Key Insights

The Aviation Maintenance, Repair, and Overhaul (MRO) Software market is experiencing significant expansion, driven by the imperative for enhanced maintenance management, operational efficiency, and aviation safety. Key growth catalysts include a growing global aircraft fleet, stringent regulatory compliance, and the widespread adoption of digital technologies. Stakeholders such as airlines, MRO providers, and Original Equipment Manufacturers (OEMs) are increasingly leveraging cloud-based solutions to optimize processes, reduce costs, and gain actionable insights. Predictive maintenance, powered by advanced data analytics and AI, is a transformative trend shaping market dynamics. While initial software investment may be considerable, the long-term advantages, including minimized downtime, optimized resource allocation, and improved safety, justify the expenditure. The market is characterized by robust competition among established entities and emerging technology firms. Segmentation by deployment (cloud-based, on-premises) and end-user (Airlines, MROs, OEMs) highlights the projected dominance of cloud-based solutions, reflecting the ongoing digital transformation of the aviation sector. Asia-Pacific is poised for exceptional growth, fueled by burgeoning air travel and expanding fleets.

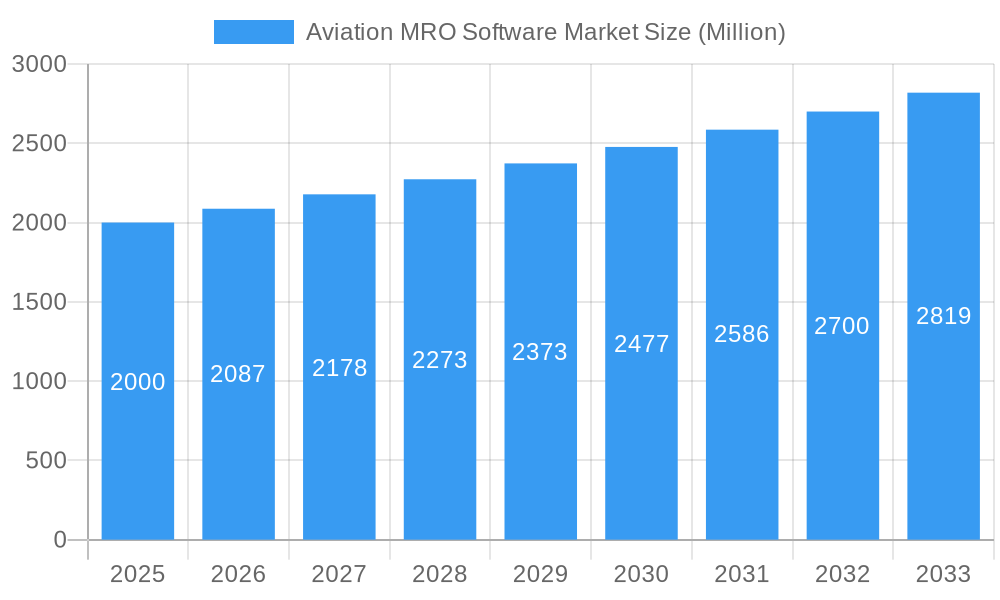

Aviation MRO Software Market Market Size (In Billion)

The market, valued at $6.9 billion in 2020, is projected to grow at a Compound Annual Growth Rate (CAGR) of 2.9%. Despite challenges such as integration complexities with legacy systems, data security apprehensions, and the requirement for skilled personnel, these obstacles are progressively being addressed through technological innovation and industry collaboration. The persistent focus on digital transformation and the ongoing need for optimized maintenance processes solidify the Aviation MRO Software market as a dynamic and promising sector for investment and innovation.

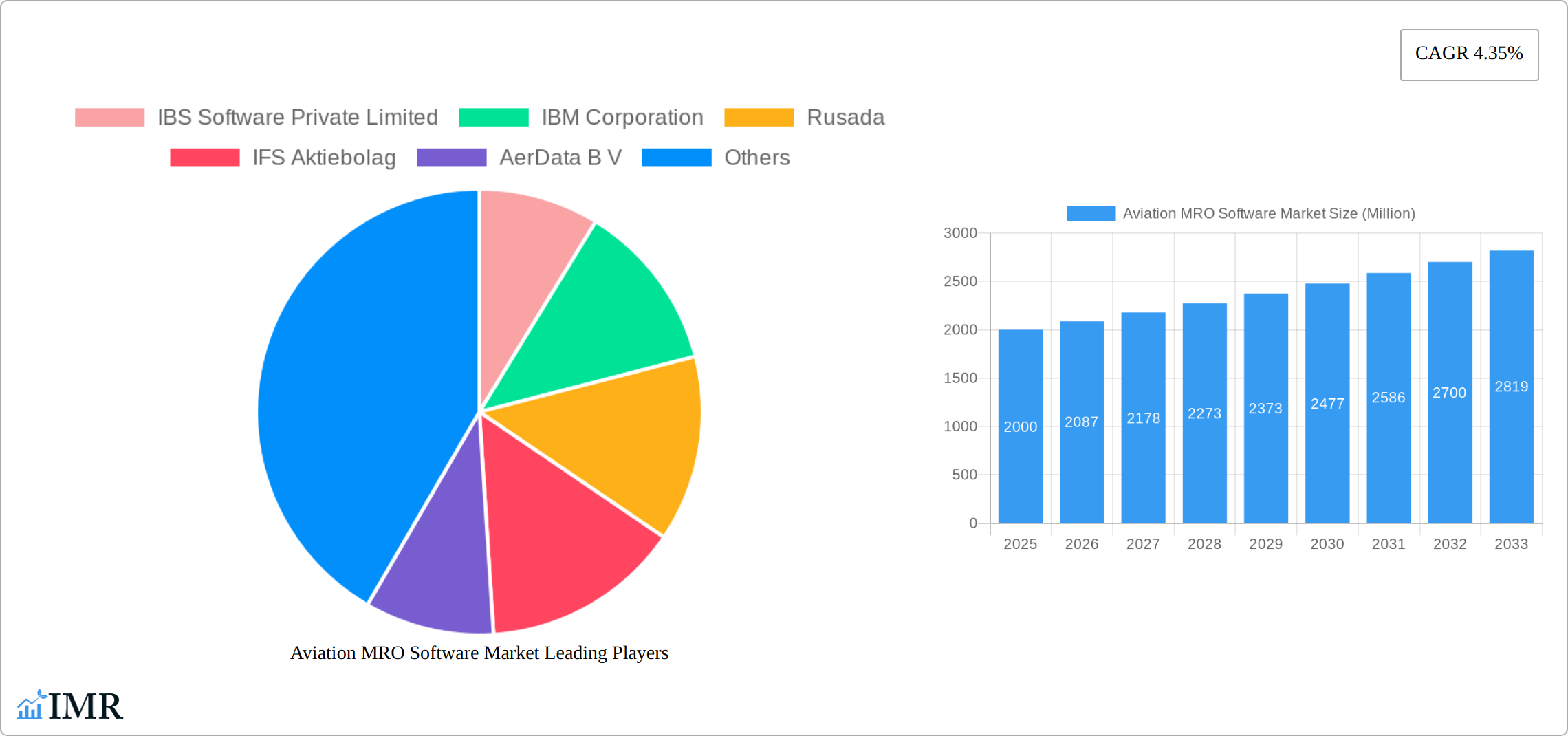

Aviation MRO Software Market Company Market Share

Aviation MRO Software Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Aviation MRO Software market, encompassing market dynamics, growth trends, regional segmentation, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period of 2025-2033 and a base year of 2025. The market is segmented by end-user (Airlines, MROs, OEMs) and deployment (Cloud-based, On-premises). The total market size in 2025 is estimated at xx Million, expected to reach xx Million by 2033.

Aviation MRO Software Market Dynamics & Structure

The Aviation MRO Software market is characterized by moderate concentration, with a few major players holding significant market share. Technological innovation, driven by the increasing adoption of cloud-based solutions and the need for advanced analytics, is a key growth driver. Stringent regulatory frameworks, particularly concerning data security and aircraft maintenance compliance, also shape market dynamics. Competitive pressures arise from both established players and emerging technology providers. The market exhibits considerable M&A activity, reflecting the strategic importance of software solutions within the broader aviation ecosystem.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2025.

- Innovation Drivers: Cloud computing, AI, big data analytics, and IoT integration.

- Regulatory Landscape: Stringent regulations impacting data security and maintenance compliance.

- Competitive Substitutes: Legacy systems and in-house developed solutions.

- End-User Demographics: Airlines, MROs, and OEMs representing different market segments and technological requirements.

- M&A Trends: Significant increase in M&A activity in the recent past, with xx major deals observed between 2019-2024.

Aviation MRO Software Market Growth Trends & Insights

The Aviation MRO Software market has experienced robust growth over the historical period (2019-2024), driven by the increasing adoption of digital technologies across the aviation industry. The market is witnessing a significant shift towards cloud-based solutions, offering scalability, cost-effectiveness, and enhanced data accessibility. Growing demand for predictive maintenance and real-time operational insights is fueling demand. Technological disruptions, such as the advent of AI-powered analytics and IoT-enabled sensor integration, are reshaping the competitive landscape. The market is poised for continued growth, fueled by rising air travel demand and the need for efficient maintenance operations. The CAGR during the forecast period (2025-2033) is projected at xx%. Market penetration of cloud-based solutions is expected to reach xx% by 2033.

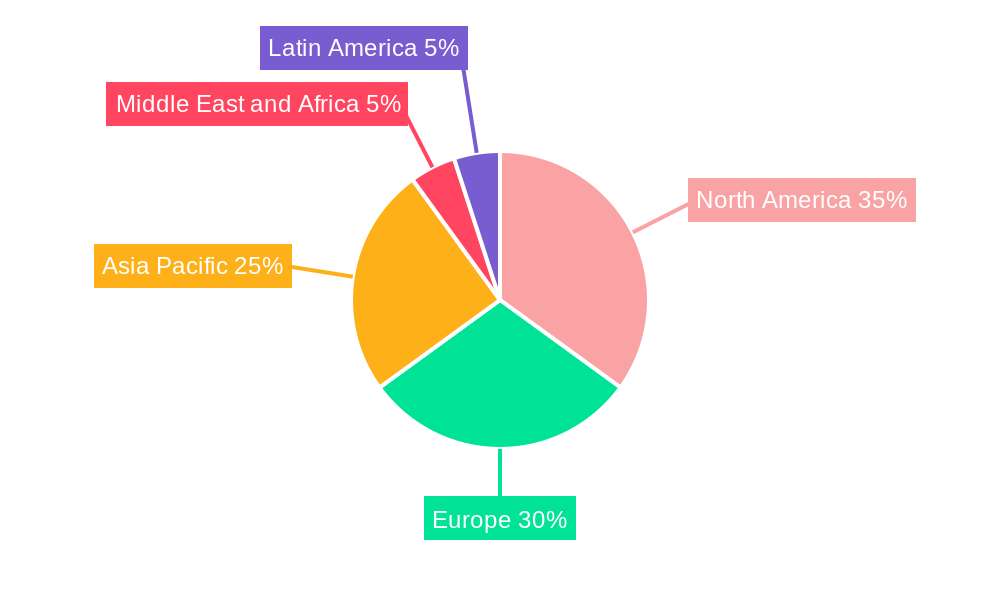

Dominant Regions, Countries, or Segments in Aviation MRO Software Market

North America continues to hold a commanding position in the Aviation MRO Software market, propelled by its extensive network of airlines, established MRO providers, and a relentless drive for technological innovation. Europe and the Asia-Pacific region are also demonstrating substantial growth, fueled by increasing aviation activity and digital transformation initiatives. Within the end-user segments, Airlines remain the largest consumer of MRO software, followed closely by independent MROs and Original Equipment Manufacturers (OEMs). The adoption of cloud-based deployment models is accelerating significantly, outpacing traditional on-premises solutions due to their inherent flexibility and accessibility.

- Key Growth Catalysts: A robust technological infrastructure, high penetration of digital technologies, and supportive governmental policies aimed at fostering digital advancements, including incentives for modernization, are primary drivers.

- North American Leadership: The region's dominance is attributed to a high concentration of leading airlines and MRO organizations, a sophisticated technology landscape, and early, widespread adoption of cloud-based MRO solutions.

- European Expansion: European markets are prioritizing efficiency gains and the reduction of operational expenditures. A strong regulatory emphasis on digitalization further accelerates the adoption of advanced MRO software.

- Asia-Pacific Opportunities: The burgeoning demand for air travel, coupled with significant investments in aviation infrastructure and governmental support for technological upgrades, presents immense growth potential for the Asia-Pacific region.

- Cloud-Based Adoption: The superior scalability, cost-effectiveness, and remote accessibility offered by cloud-based MRO software are key factors driving its widespread adoption across the industry.

Aviation MRO Software Market Product Landscape

The Aviation MRO Software market is characterized by a comprehensive suite of solutions designed to optimize maintenance, repair, and overhaul operations. This includes robust Computerized Maintenance Management Systems (CMMS), versatile Enterprise Asset Management (EAM) platforms, and specialized applications for critical functions such as parts management, inventory control, and sophisticated maintenance scheduling. Recent advancements are heavily focused on the integration of cutting-edge technologies like Artificial Intelligence (AI), Machine Learning (ML), and predictive analytics. These innovations are pivotal in enhancing maintenance efficiency, proactively identifying potential issues, and significantly reducing costly aircraft downtime. Key differentiators within the product landscape include real-time data visualization capabilities, advanced predictive maintenance algorithms, and seamless interoperability with existing aviation ecosystem components.

Key Drivers, Barriers & Challenges in Aviation MRO Software Market

Key Drivers: The need for improved operational efficiency, reducing maintenance costs, regulatory compliance, and real-time data analysis are major drivers. The rising adoption of digital technologies and growing air traffic are further contributing to market expansion.

Challenges & Restraints: High initial investment costs, integration complexities with existing systems, data security concerns, and the need for skilled personnel to operate advanced software solutions pose significant challenges. The xx% increase in cybersecurity incidents in the aviation sector in 2024 highlights the critical nature of this challenge.

Emerging Opportunities in Aviation MRO Software Market

The Aviation MRO Software market is ripe with emerging opportunities. The integration of Extended Reality (XR) technologies, including augmented and virtual reality, holds immense promise for revolutionizing remote maintenance support and training. Furthermore, the continuous development and refinement of AI-powered predictive maintenance tools are expected to unlock new levels of operational efficiency and safety. The strategic expansion of MRO software services into rapidly growing emerging markets, particularly in Asia and Africa, presents a significant avenue for growth. Additionally, the market is witnessing a strong demand for modular and highly scalable software solutions that can adapt to the evolving needs of aviation organizations.

Growth Accelerators in the Aviation MRO Software Market Industry

Strategic partnerships between software vendors and major airlines or MRO providers are key growth catalysts. Technological advancements, such as the integration of blockchain technology for secure data management and the use of digital twins for enhanced predictive maintenance, will further fuel growth. Expansion into new markets and enhanced customer service capabilities are additional accelerants.

Key Players Shaping the Aviation MRO Software Market Market

- IBS Software Private Limited

- IBM Corporation

- Rusada

- IFS Aktiebolag

- AerData B V

- Swiss AviationSoftware Ltd (Swiss-AS)

- Flatirons Solutions Inc

- Oracle Corporation

- Communications Software (Airline Systems) Limited

- Ramco Systems Ltd

- HCL Technologies Limited

- SAP SE

Notable Milestones in Aviation MRO Software Market Sector

- March 2023: The UK Royal Navy, in collaboration with Microsoft, introduced "Motherlode," a groundbreaking initiative designed to dramatically expedite the processing of aircraft maintenance data, showcasing advancements in data analytics for MRO.

- January 2023: Lufthansa Technik's acquisition of 100% ownership of Swiss-AS marked a significant strategic move, reinforcing its commitment to digital transformation and enhancing its capabilities in the aviation MRO software domain.

In-Depth Aviation MRO Software Market Market Outlook

The Aviation MRO Software market is projected to experience sustained growth over the forecast period, driven by the increasing adoption of advanced technologies and the growing need for efficient maintenance operations. Strategic partnerships, technological breakthroughs, and expansion into new markets will continue to shape the market's trajectory. The market offers significant opportunities for both established players and new entrants, emphasizing the need for innovative solutions and efficient customer service.

Aviation MRO Software Market Segmentation

-

1. Deployment

- 1.1. Cloud-based

- 1.2. On-premises

-

2. End User

- 2.1. Airlines

- 2.2. MROs

- 2.3. OEMs

Aviation MRO Software Market Segmentation By Geography

- 1. North America

- 2. Europe

- 3. Asia Pacific

- 4. Middle East and Africa

- 5. Latin America

Aviation MRO Software Market Regional Market Share

Geographic Coverage of Aviation MRO Software Market

Aviation MRO Software Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 2.9% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. The MRO Segment Dominated the Market During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Aviation MRO Software Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 5.1.1. Cloud-based

- 5.1.2. On-premises

- 5.2. Market Analysis, Insights and Forecast - by End User

- 5.2.1. Airlines

- 5.2.2. MROs

- 5.2.3. OEMs

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. Europe

- 5.3.3. Asia Pacific

- 5.3.4. Middle East and Africa

- 5.3.5. Latin America

- 5.1. Market Analysis, Insights and Forecast - by Deployment

- 6. North America Aviation MRO Software Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 6.1.1. Cloud-based

- 6.1.2. On-premises

- 6.2. Market Analysis, Insights and Forecast - by End User

- 6.2.1. Airlines

- 6.2.2. MROs

- 6.2.3. OEMs

- 6.1. Market Analysis, Insights and Forecast - by Deployment

- 7. Europe Aviation MRO Software Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 7.1.1. Cloud-based

- 7.1.2. On-premises

- 7.2. Market Analysis, Insights and Forecast - by End User

- 7.2.1. Airlines

- 7.2.2. MROs

- 7.2.3. OEMs

- 7.1. Market Analysis, Insights and Forecast - by Deployment

- 8. Asia Pacific Aviation MRO Software Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 8.1.1. Cloud-based

- 8.1.2. On-premises

- 8.2. Market Analysis, Insights and Forecast - by End User

- 8.2.1. Airlines

- 8.2.2. MROs

- 8.2.3. OEMs

- 8.1. Market Analysis, Insights and Forecast - by Deployment

- 9. Middle East and Africa Aviation MRO Software Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 9.1.1. Cloud-based

- 9.1.2. On-premises

- 9.2. Market Analysis, Insights and Forecast - by End User

- 9.2.1. Airlines

- 9.2.2. MROs

- 9.2.3. OEMs

- 9.1. Market Analysis, Insights and Forecast - by Deployment

- 10. Latin America Aviation MRO Software Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 10.1.1. Cloud-based

- 10.1.2. On-premises

- 10.2. Market Analysis, Insights and Forecast - by End User

- 10.2.1. Airlines

- 10.2.2. MROs

- 10.2.3. OEMs

- 10.1. Market Analysis, Insights and Forecast - by Deployment

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 IBS Software Private Limited

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 IBM Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Rusada

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IFS Aktiebolag

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 AerData B V

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Swiss AviationSoftware Ltd (Swiss-AS)

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Flatirons Solutions Inc

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Oracle Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Communications Software (Airline Systems) Limited

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Ramco Systems Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 HCL Technologies Limited

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.12 SAP SE

- 11.2.12.1. Overview

- 11.2.12.2. Products

- 11.2.12.3. SWOT Analysis

- 11.2.12.4. Recent Developments

- 11.2.12.5. Financials (Based on Availability)

- 11.2.1 IBS Software Private Limited

List of Figures

- Figure 1: Global Aviation MRO Software Market Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: North America Aviation MRO Software Market Revenue (billion), by Deployment 2025 & 2033

- Figure 3: North America Aviation MRO Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 4: North America Aviation MRO Software Market Revenue (billion), by End User 2025 & 2033

- Figure 5: North America Aviation MRO Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 6: North America Aviation MRO Software Market Revenue (billion), by Country 2025 & 2033

- Figure 7: North America Aviation MRO Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 8: Europe Aviation MRO Software Market Revenue (billion), by Deployment 2025 & 2033

- Figure 9: Europe Aviation MRO Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 10: Europe Aviation MRO Software Market Revenue (billion), by End User 2025 & 2033

- Figure 11: Europe Aviation MRO Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 12: Europe Aviation MRO Software Market Revenue (billion), by Country 2025 & 2033

- Figure 13: Europe Aviation MRO Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: Asia Pacific Aviation MRO Software Market Revenue (billion), by Deployment 2025 & 2033

- Figure 15: Asia Pacific Aviation MRO Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 16: Asia Pacific Aviation MRO Software Market Revenue (billion), by End User 2025 & 2033

- Figure 17: Asia Pacific Aviation MRO Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 18: Asia Pacific Aviation MRO Software Market Revenue (billion), by Country 2025 & 2033

- Figure 19: Asia Pacific Aviation MRO Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 20: Middle East and Africa Aviation MRO Software Market Revenue (billion), by Deployment 2025 & 2033

- Figure 21: Middle East and Africa Aviation MRO Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 22: Middle East and Africa Aviation MRO Software Market Revenue (billion), by End User 2025 & 2033

- Figure 23: Middle East and Africa Aviation MRO Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 24: Middle East and Africa Aviation MRO Software Market Revenue (billion), by Country 2025 & 2033

- Figure 25: Middle East and Africa Aviation MRO Software Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Aviation MRO Software Market Revenue (billion), by Deployment 2025 & 2033

- Figure 27: Latin America Aviation MRO Software Market Revenue Share (%), by Deployment 2025 & 2033

- Figure 28: Latin America Aviation MRO Software Market Revenue (billion), by End User 2025 & 2033

- Figure 29: Latin America Aviation MRO Software Market Revenue Share (%), by End User 2025 & 2033

- Figure 30: Latin America Aviation MRO Software Market Revenue (billion), by Country 2025 & 2033

- Figure 31: Latin America Aviation MRO Software Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Aviation MRO Software Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 2: Global Aviation MRO Software Market Revenue billion Forecast, by End User 2020 & 2033

- Table 3: Global Aviation MRO Software Market Revenue billion Forecast, by Region 2020 & 2033

- Table 4: Global Aviation MRO Software Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 5: Global Aviation MRO Software Market Revenue billion Forecast, by End User 2020 & 2033

- Table 6: Global Aviation MRO Software Market Revenue billion Forecast, by Country 2020 & 2033

- Table 7: Global Aviation MRO Software Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 8: Global Aviation MRO Software Market Revenue billion Forecast, by End User 2020 & 2033

- Table 9: Global Aviation MRO Software Market Revenue billion Forecast, by Country 2020 & 2033

- Table 10: Global Aviation MRO Software Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 11: Global Aviation MRO Software Market Revenue billion Forecast, by End User 2020 & 2033

- Table 12: Global Aviation MRO Software Market Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global Aviation MRO Software Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 14: Global Aviation MRO Software Market Revenue billion Forecast, by End User 2020 & 2033

- Table 15: Global Aviation MRO Software Market Revenue billion Forecast, by Country 2020 & 2033

- Table 16: Global Aviation MRO Software Market Revenue billion Forecast, by Deployment 2020 & 2033

- Table 17: Global Aviation MRO Software Market Revenue billion Forecast, by End User 2020 & 2033

- Table 18: Global Aviation MRO Software Market Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Aviation MRO Software Market?

The projected CAGR is approximately 2.9%.

2. Which companies are prominent players in the Aviation MRO Software Market?

Key companies in the market include IBS Software Private Limited, IBM Corporation, Rusada, IFS Aktiebolag, AerData B V, Swiss AviationSoftware Ltd (Swiss-AS), Flatirons Solutions Inc, Oracle Corporation, Communications Software (Airline Systems) Limited, Ramco Systems Ltd, HCL Technologies Limited, SAP SE.

3. What are the main segments of the Aviation MRO Software Market?

The market segments include Deployment, End User.

4. Can you provide details about the market size?

The market size is estimated to be USD 6.9 billion as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

The MRO Segment Dominated the Market During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

March 2023: The UK Royal Navy and Microsoft introduced advanced software, Motherlode, which processes aircraft maintenance data much faster, in some cases reducing months to minutes. It was developed by the Portsmouth-based 1710 Naval Air Squadron (NAS), a group of experts in aircraft overhaul, helicopter monitoring, and airborne-related scientific research. It helps in real-time data processing and advanced analytics to predict material functionality, optimize maintenance timelines, and bolster the Royal Navy's overall fleet availability.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Aviation MRO Software Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Aviation MRO Software Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Aviation MRO Software Market?

To stay informed about further developments, trends, and reports in the Aviation MRO Software Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence