Key Insights

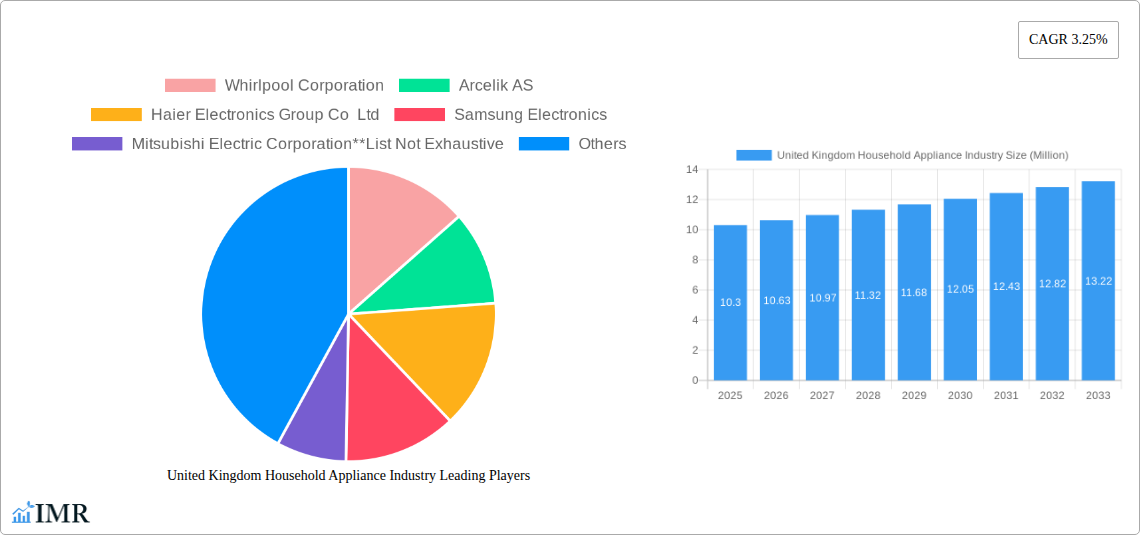

The United Kingdom household appliance market is poised for steady expansion, projected to reach an estimated £10.30 million by 2025, with a Compound Annual Growth Rate (CAGR) of 3.25% anticipated through 2033. This growth is fueled by a confluence of factors, including an increasing consumer demand for energy-efficient and smart appliances, driven by rising utility costs and a growing environmental consciousness. Furthermore, the ongoing trend of home renovation and the release of new, technologically advanced products by major players such as Whirlpool, Samsung, and LG Electronics are significant growth catalysts. These innovations, often integrating IoT capabilities for enhanced convenience and connectivity, are resonating with UK consumers seeking to modernize their living spaces. The market's resilience is also supported by the fundamental need for household appliances, ensuring consistent demand across various economic cycles.

United Kingdom Household Appliance Industry Market Size (In Million)

Despite the positive outlook, the UK household appliance market faces certain headwinds. Rising raw material costs and supply chain disruptions, exacerbated by global economic uncertainties, present a key restraint, potentially impacting profit margins for manufacturers and leading to price increases for consumers. Additionally, intense competition within the market necessitates continuous innovation and competitive pricing strategies from leading companies like Electrolux and BSH Hausgeräte GmbH. The market is segmented across production, consumption, import/export analysis, and price trends, with each segment offering unique dynamics. The United Kingdom's focus on sustainability and technological integration is expected to shape consumption patterns, favoring appliances with lower energy footprints and smart features. Navigating these dynamics will be crucial for sustained market success.

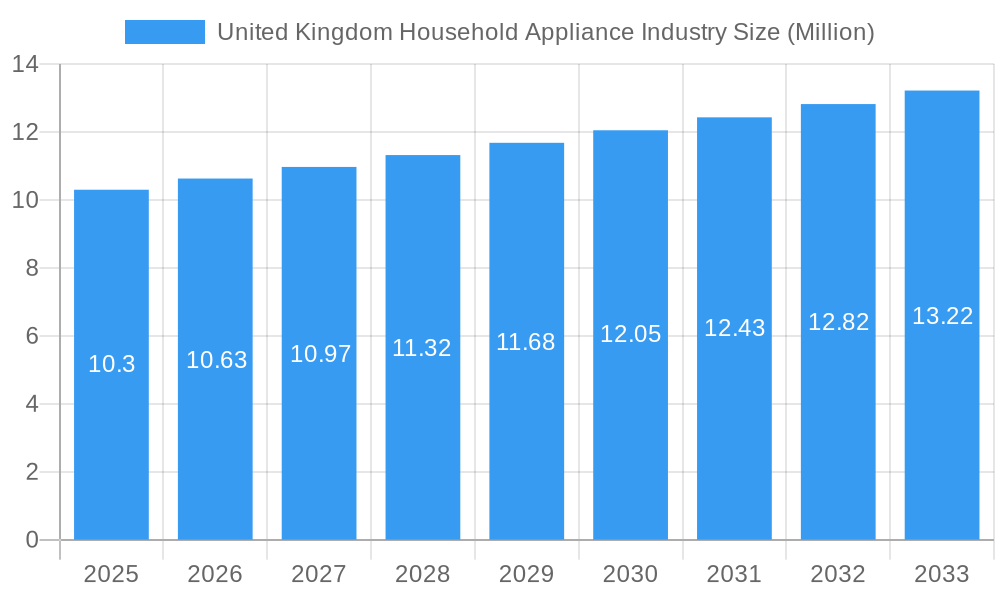

United Kingdom Household Appliance Industry Company Market Share

United Kingdom Household Appliance Industry Market Dynamics & Structure

The United Kingdom household appliance industry is characterized by a moderately concentrated market, with major players like Whirlpool Corporation, Arcelik AS, Haier Electronics Group Co Ltd, Samsung Electronics, and Mitsubishi Electric Corporation holding significant market share. This concentration is driven by substantial capital investment requirements, established brand recognition, and economies of scale in production and distribution. Technological innovation serves as a primary driver, with advancements in energy efficiency, smart home integration, and user-friendly interfaces constantly reshaping product offerings. Regulatory frameworks, particularly those focused on energy consumption standards and product safety, also play a crucial role in dictating product design and market entry. Competitive product substitutes, such as the increasing adoption of multi-functional appliances and the growing second-hand market, present ongoing challenges. End-user demographics, influenced by factors like disposable income, household size, and a rising interest in sustainable living, are shaping demand for specific appliance categories. Merger and acquisition (M&A) trends are evident as companies seek to expand their product portfolios, gain market access, and achieve operational efficiencies. For instance, the acquisition of Tristar's Appliance and Cookware Business by Spectrum Brands in February 2022 illustrates this trend. Innovation barriers include the high cost of R&D for cutting-edge technologies and the need to comply with evolving environmental regulations.

United Kingdom Household Appliance Industry Growth Trends & Insights

The United Kingdom household appliance industry is poised for steady growth, driven by a confluence of factors including evolving consumer lifestyles, technological advancements, and a persistent demand for modern home solutions. The market size is projected to expand significantly throughout the forecast period (2025–2033), building upon a robust historical performance from 2019–2024. The base year, 2025, represents a crucial point for understanding current market dynamics and projecting future trajectories. Adoption rates for innovative appliances, particularly those with smart home capabilities and enhanced energy efficiency, are on an upward trend. This surge in adoption is fueled by increasing consumer awareness of environmental impact and a desire for greater convenience and cost savings in the long run. Technological disruptions, such as the integration of AI for predictive maintenance and personalized user experiences, are revolutionizing product design and functionality. Furthermore, shifts in consumer behavior, including a growing preference for sustainable and ethically produced goods, are compelling manufacturers to prioritize eco-friendly materials and manufacturing processes. The market is also experiencing a revival in demand for built-in appliances as homeowners invest in kitchen renovations and upgrades. The increasing number of smaller households and single-person occupancy also contributes to the demand for compact and multi-functional appliances. The report leverages comprehensive XXX data to deliver a nuanced analysis of these trends, offering specific metrics such as Compound Annual Growth Rate (CAGR) projections and market penetration figures for key appliance categories like refrigeration, laundry, cooking, and dishwashing. The penetration of smart appliances is expected to reach xx% by 2033, indicating a significant shift in consumer preferences towards connected homes.

Dominant Regions, Countries, or Segments in United Kingdom Household Appliance Industry

The Consumption Analysis segment is currently the dominant driver of market growth within the United Kingdom household appliance industry. This dominance is underpinned by several key factors, including a mature and affluent consumer base, consistent replacement cycles for existing appliances, and a strong propensity for early adoption of new technologies. The United Kingdom’s well-established retail infrastructure, encompassing both large physical stores and a sophisticated e-commerce network, facilitates widespread access to a diverse range of household appliances, further stimulating consumption. Economic policies that support consumer spending, such as favorable interest rates for financing and disposable income levels, directly impact the volume and value of appliance purchases.

The Import Market Analysis (Value & Volume) also plays a pivotal role, reflecting the UK’s reliance on global manufacturing hubs and specialized components. While domestic production exists, the sheer volume and variety of appliances available in the UK market are heavily influenced by imports. The UK's strategic location and robust logistics networks facilitate the efficient import of goods, contributing significantly to market availability and competitive pricing.

While Production Analysis is important for the domestic economy, its contribution to market volume and value is relatively smaller compared to consumption and imports, with a projected contribution of xx% and xx% respectively. Export Market Analysis is a smaller segment, with the UK primarily acting as a net importer of household appliances, contributing only xx% to the global export market. Price Trend Analysis is an outcome of these dynamics, influenced by import costs, production efficiencies, and consumer demand.

United Kingdom Household Appliance Industry Product Landscape

The product landscape of the United Kingdom household appliance industry is characterized by a relentless pursuit of innovation, focusing on enhanced functionality, energy efficiency, and seamless integration into the smart home ecosystem. Manufacturers are increasingly developing appliances with intuitive user interfaces, often controlled via mobile applications, offering features such as remote operation, personalized settings, and proactive maintenance alerts. Energy efficiency remains a paramount concern, with new models consistently exceeding previous energy rating standards to meet consumer demand for sustainability and lower utility bills. The trend towards multi-functional appliances that combine several tasks into a single unit, such as washer-dryer combos and oven-grill-microwave combinations, is also prominent, catering to space-conscious consumers and those seeking greater convenience. Performance metrics are increasingly being measured by user experience and connectivity capabilities, alongside traditional measures of durability and effectiveness.

Key Drivers, Barriers & Challenges in United Kingdom Household Appliance Industry

The United Kingdom household appliance industry is propelled by several key drivers. Technological advancements, particularly in AI and IoT for smart appliances, are significantly boosting demand. Growing consumer awareness of energy conservation and sustainability is a major catalyst, driving sales of eco-friendly and energy-efficient models. Increasing disposable incomes and a preference for modern home aesthetics further fuel market growth.

However, the industry faces significant barriers and challenges. Supply chain disruptions, exacerbated by global events, continue to impact production timelines and component availability. Stringent regulatory hurdles related to product safety and environmental standards require continuous adaptation and investment. Intense competition from both domestic and international players, coupled with price sensitivity among some consumer segments, puts pressure on profit margins.

Emerging Opportunities in United Kingdom Household Appliance Industry

Emerging opportunities in the United Kingdom household appliance industry lie in the burgeoning demand for sustainable and repairable appliances. Consumers are increasingly seeking products with longer lifespans and readily available spare parts, creating a market for manufacturers who prioritize circular economy principles. The growth of the rental and subscription-based appliance market also presents a significant opportunity for service-oriented business models. Furthermore, the integration of advanced health and wellness features into appliances, such as air purifiers with advanced filtration and refrigerators with improved food preservation capabilities, is gaining traction. The development of highly energy-efficient appliances that utilize renewable energy sources or smart grid integration will also capture a growing market share.

Growth Accelerators in the United Kingdom Household Appliance Industry Industry

Several factors are acting as significant growth accelerators for the United Kingdom household appliance industry. The ongoing digital transformation of homes, with the widespread adoption of smart home technology, is creating a sustained demand for connected and intelligent appliances. Strategic partnerships between appliance manufacturers and technology companies are fostering innovation and the development of integrated home ecosystems. Government incentives and grants aimed at promoting energy efficiency and sustainable consumption also play a crucial role in accelerating the adoption of eco-friendly appliances. Furthermore, the increasing focus on a circular economy and the demand for refurbished or second-life appliances present new avenues for market expansion and revenue generation.

Key Players Shaping the United Kingdom Household Appliance Industry Market

Notable Milestones in United Kingdom Household Appliance Industry Sector

In-Depth United Kingdom Household Appliance Industry Market Outlook

The future outlook for the United Kingdom household appliance industry is exceptionally positive, driven by a robust interplay of technological innovation and evolving consumer preferences. Growth accelerators such as the pervasive integration of smart home technology, a heightened consumer demand for energy-efficient and sustainable products, and government-led initiatives promoting eco-friendly consumption will continue to shape the market. Strategic partnerships between appliance manufacturers and technology firms are expected to unlock new frontiers in product development, offering consumers increasingly connected and personalized home experiences. The growing emphasis on the circular economy also presents a significant opportunity for market expansion through the provision of repair services, refurbishment, and subscription-based models, aligning with consumer desires for longevity and reduced environmental impact.

- Market Concentration: Dominated by a few key international manufacturers.

- Technological Innovation: Driven by energy efficiency, smart home connectivity, and convenience features.

- Regulatory Frameworks: Stringent energy efficiency standards and product safety regulations.

- Competitive Substitutes: Multi-functional appliances and the growing pre-owned market.

- End-User Demographics: Influence of income levels, household size, and sustainability preferences.

- M&A Trends: Strategic acquisitions for market expansion and portfolio enhancement.

- Innovation Barriers: High R&D costs and evolving environmental compliance.

- Consumption Analysis: The primary engine of market growth, driven by consumer demand and purchasing power.

- Key Drivers:

- Affluent Consumer Base: High disposable income supports premium appliance purchases.

- Replacement Cycles: Regular replacement of older, less efficient appliances.

- Smart Home Adoption: Growing demand for connected and intelligent appliances.

- Retail Infrastructure: Extensive physical and online retail presence ensuring accessibility.

- Economic Policies: Supportive fiscal policies and consumer credit availability.

- Key Drivers:

- Market Share and Growth Potential: Consumption is projected to contribute xx% to the overall market value by 2033, with an estimated CAGR of xx%. The segment benefits from consistent demand across various appliance categories, from large white goods to small kitchen appliances.

- Import Market Analysis: Crucial for product diversity and competitive pricing.

- Key Drivers:

- Global Manufacturing Specialization: Sourcing from regions with lower production costs or advanced manufacturing capabilities.

- Logistics and Infrastructure: Efficient port operations and distribution networks.

- Trade Agreements: Facilitation of international trade and reduced tariffs.

- Product Variety: Access to a wider range of brands and specialized appliances not manufactured domestically.

- Key Drivers:

- Market Share and Growth Potential: Imports are estimated to account for xx% of the total market volume and xx% of the market value, with a projected CAGR of xx% during the forecast period.

- Key Drivers:

- Technological Advancements: Smart home integration, AI, and energy-saving features.

- Sustainability Concerns: Consumer demand for eco-friendly appliances.

- Rising Disposable Income: Increased consumer spending power.

- Home Renovation Trends: Demand for updated and aesthetically pleasing appliances.

- Replacement Cycles: Natural obsolescence and upgrading of older appliances.

- Barriers & Challenges:

- Supply Chain Volatility: Disruptions affecting component sourcing and delivery.

- Regulatory Compliance: Adhering to evolving safety and environmental standards.

- Intense Competition: Pressure from global manufacturers and private labels.

- Price Sensitivity: Consumer demand for cost-effective options.

- Skilled Labor Shortages: Difficulty in finding qualified personnel for manufacturing and repair.

- Whirlpool Corporation

- Arcelik AS

- Haier Electronics Group Co Ltd

- Samsung Electronics

- Mitsubishi Electric Corporation

- Gorenje Group

- BSH Hausgeräte GmbH

- Electrolux AB

- Panasonic Corporation

- LG Electronics

- May 2022: Whirlpool Corporation launched WoW Studios, a new marketing organization designed to infuse magic into the home appliance consumer.

- February 2022: Spectrum Brands acquired Tristar's Appliance and Cookware Business and combined it with its Home and Personal Care segment.

United Kingdom Household Appliance Industry Segmentation

- 1. Production Analysis

- 2. Consumption Analysis

- 3. Import Market Analysis (Value & Volume)

- 4. Export Market Analysis (Value & Volume)

- 5. Price Trend Analysis

United Kingdom Household Appliance Industry Segmentation By Geography

- 1. United Kingdom

United Kingdom Household Appliance Industry Regional Market Share

Geographic Coverage of United Kingdom Household Appliance Industry

United Kingdom Household Appliance Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.25% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Urbanization is Driving the Market; Rising Disposable Income is Driving the Market

- 3.3. Market Restrains

- 3.3.1 Price Sensitivity of Consumers is Restraining the Market; Saturation of the Market

- 3.3.2 with Availability of Wide Range of Brands and Products

- 3.4. Market Trends

- 3.4.1. Innovative Products are Driving the Sales Volume of the Market

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. United Kingdom Household Appliance Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 5.2. Market Analysis, Insights and Forecast - by Consumption Analysis

- 5.3. Market Analysis, Insights and Forecast - by Import Market Analysis (Value & Volume)

- 5.4. Market Analysis, Insights and Forecast - by Export Market Analysis (Value & Volume)

- 5.5. Market Analysis, Insights and Forecast - by Price Trend Analysis

- 5.6. Market Analysis, Insights and Forecast - by Region

- 5.6.1. United Kingdom

- 5.1. Market Analysis, Insights and Forecast - by Production Analysis

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Whirlpool Corporation

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Arcelik AS

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Haier Electronics Group Co Ltd

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Samsung Electronics

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi Electric Corporation**List Not Exhaustive

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Gorenje Group

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 BSH Hausgeräte GmbH

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Electrolux AB

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Panasonic Corporation

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 LG Electronics

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Whirlpool Corporation

List of Figures

- Figure 1: United Kingdom Household Appliance Industry Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: United Kingdom Household Appliance Industry Share (%) by Company 2025

List of Tables

- Table 1: United Kingdom Household Appliance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 2: United Kingdom Household Appliance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 3: United Kingdom Household Appliance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 4: United Kingdom Household Appliance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 5: United Kingdom Household Appliance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 6: United Kingdom Household Appliance Industry Revenue Million Forecast, by Region 2020 & 2033

- Table 7: United Kingdom Household Appliance Industry Revenue Million Forecast, by Production Analysis 2020 & 2033

- Table 8: United Kingdom Household Appliance Industry Revenue Million Forecast, by Consumption Analysis 2020 & 2033

- Table 9: United Kingdom Household Appliance Industry Revenue Million Forecast, by Import Market Analysis (Value & Volume) 2020 & 2033

- Table 10: United Kingdom Household Appliance Industry Revenue Million Forecast, by Export Market Analysis (Value & Volume) 2020 & 2033

- Table 11: United Kingdom Household Appliance Industry Revenue Million Forecast, by Price Trend Analysis 2020 & 2033

- Table 12: United Kingdom Household Appliance Industry Revenue Million Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the United Kingdom Household Appliance Industry?

The projected CAGR is approximately 3.25%.

2. Which companies are prominent players in the United Kingdom Household Appliance Industry?

Key companies in the market include Whirlpool Corporation, Arcelik AS, Haier Electronics Group Co Ltd, Samsung Electronics, Mitsubishi Electric Corporation**List Not Exhaustive, Gorenje Group, BSH Hausgeräte GmbH, Electrolux AB, Panasonic Corporation, LG Electronics.

3. What are the main segments of the United Kingdom Household Appliance Industry?

The market segments include Production Analysis, Consumption Analysis, Import Market Analysis (Value & Volume), Export Market Analysis (Value & Volume), Price Trend Analysis.

4. Can you provide details about the market size?

The market size is estimated to be USD 10.30 Million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Urbanization is Driving the Market; Rising Disposable Income is Driving the Market.

6. What are the notable trends driving market growth?

Innovative Products are Driving the Sales Volume of the Market.

7. Are there any restraints impacting market growth?

Price Sensitivity of Consumers is Restraining the Market; Saturation of the Market. with Availability of Wide Range of Brands and Products.

8. Can you provide examples of recent developments in the market?

In May 2022, Whirlpool corporation launched WoW Studios, a new marketing organization designed to infuse magic into the home appliance consumer.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "United Kingdom Household Appliance Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the United Kingdom Household Appliance Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the United Kingdom Household Appliance Industry?

To stay informed about further developments, trends, and reports in the United Kingdom Household Appliance Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence