Key Insights

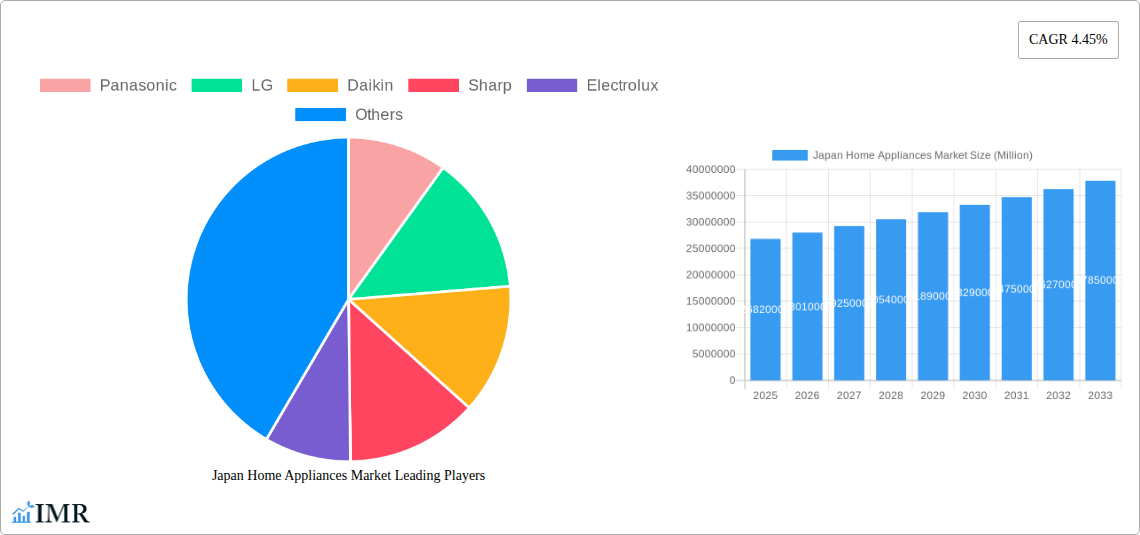

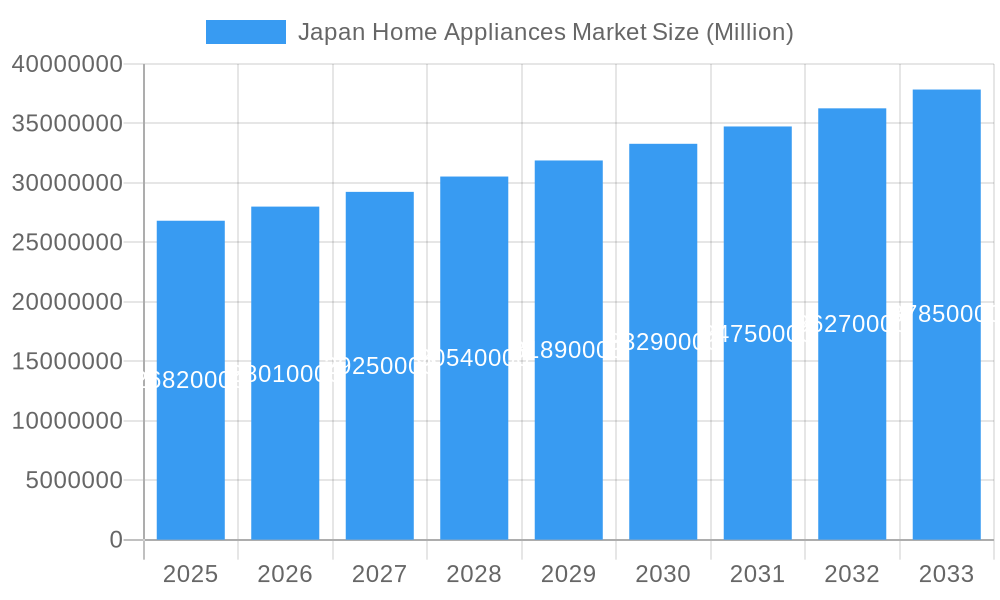

The Japan Home Appliances Market is poised for substantial growth, projected to reach a significant valuation of $26.82 million by 2025, with a robust Compound Annual Growth Rate (CAGR) of 4.45% anticipated throughout the forecast period of 2025-2033. This upward trajectory is primarily driven by increasing consumer demand for energy-efficient and technologically advanced appliances, reflecting a growing awareness of environmental sustainability and a preference for smart home solutions. The aging population in Japan also contributes to this demand, with a need for user-friendly and convenient appliances that simplify daily life. Furthermore, rising disposable incomes among households, coupled with evolving lifestyle trends that emphasize comfort and convenience, are key factors fueling market expansion. The market is witnessing a significant shift towards smart and connected appliances, integrating IoT capabilities for enhanced functionality and remote control, catering to the tech-savvy Japanese consumer.

Japan Home Appliances Market Market Size (In Million)

The market segmentation reveals a balanced performance across both Major Appliances and Small Appliances. Within Major Appliances, Refrigerators and Air Conditioners are expected to lead due to their essential nature and continuous innovation in energy efficiency and smart features. Washing Machines and Dishwashing Machines also represent strong segments, addressing the need for convenience and time-saving solutions. In the Small Appliances category, Coffee or Tea Makers and Vacuum Cleaners are gaining traction, driven by changing consumer preferences for convenience and a desire for a higher quality of life at home. The distribution channels are evolving, with a notable surge in online sales complementing the traditional presence of Multi-brand Stores and Exclusive Stores. This diversification in purchasing options caters to a wider consumer base and enhances market accessibility. Leading companies such as Panasonic, LG, Daikin, Sharp, Electrolux, Haier, Bosch, Toshiba, Midea Group, and Hitachi are actively investing in research and development to introduce innovative products that align with these emerging trends, further stimulating market growth.

Japan Home Appliances Market Company Market Share

Here's a compelling, SEO-optimized report description for the Japan Home Appliances Market, designed to maximize search engine visibility and engage industry professionals.

Report Title: Japan Home Appliances Market Analysis 2019-2033: Growth Drivers, Segment Dominance, and Key Player Strategies

Report Description:

Gain a comprehensive understanding of the Japan Home Appliances Market with this in-depth report. Covering the period from 2019 to 2033, with a base year of 2025, this analysis provides critical insights into the evolving landscape of major and small home appliances in Japan. Discover key market drivers, emerging opportunities, and the strategies of leading companies like Panasonic, LG, Daikin, Sharp, Electrolux, Haier, Bosch, Toshiba, Midea Group, and Hitachi. Essential for market researchers, manufacturers, distributors, and investors, this report details market size evolution, technological disruptions, consumer behavior shifts, and regional dominance. Explore the intricate dynamics of refrigerators, freezers, dishwashing machines, washing machines, ovens, air conditioners, coffee makers, food processors, vacuum cleaners, and more, alongside critical distribution channels including multi-brand stores, exclusive stores, and online platforms. Uncover the impact of recent industry developments and strategic acquisitions shaping the future of this dynamic market. All unit values are presented in Million units.

Japan Home Appliances Market Market Dynamics & Structure

The Japan Home Appliances Market exhibits a moderate to high degree of market concentration, with established global and domestic players like Panasonic, LG, and Daikin holding significant shares. Technological innovation remains a primary driver, fueled by an increasing consumer demand for energy efficiency, smart connectivity, and enhanced user convenience in both major appliances and small appliances. Regulatory frameworks, particularly those focused on environmental sustainability and appliance safety standards, play a crucial role in shaping product development and market entry strategies. Competitive product substitutes are emerging, especially in the small appliances segment, with multifunctional devices gaining traction. End-user demographics are shifting, with an aging population emphasizing reliability and ease of use, while younger generations prioritize smart features and design aesthetics. Mergers & Acquisitions (M&A) trends are notable, with strategic acquisitions aimed at expanding product portfolios, enhancing technological capabilities, and gaining market access.

- Market Concentration: Dominated by a mix of Japanese giants and international conglomerates.

- Technological Innovation Drivers: Energy efficiency, IoT integration, AI-powered functionalities, and compact designs are key.

- Regulatory Frameworks: Strict energy conservation laws and safety certifications influence product design and marketing.

- Competitive Product Substitutes: Growing adoption of multi-functional small appliances, reducing the need for single-purpose devices.

- End-User Demographics: Growing demand for user-friendly, accessible appliances for the elderly and tech-savvy features for younger demographics.

- M&A Trends: Strategic acquisitions to bolster market presence and acquire advanced technologies, as exemplified by Daikin's recent moves.

Japan Home Appliances Market Growth Trends & Insights

The Japan Home Appliances Market has witnessed consistent growth, underpinned by a strong domestic economy and a discerning consumer base that values quality and innovation. The market size evolution has been characterized by steady expansion in both the major appliances and small appliances segments, with specific product categories experiencing surges based on technological advancements and changing lifestyle needs. Adoption rates for smart home appliances are progressively increasing, driven by enhanced connectivity features and greater consumer awareness of the benefits of integrated home systems. Technological disruptions are continually reshaping the product landscape, with advancements in AI, robotics, and sustainable materials leading to the development of next-generation appliances. Consumer behavior shifts are a significant factor, reflecting a growing preference for products that offer convenience, health benefits, and aesthetic appeal, alongside a heightened awareness of environmental impact. The base year of 2025 is pivotal, reflecting current market maturity and setting the stage for robust growth in the subsequent forecast period of 2025–2033. The historical period of 2019–2024 provides crucial context for understanding the foundational trends and initial impacts of early technological integrations. Market penetration for high-end and feature-rich appliances remains high, indicating a consumer willingness to invest in premium products. The compound annual growth rate (CAGR) for the forecast period is projected to be robust, reflecting the continued integration of smart technologies and a sustained demand for energy-efficient solutions. The influence of Japanese design principles, emphasizing minimalism and functionality, continues to shape product development across all categories.

Dominant Regions, Countries, or Segments in Japan Home Appliances Market

The Japan Home Appliances Market is predominantly driven by the Major Appliances segment, with Air Conditioners and Refrigerators consistently emerging as leading product categories. This dominance is attributed to Japan's climate, necessitating effective cooling and temperature control solutions, and the fundamental role of refrigerators in daily household management. Within the Major Appliances segment, growth is further propelled by a continuous stream of product innovations focused on enhanced energy efficiency, advanced cooling technologies, and integrated smart features. The Small Appliances segment, while smaller in market share compared to major appliances, exhibits significant growth potential, driven by the increasing popularity of Coffee or Tea Makers and Food Processors, catering to evolving culinary trends and busy lifestyles.

Distribution channels play a critical role in market penetration. Multi-brand Stores have historically been dominant, offering consumers a wide selection and competitive pricing. However, the Online distribution channel is rapidly gaining traction, driven by the convenience of e-commerce and the increasing digital savviness of Japanese consumers. Exclusive brand stores are also important for brands seeking to showcase their premium offerings and build direct customer relationships.

Key drivers of dominance include:

- Economic Policies: Government initiatives promoting energy conservation and appliance upgrades stimulate demand for efficient products.

- Infrastructure: Well-developed retail and logistics networks ensure efficient product distribution across the nation.

- Technological Adoption: Japan's high internet penetration and embrace of smart technologies facilitate the adoption of connected home appliances.

- Consumer Preferences: A strong emphasis on quality, durability, and aesthetic appeal ensures sustained demand for premium appliances.

- Market Share: Air conditioners and refrigerators command the largest market shares within major appliances, while coffee makers show strong growth in small appliances.

- Growth Potential: The online channel is exhibiting the highest growth potential for distribution, alongside niche segments within small appliances like air purifiers and smart kitchen gadgets.

Japan Home Appliances Market Product Landscape

The Japan Home Appliances Market is characterized by a vibrant product landscape focused on innovation, performance, and user experience. Key product innovations include refrigerators with advanced multi-zone cooling systems and smart inventory management, washing machines with AI-driven fabric care and reduced water consumption, and air conditioners offering superior air purification and energy-saving technologies. Small appliances are seeing a surge in multifunctional devices, such as high-performance blenders with integrated cooking functions and advanced coffee makers capable of personalized beverage creation. Performance metrics emphasize energy efficiency (e.g., top-tier Eco-label ratings), noise reduction, enhanced durability, and intuitive user interfaces. Unique selling propositions often revolve around sleek Japanese design, cutting-edge smart home integration, and commitment to sustainability. Technological advancements are continually pushing the boundaries, with an increasing integration of IoT capabilities allowing for remote control, predictive maintenance, and personalized settings.

Key Drivers, Barriers & Challenges in Japan Home Appliances Market

Key Drivers:

- Technological Advancements: The relentless pursuit of smarter, more energy-efficient, and user-friendly appliances is a primary growth catalyst. Features like AI integration, IoT connectivity, and advanced energy-saving technologies are highly sought after.

- Consumer Demand for Convenience and Comfort: An aging population and busy lifestyles drive demand for appliances that simplify daily tasks and enhance home comfort.

- Sustainability and Energy Efficiency Regulations: Government mandates and growing consumer awareness of environmental issues push manufacturers to develop eco-friendly products, creating a market for high-efficiency appliances.

- Rising Disposable Incomes: A stable economy and increasing disposable incomes allow consumers to invest in premium and technologically advanced home appliances.

Barriers & Challenges:

- Intense Competition: The market is highly saturated with both domestic and international players, leading to price pressures and challenges in market differentiation.

- Supply Chain Volatility: Global supply chain disruptions, including the availability and cost of raw materials and components, can impact production volumes and lead times.

- High R&D Costs: Continuous innovation requires significant investment in research and development, posing a barrier for smaller companies.

- Aging Population's Affordability Concerns: While demand for convenient appliances is high among the elderly, cost can be a significant deterrent for purchasing premium, feature-rich models.

- Evolving Consumer Preferences: Rapidly changing consumer tastes and technological trends necessitate constant product updates and can make long-term product planning challenging.

Emerging Opportunities in Japan Home Appliances Market

Emerging opportunities in the Japan Home Appliances Market lie in the burgeoning demand for smart home ecosystems, offering integrated solutions that enhance convenience, security, and energy management. The increasing focus on health and wellness presents a significant opportunity for appliances with advanced air purification, water filtration, and specialized cooking functionalities. Furthermore, the growing demand for sustainable and eco-friendly products, coupled with government incentives, creates a strong market for energy-efficient and durable appliances. The development of ultra-compact appliances catering to smaller living spaces, prevalent in urban Japan, also represents an untapped market segment.

Growth Accelerators in the Japan Home Appliances Market Industry

Several catalysts are accelerating growth within the Japan Home Appliances Market. The continuous drive towards technological integration, particularly the incorporation of Artificial Intelligence (AI) and the Internet of Things (IoT), is transforming ordinary appliances into smart, connected devices that offer unprecedented convenience and efficiency. Strategic partnerships between appliance manufacturers and technology companies are fostering innovation and accelerating the development of next-generation products. Moreover, market expansion strategies, including the increasing adoption of online sales channels and the development of subscription-based appliance services, are broadening market reach and accessibility. The focus on product modularity and repairability is also gaining traction, aligning with sustainability trends and extending product lifecycles.

Key Players Shaping the Japan Home Appliances Market Market

- Panasonic

- LG

- Daikin

- Sharp

- Electrolux

- Haier

- Bosch

- Toshiba

- Midea Group

- Hitachi

Notable Milestones in Japan Home Appliances Market Sector

- July 2023: AirReps, a subsidiary of Daikin Comfort Technologies North America, Inc., acquired the business and personnel of Integrated Systems and Controls, LLC (Integrated) and InControl. This move strengthens Daikin's service and support capabilities, particularly in complex installations and OEM warranty support.

- April 2022: Daikin Industries, Ltd. acquired Duplomatic MS S.p.A., an Italian manufacturer of hydraulic equipment, for USD 239 million. This acquisition diversifies Daikin's business portfolio and expands its technological reach into industrial automation.

In-Depth Japan Home Appliances Market Market Outlook

The Japan Home Appliances Market is poised for sustained growth, driven by an unwavering commitment to technological innovation and a consumer base that consistently prioritizes quality and advanced features. The increasing integration of AI and IoT into home appliances will continue to be a significant growth accelerator, creating more intuitive and efficient living environments. The market's outlook is further bolstered by a strong emphasis on sustainability, with eco-friendly and energy-efficient products expected to see accelerated adoption. Strategic collaborations and market expansion initiatives, especially through the rapidly growing online retail sector, will enhance accessibility and customer reach. The development of specialized appliances catering to evolving demographic needs and lifestyle trends will also play a crucial role in shaping the future of this dynamic market.

Japan Home Appliances Market Segmentation

-

1. Major Appliances

- 1.1. Refrigerators

- 1.2. Freezers

- 1.3. Dishwashing Machines

- 1.4. Washing Machines

- 1.5. Ovens

- 1.6. Air Conditioners

- 1.7. Other Major Appliances

-

2. Small Appliances

- 2.1. Coffee or Tea Makers

- 2.2. Food Processors

- 2.3. Grills & Roasters

- 2.4. Vacuum Cleaners

- 2.5. Other Small Appliances

-

3. Distribution Channel

- 3.1. Multi-brand Stores

- 3.2. Exclusive Stores

- 3.3. Online

- 3.4. Other Distribution Channels

Japan Home Appliances Market Segmentation By Geography

- 1. Japan

Japan Home Appliances Market Regional Market Share

Geographic Coverage of Japan Home Appliances Market

Japan Home Appliances Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.45% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. The Rise of Online Retail and E-Commerce Platforms

- 3.3. Market Restrains

- 3.3.1. The Risk of Fire and Electrical Short-Circuit in Electrical Appliances; High Power Consumption by Major Household Appliances

- 3.4. Market Trends

- 3.4.1. Smart Home Appliances is Driving the Growth of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Japan Home Appliances Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Major Appliances

- 5.1.1. Refrigerators

- 5.1.2. Freezers

- 5.1.3. Dishwashing Machines

- 5.1.4. Washing Machines

- 5.1.5. Ovens

- 5.1.6. Air Conditioners

- 5.1.7. Other Major Appliances

- 5.2. Market Analysis, Insights and Forecast - by Small Appliances

- 5.2.1. Coffee or Tea Makers

- 5.2.2. Food Processors

- 5.2.3. Grills & Roasters

- 5.2.4. Vacuum Cleaners

- 5.2.5. Other Small Appliances

- 5.3. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.3.1. Multi-brand Stores

- 5.3.2. Exclusive Stores

- 5.3.3. Online

- 5.3.4. Other Distribution Channels

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. Japan

- 5.1. Market Analysis, Insights and Forecast - by Major Appliances

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Panasonic

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 LG

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Daikin

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Sharp

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Electrolux

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Bosch

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Toshiba

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Midea group

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Hitachi

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Panasonic

List of Figures

- Figure 1: Japan Home Appliances Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Japan Home Appliances Market Share (%) by Company 2025

List of Tables

- Table 1: Japan Home Appliances Market Revenue Million Forecast, by Major Appliances 2020 & 2033

- Table 2: Japan Home Appliances Market Volume K Unit Forecast, by Major Appliances 2020 & 2033

- Table 3: Japan Home Appliances Market Revenue Million Forecast, by Small Appliances 2020 & 2033

- Table 4: Japan Home Appliances Market Volume K Unit Forecast, by Small Appliances 2020 & 2033

- Table 5: Japan Home Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 6: Japan Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 7: Japan Home Appliances Market Revenue Million Forecast, by Region 2020 & 2033

- Table 8: Japan Home Appliances Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 9: Japan Home Appliances Market Revenue Million Forecast, by Major Appliances 2020 & 2033

- Table 10: Japan Home Appliances Market Volume K Unit Forecast, by Major Appliances 2020 & 2033

- Table 11: Japan Home Appliances Market Revenue Million Forecast, by Small Appliances 2020 & 2033

- Table 12: Japan Home Appliances Market Volume K Unit Forecast, by Small Appliances 2020 & 2033

- Table 13: Japan Home Appliances Market Revenue Million Forecast, by Distribution Channel 2020 & 2033

- Table 14: Japan Home Appliances Market Volume K Unit Forecast, by Distribution Channel 2020 & 2033

- Table 15: Japan Home Appliances Market Revenue Million Forecast, by Country 2020 & 2033

- Table 16: Japan Home Appliances Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Japan Home Appliances Market?

The projected CAGR is approximately 4.45%.

2. Which companies are prominent players in the Japan Home Appliances Market?

Key companies in the market include Panasonic, LG, Daikin, Sharp, Electrolux, Haier, Bosch, Toshiba, Midea group, Hitachi.

3. What are the main segments of the Japan Home Appliances Market?

The market segments include Major Appliances, Small Appliances, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 26.82 Million as of 2022.

5. What are some drivers contributing to market growth?

The Rise of Online Retail and E-Commerce Platforms.

6. What are the notable trends driving market growth?

Smart Home Appliances is Driving the Growth of the Market.

7. Are there any restraints impacting market growth?

The Risk of Fire and Electrical Short-Circuit in Electrical Appliances; High Power Consumption by Major Household Appliances.

8. Can you provide examples of recent developments in the market?

July 2023: AirReps, a Daikin Comfort Technologies North America, Inc. subsidiary, purchased the business and personnel of Integrated Systems and Controls, LLC (Integrated) and InControl. Both companies are operating long and are presently based in the Seattle metropolitan area. Integrated Systems is well-known nationwide for providing OEM warranty support and setup assistance. They deal with some of the trickiest locations and circumstances when it comes to sophisticated machinery and applications.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Japan Home Appliances Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Japan Home Appliances Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Japan Home Appliances Market?

To stay informed about further developments, trends, and reports in the Japan Home Appliances Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence