Key Insights

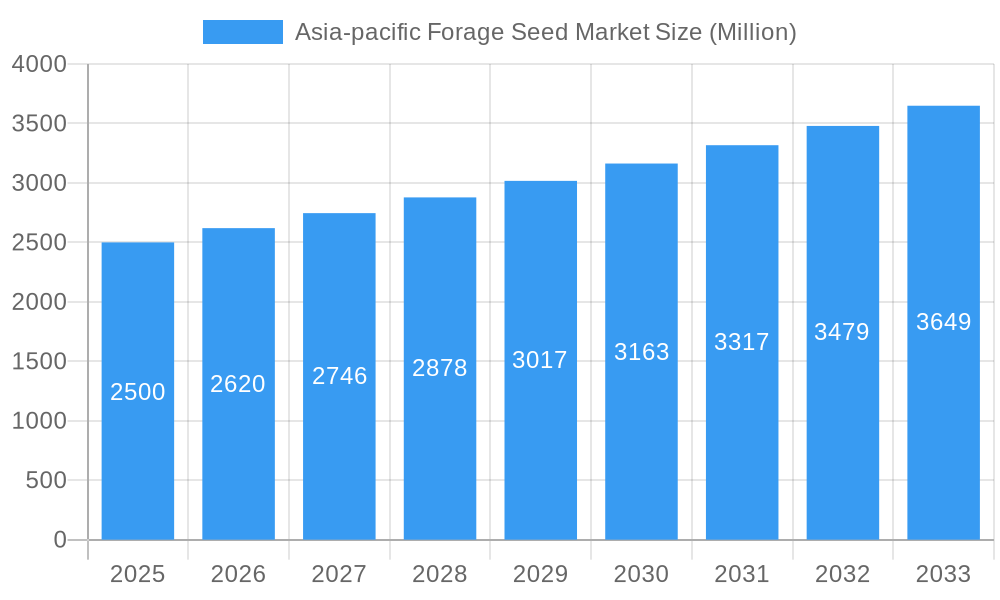

The Asia-Pacific forage seed market, valued at approximately $XX million in 2025, is projected to experience robust growth, driven by a Compound Annual Growth Rate (CAGR) of 4.70% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing demand for livestock feed in rapidly developing economies like India, China, and Indonesia is a major catalyst. Rising populations and increasing meat consumption are boosting the need for efficient and high-yielding forage crops, driving up seed demand. Secondly, advancements in breeding technologies, such as the development of hybrid varieties with improved yield, disease resistance, and nutritional content, are enhancing the productivity and profitability of forage cultivation. This technological progress, coupled with government initiatives promoting sustainable agriculture and livestock farming, further propels market growth. Furthermore, the adoption of improved farming practices and increased investment in agricultural infrastructure are contributing to the market's positive trajectory. However, challenges such as climate change, fluctuating weather patterns, and the prevalence of certain forage crop diseases pose potential restraints on market expansion.

Asia-pacific Forage Seed Market Market Size (In Billion)

The market segmentation reveals significant opportunities across various crops and countries within the Asia-Pacific region. Alfalfa, forage corn, and forage sorghum are prominent forage crops driving market growth, with varying levels of adoption across different countries. China and India represent substantial market segments, accounting for a significant portion of the overall demand due to their large livestock populations and agricultural land areas. Other countries in the region, such as Australia, Vietnam, and Thailand, also contribute to market growth, albeit at different scales. The choice of breeding technology—hybrids, open-pollinated varieties, and hybrid derivatives—also plays a significant role in influencing market dynamics, with the adoption of advanced hybrids gaining traction due to their superior performance. Major players like Bayer AG, PGG Wrightson Seeds, and Corteva Agriscience are shaping the competitive landscape through their product innovation and strategic partnerships. The forecast period anticipates continued growth, albeit potentially moderated by external factors influencing agricultural production and demand.

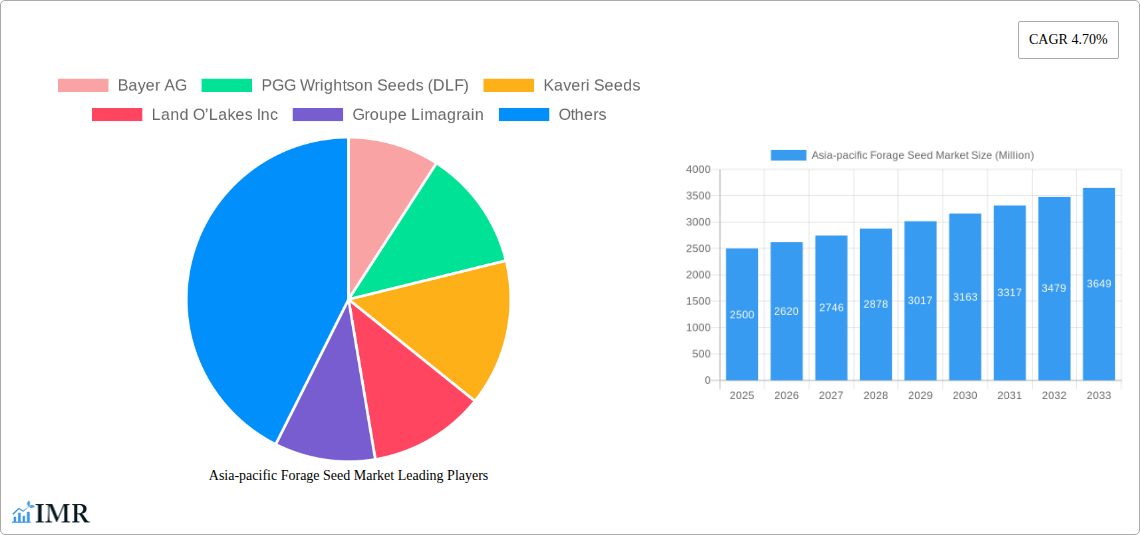

Asia-pacific Forage Seed Market Company Market Share

Asia-Pacific Forage Seed Market Report: 2019-2033

This comprehensive report provides a detailed analysis of the Asia-Pacific forage seed market, covering the period from 2019 to 2033. It offers in-depth insights into market dynamics, growth trends, dominant segments, key players, and future opportunities. The report is essential for industry professionals, investors, and stakeholders seeking to understand and capitalize on the growth potential within this vital agricultural sector. Market values are presented in million units.

Asia-Pacific Forage Seed Market Dynamics & Structure

The Asia-Pacific forage seed market is characterized by a moderately concentrated landscape, with several multinational corporations and regional players competing for market share. Technological innovation, particularly in hybrid seed development and trait improvement (e.g., herbicide tolerance, disease resistance), is a key driver of growth. Stringent regulatory frameworks governing seed production and distribution vary across countries, impacting market access and competitiveness. Substitute products, such as imported forage, exert competitive pressure, particularly in regions with underdeveloped domestic seed production capabilities. The market is influenced by end-user demographics, primarily livestock farmers and agricultural businesses, with varying levels of technological adoption and farming practices across the region. Mergers and acquisitions (M&A) activity has been moderate, with larger players strategically acquiring smaller companies to expand their product portfolios and geographic reach. In 2024, the estimated value of M&A deals in the Asia-Pacific forage seed market totaled approximately xx million.

- Market Concentration: Moderately concentrated, with a few dominant players and numerous smaller regional players.

- Technological Innovation: Driven by advancements in hybrid breeding, genetic modification, and trait enhancement.

- Regulatory Framework: Varies across countries, influencing market access and compliance costs.

- Competitive Substitutes: Imported forage and alternative feed sources pose competition.

- End-User Demographics: Primarily livestock farmers and agricultural businesses.

- M&A Trends: Moderate activity, with larger companies acquiring smaller ones for expansion.

Asia-Pacific Forage Seed Market Growth Trends & Insights

The Asia-Pacific forage seed market exhibited a CAGR of xx% during the historical period (2019-2024), reaching a market size of xx million in 2024. This growth is primarily driven by increasing livestock production, rising demand for high-quality forage, and government initiatives promoting agricultural development. The adoption rate of improved forage seed varieties is gradually increasing, although it remains lower compared to developed regions. Technological disruptions, such as precision agriculture and data-driven farming practices, are beginning to influence seed selection and usage. Consumer behavior is shifting towards higher-yielding, disease-resistant, and easy-to-manage forage varieties, boosting demand for advanced seed technologies. The forecast period (2025-2033) projects a CAGR of xx%, leading to a market size of xx million in 2033. Market penetration of hybrid forage seeds is expected to increase from xx% in 2024 to xx% in 2033.

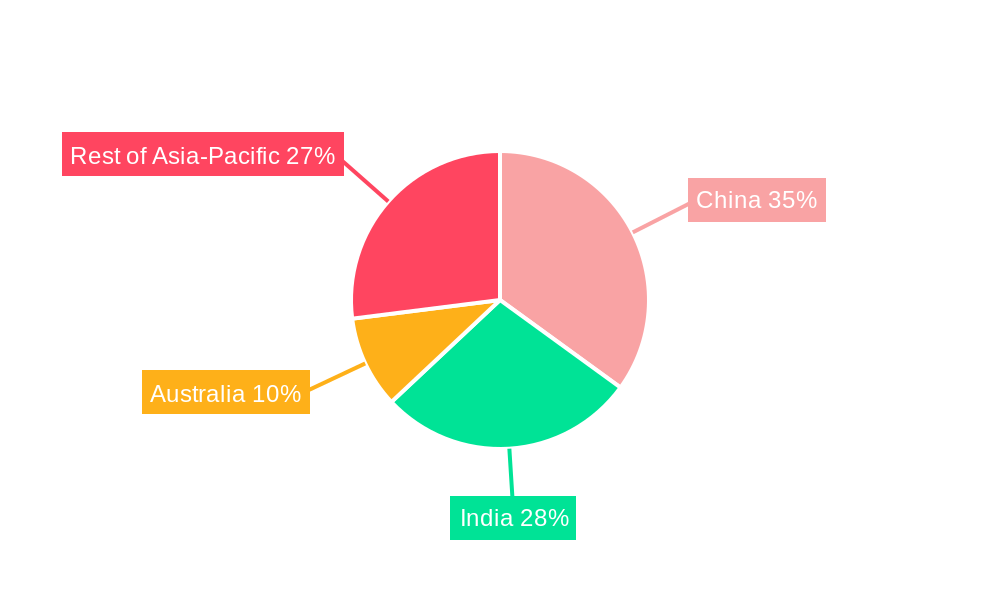

Dominant Regions, Countries, or Segments in Asia-Pacific Forage Seed Market

India and China are the leading countries in the Asia-Pacific forage seed market, driven by their extensive livestock populations and expanding agricultural sectors. Among crop segments, forage corn and alfalfa dominate, due to their widespread adaptability and high nutritional value. Hybrid seeds are gaining popularity over open-pollinated varieties and hybrid derivatives due to their superior yield potential.

- Leading Countries: India and China, followed by Australia and other Southeast Asian nations.

- Dominant Crop Segments: Forage corn and alfalfa exhibit the largest market share.

- Key Breeding Technologies: Hybrid seeds are experiencing rapid adoption due to higher yield and improved traits.

- Growth Drivers: Increasing livestock population, government support for agricultural development, rising consumer awareness of forage quality.

Asia-Pacific Forage Seed Market Product Landscape

The market offers a diverse range of forage seed varieties, tailored to specific climatic conditions and livestock needs. Product innovations focus on improving yield, disease resistance, drought tolerance, and nutritional value. Technological advancements include marker-assisted selection (MAS) and genomic selection for accelerated breeding programs. Unique selling propositions often emphasize enhanced performance characteristics, such as higher digestibility or improved palatability, contributing to greater livestock productivity and profitability.

Key Drivers, Barriers & Challenges in Asia-Pacific Forage Seed Market

Key Drivers: The increasing demand for animal protein, coupled with government policies supporting livestock development, is a primary growth driver. Technological advancements in seed breeding and the adoption of improved farming practices further accelerate market expansion. Furthermore, favorable climate conditions in certain regions boost forage yield and seed production.

Challenges: Supply chain inefficiencies, particularly in seed distribution and logistics, pose a significant challenge. High input costs, including seed prices and other agricultural inputs, can constrain adoption. Strict regulatory frameworks and compliance requirements can increase the cost of bringing new products to market. Competition from substitute products and imported forage seeds also impacts market growth. The inconsistent availability of quality irrigation further limits widespread growth.

Emerging Opportunities in Asia-Pacific Forage Seed Market

Untapped markets in Southeast Asia present significant opportunities for expansion. Innovative applications of forage seeds in silage production and specialized livestock feeding systems are gaining traction. Evolving consumer preferences towards sustainable and environmentally friendly agriculture drive the demand for improved forage varieties with reduced environmental impact. The development of climate-resilient forage varieties is a key area of focus.

Growth Accelerators in the Asia-Pacific Forage Seed Market Industry

Technological breakthroughs in seed breeding, such as gene editing and advanced genomic techniques, will drive long-term growth. Strategic partnerships between seed companies and agricultural technology providers are crucial for enhancing market access and accelerating product development. Expanding into new markets and developing customized seed varieties to address the unique needs of different livestock farming systems will also boost growth.

Key Players Shaping the Asia-Pacific Forage Seed Market Market

- Bayer AG

- PGG Wrightson Seeds (DLF)

- Kaveri Seeds

- Land O’Lakes Inc

- Groupe Limagrain

- Cates Grain and Seeds Ltd

- Royal Barenbrug Group

- Advanta Seeds - UPL

- Ampac Seed Company

- Corteva Agriscience

Notable Milestones in Asia-Pacific Forage Seed Market Sector

- July 2022: Corteva Agriscience launched Bovalta BMR corn silage, enhancing yield and milk production.

- July 2021: Advanta Seeds (Alta Seeds) introduced herbicide-tolerant non-GMO forage sorghum seeds (ADV F848IG).

- July 2020: Barenbrug Australia partnered with Nuseed, strengthening its alfalfa market presence.

In-Depth Asia-Pacific Forage Seed Market Market Outlook

The Asia-Pacific forage seed market is poised for robust growth, driven by technological advancements, increasing livestock production, and supportive government policies. Strategic investments in research and development, coupled with effective market expansion strategies, will be crucial for companies seeking to capitalize on the long-term growth potential of this dynamic market. The focus on developing climate-resilient varieties and sustainable farming practices will further shape the market’s future trajectory.

Asia-pacific Forage Seed Market Segmentation

-

1. Breeding Technology

-

1.1. Hybrids

- 1.1.1. Non-Transgenic Hybrids

- 1.1.2. Herbicide Tolerant Hybrids

- 1.1.3. Other Traits

- 1.2. Open Pollinated Varieties & Hybrid Derivatives

-

1.1. Hybrids

-

2. Crop

- 2.1. Alfalfa

- 2.2. Forage Corn

- 2.3. Forage Sorghum

- 2.4. Other Forage Crops

-

3. Breeding Technology

-

3.1. Hybrids

- 3.1.1. Non-Transgenic Hybrids

- 3.1.2. Herbicide Tolerant Hybrids

- 3.1.3. Other Traits

- 3.2. Open Pollinated Varieties & Hybrid Derivatives

-

3.1. Hybrids

-

4. Crop

- 4.1. Alfalfa

- 4.2. Forage Corn

- 4.3. Forage Sorghum

- 4.4. Other Forage Crops

Asia-pacific Forage Seed Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-pacific Forage Seed Market Regional Market Share

Geographic Coverage of Asia-pacific Forage Seed Market

Asia-pacific Forage Seed Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 3.56% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming

- 3.3. Market Restrains

- 3.3.1. Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns

- 3.4. Market Trends

- 3.4.1. OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-pacific Forage Seed Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.1.1. Hybrids

- 5.1.1.1. Non-Transgenic Hybrids

- 5.1.1.2. Herbicide Tolerant Hybrids

- 5.1.1.3. Other Traits

- 5.1.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.1.1. Hybrids

- 5.2. Market Analysis, Insights and Forecast - by Crop

- 5.2.1. Alfalfa

- 5.2.2. Forage Corn

- 5.2.3. Forage Sorghum

- 5.2.4. Other Forage Crops

- 5.3. Market Analysis, Insights and Forecast - by Breeding Technology

- 5.3.1. Hybrids

- 5.3.1.1. Non-Transgenic Hybrids

- 5.3.1.2. Herbicide Tolerant Hybrids

- 5.3.1.3. Other Traits

- 5.3.2. Open Pollinated Varieties & Hybrid Derivatives

- 5.3.1. Hybrids

- 5.4. Market Analysis, Insights and Forecast - by Crop

- 5.4.1. Alfalfa

- 5.4.2. Forage Corn

- 5.4.3. Forage Sorghum

- 5.4.4. Other Forage Crops

- 5.5. Market Analysis, Insights and Forecast - by Region

- 5.5.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Breeding Technology

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Bayer AG

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 PGG Wrightson Seeds (DLF)

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Kaveri Seeds

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Land O’Lakes Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Groupe Limagrain

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Cates Grain and Seeds Ltd

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Royal Barenbrug Grou

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Advanta Seeds - UPL

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.9 Ampac Seed Company

- 6.2.9.1. Overview

- 6.2.9.2. Products

- 6.2.9.3. SWOT Analysis

- 6.2.9.4. Recent Developments

- 6.2.9.5. Financials (Based on Availability)

- 6.2.10 Corteva Agriscience

- 6.2.10.1. Overview

- 6.2.10.2. Products

- 6.2.10.3. SWOT Analysis

- 6.2.10.4. Recent Developments

- 6.2.10.5. Financials (Based on Availability)

- 6.2.1 Bayer AG

List of Figures

- Figure 1: Asia-pacific Forage Seed Market Revenue Breakdown (undefined, %) by Product 2025 & 2033

- Figure 2: Asia-pacific Forage Seed Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 2: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Crop 2020 & 2033

- Table 3: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 4: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Crop 2020 & 2033

- Table 5: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 6: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 7: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Crop 2020 & 2033

- Table 8: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Breeding Technology 2020 & 2033

- Table 9: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Crop 2020 & 2033

- Table 10: Asia-pacific Forage Seed Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 11: China Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 12: Japan Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 13: South Korea Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 14: India Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 15: Australia Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: New Zealand Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: Indonesia Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Malaysia Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Singapore Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Thailand Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 21: Vietnam Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 22: Philippines Asia-pacific Forage Seed Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-pacific Forage Seed Market?

The projected CAGR is approximately 3.56%.

2. Which companies are prominent players in the Asia-pacific Forage Seed Market?

Key companies in the market include Bayer AG, PGG Wrightson Seeds (DLF), Kaveri Seeds, Land O’Lakes Inc, Groupe Limagrain, Cates Grain and Seeds Ltd, Royal Barenbrug Grou, Advanta Seeds - UPL, Ampac Seed Company, Corteva Agriscience.

3. What are the main segments of the Asia-pacific Forage Seed Market?

The market segments include Breeding Technology, Crop, Breeding Technology, Crop.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

Seed Treatment As A Solution To Enhance Yield; Growing Awareness For Seed Treatment Among The Farmers; Rising Trend Of Organic Farming.

6. What are the notable trends driving market growth?

OTHER KEY INDUSTRY TRENDS COVERED IN THE REPORT.

7. Are there any restraints impacting market growth?

Limitations Across Farm-Level Seed Treatment; Rising Environmental Concerns.

8. Can you provide examples of recent developments in the market?

July 2022: Corteva Agriscience introduced Bovalta BMR (brown midrib) corn silage product that is designed to meet the highest yield and milk production standards.July 2021: Alta Seeds, a subsidiary of Advanta Seeds, introduced new herbicide-tolerant non-GMO forage sorghum seeds, "ADV F848IG," into the market.July 2020: Barenbrug Australia Pty Ltd made an agreement with Nuseed Pty Ltd to license Nuseed’s alfalfa germplasm portfolio and carry out R&D, plant breeding, and commercialization services. Nuseed alfalfa sales and distribution were also licensed to Barenbrug, strengthening its market presence in the country.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-pacific Forage Seed Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-pacific Forage Seed Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-pacific Forage Seed Market?

To stay informed about further developments, trends, and reports in the Asia-pacific Forage Seed Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence