Key Insights

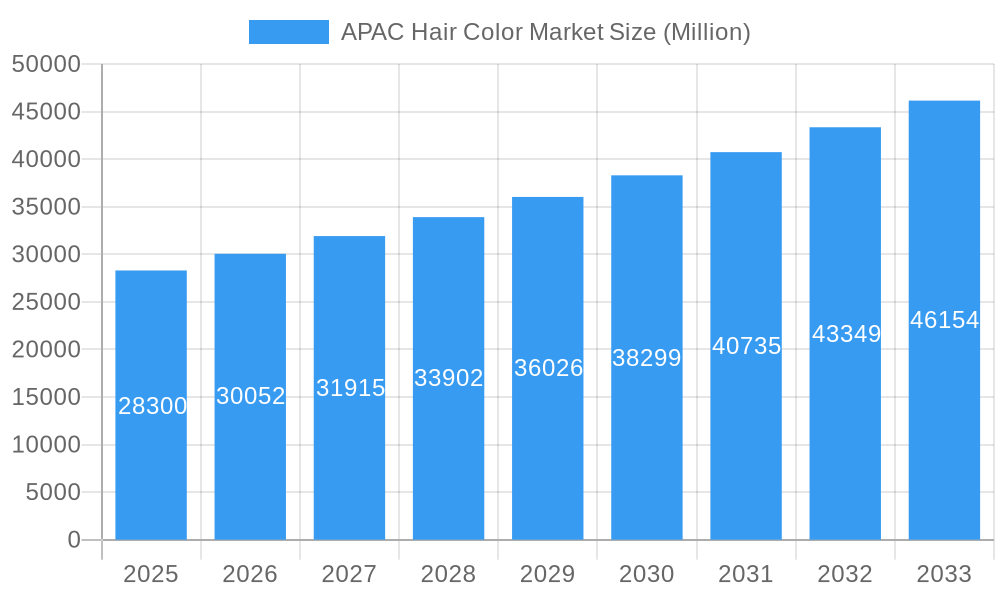

The Asia Pacific (APAC) Hair Color Market is projected for substantial growth, anticipated to reach $5318.8 million by 2025, with an estimated Compound Annual Growth Rate (CAGR) of 6.5% through 2033. This expansion is driven by shifting consumer preferences, rising disposable incomes, and increasing beauty consciousness across the region. Key growth factors include the trend of self-expression through personal grooming, the adoption of hair coloring as a fashion statement, and the influence of social media and celebrity endorsements popularizing diverse hair color trends. The growing availability of innovative and safe hair coloring products for both temporary and permanent applications is further stimulating demand. Permanent colorants are seeing increased demand for their longevity and coverage, while semi-permanent and temporary options remain popular for experimentation.

APAC Hair Color Market Market Size (In Billion)

Distribution channels are evolving, with online retail emerging as a significant channel, offering convenience and a wide product selection to digitally engaged consumers. Specialty retailers and supermarkets also contribute to market accessibility and impulse purchases. Market challenges include growing concerns over potential side effects of certain hair coloring chemicals and the rising popularity of natural alternatives like henna. However, innovation from leading companies such as L'Oréal S.A., Procter & Gamble Co., and Kao Corporation, focusing on safer formulations and vibrant, long-lasting colors, is expected to mitigate these restraints. China and India are leading consumption within the APAC region, fueled by their large populations and expanding middle class.

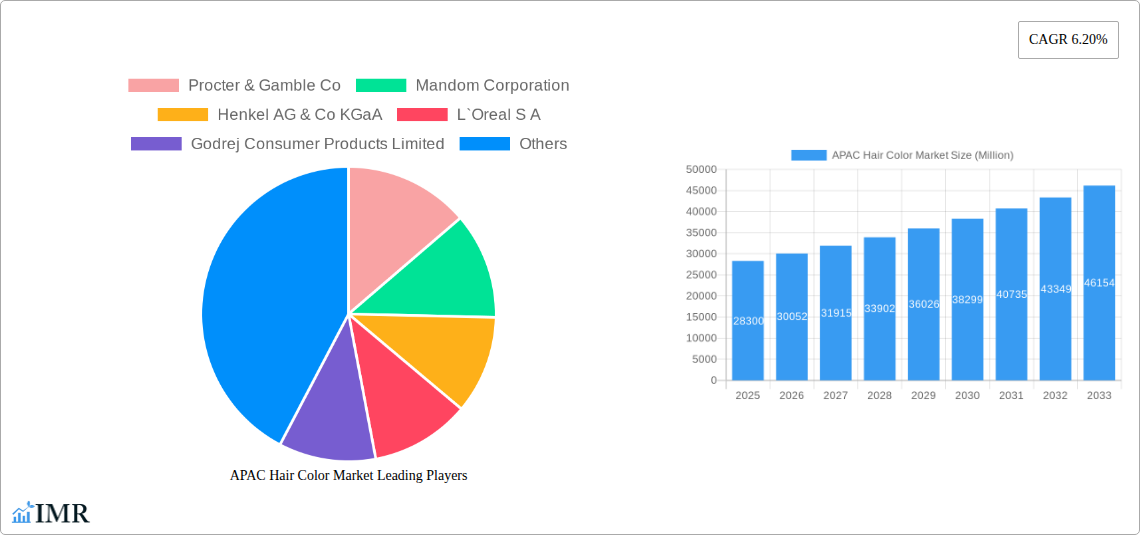

APAC Hair Color Market Company Market Share

APAC Hair Color Market: Comprehensive Analysis and Future Outlook (2019-2033)

This in-depth report provides a definitive analysis of the APAC Hair Color Market, encompassing its current landscape, historical performance, and future projections. Covering a study period from 2019 to 2033, with a base and estimated year of 2025, this research offers critical insights into market dynamics, growth trends, regional dominance, product innovations, and the strategic moves of key industry players. Leveraging high-traffic keywords such as "APAC hair color market," "hair dye trends," "permanent hair color Asia," "semi-permanent hair color," "hair bleaches market," "professional hair color," "DTC hair color," and "sustainable hair color," this report is optimized for maximum search engine visibility and engagement with industry professionals, investors, and market strategists. The analysis includes granular details on product types, distribution channels, and significant industry developments, providing a holistic view for informed decision-making. All values are presented in Million units.

APAC Hair Color Market Market Dynamics & Structure

The APAC hair color market is characterized by a moderate to high level of concentration, with leading global players and a growing number of regional and direct-to-consumer (DTC) brands vying for market share. Technological innovation is a significant driver, with companies continuously investing in R&D to develop ammonia-free formulations, long-lasting colors, and user-friendly application methods, especially for the burgeoning male grooming segment. Regulatory frameworks, while varying across countries, generally focus on product safety and ingredient transparency, influencing product development and market entry strategies. Competitive product substitutes include temporary hair colorants and styling products. End-user demographics are shifting, with increasing adoption among younger populations and a growing demand for natural and organic hair color options. Mergers and acquisitions (M&A) are also shaping the market, as seen with the acquisition of BBlunt by Honasa Consumer, indicating consolidation and expansion strategies.

- Market Concentration: Dominated by a few key multinational corporations alongside a rising number of local and niche brands.

- Technological Innovation Drivers: Focus on ammonia-free, semi-permanent, and easy-to-apply hair color solutions; increasing demand for personalized and sustainable options.

- Regulatory Frameworks: Emphasis on ingredient safety, labeling requirements, and environmental impact assessments.

- Competitive Product Substitutes: Temporary color sprays, chalks, and hair dyes from smaller, less established brands.

- End-User Demographics: Growing interest from younger demographics and an increasing male consumer base; rising awareness of hair health and ingredient safety.

- M&A Trends: Strategic acquisitions to expand product portfolios, gain market access, and strengthen DTC presence.

APAC Hair Color Market Growth Trends & Insights

The APAC hair color market is poised for robust growth, driven by evolving consumer preferences, increasing disposable incomes, and the growing influence of social media and beauty trends across the region. The market size is projected to witness a significant expansion from xx Million units in 2019 to an estimated xx Million units by 2033, exhibiting a Compound Annual Growth Rate (CAGR) of xx% during the forecast period (2025-2033). Adoption rates for hair coloring products are on an upward trajectory, fueled by a desire for self-expression and aesthetic enhancement. Technological disruptions are evident in the development of advanced formulations offering superior color payoff, reduced damage, and enhanced ease of use. Consumer behavior shifts are marked by a growing demand for natural, organic, and sustainable hair color options, as well as a rise in at-home coloring trends, particularly accelerated by the convenience offered by online retailers. The penetration of hair color products is expanding beyond urban centers into semi-urban and rural areas, driven by increased awareness and accessibility.

Dominant Regions, Countries, or Segments in APAC Hair Color Market

Within the APAC Hair Color Market, Permanent Colorants are consistently identified as the dominant segment by product type, contributing significantly to the overall market value and volume. This dominance is fueled by the widespread consumer preference for long-lasting color solutions and the robust product portfolios offered by leading manufacturers in this category. The Online Retailers distribution channel is emerging as a powerful growth engine, rapidly gaining market share due to the increasing internet penetration and e-commerce adoption across the APAC region.

Key Drivers for Permanent Colorants Dominance:

- Consumer Preference for Longevity: A persistent demand for grey coverage and enduring color vibrancy.

- Brand Loyalty: Established brands with a strong presence in permanent colorants command significant consumer trust.

- Product Innovation: Continuous development of improved formulations with reduced hair damage and enhanced color saturation.

Key Drivers for Online Retailers' Growth:

- Convenience and Accessibility: Consumers can easily browse, compare, and purchase a wide array of hair color products from the comfort of their homes.

- Competitive Pricing and Promotions: Online platforms often offer attractive discounts and bundled deals, attracting price-sensitive consumers.

- Wider Product Selection: Online channels provide access to niche brands and specialized hair color products not readily available in physical stores.

- Influence of Social Media: Online influencers and beauty bloggers play a crucial role in driving product discovery and purchase decisions through digital platforms.

- Growing E-commerce Infrastructure: Improved logistics and payment gateways across APAC countries further facilitate online sales.

APAC Hair Color Market Product Landscape

The APAC hair color market is characterized by a dynamic product landscape driven by innovation and evolving consumer demands. Permanent colorants remain the staple, offering long-lasting grey coverage and vibrant hues. Semi-permanent colorants are gaining traction for their less damaging nature and ability to experiment with fashion shades. The introduction of ammonia-free formulations, such as L'Oréal's One-Twist Hair Color, signifies a significant trend towards healthier hair coloring. Bleachers and highlighters are popular for professional styling and fashion-forward looks. The market is also seeing a rise in natural and henna-based hair colorants, catering to the growing demand for sustainable and chemical-free options. Unique selling propositions often revolve around ease of application, color longevity, hair health benefits, and a wide spectrum of shades.

Key Drivers, Barriers & Challenges in APAC Hair Color Market

Key Drivers:

- Rising Disposable Incomes: Enhanced purchasing power across APAC countries fuels demand for beauty and personal care products, including hair color.

- Growing Fashion Consciousness: Increased awareness of beauty trends and a desire for self-expression drive product adoption.

- Urbanization and Westernization: Exposure to global beauty standards and a shift in lifestyle preferences contribute to hair coloring trends.

- Product Innovations: Development of user-friendly, ammonia-free, and long-lasting hair color formulations.

Barriers & Challenges:

- Price Sensitivity: A significant portion of the APAC consumer base remains price-sensitive, impacting adoption of premium products.

- Hair Damage Concerns: Consumer apprehension regarding the potential damage caused by chemical hair coloring.

- Regulatory Hurdles: Navigating diverse and evolving regulatory landscapes across different APAC nations can be complex for manufacturers.

- Supply Chain Disruptions: Geopolitical factors and logistical challenges can impact the availability and cost of raw materials and finished goods.

- Competition: Intense competition from established global brands and emerging local players.

Emerging Opportunities in APAC Hair Color Market

Emerging opportunities in the APAC hair color market lie in the burgeoning demand for sustainable and natural hair color solutions, driven by increasing consumer awareness of environmental and health concerns. The men's grooming segment presents significant untapped potential, with a growing number of men embracing hair coloring for fashion and grey coverage. The expansion of direct-to-consumer (DTC) channels and personalized online consultations offers avenues for brands to connect directly with consumers and offer tailored product recommendations. Furthermore, the development of innovative application technologies that simplify at-home coloring and minimize mess will attract a wider consumer base.

Growth Accelerators in the APAC Hair Color Market Industry

Technological breakthroughs in hair color formulations, focusing on reduced damage, enhanced longevity, and vibrant, natural-looking results, are significant growth accelerators. Strategic partnerships between cosmetic companies and technology providers to develop personalized color solutions based on AI and consumer data are poised to drive market expansion. Furthermore, aggressive market expansion strategies by key players into emerging economies within APAC, coupled with effective marketing campaigns that highlight product benefits and cater to local preferences, will fuel long-term growth. The increasing adoption of e-commerce and digital marketing strategies to reach a wider audience and facilitate direct consumer engagement also acts as a crucial growth catalyst.

Key Players Shaping the APAC Hair Color Market Market

- Procter & Gamble Co

- Mandom Corporation

- Henkel AG & Co KGaA

- L`Oreal S A

- Godrej Consumer Products Limited

- Natura Co Holding S/A

- Henna Industries Private Limited

- Kao Corporation

- Hoyu Co Ltd

- Shanghai Zhanghua Health Care Cosmetics Sales Co Ltd

Notable Milestones in APAC Hair Color Market Sector

- June 2022: L'Oréal introduced its first permanent hair color technology, L'Oréal Paris Men Expert One-Twist Hair Color, made especially for men. It is ammonia-free and available in seven shades, offering blended gray coverage for up to six weeks.

- February 2022: Mamaearth, a direct-to-consumer (D2C) startup, acquired Mumbai-based BBlunt from Godrej Consumer Products Limited (GCPL). BBlunt's hair care and styling products business will be completely owned and managed by Mamaearth's parent, Honasa Consumer, expanding its product portfolio to include hair color.

- January 2022: L'Oréal launched two new technologies for mass-market consumers and stylists designed to circumvent hair coloring problems, focusing on ease of use and color application.

In-Depth APAC Hair Color Market Market Outlook

The APAC Hair Color Market is set for sustained growth, driven by ongoing technological advancements in formulation, a deepening understanding of diverse consumer needs, and the strategic expansion of distribution networks, particularly online. The increasing preference for products that offer both aesthetic appeal and hair health benefits will continue to shape product development. Opportunities abound in catering to the evolving preferences of younger demographics and the growing male consumer base. Brands that can effectively leverage digital platforms for direct consumer engagement, offer sustainable and personalized solutions, and navigate the regulatory landscapes of various APAC nations will be well-positioned to capture future market potential.

APAC Hair Color Market Segmentation

-

1. Product Type

- 1.1. Bleachers

- 1.2. Highlighters

- 1.3. Permanent Colorants

- 1.4. Semi-Permanent Colorants

- 1.5. Other Hair Colorants

-

2. Distribution Channel

- 2.1. Supermarkets and Hypermarkets

- 2.2. Convenience Stores

- 2.3. Pharmacies & Drug Stores

- 2.4. Specialist Retailers

- 2.5. Online Retailers

- 2.6. Other Distribution Channels

APAC Hair Color Market Segmentation By Geography

-

1. North America

- 1.1. United States

- 1.2. Canada

- 1.3. Mexico

-

2. South America

- 2.1. Brazil

- 2.2. Argentina

- 2.3. Rest of South America

-

3. Europe

- 3.1. United Kingdom

- 3.2. Germany

- 3.3. France

- 3.4. Italy

- 3.5. Spain

- 3.6. Russia

- 3.7. Benelux

- 3.8. Nordics

- 3.9. Rest of Europe

-

4. Middle East & Africa

- 4.1. Turkey

- 4.2. Israel

- 4.3. GCC

- 4.4. North Africa

- 4.5. South Africa

- 4.6. Rest of Middle East & Africa

-

5. Asia Pacific

- 5.1. China

- 5.2. India

- 5.3. Japan

- 5.4. South Korea

- 5.5. ASEAN

- 5.6. Oceania

- 5.7. Rest of Asia Pacific

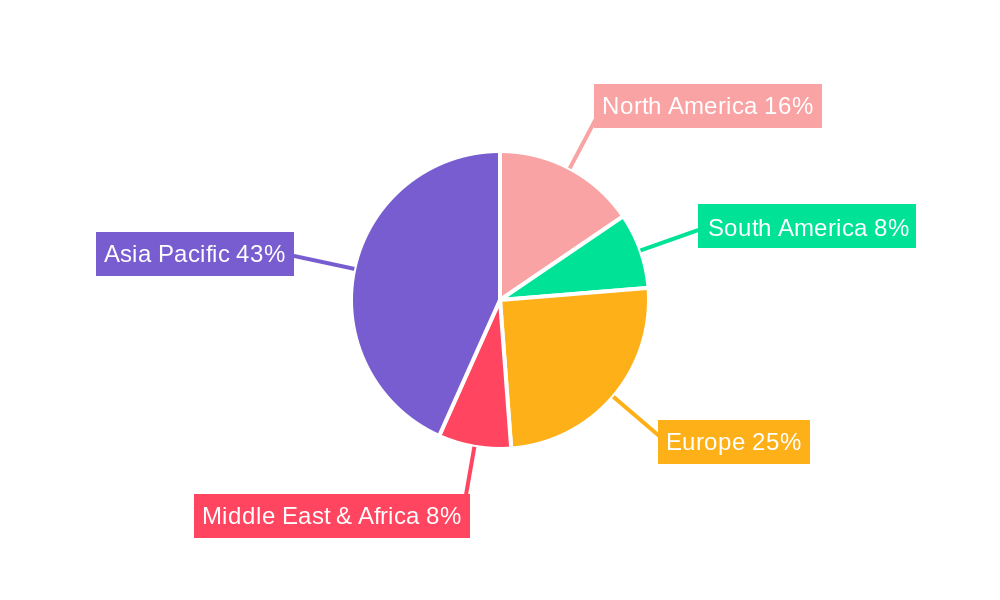

APAC Hair Color Market Regional Market Share

Geographic Coverage of APAC Hair Color Market

APAC Hair Color Market REPORT HIGHLIGHTS

| Aspects | Details |

|---|---|

| Study Period | 2020-2034 |

| Base Year | 2025 |

| Estimated Year | 2026 |

| Forecast Period | 2026-2034 |

| Historical Period | 2020-2025 |

| Growth Rate | CAGR of 6.5% from 2020-2034 |

| Segmentation |

|

Table of Contents

- 1. Introduction

- 1.1. Research Scope

- 1.2. Market Segmentation

- 1.3. Research Methodology

- 1.4. Definitions and Assumptions

- 2. Executive Summary

- 2.1. Introduction

- 3. Market Dynamics

- 3.1. Introduction

- 3.2. Market Drivers

- 3.2.1. Increasing Demand for Natural/Organic Products; Increased Focus on Facial Care Regimes

- 3.3. Market Restrains

- 3.3.1. Presence of Counterfeit Products Restraints Growth

- 3.4. Market Trends

- 3.4.1. Growing Ageing Population Driving Sales of Hair Colorants

- 4. Market Factor Analysis

- 4.1. Porters Five Forces

- 4.2. Supply/Value Chain

- 4.3. PESTEL analysis

- 4.4. Market Entropy

- 4.5. Patent/Trademark Analysis

- 5. Global APAC Hair Color Market Analysis, Insights and Forecast, 2020-2032

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 5.1.1. Bleachers

- 5.1.2. Highlighters

- 5.1.3. Permanent Colorants

- 5.1.4. Semi-Permanent Colorants

- 5.1.5. Other Hair Colorants

- 5.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 5.2.1. Supermarkets and Hypermarkets

- 5.2.2. Convenience Stores

- 5.2.3. Pharmacies & Drug Stores

- 5.2.4. Specialist Retailers

- 5.2.5. Online Retailers

- 5.2.6. Other Distribution Channels

- 5.3. Market Analysis, Insights and Forecast - by Region

- 5.3.1. North America

- 5.3.2. South America

- 5.3.3. Europe

- 5.3.4. Middle East & Africa

- 5.3.5. Asia Pacific

- 5.1. Market Analysis, Insights and Forecast - by Product Type

- 6. North America APAC Hair Color Market Analysis, Insights and Forecast, 2020-2032

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 6.1.1. Bleachers

- 6.1.2. Highlighters

- 6.1.3. Permanent Colorants

- 6.1.4. Semi-Permanent Colorants

- 6.1.5. Other Hair Colorants

- 6.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 6.2.1. Supermarkets and Hypermarkets

- 6.2.2. Convenience Stores

- 6.2.3. Pharmacies & Drug Stores

- 6.2.4. Specialist Retailers

- 6.2.5. Online Retailers

- 6.2.6. Other Distribution Channels

- 6.1. Market Analysis, Insights and Forecast - by Product Type

- 7. South America APAC Hair Color Market Analysis, Insights and Forecast, 2020-2032

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 7.1.1. Bleachers

- 7.1.2. Highlighters

- 7.1.3. Permanent Colorants

- 7.1.4. Semi-Permanent Colorants

- 7.1.5. Other Hair Colorants

- 7.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 7.2.1. Supermarkets and Hypermarkets

- 7.2.2. Convenience Stores

- 7.2.3. Pharmacies & Drug Stores

- 7.2.4. Specialist Retailers

- 7.2.5. Online Retailers

- 7.2.6. Other Distribution Channels

- 7.1. Market Analysis, Insights and Forecast - by Product Type

- 8. Europe APAC Hair Color Market Analysis, Insights and Forecast, 2020-2032

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 8.1.1. Bleachers

- 8.1.2. Highlighters

- 8.1.3. Permanent Colorants

- 8.1.4. Semi-Permanent Colorants

- 8.1.5. Other Hair Colorants

- 8.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 8.2.1. Supermarkets and Hypermarkets

- 8.2.2. Convenience Stores

- 8.2.3. Pharmacies & Drug Stores

- 8.2.4. Specialist Retailers

- 8.2.5. Online Retailers

- 8.2.6. Other Distribution Channels

- 8.1. Market Analysis, Insights and Forecast - by Product Type

- 9. Middle East & Africa APAC Hair Color Market Analysis, Insights and Forecast, 2020-2032

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 9.1.1. Bleachers

- 9.1.2. Highlighters

- 9.1.3. Permanent Colorants

- 9.1.4. Semi-Permanent Colorants

- 9.1.5. Other Hair Colorants

- 9.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 9.2.1. Supermarkets and Hypermarkets

- 9.2.2. Convenience Stores

- 9.2.3. Pharmacies & Drug Stores

- 9.2.4. Specialist Retailers

- 9.2.5. Online Retailers

- 9.2.6. Other Distribution Channels

- 9.1. Market Analysis, Insights and Forecast - by Product Type

- 10. Asia Pacific APAC Hair Color Market Analysis, Insights and Forecast, 2020-2032

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 10.1.1. Bleachers

- 10.1.2. Highlighters

- 10.1.3. Permanent Colorants

- 10.1.4. Semi-Permanent Colorants

- 10.1.5. Other Hair Colorants

- 10.2. Market Analysis, Insights and Forecast - by Distribution Channel

- 10.2.1. Supermarkets and Hypermarkets

- 10.2.2. Convenience Stores

- 10.2.3. Pharmacies & Drug Stores

- 10.2.4. Specialist Retailers

- 10.2.5. Online Retailers

- 10.2.6. Other Distribution Channels

- 10.1. Market Analysis, Insights and Forecast - by Product Type

- 11. Competitive Analysis

- 11.1. Global Market Share Analysis 2025

- 11.2. Company Profiles

- 11.2.1 Procter & Gamble Co

- 11.2.1.1. Overview

- 11.2.1.2. Products

- 11.2.1.3. SWOT Analysis

- 11.2.1.4. Recent Developments

- 11.2.1.5. Financials (Based on Availability)

- 11.2.2 Mandom Corporation

- 11.2.2.1. Overview

- 11.2.2.2. Products

- 11.2.2.3. SWOT Analysis

- 11.2.2.4. Recent Developments

- 11.2.2.5. Financials (Based on Availability)

- 11.2.3 Henkel AG & Co KGaA

- 11.2.3.1. Overview

- 11.2.3.2. Products

- 11.2.3.3. SWOT Analysis

- 11.2.3.4. Recent Developments

- 11.2.3.5. Financials (Based on Availability)

- 11.2.4 L`Oreal S A

- 11.2.4.1. Overview

- 11.2.4.2. Products

- 11.2.4.3. SWOT Analysis

- 11.2.4.4. Recent Developments

- 11.2.4.5. Financials (Based on Availability)

- 11.2.5 Godrej Consumer Products Limited

- 11.2.5.1. Overview

- 11.2.5.2. Products

- 11.2.5.3. SWOT Analysis

- 11.2.5.4. Recent Developments

- 11.2.5.5. Financials (Based on Availability)

- 11.2.6 Natura Co Holding S/A*List Not Exhaustive

- 11.2.6.1. Overview

- 11.2.6.2. Products

- 11.2.6.3. SWOT Analysis

- 11.2.6.4. Recent Developments

- 11.2.6.5. Financials (Based on Availability)

- 11.2.7 Henna Industries Private Limited

- 11.2.7.1. Overview

- 11.2.7.2. Products

- 11.2.7.3. SWOT Analysis

- 11.2.7.4. Recent Developments

- 11.2.7.5. Financials (Based on Availability)

- 11.2.8 Kao Corporation

- 11.2.8.1. Overview

- 11.2.8.2. Products

- 11.2.8.3. SWOT Analysis

- 11.2.8.4. Recent Developments

- 11.2.8.5. Financials (Based on Availability)

- 11.2.9 Hoyu Co Ltd

- 11.2.9.1. Overview

- 11.2.9.2. Products

- 11.2.9.3. SWOT Analysis

- 11.2.9.4. Recent Developments

- 11.2.9.5. Financials (Based on Availability)

- 11.2.10 Shanghai Zhanghua Health Care Cosmetics Sales Co Ltd

- 11.2.10.1. Overview

- 11.2.10.2. Products

- 11.2.10.3. SWOT Analysis

- 11.2.10.4. Recent Developments

- 11.2.10.5. Financials (Based on Availability)

- 11.2.1 Procter & Gamble Co

List of Figures

- Figure 1: Global APAC Hair Color Market Revenue Breakdown (million, %) by Region 2025 & 2033

- Figure 2: Global APAC Hair Color Market Volume Breakdown (K Units, %) by Region 2025 & 2033

- Figure 3: North America APAC Hair Color Market Revenue (million), by Product Type 2025 & 2033

- Figure 4: North America APAC Hair Color Market Volume (K Units), by Product Type 2025 & 2033

- Figure 5: North America APAC Hair Color Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 6: North America APAC Hair Color Market Volume Share (%), by Product Type 2025 & 2033

- Figure 7: North America APAC Hair Color Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 8: North America APAC Hair Color Market Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 9: North America APAC Hair Color Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 10: North America APAC Hair Color Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 11: North America APAC Hair Color Market Revenue (million), by Country 2025 & 2033

- Figure 12: North America APAC Hair Color Market Volume (K Units), by Country 2025 & 2033

- Figure 13: North America APAC Hair Color Market Revenue Share (%), by Country 2025 & 2033

- Figure 14: North America APAC Hair Color Market Volume Share (%), by Country 2025 & 2033

- Figure 15: South America APAC Hair Color Market Revenue (million), by Product Type 2025 & 2033

- Figure 16: South America APAC Hair Color Market Volume (K Units), by Product Type 2025 & 2033

- Figure 17: South America APAC Hair Color Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 18: South America APAC Hair Color Market Volume Share (%), by Product Type 2025 & 2033

- Figure 19: South America APAC Hair Color Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 20: South America APAC Hair Color Market Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 21: South America APAC Hair Color Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 22: South America APAC Hair Color Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 23: South America APAC Hair Color Market Revenue (million), by Country 2025 & 2033

- Figure 24: South America APAC Hair Color Market Volume (K Units), by Country 2025 & 2033

- Figure 25: South America APAC Hair Color Market Revenue Share (%), by Country 2025 & 2033

- Figure 26: South America APAC Hair Color Market Volume Share (%), by Country 2025 & 2033

- Figure 27: Europe APAC Hair Color Market Revenue (million), by Product Type 2025 & 2033

- Figure 28: Europe APAC Hair Color Market Volume (K Units), by Product Type 2025 & 2033

- Figure 29: Europe APAC Hair Color Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 30: Europe APAC Hair Color Market Volume Share (%), by Product Type 2025 & 2033

- Figure 31: Europe APAC Hair Color Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 32: Europe APAC Hair Color Market Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 33: Europe APAC Hair Color Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 34: Europe APAC Hair Color Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 35: Europe APAC Hair Color Market Revenue (million), by Country 2025 & 2033

- Figure 36: Europe APAC Hair Color Market Volume (K Units), by Country 2025 & 2033

- Figure 37: Europe APAC Hair Color Market Revenue Share (%), by Country 2025 & 2033

- Figure 38: Europe APAC Hair Color Market Volume Share (%), by Country 2025 & 2033

- Figure 39: Middle East & Africa APAC Hair Color Market Revenue (million), by Product Type 2025 & 2033

- Figure 40: Middle East & Africa APAC Hair Color Market Volume (K Units), by Product Type 2025 & 2033

- Figure 41: Middle East & Africa APAC Hair Color Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 42: Middle East & Africa APAC Hair Color Market Volume Share (%), by Product Type 2025 & 2033

- Figure 43: Middle East & Africa APAC Hair Color Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 44: Middle East & Africa APAC Hair Color Market Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 45: Middle East & Africa APAC Hair Color Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 46: Middle East & Africa APAC Hair Color Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 47: Middle East & Africa APAC Hair Color Market Revenue (million), by Country 2025 & 2033

- Figure 48: Middle East & Africa APAC Hair Color Market Volume (K Units), by Country 2025 & 2033

- Figure 49: Middle East & Africa APAC Hair Color Market Revenue Share (%), by Country 2025 & 2033

- Figure 50: Middle East & Africa APAC Hair Color Market Volume Share (%), by Country 2025 & 2033

- Figure 51: Asia Pacific APAC Hair Color Market Revenue (million), by Product Type 2025 & 2033

- Figure 52: Asia Pacific APAC Hair Color Market Volume (K Units), by Product Type 2025 & 2033

- Figure 53: Asia Pacific APAC Hair Color Market Revenue Share (%), by Product Type 2025 & 2033

- Figure 54: Asia Pacific APAC Hair Color Market Volume Share (%), by Product Type 2025 & 2033

- Figure 55: Asia Pacific APAC Hair Color Market Revenue (million), by Distribution Channel 2025 & 2033

- Figure 56: Asia Pacific APAC Hair Color Market Volume (K Units), by Distribution Channel 2025 & 2033

- Figure 57: Asia Pacific APAC Hair Color Market Revenue Share (%), by Distribution Channel 2025 & 2033

- Figure 58: Asia Pacific APAC Hair Color Market Volume Share (%), by Distribution Channel 2025 & 2033

- Figure 59: Asia Pacific APAC Hair Color Market Revenue (million), by Country 2025 & 2033

- Figure 60: Asia Pacific APAC Hair Color Market Volume (K Units), by Country 2025 & 2033

- Figure 61: Asia Pacific APAC Hair Color Market Revenue Share (%), by Country 2025 & 2033

- Figure 62: Asia Pacific APAC Hair Color Market Volume Share (%), by Country 2025 & 2033

List of Tables

- Table 1: Global APAC Hair Color Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 2: Global APAC Hair Color Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 3: Global APAC Hair Color Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 4: Global APAC Hair Color Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 5: Global APAC Hair Color Market Revenue million Forecast, by Region 2020 & 2033

- Table 6: Global APAC Hair Color Market Volume K Units Forecast, by Region 2020 & 2033

- Table 7: Global APAC Hair Color Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 8: Global APAC Hair Color Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 9: Global APAC Hair Color Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 10: Global APAC Hair Color Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 11: Global APAC Hair Color Market Revenue million Forecast, by Country 2020 & 2033

- Table 12: Global APAC Hair Color Market Volume K Units Forecast, by Country 2020 & 2033

- Table 13: United States APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 14: United States APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 15: Canada APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 16: Canada APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 17: Mexico APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 18: Mexico APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 19: Global APAC Hair Color Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 20: Global APAC Hair Color Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 21: Global APAC Hair Color Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 22: Global APAC Hair Color Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 23: Global APAC Hair Color Market Revenue million Forecast, by Country 2020 & 2033

- Table 24: Global APAC Hair Color Market Volume K Units Forecast, by Country 2020 & 2033

- Table 25: Brazil APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 26: Brazil APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 27: Argentina APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 28: Argentina APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 29: Rest of South America APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 30: Rest of South America APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 31: Global APAC Hair Color Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 32: Global APAC Hair Color Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 33: Global APAC Hair Color Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 34: Global APAC Hair Color Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 35: Global APAC Hair Color Market Revenue million Forecast, by Country 2020 & 2033

- Table 36: Global APAC Hair Color Market Volume K Units Forecast, by Country 2020 & 2033

- Table 37: United Kingdom APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 38: United Kingdom APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 39: Germany APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 40: Germany APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 41: France APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 42: France APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 43: Italy APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 44: Italy APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 45: Spain APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 46: Spain APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 47: Russia APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 48: Russia APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 49: Benelux APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 50: Benelux APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 51: Nordics APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 52: Nordics APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 53: Rest of Europe APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 54: Rest of Europe APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 55: Global APAC Hair Color Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 56: Global APAC Hair Color Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 57: Global APAC Hair Color Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 58: Global APAC Hair Color Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 59: Global APAC Hair Color Market Revenue million Forecast, by Country 2020 & 2033

- Table 60: Global APAC Hair Color Market Volume K Units Forecast, by Country 2020 & 2033

- Table 61: Turkey APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 62: Turkey APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 63: Israel APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 64: Israel APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 65: GCC APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 66: GCC APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 67: North Africa APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 68: North Africa APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 69: South Africa APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 70: South Africa APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 71: Rest of Middle East & Africa APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 72: Rest of Middle East & Africa APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 73: Global APAC Hair Color Market Revenue million Forecast, by Product Type 2020 & 2033

- Table 74: Global APAC Hair Color Market Volume K Units Forecast, by Product Type 2020 & 2033

- Table 75: Global APAC Hair Color Market Revenue million Forecast, by Distribution Channel 2020 & 2033

- Table 76: Global APAC Hair Color Market Volume K Units Forecast, by Distribution Channel 2020 & 2033

- Table 77: Global APAC Hair Color Market Revenue million Forecast, by Country 2020 & 2033

- Table 78: Global APAC Hair Color Market Volume K Units Forecast, by Country 2020 & 2033

- Table 79: China APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 80: China APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 81: India APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 82: India APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 83: Japan APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 84: Japan APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 85: South Korea APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 86: South Korea APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 87: ASEAN APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 88: ASEAN APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 89: Oceania APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 90: Oceania APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

- Table 91: Rest of Asia Pacific APAC Hair Color Market Revenue (million) Forecast, by Application 2020 & 2033

- Table 92: Rest of Asia Pacific APAC Hair Color Market Volume (K Units) Forecast, by Application 2020 & 2033

Frequently Asked Questions

1. What is the projected Compound Annual Growth Rate (CAGR) of the APAC Hair Color Market?

The projected CAGR is approximately 6.5%.

2. Which companies are prominent players in the APAC Hair Color Market?

Key companies in the market include Procter & Gamble Co, Mandom Corporation, Henkel AG & Co KGaA, L`Oreal S A, Godrej Consumer Products Limited, Natura Co Holding S/A*List Not Exhaustive, Henna Industries Private Limited, Kao Corporation, Hoyu Co Ltd, Shanghai Zhanghua Health Care Cosmetics Sales Co Ltd.

3. What are the main segments of the APAC Hair Color Market?

The market segments include Product Type, Distribution Channel.

4. Can you provide details about the market size?

The market size is estimated to be USD 5318.8 million as of 2022.

5. What are some drivers contributing to market growth?

Increasing Demand for Natural/Organic Products; Increased Focus on Facial Care Regimes.

6. What are the notable trends driving market growth?

Growing Ageing Population Driving Sales of Hair Colorants.

7. Are there any restraints impacting market growth?

Presence of Counterfeit Products Restraints Growth.

8. Can you provide examples of recent developments in the market?

June 2022: L'Oréal introduced its first permanent hair color technology, L'Oréal Paris Men Expert One-Twist Hair Color, made especially for men. It is ammonia free and is available in seven shades. The company claims that it gives blended gray coverage for up to six weeks.

9. What pricing options are available for accessing the report?

Pricing options include single-user, multi-user, and enterprise licenses priced at USD 4750, USD 4950, and USD 6800 respectively.

10. Is the market size provided in terms of value or volume?

The market size is provided in terms of value, measured in million and volume, measured in K Units.

11. Are there any specific market keywords associated with the report?

Yes, the market keyword associated with the report is "APAC Hair Color Market," which aids in identifying and referencing the specific market segment covered.

12. How do I determine which pricing option suits my needs best?

The pricing options vary based on user requirements and access needs. Individual users may opt for single-user licenses, while businesses requiring broader access may choose multi-user or enterprise licenses for cost-effective access to the report.

13. Are there any additional resources or data provided in the APAC Hair Color Market report?

While the report offers comprehensive insights, it's advisable to review the specific contents or supplementary materials provided to ascertain if additional resources or data are available.

14. How can I stay updated on further developments or reports in the APAC Hair Color Market?

To stay informed about further developments, trends, and reports in the APAC Hair Color Market, consider subscribing to industry newsletters, following relevant companies and organizations, or regularly checking reputable industry news sources and publications.

Methodology

Step 1 - Identification of Relevant Samples Size from Population Database

Step 2 - Approaches for Defining Global Market Size (Value, Volume* & Price*)

Note*: In applicable scenarios

Step 3 - Data Sources

Primary Research

- Web Analytics

- Survey Reports

- Research Institute

- Latest Research Reports

- Opinion Leaders

Secondary Research

- Annual Reports

- White Paper

- Latest Press Release

- Industry Association

- Paid Database

- Investor Presentations

Step 4 - Data Triangulation

Involves using different sources of information in order to increase the validity of a study

These sources are likely to be stakeholders in a program - participants, other researchers, program staff, other community members, and so on.

Then we put all data in single framework & apply various statistical tools to find out the dynamic on the market.

During the analysis stage, feedback from the stakeholder groups would be compared to determine areas of agreement as well as areas of divergence