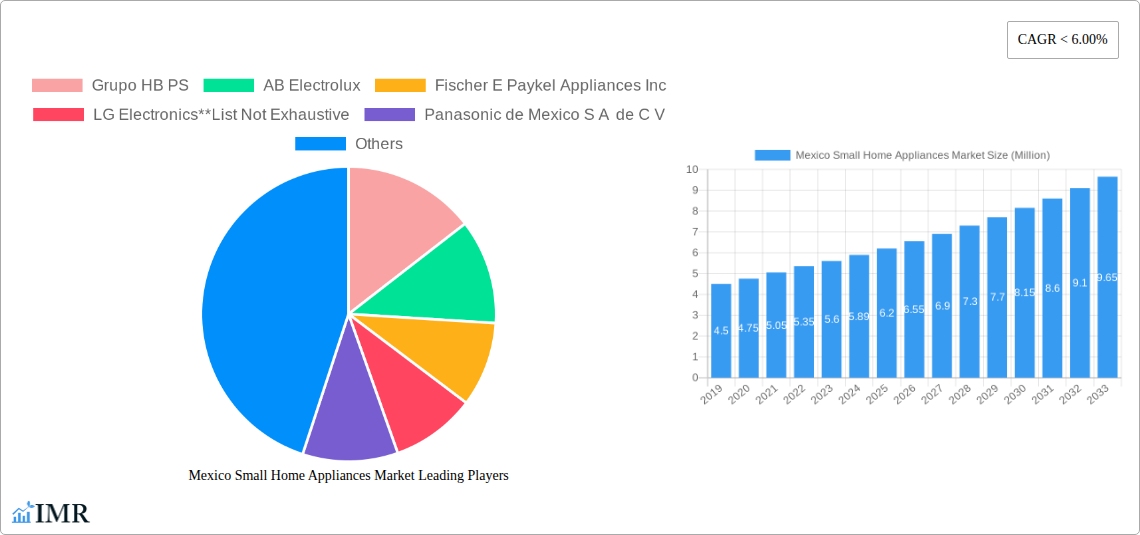

Mexico Small Home Appliances Market Market Size (In Million)

Further analysis of the Mexico Small Home Appliances Market reveals a dynamic landscape driven by both macro-economic trends and micro-consumer behaviors. Urbanization continues to be a significant driver, leading to a higher demand for compact and multi-functional appliances that cater to smaller living spaces. The increasing penetration of e-commerce platforms has also democratized access to a wider range of products, stimulating competition and encouraging manufacturers to offer more diverse and competitively priced options. Government initiatives promoting energy efficiency and sustainable consumption are likely to influence product development, with a growing emphasis on eco-friendly and power-saving small home appliances. The estimated market value in 2025 stands at USD 5.89 billion, with projections indicating a substantial increase by 2033, driven by the aforementioned CAGR. This sustained growth underscores the Mexican market's strategic importance and its potential for continued investment and innovation within the small home appliance sector.

Mexico Small Home Appliances Market Company Market Share

Mexico Small Home Appliances Market Report: Unveiling Growth Dynamics and Emerging Opportunities (2019-2033)

This comprehensive report delves deep into the Mexico small home appliances market, providing an in-depth analysis of its current state and future trajectory. Covering the period from 2019 to 2033, with a base and estimated year of 2025, this study offers critical insights for stakeholders seeking to capitalize on this dynamic sector. The report dissects parent market trends and their influence on the child market of small home appliances, offering a holistic view of the industry. We meticulously examine market segmentation, key players, growth drivers, barriers, and emerging opportunities, all presented with actionable data and forecasts.

Report Highlights:

- Study Period: 2019–2033

- Base Year: 2025

- Estimated Year: 2025

- Forecast Period: 2025–2033

- Historical Period: 2019–2024

- Key Companies: Grupo HB PS, AB Electrolux, Fischer E Paykel Appliances Inc, LG Electronics (List Not Exhaustive), Panasonic de Mexico S A de C V, BSH Hausgerate GmbH, Mabe S A de C V Av, Daewoo Electronics Mexico, Panasonic Corporation, Hamilton Beach Brands, Diehl Controls.

- Segments Covered:

- Product: Vacuum Cleaners, Coffee Machines, Food Processors, Irons, Toasters, Grills & Roasters, Tea Machines, Hair Dryers, Other Small Home Appliances*

- Distribution Channel: Multi branded stores, Specialty Stores, Online, Other Distribution Channels

- Values Presented in: Million Units

Mexico Small Home Appliances Market Market Dynamics & Structure

The Mexico small home appliances market is characterized by a moderate level of concentration, with a few key global and regional players holding significant market share. Technological innovation is a primary driver, fueled by consumer demand for convenience, energy efficiency, and smart features. Regulatory frameworks, while generally supportive of business, can present challenges related to import duties and product safety standards. Competitive product substitutes are abundant, forcing manufacturers to continually differentiate through features, price, and brand reputation. End-user demographics in Mexico are evolving, with a growing middle class and increasing urbanization driving demand for modern home solutions. Mergers and acquisitions (M&A) trends are expected to play a role in consolidating the market, allowing larger entities to expand their product portfolios and geographical reach.

- Market Concentration: Dominated by a mix of multinational corporations and established local brands, with key players vying for market share through product innovation and aggressive marketing.

- Technological Innovation Drivers: Increasing consumer demand for smart appliances, energy-efficient models, and multi-functional devices.

- Regulatory Frameworks: Adherence to national safety standards and potential impacts of trade agreements on import/export dynamics.

- Competitive Product Substitutes: Availability of a wide range of brands and product categories, necessitating strong value propositions.

- End-User Demographics: Growing middle-income population, urbanization, and a rising trend in nuclear families are key demographic shifts influencing purchase patterns.

- M&A Trends: Potential for consolidation as larger companies seek to acquire smaller, innovative brands or expand their manufacturing capabilities within Mexico.

Mexico Small Home Appliances Market Growth Trends & Insights

The Mexico small home appliances market is poised for robust growth over the forecast period, driven by a confluence of economic, social, and technological factors. The market size evolution is expected to witness a steady upward trend, propelled by increasing disposable incomes and a rising consumer appetite for modern conveniences that enhance daily life. Adoption rates for various small home appliances, particularly those with innovative features like smart connectivity and enhanced energy efficiency, are projected to accelerate. Technological disruptions, such as the integration of AI and IoT into everyday appliances, are set to redefine consumer expectations and product offerings. Consumer behavior shifts are also playing a pivotal role; there's a discernible move towards online purchasing for convenience and better price comparisons, alongside a growing preference for aesthetically pleasing and sustainable products. The CAGR for the Mexico small home appliances market is anticipated to remain strong, reflecting sustained demand and evolving consumer preferences. Market penetration of advanced small home appliances is expected to increase significantly as affordability and awareness grow. The inherent desire for comfort and efficiency in households is a foundational element driving these positive growth trends.

Dominant Regions, Countries, or Segments in Mexico Small Home Appliances Market

The Online distribution channel is emerging as a dominant force within the Mexico small home appliances market, experiencing rapid growth and capturing an increasing share of consumer spending. This dominance is attributed to several key drivers, including the widespread adoption of e-commerce across Mexico, offering unparalleled convenience and accessibility to a vast consumer base. Consumers are increasingly comfortable making purchasing decisions for small home appliances online, leveraging detailed product descriptions, customer reviews, and competitive pricing. Furthermore, online platforms provide a wider selection of brands and models compared to traditional brick-and-mortar stores, catering to diverse consumer preferences. The robust growth of e-commerce infrastructure, including efficient logistics and payment gateways, further solidifies its leading position.

- Online Distribution Channel Dominance:

- Key Drivers:

- Increased Internet Penetration: Growing access to the internet across urban and semi-urban areas.

- Convenience and Accessibility: 24/7 shopping availability and doorstep delivery.

- Price Competitiveness: Online retailers often offer more competitive pricing due to lower overheads.

- Wide Product Selection: Access to a broader range of brands and models not always available in physical stores.

- Enhanced Consumer Reviews and Information: Facilitating informed purchase decisions.

- Market Share & Growth Potential: The online segment is projected to continue its upward trajectory, outperforming traditional retail channels in terms of growth rate and market penetration. Its share is expected to expand significantly as more consumers embrace digital shopping habits for home goods. The potential for reaching a wider demographic, including those in remote areas, further amplifies its growth prospects.

- Key Drivers:

Mexico Small Home Appliances Market Product Landscape

The product landscape of the Mexico small home appliances market is characterized by continuous innovation aimed at enhancing user experience, efficiency, and convenience. Key product categories such as Coffee Machines are witnessing advancements with the introduction of smart brewing functionalities and personalized settings. Vacuum Cleaners are evolving to offer greater suction power, quieter operation, and advanced filtration systems. Food Processors are becoming more versatile with multiple attachments and intuitive controls. The market is also seeing a rise in demand for energy-efficient Irons and faster-heating Toasters. Grills & Roasters are increasingly designed for both indoor and outdoor use, offering greater flexibility. The overall trend is towards sleeker designs, durable materials, and integrated smart technologies that seamlessly blend into modern households, providing unique selling propositions and technological advancements that appeal to discerning consumers.

Key Drivers, Barriers & Challenges in Mexico Small Home Appliances Market

Key Drivers: The Mexico small home appliances market is primarily propelled by a growing middle-class population with increasing disposable income, leading to a higher demand for convenience-enhancing products. Technological advancements, such as the integration of smart features and energy efficiency, are significant drivers, aligning with consumer preferences for modern and sustainable living. Government initiatives promoting domestic manufacturing and trade agreements that facilitate imports also contribute to market expansion. The rising trend of nuclear families and smaller living spaces further fuels the demand for compact and multi-functional small home appliances.

Barriers & Challenges: Despite the positive outlook, the market faces several barriers and challenges. Intense competition from both international and local brands can lead to price wars and pressure on profit margins. Economic volatility and fluctuating currency exchange rates can impact import costs and consumer purchasing power. Supply chain disruptions, particularly those related to global logistics and component sourcing, can affect product availability and lead times. Furthermore, evolving consumer preferences and the need for continuous product innovation require significant investment in research and development, posing a challenge for smaller players.

Emerging Opportunities in Mexico Small Home Appliances Market

Emerging opportunities in the Mexico small home appliances market lie in the burgeoning demand for eco-friendly and sustainable products. Consumers are increasingly conscious of their environmental impact, creating a niche for energy-efficient appliances and those made from recycled materials. The growing adoption of smart home technology presents another significant opportunity, with integrated IoT capabilities becoming a key selling point for various small appliances. Furthermore, there's an untapped potential in catering to specific demographic needs, such as compact appliances for smaller urban apartments or specialized products for a growing elderly population. The expansion of e-commerce into less-penetrated regions also offers a vast landscape for market growth.

Growth Accelerators in the Mexico Small Home Appliances Market Industry

Long-term growth in the Mexico small home appliances market is significantly accelerated by continuous technological breakthroughs, such as the development of more sophisticated AI-powered functionalities and enhanced energy-saving technologies. Strategic partnerships between manufacturers, retailers, and technology providers are crucial for expanding distribution networks and fostering innovation. Market expansion strategies, including penetration into emerging urban centers and rural areas, coupled with targeted marketing campaigns that highlight product benefits and value, are also vital growth accelerators. The increasing consumer awareness of the benefits of adopting modern small home appliances, driven by effective marketing and positive word-of-mouth, further propels sustained market expansion.

Key Players Shaping the Mexico Small Home Appliances Market Market

- Grupo HB PS

- AB Electrolux

- Fischer E Paykel Appliances Inc

- LG Electronics

- Panasonic de Mexico S A de C V

- BSH Hausgerate GmbH

- Mabe S A de C V Av

- Daewoo Electronics Mexico

- Panasonic Corporation

- Hamilton Beach Brands

- Diehl Controls

Notable Milestones in Mexico Small Home Appliances Market Sector

- March 2022: The German BSH Group, a subsidiary of Bosch, and the Chinese Hisense Group, announced the construction of new home appliance plants in the state of Nuevo Leon, each investing USD 260 Mio. This significant investment underscores the increasing demand in the Mexican market and signals a strong trend of international companies expanding their local presence.

- June 2023: Spectrum Brands Holdings, Inc., a prominent global branded consumer products and home essentials company, announced the sale of its Hardware and Home Improvement segment ("HHI") to ASSA ABLOY for USD 4.3 billion in cash. While this pertains to a broader home improvement sector, such strategic divestments can lead to market realignments and potential shifts in focus for other consumer product categories.

In-Depth Mexico Small Home Appliances Market Market Outlook

The outlook for the Mexico small home appliances market remains exceptionally positive, driven by persistent economic development and evolving consumer lifestyles. Growth accelerators such as the increasing integration of smart home technology and a rising preference for energy-efficient and sustainable products will continue to shape market dynamics. Strategic expansions by key players and the continuous introduction of innovative, user-friendly appliances are poised to further stimulate demand. The market is expected to witness sustained growth in segments like kitchen appliances and personal care devices, supported by a growing middle-class with increased purchasing power and a strong inclination towards adopting modern household conveniences. This forecast suggests a robust future for the Mexico small home appliances sector, offering significant opportunities for investment and market penetration.

Mexico Small Home Appliances Market Segmentation

-

1. Product

- 1.1. Vacuum Cleaners

- 1.2. Coffee Machines

- 1.3. Food Processors

- 1.4. Irons

- 1.5. Toasters

- 1.6. Grills & Roasters

- 1.7. Tea Machines

- 1.8. Hair Dryers

- 1.9. Other Small Home Appliances*

-

2. Distribution Channel

- 2.1. Multi branded stores

- 2.2. Specialty Stores

- 2.3. Online

- 2.4. Other Distribution Channels

Mexico Small Home Appliances Market Segmentation By Geography

- 1. Mexico

Mexico Small Home Appliances Market Regional Market Share

Geographic Coverage of Mexico Small Home Appliances Market

Mexico Small Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of < 6.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1 The rapid growth of e-commerce in Mexico has made it easier for consumers to access a wide range of small home appliances. Online shopping platforms offer consumers greater convenience

- 3.2.2 competitive pricing

- 3.2.3 and a broader selection of products

- 3.2.4 contributing to the market’s growth.

- 3.3. Market Restrains

- 3.3.1 A significant portion of the Mexican consumer base is price-sensitive

- 3.3.2 especially in the lower-income segments. This price sensitivity can limit the market for premium or high-end small home appliances

- 3.3.3 with many consumers opting for more affordable options.

- 3.4. Market Trends

- 3.4.1 The adoption of smart home technology is growing in Mexico

- 3.4.2 with increasing demand for smart and connected small home appliances. Consumers are looking for appliances that can be controlled remotely via smartphones and integrated into broader smart home ecosystems

- 3.4.3 such as smart ovens

- 3.4.4 connected coffee makers

- 3.4.5 and IoT-enabled air purifiers.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Mexico Small Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Vacuum Cleaners

- 5.1.2. Coffee Machines

- 5.1.3. Food Processors

- 5.1.4. Irons

- 5.1.5. Toasters

- 5.1.6. Grills & Roasters

- 5.1.7. Tea Machines

- 5.1.8. Hair Dryers

- 5.1.9. Other Small Home Appliances*

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Multi branded stores

- 5.2.2. Specialty Stores

- 5.2.3. Online

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. Mexico

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Grupo HB PS

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 AB Electrolux

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Fischer E Paykel Appliances Inc

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 LG Electronics**List Not Exhaustive

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Panasonic de Mexico S A de C V

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 BSH Hausgerate GmbH

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Mabe S A de C V Av

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Daewoo Electronics Mexico

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hamilton Beach Brands

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Diehl Controls

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.1 Grupo HB PS

List of Figures

- Figure 1: Mexico Small Home Appliances Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Mexico Small Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Mexico Small Home Appliances Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: Mexico Small Home Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 3: Mexico Small Home Appliances Market Revenue Million Forecast, by Region 2020 & 2033

- Table 4: Mexico Small Home Appliances Market Revenue Million Forecast, by Product 2020 & 2033

- Table 5: Mexico Small Home Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Mexico Small Home Appliances Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Mexico Small Home Appliances Market?

The projected CAGR is approximately < 6.00%.

2. Which companies are prominent players in the Mexico Small Home Appliances Market?

Key companies in the market include Grupo HB PS, AB Electrolux, Fischer E Paykel Appliances Inc, LG Electronics**List Not Exhaustive, Panasonic de Mexico S A de C V, BSH Hausgerate GmbH, Mabe S A de C V Av, Daewoo Electronics Mexico, Panasonic Corporation, Hamilton Beach Brands, Diehl Controls.

3. What are the main segments of the Mexico Small Home Appliances Market?

The market segments include Product, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5.89 Million as of 2022.

5. What are some drivers contributing to market growth?

The rapid growth of e-commerce in Mexico has made it easier for consumers to access a wide range of small home appliances. Online shopping platforms offer consumers greater convenience. competitive pricing. and a broader selection of products. contributing to the market’s growth..

6. What are the notable trends driving market growth?

The adoption of smart home technology is growing in Mexico. with increasing demand for smart and connected small home appliances. Consumers are looking for appliances that can be controlled remotely via smartphones and integrated into broader smart home ecosystems. such as smart ovens. connected coffee makers. and IoT-enabled air purifiers..

7. Are there any restraints impacting market growth?

A significant portion of the Mexican consumer base is price-sensitive. especially in the lower-income segments. This price sensitivity can limit the market for premium or high-end small home appliances. with many consumers opting for more affordable options..

8. Can you provide examples of recent developments in the market?

March 2022: the German BSH Group, a subsidiary of Bosch, as well as the Chinese Hisense Group, announced the construction of new home appliance plants in the state of Nuevo Leon, each investing USD 260 Mio. With an increase in demand, international companies began investing heavily in their Mexican locations or even opening new ones.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Mexico Small Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Mexico Small Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Mexico Small Home Appliances Market?

To stay informed about further developments, trends, and reports in the Mexico Small Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence