Key Insights

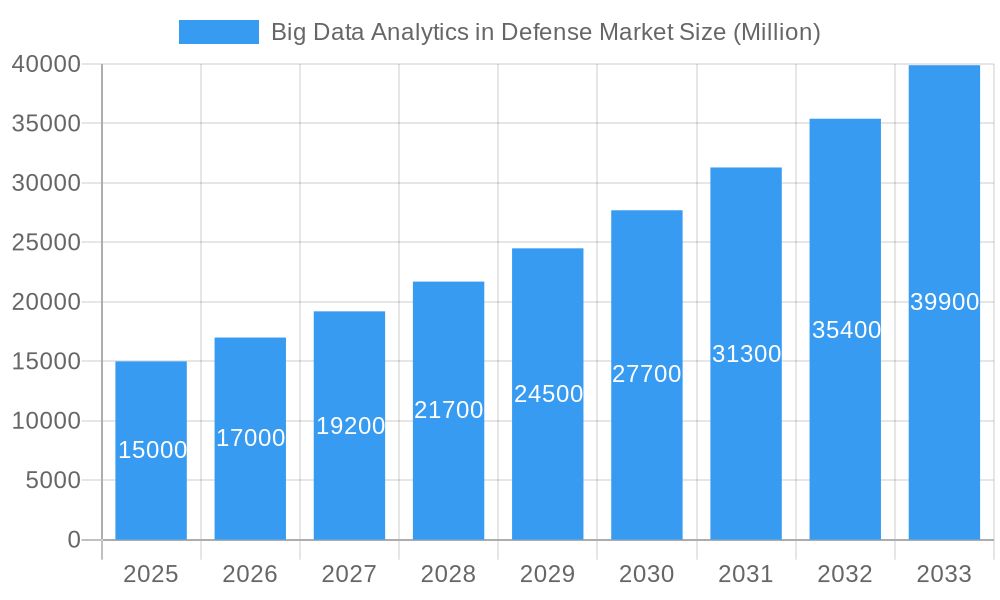

The global Big Data Analytics in Defense market is experiencing robust growth, projected to maintain a Compound Annual Growth Rate (CAGR) exceeding 13% from 2025 to 2033. This expansion is fueled by several key factors. Firstly, the increasing volume and complexity of data generated by modern military operations necessitate sophisticated analytics capabilities for improved situational awareness, predictive intelligence, and resource optimization. Secondly, advancements in artificial intelligence (AI) and machine learning (ML) are significantly enhancing the analytical power of big data platforms, enabling defense organizations to extract actionable insights from diverse data sources, including sensor networks, satellite imagery, and social media. The adoption of cloud-based solutions further accelerates this trend, providing scalability, accessibility, and cost-effectiveness. Finally, the growing need for enhanced cybersecurity and counter-terrorism strategies is driving demand for advanced big data analytics tools to identify threats and vulnerabilities more effectively. While potential restraints exist, such as data security concerns and the need for skilled personnel, the overall market outlook remains extremely positive.

Big Data Analytics in Defense Market Market Size (In Billion)

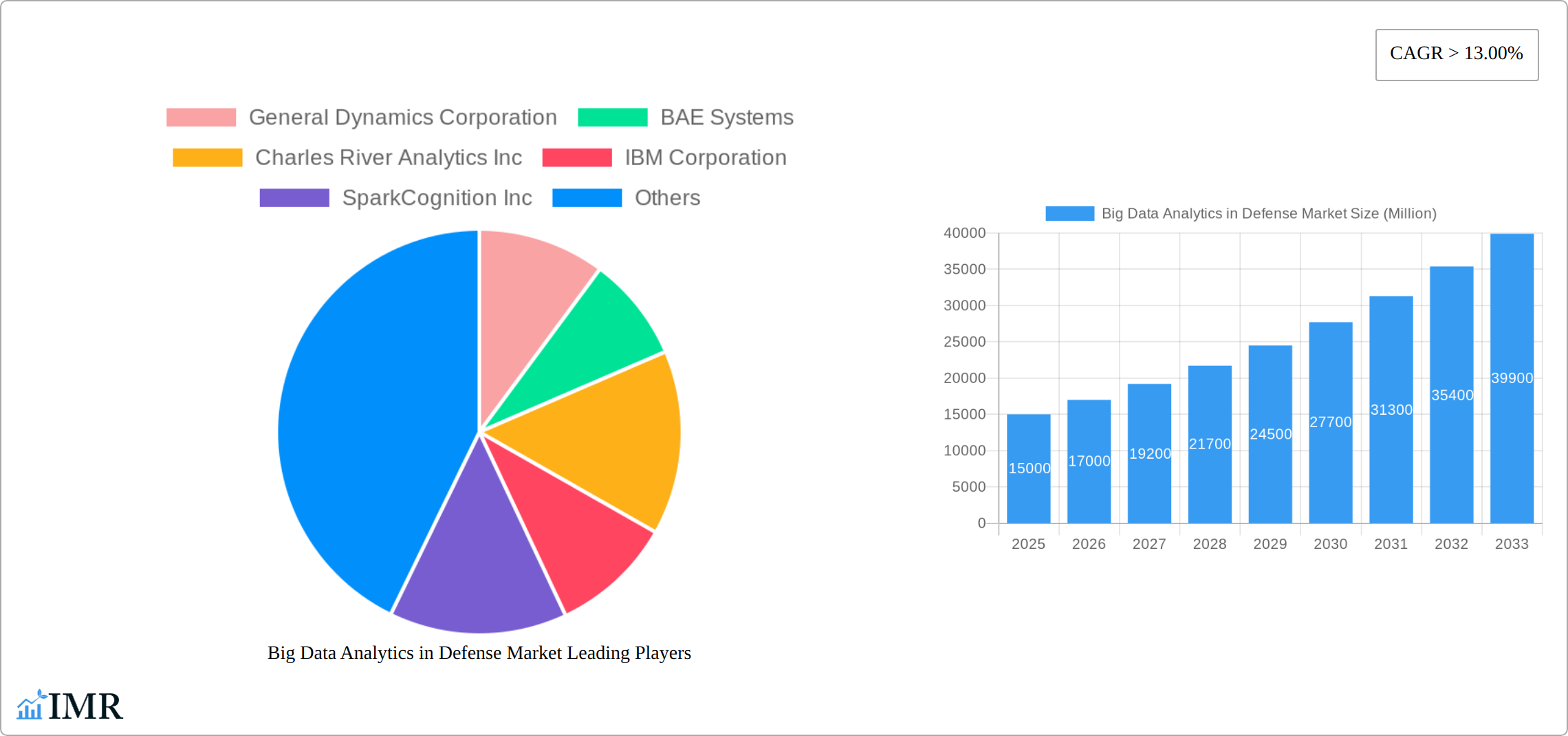

The market segmentation reveals a strong preference for AI-driven solutions within the technology segment, reflecting the increasing reliance on automation and predictive modeling. Geographically, North America currently holds a significant market share due to the presence of major defense contractors and advanced technological infrastructure. However, the Asia-Pacific region is expected to exhibit considerable growth in the coming years, driven by increasing defense budgets and modernization initiatives. The market is largely dominated by established defense contractors such as General Dynamics, BAE Systems, and Lockheed Martin, alongside technology giants like IBM. However, specialized companies like SparkCognition and Shield AI are also gaining prominence by providing innovative AI-driven solutions tailored to the specific needs of the defense sector. This competitive landscape is fostering continuous innovation and delivering increasingly sophisticated big data analytics capabilities to the global defense community.

Big Data Analytics in Defense Market Company Market Share

Big Data Analytics in Defense Market: A Comprehensive Report (2019-2033)

This comprehensive report provides an in-depth analysis of the Big Data Analytics in Defense market, encompassing market dynamics, growth trends, regional analysis, product landscape, key players, and future outlook. The report covers the period from 2019 to 2033, with a focus on the forecast period 2025-2033 and a base year of 2025. The market is segmented by technology (Artificial Intelligence, Big Data Analytics, Others), platform (Army, Navy, Air Force), and offering (Hardware, Software, Services). This report is essential for defense contractors, technology providers, investors, and government agencies seeking to understand and capitalize on opportunities within this rapidly evolving market. The market is projected to reach xx Million by 2033.

Big Data Analytics in Defense Market Dynamics & Structure

The Big Data Analytics in Defense market is characterized by a moderately concentrated landscape, with key players like General Dynamics Corporation, BAE Systems, and Lockheed Martin Corporation holding significant market share. However, the emergence of innovative startups and the increasing adoption of open-source technologies are fostering competition. Technological innovation, driven by advancements in AI, machine learning, and cloud computing, is a primary growth driver. Stringent regulatory frameworks concerning data security and privacy, coupled with the need for interoperability, pose significant challenges. The market also witnesses substantial M&A activity, reflecting the strategic importance of big data analytics capabilities in national defense.

- Market Concentration: Moderately concentrated, with top 5 players holding approximately xx% market share in 2024.

- Technological Innovation: Rapid advancements in AI, machine learning, and cloud computing are driving market growth.

- Regulatory Frameworks: Stringent data security and privacy regulations influence market dynamics.

- Competitive Product Substitutes: Limited direct substitutes, but competitive pressure exists from alternative data analysis solutions.

- End-User Demographics: Primarily government agencies (defense ministries, armed forces) and defense contractors.

- M&A Trends: Significant M&A activity, with an estimated xx M&A deals completed between 2019 and 2024.

Big Data Analytics in Defense Market Growth Trends & Insights

The Big Data Analytics in Defense market experienced robust growth during the historical period (2019-2024), with a Compound Annual Growth Rate (CAGR) of xx%. This growth is attributed to increasing defense budgets globally, the rising adoption of big data analytics for intelligence, surveillance, and reconnaissance (ISR), and the need for enhanced cybersecurity. The market penetration of big data analytics solutions within defense organizations is steadily increasing, driven by the realization of improved operational efficiency, strategic decision-making, and enhanced situational awareness. Technological disruptions, such as the emergence of edge computing and quantum computing, are expected to further accelerate market growth in the forecast period (2025-2033). Consumer behavior shifts, although less directly applicable to the defense sector, are indirectly influencing demand through the need for adaptable and user-friendly analytics platforms. The market is projected to reach xx Million by 2033, with a CAGR of xx% during the forecast period.

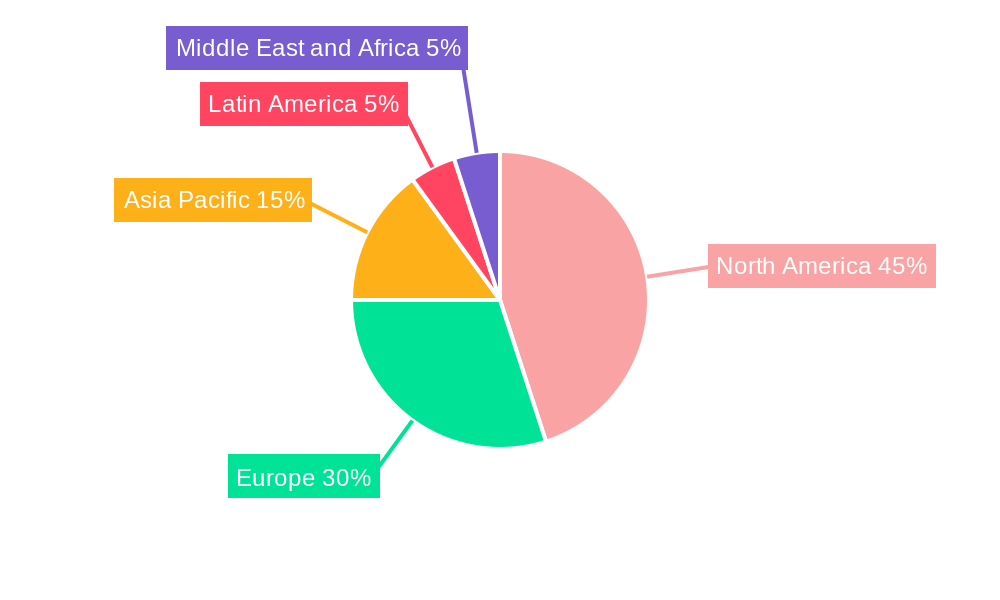

Dominant Regions, Countries, or Segments in Big Data Analytics in Defense Market

North America (particularly the United States) currently dominates the Big Data Analytics in Defense market, driven by substantial defense spending and advanced technological capabilities. However, regions like Asia-Pacific are experiencing rapid growth, fueled by increasing defense budgets and modernization efforts. Within the market segmentation, the Artificial Intelligence segment holds the largest market share due to its versatility and capability in addressing complex defense challenges. The Army segment is the largest end-user platform, followed by the Air Force and Navy. The software segment dominates the offering segment due to its flexibility and scalability.

- Key Drivers:

- High Defense Budgets: Significant investments in defense modernization globally.

- Technological Advancements: Innovation in AI, machine learning, and cloud computing.

- Geopolitical Factors: Increased global instability driving demand for advanced defense technologies.

- Dominant Segments:

- By Technology: Artificial Intelligence (Largest Market Share)

- By Platform: Army (Largest End-User)

- By Offering: Software (Largest Offering Segment)

Big Data Analytics in Defense Market Product Landscape

The Big Data Analytics in Defense market is characterized by a sophisticated and evolving product ecosystem. This includes advanced analytics platforms capable of processing and deriving insights from massive datasets, highly specialized software solutions tailored for Intelligence, Surveillance, and Reconnaissance (ISR) operations, and comprehensive integrated hardware-software solutions designed for robust data processing, real-time analysis, and secure storage. These solutions extensively leverage cutting-edge technologies such as artificial intelligence (AI), machine learning (ML) algorithms, advanced statistical modeling, and scalable cloud-based or on-premise infrastructures. The primary value propositions revolve around delivering actionable, real-time intelligence, significantly improving operational efficiency, bolstering decision-making accuracy, and ensuring seamless integration with legacy defense systems and platforms. Current technological advancements are aggressively focused on accelerating data processing speeds, fortifying data security and integrity, enhancing AI-driven anomaly detection, and developing resilient solutions for edge computing environments, enabling data analysis closer to the point of collection.

Key Drivers, Barriers & Challenges in Big Data Analytics in Defense Market

Key Drivers: The market is propelled by an escalating demand for enhanced situational awareness across complex operational theaters. The imperative to strengthen cybersecurity postures against evolving threats is a significant catalyst. Furthermore, the increasing adoption of AI for developing and operating autonomous systems, from drones to unmanned vehicles, requires robust data analytics capabilities. Finally, the persistent pursuit of improving decision-making efficiency and speed in high-stakes environments is a core driver.

Challenges and Restraints: Significant hurdles include the substantial initial investment costs associated with acquiring and deploying advanced analytics infrastructure. Pervasive concerns surrounding data security and privacy, especially when dealing with classified or sensitive information, remain a major impediment. The inherent complexities of data integration and interoperability across disparate legacy systems and new platforms are also a considerable challenge. Moreover, a critical shortage of specialized skilled personnel capable of implementing, managing, and interpreting these advanced systems limits widespread adoption. These combined challenges can lead to a slower adoption rate and a moderated market growth trajectory in certain regions, potentially impacting overall market expansion by an estimated 5-8% by 2033 if not strategically addressed.

Emerging Opportunities in Big Data Analytics in Defense Market

The landscape of emerging opportunities is rich and transformative. A key area of growth lies in the synergistic integration of big data analytics with the burgeoning Internet of Things (IoT) ecosystem, particularly for enhancing battlefield awareness through real-time sensor data fusion. The development and widespread deployment of AI-powered predictive maintenance systems for military equipment promise significant cost savings and improved readiness. Furthermore, the application of sophisticated big data analytics to optimize complex logistics and supply chain management offers substantial operational efficiencies. Untapped markets are particularly evident in rapidly developing nations that are experiencing increasing defense budgets and a strategic imperative to modernize their military capabilities and adopt advanced technological solutions.

Growth Accelerators in the Big Data Analytics in Defense Market Industry

Strategic partnerships between defense contractors and technology companies are crucial in accelerating market growth. Technological breakthroughs, such as advancements in quantum computing and edge AI, will significantly impact the market. Market expansion strategies focusing on developing nations and emerging defense applications will further contribute to long-term growth.

Key Players Shaping the Big Data Analytics in Defense Market Market

Notable Milestones in Big Data Analytics in Defense Market Sector

- September 2022: The United States Air Force awarded a significant USD 1.25 million contract to ZeroEyes for their AI gun detection solution, specifically for deployment on Unmanned Aerial Vehicles (UAVs) at Dover Air Force Base. This contract underscores the growing confidence and investment in AI-driven security and threat detection technologies within the defense sector.

- July 2022: The Indian Ministry of Defense made a substantial commitment to technological advancement by launching 75 AI products and technologies. This initiative highlights the nation's strategic focus on leveraging AI and big data analytics to enhance its defense capabilities, signifying a major investment and recognizing the pivotal role of these technologies in modern warfare.

In-Depth Big Data Analytics in Defense Market Market Outlook

The future trajectory of the Big Data Analytics in Defense market is exceptionally promising, fueled by relentless technological innovation and a consistent increase in global defense expenditures. Strategic alliances, substantial investments in research and development (R&D), and the continuous exploration of novel applications will be instrumental in shaping the market's evolution. The inherent potential for market growth is rooted in its profound ability to enhance national security, streamline and optimize diverse defense operations, and significantly improve the speed and quality of decision-making across all military domains. The pervasive integration of AI and big data analytics is no longer a secondary consideration but will become an indispensable element for any nation seeking to maintain a decisive technological edge in the increasingly complex and competitive global defense landscape.

Big Data Analytics in Defense Market Segmentation

-

1. Offering

- 1.1. Hardware

- 1.2. Software

- 1.3. Services

-

2. Technology

- 2.1. Artificial Intelligence

- 2.2. Big Data Analytics

- 2.3. Other Te

-

3. Platform

- 3.1. Army

- 3.2. Navy

- 3.3. Airforce

Big Data Analytics in Defense Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

-

2. Europe

- 2.1. Germany

- 2.2. United Kingdom

- 2.3. France

- 2.4. Russia

- 2.5. Rest of Europe

-

3. Asia Pacific

- 3.1. India

- 3.2. China

- 3.3. Japan

- 3.4. South Korea

- 3.5. Rest of Asia Pacific

-

4. Latin America

- 4.1. Brazil

- 4.2. Rest of Latin America

-

5. Middle East and Africa

- 5.1. United Arab Emirates

- 5.2. Saudi Arabia

- 5.3. Egypt

- 5.4. Rest of Middle East and Africa

Big Data Analytics in Defense Market Regional Market Share

Geographic Coverage of Big Data Analytics in Defense Market

Big Data Analytics in Defense Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 13.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.3. Market Restrains

- 3.4. Market Trends

- 3.4.1. Software Segment Will Showcase Remarkable Growth During the Forecast Period

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 5.1.1. Hardware

- 5.1.2. Software

- 5.1.3. Services

- 5.2. Market Analysis, Insights and Forecast - by Technology

- 5.2.1. Artificial Intelligence

- 5.2.2. Big Data Analytics

- 5.2.3. Other Te

- 5.3. Market Analysis, Insights and Forecast - by Platform

- 5.3.1. Army

- 5.3.2. Navy

- 5.3.3. Airforce

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. North America

- 5.4.2. Europe

- 5.4.3. Asia Pacific

- 5.4.4. Latin America

- 5.4.5. Middle East and Africa

- 5.1. Market Analysis, Insights and Forecast - by Offering

- 6. North America Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 6.1.1. Hardware

- 6.1.2. Software

- 6.1.3. Services

- 6.2. Market Analysis, Insights and Forecast - by Technology

- 6.2.1. Artificial Intelligence

- 6.2.2. Big Data Analytics

- 6.2.3. Other Te

- 6.3. Market Analysis, Insights and Forecast - by Platform

- 6.3.1. Army

- 6.3.2. Navy

- 6.3.3. Airforce

- 6.1. Market Analysis, Insights and Forecast - by Offering

- 7. Europe Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 7.1.1. Hardware

- 7.1.2. Software

- 7.1.3. Services

- 7.2. Market Analysis, Insights and Forecast - by Technology

- 7.2.1. Artificial Intelligence

- 7.2.2. Big Data Analytics

- 7.2.3. Other Te

- 7.3. Market Analysis, Insights and Forecast - by Platform

- 7.3.1. Army

- 7.3.2. Navy

- 7.3.3. Airforce

- 7.1. Market Analysis, Insights and Forecast - by Offering

- 8. Asia Pacific Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 8.1.1. Hardware

- 8.1.2. Software

- 8.1.3. Services

- 8.2. Market Analysis, Insights and Forecast - by Technology

- 8.2.1. Artificial Intelligence

- 8.2.2. Big Data Analytics

- 8.2.3. Other Te

- 8.3. Market Analysis, Insights and Forecast - by Platform

- 8.3.1. Army

- 8.3.2. Navy

- 8.3.3. Airforce

- 8.1. Market Analysis, Insights and Forecast - by Offering

- 9. Latin America Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 9.1.1. Hardware

- 9.1.2. Software

- 9.1.3. Services

- 9.2. Market Analysis, Insights and Forecast - by Technology

- 9.2.1. Artificial Intelligence

- 9.2.2. Big Data Analytics

- 9.2.3. Other Te

- 9.3. Market Analysis, Insights and Forecast - by Platform

- 9.3.1. Army

- 9.3.2. Navy

- 9.3.3. Airforce

- 9.1. Market Analysis, Insights and Forecast - by Offering

- 10. Middle East and Africa Big Data Analytics in Defense Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 10.1.1. Hardware

- 10.1.2. Software

- 10.1.3. Services

- 10.2. Market Analysis, Insights and Forecast - by Technology

- 10.2.1. Artificial Intelligence

- 10.2.2. Big Data Analytics

- 10.2.3. Other Te

- 10.3. Market Analysis, Insights and Forecast - by Platform

- 10.3.1. Army

- 10.3.2. Navy

- 10.3.3. Airforce

- 10.1. Market Analysis, Insights and Forecast - by Offering

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 General Dynamics Corporation

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 BAE Systems

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Charles River Analytics Inc

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 IBM Corporation

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 SparkCognition Inc

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Shield AI

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Leidos

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Thales Group

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Northrop Grumman

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Lockheed Martin Corportaion

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.11 Raytheon Technologies Inc

- 11.2.11.1. Overview

- 11.2.11.2. Products

- 11.2.11.3. SWOT Analysis

- 11.2.11.4. Recent Developments

- 11.2.11.5. Financials (Based on Availability)

- 11.2.1 General Dynamics Corporation

List of Figures

- Figure 1: Global Big Data Analytics in Defense Market Revenue Breakdown (undefined, %) by Region 2025 & 2033

- Figure 2: North America Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 3: North America Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 4: North America Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 5: North America Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 6: North America Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 7: North America Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 8: North America Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 9: North America Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 10: Europe Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 11: Europe Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 12: Europe Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 13: Europe Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 14: Europe Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 15: Europe Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 16: Europe Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 17: Europe Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 18: Asia Pacific Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 19: Asia Pacific Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 20: Asia Pacific Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 21: Asia Pacific Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 22: Asia Pacific Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 23: Asia Pacific Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 24: Asia Pacific Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 25: Asia Pacific Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: Latin America Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 27: Latin America Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 28: Latin America Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 29: Latin America Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 30: Latin America Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 31: Latin America Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 32: Latin America Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 33: Latin America Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

- Figure 34: Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined), by Offering 2025 & 2033

- Figure 35: Middle East and Africa Big Data Analytics in Defense Market Revenue Share (%), by Offering 2025 & 2033

- Figure 36: Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined), by Technology 2025 & 2033

- Figure 37: Middle East and Africa Big Data Analytics in Defense Market Revenue Share (%), by Technology 2025 & 2033

- Figure 38: Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined), by Platform 2025 & 2033

- Figure 39: Middle East and Africa Big Data Analytics in Defense Market Revenue Share (%), by Platform 2025 & 2033

- Figure 40: Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined), by Country 2025 & 2033

- Figure 41: Middle East and Africa Big Data Analytics in Defense Market Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 2: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 3: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 4: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Region 2020 & 2033

- Table 5: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 6: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 7: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 8: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 9: United States Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 10: Canada Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 11: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 12: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 13: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 14: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 15: Germany Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 16: United Kingdom Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 17: France Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 18: Russia Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 19: Rest of Europe Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 20: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 21: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 22: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 23: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 24: India Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 25: China Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 26: Japan Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 27: South Korea Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 28: Rest of Asia Pacific Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 29: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 30: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 31: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 32: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 33: Brazil Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 34: Rest of Latin America Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 35: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Offering 2020 & 2033

- Table 36: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Technology 2020 & 2033

- Table 37: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Platform 2020 & 2033

- Table 38: Global Big Data Analytics in Defense Market Revenue undefined Forecast, by Country 2020 & 2033

- Table 39: United Arab Emirates Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 40: Saudi Arabia Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 41: Egypt Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

- Table 42: Rest of Middle East and Africa Big Data Analytics in Defense Market Revenue (undefined) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the Big Data Analytics in Defense Market?

The projected CAGR is approximately 13.5%.

2. Which companies are prominent players in the Big Data Analytics in Defense Market?

Key companies in the market include General Dynamics Corporation, BAE Systems, Charles River Analytics Inc, IBM Corporation, SparkCognition Inc, Shield AI, Leidos, Thales Group, Northrop Grumman, Lockheed Martin Corportaion, Raytheon Technologies Inc.

3. What are the main segments of the Big Data Analytics in Defense Market?

The market segments include Offering, Technology, Platform.

4. Can you provide details about the market size?

The market size is estimated to be USD XXX N/A as of 2022.

5. What are some drivers contributing to market growth?

N/A

6. What are the notable trends driving market growth?

Software Segment Will Showcase Remarkable Growth During the Forecast Period.

7. Are there any restraints impacting market growth?

N/A

8. Can you provide examples of recent developments in the market?

September 2022: The United States Air Force signed a contract worth USD 1.25 million with ZeroEyto procure an AI gun detection solution for the service's unmanned aerial vehicles (UAVs) at the Dover Air Force Base, Delaware. ZeroEyes' technology will enable drones to detect handheld weapons for base protection.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in N/A.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "Big Data Analytics in Defense Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the Big Data Analytics in Defense Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the Big Data Analytics in Defense Market?

To stay informed about further developments, trends, and reports in the Big Data Analytics in Defense Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence