Key Insights

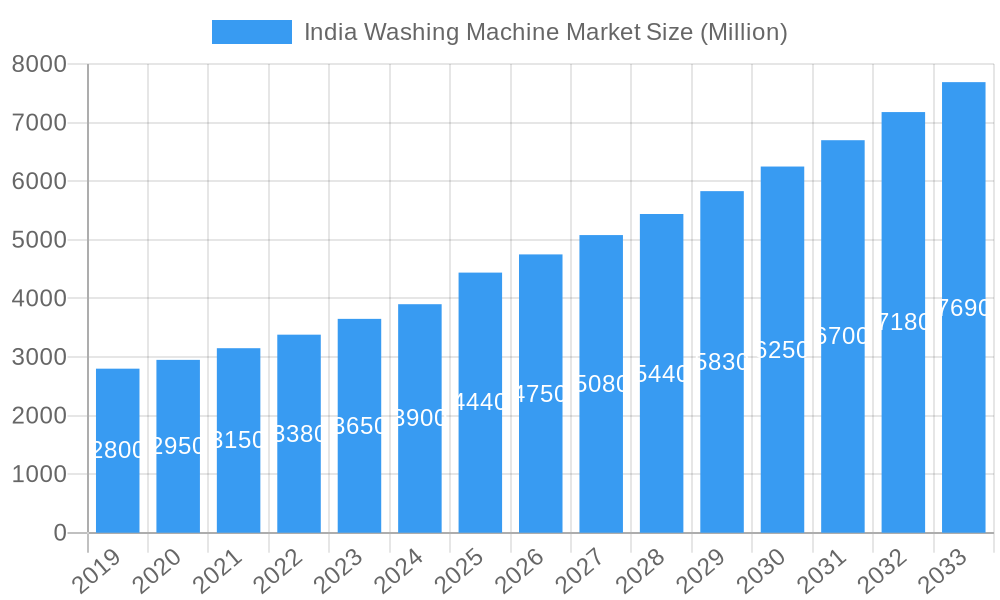

The Indian washing machine market is poised for robust growth, projected to reach approximately INR 4,440 million by 2025 and expand at a significant Compound Annual Growth Rate (CAGR) of 7.14% through 2033. This upward trajectory is primarily fueled by a burgeoning middle class with increasing disposable incomes, a growing preference for modern conveniences, and a rising awareness of the time-saving benefits offered by automated laundry solutions. The increasing urbanization across India also plays a crucial role, as smaller living spaces often necessitate compact and efficient appliances, making washing machines a desirable home essential. Furthermore, the government's focus on improving living standards and promoting consumer durables through various initiatives further underpins this market expansion. Key drivers include the demand for energy-efficient models, the growing adoption of smart home technology, and a shift towards premium and feature-rich washing machines.

India Washing Machine Market Market Size (In Billion)

The market segmentation reveals a dynamic landscape. Fully automatic washing machines are expected to dominate, driven by consumer demand for convenience and advanced features, while semi-automatic models will continue to cater to budget-conscious segments. Within types, both front-load and top-load machines will see sustained demand, with front-load models gaining traction due to their superior washing performance and water efficiency. The distribution channels are also evolving, with online sales platforms emerging as a significant force, offering wider reach and competitive pricing. Supermarkets and hypermarkets, along with specialty stores, will continue to play a vital role, providing consumers with the opportunity for hands-on product evaluation. Key players like Samsung, LG, Whirlpool, and Bosch are actively investing in product innovation and expanding their distribution networks to capture a larger market share in this highly competitive environment.

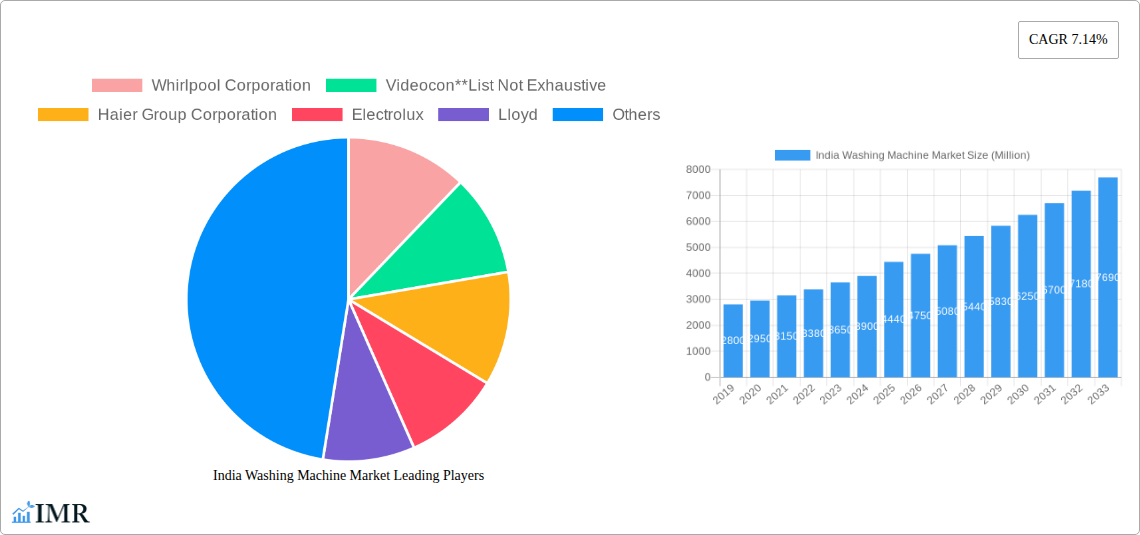

India Washing Machine Market Company Market Share

Unlock deep insights into the burgeoning India Washing Machine Market with this comprehensive report. Analyze parent and child market dynamics, front load washing machine market trends, top load washing machine market evolution, and the rising adoption of fully automatic washing machines and semi-automatic washing machines. This report provides an in-depth forecast for the Indian home appliance market, specifically focusing on washing machine sales in India from 2019 to 2033, with a base year of 2025. Discover market size in million units, understand competitive landscapes, and identify growth opportunities driven by AI washing machines, smart washing machines, and innovations from leading players like Samsung India, LG Electronics India, Whirlpool India, Haier India, Bosch India, and IFB Appliances.

India Washing Machine Market Market Dynamics & Structure

The India Washing Machine Market is characterized by a moderate to high concentration, with a few key players dominating market share. This intensity is driven by significant investment in technological innovation, particularly in areas like energy efficiency, smart features, and advanced fabric care. Regulatory frameworks, including those related to energy consumption standards and consumer protection, play a crucial role in shaping product development and market entry strategies. Competitive product substitutes, ranging from basic semi-automatic models to high-end smart front-load machines, cater to a diverse consumer base. End-user demographics are shifting, with increasing urbanization, a growing middle class, and a rising disposable income fueling demand for advanced appliances. Mergers and acquisitions (M&A) trends, while not as frequent as in some mature markets, contribute to market consolidation and expansion. For instance, strategic partnerships and acquisitions can significantly alter the competitive landscape. Key innovation drivers include the demand for convenience, water and energy savings, and integrated smart home solutions. Barriers to entry for new players include high capital investment, established brand loyalty, and the need for robust distribution networks. The market is projected to see sustained growth, driven by the increasing penetration of washing machines in Tier 2 and Tier 3 cities.

- Market Concentration: Dominated by a few major players, indicating a competitive yet consolidated market structure.

- Technological Innovation Drivers: Focus on energy efficiency (e.g., inverter technology), AI-powered features, smart connectivity (IoT), and diverse wash programs.

- Regulatory Frameworks: Adherence to BEE star ratings, safety standards, and import-export regulations influencing product design and market access.

- Competitive Product Substitutes: Wide range from basic semi-automatic to premium AI-enabled front-load machines, catering to varied price points and needs.

- End-User Demographics: Increasing urbanization, a growing nuclear family structure, rising disposable incomes, and a preference for convenience and time-saving solutions.

- M&A Trends: Strategic partnerships and potential acquisitions aimed at market expansion, technology acquisition, and strengthening distribution channels.

India Washing Machine Market Growth Trends & Insights

The India Washing Machine Market has witnessed robust growth over the historical period (2019-2024), driven by increasing consumer awareness, improving affordability, and a growing demand for convenience. The market size, valued in million units, is projected to experience a healthy Compound Annual Growth Rate (CAGR) during the forecast period (2025-2033). This growth is fueled by a combination of factors, including the expanding middle class, a shift towards semi-urban and rural penetration, and the rising aspirational value attached to modern home appliances. Adoption rates for fully automatic washing machines are steadily increasing, eclipsing semi-automatic models as consumers prioritize ease of use and better wash quality. Technological disruptions, such as the integration of Artificial Intelligence (AI) for optimizing wash cycles and energy consumption, are reshaping consumer preferences and driving demand for premium segments. Consumer behavior shifts are evident, with a growing preference for larger capacity machines to accommodate the needs of growing families and a greater emphasis on durability and energy efficiency. The online sales of washing machines have also emerged as a significant channel, offering wider reach and competitive pricing. The market penetration of washing machines, while high in urban areas, still offers substantial room for growth in Tier 2 and Tier 3 cities, making it a key focus for manufacturers and distributors. The overall market trajectory indicates a sustained upward trend, underpinned by favorable economic conditions and evolving consumer lifestyles.

Dominant Regions, Countries, or Segments in India Washing Machine Market

The India Washing Machine Market exhibits significant regional variations and segment dominance. Fully Automatic Washing Machines represent the leading segment, driven by strong consumer preference for convenience and superior wash performance. Within this, Front Load Washing Machines are experiencing faster growth due to their advanced features, energy efficiency, and gentler fabric care capabilities, although Top Load Washing Machines continue to hold a significant market share due to their affordability and ease of use in certain demographics. Geographically, the Western region of India, encompassing states like Maharashtra, Gujarat, and Rajasthan, often leads in terms of market size and adoption of advanced washing machine technologies. This dominance is attributable to a higher concentration of disposable income, a larger urban population, and a strong presence of organized retail channels. Economic policies promoting domestic manufacturing and consumer spending, coupled with well-developed infrastructure, further bolster growth in these regions.

- Leading Segment (Technology): Fully Automatic Washing Machines

- Key Drivers: Increasing disposable income, desire for convenience, superior wash quality, and advanced features.

- Market Share Contribution: Expected to continue its upward trend, capturing a larger share from semi-automatic models.

- Leading Segment (Type): While both Front Load and Top Load are significant, Front Load is the faster-growing segment.

- Front Load Drivers: Energy and water efficiency, advanced wash programs, gentler fabric care, premium appeal.

- Top Load Drivers: Affordability, ease of use for smaller loads, familiarity.

- Dominant Geographical Region: Western India (Maharashtra, Gujarat, Rajasthan)

- Dominance Factors: Higher disposable income, higher urbanization rates, strong presence of organized retail, proactive government incentives for appliance adoption.

- Growth Potential: Continued expansion into Tier 2 and Tier 3 cities within these regions.

- Key Distribution Channel: Online channels and Specialty Stores are increasingly important, complementing Supermarkets and Hypermarkets.

- Online Channel Drivers: Wider reach, competitive pricing, convenience of doorstep delivery, easy comparison of features.

- Specialty Store Drivers: Expert advice, product demonstrations, enhanced customer experience.

India Washing Machine Market Product Landscape

The India Washing Machine Market product landscape is dynamic, marked by continuous innovation. Manufacturers are focusing on developing washing machines with enhanced energy and water efficiency ratings, catering to the growing environmental consciousness of Indian consumers. Key product innovations include the integration of AI and IoT capabilities, enabling features like personalized wash cycles, remote control via smartphone apps, and predictive maintenance. AI EcobubbleTM technology, as seen in Samsung's latest launches, offers superior fabric care by penetrating clothes faster. Similarly, AI-enabled Direct Motion Motor technology from Haier ensures quieter operation and better durability. Other notable advancements include improved drum designs for gentler fabric handling, specialized wash programs for Indian fabrics and climate conditions, and enhanced safety features like soft-closing lids and child locks. Performance metrics are increasingly being measured by wash effectiveness, energy consumption (kWh per cycle), water usage, noise levels, and durability. The trend is towards smarter, more efficient, and user-friendly appliances that simplify the laundry experience.

Key Drivers, Barriers & Challenges in India Washing Machine Market

Key Drivers:

- Rising Disposable Income: A growing middle class with increased purchasing power fuels demand for home appliances.

- Urbanization and Shifting Lifestyles: Increasing nuclear families and a faster pace of life necessitate convenient and time-saving solutions.

- Technological Advancements: Introduction of AI-powered features, energy-efficient technologies, and smart connectivity enhances product appeal.

- Government Initiatives: Schemes promoting manufacturing and consumer spending contribute to market growth.

- Increasing Brand Awareness and Consumer Education: Growing awareness of the benefits of advanced washing machines drives adoption.

Barriers & Challenges:

- Price Sensitivity: A significant portion of the Indian market remains price-sensitive, limiting adoption of premium models.

- Infrastructure Gaps: Inadequate electricity and water supply in some rural and semi-urban areas can hinder the adoption of advanced washing machines.

- Intense Competition: A crowded market with numerous players leads to price wars and pressure on profit margins.

- Supply Chain Disruptions: Global and local supply chain issues can impact raw material availability and production timelines.

- After-Sales Service Network: Establishing and maintaining an efficient after-sales service network across a vast country remains a challenge.

Emerging Opportunities in India Washing Machine Market

Emerging opportunities in the India Washing Machine Market lie in untapped rural and semi-urban markets, where penetration is still relatively low. Manufacturers can focus on developing more affordable, yet feature-rich, washing machines tailored to the specific needs and economic capabilities of these regions. The growing demand for sustainable and eco-friendly appliances presents an opportunity for brands to highlight and further innovate in energy and water-efficient technologies. The integration of advanced IoT features for seamless smart home integration is another significant avenue, appealing to the tech-savvy urban consumer. Furthermore, the increasing focus on health and hygiene is driving demand for washing machines with specialized sterilization and sanitization cycles. Developing niche products, such as compact washing machines for smaller living spaces or specialized machines for specific fabric types, could also unlock new market segments.

Growth Accelerators in the India Washing Machine Market Industry

Several catalysts are accelerating long-term growth in the India Washing Machine Market. Technological breakthroughs, particularly in the realm of AI and machine learning, are leading to more intelligent and efficient washing machines that appeal to a wider consumer base. Strategic partnerships between manufacturers and e-commerce platforms are crucial for expanding reach and facilitating sales, especially in remote areas. Furthermore, government incentives aimed at boosting domestic manufacturing under initiatives like "Make in India" are driving investment and innovation. Market expansion strategies, including increased focus on after-sales service and customer support, are building consumer confidence and loyalty. The continuous introduction of differentiated products that address specific consumer pain points, such as water scarcity or electricity fluctuations, will also act as significant growth accelerators.

Key Players Shaping the India Washing Machine Market Market

- Whirlpool Corporation

- Videocon

- Haier Group Corporation

- Electrolux

- Lloyd

- Godrej

- IFB

- Bosch

- Samsung India Electronics Ltd

- LG Electronic Inc

Notable Milestones in India Washing Machine Market Sector

- March 2024: Samsung launched a new lineup of AI EcobubbleTM fully automatic front-load washing machines, pioneering the 11 kg category with AI Wash, Q-DriveTM, and Auto Dispense.

- September 2023: Haier India introduced AI-enabled 959 Direct Motion Motor Fully Automatic Front Load Washing Machines, emphasizing its 'Make in India, Made for India' mission and smart home solutions.

- May 2023: Samsung unveiled its latest range of semi-automatic washing machines in India, featuring Soft Closing, Toughened Glass Lid, and Dual Magic Filter for an enhanced user experience.

In-Depth India Washing Machine Market Market Outlook

The India Washing Machine Market is poised for sustained and robust growth, driven by a confluence of favorable factors. The increasing disposable incomes, rapid urbanization, and a growing preference for convenience and advanced home solutions will continue to propel demand across both urban and semi-urban landscapes. The ongoing technological evolution, particularly the integration of AI and smart features, will redefine product offerings and consumer expectations, creating a market for premium and technologically advanced washing machines. Opportunities in Tier 2 and Tier 3 cities, coupled with government support for domestic manufacturing, present a significant avenue for market expansion. Strategic initiatives by key players to enhance their distribution networks and after-sales service will further solidify market penetration and consumer trust, ensuring a bright and dynamic future for the Indian washing machine industry.

India Washing Machine Market Segmentation

-

1. Type

- 1.1. Front Load

- 1.2. Top Load

-

2. Technology

- 2.1. Fully Automatic

- 2.2. Semi Automatic

-

3. Distribution Channel

- 3.1. Supermarkets and Hypermarkets

- 3.2. Specialty Stores

- 3.3. Online

- 3.4. Other Distribution Channels

India Washing Machine Market Segmentation By Geography

- 1. India

India Washing Machine Market Regional Market Share

Geographic Coverage of India Washing Machine Market

India Washing Machine Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 7.14% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing disposable income and consumer spending; Increasing purchasing power and rapid urbanization

- 3.3. Market Restrains

- 3.3.1. Technological Disruptions Challenges Market Growth; Supply Chain Disruptions Impedes Market Growth

- 3.4. Market Trends

- 3.4.1. The Enhancement of Smart Home Technology is Driving Additional Expansion in the Washing Machine Industry.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Washing Machine Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Type

- 5.1.1. Front Load

- 5.1.2. Top Load

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Fully Automatic

- 5.2.2. Semi Automatic

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Supermarkets and Hypermarkets

- 5.3.2. Specialty Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. India

- 5.1. Market Analysis, Insights and Forecast - by Type

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Videocon**List Not Exhaustive

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haier Group Corporation

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Electrolux

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Lloyd

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Godrej

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 IFB

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Bosch

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Samsung India Electronics Ltd

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronic Inc

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: India Washing Machine Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Washing Machine Market Share (%) by Company 2025

List of Tables

- Table 1: India Washing Machine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 2: India Washing Machine Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 3: India Washing Machine Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 4: India Washing Machine Market Revenue Million Forecast, by Region 2020 & 2033

- Table 5: India Washing Machine Market Revenue Million Forecast, by Type 2020 & 2033

- Table 6: India Washing Machine Market Revenue Million Forecast, by Technology 2020 & 2033

- Table 7: India Washing Machine Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 8: India Washing Machine Market Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Washing Machine Market?

The projected CAGR is approximately 7.14%.

2. Which companies are prominent players in the India Washing Machine Market?

Key companies in the market include Whirlpool Corporation, Videocon**List Not Exhaustive, Haier Group Corporation, Electrolux, Lloyd, Godrej, IFB, Bosch, Samsung India Electronics Ltd, LG Electronic Inc.

3. What are the main segments of the India Washing Machine Market?

The market segments include Type, Technology, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 4.44 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing disposable income and consumer spending; Increasing purchasing power and rapid urbanization.

6. What are the notable trends driving market growth?

The Enhancement of Smart Home Technology is Driving Additional Expansion in the Washing Machine Industry..

7. Are there any restraints impacting market growth?

Technological Disruptions Challenges Market Growth; Supply Chain Disruptions Impedes Market Growth.

8. Can you provide examples of recent developments in the market?

In March 2024, Samsung, the leading consumer electronics brand in India, launched a new lineup of AI EcobubbleTM fully automatic front-load washing machines. This latest series of washing machines is the pioneer in the 11 kg category, offering innovative features such as AI Wash, Q-DriveTM, and Auto Dispense.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Washing Machine Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Washing Machine Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Washing Machine Market?

To stay informed about further developments, trends, and reports in the India Washing Machine Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence