Key Insights

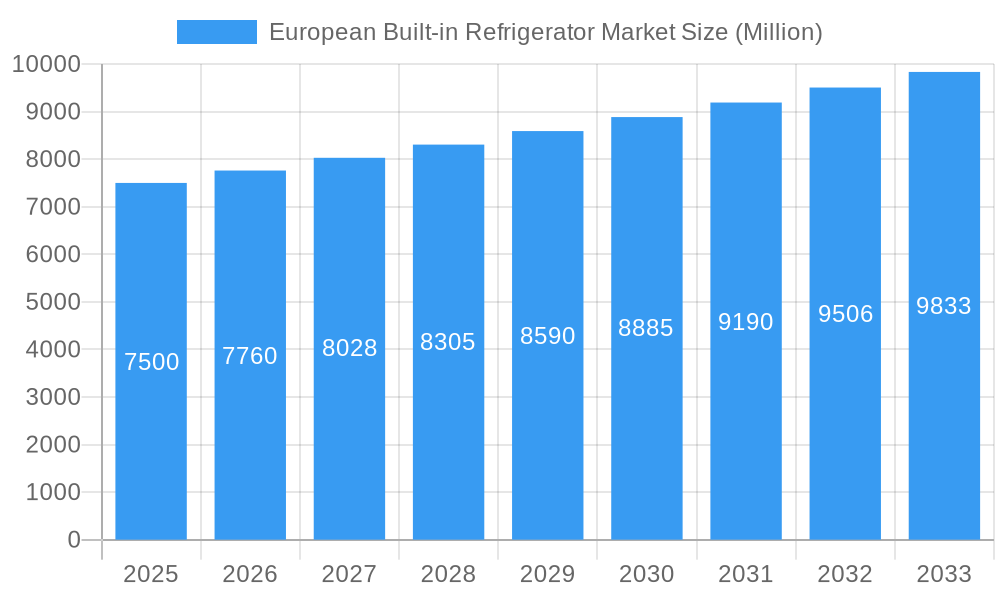

The European Built-in Refrigerator Market is poised for robust growth, projected to expand at a Compound Annual Growth Rate (CAGR) exceeding 3.59% over the forecast period of 2025-2033. With a current market size of approximately [Estimate a logical value, e.g., €7,500 million] million, the demand for integrated refrigeration solutions is being significantly driven by evolving consumer lifestyles, increasing disposable incomes, and a growing preference for premium, aesthetically pleasing kitchen designs. The trend towards open-plan living spaces in European households further amplifies the appeal of built-in refrigerators, as they seamlessly blend with cabinetry, offering a sophisticated and uncluttered look. The residential segment is expected to remain the dominant force, fueled by new home constructions and renovation projects that prioritize modern kitchen aesthetics and functionality. Furthermore, the convenience and wider product selection offered by online distribution channels are increasingly influencing purchasing decisions, although traditional offline retail remains a crucial touchpoint for consumers seeking hands-on product evaluation.

European Built-in Refrigerator Market Market Size (In Billion)

The market's growth trajectory is further supported by continuous innovation in refrigerator technology, including enhanced energy efficiency, advanced cooling systems, and smart features that offer greater convenience and food preservation. Manufacturers like LG Corp, SAMSUNG Electronics, Bosch Ltd, and Miele are at the forefront of these advancements, introducing a diverse range of product types from single-door units to sophisticated French door and side-by-side models. However, the market also faces certain restraints, including the premium pricing associated with built-in appliances compared to freestanding models, and the complexity and cost of installation, which can deter some consumers. Geographically, while the United Kingdom, France, and Germany represent key markets, the "Others" category, encompassing rapidly developing Eastern European nations, also presents substantial untapped potential, driven by improving economic conditions and a rising middle class eager to adopt modern home appliances.

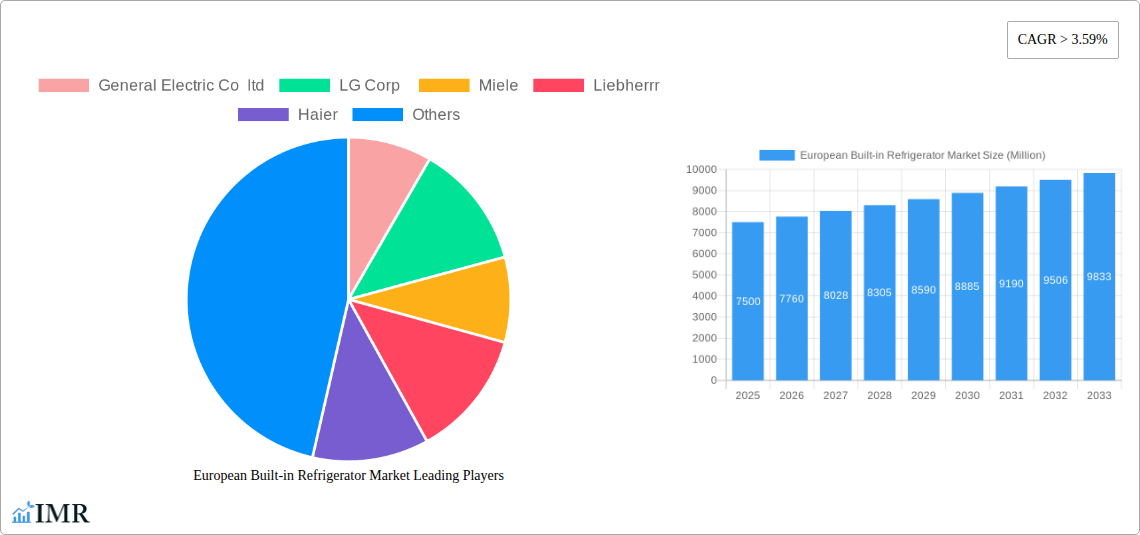

European Built-in Refrigerator Market Company Market Share

This in-depth report provides an exhaustive analysis of the European built-in refrigerator market, meticulously examining its dynamics, growth trajectories, and future potential from 2019 to 2033. Delving into crucial segments like commercial refrigeration and residential built-in refrigerators, this study offers unparalleled insights for industry professionals, manufacturers, and investors navigating this complex landscape. With a focus on parent and child market analysis, we dissect market share, adoption rates, and consumer behavior shifts, presenting all values in million units.

The report utilizes a robust methodology, with the base year of 2025 and a comprehensive forecast period from 2025 to 2033, building upon historical data from 2019-2024. Leverage our expert analysis to understand the impact of regulatory shifts, technological innovations, and evolving consumer preferences on the European built-in refrigerator market.

European Built-in Refrigerator Market Dynamics & Structure

The European built-in refrigerator market exhibits a moderate to high concentration, with leading players like Miele, Liebherr, Bosch Ltd, Whirlpool, and Electrolux AB holding significant market share. Technological innovation is a primary driver, fueled by increasing demand for energy efficiency and smart features. Regulatory frameworks, particularly the EU's stringent energy label requirements, are profoundly shaping product development and consumer choices. Competitive product substitutes, including freestanding refrigerators and alternative cooling solutions, exert some pressure, but the aesthetic and space-saving advantages of built-in units maintain their dominance in premium segments. End-user demographics are shifting towards a younger, tech-savvy consumer base valuing convenience and sustainability. Merger and acquisition (M&A) trends are less prominent, indicating a mature market with established players focusing on organic growth and product differentiation.

- Market Concentration: Dominated by a few key manufacturers, indicating a competitive yet consolidated landscape.

- Technological Innovation Drivers: Focus on energy efficiency (new EU energy labels), smart connectivity (e.g., Samsung's Family Hub), and premium design aesthetics.

- Regulatory Frameworks: The EU's new energy labeling system (A-G scale) is a critical factor, pushing manufacturers towards more sustainable designs.

- Competitive Product Substitutes: Freestanding units and integrated appliance solutions offer alternatives, though the aesthetic appeal of built-in models remains strong.

- End-User Demographics: Growing demand from affluent households and modern living spaces prioritizing seamless integration and advanced features.

- M&A Trends: Limited significant M&A activity, with companies prioritizing R&D and market expansion within existing structures.

European Built-in Refrigerator Market Growth Trends & Insights

The European built-in refrigerator market is poised for steady growth, driven by increasing disposable incomes, a rising trend in kitchen renovations, and a growing preference for integrated living spaces. The market size evolution is expected to witness a healthy Compound Annual Growth Rate (CAGR) of approximately 4.5% during the forecast period. Adoption rates for advanced features, such as smart connectivity and enhanced cooling technologies, are on the rise, particularly in Western European countries. Technological disruptions, including the integration of AI for food management and improved energy efficiency technologies, are key to capturing market share. Consumer behavior shifts towards sustainability and health consciousness are influencing purchasing decisions, with a greater emphasis on refrigerators that minimize food waste and maintain optimal freshness. The perceived value of built-in appliances, offering a premium aesthetic and ergonomic benefits, continues to drive market penetration, especially in new constructions and high-end renovations. We anticipate the total market size to reach approximately 35.8 million units by 2033.

- Market Size Evolution: Projected to reach 35.8 million units by 2033, with a CAGR of 4.5% from 2025-2033.

- Adoption Rates: Increasing adoption of smart features and energy-efficient models, particularly in Germany and France.

- Technological Disruptions: Innovations in cooling technology, AI integration for food management, and sustainable material usage.

- Consumer Behavior Shifts: Growing demand for health-conscious features, reduced food waste, and seamless kitchen aesthetics.

- Market Penetration: Strong penetration in new residential constructions and luxury kitchen renovations.

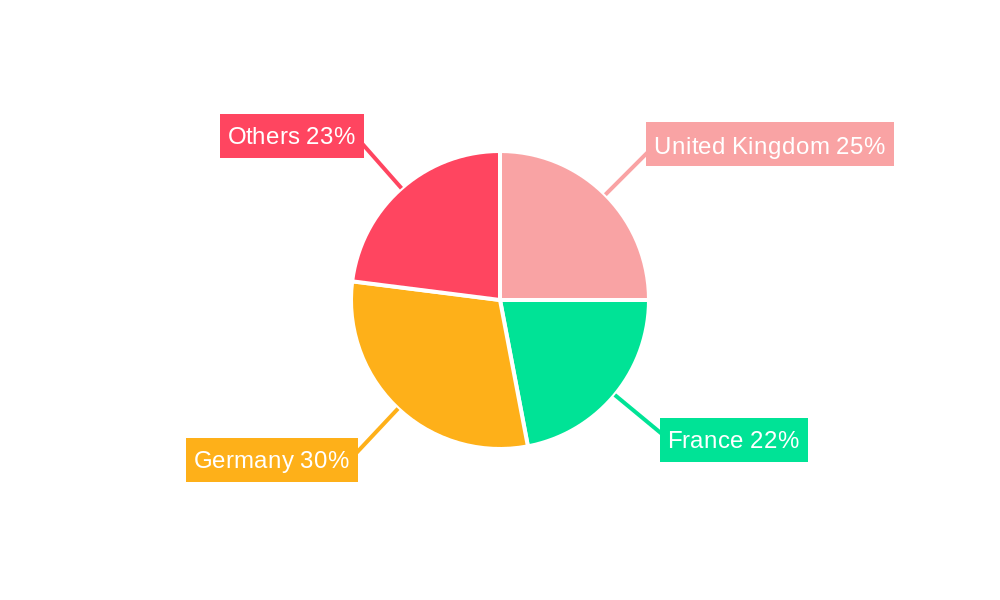

Dominant Regions, Countries, or Segments in European Built-in Refrigerator Market

Germany stands out as the dominant region in the European built-in refrigerator market, consistently driving demand for high-quality, energy-efficient appliances. The country's strong economy, high disposable incomes, and deeply ingrained culture of kitchen integration and renovation contribute significantly to its market leadership. The residential segment is the primary growth engine, with consumers investing heavily in modern kitchens that prioritize both functionality and aesthetics. Within the product type segmentation, Double Door and Side by Side Door refrigerators represent the largest share due to their balance of capacity and accessibility. The Offline Channel continues to hold a dominant position, with consumers valuing the in-store experience for high-value purchases like built-in appliances, allowing for tactile inspection and expert advice. However, the Online Channel is rapidly gaining traction, driven by convenience and price comparison.

- Dominant Geography: Germany leads, followed by France and the United Kingdom.

- Key Segment Drivers (Residential): High consumer spending, focus on kitchen aesthetics, and demand for durable, energy-efficient appliances.

- Dominant Product Type: Double Door and Side by Side Door refrigerators command the largest market share.

- Distribution Channel Dominance: Offline channels remain strong, but online sales are experiencing significant growth.

- Market Share Insights: Germany accounts for an estimated 25% of the total European built-in refrigerator market.

- Growth Potential: Emerging markets within "Others*" (e.g., Netherlands, Scandinavia) show significant untapped potential.

European Built-in Refrigerator Market Product Landscape

The European built-in refrigerator market is characterized by a relentless pursuit of product innovation, focusing on enhanced user experience and sustainability. Manufacturers are introducing advanced cooling technologies that optimize temperature and humidity control, significantly extending food shelf life and reducing waste. Smart features, such as integrated cameras for inventory management and connectivity to home ecosystems, are becoming standard in premium models. Unique selling propositions revolve around seamless integration into kitchen cabinetry, silent operation, and superior energy efficiency ratings. Technological advancements include variable speed compressors for optimized energy consumption and novel antimicrobial interior surfaces. The demand for customizable designs, catering to specific aesthetic preferences, is also a key trend.

Key Drivers, Barriers & Challenges in European Built-in Refrigerator Market

Key Drivers:

- Increasing Demand for Kitchen Aesthetics: Consumers prioritize seamless integration of appliances for a modern, minimalist kitchen design.

- Energy Efficiency Regulations: Strict EU energy labeling is pushing manufacturers to innovate and develop highly efficient models, appealing to eco-conscious consumers.

- Rising Disposable Incomes: Higher consumer spending power enables investment in premium built-in appliances.

- Technological Advancements: Smart features, advanced cooling systems, and user-friendly interfaces enhance appeal.

Barriers & Challenges:

- High Initial Cost: Built-in refrigerators are generally more expensive than freestanding models, posing a barrier for some consumer segments.

- Installation Complexity: Requires professional installation, adding to the overall cost and potentially delaying adoption.

- Supply Chain Disruptions: Global supply chain issues can impact component availability and lead to production delays and increased costs.

- Economic Uncertainty: Potential economic downturns could dampen consumer spending on luxury home appliances.

- Competitive Pressure: Intense competition from established brands and potential new entrants necessitates continuous innovation and competitive pricing.

Emerging Opportunities in European Built-in Refrigerator Market

Emerging opportunities in the European built-in refrigerator market lie in the growing demand for sustainable refrigeration solutions beyond basic energy efficiency. This includes refrigerators utilizing advanced insulation materials and refrigerants with lower global warming potential. The integration of AI-powered food management systems, capable of suggesting recipes based on available ingredients and tracking expiry dates, presents a significant untapped area. Furthermore, the expanding online channel for appliance sales offers a distinct opportunity for direct-to-consumer engagement and personalized marketing strategies. The "Others*" geographical segment, encompassing Scandinavian countries and the Benelux region, presents untapped potential due to their progressive adoption of smart home technologies and high environmental consciousness. The catering and hospitality sector, a key segment of commercial refrigeration, is also showing increased interest in sophisticated built-in units for restaurants and hotels.

Growth Accelerators in the European Built-in Refrigerator Market Industry

The long-term growth of the European built-in refrigerator market is being significantly accelerated by a confluence of factors. Technological breakthroughs in smart home integration are creating a demand for interconnected kitchen appliances, with refrigerators playing a central role in the smart home ecosystem. Strategic partnerships between appliance manufacturers and smart home platform providers are crucial in this regard. Furthermore, the continuous push towards circular economy principles and sustainable manufacturing processes is not only meeting regulatory demands but also appealing to a growing segment of environmentally conscious consumers. Market expansion strategies, particularly focusing on newer housing developments and integrated urban living concepts, are vital for capturing future demand. The increasing focus on health and wellness within households also drives demand for refrigerators that actively contribute to preserving food quality and reducing waste.

Key Players Shaping the European Built-in Refrigerator Market Market

- General Electric Co ltd

- LG Corp

- Miele

- Liebherr

- Haier

- Whirlpool

- Electrolux AB

- SAMSUNG Electronics

- Bosch Ltd

Notable Milestones in European Built-in Refrigerator Market Sector

- March 2022: EU enacts new energy label requirements, replacing A+++ with a new A-G scale, driving significant manufacturer focus on energy efficiency.

- February 2022: Samsung Electronics Italia launches the Family Hub smart refrigerator with a 'View Inside' function, promoting food waste reduction awareness.

In-Depth European Built-in Refrigerator Market Market Outlook

The future outlook for the European built-in refrigerator market is exceptionally bright, fueled by a sustained wave of growth accelerators. The increasing integration of smart technology, from AI-powered food management to seamless connectivity with other smart home devices, will continue to define premium offerings. Manufacturers who prioritize sustainability, not just in energy efficiency but also in material sourcing and end-of-life recycling, will gain a significant competitive advantage. Strategic alliances and a focus on consumer education around the benefits of built-in appliances, particularly in emerging markets within Europe, will unlock substantial growth potential. The market's trajectory indicates a strong shift towards personalized, intelligent, and environmentally responsible kitchen solutions.

European Built-in Refrigerator Market Segmentation

-

1. Application

- 1.1. Commercial

- 1.2. Residential

-

2. distribution channel

- 2.1. Online Channel

- 2.2. Offline Channel

-

3. Product Type

- 3.1. Single Door

- 3.2. Double Door

- 3.3. Side by Side Door

- 3.4. French Door

- 3.5. Other

-

4. Geography

- 4.1. United Kingdom

- 4.2. France

- 4.3. Germany

- 4.4. Others*

European Built-in Refrigerator Market Segmentation By Geography

- 1. United Kingdom

- 2. France

- 3. Germany

- 4. Others

European Built-in Refrigerator Market Regional Market Share

Geographic Coverage of European Built-in Refrigerator Market

European Built-in Refrigerator Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 5.2% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Consumption of Frozen Food Products is Driving the Market

- 3.3. Market Restrains

- 3.3.1. Rising Awareness on Environmental Protection to Hinder the Market Growth

- 3.4. Market Trends

- 3.4.1. Increase in Online Purchase of Household Appliances

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Application

- 5.1.1. Commercial

- 5.1.2. Residential

- 5.2. Market Analysis, Insights and Forecast - by distribution channel

- 5.2.1. Online Channel

- 5.2.2. Offline Channel

- 5.3. Market Analysis, Insights and Forecast - by Product Type

- 5.3.1. Single Door

- 5.3.2. Double Door

- 5.3.3. Side by Side Door

- 5.3.4. French Door

- 5.3.5. Other

- 5.4. Market Analysis, Insights and Forecast - by Geography

- 5.4.1. United Kingdom

- 5.4.2. France

- 5.4.3. Germany

- 5.4.4. Others*

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. United Kingdom

- 5.5.2. France

- 5.5.3. Germany

- 5.5.4. Others

- 5.1. Market Analysis, Insights and Forecast - by Application

- 6. United Kingdom European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Application

- 6.1.1. Commercial

- 6.1.2. Residential

- 6.2. Market Analysis, Insights and Forecast - by distribution channel

- 6.2.1. Online Channel

- 6.2.2. Offline Channel

- 6.3. Market Analysis, Insights and Forecast - by Product Type

- 6.3.1. Single Door

- 6.3.2. Double Door

- 6.3.3. Side by Side Door

- 6.3.4. French Door

- 6.3.5. Other

- 6.4. Market Analysis, Insights and Forecast - by Geography

- 6.4.1. United Kingdom

- 6.4.2. France

- 6.4.3. Germany

- 6.4.4. Others*

- 6.1. Market Analysis, Insights and Forecast - by Application

- 7. France European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Application

- 7.1.1. Commercial

- 7.1.2. Residential

- 7.2. Market Analysis, Insights and Forecast - by distribution channel

- 7.2.1. Online Channel

- 7.2.2. Offline Channel

- 7.3. Market Analysis, Insights and Forecast - by Product Type

- 7.3.1. Single Door

- 7.3.2. Double Door

- 7.3.3. Side by Side Door

- 7.3.4. French Door

- 7.3.5. Other

- 7.4. Market Analysis, Insights and Forecast - by Geography

- 7.4.1. United Kingdom

- 7.4.2. France

- 7.4.3. Germany

- 7.4.4. Others*

- 7.1. Market Analysis, Insights and Forecast - by Application

- 8. Germany European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Application

- 8.1.1. Commercial

- 8.1.2. Residential

- 8.2. Market Analysis, Insights and Forecast - by distribution channel

- 8.2.1. Online Channel

- 8.2.2. Offline Channel

- 8.3. Market Analysis, Insights and Forecast - by Product Type

- 8.3.1. Single Door

- 8.3.2. Double Door

- 8.3.3. Side by Side Door

- 8.3.4. French Door

- 8.3.5. Other

- 8.4. Market Analysis, Insights and Forecast - by Geography

- 8.4.1. United Kingdom

- 8.4.2. France

- 8.4.3. Germany

- 8.4.4. Others*

- 8.1. Market Analysis, Insights and Forecast - by Application

- 9. Others European Built-in Refrigerator Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Application

- 9.1.1. Commercial

- 9.1.2. Residential

- 9.2. Market Analysis, Insights and Forecast - by distribution channel

- 9.2.1. Online Channel

- 9.2.2. Offline Channel

- 9.3. Market Analysis, Insights and Forecast - by Product Type

- 9.3.1. Single Door

- 9.3.2. Double Door

- 9.3.3. Side by Side Door

- 9.3.4. French Door

- 9.3.5. Other

- 9.4. Market Analysis, Insights and Forecast - by Geography

- 9.4.1. United Kingdom

- 9.4.2. France

- 9.4.3. Germany

- 9.4.4. Others*

- 9.1. Market Analysis, Insights and Forecast - by Application

- 10. Competitive Analysis

- 10.1. Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 General Electric Co ltd

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 LG Corp

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 Miele

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Liebherrr

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Haier

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Whirlpool

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 Electrolux AB

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 SAMSUNG Electronics

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Bosch Ltd

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.1 General Electric Co ltd

List of Figures

- Figure 1: European Built-in Refrigerator Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: European Built-in Refrigerator Market Share (%) by Company 2025

List of Tables

- Table 1: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 2: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 3: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 4: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 5: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 6: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 7: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 8: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 9: European Built-in Refrigerator Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 10: European Built-in Refrigerator Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 11: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 12: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 13: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 14: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 15: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 16: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 17: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 18: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 19: European Built-in Refrigerator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 20: European Built-in Refrigerator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 21: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 22: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 23: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 24: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 25: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 26: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 27: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 28: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 29: European Built-in Refrigerator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 30: European Built-in Refrigerator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 31: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 32: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 33: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 34: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 35: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 36: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 37: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 38: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 39: European Built-in Refrigerator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 40: European Built-in Refrigerator Market Volume K Unit Forecast, by Country 2020 & 2033

- Table 41: European Built-in Refrigerator Market Revenue undefined Forecast, by Application 2020 & 2033

- Table 42: European Built-in Refrigerator Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 43: European Built-in Refrigerator Market Revenue undefined Forecast, by distribution channel 2020 & 2033

- Table 44: European Built-in Refrigerator Market Volume K Unit Forecast, by distribution channel 2020 & 2033

- Table 45: European Built-in Refrigerator Market Revenue undefined Forecast, by Product Type 2020 & 2033

- Table 46: European Built-in Refrigerator Market Volume K Unit Forecast, by Product Type 2020 & 2033

- Table 47: European Built-in Refrigerator Market Revenue undefined Forecast, by Geography 2020 & 2033

- Table 48: European Built-in Refrigerator Market Volume K Unit Forecast, by Geography 2020 & 2033

- Table 49: European Built-in Refrigerator Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 50: European Built-in Refrigerator Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the European Built-in Refrigerator Market?

The projected CAGR is approximately 5.2%.

2. Which companies are prominent players in the European Built-in Refrigerator Market?

Key companies in the market include General Electric Co ltd, LG Corp , Miele, Liebherrr, Haier, Whirlpool, Electrolux AB, SAMSUNG Electronics, Bosch Ltd.

3. What are the main segments of the European Built-in Refrigerator Market?

The market segments include Application, distribution channel, Product Type, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Growing Consumption of Frozen Food Products is Driving the Market.

6. What are the notable trends driving market growth?

Increase in Online Purchase of Household Appliances.

7. Are there any restraints impacting market growth?

Rising Awareness on Environmental Protection to Hinder the Market Growth.

8. Can you provide examples of recent developments in the market?

In March 2022, the EU's new energy label requirements were enacted. All white goods sold in EU countries from this time will need to feature an updated sticker communicating their energy rating, with the current classifications of 'A+,' 'A++,' and 'A+++' replaced by a new scale of lettering from A to G, with 'A' being the most ecologically friendly. This could entail manufacturers undertaking significant work to bring their models up to the desired rating.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "European Built-in Refrigerator Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the European Built-in Refrigerator Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the European Built-in Refrigerator Market?

To stay informed about further developments, trends, and reports in the European Built-in Refrigerator Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence