Key Insights

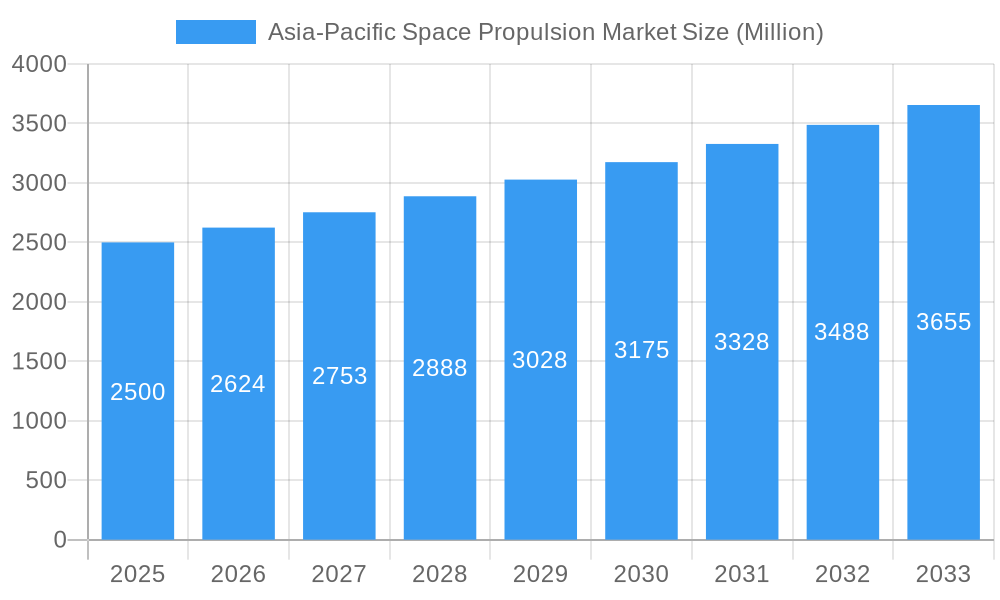

The Asia-Pacific space propulsion market is experiencing robust growth, driven by increasing government investments in space exploration and national security programs across the region. China, Japan, India, and South Korea are key contributors to this expansion, fueled by ambitious space missions, satellite deployments, and the development of indigenous launch capabilities. The market's compound annual growth rate (CAGR) of 4.96% from 2019 to 2024 indicates a consistent upward trajectory. This growth is further propelled by advancements in electric propulsion technologies, offering improved fuel efficiency and longer mission durations, and a rising demand for smaller, more agile satellites for Earth observation, communication, and navigation. The shift towards reusable launch vehicles also contributes to cost reduction, making space exploration more accessible and spurring further market expansion. While challenges remain, such as the high cost of development and the complexity of space-based technologies, the long-term outlook for the Asia-Pacific space propulsion market remains exceptionally positive.

Asia-Pacific Space Propulsion Market Market Size (In Billion)

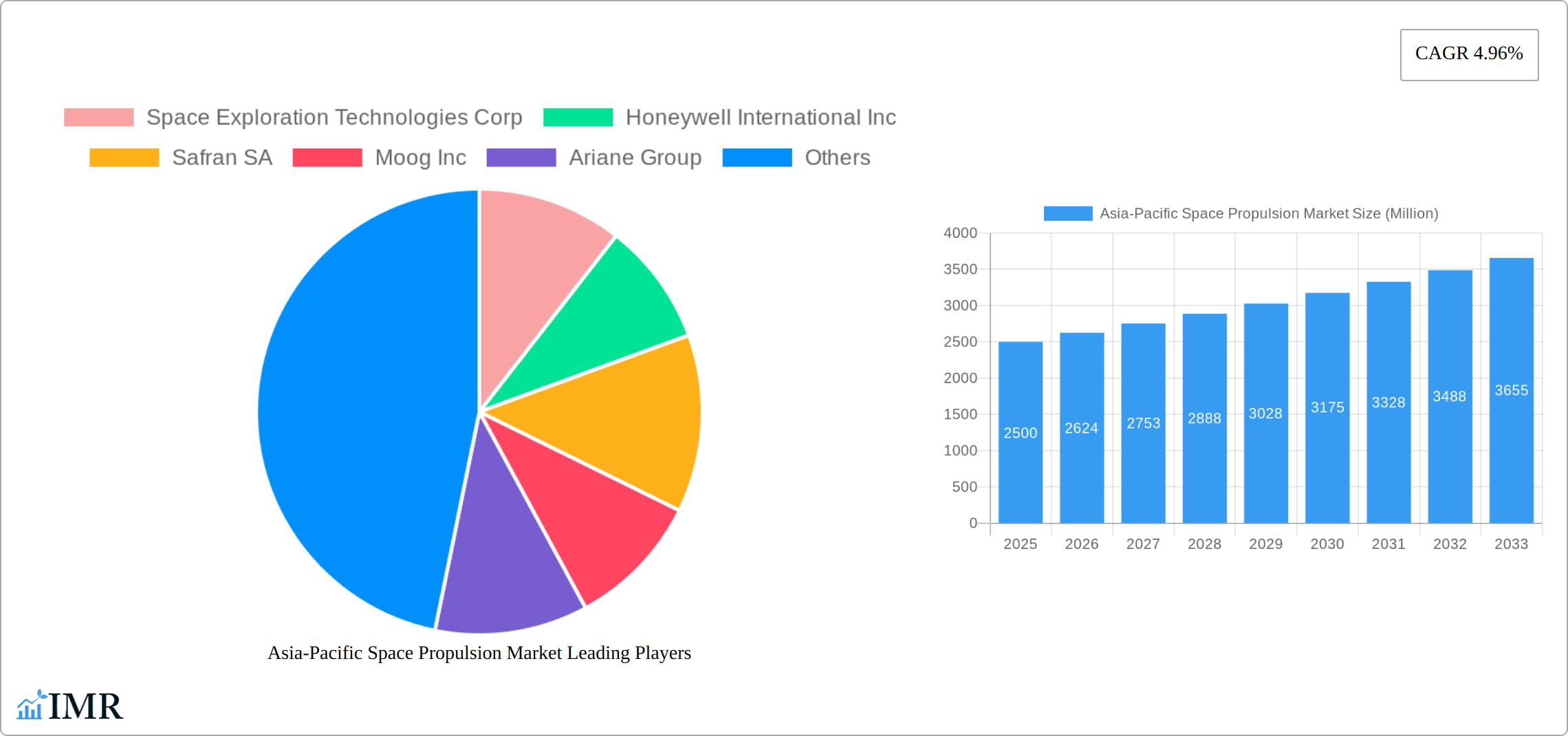

The market segmentation reveals significant opportunities within various propulsion technologies. Electric propulsion is projected to gain significant traction due to its efficiency advantages. Gas-based and liquid fuel systems will continue to hold substantial market share, particularly in larger launch vehicles. Significant regional variations exist, with China and India expected to dominate the market due to their large-scale space programs and growing private sector participation. Competition among major players like Space Exploration Technologies Corp., Honeywell International Inc., and Safran SA is intense, driving innovation and price competitiveness. The forecast period of 2025-2033 promises further expansion, driven by ongoing technological advancements, increased collaboration among nations, and the expanding commercial space sector. The market size in 2025 is estimated to be approximately $X billion (Assuming a logical extrapolation based on the 4.96% CAGR and a reasonable starting point in 2019, the specific value is dependent on unavailable data), poised for continued growth throughout the forecast period.

Asia-Pacific Space Propulsion Market Company Market Share

Asia-Pacific Space Propulsion Market: A Comprehensive Report (2019-2033)

This in-depth report provides a comprehensive analysis of the Asia-Pacific space propulsion market, encompassing market dynamics, growth trends, dominant segments, and key players. With a focus on the parent market (Space Propulsion) and child markets (Electric, Gas-based, and Liquid Fuel propulsion technologies) across key nations, this report offers invaluable insights for industry professionals, investors, and strategists. The study period spans 2019-2033, with a base year of 2025 and a forecast period of 2025-2033. Market values are presented in million units.

Asia-Pacific Space Propulsion Market Market Dynamics & Structure

The Asia-Pacific space propulsion market is a dynamic and evolving sector, characterized by a moderately concentrated competitive landscape. Key industry titans such as SpaceX, Honeywell, Safran, and Northrop Grumman are prominent players, collectively holding a substantial market share. A significant catalyst for this growth is the relentless pace of technological innovation, particularly in the realm of advanced electric propulsion systems, which offer enhanced efficiency and performance. This innovation is further bolstered by robust government initiatives and escalating investments in space exploration and satellite deployment across the region's burgeoning economies. Despite these positive trends, the market encounters hurdles such as the substantial capital investment required for research, development, and manufacturing, alongside the complex and stringent regulatory frameworks governing space activities. The market is also observing a notable uptick in mergers and acquisitions (M&A) activity, indicative of strategic consolidation and the pursuit of synergistic capabilities. Competition from alternative launch technologies and the volatility of fuel prices also play a crucial role in shaping the overall market dynamics.

- Market Concentration: Moderately concentrated, with leading players commanding a significant majority of the market share, emphasizing the importance of established entities.

- Technological Innovation: Electric propulsion is at the forefront of innovation, driving advancements in satellite maneuverability and efficiency. Gas-based and liquid fuel systems continue to see incremental improvements in performance and reliability.

- Regulatory Framework: Stringent safety, environmental, and export control regulations significantly influence product development cycles, market entry strategies, and operational procedures.

- Competitive Landscape: While direct substitutes for core propulsion technologies are limited, advancements in alternative launch methodologies and the increasing payload capacity of existing systems indirectly influence market demand and competitive strategies.

- M&A Activity: A notable trend of mergers and acquisitions signals a maturing market, with companies seeking to expand their portfolios, gain access to new technologies, and achieve economies of scale.

- Innovation Barriers: Significant challenges to innovation include the exceptionally high costs associated with research and development, the complexities of rigorous testing and qualification processes, and the persistent shortage of highly skilled aerospace engineering talent.

Asia-Pacific Space Propulsion Market Growth Trends & Insights

The Asia-Pacific space propulsion market is experiencing robust growth, driven by increasing government spending on space programs, growing commercial space activities, and rising demand for satellite launches and space exploration missions. The market size is projected to grow at a Compound Annual Growth Rate (CAGR) of xx% from 2025 to 2033, reaching xx million units by 2033. Electric propulsion is gaining traction due to its higher efficiency and cost-effectiveness, leading to increased adoption rates. Technological disruptions, such as advancements in materials science and propulsion systems, further fuel market expansion. Consumer behavior shifts, reflected in growing private sector involvement and increasing public interest in space, also contribute to this growth. Market penetration is currently estimated at xx%, projected to reach xx% by 2033.

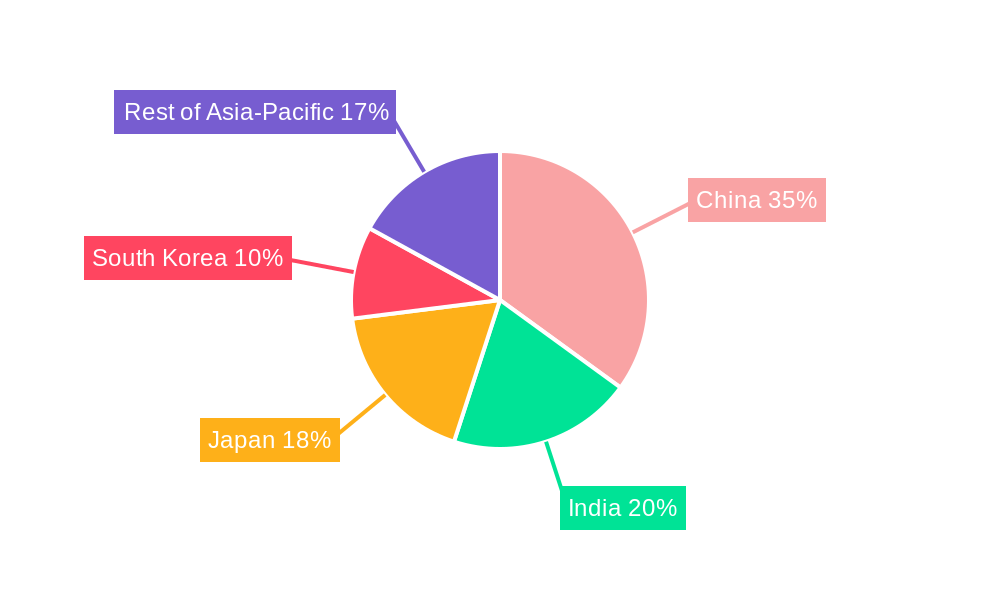

Dominant Regions, Countries, or Segments in Asia-Pacific Space Propulsion Market

China, followed by India and Japan, are the leading nations driving the Asia-Pacific space propulsion market growth. China's significant investment in space exploration and satellite technology development significantly influences market demand. India's burgeoning space sector and focus on cost-effective solutions also contribute to growth. Japan's advanced technological capabilities and participation in international collaborations fuel market expansion. The Electric propulsion segment exhibits the highest growth potential due to its advantages in efficiency and cost.

Key Drivers:

- China: Massive government investment in space programs and domestic technology development.

- India: Focus on cost-effective satellite launches and expanding space capabilities.

- Japan: Advanced technology, international collaborations, and a strong private sector presence.

- Electric Propulsion Segment: Higher efficiency, lower fuel consumption, and reduced operational costs.

Dominance Factors: Government support, technological advancements, and strategic partnerships.

Growth Potential: Electric propulsion segment shows highest growth potential with a projected xx% CAGR over the forecast period.

Asia-Pacific Space Propulsion Market Product Landscape

The Asia-Pacific space propulsion market features diverse product offerings, including electric, gas-based, and liquid fuel propulsion systems with varying thrust levels and applications. Recent innovations include miniaturized propulsion systems for small satellites, improved fuel efficiency, and enhanced reliability. These advancements cater to the increasing demand for cost-effective and efficient space missions. Unique selling propositions focus on improved performance metrics, reduced weight, and enhanced reliability.

Key Drivers, Barriers & Challenges in Asia-Pacific Space Propulsion Market

Key Drivers:

- Increasing government funding for space exploration and satellite technologies across Asia-Pacific.

- Growth of the commercial space sector, with more private companies investing in space-related projects.

- Advancements in propulsion technology leading to more efficient and reliable systems.

Key Challenges:

- High development and manufacturing costs of advanced propulsion systems, potentially limiting market access.

- Stringent regulations and safety standards for space launches, causing delays and increasing costs.

- Intense competition among established players and emerging startups, which can lead to price wars. This competition is estimated to reduce average profit margins by xx% over the next 5 years.

Emerging Opportunities in Asia-Pacific Space Propulsion Market

The Asia-Pacific space propulsion market is ripe with emerging opportunities, particularly in the rapidly expanding small satellite and CubeSat segments. The demand for miniaturized and highly efficient propulsion systems tailored for these platforms is surging. Furthermore, the development of reusable propulsion systems is a key focus, aimed at drastically reducing the overall cost of space access and fostering more frequent missions. The burgeoning space tourism industry and the ever-increasing demand for high-resolution Earth observation data for environmental monitoring, disaster management, and agricultural applications also present substantial growth avenues. In line with global sustainability imperatives, there is a significant opportunity in the research and development of 'green' propulsion technologies, focusing on environmentally friendly propellants and more sustainable operational practices.

Growth Accelerators in the Asia-Pacific Space Propulsion Market Industry

Technological breakthroughs in electric propulsion, leading to higher efficiency and lower costs, are key growth drivers. Strategic partnerships between government agencies, research institutions, and private companies are accelerating innovation and market expansion. Governments' increasing focus on domestic space capabilities and the growing interest in space-based services will further accelerate market growth in the coming years.

Key Players Shaping the Asia-Pacific Space Propulsion Market Market

Notable Milestones in Asia-Pacific Space Propulsion Market Sector

- February 2023: Thales Alenia Space secured a crucial contract with the Korea Aerospace Research Institute (KARI) to supply advanced electric propulsion systems for the GEO-KOMPSAT-3 satellite. This strategic agreement underscores the accelerating adoption and confidence in electric propulsion technologies for sophisticated satellite missions within the region.

- December 2022: GKN Aerospace entered into a significant contract with ArianeGroup, a leading European space launch provider, for the supply of turbine and nozzle components for the Ariane 6 rocket. This collaboration highlights the intricate supply chains and partnerships that are vital for the development of next-generation launch vehicles.

- November 2022: Northrop Grumman's robust solid rocket boosters played a pivotal role in the successful maiden voyage of NASA's Artemis I mission. This event reaffirms the continued reliance on proven and high-performance traditional propulsion technologies for ambitious deep-space exploration endeavors.

In-Depth Asia-Pacific Space Propulsion Market Market Outlook

The Asia-Pacific space propulsion market is projected for substantial and sustained growth in the coming years. This optimistic outlook is underpinned by a confluence of factors, including continuous advancements in propulsion technologies, a robust influx of both government and private capital, and the dynamic expansion of the commercial space industry. Strategic alliances, joint ventures, and collaborative research initiatives among various stakeholders are expected to act as key accelerators for market expansion. The future trajectory of the market will be significantly shaped by the ongoing pursuit of sustainable, environmentally friendly, and cost-effective propulsion solutions. This focus is anticipated to unlock novel avenues for innovation, leading to the development of more efficient and versatile propulsion systems, and consequently, a broader range of applications. The long-term forecast for the Asia-Pacific space propulsion market is overwhelmingly positive, indicating considerable potential for both market expansion and strategic diversification across various sub-sectors.

Asia-Pacific Space Propulsion Market Segmentation

-

1. Propulsion Tech

- 1.1. Electric

- 1.2. Gas based

- 1.3. Liquid Fuel

Asia-Pacific Space Propulsion Market Segmentation By Geography

-

1. Asia Pacific

- 1.1. China

- 1.2. Japan

- 1.3. South Korea

- 1.4. India

- 1.5. Australia

- 1.6. New Zealand

- 1.7. Indonesia

- 1.8. Malaysia

- 1.9. Singapore

- 1.10. Thailand

- 1.11. Vietnam

- 1.12. Philippines

Asia-Pacific Space Propulsion Market Regional Market Share

Geographic Coverage of Asia-Pacific Space Propulsion Market

Asia-Pacific Space Propulsion Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 4.96% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Increasing investments in space startups

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Asia-Pacific Space Propulsion Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 5.1.1. Electric

- 5.1.2. Gas based

- 5.1.3. Liquid Fuel

- 5.2. Market Analysis, Insights and Forecast - by Region

- 5.2.1. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Propulsion Tech

- 6. Competitive Analysis

- 6.1. Market Share Analysis 2025

- 6.2. Company Profiles

- 6.2.1 Space Exploration Technologies Corp

- 6.2.1.1. Overview

- 6.2.1.2. Products

- 6.2.1.3. SWOT Analysis

- 6.2.1.4. Recent Developments

- 6.2.1.5. Financials (Based on Availability)

- 6.2.2 Honeywell International Inc

- 6.2.2.1. Overview

- 6.2.2.2. Products

- 6.2.2.3. SWOT Analysis

- 6.2.2.4. Recent Developments

- 6.2.2.5. Financials (Based on Availability)

- 6.2.3 Safran SA

- 6.2.3.1. Overview

- 6.2.3.2. Products

- 6.2.3.3. SWOT Analysis

- 6.2.3.4. Recent Developments

- 6.2.3.5. Financials (Based on Availability)

- 6.2.4 Moog Inc

- 6.2.4.1. Overview

- 6.2.4.2. Products

- 6.2.4.3. SWOT Analysis

- 6.2.4.4. Recent Developments

- 6.2.4.5. Financials (Based on Availability)

- 6.2.5 Ariane Group

- 6.2.5.1. Overview

- 6.2.5.2. Products

- 6.2.5.3. SWOT Analysis

- 6.2.5.4. Recent Developments

- 6.2.5.5. Financials (Based on Availability)

- 6.2.6 Sitael S p A

- 6.2.6.1. Overview

- 6.2.6.2. Products

- 6.2.6.3. SWOT Analysis

- 6.2.6.4. Recent Developments

- 6.2.6.5. Financials (Based on Availability)

- 6.2.7 Thale

- 6.2.7.1. Overview

- 6.2.7.2. Products

- 6.2.7.3. SWOT Analysis

- 6.2.7.4. Recent Developments

- 6.2.7.5. Financials (Based on Availability)

- 6.2.8 Northrop Grumman Corporation

- 6.2.8.1. Overview

- 6.2.8.2. Products

- 6.2.8.3. SWOT Analysis

- 6.2.8.4. Recent Developments

- 6.2.8.5. Financials (Based on Availability)

- 6.2.1 Space Exploration Technologies Corp

List of Figures

- Figure 1: Asia-Pacific Space Propulsion Market Revenue Breakdown (Million, %) by Product 2025 & 2033

- Figure 2: Asia-Pacific Space Propulsion Market Share (%) by Company 2025

List of Tables

- Table 1: Asia-Pacific Space Propulsion Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 2: Asia-Pacific Space Propulsion Market Revenue Million Forecast, by Region 2020 & 2033

- Table 3: Asia-Pacific Space Propulsion Market Revenue Million Forecast, by Propulsion Tech 2020 & 2033

- Table 4: Asia-Pacific Space Propulsion Market Revenue Million Forecast, by Country 2020 & 2033

- Table 5: China Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 6: Japan Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 7: South Korea Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 8: India Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 9: Australia Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 10: New Zealand Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 11: Indonesia Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 12: Malaysia Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 13: Singapore Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 14: Thailand Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 15: Vietnam Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

- Table 16: Philippines Asia-Pacific Space Propulsion Market Revenue (Million) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Asia-Pacific Space Propulsion Market?

The projected CAGR is approximately 4.96%.

2. Which companies are prominent players in the Asia-Pacific Space Propulsion Market?

Key companies in the market include Space Exploration Technologies Corp, Honeywell International Inc, Safran SA, Moog Inc, Ariane Group, Sitael S p A, Thale, Northrop Grumman Corporation.

3. What are the main segments of the Asia-Pacific Space Propulsion Market?

The market segments include Propulsion Tech.

4. Can you provide details about the market size?

The market size is estimated to be USD XX Million as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Increasing investments in space startups.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

February 2023: Thales Alenia Space has contracted with the Korea Aerospace Research Institute (KARI) to provide the integrated electric propulsion on their GEO-KOMPSAT-3 (GK3) satellite.December 2022: GKN Aerospace contracted with ArianeGroup to supply the next stage of the Ariane 6 turbine and Vulcain nozzle. The contract covers the manufacturing and supply of units for 14 Ariane 6 launchers, which are expected to go into production by 2025. GKN Aerospace is currently focused on industrializing and integrating novel and innovative technologies into the Ariane 6 product.November 2022: Two Northrop Grumman Corporation five-stage solid rocket boosters helped launch the first flight of NASA's Space Launch System "SLS"; as part of the Artemis I mission. This is the first in a series of Artemis missions focused on deep space exploration.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 3800, USD 4500, and USD 5800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in Million.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Asia-Pacific Space Propulsion Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Asia-Pacific Space Propulsion Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Asia-Pacific Space Propulsion Market?

To stay informed about further developments, trends, and reports in the Asia-Pacific Space Propulsion Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence