Key Insights

The Asia-Pacific (APAC) E-Cigarette Market is projected for robust expansion, expected to reach approximately 423.7 billion by 2025, exhibiting a Compound Annual Growth Rate (CAGR) of 1.8% through 2033. This growth is driven by a shift in consumer preferences towards reduced-harm alternatives to traditional tobacco products, especially among younger demographics in developing economies. The expanding availability of diverse e-cigarette devices and e-liquids, supported by broadening distribution channels including both physical retail and the burgeoning online sector, will further enhance market penetration. Key markets like New Zealand, Bangladesh, and Indonesia are anticipated to be significant growth engines, influenced by rising disposable incomes and increased recognition of vaping as a smoking cessation aid. The competitive environment is characterized by major global entities such as British American Tobacco, Philip Morris International, and JUUL Labs, alongside prominent Asian manufacturers including RELX International and Smoore International Holdings.

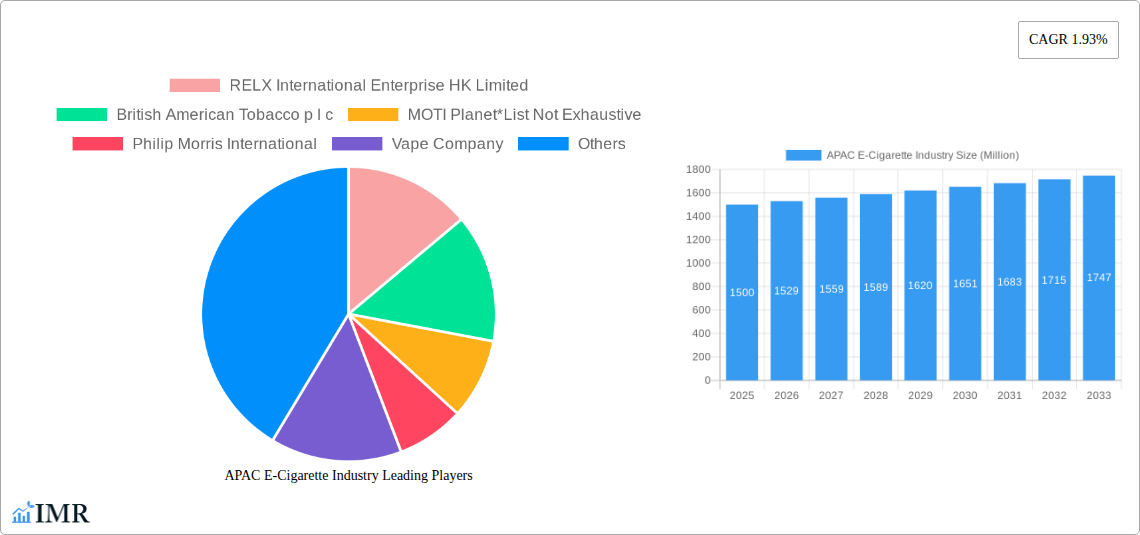

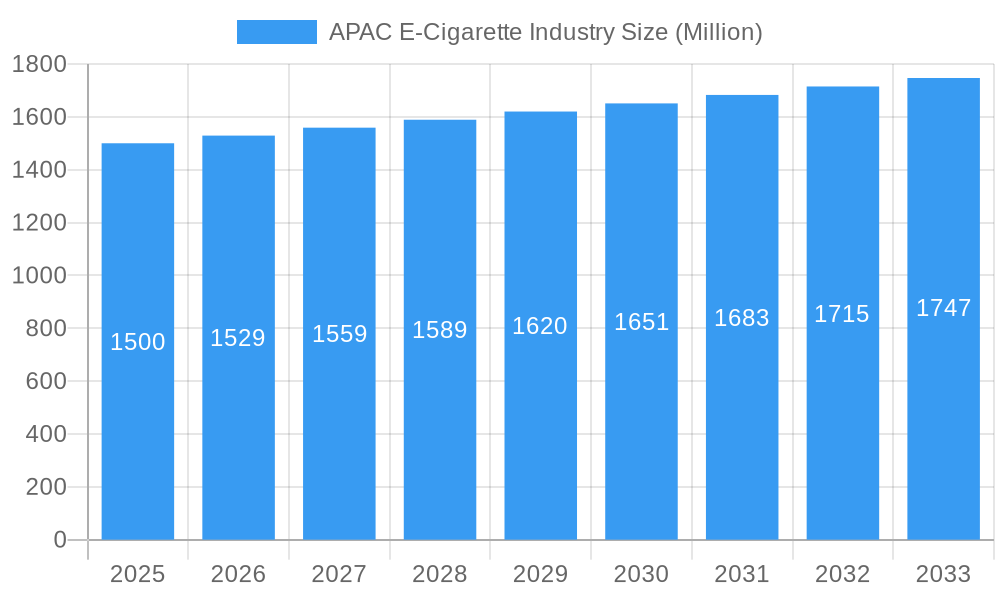

APAC E-Cigarette Industry Market Size (In Billion)

Despite the positive outlook, the APAC E-Cigarette industry confronts challenges. Stringent regulatory environments across various APAC nations, ongoing concerns about the long-term health implications of vaping, and public health initiatives discouraging e-cigarette use present considerable hurdles. Nevertheless, continuous innovation in product design, flavor profiles, and advanced device technologies is expected to counterbalance these restraints and sustain consumer engagement. The market is segmented by e-cigarette devices and e-liquids, with both segments anticipated to experience consistent demand. Distribution channels are also evolving, with online retail gaining significant momentum due to its convenience and extensive product offerings, complementing the established offline retail network. The ongoing adoption of e-cigarettes across the Asia-Pacific region, particularly in emerging economies, will define this market's trajectory.

APAC E-Cigarette Industry Company Market Share

APAC E-Cigarette Industry Report: Market Dynamics, Growth Trends, and Key Players (2019-2033)

This comprehensive report offers an in-depth analysis of the dynamic APAC E-Cigarette Industry, providing critical insights for industry professionals, investors, and stakeholders. Spanning from 2019 to 2033, with a base and estimated year of 2025, the report meticulously examines market evolution, technological advancements, regulatory landscapes, and emerging opportunities. We delve into the intricate market structure, analyze growth trajectories, identify dominant segments, and spotlight key players shaping the future of e-cigarettes in the Asia-Pacific region. All values are presented in Million units.

APAC E-Cigarette Industry Market Dynamics & Structure

The APAC E-Cigarette Industry is characterized by a moderate to high level of market concentration, with a few dominant players holding significant market share, particularly in the e-cigarette devices segment. Technological innovation serves as a primary driver, with companies consistently investing in research and development to create advanced vaping experiences, safer nicotine delivery systems, and user-friendly devices. The regulatory framework across the APAC region is highly fragmented, ranging from outright bans in some countries to relatively lenient regulations in others. This presents both challenges and opportunities for market players, requiring tailored strategies for each jurisdiction. Competitive product substitutes include traditional tobacco products, nicotine patches, and other cessation aids, though e-cigarettes are gaining traction due to perceived reduced harm and diverse flavor options. End-user demographics are evolving, with a growing segment of ex-smokers and a younger demographic exploring vaping as an alternative. Mergers and acquisitions (M&A) trends are observed, driven by the pursuit of market consolidation and access to new technologies or distribution networks. The market anticipates an increasing number of strategic alliances as companies seek to navigate complex regulatory environments and expand their global reach.

- Market Concentration: Dominated by key manufacturers in e-cigarette devices.

- Technological Innovation: Focus on device efficiency, flavor technology, and harm reduction.

- Regulatory Fragmentation: Divergent policies across APAC nations impact market access.

- Competitive Landscape: Competition from traditional tobacco and nicotine replacement therapies.

- End-User Demographics: Shift towards adult smokers seeking alternatives and a growing younger demographic.

- M&A Activity: Strategic acquisitions for market consolidation and technological integration.

APAC E-Cigarette Industry Growth Trends & Insights

The APAC E-Cigarette Industry is poised for robust growth, projected to expand significantly throughout the forecast period. The market size evolution is a testament to increasing consumer adoption driven by a growing awareness of e-cigarettes as a potential harm reduction tool compared to combustible cigarettes. Adoption rates are accelerating, particularly in urban centers with higher disposable incomes and greater exposure to new lifestyle trends. Technological disruptions are a constant feature, with the introduction of innovative pod systems, temperature control technologies, and longer-lasting battery lives continuously enhancing the user experience. Consumer behavior shifts are evident, with a growing preference for disposable e-cigarettes due to their convenience and ease of use, alongside a rising interest in customizable e-liquids. The CAGR is estimated at XX% for the forecast period, indicating a healthy and sustained expansion. Market penetration is expected to rise from XX% in the historical period to an estimated XX% by 2033, reflecting the increasing acceptance and availability of e-cigarette products across the region. The transition from traditional smoking to vaping is a key driver, fueled by a combination of product innovation, targeted marketing, and evolving societal perceptions.

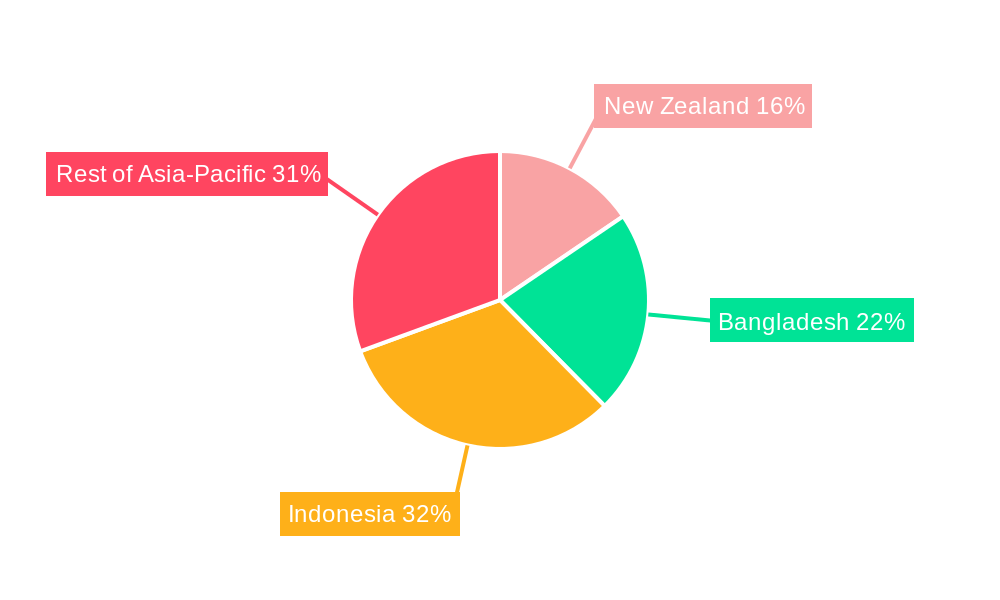

Dominant Regions, Countries, or Segments in APAC E-Cigarette Industry

The "Rest of Asia-Pacific" region is emerging as a dominant force in the APAC E-Cigarette Industry, exhibiting the highest market share and projected growth potential. This expansive segment encompasses a diverse range of economies, each contributing to the overall market expansion through unique economic policies, evolving consumer preferences, and developing infrastructure that supports the distribution of e-cigarette products. Within this broad category, countries like Vietnam and Thailand are showing particularly strong growth in the e-cigarette devices segment, driven by a burgeoning youth population and increasing disposable incomes. The e-liquid segment is also witnessing substantial growth across the entire region, with a rising demand for diverse flavor profiles. Offline retail stores remain a primary distribution channel, especially in less developed markets, offering accessibility and immediate purchase options for consumers. However, online retail stores are rapidly gaining prominence, particularly in more developed economies within the "Rest of Asia-Pacific," facilitated by widespread internet penetration and the convenience of e-commerce platforms. The growth is further propelled by a segment of the population actively seeking alternatives to traditional tobacco, creating a fertile ground for e-cigarette adoption.

- Dominant Segment: Rest of Asia-Pacific region, driven by economic growth and consumer adoption.

- Key Countries for Devices: Vietnam and Thailand showing substantial growth in e-cigarette device sales.

- E-liquid Demand: Strong and growing across the entire region with a preference for diverse flavors.

- Distribution Channel Dominance: Offline retail stores are crucial for accessibility, while online retail is rapidly expanding.

- Driver Factors: Economic policies favorable to consumer spending, evolving lifestyle trends, and a desire for smoking alternatives.

APAC E-Cigarette Industry Product Landscape

The APAC E-Cigarette Industry is witnessing a surge in product innovations, with a focus on enhancing user experience and safety. E-cigarette devices are evolving from basic models to sophisticated systems incorporating advanced temperature control, longer battery life, and improved coil technology for superior vapor production. The e-liquid segment is characterized by an ever-expanding array of flavors, catering to diverse consumer preferences, alongside the development of nicotine salt formulations for smoother inhalation and faster nicotine delivery. Applications range from simple nicotine delivery for adult smokers seeking an alternative to recreational use, with a growing emphasis on closed-system devices for ease of use and reduced leakage. Performance metrics are improving, with devices offering greater puff counts, enhanced flavor intensity, and more consistent performance. Unique selling propositions often revolve around sleek design, compact portability, and the development of proprietary nicotine delivery systems. Technological advancements are leading to the creation of more discreet and aesthetically pleasing devices, further attracting a wider consumer base.

Key Drivers, Barriers & Challenges in APAC E-Cigarette Industry

The APAC E-Cigarette Industry is propelled by several key drivers, including the growing demand for harm reduction alternatives to traditional smoking, technological advancements leading to more sophisticated and user-friendly devices, and increasing disposable incomes across many APAC nations. The growing awareness among adult smokers about the potential benefits of vaping compared to combustible cigarettes is a significant economic driver.

However, the industry faces considerable barriers and challenges. Regulatory uncertainty and patchwork legislation across different countries create a complex operating environment and limit market access for some products. Concerns regarding potential health risks, particularly among youth, lead to strict marketing restrictions and public health scrutiny. Supply chain disruptions, although less prevalent in the forecast period, can impact product availability and pricing.

- Drivers: Harm reduction appeal, technological innovation, rising disposable incomes.

- Barriers: Regulatory fragmentation, public health concerns, potential for youth uptake.

- Challenges: Supply chain volatility, evolving consumer preferences, intense competition.

Emerging Opportunities in APAC E-Cigarette Industry

Emerging opportunities within the APAC E-Cigarette Industry are manifold, driven by an increasing demand for innovative product designs and a growing acceptance of vaping as a lifestyle choice. The development of next-generation devices that offer enhanced safety features and personalized user experiences presents a significant avenue for growth. Untapped markets in developing economies within the region offer substantial potential for expansion, provided that regulatory landscapes become more conducive. Evolving consumer preferences for sustainable and eco-friendly vaping options are also creating niche market opportunities for manufacturers focusing on recyclable materials and reduced environmental impact. The integration of smart technologies in vaping devices, such as app connectivity for usage tracking and device customization, represents another promising frontier.

Growth Accelerators in the APAC E-Cigarette Industry Industry

The long-term growth of the APAC E-Cigarette Industry is significantly accelerated by continuous technological breakthroughs, leading to the development of more efficient, safer, and appealing products. Strategic partnerships between manufacturers, distributors, and retailers are crucial for expanding market reach and navigating diverse regulatory environments across the region. Furthermore, aggressive market expansion strategies by key players, targeting both urban centers and emerging rural markets, are vital catalysts for sustained growth. The ongoing shift in consumer perception, from viewing e-cigarettes solely as a smoking cessation tool to embracing them as a lifestyle product, also plays a pivotal role in accelerating market expansion.

Key Players Shaping the APAC E-Cigarette Industry Market

- RELX International Enterprise HK Limited

- British American Tobacco p l c

- MOTI Planet

- Philip Morris International

- Vape Company

- Smoore International Holdings Ltd

- JUUL Labs Inc

- Imperial Brands

- Japan Tobacco International

- Vaping Gadget Limited

Notable Milestones in APAC E-Cigarette Industry Sector

- November 2022: Moti Planet expanded its business operations in the Malaysian market by launching its flagship product MOTI K Pro. The company also presented other products such as MIOTI X Mini, MOTI X Play, and new disposable products MOTI BOTO 6000, MOTI Box R7000 at International Electronic Cigarettes Exhibitions in Malaysia. The industry's first replaceable disposable electronic cigarettes, MOTI One 4000, were also showcased.

- August 2021: Philip Morris International Inc. launched IQOS ILUMA, described as one of the most innovative additions to its portfolio of smoke-free products for adult smokers.

- August 2021: Japan Tobacco Inc. launched Ploom X, a next-generation heated tobacco device, with plans to sell across Japan through convenience stores and selected tobacco retail stores.

In-Depth APAC E-Cigarette Industry Market Outlook

The future outlook for the APAC E-Cigarette Industry is exceptionally promising, fueled by a confluence of growth accelerators. Continued innovation in device technology and e-liquid formulations will cater to evolving consumer demands for superior performance and diverse flavor profiles. Strategic market expansion initiatives, particularly in developing economies within the region, will unlock significant untapped potential. The ongoing pivot in consumer perception towards vaping as an acceptable lifestyle choice, rather than solely a cessation aid, will further bolster demand. Moreover, strategic collaborations and potential regulatory clarity in key markets will pave the way for more predictable and sustained growth, positioning the APAC region as a critical hub for the global e-cigarette industry.

APAC E-Cigarette Industry Segmentation

-

1. Product Type

- 1.1. E-cigarette Devices

- 1.2. E-liquid

-

2. Distribution Channel

- 2.1. Offline Retail Stores

- 2.2. Online Retail Stores

-

3. Geography

- 3.1. New Zealand

- 3.2. Bangladesh

- 3.3. Indonesia

- 3.4. Rest of Asia-Pacific

APAC E-Cigarette Industry Segmentation By Geography

- 1. New Zealand

- 2. Bangladesh

- 3. Indonesia

- 4. Rest of Asia Pacific

APAC E-Cigarette Industry Regional Market Share

Geographic Coverage of APAC E-Cigarette Industry

APAC E-Cigarette Industry REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 1.8% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism

- 3.3. Market Restrains

- 3.3.1. Presence of counterfeit products

- 3.4. Market Trends

- 3.4.1. Demand for Nicotine-free Products

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. E-cigarette Devices

- 5.1.2. E-liquid

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Offline Retail Stores

- 5.2.2. Online Retail Stores

- 5.3. Market Analysis, Insights and Forecast - by Geography

- 5.3.1. New Zealand

- 5.3.2. Bangladesh

- 5.3.3. Indonesia

- 5.3.4. Rest of Asia-Pacific

- 5.4. Market Analysis, Insights and Forecast - by Region

- 5.4.1. New Zealand

- 5.4.2. Bangladesh

- 5.4.3. Indonesia

- 5.4.4. Rest of Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. New Zealand APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. E-cigarette Devices

- 6.1.2. E-liquid

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Offline Retail Stores

- 6.2.2. Online Retail Stores

- 6.3. Market Analysis, Insights and Forecast - by Geography

- 6.3.1. New Zealand

- 6.3.2. Bangladesh

- 6.3.3. Indonesia

- 6.3.4. Rest of Asia-Pacific

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. Bangladesh APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. E-cigarette Devices

- 7.1.2. E-liquid

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Offline Retail Stores

- 7.2.2. Online Retail Stores

- 7.3. Market Analysis, Insights and Forecast - by Geography

- 7.3.1. New Zealand

- 7.3.2. Bangladesh

- 7.3.3. Indonesia

- 7.3.4. Rest of Asia-Pacific

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Indonesia APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. E-cigarette Devices

- 8.1.2. E-liquid

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Offline Retail Stores

- 8.2.2. Online Retail Stores

- 8.3. Market Analysis, Insights and Forecast - by Geography

- 8.3.1. New Zealand

- 8.3.2. Bangladesh

- 8.3.3. Indonesia

- 8.3.4. Rest of Asia-Pacific

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Rest of Asia Pacific APAC E-Cigarette Industry Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. E-cigarette Devices

- 9.1.2. E-liquid

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Offline Retail Stores

- 9.2.2. Online Retail Stores

- 9.3. Market Analysis, Insights and Forecast - by Geography

- 9.3.1. New Zealand

- 9.3.2. Bangladesh

- 9.3.3. Indonesia

- 9.3.4. Rest of Asia-Pacific

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Competitive Analysis

- 10.1. Global Market Share Analysis 2025

- 10.2. Company Profiles

- 10.2.1 RELX International Enterprise HK Limited

- 10.2.1.1. Overview

- 10.2.1.2. Products

- 10.2.1.3. SWOT Analysis

- 10.2.1.4. Recent Developments

- 10.2.1.5. Financials (Based on Availability)

- 10.2.2 British American Tobacco p l c

- 10.2.2.1. Overview

- 10.2.2.2. Products

- 10.2.2.3. SWOT Analysis

- 10.2.2.4. Recent Developments

- 10.2.2.5. Financials (Based on Availability)

- 10.2.3 MOTI Planet*List Not Exhaustive

- 10.2.3.1. Overview

- 10.2.3.2. Products

- 10.2.3.3. SWOT Analysis

- 10.2.3.4. Recent Developments

- 10.2.3.5. Financials (Based on Availability)

- 10.2.4 Philip Morris International

- 10.2.4.1. Overview

- 10.2.4.2. Products

- 10.2.4.3. SWOT Analysis

- 10.2.4.4. Recent Developments

- 10.2.4.5. Financials (Based on Availability)

- 10.2.5 Vape Company

- 10.2.5.1. Overview

- 10.2.5.2. Products

- 10.2.5.3. SWOT Analysis

- 10.2.5.4. Recent Developments

- 10.2.5.5. Financials (Based on Availability)

- 10.2.6 Smoore International Holdings Ltd

- 10.2.6.1. Overview

- 10.2.6.2. Products

- 10.2.6.3. SWOT Analysis

- 10.2.6.4. Recent Developments

- 10.2.6.5. Financials (Based on Availability)

- 10.2.7 JUUL Labs Inc

- 10.2.7.1. Overview

- 10.2.7.2. Products

- 10.2.7.3. SWOT Analysis

- 10.2.7.4. Recent Developments

- 10.2.7.5. Financials (Based on Availability)

- 10.2.8 Imperial Brands

- 10.2.8.1. Overview

- 10.2.8.2. Products

- 10.2.8.3. SWOT Analysis

- 10.2.8.4. Recent Developments

- 10.2.8.5. Financials (Based on Availability)

- 10.2.9 Japan Tobacco International

- 10.2.9.1. Overview

- 10.2.9.2. Products

- 10.2.9.3. SWOT Analysis

- 10.2.9.4. Recent Developments

- 10.2.9.5. Financials (Based on Availability)

- 10.2.10 Vaping Gadget Limited

- 10.2.10.1. Overview

- 10.2.10.2. Products

- 10.2.10.3. SWOT Analysis

- 10.2.10.4. Recent Developments

- 10.2.10.5. Financials (Based on Availability)

- 10.2.1 RELX International Enterprise HK Limited

List of Figures

- Figure 1: Global APAC E-Cigarette Industry Revenue Breakdown (billion, %) by Region 2025 & 2033

- Figure 2: New Zealand APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 3: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 4: New Zealand APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 5: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 6: New Zealand APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 7: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 8: New Zealand APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 9: New Zealand APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 10: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 11: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 12: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 13: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 14: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 15: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 16: Bangladesh APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 17: Bangladesh APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 18: Indonesia APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 19: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 20: Indonesia APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 21: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: Indonesia APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 23: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 24: Indonesia APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 25: Indonesia APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

- Figure 26: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Product Type 2025 & 2033

- Figure 27: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Product Type 2025 & 2033

- Figure 28: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Distribution Channel 2025 & 2033

- Figure 29: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 30: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Geography 2025 & 2033

- Figure 31: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Geography 2025 & 2033

- Figure 32: Rest of Asia Pacific APAC E-Cigarette Industry Revenue (billion), by Country 2025 & 2033

- Figure 33: Rest of Asia Pacific APAC E-Cigarette Industry Revenue Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 3: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 4: Global APAC E-Cigarette Industry Revenue billion Forecast, by Region 2020 & 2033

- Table 5: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 6: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 7: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 8: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 9: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 10: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 12: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 13: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 14: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 15: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 16: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

- Table 17: Global APAC E-Cigarette Industry Revenue billion Forecast, by Product Type 2020 & 2033

- Table 18: Global APAC E-Cigarette Industry Revenue billion Forecast, by Distribution Channel 2020 & 2033

- Table 19: Global APAC E-Cigarette Industry Revenue billion Forecast, by Geography 2020 & 2033

- Table 20: Global APAC E-Cigarette Industry Revenue billion Forecast, by Country 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC E-Cigarette Industry?

The projected CAGR is approximately 1.8%.

2. Which companies are prominent players in the APAC E-Cigarette Industry?

Key companies in the market include RELX International Enterprise HK Limited, British American Tobacco p l c, MOTI Planet*List Not Exhaustive, Philip Morris International, Vape Company, Smoore International Holdings Ltd, JUUL Labs Inc, Imperial Brands, Japan Tobacco International, Vaping Gadget Limited.

3. What are the main segments of the APAC E-Cigarette Industry?

The market segments include Product Type, Distribution Channel, Geography.

4. Can you provide details about the market size?

The market size is estimated to be USD 423.7 billion as of 2022.

5. What are some drivers contributing to market growth?

Enhanced Participation In Water Sports; Popularity Of Beach Culture And Adventure Tourism.

6. What are the notable trends driving market growth?

Demand for Nicotine-free Products.

7. Are there any restraints impacting market growth?

Presence of counterfeit products.

8. Can you provide examples of recent developments in the market?

November 2022: Moti Planet expanded its business operation in the Malaysian market by launching its flagship product MOTI K Pro. At International Electronic Cigarettes Exhibitions in Malaysia, the company has also presented other products such as MIOTI X Mini, and MOTI X Play, as well as disposable new products MOTI BOTO 6000, MOTI Box R7000, and the industry's first replaceable disposable electronic cigarettes were also presented in exhibitions i.e., MOTI One 4000.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 5250, and USD 8750 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in billion.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC E-Cigarette Industry," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC E-Cigarette Industry report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC E-Cigarette Industry?

To stay informed about further developments, trends, and reports in the APAC E-Cigarette Industry, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence