Key Insights

The Turkish floor covering market is projected for significant expansion, expected to reach a market size of 0.74 billion by 2024, with a robust Compound Annual Growth Rate (CAGR) of 4.09%. This growth is propelled by a dynamic construction sector, rising disposable incomes, and increased demand from the commercial real estate segment, particularly in hospitality and retail. Government-led urbanization and infrastructure development initiatives further bolster demand for premium floor coverings, supporting a diverse market that includes both traditional and contemporary solutions.

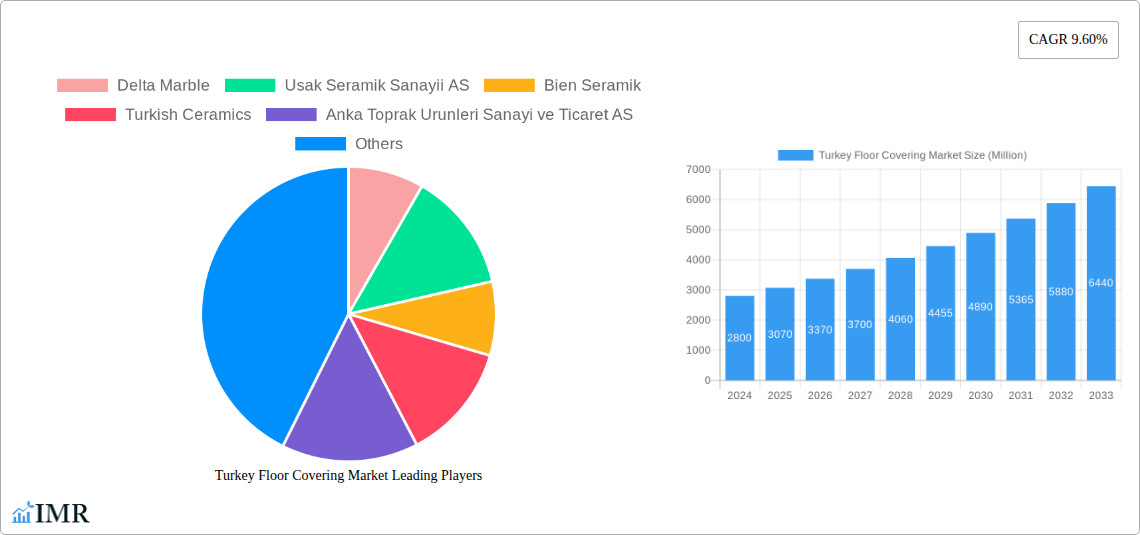

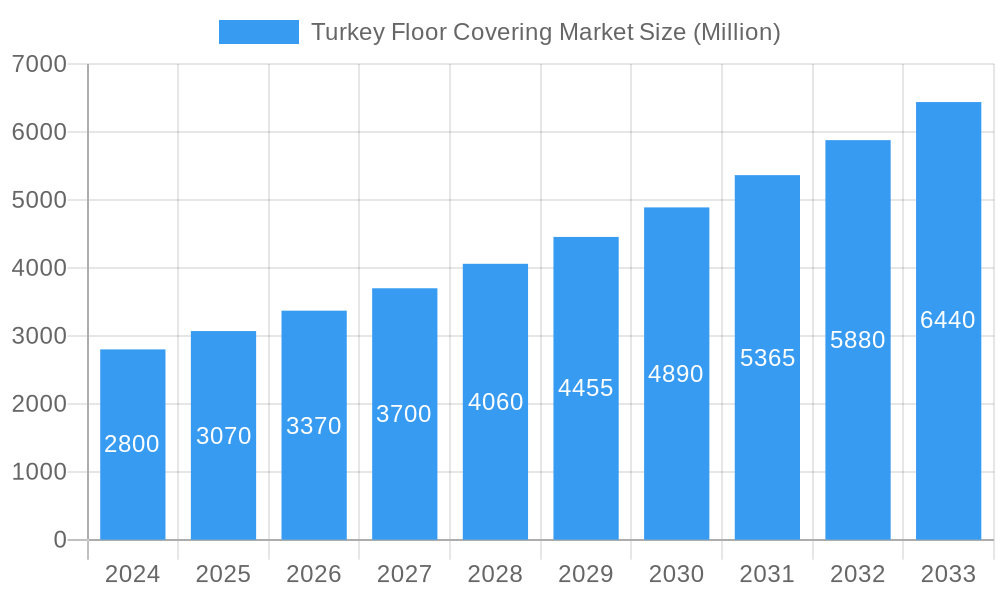

Turkey Floor Covering Market Market Size (In Million)

Key flooring categories within the Turkish market include resilient options such as vinyl, alongside substantial demand for non-resilient materials like ceramic, wood, and stone. Carpets and area rugs also hold a significant share, meeting diverse aesthetic and comfort needs. Distribution is facilitated through established networks of contractors, specialty stores, and home centers. Primary end-user segments comprise residential renovations, commercial projects, and new residential construction. Leading companies, including Usak Seramik Sanayii AS, Bien Seramik, and Graniser, are instrumental in driving market evolution through innovation and strategic collaborations. While market prospects are positive, potential challenges such as fluctuating raw material costs and a growing consumer preference for sustainable products require strategic consideration.

Turkey Floor Covering Market Company Market Share

This comprehensive report offers an in-depth analysis of the Turkish floor covering market, providing essential insights into market dynamics, growth trajectories, regional influence, and the competitive environment from 2019 to 2033, with 2024 as the base year. The analysis includes a detailed examination of parent and child markets, with all data presented in billion units. This report is designed to equip industry professionals with the strategic intelligence necessary to navigate the evolving Turkish flooring industry, capitalize on emerging opportunities, and effectively address challenges within the resilient flooring, carpet and area rugs, wood flooring, ceramic tile, and laminate flooring segments.

Turkey Floor Covering Market Market Dynamics & Structure

The Turkey floor covering market exhibits a moderate concentration, with key players like Delta Marble, Usak Seramik Sanayii AS, Bien Seramik, Turkish Ceramics, Anka Toprak Urunleri Sanayi ve Ticaret AS, Karoistanbul, Graniser, Okur Zemin, Tureks, and Polyflor Ltd. actively competing. Technological innovation is a significant driver, with advancements in sustainable materials, digital printing for ceramic tiles, and enhanced durability for resilient flooring influencing product development. The regulatory framework, particularly concerning environmental standards and construction safety, shapes manufacturing processes and product adoption. Competitive product substitutes are abundant, ranging from natural stone and wood to modern vinyl and carpet solutions, each catering to different aesthetic preferences and budget considerations. End-user demographics are shifting, with an increasing demand for aesthetically pleasing, durable, and eco-friendly flooring solutions in both residential and commercial sectors. Merger and acquisition (M&A) trends, while not excessively dominant, reflect a strategic consolidation of smaller players and expansion of product portfolios by larger entities.

- Market Concentration: Moderate, with several established domestic and international manufacturers.

- Technological Innovation Drivers: Sustainability in material sourcing, advanced manufacturing techniques (e.g., digital inkjet printing for ceramics), improved product performance (e.g., scratch resistance, water repellency).

- Regulatory Frameworks: Growing emphasis on eco-labeling, energy efficiency, and adherence to international building codes.

- Competitive Product Substitutes: Wide array of options from natural materials to synthetic alternatives, driven by cost, aesthetics, and performance.

- End-User Demographics: Maturing middle class driving demand for premium and customized flooring; growing awareness of health and wellness impacting material choices.

- M&A Trends: Strategic acquisitions aimed at market share expansion and diversification of product offerings.

Turkey Floor Covering Market Growth Trends & Insights

The Turkey floor covering market is projected for robust growth, driven by several interconnected factors. The Turkish construction sector, a primary consumer of floor coverings, is experiencing a sustained recovery and expansion, fueled by both domestic infrastructure projects and ongoing urbanization. This trend directly translates to an increased demand for a wide spectrum of flooring materials, from durable ceramic tiles for commercial spaces to aesthetically pleasing wood and laminate flooring for residential applications. Consumer preferences are evolving, with a noticeable shift towards higher-quality, aesthetically sophisticated, and eco-conscious flooring solutions. This is evidenced by the growing popularity of engineered wood, luxury vinyl tiles (LVT), and carpets made from recycled materials. The home renovation and replacement market is also a significant contributor, as homeowners increasingly invest in upgrading their living spaces with modern and visually appealing flooring. Furthermore, technological advancements in manufacturing are leading to more innovative and cost-effective production of existing and new materials, such as advanced vinyl compositions and high-resolution printed ceramic tiles, making them more accessible to a broader consumer base. The forecast period (2025-2033) anticipates a sustained Compound Annual Growth Rate (CAGR) of approximately 6.5%, with the market size expected to reach 1,250 million units by 2033. The adoption rate of LVT and SPC (Stone Plastic Composite) flooring is expected to witness a substantial surge, driven by their versatility, water resistance, and ease of installation. The online retail channel for floor coverings is also gaining traction, offering consumers greater convenience and access to a wider variety of products. The interplay of economic stability, rising disposable incomes, and a continued focus on improving living standards will remain pivotal in shaping the trajectory of the Turkish flooring industry.

- Market Size Evolution: Expected to grow from an estimated 780 million units in 2025 to 1,250 million units by 2033.

- CAGR: Projected at approximately 6.5% during the forecast period (2025-2033).

- Adoption Rates: Significant increase in LVT and SPC flooring adoption due to superior performance characteristics.

- Technological Disruptions: Innovations in sustainable materials and advanced manufacturing processes are driving product differentiation and cost efficiencies.

- Consumer Behavior Shifts: Growing preference for aesthetic appeal, durability, ease of maintenance, and eco-friendly options.

- Market Penetration: Increasing penetration of premium and specialized flooring solutions in both residential and commercial segments.

Dominant Regions, Countries, or Segments in Turkey Floor Covering Market

Within the Turkey floor covering market, Istanbul emerges as the dominant region, driven by its status as the country's economic and population hub, alongside a robust construction and renovation pipeline. This metropolis commands a significant share in almost all product segments. Ceramic Flooring stands out as a leading segment within the Non-resilent Flooring category, boasting strong domestic production capabilities and export potential, with companies like Usak Seramik Sanayii AS and Bien Seramik playing a pivotal role. The Resilent Flooring segment, particularly Vinyl Flooring (including LVT and SPC), is experiencing rapid growth, outpacing traditional materials in certain applications due to its versatility, cost-effectiveness, and performance. This segment is further bolstered by the increasing popularity of Builder as an end-user segment, where developers opt for these materials in new construction projects for their balance of aesthetics and practicality.

The Contractors distribution channel holds substantial sway, as they are instrumental in specifying and installing flooring solutions in both residential and commercial projects. Their purchasing decisions are influenced by factors such as product availability, ease of installation, durability, and client satisfaction. In terms of end-users, the Residential Replacement market, fueled by a growing middle class with disposable income and a desire for home improvement, represents a significant growth driver. However, the Commercial sector, encompassing retail spaces, offices, hotels, and healthcare facilities, also contributes substantially, demanding durable, aesthetically pleasing, and highly functional flooring solutions.

- Dominant Region: Istanbul, due to its high population density, economic activity, and extensive construction projects.

- Dominant Segment (Material): Ceramic Flooring, supported by strong domestic manufacturing and export capabilities.

- Growth Segment (Material): Vinyl Flooring (LVT/SPC), driven by its versatility, durability, and aesthetic appeal.

- Dominant Distribution Channel: Contractors, who are key influencers and installers in major projects.

- Key End User Segments: Residential Replacement and Commercial sectors, each with distinct demand drivers.

- Growth Factors for Dominance:

- Ceramic Flooring: Strong production capacity, wide variety of designs, export potential.

- Vinyl Flooring: Cost-effectiveness, water resistance, ease of installation, modern aesthetics.

- Contractors: Influence in project specifications and installation expertise.

- Residential Replacement: Rising disposable incomes, desire for home upgrades.

- Commercial: Demand for durable, functional, and aesthetically pleasing spaces.

Turkey Floor Covering Market Product Landscape

The Turkey floor covering market product landscape is characterized by a dynamic blend of traditional materials and innovative solutions. Ceramic flooring continues to evolve with advanced digital printing technologies that replicate natural textures like wood and stone with remarkable accuracy. The resilient flooring sector is witnessing a surge in LVT and SPC, offering enhanced durability, water resistance, and sophisticated designs, making them ideal for high-traffic areas and moisture-prone environments. Carpet and area rugs are seeing innovation in sustainable fibers and stain-resistant treatments, catering to environmentally conscious consumers and families. Wood flooring, while facing competition, is experiencing a resurgence with engineered wood options that offer greater stability and wider plank formats. Stone flooring remains a premium choice, with ongoing advancements in sealing and finishing techniques to improve longevity and reduce maintenance.

Key Drivers, Barriers & Challenges in Turkey Floor Covering Market

Key Drivers:

- Robust Construction Activity: A steadily growing construction sector, driven by urbanization and infrastructure development, fuels demand across all flooring categories.

- Rising Disposable Incomes: Increasing purchasing power among the Turkish population allows for greater investment in home renovation and upgrades.

- Technological Advancements: Innovations in manufacturing processes and material science are leading to more durable, aesthetically appealing, and cost-effective flooring solutions.

- Growing Environmental Awareness: A significant shift towards sustainable and eco-friendly flooring options is influencing consumer choices and product development.

Barriers & Challenges:

- Raw Material Price Volatility: Fluctuations in the prices of raw materials, such as PVC, ceramics, and natural fibers, can impact manufacturing costs and profit margins.

- Intense Competition: The market is highly competitive, with numerous domestic and international players vying for market share, leading to price pressures.

- Economic Instability: Potential economic downturns or currency fluctuations can affect consumer spending on non-essential home improvement items.

- Skilled Labor Shortages: A lack of adequately skilled labor for installation, particularly for specialized flooring types, can hinder market growth.

- Supply Chain Disruptions: Global supply chain issues can impact the availability of certain raw materials and finished products.

Emerging Opportunities in Turkey Floor Covering Market

Emerging opportunities in the Turkey floor covering market lie in the burgeoning demand for sustainable and eco-friendly flooring solutions, including recycled content carpets and FSC-certified wood products. The increasing adoption of smart home technology presents an opportunity for the integration of flooring with smart systems, such as temperature control or integrated lighting. The growth of e-commerce and direct-to-consumer (DTC) models offers untapped potential for smaller manufacturers and specialized product lines to reach a wider customer base. Furthermore, the ongoing renovation of older commercial properties and residential buildings creates a sustained demand for modern, high-performance flooring that meets contemporary aesthetic and functional requirements.

Growth Accelerators in the Turkey Floor Covering Market Industry

Long-term growth in the Turkey floor covering market is being accelerated by significant investments in research and development, leading to the creation of next-generation flooring materials with superior performance characteristics, such as enhanced scratch resistance, antimicrobial properties, and improved acoustic insulation. Strategic partnerships between manufacturers, designers, and construction firms are fostering collaborative innovation and the development of integrated flooring solutions. The Turkish government's initiatives to promote exports and attract foreign investment are also playing a crucial role in expanding the market's reach and driving growth. Furthermore, the increasing urbanization and the construction of modern residential and commercial complexes will continue to provide a consistent demand for diverse flooring options.

Key Players Shaping the Turkey Floor Covering Market Market

- Delta Marble

- Usak Seramik Sanayii AS

- Bien Seramik

- Turkish Ceramics

- Anka Toprak Urunleri Sanayi ve Ticaret AS

- Karoistanbul

- Graniser

- Okur Zemin

- Tureks

- Polyflor Ltd

Notable Milestones in Turkey Floor Covering Market Sector

- 2019: Introduction of advanced digital printing techniques for ceramic tiles by leading manufacturers, enhancing design possibilities and realism.

- 2020: Increased focus on sustainable material sourcing and production methods, driven by growing consumer demand for eco-friendly products.

- 2021: Significant growth in the adoption of Luxury Vinyl Tile (LVT) and Stone Plastic Composite (SPC) flooring in both residential and commercial sectors.

- 2022: Expansion of export markets for Turkish ceramic and resilient flooring products, driven by competitive pricing and quality.

- 2023: Introduction of antimicrobial coatings and enhanced hygiene features in various flooring materials to cater to post-pandemic consumer concerns.

- 2024: Increased investment in e-commerce platforms and online sales channels by flooring retailers and manufacturers.

In-Depth Turkey Floor Covering Market Market Outlook

The Turkey floor covering market is poised for sustained and dynamic growth, driven by a confluence of favorable economic conditions, technological innovation, and evolving consumer preferences. The continued expansion of the construction sector, coupled with rising disposable incomes, will fuel demand across all flooring segments, from high-end stone and wood to versatile resilient options. Strategic investments in R&D and manufacturing will ensure the continuous introduction of innovative, sustainable, and high-performance products. Opportunities for market expansion, particularly in emerging regions and through diversified distribution channels, are abundant. Industry players that prioritize sustainability, embrace digital transformation, and adapt to changing consumer demands will be best positioned to capitalize on the promising future of the Turkish flooring industry.

Turkey Floor Covering Market Segmentation

-

1. Material

- 1.1. Carpet and Area Rugs

-

1.2. Resilent Flooring

- 1.2.1. Vinyl Flooring

- 1.2.2. Other Resilient Flooring

-

1.3. Non-resilent Flooring

- 1.3.1. Wood Flooring

- 1.3.2. Ceramic Flooring

- 1.3.3. Laminate Flooring

- 1.3.4. Stone Flooring

-

2. Distribution Channel

- 2.1. Contractors

- 2.2. Specialty Stores

- 2.3. Home Centers

- 2.4. Other Distribution Channels

-

3. End User

- 3.1. Residential Replacement

- 3.2. Commercial

- 3.3. Builder

Turkey Floor Covering Market Segmentation By Geography

- 1. Turkey

Turkey Floor Covering Market Regional Market Share

Geographic Coverage of Turkey Floor Covering Market

Turkey Floor Covering Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.09% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Urbanization is Driving the Market; Increase in Rising Disposable Income

- 3.3. Market Restrains

- 3.3.1. Price Sensitivity is a Significant Challenge in the Indian Furniture Market

- 3.4. Market Trends

- 3.4.1. Global Recognition and Demand for Turkish Carpets are Driving the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Turkey Floor Covering Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Material

- 5.1.1. Carpet and Area Rugs

- 5.1.2. Resilent Flooring

- 5.1.2.1. Vinyl Flooring

- 5.1.2.2. Other Resilient Flooring

- 5.1.3. Non-resilent Flooring

- 5.1.3.1. Wood Flooring

- 5.1.3.2. Ceramic Flooring

- 5.1.3.3. Laminate Flooring

- 5.1.3.4. Stone Flooring

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Contractors

- 5.2.2. Specialty Stores

- 5.2.3. Home Centers

- 5.2.4. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by End User

- 5.3.1. Residential Replacement

- 5.3.2. Commercial

- 5.3.3. Builder

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Turkey

- 5.1. Market Analysis, Insights and Forecast - by Material

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Delta Marble

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Usak Seramik Sanayii AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Bien Seramik

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Turkish Ceramics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Anka Toprak Urunleri Sanayi ve Ticaret AS

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Karoistanbul

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Graniser

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Okur Zemin

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Tureks

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Polyflor Ltd

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Delta Marble

List of Figures

- Figure 1: Turkey Floor Covering Market Revenue Breakdown (billion, %) by Product 2025 & 2033

- Figure 2: Turkey Floor Covering Market Share (%) by Company 2025

List of Tables

- Table 1: Turkey Floor Covering Market Revenue billion Forecast, by Material 2020 & 2033

- Table 2: Turkey Floor Covering Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 3: Turkey Floor Covering Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 4: Turkey Floor Covering Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 5: Turkey Floor Covering Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Turkey Floor Covering Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 7: Turkey Floor Covering Market Revenue billion Forecast, by Region 2020 & 2033

- Table 8: Turkey Floor Covering Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Turkey Floor Covering Market Revenue billion Forecast, by Material 2020 & 2033

- Table 10: Turkey Floor Covering Market Volume K Unit Forecast, by Material 2020 & 2033

- Table 11: Turkey Floor Covering Market Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 12: Turkey Floor Covering Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 13: Turkey Floor Covering Market Revenue billion Forecast, by End User 2020 & 2033

- Table 14: Turkey Floor Covering Market Volume K Unit Forecast, by End User 2020 & 2033

- Table 15: Turkey Floor Covering Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Turkey Floor Covering Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Turkey Floor Covering Market?

The projected CAGR is approximately 4.09%.

2. Which companies are prominent players in the Turkey Floor Covering Market?

Key companies in the market include Delta Marble, Usak Seramik Sanayii AS, Bien Seramik, Turkish Ceramics, Anka Toprak Urunleri Sanayi ve Ticaret AS, Karoistanbul, Graniser, Okur Zemin, Tureks, Polyflor Ltd.

3. What are the main segments of the Turkey Floor Covering Market?

The market segments include Material, Distribution Channel, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 0.74 billion as of 2022.

5. What are some drivers contributing to market growth?

Growing Urbanization is Driving the Market; Increase in Rising Disposable Income.

6. What are the notable trends driving market growth?

Global Recognition and Demand for Turkish Carpets are Driving the Market.

7. Are there any restraints impacting market growth?

Price Sensitivity is a Significant Challenge in the Indian Furniture Market.

8. Can you provide examples of recent developments in the market?

N/A

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Turkey Floor Covering Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Turkey Floor Covering Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Turkey Floor Covering Market?

To stay informed about further developments, trends, and reports in the Turkey Floor Covering Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence