Key Insights

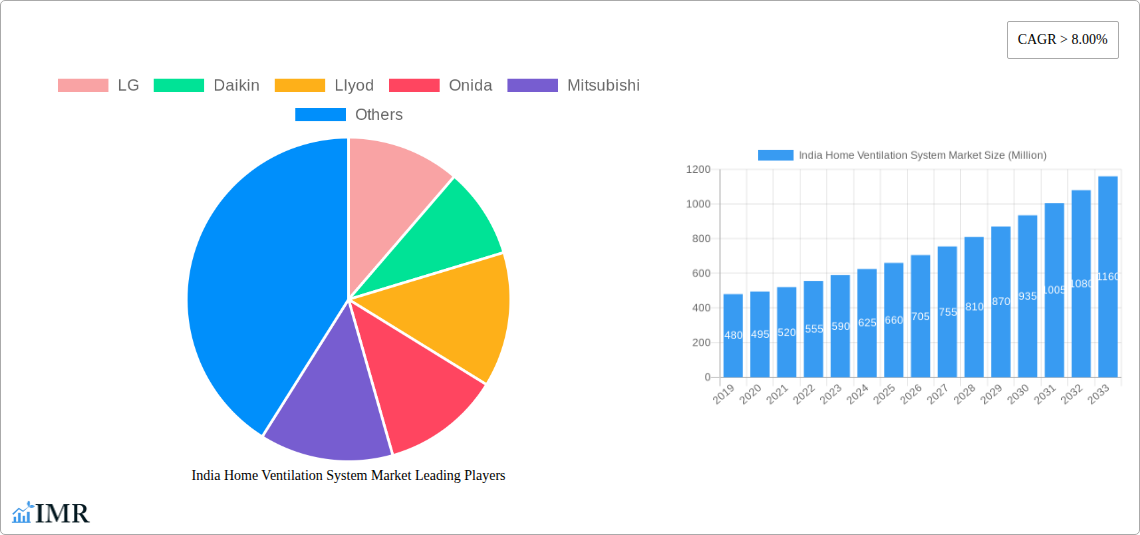

The Indian home ventilation system market is poised for substantial expansion, driven by an increasing awareness of indoor air quality (IAQ) and a growing preference for healthier living environments. With an estimated market size of USD 650 million in 2025, the sector is projected to witness robust growth, exhibiting a Compound Annual Growth Rate (CAGR) exceeding 8.00% throughout the forecast period of 2025-2033. This upward trajectory is fueled by evolving consumer lifestyles, a greater emphasis on well-being post-pandemic, and the rising adoption of smart home technologies that integrate ventilation systems for enhanced comfort and control. The demand for innovative solutions that combat pollution, manage humidity, and ensure a consistent supply of fresh air is escalating, making this a highly attractive market for both domestic and international players. Key drivers include urbanization, increasing disposable incomes, and stricter building codes that promote healthier indoor spaces.

India Home Ventilation System Market Market Size (In Million)

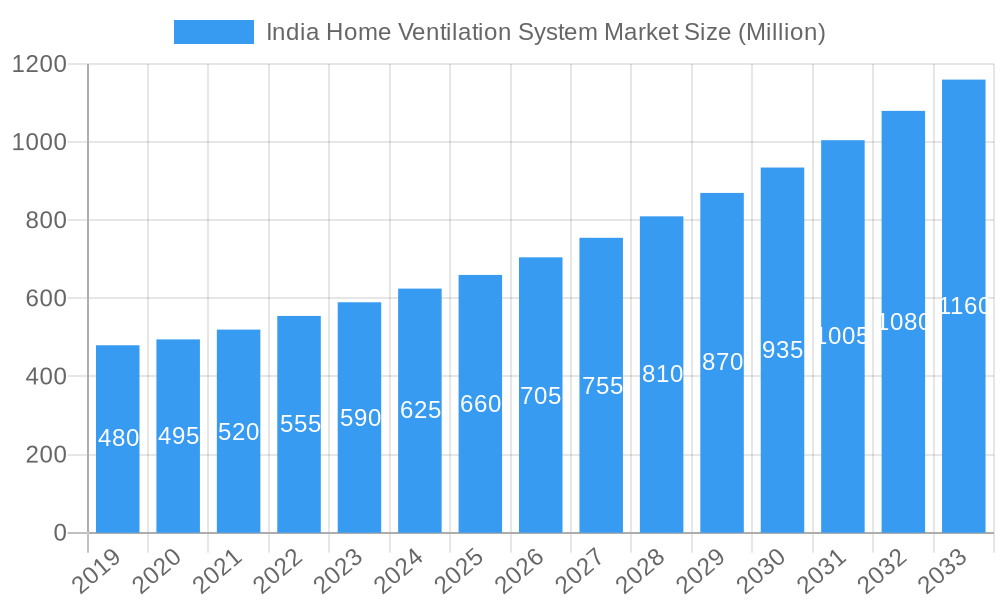

The market's segmentation reveals a strong demand across various product categories, with Exhaust Ventilation Systems and Supply Ventilation Systems likely to dominate due to their fundamental role in air exchange. Energy Recovering Systems are also gaining traction as consumers become more conscious of energy efficiency and the long-term cost savings associated with them. In terms of applications, both New Decoration and Renovation segments are expected to contribute significantly. While new constructions are integrating advanced ventilation from the outset, the renovation market presents a substantial opportunity for retrofitting existing homes with modern IAQ solutions. The competitive landscape is dynamic, featuring established global giants such as LG, Daikin, Mitsubishi, and Samsung, alongside prominent Indian brands like Blue Star and Voltas. These companies are increasingly focusing on product innovation, smart features, and tailored solutions to cater to the diverse needs of the Indian consumer base, further stimulating market growth.

India Home Ventilation System Market Company Market Share

India Home Ventilation System Market: Comprehensive Report Analysis & Future Outlook (2019–2033)

This in-depth report provides a detailed analysis of the India Home Ventilation System Market, offering critical insights into its current landscape, growth trajectories, and future potential. Covering a study period from 2019 to 2033, with 2025 as the base and estimated year, the report delves into market dynamics, key drivers, emerging opportunities, and the strategies of leading industry players. It segments the market by product type (Exhaust, Supply, Balanced, Energy Recovering Ventilation Systems) and application (New Decoration, Renovation), offering a granular understanding of segment-specific growth and adoption. With a focus on high-traffic keywords such as "home ventilation India," "indoor air quality solutions," "energy-efficient ventilation," and "HVAC India," this report is optimized for maximum search engine visibility and engagement with industry professionals, including manufacturers, distributors, policymakers, and real estate developers.

India Home Ventilation System Market Market Dynamics & Structure

The India Home Ventilation System Market exhibits a moderately concentrated structure, with a few key players dominating market share, while a growing number of smaller manufacturers compete in niche segments. Technological innovation is a primary driver, fueled by increasing consumer awareness regarding indoor air quality (IAQ) and the health benefits of well-ventilated homes. Government initiatives promoting energy efficiency and stricter building codes indirectly support the adoption of advanced ventilation solutions. Competitive product substitutes include basic exhaust fans and natural ventilation methods; however, the superior performance and IAQ control offered by dedicated ventilation systems are increasingly recognized. End-user demographics reveal a growing demand from urban middle to high-income households, particularly in metropolitan areas experiencing rising pollution levels and a greater understanding of health-related issues. Mergers and acquisitions (M&A) are expected to play a role in market consolidation, as larger players seek to expand their product portfolios and geographical reach.

- Market Concentration: Moderate, with key players holding significant market share.

- Technological Innovation Drivers: Rising IAQ awareness, health concerns, smart home integration, and energy efficiency demands.

- Regulatory Frameworks: Growing influence of building codes and environmental regulations on IAQ standards.

- Competitive Product Substitutes: Traditional exhaust fans, natural ventilation, basic air purifiers.

- End-User Demographics: Primarily urban, middle-to-high income households; increasing interest from commercial real estate.

- M&A Trends: Potential for consolidation to enhance market position and product offerings.

India Home Ventilation System Market Growth Trends & Insights

The India Home Ventilation System Market is poised for substantial growth, driven by a confluence of escalating environmental concerns and a heightened consumer consciousness towards indoor air quality (IAQ). As urbanization intensifies and pollution levels in major Indian cities continue to be a significant concern, the demand for effective ventilation solutions that mitigate airborne contaminants and ensure a healthier living environment is rapidly increasing. The market size evolution is projected to witness a robust expansion, transitioning from approximately XX million units in the historical period (2019-2024) to an estimated YY million units in 2025, and further accelerating through the forecast period (2025-2033). This growth trajectory is underpinned by increasing adoption rates, particularly in new construction projects and during home renovations, where integrated ventilation systems are becoming a standard feature.

Technological disruptions are playing a pivotal role in shaping market trends. The introduction of energy-efficient ventilation systems, such as Energy Recovery Ventilators (ERVs) and Heat Recovery Ventilators (HRVs), is gaining traction as homeowners seek to balance IAQ with reduced energy consumption. The integration of smart technologies, enabling remote control and automated adjustments based on IAQ sensor data, is further enhancing the appeal of these systems. Consumer behavior shifts are evident, with a growing preference for holistic home comfort solutions that prioritize health and well-being. This includes a rising awareness of the detrimental effects of poor IAQ on respiratory health, allergies, and overall quality of life. The market penetration of dedicated home ventilation systems, while still nascent in many regions, is expected to surge as awareness campaigns and product accessibility improve. The CAGR is projected to be Z% during the forecast period, indicating a dynamic and rapidly expanding market.

Dominant Regions, Countries, or Segments in India Home Ventilation System Market

Within the India Home Ventilation System Market, the Exhaust Ventilation System segment consistently leads in terms of market share and adoption. This dominance is primarily attributed to its established presence, relatively lower cost of initial investment, and its critical role in removing moisture, odors, and pollutants from enclosed spaces like kitchens and bathrooms, which are common pain points for Indian households. The application segment of New Decoration also plays a significant role in driving market growth. As India witnesses a boom in residential construction and interior design, the integration of ventilation systems during the initial building phase offers a more seamless and cost-effective installation, ensuring optimal performance from the outset.

The metropolitan and Tier-1 cities, including Delhi NCR, Mumbai, Bangalore, Chennai, and Kolkata, represent the dominant geographical regions for home ventilation systems. These areas are characterized by higher disposable incomes, greater awareness of IAQ issues stemming from severe air pollution, and a more developed real estate market that incorporates modern amenities. Government initiatives promoting smart cities and sustainable construction also indirectly contribute to the adoption of advanced ventilation solutions in these urban centers. The Supply Ventilation System and Balanced Ventilation System segments are experiencing a steady rise, driven by a growing demand for more comprehensive IAQ management and the increasing adoption of technologies that offer better control over indoor air quality. The Energy Recovering System segment, while currently a smaller portion of the market, holds immense potential for growth due to its energy-saving capabilities and is expected to gain significant traction as environmental consciousness and utility costs escalate. The renovation application segment is also a growing contributor, as homeowners increasingly invest in upgrading their living spaces to improve comfort and health.

- Dominant Product Segment: Exhaust Ventilation System, driven by its fundamental role in moisture and odor removal.

- Dominant Application Segment: New Decoration, facilitated by new construction and ease of integrated installation.

- Dominant Regions: Metropolitan and Tier-1 cities (Delhi NCR, Mumbai, Bangalore, Chennai, Kolkata) due to pollution concerns and higher income levels.

- Key Growth Drivers in Dominant Segments:

- Exhaust Ventilation: Addressing moisture and odor issues in kitchens and bathrooms.

- New Decoration: Integration during construction, cost-effectiveness.

- Dominant Regions: High pollution levels, rising health awareness, increased disposable income, smart city initiatives.

India Home Ventilation System Market Product Landscape

The product landscape of the India Home Ventilation System Market is characterized by a growing array of innovative solutions designed to enhance indoor air quality and occupant comfort. Exhaust Ventilation Systems remain a staple, featuring advancements in quieter operation, higher efficiency, and integration with humidity sensors. Supply Ventilation Systems are increasingly sophisticated, offering multi-stage filtration and controlled air intake. Balanced Ventilation Systems, which balance incoming and outgoing air, are seeing a rise in demand for their comprehensive IAQ management capabilities. The forefront of innovation lies in Energy Recovering Systems, including ERVs and HRVs, which not only ventilate but also recover thermal energy from outgoing air, significantly reducing heating and cooling costs. Smart features, app connectivity, and AI-driven automation are becoming standard in premium offerings, allowing users to monitor and control their indoor environment remotely.

Key Drivers, Barriers & Challenges in India Home Ventilation System Market

Key Drivers:

- Escalating Indoor Air Pollution: Growing awareness of health risks associated with poor IAQ due to outdoor pollution and indoor sources.

- Health and Wellness Trend: Increased consumer focus on health, leading to a demand for cleaner indoor environments, especially for vulnerable populations like children and the elderly.

- Government Initiatives & Regulations: Potential for stricter building codes and incentives promoting energy efficiency and IAQ standards.

- Urbanization and Modern Construction: Rapid development of housing projects and a shift towards more sophisticated building designs incorporating advanced amenities.

- Technological Advancements: Development of energy-efficient, smart, and user-friendly ventilation systems.

Barriers & Challenges:

- High Initial Cost: The upfront investment for advanced ventilation systems can be a deterrent for price-sensitive consumers.

- Lack of Consumer Awareness: Limited understanding of the benefits and necessity of dedicated home ventilation systems compared to traditional methods.

- Skilled Labor Shortage: Insufficient availability of trained professionals for installation and maintenance of complex ventilation systems.

- Fragmented Distribution Channels: Challenges in reaching a wider customer base across diverse geographical locations.

- Electricity Consumption Concerns: Despite energy-efficient designs, some consumers remain apprehensive about the additional electricity load.

Emerging Opportunities in India Home Ventilation System Market

The India Home Ventilation System Market presents several promising emerging opportunities. The increasing prevalence of allergies and respiratory ailments is creating a niche for specialized ventilation solutions designed to mitigate allergens and airborne irritants, particularly for sensitive individuals. The rapid growth of the smart home ecosystem offers a significant opportunity for the integration of ventilation systems with other smart devices, enabling comprehensive home automation and IAQ management. Furthermore, the burgeoning real estate sector in emerging urban centers and Tier-2/Tier-3 cities, coupled with rising disposable incomes, presents an untapped market for affordable and effective ventilation solutions. There is also a growing demand for retrofitting older homes with ventilation systems during renovation projects, opening avenues for specialized installation services and product offerings tailored for existing structures.

Growth Accelerators in the India Home Ventilation System Market Industry

Several catalysts are accelerating the long-term growth of the India Home Ventilation System Market. Technological breakthroughs in developing quieter, more energy-efficient, and intelligent ventilation units are making these systems more accessible and appealing to a wider consumer base. Strategic partnerships between HVAC manufacturers, real estate developers, and interior designers are crucial for embedding ventilation solutions from the design phase of new constructions. Market expansion strategies focusing on comprehensive awareness campaigns highlighting the health benefits of good IAQ will be instrumental in driving consumer demand. The increasing availability of financing options and government subsidies for energy-efficient appliances could further boost adoption rates, making advanced ventilation systems a more feasible investment for households across different income strata.

Key Players Shaping the India Home Ventilation System Market Market

- LG

- Daikin

- Llyod

- Onida

- Mitsubishi

- Haier

- Carrier

- Blue star

- O General

- Voltas

- Samsung

- Hitachi

Notable Milestones in India Home Ventilation System Market Sector

- June 2022: Voltas launched India's first Air conditioner with HEPA Filter technology. This latest offering, the Voltas' Pure Air 6 Stage Adjustable Inverter AC comes with a unique value proposition of 'Pure & Flexible Air Conditioning', powered with HEPA Filter, PM 1.0 Sensor and AQI Indicator, that helps in purifying the indoor air.

- August 2021: Hitachi announced its expansion plans to capture the promising residential and commercial air conditioning market in Gujarat. The company is doubling its channel partner strength in Gujarat by taking the current 120 dealers count to over 250 in the next 3 years.

In-Depth India Home Ventilation System Market Market Outlook

The future outlook for the India Home Ventilation System Market is exceptionally promising, driven by sustained growth accelerators. The ongoing evolution towards smart homes and the increasing prioritization of health and wellness will continue to propel demand for advanced IAQ solutions. Investments in research and development leading to more cost-effective and energy-efficient ventilation technologies are expected to broaden market accessibility. Strategic alliances and collaborations within the construction and real estate industries will be pivotal in integrating ventilation systems as standard features in new developments. The market is poised for significant expansion, fueled by a growing understanding of the long-term health and comfort benefits of well-ventilated living spaces, thereby solidifying its position as a critical component of modern Indian homes.

India Home Ventilation System Market Segmentation

-

1. Product

- 1.1. Exhaust Ventilation System

- 1.2. Supply Ventilation System

- 1.3. Balanced Ventilation System

- 1.4. Energy Recovering System

-

2. Application

- 2.1. New Decoration

- 2.2. Renovation

India Home Ventilation System Market Segmentation By Geography

- 1. India

India Home Ventilation System Market Regional Market Share

Geographic Coverage of India Home Ventilation System Market

India Home Ventilation System Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of > 8.00% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Growing Installation of Energy Efficient Heating Systems Drives The Market

- 3.3. Market Restrains

- 3.3.1. Availability of alternatives

- 3.4. Market Trends

- 3.4.1. Rising Residential Construction Sector in India Driving the Market.

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. India Home Ventilation System Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product

- 5.1.1. Exhaust Ventilation System

- 5.1.2. Supply Ventilation System

- 5.1.3. Balanced Ventilation System

- 5.1.4. Energy Recovering System

- 5.2. Market Analysis, Insights and Forecast - by Application

- 5.2.1. New Decoration

- 5.2.2. Renovation

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. India

- 5.1. Market Analysis, Insights and Forecast - by Product

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 LG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Daikin

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Llyod

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Onida

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Mitsubishi

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Haier

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Carrier

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Blue star

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 O General

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Voltas

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.11 Samsung

- 6.2.11.1. Overview

- 6.2.11.2. Products

- 6.2.11.3. SWOT Analysis

- 6.2.11.4. Recent Developments

- 6.2.11.5. Financials (Based on Availability)

- 6.2.12 Hitachi

- 6.2.12.1. Overview

- 6.2.12.2. Products

- 6.2.12.3. SWOT Analysis

- 6.2.12.4. Recent Developments

- 6.2.12.5. Financials (Based on Availability)

- 6.2.1 LG

List of Figures

- Figure 1: India Home Ventilation System Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: India Home Ventilation System Market Share (%) by Company 2025

List of Tables

- Table 1: India Home Ventilation System Market Revenue Million Forecast, by Product 2020 & 2033

- Table 2: India Home Ventilation System Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 3: India Home Ventilation System Market Revenue Million Forecast, by Application 2020 & 2033

- Table 4: India Home Ventilation System Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 5: India Home Ventilation System Market Revenue Million Forecast, by Region 2020 & 2033

- Table 6: India Home Ventilation System Market Volume K Unit Forecast, by Region 2020 & 2033

- Table 7: India Home Ventilation System Market Revenue Million Forecast, by Product 2020 & 2033

- Table 8: India Home Ventilation System Market Volume K Unit Forecast, by Product 2020 & 2033

- Table 9: India Home Ventilation System Market Revenue Million Forecast, by Application 2020 & 2033

- Table 10: India Home Ventilation System Market Volume K Unit Forecast, by Application 2020 & 2033

- Table 11: India Home Ventilation System Market Revenue Million Forecast, by Country 2020 & 2033

- Table 12: India Home Ventilation System Market Volume K Unit Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the India Home Ventilation System Market?

The projected CAGR is approximately > 8.00%.

2. Which companies are prominent players in the India Home Ventilation System Market?

Key companies in the market include LG, Daikin, Llyod, Onida, Mitsubishi, Haier, Carrier, Blue star, O General, Voltas, Samsung, Hitachi.

3. What are the main segments of the India Home Ventilation System Market?

The market segments include Product, Application.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

Growing Installation of Energy Efficient Heating Systems Drives The Market.

6. What are the notable trends driving market growth?

Rising Residential Construction Sector in India Driving the Market..

7. Are there any restraints impacting market growth?

Availability of alternatives.

8. Can you provide examples of recent developments in the market?

On June 13, 2022, Voltas launched India's first Air conditioner with HEPA Filter technology. This latest offering, the Voltas' Pure Air 6 Stage Adjustable Inverter AC comes with a unique value proposition of 'Pure & Flexible Air Conditioning', powered with HEPA Filter, PM 1.0 Sensor and AQI Indicator, that helps in purifying the indoor air.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million and volume, measured in K Unit.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "India Home Ventilation System Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the India Home Ventilation System Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the India Home Ventilation System Market?

To stay informed about further developments, trends, and reports in the India Home Ventilation System Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence